Minister’s message

Over the past five years, our government has worked to make Ontario the best place to create jobs and build the industries of the future. By reducing electricity costs, lowering taxes and cutting red tape we have significantly reduced the cost of doing business and we’ve seen companies and investment surge into our province as a result.

Ontario is quickly becoming a leader in building electric vehicles and batteries with historic investments from Stellantis in Windsor to Volkswagen in St. Thomas. And we are working with the steel industry to end coal use and electrify their operations to support the production of green steel in Hamilton and Sault Ste. Marie, fueling our growing automotive sector.

At the same time, our government has a plan to build 1.5 million new homes as Ontario’s population is expected to grow by two million people by the end of this decade.

As a result, for the first time since 2005 Ontario’s electricity demand is rising, and we know that to support this type of growth we need to ensure the continued availability of reliable, affordable, and clean energy.

Our government is on track to acquire the electricity resources we need this decade to power economic growth and increasing electrification, with major projects and procurements already announced, including Canada’s first grid-scale small modular nuclear reactor (SMR), a $342 million expansion of energy efficiency programs and the largest energy storage procurement in Canada’s history.

But looking ahead on the path to 2050, we know economic growth and electrification are going to continue to increase energy demand. In fact, Ontario’s Independent Electricity System Operator's (IESO) analysis shows that electricity demand could more than double by 2050.

We need to act today to ensure we have the energy we need to power economic growth and electrification over the next three decades while maintaining our clean electricity advantage.

Powering Ontario’s Growth is the next chapter in Ontario’s clean energy story and lays out the plan to provide families and industries with the reliable, low-cost and clean power we need to power Ontario's growth.

Generational decisions, like starting pre-development work for a new nuclear station at Bruce, the first large scale nuclear build since 1993, and advancing three additional small modular reactors at Darlington will provide the dependable, clean, green, zero-emissions electricity that businesses around the world are looking for.

Connecting Ontario and opening new regions for clean energy generation through strategic new transmission lines and developing long-duration storage, like pumped hydroelectric, will also be pivotal to ensuring our grid is as efficient as possible. While we build the next phase of Ontario’s electricity grid to reliably meet peak demand, in the near-term natural gas generation will continue to provide our province with an insurance policy to maintain system reliability and support electrification across our economy.

This growth can only be successful with the participation and leadership from Indigenous communities and partners across the province, whose voices will help ensure energy infrastructure is developed in a way that considers future generations.

With the world-class talent in Ontario’s energy sector, I’m confident we will continue to build our clean energy advantage that has made our province so attractive for investment, while providing the reliable and affordable electricity that will keep energy costs down for families.

Sincerely,

Todd Smith

Minister of Energy

Top 10 things to know

The Government of Ontario is taking action to build the electricity system to support new investments, electrify our economy and power the 1.5 million homes the province is building to house our growing population. All of this work has been informed by the advice of Ontario’s Independent Electricity System Operator who identified “no-regret actions” to meet growing energy demands through 2050.

- New Nuclear at Bruce: Starting pre-development work to site the first large-scale nuclear build since 1993 at the Bruce nuclear site.

- New Nuclear at Darlington: Moving ahead with three additional small modular reactors at the Darlington nuclear site.

- Building New Transmission: Three new transmission lines to power the conversion from coal to power the Electric Arc Furnaces at Algoma Steel as well as growth in Northeastern Ontario.

- Building New Transmission: One new transmission line to power growth in the Ottawa region and across eastern Ontario.

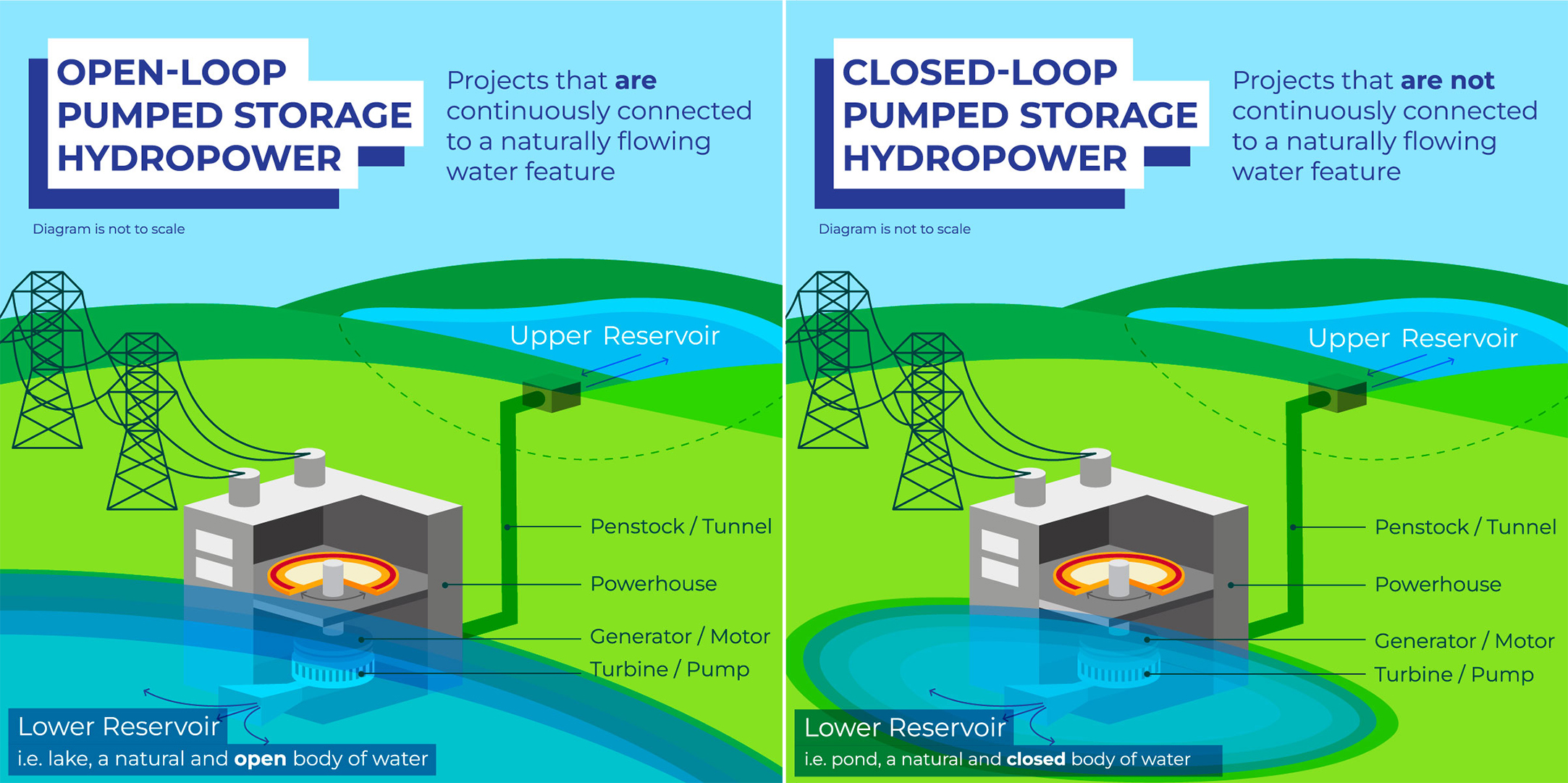

- Pumped Hydroelectric Storage: Advancing the Ontario Pumped Storage Project and Marmora Pumped Storage Project to Ontario’s first Long-Duration Storage Assessment.

- Hydroelectric Power: Optimizing Ontario Power Generation’s hydroelectric fleet to increase generation

- Energy Efficiency: Planning for the future of energy efficiency programs in Ontario

- Next Competitive Electricity Procurement: Starting planning for Ontario’s next competitive electricity procurement focused on new clean resources including wind, solar, hydroelectric, batteries and biogas.

- Integrated Energy Planning: Advancing foundational work toward Ontario’s first long-term integrated energy plan through the Electrification and Energy Transition Panel.

- Keeping Costs Down: Ontario is cementing its commitment to maintain an affordable electricity system to support electrification across our economy.

Executive summary

Ontario’s economy and the day-to-day lives of its 15 million residents depend on a reliable electricity system that delivers power on demand.

Demand for electricity is increasing in Ontario, because of the province’s economic success and global attractiveness as a place to live and work. As rapid economic growth and electrification continue, demand for electricity will increase at a rate not seen since the 1970s.

According to the Independent Electricity System Operator’s (IESO) Pathways to Decarbonization (P2D) report high-growth scenario, in less than 30 years Ontario could need to more than double electricity generating capacity, from 42,000 megawatts (MW) today to 88,000 MW in 2050. Up to 20,000 MW in capacity may be needed just to replace generation that will come to the end of its life or be phased out over the next three decades.

| Capacity | Megawatts |

|---|---|

| Today’s system capacity | 41,763 |

| 2050 P2D forecast capacity | 88,393 |

Note: Peak demand in the P2D Pathways forecast changes to a winter peak after 2030. Other peak demands are summer peaks.

The Ontario government is planning and building the electricity infrastructure for a more electrified Ontario, where economic growth continues to drive new jobs and emissions continue to be reduced. It is developing an integrated planning process that looks at the province’s energy mix and system as a whole (electricity, oil and natural gas), unlike previous governments, which built and planned energy systems in isolation, and it is taking the necessary steps to ensure the province is set up for success.

To meet this growing demand this decade, the government has already acted by re-contracting existing resources, increasing energy efficiency programs in the electricity and natural gas sectors, supporting the continued safe operation of the Pickering Nuclear Generating Station, and building 4,000 MW of new generation and storage as well as Canada’s first grid scale small modular reactor (SMR).

As the planning process moves forward, the Ontario government is acting now to ensure that the province has the electricity it will need this decade while making the decisions necessary to prepare for the decades ahead. That includes starting the development of long-lead generation and storage assets like nuclear and pumped hydroelectric so the government has a range of options to choose from to contribute to our diverse energy system.

This work will ensure Ontario maintains and builds on the clean electricity advantage that has made our province so attractive for new investments.

Working in partnership with Indigenous leaders and communities, as well as ensuring meaningful opportunities for consultation and Indigenous community participation in energy planning and projects, will be key to achieving these goals.

This document is a road map to that reliable, affordable, and clean energy future. It provides a detailed overview of where the province is now and how it will build the electricity system that is needed in the years ahead:

- Chapter 1 provides an outline of Ontario’s overall energy mix today with electricity, natural gas and refined petroleum products making up 96 per cent of the energy the province consumes.

- Chapter 2 explores the factors driving demand for electricity, including the province’s robust economic growth, electrification, and the demand for clean energy.

- Chapter 3 describes the current actions that the province is taking to meet the needs of this decade, from new battery storage, Canada’s first small modular reactor and small-scale hydro projects to the refurbishment of Ontario’s nuclear generation fleet, supported by natural gas generation.

- Chapter 4 outlines the steps the government will take to meet the needs of the 2030s and beyond and create an emissions-free electricity system, potentially doubling today’s capacity, and ensuring Ontario is on the path to meet the demand for electricity in 2050.

- Chapter 5 describes Ontario’s progress towards integrated energy planning that considers energy investments at a macro level, whether they be electricity, natural gas or green and renewable fuels.

Ontario’s energy system

Introduction

Ontario relies on a mix of energy sources to drive its economy, heat, cool and light the homes of its 15 million residents and move people and goods across our vast province.

Electricity, natural gas, and refined petroleum products together account for 96 per cent of the energy Ontario needs with other fuel types such as bio- and industrial-fuels (coal, coke and coke oven gas which are being phased out through the electrification of the steel sector) — accounting for the remaining four per cent.

| Energy Type — Ontario | 2021 (PJ) | % |

|---|---|---|

| Other | 107 | 4 |

| Electricity | 502 | 21 |

| Natural Gas | 928 | 39 |

| Refined Petroleum Products | 848 | 36 |

| Total | 2,384 | 100 |

Source: Statistics Canada. Table 25-10-0029-01 Supply and demand of primary and secondary energy in terajoules, annual

Average household energy consumption is similar to the overall economy with natural gas and gasoline accounting for approximately 44.4 and 40.8 per cent respectively with electricity providing the remaining 14.8 per cent (Table 1.2). These levels will change as individuals make choices to electrify vehicles and home heating.

Through investment, regulation and innovative public policy, the Ontario government has a leading role in ensuring the province has access to the reliable, affordable supply of energy needed to keep people safe, create jobs and grow the economy.

This chapter describes the role of electricity, oil, refined petroleum products and natural gas in Ontario’s energy mix and how they work together to deliver the energy the province needs. It includes an overview of the steps being taken to ensure a reliable supply of electricity and to keep electricity and natural gas costs affordable as needed investments are made to increase generating capacity and meet anticipated demand.

| Energy Type | 2019 (GJ) | % |

|---|---|---|

| Electricity | 28.9 | 14.8 |

| Gasoline | 79.9 | 40.8 |

| Natural Gas | 86.7 | 44.4 |

Source: Statistics Canada data.

Ontario’s clean electricity advantage

Ontario’s electricity system is one of the cleanest and most reliable in the world, providing affordable electricity to serve a growing population, attract new investment and continue to power the province’s strong economic growth.

Ontario’s world-class electricity grid benefits from being comprised of a range of diverse resources, including hydroelectric, nuclear, natural gas, solar, wind and bioenergy. Each resource generates electricity differently and has unique operating characteristics. Because no single resource can meet all of the system’s needs at all times, maintaining a diverse supply mix is an effective way to ensure the ongoing reliability of Ontario’s electricity system.

| Electricity Source | Tx-Connected (direct) | Dx-Connected (embedded) | Total |

|---|---|---|---|

| Nuclear | 13,089 | N/A | 13,089 |

| Hydro | 8,985 | 333 | 9,318 |

| Natural Gas | 10,482 | 320 | 10,802 |

| Wind | 4,883 | 591 | 5,474 |

| Solar PV | 478 | 2,171 | 2,649 |

| Bioenergy | 296 | 110 | 406 |

| Waste | N/A | 24 | 24 |

| Total | 38,213 | 3,550 | 41,763 |

Source: Supply Mix and Generation

‘Capacity’ is a measure of the maximum amount of electricity the province’s system can supply at any given time. Ontario’s capacity is constantly changing as new supply comes online, older generators are taken out of service and new innovative technologies are introduced (Table 1.3). Resources like nuclear, natural gas and hydroelectric that can be depended upon are said to have a ‘high-capacity factor’, while intermittent resources like wind and solar have a ‘low-capacity factor,’ unless paired with energy storage. While nuclear, hydroelectric, and natural gas each account for between 25 to 35 per cent of the province’s total capacity, that does not correlate to the amount of electricity they supply every day. Ontario’s nuclear and hydroelectric fleet run most often, while natural as plants fulfil an insurance policy role, providing electricity at times of peak demand when other generators cannot.

| Electricity Source | Tx-Connected (direct) | Dx-Connected (embedded) | Total |

|---|---|---|---|

| Nuclear | 78.80 | N/A | 78.80 |

| Water Power | 38.00 | 0.76 | 38.76 |

| Natural Gas | 15.20 | 0.56 | 15.76 |

| Wind | 13.80 | 1.57 | 15.37 |

| Solar PV | 0.75 | 3.07 | 3.82 |

| Bioenergy | 0.30 | 0.31 | 0.61 |

| Other (non-contracted) | 0.01 | 1.44 | 1.45 |

| Total | 146.86 | 7.71 | 154.57 |

Note: 1. Components may not sum to the total due to rounding. 2. Figures do not account for the sale and retirement of Clean Energy Credits (CECs).

While capacity represents the maximum amount of electricity that the system can supply, ‘energy’ represents the actual amount of power that a specific resource provides (Table 1.4). For example, while natural gas represented about 26 per cent of Ontario’s capacity in 2022, it only produced about 10 per cent of the province’s electricity. In contrast, nuclear and hydroelectric respectively accounted for 51 and 25 per cent of Ontario’s electricity, providing reliable sources of emissions-free baseload power, required to ensure system reliability.

For many hours of a typical day, all of the province’s energy needs can be met by baseload and intermittent (i.e. wind and solar) resources. However, as Ontario is a province with hot summer days and cold winter nights, energy demand tends to ‘peak’ largely due to weather. A mix of natural gas, hydroelectric with reservoirs and bioenergy provides additional energy on those days when electricity demand rises. According to the IESO, Ontario’s natural gas fleet will remain a critical capacity resource, complementing the province’s nuclear and hydroelectric fleets when needed to support homes and businesses with reliable power and keeping bills down while the province further builds out its clean electricity grid.

While meeting Ontario’s own energy needs, Ontario also engages in trading with neighbouring jurisdictions like Quebec, New York, Michigan, and others. Each day, electricity is imported or exported based on market conditions in the province and neighbouring markets, ensuring system reliability in Ontario and elsewhere while also decreasing costs for ratepayers.

Ontario is also the first jurisdiction in North America to completely phase out coal-fired electricity generation, a landmark achievement made possible in large part by the province’s fleet of CANDU nuclear reactors.

As a result, in 2022 Ontario had one of the cleanest electricity grids in North America and the world, with about 90 per cent of Ontario’s electricity coming from non-emitting sources. Compared to neighbouring Great Lakes States, Ontario’s system emits far less greenhouse gas per unit of electricity produced — seven times less than New York, 17 times less than Michigan and 26 times less than Indiana. Jurisdictions like Quebec and Manitoba are able to reduce their emissions even further due to their abundant access to clean hydroelectricity, a resource that is not as plentiful in Ontario due to its topography.

| Location | CO2e (g/kWh) 2001 |

|---|---|

| Alabama | 347 |

| Alaska | 501 |

| Arizona | 318 |

| Arkansas | 505 |

| California | 164 |

| Colorado | 547 |

| Connecticut | 206 |

| Delaware | 435 |

| District Of Columbia | 522 |

| Florida | 368 |

| Georgia | 335 |

| Hawaii | 553 |

| Idaho | 118 |

| Illinois | 290 |

| Indiana | 730 |

| Iowa | 374 |

| Kansas | 377 |

| Kentucky | 794 |

| Louisiana | 394 |

| Maine | 122 |

| Maryland | 298 |

| Massachusetts | 294 |

| Michigan | 475 |

| Minnesota | 378 |

| Mississippi | 379 |

| Missouri | 739 |

| Montana | 506 |

| Nebraska | 501 |

| Nevada | 329 |

| New Hampshire | 118 |

| New Jersey | 212 |

| New Mexico | 507 |

| New York | 210 |

| North Carolina | 302 |

| North Dakota | 654 |

| Ohio | 559 |

| Oklahoma | 341 |

| Oregon | 138 |

| Pennsylvania | 324 |

| Rhode Island | 408 |

| South Carolina | 255 |

| South Dakota | 144 |

| Tennessee | 300 |

| Texas | 393 |

| Utah | 694 |

| Vermont | 0 |

| Virginia | 260 |

| Washington | 92 |

| West Virginia | 889 |

| Wisconsin | 563 |

| Wyoming | 823 |

| Newfoundland and Labrador | 16 |

| Prince Edward Island | 3 |

| Nova Scotia | 660 |

| New Brunswick | 290 |

| Quebec | 1.3 |

| Ontario | 28 |

| Manitoba | 1.9 |

| Saskatchewan | 670 |

| Alberta | 510 |

| British Columbia | 14 |

| Yukon | 70 |

| Northwest Territories | 170 |

| Nunavut | 800 |

Source: U.S. data: U.S. Environomental Protection Agency — Data Extracted from EPA's FLIGHT Tool. Canada data: 2023 NIR — CAN (Table A13-1 Electricity Generation and GHG Emission Details for Canada)

| Economic Sector | Mt CO2 eq | % |

|---|---|---|

| Transportation | 47.2 | 31.4 |

| Buildings | 37.6 | 25.0 |

| Industry | 27.6 | 18.3 |

| Electricity | 3.4 | 2.2 |

| Oil and Gas | 7.7 | 5.1 |

| Agriculture | 12.1 | 8.0 |

| Light Manufacturing, Construction and Forest Resources | 8.8 | 5.9 |

| Waste | 6.1 | 4.1 |

| GHG Total | 150.6 | 100.0 |

Source: 2023 NIR — Ontario

Thanks to our diverse supply mix, Ontario’s world-leading clean electricity sector accounts for only two per cent of the province’s total greenhouse gas emissions, and as such is a key tool in helping other sectors of the Ontario economy reduce emissions through electrification. Today, Ontario’s transportation, industrial and building sectors currently are responsible for 75 per cent of the province’s emissions but electrification is playing a critical role in driving down emissions in these sectors. For example, charging an electric vehicle on Ontario’s grid could reduce that vehicle’s emissions by up to 90 per cent in comparison to a traditional internal combustion engine vehicle. But to meet increasing demand as other sectors of Ontario’s economy electrify, new generating resources will need to come online to provide the key services the grid needs, like capacity and energy.

Over the last few years, the Ontario government has acted through a multi-pronged approach, outlined in this plan, to ensure continued system reliability and support a growing and increasingly electrifying province this decade. This plan also outlines the steps the government is taking to develop new long-lead assets that will meet demand in the decades to come.

Keeping electricity affordable for Ontario residents and businesses

To ensure the province’s continued success in attracting new investments and growing Ontario’s economy, the government remains focused on keeping electricity affordable as demand grows. The province is also committed to continuing to provide electricity relief for residents and businesses while making the needed investments in the system.

| Energy Type | Total Unit Cost (¢) |

|---|---|

| Nuclear | 10.1 |

| Hydro | 6.1 |

| Gas | 11.3 |

| Wind | 15.4 |

| Solar | 50.2 |

| Bioenergy | 25.8 |

Source: OEB Regulated Price Plan (RPP) Price report, October 21, 2022 (p. 19)

The government’s approach to ensuring affordability is based on leveraging the existing resources on the system today. Currently hydroelectric and nuclear provide the lowest-cost power to Ontario’s grid, with contracted solar and wind costs being higher, reflecting the over-market priced contracts signed between 2004 and 2016. Ontario’s recently procured clean storage resources will help these renewable energy resources provide capacity, by addressing their intermittency due to weather-dependency, while also helping Ontario to better integrate future renewables assets to support the province’s growing electricity needs.

Support for residential customers

To keep costs down for families, Ontario residential customers benefit from the Comprehensive Electricity Plan, the Ontario Electricity Rebate and other more targeted programs that support our province’s most vulnerable.

Comprehensive Electricity Plan (CEP)

Ontario’s Comprehensive Electricity Plan (CEP) is lowering electricity commodity costs for all electricity consumers by funding the above-market costs of the approximately 33,000 existing renewable energy contracts, signed between 2004 and 2016.

Ontario Electricity Rebate (OER)

Introduced in 2018, the Ontario Electricity Rebate (OER provides electricity rate relief to eligible customers including households, farms, long-term care homes and small businesses. Effective November 1, 2022, the OER is providing an 11.7 per cent rebate on electricity bills. The OER is adjusted every November following the Ontario Energy Board’s annual electricity rate setting to help provide consumers with affordable and predictable electricity bills.

The OER and CEP are automatically applied to all consumers’ bills. Together, the OER and CEP reduce an average residential bill by about 23 per cent in 2023.

Ontario Electricity Support Program (OESP)

The Ontario Electricity Support Program (OESP) provides a fixed monthly credit directly on qualified low-income customers’ electricity bills. Credit amounts range from $35 to $113 and are based on household income and size, as well as energy intensity criteria. The credit further reduces electricity bills for lower-income households.

Energy Affordability Program (EAP)

The Energy Affordability Program (EAP) offers electricity savings measures that can help eligible low-income households further manage their energy use and lower electricity bills by up to and additional $750 per year at no cost to the customer.

In 2023, Ontario raised the income eligibility thresholds, by $11,715 for a four-person household and by $8,285 for a couple, helping thousands more Ontario families reduce energy use and save money. Customers who already receive benefits from a list of energy bill support and social assistance programs automatically qualify.

The energy efficiency upgrades and types of support available are based on factors including home heating system, location, and an assessment of energy needs. Some free measures include energy-efficient refrigerators, window air conditioners, additional attic or basement insulation, smart thermostats and weatherstripping around doors and windows.

Since 2018, the IESO's Energy Affordability Program and the previous Home Assistance Program have helped more than 47,000 households across Ontario create more energy efficient homes, lowering electricity bills for years to come.

The Energy Affordability Program (electricity efficiency) and Enbridge’s Home Winterization Program (natural gas efficiency) are now also delivered through a one-window approach, improving customer experience, and making it easier for income-qualified consumers to receive free energy-efficient measures and products that will help lower both electricity and natural gas bills.

Rural or Remote Rate Protection Program (RRRP)

The Rural or Remote Rate Protection Program (RRRP) is a $60.50 monthly credit for eligible customers of Hydro One’s R2 (low density) rate class. The RRRP also provides support to customers of Hydro One Remote Communities Inc., Algoma Power and three First Nation-owned distributors on the James Bay coast. This program helps to lower electricity bills for those living in rural and remote areas where the cost of electricity service is higher.

Distribution Rate Protection Program (DRP)

The Distribution Rate Protection (DRP) Program caps base distribution charges for eligible residential customers of eight prescribed Local Distribution Companies (LDC) serving lower density parts of the province.

The LDCs are:

- Algoma Power Inc..

- Atikokan Hydro Inc.

- Chapleau Public Utilities Corporation

- Hydro One Networks Inc. R1, R2 customers

- InnPower Corporation

- Lakeland Power Distribution Ltd. (including the former Parry Sound Power service area)

- Northern Ontario Wires Inc.

- Sioux Lookout Hydro Inc.

This program helps to lower electricity bills for those that have a higher-than-average electricity distribution cost due to their geography.

Disconnection ban

Between November 15 and April 30 every year, the OEB prohibits LDCs and rate-regulated gas distributors from disconnecting homes and turning off electricity for non-payment, ensuring that these customers continue to have access to heat and electricity during the cold winter months.

First Nations Delivery Credit (FNDC)

The Ontario government has provides immediate relief on delivery charges for on-reserve First Nation residential customers through the First Nation Delivery Credit (FNDC) Program. FNDC funding, which was $28 million in 2021, provides a 100-per-cent credit to cover the electricity delivery charge on the bills of on-reserve First Nation residential customers of licensed distributors.

Consumer Choice

While the government focuses on reliable, affordable, and sustainable electricity, the province is also giving households more control over their energy bills. Customers can now choose a billing structure that best suits their lifestyle and individual electricity use. In November 2020, the provincial government introduced Customer Choice, giving residential and small business customers who pay Time-of-Use (TOU) pricing under the Regulated Price Plan (RPP) the choice to switch to Tiered pricing.

TOU pricing may be best for consumers who use most electricity during evenings and weekends, which are off-peak hours. Tiered Pricing structures may be better for consumers who use electricity mostly during higher-peak times like weekdays.

Ultra-Low Overnight price plan

In May 2023, the province provided a third choice to customers with the introduction of the Ultra-Low Overnight electricity price plan, giving families and small businesses that use more electricity overnight more ways to save.

The Ultra-Low Overnight rate of 2.4 cents per kilowatt-hour is possible as the province continues to have excess clean electricity during overnight hours.

The new price plan is most likely to benefit those who are employed in shiftwork, electrically heat their home, or charge their EV and could save them up to $90 per year by shifting demand to the overnight period when province-wide electricity demand is lower.

We strongly support the province's ultra-low overnight electricity price. This rate structure will not only make electric vehicles even more affordable to own and operate but will also make better use of Ontario's surplus of electricity at night, benefiting the electricity system as a whole.

Cara Clairman President and CEO, Plug'n Drive

The introduction of Ontario's new Ultra-Low Overnight Electricity Pricing Plan provides customers another pricing option to fit their business and lifestyle needs. Customers now have additional choice and flexibility to manage their energy costs and consumption. We welcome this initiative as a positive step towards supporting electrification and a sustainable energy future in Ontario.

Teresa Sarkesian President and CEO, Electricity Distributors Association

Support for business customers

Ontario also provides clean and affordable electricity to power businesses through the Comprehensive Electricity Plan, Industrial Conservation Initiative, and other programs. As a result, Ontario electricity rates are priced at or below the rates in neighbouring Great Lakes States. As environmental and sustainability goals become more important for businesses making decisions on where to invest, this advantage makes Ontario the best place to create jobs and to grow or electrify their businesses.

| All-in rates (C ¢/MWh) | 2022 |

|---|---|

| Ontario — North | 7.2 |

| Ontario — South | 9.2 |

| New York State | 9.9 |

| Ohio | 10.5 |

| Pennsylvania | 10.5 |

| Wisconsin | 11.1 |

| Indiana | 11.2 |

| Illinois | 11.5 |

| Michigan | 11.6 |

Comprehensive Electricity Plan (CEP)

The Comprehensive Electricity Plan, introduced on January 1, 2021, is reducing electricity costs for industrial and commercial businesses by funding the above-market cost of Ontario’s approximately 33,000 renewable energy contracts signed between 2004 and 2016.

In 2023, industrial and commercial customers could see average savings from the CEP of between 14 and 17 per cent. Savings vary depending on location and consumption.

Industrial Conservation Initiative (ICI)

The Industrial Conservation Initiative (ICI) is a demand response program in which participants — including large manufacturers, mines, and forest product operations — can significantly reduce Global Adjustment costs by reducing their electricity demand during peak periods. This reduction in peak demand helps the province defer investments in new electricity infrastructure that would otherwise be needed, keeping costs down for all customers.

Interruptible Rate Pilot (IRP)

In 2021, the Minister of Energy directed the IESO to develop an Interruptible Rate Pilot to that would provide increased rate predictability to large industrial customers in exchange for an agreement that these facilities will reduce their electricity use when the province’s electricity demand is high. If the pilot is successful, leading to the creation of a permanent interruptible rate, large consumers would be able to choose a rate that best suits their manufacturing process and corresponding electricity usage profile. The pilot launched on July 1, 2023.

Natural gas

Natural gas makes up almost 40 per cent of Ontario’s energy mix and is the dominant fuel used for heating in Ontario, serving about 3.7 million customers. About 75 per cent of Ontario’s residential customers use natural gas to heat their homes. Additional uses for natural gas include industrial processes (e.g., to produce chemicals and for process heat) and as a transportation fuel. It is also used for electricity generation.

While residential consumers represent about 96 per cent of all customers, they account for about 33 per cent of all natural gas volumes consumed, as industrial processes often require large volumes of natural gas.

Ontario’s natural gas supply

Ontario imports almost all its natural gas from other jurisdictions. Historically, Ontario was predominantly supplied by Western Canada, but now also has a variety of sources from the United States, including nearby jurisdictions such as Pennsylvania, Ohio, and West Virginia. Once natural gas is delivered to the province, Ontario’s extensive pipeline infrastructure transports it to end users.

The Enbridge Gas Dawn Hub, located in southwestern Ontario, is one of the largest integrated underground natural gas storage facilities in North America. Dawn is also one of the top three physical trading points in North America. Natural gas storage at Dawn helps meet Ontario’s seasonal natural gas demand. Natural gas is injected into storage during periods of low use in spring, summer and fall when natural gas costs are low, and then withdrawn during periods of peak demand in the winter when natural gas import costs are higher. This ensures sufficient volumes of gas are available during the peak winter heating season and helps protect natural gas ratepayers.

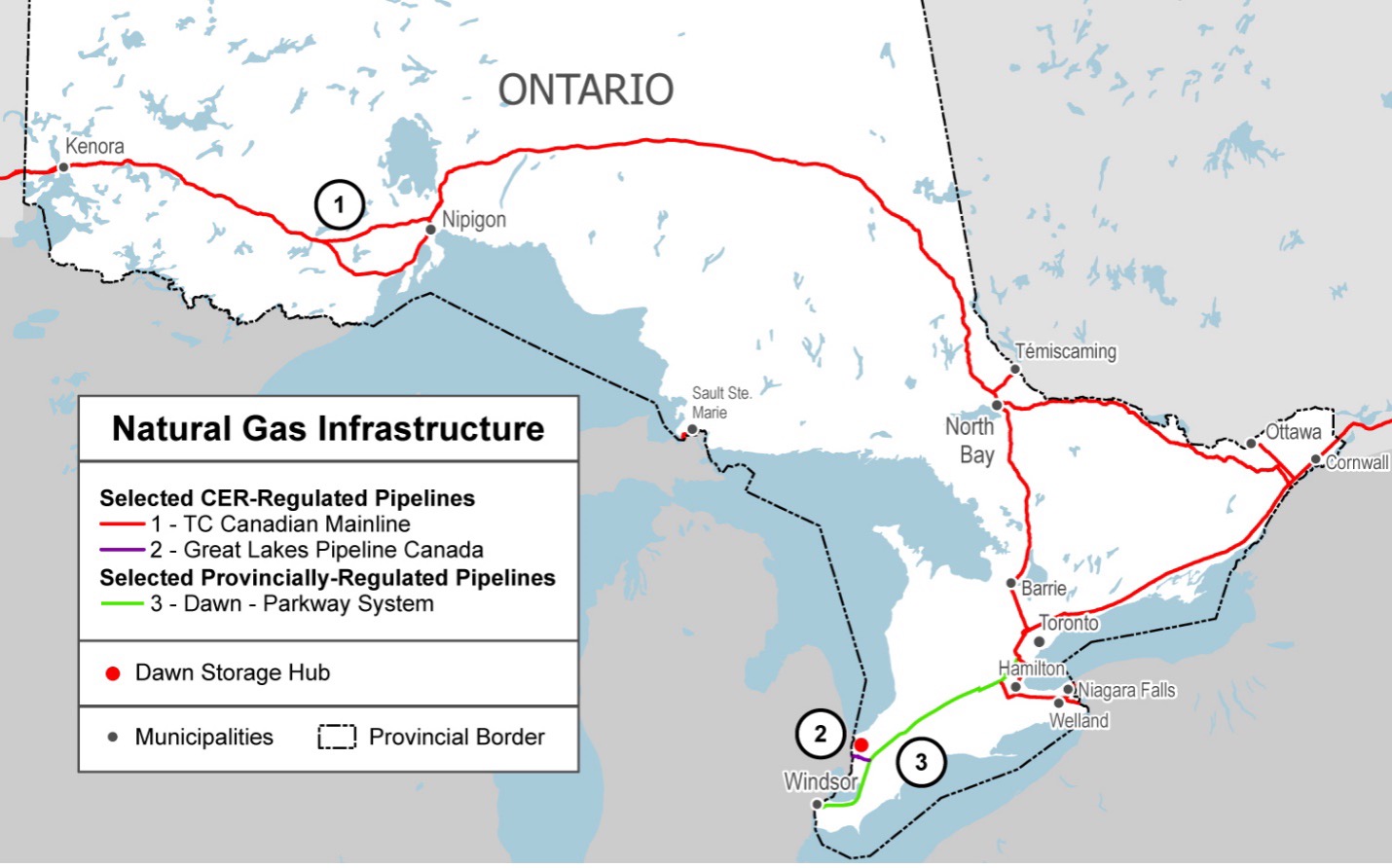

Figure 1.9: Southwestern Ontario natural gas infrastructure: dawn storage hub and pipeline connections

Availability of natural gas for residential, commercial, and industrial users is restricted to parts of the province with pipeline access.

Ontario’s natural gas distribution utilities are regulated by the Ontario Energy Board (OEB), Ontario’s independent energy regulator. The OEB uses the Quarterly Rate Adjustment Mechanism (QRAM) to protect consumers from fluctuations in market prices due to factors such as seasonal demand, bad weather, and interruptions in supply. For example, the QRAM protected Ontario consumers by smoothing gas prices in 2022, which spiked on international markets in the early months following the Russian invasion of Ukraine. Utilities are also not allowed to earn a profit on the sale of gas, regardless of price fluctuations. They are permitted to pass through only the cost of obtaining natural gas on their customer’s behalf. The OEB regulates the delivery rates Enbridge and EPCOR can charge customers for their delivery service (i.e., storage and delivery of natural gas to customers through their distribution system) from which the distributors recover their operating and capital costs and earn a return. Under the QRAM, the OEB requires Enbridge and EPCOR Ontario’s two major natural gas utilities, to forecast market prices every three months and use that forecast to seek OEB approval of any price changes. Forecasts are based on future costs — the estimated market prices for natural gas for the next 12 months, and past costs. If a utility collected more from customers than it paid for gas in the past, the difference is credited to a customer’s account. If not enough was collected, the rate would be higher. Natural gas prices are however impacted by the federal carbon tax, which is scheduled to increase each year through at least 2030, which will increase costs for consumers who heat their homes using natural gas. Regardless, for areas with existing natural gas access, in most cases natural gas remains the most cost-effective home heating source.

| Date | FCC NG |

|---|---|

| Apr 2023 | 0.1239 |

| Apr 2024 | 0.1525 |

| Apr 2025 | 0.1811 |

| Apr 2026 | 0.2097 |

| Apr 2027 | 0.2383 |

| Apr 2028 | 0.2669 |

| Apr 2029 | 0.2954 |

| Apr 2030 | 0.324 |

To help families keep energy costs down and move off higher-emitting fuel sources including propane and home heating oil the Ontario government is expanding access to natural gas across the province to help keep the cost of energy low for families, businesses and farmers while reducing emissions.

In 2021, the province allocated $234 million in Phase 2 of the Natural Gas Expansion Program to support approximately 8,750 connections in 43 rural, northern, and Indigenous communities. The average household could save between $250 to $1,500 a year in energy costs by switching to natural gas from costlier fuel sources. Businesses are expected to save up to 30 per cent on energy costs a year.

I thank the Government of Ontario for introducing this innovative program, which will not only help homeowners save money on their energy bills, but also help significantly reduce their emissions. It’s a win-win for the wallet and the environment.

Kevin Ashe Mayor, City of Pickering

A hybrid heating system can reduce a home’s greenhouse gas emissions by as much as 30 percent a year while increasing the flexibility and reliability of its heating system. We appreciate the support from the provincial government, participating cities and the electricity sector for supporting this program and its ongoing commitment to energy efficiency and carbon reduction measures. Together, we are working towards a cleaner energy future.

Sarah Van Der Paelt Director of Marketing and Energy Conservation, Enbridge Gas

Energy efficiency and innovation

New technologies and innovative approaches are being introduced to reduce emissions from natural gas. This includes energy efficiency programs designed to reduce the usage of natural gas, and the expansion of lower emissions fuels such as low-carbon hydrogen and renewable natural gas that can be injected into the existing natural gas pipeline system.

Natural gas energy efficiency

Ontario has many energy-efficiency programs in place that help residential and business consumers manage their natural gas usage and bills through the installation of energy-saving measures.

Ontario natural gas customers pay roughly $2 per month to fund energy efficiency programs as a cost-effective way to reduce natural gas demand. Ontario’s primary natural gas utility, Enbridge Gas, is delivering natural gas conservation programs to its customers under a 2023–2025 Demand Side Management Plan. For 2023, the budget is $167 million, and the natural gas savings target is 114 million cubic metres (m3) in the first year. This is equivalent to GHG emissions reductions of about 0.2 Mt per year. These natural gas savings and GHG emissions reductions are driven by a range of programs such as Residential Whole Home, which provides funding for measures including new insulation, air sealing and heat pumps.

On May 27, 2021, Natural Resources Canada (NRCan) launched the Canada Greener Homes Grant to provide up to $5,000 in grants to help homeowners make energy-efficient improvements. Starting January 2023, Ontario’s natural gas energy efficiency programs are being co-delivered with the Canada Greener Homes Grant through the new Home Efficiency Rebate Plus program, which allows customers to stack funding from both programs to implement energy conservation measures.

According to the Ontario Energy Board, for each $1 spent on natural gas conservation in 2021, there were up to $2.56 in future savings.

Low-carbon hydrogen and renewable natural gas

Low-carbon hydrogen and renewable natural gas (RNG) can both be blended with conventional natural gas in existing natural gas networks, reducing the carbon intensity of the fuel. Both low-carbon hydrogen and RNG can also be blended into natural gas-fired electricity generation facilities where feasible, helping lower the carbon footprint of these peaking units when they are required.

Ontario already has active hydrogen and RNG projects in municipalities across the province including, but not limited to, London, Ottawa, Toronto, Markham, Hamilton, Ilderton and Niagara Falls.

Enbridge Gas consumers have the option of adding RNG to their natural gas supply for $2 per month through the RNG Program voluntary OptUp program. All the funds generated from the OptUp program are used by Enbridge to purchase locally produced RNG from StormFisher’s facility in London, Ontario.

Natural gas will continue to play a critical role in providing Ontarians with a reliable and cost-effective fuel supply for space heating, industrial growth, and economic prosperity. With developments in energy efficiency, and low-carbon fuels such as RNG and low-carbon hydrogen, the natural gas distribution system will help contribute to the province’s transition from higher carbon fuels in a cost-effective way.

Oil and refined petroleum products

Petroleum products, derived from crude oil, comprise just under 40 per cent of Ontario’s end-use energy consumption. Petroleum products are critical fuels to move goods and people, heat homes and have non-energy applications.

Transportation fuels account for about 80 per cent of Ontario petroleum consumption ― gasoline (49 per cent), diesel (22 per cent), and jet fuel (8 per cent). Non-energy uses of petroleum include inputs to the petrochemical sector (7 per cent) and asphalt (3 per cent). Other applications — including lubricants and heating oil — account for about 10 per cent of overall petroleum demand.

While the first oil well in North America was drilled in Oil Springs, near Sarnia, Ontario crude oil production now accounts for less than one per cent of Ontario refinery requirements today. Ontario relies almost entirely on imported crude oil, primarily delivered by interprovincial and international pipelines. The main pipeline network (Enbridge Mainline) supplying Ontario with crude oil originates in Western Canada and passes through the U.S. before entering Canada near Sarnia (Enbridge Line 5 and Line 78). U.S. crude oil production can also access the U.S. portion of the Enbridge Mainline and supply Ontario. In 2021, about 86 per cent of Ontario’s crude oil requirements came from Alberta, Saskatchewan, and British Columbia; 14 per cent came from the U.S.

Ontario’s four refineries supply approximately 78 per cent of Ontario’s refined product demand, with Quebec and the U.S. supplying the remainder. Pipelines, rail, marine (during the shipping season) and trucks (for delivery to retail gasoline stations) are all part of the supply chain to move fuel from refineries to end-users. Petroleum product infrastructure (terminals, bulk plants, pipelines, retail stations) is owned by private companies in Ontario.

The Sarnia Natural Gas Liquids (NGL) fractionator is one of the main sources of propane and butane for eastern Canada. It processes NGL mix delivered from western Canada by the Enbridge Mainline (Lines 1 and 5). From Sarnia, propane is delivered by rail and truck to locations in Ontario, Quebec, other eastern Canadian provinces, and to export markets in the U.S. Midwest and East Coast.

Ontario’s gasoline market and diesel market

The Competition Bureau, an independent federal agency, oversees competition in Canada’s gasoline market. The Bureau enforces the Competition Act and investigates anti-competitive practices, such as price fixing.

For retail gasoline prices, crude oil costs and taxes typically account for the bulk of retail gasoline prices in Ontario (75–80 per cent). The refining (or wholesale), and retail components for the supply chain account for about 20–25 per cent of the gasoline price. To illustrate, using 2022 average retail gasoline prices in Toronto, crude oil costs accounted for 45.9 per cent of the retail price, taxes 30.5 per cent, wholesale gross margins (also called refining margins) 18.5 per cent and retail gross margins 5.1 per cent.

As part of its plan to help keep costs down for Ontario families and businesses, the government extended the current gas and fuel tax rate cuts to December 31, 2023. The government cut the gas tax by 5.7 cents per litre which will save Ontario households $195 on average between July 1, 2022 and December 31, 2023. The federal government continues to charge a 10 cent/L federal excise tax and a 14.3 cent/L federal carbon tax.

In 2020, the government announced the Cleaner Transportation Fuels Regulation, which requires that fuel suppliers blend 10 per cent renewable content (such as ethanol) in gasoline from 2020 to 2024, 11 per cent in 2025, 13 per cent in 2028, and 15 per cent in 2030 and onward. The regulation also requires 4 per cent renewable content in diesel.

The use of petroleum fuels in cars and trucks is declining as electrification spreads. As of May 2023, there are more than 118,000 EVs registered in Ontario, including both battery-electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). By 2030, there are expected to be more than one million EVs on the road in Ontario, reducing the use of refined petroleum products like gasoline.

As electric cars use electricity instead of gasoline, they are using a much more affordable fuel. This is especially true if you charge overnight or on weekends when the cost of electricity is lower. The average Ontario driver, travelling 20,000 km per year, can save as much as $2,000 per year on fuel alone.

In other sectors, like shipping, heavy trucking, rail, and aviation, where electrification is more challenging, fuels like sustainable aviation fuel, renewable diesel, renewable natural gas, hydrogen, and fuel cells will help reduce emissions.

Economic growth and electrification driving electricity demand

Introduction

Demand for electricity is projected to increase at unprecedented rates over the next three decades as a result of the government's open for business approach and the energy transition.

Electricity demand is expected to grow significantly more than oil and natural gas and make up an increasing share of Ontario’s overall energy mix. By 2050, IESO forecasts indicate Ontario may need to more than double its generating capacity, from 42,000 MW to 88,000 MW, to meet demand for electricity.

This chapter explores the three main drivers of demand — economic growth, electrification, and a growing population.

Economic growth

Ontario is attracting unprecedented investments in electric vehicles (EV), battery manufacturing, clean steelmaking and other sectors creating new jobs and driving demand for new electricity generation and storage.

Five major investments alone, when they come online, will increase industrial demand by the equivalent of 21 per cent of today’s industrial load (Table 2.1).

In April 2023, the Ontario government announced a $7 billion investment by Volkswagen Group to build an EV battery manufacturing facility in St. Thomas. The plant, Volkswagen’s largest to date, will create up to 3,000 direct and 30,000 indirect jobs. Construction is expected to begin in 2024 and once complete in 2027, the plant will produce batteries for as many as one million EVs a year, bolstering Canada’s domestic battery manufacturing capacity to meet demand now and into the future. It will be the largest manufacturing plant in Canada generating about $200 billion in value.

The St. Thomas plant will be Ontario’s second EV battery manufacturing plant, following a decision by NextStar Energy, a joint venture between LG Energy Solution, Ltd. (LGES) and Stellantis N.V., to build a battery manufacturing facility in Windsor.

With a production capacity of 45 gigawatt hours (GWh) of EV batteries each year, the Windsor battery facility will employ an estimated 2,500 people and supply Stellantis plants across North America. Construction is underway with production expected to begin in the first quarter of 2024. The plant will be fully operational by 2025. In addition, Stellantis is investing $3.6 billion to retool its existing plants in Windsor and Brampton.

Ontario has also secured a major investment from Umicore Canada Inc. to establish its first North American EV battery component manufacturing plant, in Loyalist Township near Kingston.

Each component of the battery supply chain plays an important and interconnected role in the production of electric vehicles. These historic investments will advance Ontario’s mission to become a globally competitive, vertically integrated EV battery manufacturing jurisdiction and build an end-to-end supply chain to serve the North American EV market. They are helping to secure the province’s position as a competitive player in the low-carbon economy of the future.

Ontario’s combination of top-quality manufacturing talent, clean competitive electricity supply, access to investment-ready sites and commitment to streamline the approvals process continues to make the province a destination for major investments, ensuring that everyone in the province benefits from the auto sector’s long-term growth and success.

Ontario has also secured major investments in clean steelmaking projects in Hamilton and Sault Ste. Marie with ArcelorMittal Dofasco and Algoma Steel. These once-in-a-generation investments will transform the province into a world-leading producer of green steel.

These investments will also boost the robust auto parts supply chain and skilled workforce in communities with deep roots in steel manufacturing and help meet the global demand for low-carbon auto production.

| Recent Investments | (TWh) |

|---|---|

| EV battery manufacturing | 5.4 |

| Green Steel Production | 2.6 |

| Total | 8.0 |

As Ontario continues to secure massive investments, electricity demand from our industrial sector will continue to rise. Taken together, the forecast increased electricity demand from Umicore, Stellantis, Volkswagen and the electric arc furnace at Algoma and Dofasco are equivalent to the annual electricity consumption of the Ottawa Region.

Clean energy credits support investment

Access to clean energy is a key consideration for businesses making investment decisions. Companies around the world want to invest in jurisdictions with affordable, reliable, clean energy, creating a competitive advantage for Ontario.

Greenhouse gas emissions per kilowatt-hour from Ontario’s electricity system are 17 times lower than Michigan’s and 20 times lower than Ohio’s, providing a major competitive advantage over neighbouring Great Lakes States in attracting industrial and commercial investment.

To drive new investment, Ontario has introduced a Clean Energy Credit Registry to support the sale of clean energy credits (CECs). The registry will help boost competitiveness and attract jobs by helping businesses meet their environmental and sustainability goals. Proceeds from the sale of CECs will help keep costs down for electricity ratepayers and fund the construction of clean electricity projects through the new Future Clean Electricity Fund. The fund will help the province compete for new investments in electric vehicle and battery manufacturing, clean steel, and other sectors while continuing to build a clean economy.

The introduction of Clean Energy Credits in Ontario is an important step to make the allocation of renewable energy transparent and to support industrial customers as they fulfill their sustainability requirements.

Dr. Michael Reik Head of Rollout Standard Factory St. Thomas, PowerCo SE/Volkswagen

Electrification

These historic investments in EV and battery manufacturing — and many more — reflect the province’s economic competitiveness and will help build our reputation as a leader in clean transportation solutions.

As of May 2023, there are more than 118,000 EVs registered in Ontario, including both battery-electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). By 2030, there are expected to be more than one million EVs on the road in Ontario.

The IESO's 2022 Annual Planning Outlook states that electricity demand from transportation is forecast to grow from about 2 TWh in 2024 to 30 TWh in 2043, an average annual growth rate of 17 per cent. Investments in generation will ensure that energy will be there to power the future of Ontario’s transportation systems.

Many of the impacts from electrification of transportation will also be felt at the distribution level. That’s why Ontario is creating the right conditions to ensure the electricity system is ready for charging infrastructure, and that the charging infrastructure deployed can help reduce the impact of EVs on the grid.

The Minister’s 2021 mandate letter to the OEB noted that increased adoption of EVs is expected to impact Ontario’s electricity system in the coming years and the OEB must take steps to facilitate their efficient integration into the provincial electricity system, including providing guidance to LDCs on system investments to prepare for EV adoption.

Based on Minister’s direction, the OEB developed its Electric Vehicle Integration (EVI) initiative to inform actions it may take to support the efficient integration of EVs and ensure that Ontario has the transmission and distribution systems to charge them. As this work continues, Ontario is also exploring ways to reduce red tape and enable the province-wide deployment of EV charging infrastructure.

Electrification will have an impact in other areas, including the increasing use of heat pumps in hybrid home heating systems, supported by government programs to reduce cost and encourage adoption.

Population growth

Ontario’s population is expected to grow by almost 15 per cent or two million people by the end of this decade. Ontario is committed to build 1.5 million new homes to accommodate this growing population.

All of these homes will require reliable electricity, especially as households increase their consumption to heat and cool their homes and power their vehicles.

Powering Ontario this decade

Introduction

For the first time since 2005, demand for electricity in Ontario is rising. Economic development including historic investments in electric vehicles and battery manufacturing, together with population growth and electrification, are driving the demand for electricity.

Electricity demand in Windsor-Essex and Chatham-Kent alone are forecast to grow from roughly 500 MW of peak demand today to about 2,100 MW in 2035, almost the equivalent of adding a city the size of Ottawa to the grid.

The Ontario government is acting on many fronts to ensure that the province has the electricity it needs to power economic growth and meet increasing demand this decade. It is making major investments in refurbishing the province’s nuclear fleet, building new transmission lines, and expanding energy efficiency programs.

The province is taking the lead in cutting-edge technologies including building Canada and the G7’s first grid-scale SMRs, which will supply enough clean electricity to power 300,000 homes. Leadership in the SMRs field is also providing Ontario with new export opportunities and helping the province become a key player in the race to produce cost-competitive green hydrogen.

Ontario is also moving forward with the procurement of clean energy storage and incremental natural gas generation, which will be required to meet peak demand as nuclear reactors are taken temporarily offline for refurbishment while demand for electricity continues to increase. Natural gas currently plays a pivotal role in supporting grid reliability — with the ability to respond to changing system needs in ways other forms of supply simply cannot.

This chapter provides details of the actions that the provincial government is taking on all fronts to ensure reliable electricity supply this decade.

Nuclear energy

Nuclear refurbishment

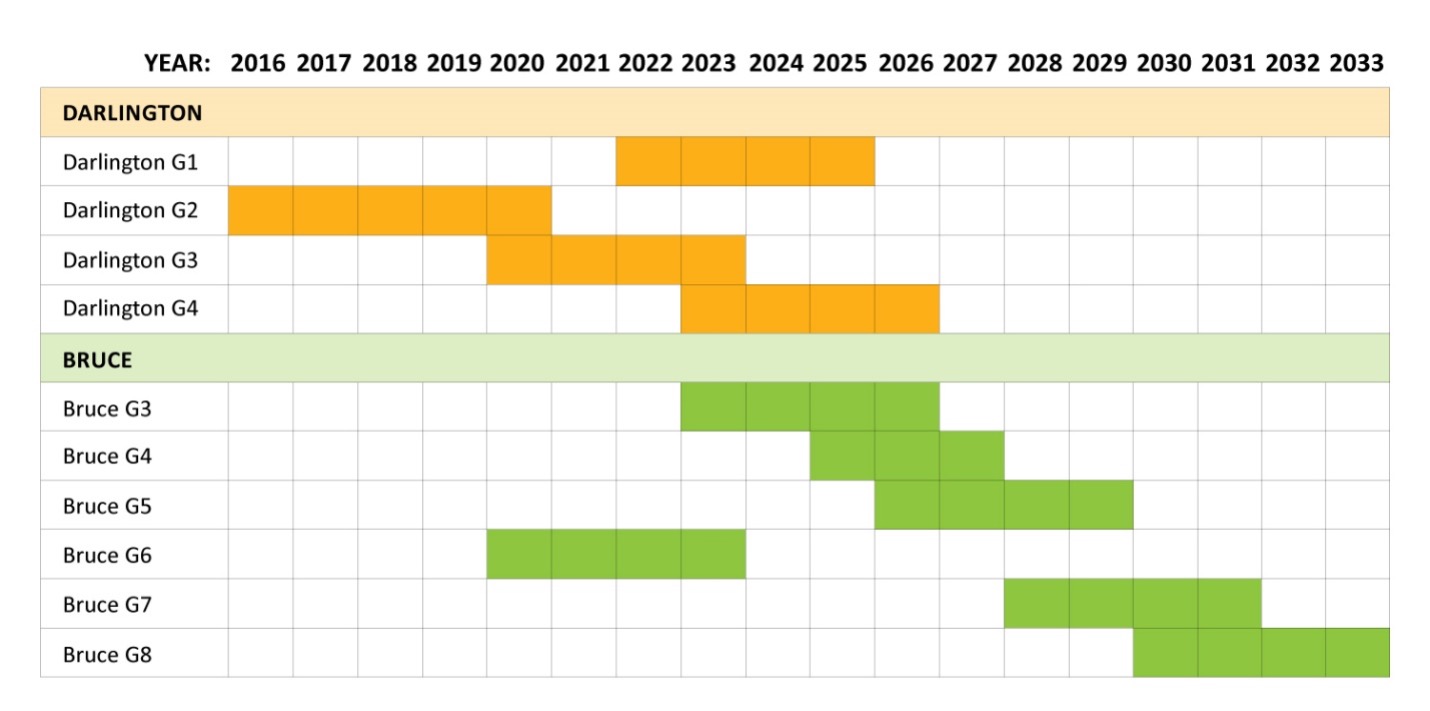

CANDU reactors require refurbishment after 30–40 years of operation. The Darlington Nuclear Generating Station and Bruce Nuclear Generating Station have now reached that point in their operating lives and refurbishments are underway. These are currently the largest clean energy projects in Ontario and these scheduled refurbishments have long been anticipated and planned for.

The Darlington refurbishment will secure 3,500 MW of clean, reliable, low-cost power until 2055. It is expected to contribute a total of $90 billion to Ontario’s GDP and increase employment across the province by an average of 14,200 jobs a year.

The Bruce refurbishment will secure at least 6,550 MW of clean, reliable, low-cost generation capacity over the long-term and enable Bruce Nuclear Generating Station operation to 2064. The refurbishment and long-term operation is expected to secure 22,000 direct and indirect jobs a year and generate $4 billion in annual economic benefits in communities throughout the province.

Once completed, these powerful CANDU reactors will secure a clean energy supply for Ontario for decades to come, as well as a supply of life-saving medical isotopes.

Figure 3.1: Darlington and Bruce refurbishment schedule

As the world’s largest operating nuclear facility, Bruce Power is investing in securing our future through our Life-Extension Program that enables operation to 2064 and beyond, while innovating to produce even more clean energy from our existing reactors.

Mike Rencheck President and CEO, Bruce Power

Continued safe operations of pickering nuclear generating station

The provincial government is also supporting OPG’s plan to continue the safe operation of the Pickering Nuclear Generating Station. Pickering A would operate until 2024, and Pickering B would operate through September 2026 to provide affordable, reliable, zero-emissions electricity.

Safety is always the top priority and OPG will continue to ensure the safe operation through rigorous monitoring, inspections and testing of the Pickering facility.

Operating Pickering through September 2026 will provide affordable and reliable electricity to power strong economic growth and electrification, lower emissions, support the continued production of life-saving medical isotopes and protect good jobs in Durham Region. It will reduce GHG emissions by 2.1 megatonnes in 2026 alone, the equivalent of taking 643,000 cars off the road and representing an approximate 20 per cent reduction in projected emissions from the electricity sector in that year.

In June 2023 OPG submitted their official application to the Canadian Nuclear Safety Commission (CNSC) to amend the power reactor operating license to operate Pickering B through September 2026. The final decision regarding the safe operating life of Pickering will be made by the CNSC following a comprehensive, transparent process.

Operating Pickering B beyond 2026 would require a refurbishment, similar to Darlington and Bruce. The Ontario government has asked OPG to update its feasibility assessment for refurbishing Pickering B units, which the province expects to receive later this year. Pickering A is expected to reach end of life in 2024 and cease operations.

Pickering Nuclear Generating Station has never been stronger in terms of both safety and performance. Due to ongoing investments and the efforts of highly skilled and dedicated employees, Pickering can continue to safely and reliably produce the clean electricity Ontarians need.

Ken Hartwick President and CEO, Ontario Power Generation

Darlington small modular reactor (SMR) build

Ontario’s CANDU reactors' unique ability to be refurbished after 30–40 years helped Canada’s nuclear sector to continue to thrive. In turn, this has positioned Ontario as a leading jurisdiction in nuclear technology at a time when tackling climate change and the need for clean zero-emitting energy is an international priority.

The provincial government is building on this experience and moving forward with the first grid-scale SMR project in North America at the Darlington nuclear site to help meet the demand for reliable, affordable, and clean electricity, while at the same time showcasing Ontario’s nuclear expertise to the world and leveraging it to create export opportunities to drive economic growth.

The new SMR at Darlington will be Ontario’s first nuclear reactor build in a generation. This project alone will deliver 300 MW of electricity, which is enough to power 300,000 homes. OPG is partnering with GE Hitachi Nuclear Energy, SNC-Lavalin, and Aecon on the project, with construction scheduled to be complete by 2028. Its “modular” construction aims to help this design to be mass-produced and easily replicable, helping to further drive down production costs of clean energy and to cement Ontario’s nuclear supply chain as the supplier of clean energy technology to the world.

The Darlington SMR project is situated on the traditional and treaty territories of the seven Williams Treaties First Nations and is also located within the traditional territory of the Huron Wendat peoples. OPG is actively engaging and consulting with potentially impacted Indigenous communities, including exploring economic opportunities in the Darlington SMR project such as commercial participation and employment.

The Canada Infrastructure Bank (CIB) has invested $970 million in the project to date, its largest investment in any clean energy project. The investment marked major step forward in demonstrating the significant opportunities of SMRs, and the important role of nuclear power in meeting future demand for reliable, zero-emissions power.

Ontario’s leadership in new nuclear technologies, particularly SMRs, is raising the province’s international profile to an unprecedented level.

Last November, the Minister of Energy concluded a successful trade mission to Czech Republic, Poland, and Estonia to discuss SMRs, strengthen existing relationships and support European allies looking to build their energy independence in the face of Russian aggression and to help reduce their reliance on coal power. The mission resulted in signing agreements with major European energy companies ČEZ and Synthos Green Energy.

Other jurisdictions are following Ontario’s lead. Earlier this year, Estonia’s Fermi Energia chose GE Hitachi’s SMR technology — the BWRX-300 — for deployment, citing the Darlington SMR project as a factor in their selection decision. Poland’s Synthos Green Energy has also signed agreements with Ontario manufactures to build components in Ontario for SMRs that will be deployed in Poland, as well as a letter of intent with OPG to provide nuclear expertise to Synthos in developing its SMR program.

Competitive procurements for new build electricity generation and storage

In October 2022 the Minister of Energy directed the IESO of new electricity generation and storage resources through competitive procurements to ensure the province has the electricity it needs this decade to support a growing population and economy. This procurement will target 2,500 MW of stand-alone energy storage resources and a maximum of 1,500 MW of natural gas generation.

Energy storage

As Ontario becomes a leader in the batteries of the future by connecting resources and workers in northern Ontario with the manufacturing might of southern Ontario, the procurement of a targeted 2,500 MW of clean energy storage represents the largest battery procurement in Canada’s history.

In the first round of the procurement which concluded in May 2023, the IESO has acquired seven new battery storage projects, representing 739 MW of new storage supply.

These facilities will support the operation of Ontario’s clean electricity grid by drawing and storing electricity off-peak when power demand is low and intermittent renewable generation is high and returning the power to the system at times of higher electricity demand. The grid will benefit from using more non-emitting energy at peak. Grid-scale energy storage also offers the potential to provide critical flexibility to help keep the system in balance.

Most of these projects are in partnership with Indigenous communities, which have at least 50 per cent economic interest in five of the seven projects. These projects complement the recent agreement for the 250 MW Oneida Energy Storage Facility and conclude the first of two stages within the procurement.

These projects are scheduled to be operational in 2026, at which time Ontario will have Canada’s three largest battery projects, located in Hagersville (285 MW), Ohsweken (250 MW), and Napanee (250 MW).

The current procurement for 4,000 MW of new capacity will run through April 2024.

| Storage type | Grid-connected storage 2023 (MW) | Projections for 2026 (MW) |

|---|---|---|

| Batteries | 43 | 1032 |

| Flywheels | 7 | 7 |

| Hydrogen | 2 | 2 |

| Pumped Hydro | 174 | 174 |

| Compressed air | 2 | 2 |

| Total | 228 | 1217 |

Energy Storage Canada applauds Ontario’s Minister of Energy, Todd Smith, whose government has just committed to the largest storage specific procurement in Canada. The Ford government recognizes the critical role clean energy storage resources must play in ensuring reliability, resiliency and helping to reduce Greenhouse Gas (GHG) emissions in Ontario’s electricity grid.

Justin Rangooni Executive Director, Energy Storage Canada

Natural gas generation

Natural gas generation currently plays a key role in supporting grid reliability, with the ability to respond to changing system needs in ways other forms of supply cannot.

When electricity demand spikes on hot summer days, Ontario’s natural gas generators can be turned on and ramped up quickly to ensure the province does not need to be reliant on emergency actions such as conservation appeals and rotating blackouts to stabilize the grid, according to the IESO.

While during most hours throughout the year Ontario can meet its electricity generation needs with nuclear, hydroelectric, bioenergy, wind and solar power, natural gas generation also acts as the province’s insurance policy that can be turned on if the wind is not blowing or sun is not shining, or another generator is offline for repairs repairs (see table 3.3). There is currently no like-for-like replacement for natural gas and the IESO has concluded it is needed to maintain system reliability until nuclear refurbishments are complete and new non-emitting technologies such as storage mature.

This means natural gas will be needed until reliable replacements (such as hydrogen) have been identified, put into service, and demonstrated their capability.

To meet this near-term need the IESO has secured 586 MW of new natural gas capacity from expansions and efficiency upgrades at existing sites through the first round of procurements.

| Date | Hour | Natural Gas | Other Generation |

|---|---|---|---|

| 2022-05-06 | 1 | 129 | 14635 |

| 2022-05-06 | 2 | 128 | 14424 |

| 2022-05-06 | 3 | 127 | 14330 |

| 2022-07-19 | 4 | 128 | 14314 |

| 2022-05-06 | 5 | 126 | 14670 |

| 2022-05-06 | 6 | 127 | 15749 |

| 2022-05-06 | 7 | 127 | 16498 |

| 2022-07-19 | 8 | 127 | 16881 |

| 2022-07-19 | 9 | 127 | 16759 |

| 2022-05-06 | 10 | 127 | 16683 |

| 2022-05-06 | 11 | 127 | 16521 |

| 2022-05-06 | 12 | 127 | 16415 |

| 2022-05-06 | 13 | 141 | 16106 |

| 2022-05-06 | 14 | 151 | 15674 |

| 2022-05-06 | 15 | 156 | 15710 |

| 2022-05-06 | 16 | 154 | 15902 |

| 2022-05-06 | 17 | 154 | 16254 |

| 2022-05-06 | 18 | 154 | 16674 |

| 2022-05-06 | 19 | 128 | 16911 |

| 2022-05-06 | 20 | 127 | 17016 |

| 2022-05-06 | 21 | 127 | 17298 |

| 2022-05-06 | 22 | 127 | 16391 |

| 2022-05-06 | 23 | 127 | 15298 |

| 2022-05-06 | 24 | 127 | 14326 |

Source: IESO

| Date | Hour | Natural Gas | Other Generation |

|---|---|---|---|

| 2022-07-19 | 1 | 686 | 15021 |

| 2022-07-19 | 2 | 542 | 15135 |

| 2022-07-19 | 3 | 732 | 14936 |

| 2022-07-19 | 4 | 637 | 14647 |

| 2022-07-19 | 5 | 758 | 14277 |

| 2022-07-19 | 6 | 1364 | 13843 |

| 2022-07-19 | 7 | 1936 | 14320 |

| 2022-07-19 | 8 | 2740 | 14832 |

| 2022-07-19 | 9 | 3655 | 14911 |

| 2022-07-19 | 10 | 4007 | 15035 |

| 2022-07-19 | 11 | 4574 | 15246 |

| 2022-07-19 | 12 | 4541 | 15799 |

| 2022-07-19 | 13 | 4643 | 16156 |

| 2022-07-19 | 14 | 4813 | 16409 |

| 2022-07-19 | 15 | 4947 | 16830 |

| 2022-07-19 | 16 | 4847 | 17240 |

| 2022-07-19 | 17 | 4825 | 17296 |

| 2022-07-19 | 18 | 5011 | 17062 |

| 2022-07-19 | 19 | 5057 | 16857 |

| 2022-07-19 | 20 | 5373 | 16308 |

| 2022-07-19 | 21 | 5311 | 16447 |

| 2022-07-19 | 22 | 4675 | 15891 |

| 2022-07-19 | 23 | 4060 | 15472 |

| 2022-07-19 | 24 | 3358 | 15383 |

Source: IESO

Energy efficiency program enhancements

Reducing electricity demand through energy efficiency programs, also known as Conservation and Demand Management (CDM), is an essential, cost-effective component of the province’s strategy to meet the increased demand for electricity in this decade and beyond.

Electrification of our homes, businesses and transportation means we will consume more electricity than ever before. This increases the importance and value of maximizing energy efficiency, as it allows us to avoid building even more supply in the future.

The IESO's Pathways to Decarbonization report identifies acceleration of energy efficiency as a no-regret action to cost-effectively help meet growing demand. It assumes the highest potential from its energy efficiency programs.

In September 2022, the provincial government increased funding for energy-efficiency programs by $342 million, bringing total funding to more than $1 billion over the current 2021–2024 CDM framework period.

This additional funding is supporting four new and expanded programs to help families and businesses reduce their electricity use and save money on their energy bills while helping to meet the province’s emerging electricity system needs by reducing demand at peak times. These are:

- A new Peak Perks Program was launched in Spring 2023 for homes with existing central air conditioning and smart thermostats to help deliver peak demand reductions. Households that meet the eligibility criteria and voluntarily enroll in this program will be paid a $75 incentive for giving their thermostat manufacturer secure access to their thermostat. This access will enable the manufacturer to reduce the participants’ air conditioner by no more than three degrees for up to three hours on up to ten summer afternoons. This will help reduce provincial peak electricity demand, while also help the participants lower their monthly electricity bills and contribute to reducing the province’s greenhouse gas emissions. Peak Perks has been designed to ensure participants are always in control and they can opt-out of any temperature change event, without impacting their incentive, by adjusting their thermostat. There are an estimated 600,000 smart thermostats installed across Ontario.

- Targeted support for greenhouses in Southwest Ontario, including incentives to install LED lighting, non-lighting measures or behind-the-meter DER, such as combined solar generation and battery storage.

- Enhancements to the Save On Energy Retrofit Program for business, municipalities, institutional and industrial consumers to include custom energy-efficiency projects. Examples of potential projects could include chiller and other HVAC upgrades for a local arena, building automation and air handling systems for a hospital, or building envelope upgrades for a local business, like new insulation or windows.

- Enhancements to the Local Initiatives Program to reduce barriers to participation and to add flexibility for incentives for DER solutions. The Local Initiatives Program provides targeted programs for areas of the province with identified system needs. For example, in Etobicoke the CoolSaver program helps homeowners and tenants upgrade their home cooling systems by offering incentives for air conditioner tune-ups, central air conditioner replacements, portable dehumidifiers and smart thermostats.

These enhancements are expected to have a particular impact in Southwest Ontario, with regional peak demand savings of 225 MW helping to alleviate electricity system constraints in the region and foster economic development.

Ontario’s energy efficiency programs will also reduce GHG emissions by an estimated three million tonnes of GHG emission reductions over the initiative’s lifetime, the equivalent to taking approximately 900,000 vehicles off the road for one year.

Save On Energy

Energy efficiency programs are delivered by the IESO through its Save On Energy brand and are available for income-eligible residents, small businesses, large businesses, and First Nations communities. They focus on cost-effectively meeting the needs of Ontario’s electricity system through provincial peak demand reductions and targeted approaches to address regional and local electricity system needs.

We applaud the government for moving to expand provincial conservation and demand management (CDM) programs, which are the most cost-effective way to meet both electricity system needs and emission reductions objectives.

Vince Brescia President and CEO, Ontario Energy Association

Ontario’s Greenhouse Vegetable Growers are on the technological cutting-edge of safe, sustainable and secure food production — here at home and around the world. Ontario’s Save on Energy initiatives are critical tools that allow greenhouse farmers to be competitive and environmentally sustainable. This is a win-win-win for our sector, the provincial government and the people of Ontario.

George Gilvesy Chair, Ontario Greenhouse Vegetable Growers

Ontario’s next energy efficiency framework

Energy efficiency and conservation programs have traditionally been under time-bound frameworks with fixed terms. For example, electricity energy efficiency programming under the current 2021–24 Conservation and Demand (CDM) Framework will end in 2024. A more efficient, long-term model is needed to recognize the role of energy efficiency as a non-emitting resource that better responds to evolving system, market, and customer needs.

In the summer of 2023, the Ministry of Energy is launching a public and stakeholder consultation, including targeted outreach to Indigenous communities in Ontario on the scoping of future energy efficiency and conservation frameworks. This will inform the Ministry’s work on developing a proposed path forward for CDM programming for January 1, 2025 and beyond.

The consultation will build on the 2021–2024 CDM Framework Mid-Term Review, which was conducted in 2022 by the IESO and included two extensive stakeholder engagements. Topics will include the primary objectives of electricity energy efficiency programming, considerations for emission reductions, the definition of CDM including treatment of beneficial electrification and fuel switching measures and improving customer experience including the coordination of CDM with natural gas demand side management programs.

Re-contracting Ontario’s small hydroelectric stations

Ontario’s fleet of 107 small hydroelectric generating stations play an important role, both in generating electricity and providing benefits such as recreational opportunities, flood control, irrigation, tourism and supporting local employment and economic development. To secure these benefits and maximize the use of these existing generating sites, some of which are 100 plus years old, the Minister of Energy has asked the IESO to design a Small Hydro Program to recontract existing facilities whose current agreements are coming to an end.

At the request of the province, OPG has several projects underway to modernize small hydro generating facilities to improve existing generating capacity, uncover additional efficiencies and in some cases, rehabilitate an entire site. Among the project now underway:

- Calabogie GS Redevelopment Project in eastern Ontario that will double hydro generation from 5 MW to approximately 11 MW.

- Smoky Falls Dam Safety Project that will rehabilitate the 100-year-old spillway and sluiceway structures along the Lower Mattagami River at OPG’s Smoky Falls Generating Station in Northeastern Ontario.

- Little Long Dam Safety Project, which will increase the discharge capacity at the existing eight-gate Adam Creek spillway on the Little Long Reservoir in Northeastern Ontario.

The provincial government has also asked OPG to identify additional opportunities for hydroelectric power generation and engage with Indigenous communities to understand how Indigenous communities could participate in and benefit from future hydroelectric generation projects.

With over 100,000 kilometres of rivers and streams, Ontario has a significant potential for hydroelectric power generation, which can be developed by individuals, businesses, or communities. The viability of new projects is largely dependent on the cost to connect to the province’s transmission grid.

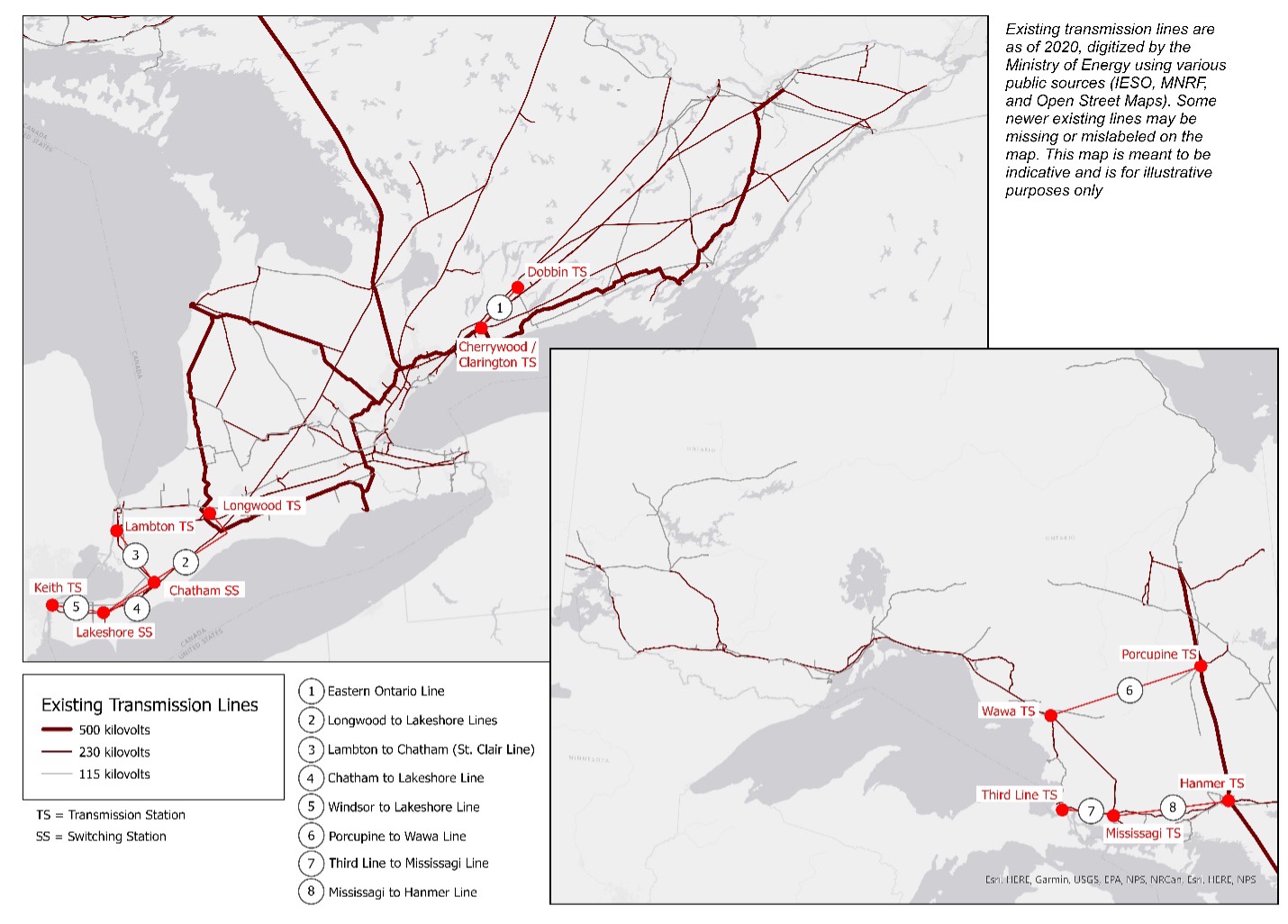

Transmission expansion

High voltage transmission lines act as a highway that carries electricity from where it is produced to local distribution companies that deliver electricity to power homes and businesses. Electricity demand in the Windsor-Essex and Chatham areas is forecast to grow from roughly 500 megawatts (MW) of peak demand today to about 2,100 MW in 2035, which is almost equivalent to adding a city the size of Ottawa to the grid. This demand is primarily driven by rapid growth in advanced manufacturing, greenhouse agriculture and electric vehicle battery manufacturing, an economic success story for the region.

New electricity transmission infrastructure is the most cost-effective way to meet this growing electricity demand and continue to drive economic growth in the region. Last year, Ontario acted to ensure the efficient and timely development of five new electricity transmission infrastructure projects in Southwest Ontario. These transmission lines include:

- Chatham to Lakeshore Line

- St. Clair Line running from Lambton to Lakeshore

- Two Longwood to Lakeshore Lines and

- Windsor to Lakeshore Line

The government has issued an Order-in-Council declaring three transmission line projects as provincial priorities, streamlining the OEB's regulatory approval process for these lines so projects can be brought online earlier. The transmission projects between London, Windsor and Sarnia represent an investment of more than $1 billion and are proposed to be developed in phases through 2030. These transmission lines also present significant economic opportunities for Indigenous communities, through potential equity partnerships or other forms of participation.

Supporting growth in Northeastern Ontario