Agencies and Appointments Directive

This directive sets out the rules and accountability framework for provincial agencies, short-term advisory bodies and special advisors, as well as the remuneration guidance for government appointments.

Introduction

The Agencies and Appointments Directive is a Management Board of Cabinet directive, issued under the Management Board of Cabinet Act.

All provincial agencies are part of government and are required to comply with legislation, government directives, policies and guidelines applicable to them. They are led by government appointees and are expected to provide a high level of goods and services to the public. Short-term advisory bodies and special advisor positions provide advice or recommendations on specific subject matter.

Government appointees are individuals appointed to perform specific functions for a provincial agency or short-term advisory board or as a special advisor. The provincial government may also make appointments to other entities, as provided for in enabling legislation. All appointees are accountable to a minister. Appointees are required to perform their functions in a professional, ethical and competent manner and avoid any real or perceived conflict of interest.

Purpose

The purpose of this directive is to set out the rules and accountability framework for:

- Provincial agencies;

- Short-term advisory bodies and special advisors;

- Government appointments; and

- Remuneration.

The directive is divided into three main parts:

- Part 1 sets out the requirements for provincial agencies;

- Part 2 sets out the requirements for short-term advisory bodies and special advisors; and

- Part 3 sets out the requirements for appointments and remuneration.

Application and Scope

The application and scope are different for each of the three main parts.

Part 1: Provincial Agencies

This part of the directive applies to all ministries and provincial agencies, including their subsidiaries.

Part 1 sets out:

- Types of provincial agencies (board-governed, non-board-governed, advisory);

- Requirements for establishing, changing (e.g., mandate change), merging and dissolving provincial agencies;

- The accountability framework for provincial agencies that includes the roles of provincial agencies, responsible ministries and Treasury Board/Management Board of Cabinet (TB/MBC); and

- A risk-based approach to managing provincial agency oversight.

Part 2: Short-term Advisory Bodies and Special Advisors

This part of the directive applies to all ministries and to all people appointed or re-appointed by the government to provide advice or make recommendations to a minister or the Premier as a member of a short-term advisory body or as a special advisor.

Part 2 sets out requirements for:

- Creation of short-term advisory bodies and special advisor positions;

- Appointment and remuneration of one or more appointees to short-term advisory bodies;

- Appointment of special advisors; and

- The accountability framework for short-term advisory bodies and special advisors.

Part 3: Government Appointments and Remuneration

This part of the directive applies to all ministries and to all persons appointed or re-appointed by the government to undertake any function on behalf of the government other than individuals referred to in Part 2 of this directive serving on short-term advisory bodies or as special advisors. This includes persons appointed by the Lieutenant Governor in Council (LGIC) or by a minister to serve on the board of a provincial agency or other entity under the authority of a ministry act or other legislation or the royal prerogative.

Part 3 sets out requirements for the appointment and remuneration of:

- All government appointees who are accountable to a minister of the Government of Ontario other than individuals referred to in Part 2 of this directive;

- All government appointees to provincial agencies; and

- All appointments made by the province to other entities where appointees are not directly accountable to a minister of the Government of Ontario (for example, a police services board, port authority).

This part does not apply to persons employed under Part III of the Public Service of Ontario Act, 2006 (PSOA) who hold a government appointment in addition to their employment except where indicated otherwise.

Administration

Decisions and Actions

There is no discretion to depart from the principles and requirements of this Directive.

All decisions should be taken carefully and documented. Decisions should be:

- able to stand up to scrutiny by auditors and members of the public;

- properly explained and documented;

- fair and equitable;

- reasonable; and

- appropriate

Operational Direction

The Secretary of Management Board of Cabinet (MBC) has the authority to issue mandatory operational policies consistent with this Directive. This is delegated authority from MBC and the rules in an operational policy carry the same weight as the rules in the Directive.

Exemption

The rules in this Directive are mandatory. A ministry must seek TB/MBC approval if, in exceptional circumstances, the ministry, or a provincial agency for which the ministry is responsible, requires an exemption from all or part of this Directive. The ministry must set out the rationale for the exemption in a business case.

The Secretary, MBC has the authority to approve exemptions from the mandatory operational policies.

Part 1 — Provincial Agencies

1.1 Executive Summary — Accountability Framework and Mandatory Requirements

The minister’s accountability for each provincial agency cannot be delegated. Certain provincial agency oversight activities, however, can be delegated to appropriate ministry officials. Consistent with this principle, TB/MBC or the minister can request risk-based reviews of any provincial agency.

TB/MBC monitoring of ministry oversight and compliance is required for all board-governed, non-board-governed and advisory agencies.

Accountability requirements are met by:

- Complying with the memorandum of understanding (MOU) or Terms of Reference (TOR);

- Meeting expectations and advancing government priorities;

- Establishing and implementing effective business plans to guide action and deliver on the agency mandate and government priorities;

- Reporting to the public on financial results and the delivery of the agency mandate through an annual report;

- Reporting and mitigating risks through risk assessment and action plans;

- Providing information and reports as requested by the responsible ministry or Treasury Board Secretariat (TBS) within the timelines provided;

- Taking corrective actions based on performance;

- Timely exchange of information on the plans, strategies, operations and administration of the agency; and

- Ensuring a collaborative partnership between the ministry and the agency.

This table summarizes the mandatory requirements for all three types of provincial agencies.

| Requirement | Board-Governed agencies | Non-Board-Governed agencies | Advisory agencies |

|---|---|---|---|

| Directives | Agencies must comply with all directives whose application and scope covers board-governed agencies, unless exempted by TB/MBC. Agencies may also be required to ensure that their directives and policies adhere to certain government directives, policies and guidelines, including those for human resources, while being mindful of collective agreement and bargaining obligations. | Agencies must comply with all directives unless exempted by TB/MBC. Ministries provide administrative support and are subject to all directives. | Agencies must comply with all directives unless exempted by TB/MBC. Ministries provide administrative support and are subject to all directives. |

| Mandate reviews | Required once every six years. | Required once every six years. | Required once every six years. |

| Annual Letter of Direction | The minister must provide the annual letter of direction to the agency in time to inform the business plan, no later than 180 calendar days prior to the start of the agency’s next fiscal year. TBS will provide ministries with the government priorities for the agency sector for the coming year by September 1. The annual letter of direction must include all government priorities for the agency sector for the coming year. | Not required. | Not required. |

| Business plan | Agencies must submit the draft business plan to the ministry’s chief administrative officer (CAO) or executive lead for provincial agencies no later than 90 calendar days prior to the beginning of the agency’s fiscal year. Ministry staff will review the business plan and provide the agency with feedback including any missing requirements to be addressed. The board-approved business plan must be submitted to the minister no later than 30 calendar days prior to the beginning of the provincial agency’s fiscal year. The business plan must demonstrate the agency’s plans in fulfilling the government priorities set out in the annual letter of direction. When the business plan is submitted to the minister for approval, an attestation memo from the agency chair must also be submitted that details how the agency plans to achieve each government priority. The minister must approve or provide suggested changes to the business plan no later than 30 calendar days from the minister’s receipt of the plan. | Agencies must submit the draft business plan to the ministry’s chief administrative officer (CAO) no later than 90 calendar days prior to the beginning of the agency’s fiscal year. Ministry staff will review the business plan and provide the agency with feedback including any missing requirements to be addressed. The chair-approved business plan must be submitted to the minister no later than 30 calendar days prior to the beginning of the provincial agency’s fiscal year. The minister must approve or provide suggested changes to the business plan no later than 30 calendar days from the minister’s receipt of the plan. | Not required. |

| Annual report | Agencies must submit the annual report to the ministry no later than 120 calendar days after the provincial agency’s fiscal year-end, and it must be reviewed by ministry staff. Or, where the Auditor General is the auditor of record, no later than 90 calendar days from the provincial agency’s receipt of the audited financial statements. Ministry staff will review the report and provide the agency with feedback including any missing requirements to be addressed. The annual report must demonstrate how the agency has fulfilled the expectations and government priorities set out in the annual letter of direction. When the annual report is submitted to the minister for approval, an attestation memo from the agency chair must also be submitted that details how the agency has achieved each government priority. The minister must approve no later than 60 calendar days from the ministry’s receipt of the report. The minister must table an agency’s annual report in the Legislative Assembly no later than 30 calendar days from minister’s approval of the report (when the Legislative Assembly is not sitting, the ministry will file the report with the Clerk’s Office). | Agencies must submit the annual report to the ministry no later than 90 calendar days after the provincial agency’s fiscal year-end. Ministry staff will review the report and provide the agency with feedback including any missing requirements to be addressed. The minister must approve no later than 60 calendar days from the ministry’s receipt of the report. The minister must table an agency’s annual report in the Legislative Assembly no later than 30 calendar days from minister’s approval (when the Legislative Assembly is not sitting, the ministry will file the report with the Clerk’s Office). | Not required by directive. Where required by constituting instrument or other direction, must follow formatting requirements set out in S.1.9.9 of this directive. |

| Certificate of Assurance (CoA) | The chair of a board-governed agency must send an attestation to the responsible minister, in alignment with the Office of the Provincial Controller Division (OPCD)’s CoA instructions, confirming that the agency has maintained an effective system of internal controls:

To support the chair, chief executive officers (CEOs) of provincial agencies must attest to the chair that the provincial agency is in compliance with mandatory requirements. The CEO and the deputy minister or an approved delegate should meet regularly and as required to discuss CoA exceptions and fraud instances and their related action plans. | Non-board-governed agencies must submit CoA (including fraud) attestations in accordance with their reporting ministry’s cascading CoA process. | Not required. |

| Public posting | MOU, business plan, and annual report must be made available to the public on a government or provincial agency website no later than 30 calendar days from minister’s approval of each. The annual letter of direction must be made available to the public on a government or provincial agency website at the same time as the agency’s business plan. | MOU, business plan, and annual report must be made available to the public on a government or provincial agency website no later than 30 calendar days from minister’s approval of each. | Not required. |

| Expense information for appointees and senior executives must be posted on a government or provincial agency website according to the Travel, Meal and Hospitality Expenses Directive. | Expense information for appointees and senior executives must be posted on a government or provincial agency website according to the Travel, Meal and Hospitality Expenses Directive. | Expense information for appointees must be posted on a government or provincial agency website according to the Travel, Meal and Hospitality Expenses Directive. | |

| Memorandum of Understanding (MOU) Or Terms of Reference (TOR) | Agencies must have an MOU reviewed and signed by the responsible minister and chair. The MOU must also be acknowledged and signed by the deputy minister and CEO (or equivalent). Upon a change in one of the signatories, the newly appointed individual must review and sign the MOU no later than four months from the new appointment. | Agencies must have an MOU reviewed and signed by the responsible minister and chair. The MOU must also be acknowledged and signed by the deputy minister. Upon a change in one of the signatories, the newly appointed individual must review and sign the MOU no later than four months from the new appointment. | Agencies must have a TOR reviewed and signed by the responsible minister and chair. The TOR must also be acknowledged and signed by the deputy minister. Upon a change in one of the signatories, the newly appointed individual must review and sign the TOR no later than four months from the new appointment. |

| Communications protocol | The TB/MBC-approved MOU template must be used by the agency, which includes a communications protocol. | The TB/MBC-approved MOU template must be used by the agency, which includes a communications protocol. | Not required. |

| Risk assessment evaluation | Agencies must identify high risks to the ministry and provide an action plan to mitigate these risks. Ministries are required to complete risk assessment evaluations for each provincial agency. Ministries are required to report to TBS as required by the Office of the Chief Risk Officer on all agency high risks including a description of each high risk, the reasons it is a high risk, what action plan is in place to manage the risk and any other ministry assessment information. | Agencies must identify high risks to the ministry and provide an action plan to mitigate these risks. Ministries are required to complete risk assessment evaluations for each provincial agency. Ministries are required to report to TBS as required by the Office of the Chief Risk Officer on all agency high risks including a description of each high risk, the reasons it is a high risk, what action plan is in place to manage the risk and any other ministry assessment information. | Ministries are required to identify and assess risks and put in place appropriate risk management action plans. Ministries are not required to report high risks to TB/MBC. |

| Financial audit | Financial statements of board-governed agencies must be audited and reported based on meeting audit threshold criteria. | Non-board-governed agencies are administratively part of the ministry and not audited as a separate entity unless specifically required. | A financial audit is not required. |

| Human resources and compensation | Agencies that are not Commission public bodies are required to comply with legislation, government directives, policies and guidelines applicable to them. Further, agencies may be required to ensure that their directives and policies adhere to certain government directives, policies and guidelines, including those for human resources, while being mindful of collective agreement and bargaining obligations. Agencies must report to TBS on workforce and operational data as requested by TBS. | Agencies must follow all government directives, policies and guidelines, including those for human resources. OPS workforce data is to be reported as required through ministry reporting. Non commission public body agencies must report to TBS on workforce and operational data as requested by TBS. | OPS workforce data is to be reported as required through ministry reporting. |

1.2 Framework and Requirements

All provincial agencies and their subsidiaries are part of government and are required to comply with legislation, government directives, policies and guidelines applicable to them.

They are led by government appointees and are expected to provide a high level of goods and services to the public. The provincial agency model allows for operational flexibility dependant on the type of agency.

1.3 Principles

Provincial agency operations are guided by key principles:

- Accountability: Provincial agencies deliver public services and are accountable to the government through the responsible minister. In delivering on their mandate, provincial agencies balance operational flexibility with the minister’s accountability for the provincial agency to Cabinet, the Legislative Assembly and the people of Ontario. Accountability of the minister for each provincial agency cannot be delegated.

Every provincial agency complies with all applicable legislation and Ontario Public Service (OPS) directives and policies. Further, agencies ensure that their directives and policies adhere to certain government directives, policies and guidelines, including those for human resources, while being mindful of collective agreement and bargaining obligations. This includes applicable legislation and directives related to procurement. - Responsiveness: Provincial agencies align their mandate and operations with government priorities and direction. Open and consistent communication between provincial agencies and their responsible ministry helps ensure that government priorities and direction are clearly understood and helps to manage risks or issues as they arise. Provincial agencies deliver a high standard of public service that meets the needs of the population that they serve.

- Efficiency: Provincial agencies use public resources efficiently and effectively to carry out their mandates, as established by their respective constituting instruments. They operate in a cost-effective manner, and pursue efficiencies throughout the agency’s service delivery and administration.

- Sustainability: Provincial agencies operate in a way so that their current form is sustainable over the long-term while delivering a high standard of service to the public.

- Transparency: Good governance and accountability practices for provincial agencies are complemented by transparency in the form of public posting of governance and accountability documents including the business plan, annual report, MOU and expenses information.

- For provincial agencies with adjudicative and regulatory responsibilities, impartial decision-making is the paramount requirement.

1.4 Characteristics of a Provincial Agency

A provincial agency has the following characteristics:

- Established by government through a constituting instrument (under or by statute, Order in Council (OIC) or regulation);

- Accountable to a minister for fulfilling its legislative obligations, the management of the resources it uses, and its standards for any services it provides;

- Majority of its appointments are made by the provincial government;

- Part of the Government of Ontario but is not organizationally part of a ministry; and

- Has authority and responsibility, granted by the government, to perform an ongoing public function or service that involves adjudicative or regulatory decision-making, operational activity, or an advisory function.

1.5 Types of Provincial Agencies

There are three types of provincial agencies:

- Board-governed agencies;

- Non-board-governed agencies (adjudicative tribunals and regulatory agencies and other non-board-governed agencies); and

- Advisory agencies.

1.5.1 Board-Governed Agencies

This type of provincial agency is characterised by the authority to make operating decisions. The board of directors is therefore a governing board.

These provincial agencies have the financial and operating authority to carry on a business and conduct operations in support of their mandates and provincial government priorities. The board of directors of the provincial agency is accountable to the minister for the achievement of its mandate and government priorities, and the chair is the board’s representative to the minister.

Many of these provincial agencies hire their own staff within their own human resource (HR) framework and do not rely on ministries for these functions.

However, all agencies and their subsidiaries are part of government and are required to comply with legislation, government directives, policies and guidelines applicable to them. Further, agencies may be required to ensure that their directives and policies adhere to certain government directives, policies and guidelines, including those for human resources, while being mindful of collective agreement and bargaining obligations. This would also include applicable legislation and directives related to procurement.

Appointees are required to exercise a duty of care for their provincial agencies, which requires them to act honestly, in good faith, and in the best interest of the provincial agency.

A board-governed provincial agency performs one of the following four functions:

Operational Enterprise

- Sells goods or services to the public in a commercial manner (including, but not necessarily, in competition with the private sector).

- Receives revenues from its commercial activities; however, it may also receive some funding from the Consolidated Revenue Fund.

Operational Service

- Delivers goods or services to the public, usually with no or minimal fees.

- Principally funded out of the Consolidated Revenue Fund.

Trust

- Administers funds and/or other assets for beneficiaries named under statute. The funds and/or other assets are administered by a trust agency for named beneficiaries (that is, the funds and/or other assets do not belong to the government).

- Is fully responsible for its operations.

- Is not funded out of the Consolidated Revenue Fund.

Regulatory (with governing board)

- Is authorized to make independent decisions for a designated sector that include inspections, investigations, prosecutions, certifications, licensing and rate-setting. The decisions may limit, promote or correct the conduct, practice, obligations, rights and responsibilities of an individual, business or corporate body.

- Is self-funding.

Note: many regulatory agencies do not have a governing board.

1.5.2 Non-Board-Governed Agencies (adjudicative tribunals, regulatory agencies without governing boards)

The main characteristic of non-board-governed agencies is the lack of authority to make their own operational decisions. Ministries must provide the operational support for these provincial agencies. Agencies must follow all government directives, policies and guidelines, including those for human resources. This would also include applicable legislation and directives related to procurement.

Adjudicative Tribunals

- These tribunals independently and impartially make binding decisions to resolve disputes regarding the obligations, rights and responsibilities of an individual, business or corporate body under existing policies, regulations and statutes.

- Appointees need experience, knowledge or training in the subject matter dealt with by the tribunal and on adjudicative practices and are appointed in accordance with a competitive merit-based process.

- Chairs and vice chairs have provincial agency governance responsibilities.

- All appointees may serve as adjudicators.

- Tribunals are administratively supported by the ministry and do not have powers of their own to conduct human resources functions under non-OPS requirements.

- Tribunals are principally funded out of the Consolidated Revenue Fund.

- Fees are set in accordance with statutory or other requirements.

- Adjudicative tribunals are also governed by the Adjudicative Tribunals Accountability, Governance and Appointments Act (ATAGAA), when prescribed and must comply with the provisions of both the legislation and this directive.

Regulatory Agencies (without governing boards)

- These agencies make independent decisions for their respective sectors that include inspections, investigations, prosecutions, certifications, licensing and rate-setting.

- Appointees do not form a governing board and are administratively supported by the ministry.

- Their decisions may limit, promote or correct the conduct, practice, obligations, rights and responsibilities of an individual, business or corporate body.

- Chairs and vice chairs have provincial agency governance responsibilities.

- All appointees may serve as regulators.

- The provincial regulatory agency is principally funded out of the Consolidated Revenue Fund.

- Fees are set in accordance with statutory or other requirements.

1.5.3 Advisory Agencies

Advisory agencies provide specific advice to a minister or the Premier. Advisory agencies are composed of one or more individuals appointed by the government. These provincial agencies are established for more than three years.

Advisory agencies’ administrative functions are carried out by the responsible ministry. These provincial agencies are created solely for the purpose of providing advice or recommendations as specified in their TOR.

1.6 Accountability Framework for Provincial Agencies

Provincial agencies are part of government and have the following accountability framework.

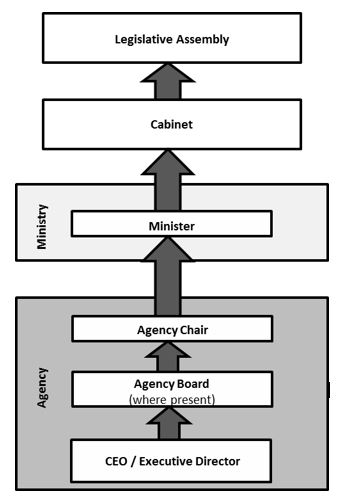

Accountability for provincial agencies can be visualized with a clear line from the agency, to the ministry, to the government as a whole.

Within an agency, the CEO or Executive Director is accountable to the agency’s board of directors (where present) and its chair. The Chair is accountable for the decisions of the board.

Each agency Chair is accountable to the Minister of the Ministry under which it is established.

In turn, a Minister reports to and is accountable to the Cabinet for the outcomes of the agency. And Cabinet is accountable to the Legislative Assembly.

Accountability of the minister for each provincial agency cannot be delegated. Certain provincial agency oversight activities, however, can be delegated to appropriate ministry officials. Risk-based reviews of any provincial agency can be requested by TB/MBC or the minister.

TB/MBC will monitor ministry oversight and compliance for all board-governed, non-board-governed and advisory agencies.

Accountability requirements are met by:

- Complying with the MOU or TOR;

- Meeting expectations and advancing government priorities;

- Establishing effective business plans to guide action and deliver on the agency mandate and government priorities;

- Reporting to the public on financial results and the delivery of the agency mandate through an annual report;

- Mitigating and reporting risks through risk assessment and action plans;

- Providing information/reports as requested by the responsible ministry or TBS within the timelines provided;

- Taking corrective actions based on performance;

- Timely exchange of information on the plans, strategies, operations and administration of the agency; and

- Ensuring a collaborative partnership between the ministry and the agency.

1.7 Risk-Based Management and Accountability

The Government of Ontario uses a risk-based approach to manage provincial agencies. Consequently, provincial agencies are required to employ a risk framework when making operational decisions (including but not limited to financial and information technology decisions). Provincial agencies are responsible for ensuring that funds and assets are used effectively and efficiently and are used for the intended purpose.

Risk-based management practices enable establishment of the optimum level of oversight, control and discipline enabling ministries and provincial agencies to manage risk in changing environments and help provide the proper level of assessment.

Risk management helps ministries and provincial agencies identify risks, assess exposures and develop appropriate action plans to help ensure provincial agencies meet business objectives.

The higher the potential risk posed by a provincial agency, including the degree of public interest and obligation of financial management, the greater the need for oversight.

1.7.1 Artificial Intelligence (AI) Risk Management

The Responsible Use of Artificial Intelligence (AI) Directive sets out the requirements for the transparent, responsible and accountable use of AI, and applies to all provincial agencies.

Agencies must apply the requirements set out in Section 6.3 (Application to Provincial Agencies) of the Responsible Use of AI Directive.

Requirements set for provincial agencies by the Responsible Use of AI Directive include engaging in AI risk management, publicly disclosing use of AI, reporting AI use to their ministry and providing an accessible avenue for the public to seek more information about AI use in certain circumstances.

See the Responsible Use of Artificial Intelligence Directive for further details.

1.8 Establishing, Changing, Merging, and Dissolving Provincial Agencies

The establishment or dissolution of all provincial agencies and any significant change (e.g., mandate change) to existing provincial agencies requires TB/MBC review and approval. A TB/MBC submission is also required to establish subsidiaries of existing provincial agencies or to acquire a controlling interest in an existing provincial agency. Note that any government directives that apply to a provincial agency also apply to subsidiaries of that provincial agency.

Mandatory requirements for establishing and making significant changes (e.g., mandate change) to provincial agencies are as follows:

- Business case;

- Draft or copy of the constituting instrument;

- Draft MOU meeting this directive’s requirements (not applicable for dissolution of an agency); and

- Agency name and unique visual identifier (if applicable).

In advance of preparing their TB/MBC submission, ministries must determine the appropriateness (e.g., alignment with agency type, mandate) of including a sunset clause in the agency’s constituting instrument. If a sunset clause is not included in an agency’s constituting instrument, ministries are required to report to TB/MBC as part of a mandate review or within five years of agency establishment on whether the agency should continue to exist in its current form or if a sunset clause should be added to wind down the agency.

Changes to provincial agencies that require TB/MBC approval include but are not limited to proposals to:

- Merge;

- Expand or amend the mandate, as per the objects within the constituting instrument;

- Change the name and unique visual identifier;

- Change the board composition;

- Change the powers and authority

- Change the governance and accountability framework.

Mandatory requirements for dissolving an agency are as follows:

- Business case including a detailed implementation plan on how any potential labour or service impacts will be mitigated;

- Proposed plan to repeal the constituting instrument, as required; and

- Risk management plan.

See the AAD Operational Policy and the Agency Establishment Guide for further details.

1.9 Details of Mandatory Requirements

1.9.1 Memorandum of Understanding (MOU)

This section applies to:

- Board-governed agencies; and

- Non-board-governed agencies.

An MOU is a governance document setting out key accountabilities of the ministry and agency including the roles and responsibilities of the minister and deputy minister of the ministry and the chairperson, board members and CEO of the agency. It sets out many key reporting requirements including communications.

The MOU must be reviewed and signed by the responsible minister and chair within four months of their appointment. The MOU must also be acknowledged and signed by the deputy minister and CEO (or equivalent) within four months of their appointment.

Ministries must use the TB/MBC-approved template. Proposed changes to the template require TB/MBC approval.

For adjudicative tribunals prescribed under ATAGAA, MOUs must contain the information required under the Act.

Approvals

An initial draft MOU must be included in the TB/MBC submission to establish the agency, and approved by TB/MBC when the provincial agency is established.

An MOU must be signed no later than three months from receiving TB/MBC approval, or for a new provincial agency, no later than three months from its operational functioning. A copy of the signed MOU must be made available to the public on a government or provincial agency website no later than 30 calendar days from the minister’s signature.

Upon a change in one of the signatories, the newly appointed individual must review and sign the MOU no later than four months from the new appointment.

Ministries must use the TB/MBC-approved template. Proposed changes to the template require TB/MBC approval.

Statutory Requirements

Provincial agencies must comply with all statutory requirements. There are a number of statutes which require provincial agencies to be prescribed in regulations in order for the statutes to apply to them. These statutes may include the PSOA, ATAGAA, and the Freedom of Information and Protection of Privacy Act.

There are also statutes that impose specific requirements without agencies having to be specifically prescribed in order for the requirements to apply. These acts include the Financial Administration Act, Accessibility for Ontarians with Disabilities Act, 2005, and the French Language Services Act.

Applicability of Government Directives to Provincial Agencies

All agencies and their subsidiaries are part of government and are required to comply with applicable government directives, policies and guidelines. Every government directive and policy includes an application section that sets out the government organizations that are required to comply with the direction. Most government direction applies to all provincial agencies. If an agency has been designated as a Commission public body, then all human resources direction, including Public Service Commission directives, also apply.

Further, agencies may be required to ensure that their directives and policies adhere to certain government directives, policies and guidelines, including those for human resources, while being mindful of collective agreement and bargaining obligations. This would also include applicable legislation and directives related to procurement.

Transfer Payment Accountability

Provincial agencies that have the authority to provide transfer payment funding must comply with the Transfer Payment Accountability Directive and other applicable transfer payment rules.

Realty Direction

Provincial agencies must ensure they operate in accordance with the MBC Realty Directive. Appendix B of the Realty Directive sets out the Mandatory Office Space Standards and Office Space Planning Practices that must be complied with when acquiring space for accommodation and program purposes.

All lease agreements for provincial agencies without realty authority are under the administration and control of the Minister of Infrastructure. Ministries must consult with the Ministry of Infrastructure (MOI) Realty Division prior to the establishment of any new agencies with regards to their proposed realty authority to acquire and/or manage and/or dispose of realty. This is in keeping with the Centralization of Broader Real Estate Authority (CBREA) Initiative which explores opportunities in the long-term for the government to centralize broader real estate authority and decision making for provincial entities into MOI to optimize government decision-making capacity and ensure alignment with enterprise-wide objectives.

OPS Procurement Directive

Provincial agencies must comply with the OPS Procurement Directive. Ministries are responsible for setting out the nature of the application, which is done at the time the agency is established and is included in the MOU. The ministry can require that the OPS Procurement Directive apply in full, the same as it applies to a ministry; or that the agency be considered an “Other Included Entity” under the OPS Procurement Directive and then the Directive applies in part. As an Other Included Entity, the agency must establish their own procurement policy and approvals framework using the parameters set out in the OPS Procurement Directive.

TB/MBC approval is required for the designation of an agency as an “Other Included Entity”.

Directives Applying to Adjudicative Tribunals and Regulatory Agencies Without Governing Boards

All government directives apply to adjudicative tribunals and regulatory agencies without governing boards, as these tribunals and agencies are administered by ministries, and ministries are subject to all directives.

Further Guidance on Applicable Directives

For more information on the application of government directives and policies, see the InsideOPS Directives and Policies page, and the AAD Operational Policy.

For information on setting out the application of corporate directives in the MOU, see the Guide to Developing a Memorandum of Understanding for Provincial Agencies and the MOU Templates.

1.9.2 Annual Letter of Direction

This section applies to board-governed agencies.

Ministers must provide each board-governed agency in their portfolio with an annual letter of direction. The annual letter of direction provided to the agency’s chair sets out the government’s priorities for the agency sector and the minister’s broad expectations with respect to service and performance for the coming fiscal year. Ministers may also issue additional letters of direction to the agency throughout the fiscal year.

The annual letter of direction should set out high-level, achievable expectations that are consistent with the agency’s legislative mandate and/or constituting instrument. These expectations are to be addressed in the agency’s business plan and progress against these priorities are to be reported in the annual report.

To support ministries, TBS will provide a list of government priorities for the agency sector by September 1 of each year. These priorities must be included in the annual letter of direction, in addition to the agency-specific expectations identified by the minister.

Agency boards must ensure they fulfil the government’s priorities and minister’s expectations set out in the annual letter of direction in establishing and approving the goals, objectives, and strategic direction for the agency.

Ministries may be asked by TBS and Cabinet Office to share letters prior to release (see the AAD Operational Policy for more information). Ministries must deliver the annual letter of direction in time for it to inform the drafting of the annual business plan, no later than 180 calendar days prior to the start of the agency’s next fiscal year.

Annual letters of direction must be made available to the public on a government or provincial agency website at the same time as the agency’s business plan.

1.9.3 Business Plans for Board-Governed Agencies

All provincial agencies with governing boards must submit a draft annual business plan to the ministry’s chief administrative officer or designated lead executive no later than 90 calendar days prior to the beginning of the agency’s fiscal year. Additional details are set out in the AAD Operational Policy.

Ministry staff will review the draft business plan and provide the agency with feedback including any missing requirements to be addressed.

The board-approved business plan must be submitted to the responsible minister for approval no later than 30 calendar days prior to the beginning of the provincial agency’s fiscal year.

The minister must approve or provide suggested changes to the business plan no later than 30 calendar days from the minister’s receipt of the plan. In certain circumstances, minister approval may be given to only certain portions of a business plan as submitted by an agency.

All business plans are to be submitted for the responsible minister’s signature and are only to be considered valid after the minister has approved the plan and the approval has been documented in writing. A business plan is for a three-year period or longer and is prepared every year, unless otherwise specified by TB/MBC or legislation. The provincial agency is required to make the business plan available to the public on a government or provincial agency website no later than 30 calendar days from minister approval of the plan.

All business plans for provincial agencies with governing boards must contain the required elements set out in the AAD Operational Policy.

The business plan must demonstrate the agency’s plans in fulfilling the government priorities set out in the annual letter of direction.

When the business plan is submitted to the minister for approval, an attestation memo from the agency chair must also be submitted that details how the agency plans to achieve each government priority. Additional details are set out in the AAD Operational Policy.

When a provincial agency has subsidiaries, the business plan for the subsidiary must meet the same requirements as for an agency as set out in the AAD Operational Policy.

See Guide to Developing Business Plans for further details.

1.9.4 Business Plans for Non-Board-Governed Agencies

All non-board-governed agencies must submit a draft annual business plan to the ministry’s chief administrative officer no later than 90 calendar days prior to the beginning of the agency’s fiscal year. Additional details are set out in the AAD Operational Policy.

Ministry staff will review the draft business plan and provide the agency with feedback including any missing requirements to be addressed.

The chair-approved business plan must be submitted to the responsible minister for approval no later than 30 calendar days prior to the beginning of the provincial agency’s fiscal year. The minister must approve or provide suggested changes to the business plan no later than 30 calendar days from the minister’s receipt of the report. In certain circumstances, minister approval may be given to only certain portions of a business plan as submitted by an agency.

All business plans are to be submitted for the responsible minister’s signature and are only to be considered valid after the minister has approved the plan and the approval has been documented in writing. A business plan is drafted for a minimum three-year period, unless otherwise specified by TB/MBC or legislation, and is prepared every year.

All business plans must contain the required elements set out in the AAD Operational Policy.

These requirements are consistent with requirements under ATAGAA.

See Guide to Developing Business Plans for Provincial Agencies for further details.

1.9.5 Mandate Reviews

This section applies to all provincial agencies.

Reviews of the mandates of any provincial agency under this directive must be completed at least every six years. Prescribed adjudicative tribunals must comply with the review requirements under ATAGAA (also every six years).

A provincial agency’s mandate sets out the parameters within which it may perform its responsibilities or provide services.

The mandate is set out in a constituting instrument and reiterated within the MOU. The depth and complexity for each mandate review will vary depending on the structure and complexity of the provincial agency being reviewed. Regardless of overall complexity, all mandate reviews must address:

- Whether the provincial agency is carrying out the activities and operations that represent its mandate;

- Whether, and the extent to which, the mandate continues to be relevant to the goals and priorities of the Government of Ontario;

- Whether or not a sunset clause should be added to the constituting instrument;

- Whether all or part of the functions of the provincial agency are best performed by the provincial agency, or whether they might be better performed by a ministry, another provincial agency or another entity;

- Whether there are short-term and long-term opportunities to enable efficiencies;

- Whether maintaining the agency in its current form is sustainable over the long-term; and

- Any other matter specified either in a directive or at the direction of TB/MBC.

Mandate reviews are not value-for-money audits, do not replace those audits and do not replace financial or other audits that may be required of a provincial agency. Ministries must ensure that all mandate reviews are conducted in a manner that ensures objectivity.

When determining scheduling for mandate reviews, ministries must consider the following:

- Results of risk assessment evaluations;

- Recent change of government/ministry policy direction that directly relates to an agency;

- Potential groupings of like provincial agencies with like mandates;

- Timing for any legislative or other requirements for mandate reviews;

- TB/MBC direction; and

- Any other relevant criteria.

When a provincial agency has subsidiaries, the mandate review must also include each subsidiary.

The results of each mandate review will be reported to TB/MBC for approval. These results will inform TB/MBC decision-making relating to whether the provincial agency continues to be the best means for delivery of the services captured under its mandate. TB/MBC could decide to maintain, dissolve, change or improve effectiveness of a provincial agency, and some of those decisions might require consequential legislative amendments in order to implement.

See Guide to Provincial Agency Mandate Reviews for further details.

1.9.6 Risk Assessment Evaluation and Reporting

This section applies to:

- Board-governed agencies; and

- Non-board-governed agencies.

Ministers and ministries are accountable for working with their provincial agencies to ensure effective management of risks.

The purpose of agency risk assessments and high risk reporting to TB/MBC is to identify any high risks for provincial agencies and the action plans in place to address those risks. On the basis of the risk assessments, TB/MBC may require further information about the agency from the ministry or direct the ministry to take corrective action. On the basis of compliance with this directive provided by the ministry, TB/MBC may also direct the ministry to take action, including providing a timetable for achieving compliance or to report back within a specified period of time confirming that compliance has been achieved.

See the Enterprise Risk Management (ERM) Directive and operational policies related to the ERM Directive.

The following are the requirements for risk assessments (see also the ERM Directive):

Agencies must:

- Identify and assess risks (including risks relating to AI use, required by the Responsible Use of Artificial Intelligence Directive) and put in place appropriate risk management action plans;

- Keep a record of the risk assessments and action plans;

- Provide ministries with an annual risk assessment and action plans with mitigating strategies including any necessary supporting information and analysis as required by the Office of the Chief Risk Officer to support tabling of ERM reports to TB/MBC to enable decision-making; and

- Update ministries on a quarterly basis on high risks.

Ministries must:

- Actively evaluate provincial agency risks on an annual basis and update high risks on a quarterly basis; and

- Report to TBS as required by the Officer of the Chief Risk Officer on all agency high risks including a description of each high risk, the reasons it is a high risk, what action plan is in place to manage the risk and any other ministry assessment information.

The risk-based approach must include an assessment and analysis of financial/fiscal implications as well as appropriate mitigation strategies.

See Guide to the Risk-Based Approach and Risk Reporting under the AAD for further details.

1.9.7 Risk Assessment Evaluations for Advisory Agencies

Ministers and ministries are accountable for working with their provincial agencies to ensure effective management of provincial agency risks.

The following are requirements for risk assessments for advisory agencies.

Ministries must:

- Identify and assess risks and put in place appropriate risk management action plans; and

- Keep a record of the risk assessments and action plans.

The risk-based approach must include an assessment and analysis of any financial/fiscal implications as well as appropriate mitigation strategies.

See Guide to the Risk-Based Approach and Risk Reporting under the AAD for further details.

1.9.8 Cyber Security

This section applies to board-governed and non-board-governed agencies.

Agencies are responsible and accountable for the ownership and management of cyber security risks and related impacts within their organization. Agencies must ensure adequate systems, protocols and procedures are established and maintained to ensure cyber resilience, recovery and maturity. An agency’s cyber security practices and protocols should be regularly reviewed and updated to address new and emerging cyber security threats.

Agencies should align with any applicable policies and standards issued by the OPS, such as the Government of Ontario Information Technology Standards (GO-ITS) 25.0 and any other relevant GO-ITS standards, Corporate Policy on Information Sensitivity Classification, Corporate Policy on Cyber Security and Cyber Risk Management, Governance and Management of Information and Data Assets Directive, Governance and Management of Information Technology Directive.

See Ontario’s Cyber Security Centre of Excellence for further information and resources.

1.9.9 Annual Reports

When creating and distributing annual reports, agencies and ministries must use digital formats and channels for distribution unless otherwise required (e.g., directive, legislation).

Annual Reports for Board-Governed Provincial Agencies

All board-governed agencies under this directive must prepare an annual report for submission to the ministry and submit their annual report to the minister no later than 120 calendar days from the provincial agency’s fiscal year-end when the auditor of record is not the Auditor General. When the Auditor General is the auditor of record, the agency must submit its annual report to the ministry no later than 90 calendar days from completing the financial audit.

Ministry staff shall review the annual report prior to submission to the minister and identify any missing requirements to be addressed. Additional details are set out in the AAD Operational Policy.

Ministers must approve an agency’s annual report no later than 60 calendar days from the ministry’s receipt of the report from the agency. Ministerial approval indicates agreement that the annual report meets the form and content requirements as specified in the directive and any agency-specific content as required by the relevant minister or applicable legislation.

In addition, annual reports must be tabled in the Legislative Assembly and then be posted on a provincial agency or government website no later than 30 calendar days from minister’s approval (when the Legislative Assembly is not sitting, the ministry will file the report with the Clerk’s Office).

The annual report must contain the required elements set out in the AAD Operational Policy.

The annual report must demonstrate how the agency has fulfilled the government priorities set out in the annual letter of direction.

When the annual report is submitted to the minister for approval, an attestation memo from the agency chair must also be submitted that details how the agency has achieved each government priority. Additional details are set out in the AAD Operational Policy.

When a provincial agency has subsidiaries, the annual report for the subsidiary must meet the same requirements as for an agency as set out in the AAD Operational Policy.

Annual Reports for Non-Board-Governed Provincial Agencies

A non-board-governed agency must submit an annual report to the ministry no later than 90 calendar days after the end of the provincial agency’s fiscal year end. Ministry staff shall review the annual report and confirm that all requirements are met prior to submission to the minister. Additional details are set out in the AAD Operational Policy.

Ministers must approve an agency’s annual report no later than 60 calendar days from the ministry’s receipt of the report from the agency. Ministerial approval indicates agreement that the annual report meets the form and content requirements as specified in the directive and any agency-specific content as required by the relevant minister or applicable legislation.

The annual report must be tabled in the Legislative Assembly and then posted on a provincial agency or government website no later than 30 calendar days from minister’s approval (when the Legislative Assembly is not sitting, the ministry will file the report with the Clerk’s Office).

The annual report must contain the required elements set out in the AAD Operational Policy.

For adjudicative tribunals, these requirements are consistent with ATAGAA’s requirements.

See Guide to Developing Annual Reports for Provincial Agencies for further details.

1.9.10 Certificate of Assurance (CoA)

This section applies to:

- Board-governed agencies; and

- Non-board-governed agencies.

Board-Governed Agencies

Deputy ministers are required to sign and submit an annual attestation, to the best of their knowledge and ability, indicating that the provincial agencies that are a responsibility of their ministry have maintained an effective system of internal controls.

The chair of a board-governed agency must send an attestation to the responsible minister, in alignment with the Office of the Provincial Controller Division (OPCD)’s CoA instructions, confirming that the agency has maintained an effective system of internal controls:

- To provide reasonable assurance regarding the reliability of financial reporting; compliance with applicable financial legislation, regulations, directives, and policies; and, the effectiveness of operations related to financial performance and safeguarding assets against loss.

- To identify and respond to the risk of fraud, and report all alleged, suspected and confirmed fraud.

To support the chair, the CEO of the agency should attest to the chair that the provincial agency is in compliance with mandatory requirements.

The letter from the chair confirming compliance will be used by the deputy minister to provide assurance to the OPCD of the provincial agency’s compliance with mandatory requirements.

The CEO and the deputy minister or an approved delegate should meet regularly and as required to discuss CoA exceptions and fraud instances and their related action plans in alignment with the OPS Fraud Management Policy.

Non-Board-Governed Agencies

Non-board-governed agencies must submit CoA (including fraud) attestations in accordance with their reporting ministry’s cascading CoA process.

1.9.11 Public Posting

This section applies to:

- Board-governed agencies; and

- Non-board-governed agencies.

The requirement of public posting of governance documents will fulfil the government’s objective to increase transparency. The documents should not disclose personal information or other confidential information consistent with the requirements of the Freedom of Information and Protection of Privacy Act (FIPPA).

Provincial agencies are required to post the following documents on a government or provincial agency website:

- Memorandum of understanding

- Annual letter of direction (board-governed agencies)

- Business plan

- Annual report

MOUs and business plans must be made available to the public on a government or provincial agency website no later than 30 calendar days from minister’s approval. Annual letters of direction must be made available to the public on a government or provincial agency website at the same time as the agency’s business plan.

Annual reports must be made available to the public on a government or provincial agency website after the report has been tabled in the Legislature and no later than 30 calendar days from minister’s approval.

Note: For agencies included in the province’s consolidated financial statements, final and audited financial statements must be made available on a government or provincial agency website. These must be made available at a date no later than 150 days after the fiscal year end or an earlier date issued by the OPCD for the reporting year.

Posted documents, particularly business plans should not disclose:

- Personal information;

- Sensitive employment and labour relations information;

- Solicitor-client privileged information;

- Cabinet confidential information;

- Trade secrets or scientific information, technical, commercial, financial or labour relations information of third parties supplied in confidence;

- Information that would prejudice the financial or commercial interests of the provincial agency in the marketplace; and

- Information that would otherwise pose a risk to the security of the facilities and/or operations of the provincial agency.

Posted documents must also adhere to Accessibility for Ontarians with Disabilities Act, 2005, and French Language Services Act requirements.

Adjudicative tribunals prescribed under ATAGAA are legislatively required to make their MOU, business plan and annual report publicly available.

1.9.12 Audits

This section applies to:

- Board-governed agencies; and

- Non-board-governed agencies.

Financial Audits

In order to further financial accountability, all provincial agencies are subject to an external financial statement audit when the provincial agency has any of the following attributes:

- Holds capital assets;

- Incurs financial liabilities or other commitments, such as borrowing or lending;

- Enters into commitments with third parties; or

- Has revenues and/or expenditures that are material to government operations.

External financial statement audits are to be performed by:

- The Auditor General of Ontario; or

- An accredited external audit firm chosen by tender by the provincial agency’s governing board.

For agencies which are to be included in the province’s consolidated financial statements, information must be submitted by agencies to ministries for the preparation and audit of the Province’s Public Accounts within the timelines, and in the format, established each year in the Public Accounts Instructions issued by the OPCD.

When provincial agencies are subject to an annual financial statement audit, the annual report will include its audited financial statements.

Auditor General

At any time, a provincial agency under this directive can be subject to periodic review and a Value-for-Money audit by the Auditor General of Ontario, under the Auditor General Act. In some cases, the Auditor General is the auditor of record for a provincial agency.

Internal/Other Audits

A provincial agency can request and/or must accept the provision of internal audit services by the Ontario Internal Audit Division in accordance with the Internal Audit Directive, including approval by the Audit and Accountability Committee.

Under the Financial Administration Act, the Minister of Finance or President of the Treasury Board may also request an audit.

Regardless of any previous or annual external audit, the minister or the chair (on behalf of the board of directors) may direct that the agency be audited.

A provincial agency will share all engagement reports (including those prepared by their own internal audit function and/or those reported to the agency’s chair) with their respective minister and deputy minister (and when requested, with the President of the Treasury Board). The provincial agency will also advise the respective minister and deputy minister annually, at minimum, on any outstanding recommendations/issues.

A provincial agency will share its approved audit plan with their respective minister and deputy minister (and when requested, with the President of the Treasury Board) to support understanding of agency risks.

The provincial agency’s chair, other appointees to the provincial agency, as well as staff of the provincial agency and ministry are to co-operate in any audit of the provincial agency.

1.9.13 Communications

The TB/MBC-approved MOU template includes a communications protocol that must be used by the ministry and agency. TB/MBC and Cabinet Office Communications approval is required for any amendments to the protocol.

1.9.14 Human Resources and Compensation

This section applies to board-governed and non-board-governed agencies.

Provincial agencies have the financial and operating authority to carry on a business and conduct operations in support of their mandates. Many of these provincial agencies have the authority to hire their own staff within their own HR framework and do not rely on ministries for these functions. However, all agencies are part of government and are required to comply with legislation, government directives, policies and guidelines applicable to them. Further, agencies may be required to ensure that their directives and policies adhere to certain government directives, policies and guidelines, including those for human resources, while being mindful of collective agreement and bargaining obligations. Non-board-governed agencies are administratively part of the ministry and must follow all OPS and HR directives.

Board-governed and non-board-governed agencies must report to TBS on workforce and operational data as requested by TBS. Additional details are set out in the AAD Operational Policy.

1.9.15 Designated Executives

The agency shall provide total compensation to its designated executives, including the CEO, in accordance with the legislation, directives, policies and guidelines applicable to them. All newly established agencies are required to have an executive compensation plan approved by the President of the Treasury Board.

1.9.16 Mandatory Requirements During the Writ Period

This section applies to:

- Board-governed agencies;

- Non-board-governed agencies; and

- Advisory agencies.

During the election “writ” period when the legislature is dissolved, compliance timelines cannot always be achieved because the government is functioning in a custodial manner. TBS will inform agencies through ministries of their compliance obligations during the writ period.

1.9.17 Diversity and Inclusion

The provincial agency, through the chair on behalf of the board of directors, must acknowledge the importance of promoting an equitable, inclusive, accessible, anti-racist and diverse workplace within the agency.

The chair, on behalf of the board of directors, must support a diverse and inclusive workplace within the agency by:

- Developing and encouraging diversity and inclusion initiatives to promote an inclusive environment free of workplace discrimination and harassment; and

- Adopting an inclusive process to ensure all voices are heard.

The chair, on behalf of the board of directors, is responsible for ensuring that the agency operates in accordance with the Human Rights Code, Accessibility for Ontarians with Disabilities Act, 2005, French Language Services Act, and Pay Equity Act.

1.10 Details of Roles and Responsibilities

1.10.1 Roles and Responsibilities for Board-Governed Provincial Agencies and their Responsible Ministries

Note that all the powers listed here are not granted to all provincial agencies, unless they are required for the fulfillment of their mandates under the constituting instrument.

Minister

The minister is accountable to Cabinet and the Legislature, representing the public.

Responsibilities:

- Reporting/responding, within prescribed timelines, to the Legislature and Cabinet on agency affairs, performance and compliance;

- Recommending establishment of new provincial agencies, changes in mandate and/or powers and public appointments for existing provincial agencies;

- Meeting with the chair at least quarterly* on:

- government and ministry priorities for the agency;

- agency, board, chair and CEO performance;

- emerging issues and opportunities;

- agency high risks and action plans including direction on corrective action, as required;

- agency business plan and capital priorities;

- Setting expectations for the agency in an annual letter of direction on government priorities;

- Providing further or amended direction by way of a letter of direction;

- Recommending application of the Procurement Directive;

- Reviewing and signing a new MOU no later than four months upon appointment;

- Reviewing and approving the agency’s governance and accountability documents (i.e., MOU, business plan, annual report); and

- Additional responsibilities as outlined in the agency’s MOU.

* See the AAD Operational Policy for further details on quarterly meetings.

Deputy Minister

The deputy minister reports to the Secretary of the Cabinet and is responsible for supporting the minister in the effective oversight of provincial agencies.

Deputy minister responsibilities may be fulfilled by a delegate approved by the Secretary of Cabinet.

Responsibilities:

- Advising, supporting and assisting the minister regarding the minister's oversight responsibilities for the provincial agency;

- Meeting with the agency’s CEO or equivalent at least quarterly on matters of mutual importance including:

- emerging issues and opportunities;

- government priorities and progress on annual letter of direction;

- agency business plan and results;

- agency high risks, the action plan and advice on corrective action as required;

- Meeting with the agency’s CEO or equivalent regularly and as required to discuss CoA exceptions and fraud instances and their related action plans;

- Providing supporting and background information for the minister’s quarterly meetings with the chair;

- Providing regular feedback to the minister on the performance of the agency;

- Providing annual feedback on the performance of the agency and CEO to the chair;

- Advising the minister on the requirements of the AAD and on documents submitted by the agency for minister review and approval and ensuring governance documents (i.e., MOU, business plan, annual report), adhere to the directive;

- Supporting ministers and minister’s offices in monitoring and tracking upcoming and existing vacancies on boards, particularly where there is a legislated minimum number of members and to maintain quorum;

- Reviewing and signing a new MOU no later than four months upon appointment;

- Reviewing the agencies’ risk assessment and action plan on an annual basis and providing input to the minister on agency high risks, the action plan and direction on corrective action, as required;

- Requesting information and data as needed to fulfill obligations under the directive;

- Monitoring the agency on behalf of the minister while respecting the agency’s authority, and providing advice and support to the CEO as appropriate;

- Working with the CEO to address any issue that may arise;

- Identifying needs for corrective action where warranted, and recommending to the minister ways of resolving any issues that might arise from time to time;

- Informing the CEO in writing of new government directives and any exceptions to, or exemptions (in whole or in part) from directives, government policies, or ministry administrative policies;

- Reporting/responding, within prescribed timelines, to TBS on compliance tracking; and

- Additional responsibilities as outlined in the agency’s MOU.

Chair

The chair is accountable to the minister for the mandate and conduct of the provincial agency.

Responsibilities:

- Providing leadership to the provincial agency board and staff, including but not limited to chairing board meetings, and fulfilling role as ethics executive;

- Meeting with the minister at least quarterly* on:

- government and ministry priorities for the agency;

- agency, board and CEO performance;

- emerging issues and opportunities;

- agency high risks and action plans including direction on corrective action, as required;

- agency business plan and capital priorities;

- Ensuring the agency is fulfilling the government’s priorities and expectations from the annual letter of direction, and working with the minister on performance measures for the agency;

- Reviewing the performance of the CEO in consultation with the board of directors and deputy minister annually;

- Reviewing and signing a new MOU no later than four months upon appointment;

- Ensuring compliance with legislative and TB/MBC policy obligations, including but not limited to, all obligations regarding business plans and annual reports;

- Sending attestations to the minister, in alignment with the OPCD’s CoA instructions;

- Utilizing the agency’s skills matrix to advise the minister of any competency skills gaps on the board and provide recommendations for recruitment strategies, appointments, or re-appointments as needed, including advising the minister on appointee attendance and performance;

- Consulting with the minister in advance regarding any activity which may have an impact on the government and ministry’s policies, directives or procedures, or on the agency’s mandate, powers or responsibilities as set out in the agency’s constituting instrument;

- Establishing and implementing artificial intelligence (AI) risk management in alignment with the principles of the Responsible Use of AI Directive and requirements in section 6.3, ensuring that they fulfill the role outlined for “Provincial Agency Heads or Equivalent” in the Responsible Use of AI Directive;

- Ensuring that the agency operates within its approved budget allocation in fulfilling its mandate (if applicable), and that public funds are used for the purpose intended with integrity and honesty.

- Acknowledging the importance of promoting an equitable, inclusive, accessible, anti-racist and diverse workplace within the agency, and supporting a diverse and inclusive workplace within the agency; and

- Additional responsibilities as outlined in the agency’s MOU.

* See the AAD Operational Policy for further details on quarterly meetings.

Governing Board of an Agency

Accountable to the minister through the chair of the board.

Responsibilities:

- Managing and controlling the affairs of the provincial agency;

- Ensuring the agency is fulfilling the government’s priorities and expectations from the annual letter of direction in the establishment of goals, objectives, and strategic direction for the provincial agency;

- Reviewing the performance of the CEO annually in consultation with the chair and deputy minister;

- Approving the provincial agency's business plan and annual reports for recommendation by the minister within the timelines established by the provincial agency's constituting instrument or by this directive;

- Ensuring compliance with directives and policies (including financial, accounting and AI policies);

- Establishing such board committees as are required for effective management, governance, and accountability, such as audit or governance committees, to advise the board on provincial agency affairs; and

- Additional responsibilities as outlined in the agency’s MOU.

Chief Executive Officer (CEO) or Equivalent

The CEO or equivalent is accountable to the board, including where the CEO officer is appointed by the LGIC.

Responsibilities:

- Being accountable to the board, including where the CEO is appointed by the LGIC;

- Managing the day-to-day operational, financial, analytical, and administrative affairs of the agency;

- Meeting with the deputy minister at least quarterly on matters of mutual importance including:

- emerging issues and opportunities;

- government priorities and progress on annual letter of direction;

- agency business plan and results;

- agency high risks, the action plan and advice on corrective action as required;

- Meeting with the deputy minister or an approved delegate regularly and as required to discuss CoA exceptions and fraud instances and their related action plans;

- Translating the government’s priorities and expectations from the annual letter of direction into operation plans and activities in accordance with the minister-approved business plan;

- Reviewing and signing a new MOU no later than four months from the new appointment;

- Providing key agency information and data to the ministry in a timely manner;

- Keeping the chair and board informed of operational matters and the implementation of policy and operations of the provincial agency;

- Advising the chair on the requirements of this Directive as well as other government and ministry directives, guidelines, policies, and procedures as well as provincial agency by-laws and policies;

- Ensuring that the provincial agency meets the requirements of this directive;

- Providing leadership, guidance, and management to the provincial agency staff, including human and financial resources management;

- Ensuring that the agency has the oversight capacity and an effective oversight framework in place for monitoring its management and operations;

- Establishing and applying a financial management framework in accordance with applicable Minister of Finance/Treasury Board Secretariat controllership directives, policies and guidelines;

- Applying policies and procedures so that public funds are used with integrity and honesty;

- Establishing and applying systems and risk management frameworks and plans;

- Fulfilling the role of ethics executive for public servants, other than government appointees, who work in the agency, if applicable;

- Promoting ethical conduct and ensuring the agency is familiar with the ethical requirements of the PSOA and the regulations and directives made under that Act, including in respect of conflict of interest, political activity, and the disclosure of wrongdoing process; and

- Additional responsibilities as outlined in the agency’s MOU.

1.10.2 Roles and Responsibilities for Non-Board-Governed Provincial Agencies and their Responsible Ministries

Minister

The minister is accountable to Cabinet and the Legislature, representing the public.

Responsibilities:

- Reporting/responding, within prescribed timelines, to the Legislature and Cabinet on agency/cluster affairs, performance and compliance;

- Recommending establishment of new provincial agencies/clusters, changes in mandate and/or powers and public appointments for existing provincial agencies/clusters;

- Meeting with the executive chair or chair (as applicable) at least quarterly* on:

- emerging issues and opportunities;

- agency/cluster high risks and action plans including direction on corrective action, as required;

- agency/cluster business plan and capital priorities;

- Recommending application of the Procurement Directive;

- Reviewing and signing a new MOU no later than four months upon appointment;

- Reviewing and approving the agency/cluster’s governance and accountability documents (i.e., MOU, business plan, annual report); and

- Additional responsibilities as outlined in the agency/cluster’s MOU.

* See the AAD Operational Policy for further details on quarterly meetings.

Deputy Minister

The deputy minister reports to the Secretary of the Cabinet and is responsible for supporting the minister in the effective oversight of provincial agencies.