Forest Sector Investment and Innovation Program guidelines

Detailed guidelines for wood product manufacturers and processors on how to get funding for business or collaboration projects.

Applications for funding through this program must be made through Transfer Payments Ontario (TPON). To apply:

- Register with TPON

- Login to your TPON account and complete the stage I eligibility checklist and application form

Overview

The objective of Forest Sector Investment and Innovation Program (FSIIP) is to encourage businesses to make investments by providing financial support for projects that will improve productivity, increase innovation, support market expansion, strengthen regional economies and supply chains, and positively impact Ontario’s broader forest sector. FSIIP will assist Ontario forestry companies to develop and implement innovative technology and encourage innovation in products, services and processes to improve the competitiveness of Ontario’s forest industry.

FSIIP will be a key tool in building Ontario’s productive and innovative capacity to create jobs of today and tomorrow by encouraging the development of products, services and processes for diverse markets, and the integration of them in the regional and global supply chain.

There are two streams — business projects

stream and collaboration projects

stream. Business projects will support capital investment projects put forward by for-profit forestry companies that meet the objectives of the program. Collaboration projects will support projects brought forward by project partners that may include for-profit forestry companies, industry associations, forestry-related not-for-profits and/or academia (including at least one Ontario-based for-profit forestry and wood products company) that will have a transformative impact on Ontario’s forest sector.

While these streams are distinctive and specialized, the application of consistent policy filters ensures that provincial business support funding directly supports Ontario’s economic development priorities.

Program objectives

The Forest Sector Investment and Innovation Program is a key component of Ontario’s Forest Sector Strategy which strives to create a business climate that fosters growth, promotes innovation, and helps the industry adapt to an ever-changing business climate. FSIIP will focus on projects that benefit the applicant, the regional economy in which they are located, and Ontario’s forest sector overall.

Principles and outcomes

Productivity:

- support a highly-skilled workforce

- increase industrial efficiency, technological development, product innovation and product variety

- adopt leading-edge technology

Innovation:

- build R&D / commercialization capabilities

- foster collaboration between partners

- embed innovation into business climate

- drive innovative products, technology and production processes

Market expansion:

- strengthen ability to compete in world markets

- greater access to markets

- foster domestic, international and interprovincial trade

Regional impact:

- project will have a positive impact on regional economies in which the company operates

- evaluation will give greater weight to the impact of a project on regions and communities experiencing regional disparities

Sectoral importance:

- project will have a positive impact on Ontario’s broader forest sector

- project addresses sectoral needs and priorities

Program eligibility

Eligible applicants/projects

The following entities are eligible to be considered for funding:

- Ontario forest and wood products corporations

- extra-provincial forest and wood products corporations

- federal forest and wood products corporations

- foreign forest and wood products corporations provided they have incorporated a Canadian/Ontario subsidiary and such entity will be the applicant

- forestry-related not-for-profit corporations (such as incorporated research/science-based organizations or not-for-profit industry associations)

- Ontario-based post-secondary education institutions

Newly-formed companies (“start-ups”) may be considered on a case by case basis, at the discretion of the province, provided the project meets objectives of the program. For the purposes of this program, the definition of start-ups

will be guided by the following parameters.

- New plant/facility in Ontario, but with owners that can demonstrate the financial capacity to undertake the project and have relevant operational and management experience (including operating mills in another jurisdiction).

- Spin-outs or newly established subsidiaries of established companies that do not yet have plant or facility in Ontario but can demonstrate the financial capacity to undertake the project and have relevant operational and management experience.

Business projects

The Business projects

stream will have a minimum eligible project costs threshold of $3 million. Eligible projects will improve the competitiveness of the applicant’s Ontario-based operations through productivity improvements, technology, process or product innovation and/or market expansion and will have a positive impact on the regional economy in which the company operates and on the broader forest sector in Ontario. Applicants must demonstrate government support is needed to implement the project.

Eligible applicants are for-profit manufacturers and processors of wood and forest biomass across Ontario, such as sawmills, pulp and paper mills, secondary wood manufacturers, and bio-product manufacturers (utilizing forestry-based inputs).

Note: harvesting and hauling companies/projects are not eligible under the business projects stream.

Collaboration projects

The Collaboration projects

stream will have a minimum eligible project costs threshold of $3 million for projects that will have a transformative impact across Ontario’s forest and wood products sector. This will be done through a focus on industry-leading innovation, the development and/or implementation of first-in-kind innovation or adaptation or adoption of existing innovations such as:

- process innovation/modernization with broad application

- product innovation, new product development with benefits up and down the supply chain

- product innovation, new product development with broad benefits across Ontario’s forest sector and/or other related sectors (such as wood building construction and design) of Ontario’s economy

Eligible projects will have active involvement of at least three project partners (including at least one Ontario-based for-profit forestry and wood products company) with involvement or interest in Ontario’s forest industry. One of the partners will need to be designated as the applicant with responsibility for coordinating and administering the FSIIP application on behalf of the collaboration.

Eligible project partners include:

- forestry-related not-for-profit corporations

- incorporated not-for-profit industry association representing a sector of Ontario’s forest industry

- Ontario forest and wood products corporations

- extra-provincial forest and wood products corporations

- federal forest and wood products corporations

- foreign forest and wood products corporations provided they have incorporated a Canadian/Ontario subsidiary and such entity will be the applicant

- Ontario-based post-secondary education institution

Eligible project costs

For details and definitions regarding which project costs are considered eligible under the program, please see Appendix A: eligible costs

Ineligible projects

The following categories of projects are not eligible for funding under the program:

- restructuring

- mergers and acquisitions (such as purchase of an existing business)

Determination of eligibility for funding is at the sole discretion of the province.

Funding

Funding types and amounts available under the program

Business projects:

Applicants may apply for either a loan or a grant, not both.

- Performance based loans:

- up to a maximum of 30% of eligible project costs

- forgivable portion (if job, investment, and payroll targets met) to a maximum of 50% of the loan amount

- during the repayment period, after the project completion date, interest will be charged at Ontario’s cost of borrowing plus 3%

- Grants:

- up to a maximum of 15% of eligible project costs may be considered in exceptional circumstances at the sole discretion of the province for projects of strategic importance to the province

Collaboration projects:

- Grants:

- up to a maximum of 30% of eligible project costs to a maximum of $3 million

Stacking with other government funding

Business projects

- Projects receiving funding under other Ontario programs will not be eligible for funding under the business projects stream with the exception of programs that are meant to provide general benefit to a company and are not project-specific (such as Industrial Electricity Initiative, Northern Industrial Electricity Rate Program), and tax credits.

- However, applicants will be permitted to stack federal and municipal funding with FSIIP funding, provided that total funding from all government sources does not exceed 50% of the eligible costs of the project.

Collaboration projects

- Applicants will be permitted to stack funding from municipal, other provincial and federal government programs provided the total funding from all government sources does not exceed 75% of the eligible costs of the project.

Note: the program will generally allow only one funding contract/project per applicant at a time. Consideration may be given for multiple applications from a single applicant on a case by case basis, provided they are for distinct projects at distinct mill sites.

Discretionary program

The FSIIP is a competitive rounds-based program with a limited annual budget. Therefore, even if a project is assessed under stage I to meet all program objectives and criteria, there is no guarantee that funding will be awarded, as there may be other projects submitted that more effectively meet the FSIIP objectives and criteria. All applicants whose projects are approved to move on to stage II will be notified in writing.

The Government of Ontario reserves the right to impose whatever conditions it deems advisable in the acceptance of an application and in the funding agreement.

Applicants should not take any action, or incur any costs related to the program, that is predicated on receiving funding from the Government of Ontario until an application is approved and all parties have entered into a legal agreement acceptable to the Government of Ontario. The Government of Ontario is not responsible for paying any costs incurred by an applicant should the application not be approved or if the applicant fails to enter into a funding agreement acceptable to the Government of Ontario.

An application to the program does not guarantee acceptance into the program. Even if an application meets all of the stated objectives and eligibility criteria, the Government of Ontario is under no obligation to approve funding. The program is a discretionary, non-entitlement program.

FSIIP project evaluation process

Overview of project evaluation process

The program will run four competitive rounds per year. Deadlines for submitting an application form for the upcoming rounds can be found at Forestry Sector Investment Innovation Program.

In each quarter, project applications will be evaluated using the following two-stage process.

Stage I - Preliminary assessment

Interested applicants will complete an initial stage I eligibility checklist and application form, which will include an overview of the project, its alignment with objectives of the program and a checklist to confirm the project meets all eligibility requirements.

Ministry program staff will work with applicants to guide applicants and assess projects as they are received.

Projects will be assessed on whether they meet FSIIP eligibility guidelines, how well the project aligns with FSIIP objectives and criteria, and how the project compares with other projects submitted through the program.

Stage II - Project evaluation

Applicants that are approved to move to stage II will be asked to submit a detailed stage II application and supporting documentation that will allow for in-depth evaluation of the project.

The full and complete detailed stage II application and supporting documentation will be evaluated and scored against the objectives and criteria of the program and includes financial and technical due diligence and project risk assessment.

The project will undergo a comprehensive and in-depth evaluation including, but not limited to, assessment of the project’s impact to:

- the applicant’s own operations within Ontario (productivity, innovation, market expansion)

- regional economies

- Ontario’s broader forest sector (i.e. benefits of the project beyond that of the applicant)

The project will also undergo financial and technical due diligence, assessment of project risks and calculation of return on investment to the province.

The project will be scored and compared against other projects seeking funding under the FSIIP using the information provided in the stage II application.

Projects will be prioritized in comparison to other project proposals from the same quarterly round.

Please use the FSIIP stage II application form to provide the required information.

Failure to provide all required information by the deadline will result in the application being declined or deferred to the following round.

FSIIP program staff will review the submission and advise the applicant of any incomplete or missing pieces.

10 business days

Applicants will be notified of decision to advance to stage II within 10 business days of receipt of a completed stage I eligibility checklist and application form.

15 business days

Applicants approved to move on to stage II will have 15 business days to complete and submit a stage II application and all supporting documentation to be considered for the current round of project evaluations. If the application is not submitted by the deadline or if the submission is incomplete, it may be declined or deferred to the next round.

65 business days

Stage II application submission

Applicants will be advised of their stage I approval at least three weeks (15 business days) prior to the deadline for submission of the stage II application and supporting documentation. The stage II application will be assessed based on a set of evaluation criteria, supported by stringent investment and impact scorecards.

Staff will work with applicants to assist in understanding the stage II application requirements in advance of the deadline for providing such information. Applicants are encouraged to give the province an opportunity prior to the deadline to review the information to determine if it meets all requirements and to provide feedback on any missing or incomplete components. If, by the deadline, stage II application information is not provided or the information provided is incomplete, the project may be declined or deferred to the following round. Applicants should be aware that staff assistance does not provide assurance that the submission will be accepted and conditionally approved.

Project costs that may be reimbursed will be eligible costs as defined by the program (see Appendix A) and incurred and paid after the project start date, which will be the date the applicant has submitted a completed detailed stage II application along with all supporting documentation. The province, in its sole discretion, will determine if the information provided meets all program requirements.

Evaluation criteria

The evaluation criteria of projects are based on assessment of each of the following:

Project outcomes

- The proposal supports the goals of strengthening Ontario’s competitive advantage through productivity, innovation and/or market expansion whether domestic or global.

- Number of new and/or retained jobs resulting from the project.

Sector/cluster priorities and impacts

- The proposal aligns with sector and cluster priorities and is of strategic importance to Ontario’s broader forest sector. (For example, are there benefits from this project that provide positive impacts and strengthen the competitive advantage of Ontario’s broader forest and wood products sector? Do the positive impacts of this project extend beyond that of the applicant’s operations to the broader forest sector in Ontario?).

Regional impact/net economic impact

- The project positively impacts regional economies (directly and/or indirectly).

- The project will generate social and/or economic benefits beyond the immediate benefits to the applicant.

- Priority will be given to projects that will have measurable impact addressing regional disparities (such as improving economic conditions of communities/regions that are below the provincial average).

Incrementality

- Critical aspects of the proposed investment (such as scope, scale, quantum and timelines) in the project will not happen without government support.

Return on investment (business projects stream only)

- The government will achieve a net positive return on its investment, whereby revenue from main tax levers and stumpage fees arising from incremental economic impacts cover the province’s investment in the project and related administrative and potential borrowing costs.

Due diligence

- Appropriate financial and technical due diligence as well as potential financial, company, technical and public risks have been comprehensively identified, assessed and mitigated.

Due diligence

All business projects will involve external due diligence advisors to assess the company’s financial situation and risks associated with the project (such as, financial, market and technical assessors with knowledge of specific sectors to advise on likely impacts that the investments will have on the firm’s productivity or the sector as well as assessment of project risks).

Projects involving a loan will include an analysis of repayment and security risk (such as the risk of a recipient not being able to repay a loan and the amounts and types of security provided to the province to mitigate such risks). External advisors engaged by Ontario will be bound by confidentiality agreements.

For the collaboration projects stream, staff will complete an in-house due diligence assessment. In certain circumstances, based on the complexity or unique factors of a project, staff may choose to engage external due diligence advisors to assist in the assessment.

Compliance assessment

Upon receiving a signed business plan, proponents and business plans are subject to the following compliance checks:

- Ministry of Labour, Training and Skills Development – Health and Safety:

- prosecutions or convictions

- stop work orders

- Ministry of Labour, Training and Skills Development – Employment Standards:

- prosecutions or convictions

- layoff orders

- MLTSD issued orders

- Ministry of the Environment, Conservation and Parks – Environmental:

- outstanding complaints history

- prosecutions history

- orders – other abatement action history

- Accessibility compliance:

- compliance with the Accessibility for Ontarians with Disabilities Act, 2005 (AODA)

- Ministry of Finance - Tax Compliance:

- compliant with tax obligations to Ontario

- Ministry of Municipal Affairs and Housing:

- planning compliance and implications on municipal finances

Funding agreements

In order to obtain funding, applicants that have been approved for funding will be required to enter into a funding agreement with the province. No payments will be made until the funding agreement has been signed and any conditions for disbursement have been fulfilled.

Disbursements may be made in arrears, unless an initial payment is approved, after applicants provide evidence showing eligible project costs that have been incurred and paid for. Disbursements will be paid in annual instalments which shall not exceed the annual cap

for each fiscal year. The annual cap is the maximum disbursement for each fiscal year and is solely determined by the province, taking into consideration factors such as rate of investment and job creation.

For grants, a performance payment, generally 20% of the total funding, will not be disbursed until after the project has been completed in full.

Within the funding agreements, recipients will be required to make commitments related to: project investment (investment amount and timing of investment tied to milestones), jobs, and payroll for the final year of the project. To the extent that any one or more of these commitments is not achieved by the date set out, the proponent will be subject to pro rata clawbacks or re-payment of funding provided based on formulas set out in the funding agreement.

Clawback provisions

Within the funding agreement, recipients will be required to make commitments related to project investment, jobs and payroll.

In the case of grants, to the extent that each of these commitments is separately not achieved by the date set out, the recipient will be required to pay pro rata clawbacks (payments based on formulas set out in the funding agreement).

In the case of loans, to the extent that each commitment is separately not achieved by the date set out, the forgivable portion, if any, will be reduced based on formulas set out in the funding agreement.

Please see Appendix C for clawback descriptions and calculations.

Other standard terms and conditions

Funding agreements also require recipients to make commitments related to maintaining their Ontario footprint (the company’s jobs and facilities in Ontario). Closure of any Ontario facility, and failure to maintain an agreed employment footprint for all facilities in Ontario, are each events of default.

The terms of the funding agreement will contain provisions in favour of Ontario including but not limited to:

- conditions of disbursement; subject to annual funding allocation

- representations and warranties

- positive and negative covenants

- reporting requirements including annual financial statements and project status reports

- audit requirements including third party auditor certification of Eligible Costs, jobs and payroll at the Project completion date

- provisions relating to non-arm’s length transactions

- insurance and indemnities in favour of the Government of Ontario

- events of default; and remedies for default including but not limited to repayment of funds

- security: may be required for loans

- a guarantee from a parent company or other related party may also be required

- partnership or R&D collaboration with Ontario universities or colleges (as applicable)

Performance measures

Performance measures for the business projects stream have been developed to assess and evaluate how well FSIIP is performing against the achievement of key objectives including productivity, innovation, market expansion, regional impact and importance to Ontario’s forest sector. These performance measures will provide clear and consistent information on the performance of FSIIP, and whether the program is meeting its objectives and achieving real economic benefits for Ontario.

In addition to the performance measures of jobs created, jobs retained, investment leveraged and payroll (excluding bonuses paid to senior executives), FSIIP has performance measures to be reported on for productivity, innovation, and wood utilization as further set out below. For applicants with multiple Ontario locations, these performance measures need to be measured at the project facility(s) level or Ontario level.

Within the business plan, applicants will provide baseline and projected numbers for the mandatory performance measures and select a minimum of one additional performance measure from the wood utilization category below.

Performance measures for the collaboration projects stream will be determined on a case by case basis depending on the objectives and anticipated outcomes of the project.

Ontario may request that additional performance measures be reported.

Funding agreements require companies to report on the performance measures annually, including:

Mandatory performance measures:

- gross margin %

- total sales revenue

- total export sales (domestic and foreign)

- total active employees at project facility(ies)

- total active employees at Ontario facility(ies)

Wood utilization performance measures

Applicants must choose one:

- Improvements in yield/recovery (%) of wood/wood fibre used in production

- Increase in volume (%) of wood fibre inputs

Confidentiality and public reporting

The Ministry of Natural Resources and Forestry and the Ministry of Economic Development, Job Creation and Trade are subject to the Freedom of Information and Protection of Privacy Act (the Act

). The Act provides every person with a right of access to information in the custody or under the control of the province, subject to a limited set of exemptions. Section 17 of the Act provides a limited exemption for third party information that reveals a trade secret, or scientific, commercial, technical, financial or labour relations information supplied in confidence where disclosure of the information could reasonably be expected to result in certain harms. Any trade secret or any scientific, commercial, technical, financial or labour relations information submitted to the province in confidence should be clearly marked.

The province will notify you before granting access to a record that might contain information referred to in Section 17 so that you may make representations to the province concerning disclosure.

Approved projects will be the subject of public announcements.

Ministries must publicly report annually on the status of business support programs and strategic investments, including:

- Project description and project investment commitment.

- Amount of government support.

- Results achieved to date.

Conflicts of interest

Conflicts of interest includes, but is not limited to, any situation or circumstance where:

- In relation to the application process, the applicant has an unfair advantage or engages in conduct, directly or indirectly, that may give it an unfair advantage, including:

- Having, or having access to, information in the preparation of its application that is confidential to the Government of Ontario and not available to other applicants.

- Communicating with any person with a view to influencing preferred treatment in the application process, including the giving of a benefit of any kind, by or on behalf of the applicant to anyone employed by, or otherwise connected with the Government of Ontario.

- Engaging in conduct that compromises, or could be seen to compromise, the integrity of the funding application process and render that process unfair.

- In relation to the performance of its contractual obligations in a contract with the Government of Ontario, the applicant or any person who has the capacity to influence the applicant’s decisions has outside commitments, relationships or financial interests that could, or could be seen by a reasonable person to, interfere with the applicant’s objective, unbiased and impartial judgement relating to the project, the use of the proceeds of the funding, or both.

Appendix A: Eligible costs

- Eligible project costs must be directly attributable to the project and must be incurred and paid on or after the effective date of the funding agreement and up to the project completion date.

- The effective date is the date the applicant’s stage II application and supporting documents were confirmed to be complete by Ontario.

- No funding disbursements will be made until after funding agreements are executed and all appropriate conditions have been satisfied.

- Eligible costs are actual costs directly attributable to and necessary for the completion of the project and were not wholly or partially for another purpose, subject to the terms and conditions of a funding agreement, and subject to approval by Ontario.

- Eligible project costs are one-time costs directly attributable to the development and implementation of the project.

- Eligible project costs do not include ongoing costs of production or operations. Labour, materials, overhead, and other costs for the production/provision of saleable products or services are ineligible.

- Eligible project costs are actual cash outlays, net of all applicable HST, that must be documented through invoices, receipts, or records acceptable to Ontario and are subject to verification by an independent auditor. Evidence of payment must be maintained for audit purposes. Acting reasonably, Ontario’s decisions as to the expenditure eligibility and valuation are final and determinative.

Eligible cost categories

The following cost categories are considered eligible.

Project facility modifications/upgrades required for the project:

Project facility modifications/upgrades that are directly attributable to and necessary for the project, subject to prior written approval by Ontario. These include:

- project facility modifications/upgrades required for installation of project-related equipment, such as: reinforcement of an existing floor for installation of special equipment

- installation of upgraded interior power lines/gas lines/special ventilation required for new project-related equipment or processes

- project related leasehold improvements

Eligible costs may only be included in this category after review and approval by Ontario.

Equipment and machinery:

The purchase or upgrade of equipment and machinery required for the successful completion of the project is eligible. Eligible costs include the purchase price of new or used equipment and machinery and associated delivery and installation costs.

If existing equipment/machinery (purchased prior to the effective date) owned by the proponent or a related company is to be moved to a new location for use in the project, only the costs of moving and installation are eligible.

Furniture (such as desks, chairs, computer workstations) is eligible only for employees working directly on the project in the cases of greenfield/brownfield projects or facility expansions.

Capital lease:

If new equipment is acquired via capital lease (as a method of purchase-financing), the non-interest portions of the capital-lease are eligible. Interest costs are ineligible under any circumstances.

Computer hardware/software/electronics:

Project-related computer hardware and software are considered eligible. Specialized hardware and software that are directly related to the project can be eligible. Ontario will approve such expenses on a case by case basis.

- Standard office hardware (such as laptops, desktops, telecommunications devices and related hardware) is eligible only for employees working directly on the project in the cases of greenfield/brownfield projects or facility expansions.

- Standard office software (such as Microsoft Office, accounting software) is eligible only for employees working directly on the project in the cases of greenfield/brownfield projects or facility expansions.

Note: Internet connectivity is overhead and ineligible. Devices used for telecommunications are ineligible.

Materials:

Costs of direct materials necessary for, and specifically identified and measured as having been used for, the completion of the project, including:

- materials used for prototypes

- materials used for configuring and testing production processes and systems

- materials used for training employees

- other materials directly related to the project as approved by Ontario

Note: Materials used for the regular production of saleable items are ineligible.

Labour (one-time):

One-time labour costs must be directly attributable to the development and implementation of the Project. This would include direct salaries, wages and benefits, paid by the proponent, for employees of the proponent implementing the Project and in proportion to the amount of time spent working on the Project.

To allow for new market access, project-related employees of the proponent that are located in new markets for the purpose of developing the market are considered one-time eligible costs.

Note: Ongoing operational and production labour costs are ineligible. For clarity, labour costs in a new market for on-going operations, or other activities that are not directly related to the development of a new market, are ineligible.

Benefits mean employees’ regular entitlements for payroll-related benefits (CPP, EI, and employer health tax), medical and dental-related benefits, and an appropriate percentage to reflect the cost of sick leave, vacation, and statutory holidays. Ontario must approve any other benefits in writing.

The proponent is required to maintain timesheets or appropriate records for all employees working directly on the project to verify time spent on project work, to verify expenditures for audit purposes and categorize the types of labour as follows:

- management

- one-time labour directly associated with project implementation, (including staff time devoted to hiring new project-related jobs, project administration, project-related purchasing)

- scientific, engineering and technical (including skilled trades)

- quality testing

- other categories as appropriate, with the prior written approval of Ontario

Bonuses that meet the following criteria are eligible:

- non-discretionary (such as part of a compensation package that provides that a money payment at a pre-determined rate, related to explicit employee performance targets)

- paid to non-executive employees

Specific examples of eligible one-time labour expenditures include labour for:

- HR personnel hiring new project-related jobs

- project-related time spent on purchasing

- accounting and reporting related to the project

- project-related research and development (include under research and development section below)

Note: Unless the project involves the relocation of existing employees and is specifically noted in the funding agreement, employee relocation expenses are ineligible.

Research and development:

Costs incurred by the proponent for research and development, which are directly attributable to the project. This may include:

- one-time labour costs directly attributable to the project for research, development, and design work. This could include costs associated with product/process modification. The project related technologies/results need to be defined, as well as the milestones, objectives, personnel requirements and timelines

- consulting, scientific, engineering and design services for research and development conducted by firms/institutions (such as colleges and universities) at arm’s length to the proponent that are directly attributable to the project

Training

Training costs directly attributable to the Project. Training must take place in Ontario. Training that occurs outside Ontario may be approved on a case by case basis, such as training of representatives related to new market access.

Market expansion

Market expansion is defined as the development of new incremental sales where the proponent does not currently have material commercial sales/presence or for new products not previously produced by the company.

Project-related expenses that are directly attributable to market expansion are eligible, including:

- market certification, testing and regulatory compliance

- market research and one-time consulting

- translation, packaging redesign and foreign website development

- trade shows and promotional material

- hiring local market expertise

Other eligible expenses:

Travel

Travel costs are eligible if they meet all of the following:

- expenses are explicitly project-related

- expenses are the most economical option, (such as economy air fare, standard hotel room)

- expenses occur in Ontario; exceptions for travel outside Ontario that directly supports new market access or new business partnerships may be approved by Ontario on a case by case basis

If the above criteria are met, only transportation and accommodation are eligible expenses. Other expenses, including but not limited to, per diems and meals are ineligible.

Legal/accounting

The following types of expenses are eligible:

- fees paid for intellectual property protection that are directly related to the project (such as patent filing fees)

- project-related fees that are directly related to the development of commercial sales in foreign or Canadian jurisdictions where the proponent does not currently have material commercial sales

- accounting expenses that are associated with generating project reporting

- other eligible costs directly attributable to the project may be approved by Ontario

Ineligible cost categories

Only costs that are specified as eligible above or approved by the Province will be eligible for reimbursement. The following costs, among others, are ineligible:

- ongoing costs of production or operations, including those in new markets, such as:

- labour

- materials

- overhead

- any costs related to production/provision of saleable products/services

- costs related to the use of premises including rent, lease, utilities, property taxes, building maintenance, and any other costs related to the ongoing costs of operating company facilities/premises, whether used for the project or not

- equipment depreciation and maintenance

- rental (including under a rental-type lease) of equipment, including office equipment and production-related equipment. For new equipment acquired under capital lease (as a method of financing), the non-interest portions of the capital-lease payments are eligible. Interest costs are ineligible under any circumstances

- general working capital requirements, including:

- working capital requirements not directly attributable to the project including:

- debt service costs

- federal, provincial or municipal taxes

- surtaxes and special expenses (such as legal fees)

- working capital costs for ongoing costs of the proponent’s regular production or operations (such as materials)

- working capital requirements not directly attributable to the project including:

- overhead

- purchase of land or buildings

- labour costs (ongoing/operational) that are not directly related to the project including the ongoing costs of production or operations. (Note: one-time labour costs directly attributable to the development and implementation of the project are eligible)

- costs related to sales, marketing and conferences (except as outlined above)

- meals, hospitality, memberships

- travel (except as outlined above)

- business/project plan preparation

- costs associated with the preparation of the business/project plan (successful or not) such as, success fees or third-party government relations consulting services

- bonuses, dividends, or cash Incentives (except as outlined above)

- transaction costs

- legal, accounting (except as outlined above)

- vehicles and off-site equipment costs associated with the purchase/lease or operation of vehicles or off-site equipment

- costs not incurred in Ontario (except as outlined above)

- costs for project assets that will not be located at the project facility. Exceptions (such as tooling located offsite at a customer’s facility) must be approved by Ontario on a case by case basis

- mergers and acquisitions

Appendix B: Jobs definitions (business stream)

The stage II application should indicate the following regarding jobs and how the project will impact the number of jobs at the project facility(ies) and all Ontario facilities.

- Jobs created: the number of direct jobs created within the project facility(ies) in the province of Ontario that can be attributed to the project. These are net new sustainable project specific jobs, over and above the project facility’s current employment level.

- Jobs retained: the number of current jobs within the project facility(ies) in the province of Ontario and will be retained over the term of the Project.

- If there will be any reduction in jobs during the term of the Project, provide an explanation of the reason for the reduction and whether it is related to the Project. Explain how the job reductions will be managed/implemented (such as through attrition, layoffs, etc.)

- Jobs at-risk: the number of current jobs within the project facility(ies) in the province of Ontario that are expected to be eliminated if the project does not proceed.

- Footprint: the stage II application should provide details regarding the company’s total footprint, including a list of all Ontario facilities and total jobs in Ontario.

Jobs are full-time equivalent active employees as defined below.

Active employees

Active employee

means an employee (or Agency Contract Employee) of the applicant who is actively employed and actively paid. For greater certainty, (i) a person on layoff is not considered to be actively employed

and does not qualify as an active employee

and (ii) an employee on a voluntary leave of absence, including parental leave, shall continue to be considered an active employee

but his/her replacement during such absence shall not be considered as an additional active employee.

Definition of jobs

Hourly employees. A

Job

for an hourly paid active employee means in respect of any fiscal year, x, where x = a ÷ 2000 and a ≤ 2000;Where a = the total number of hours worked during each fiscal year by active employees employed by the recipient, including hours taken as paid vacation, sick leave, and for other similar reasons, at the project facility(ies). For clarity, any individual active employee may not account for more than one Job or 2000 hours during each fiscal year.

Salaried employees. A

job

for a salaried active employee means a full-time job of a salaried active employee of the applicant during one entire fiscal year. If a salaried active employee is employed for fewer than 12 months over a fiscal year, each full month that the active employee is actually employed shall be considered to be 1⁄12th of a job.Agency Contract Employees

is defined as individuals employed by an independent third-party supplier of contract workers (such supplier being approved by the applicant), and who are on an assignment performing work at the project facility(ies) for at least 80% of the time.

Notwithstanding anything to the contrary, any jobs that may be outsourced from the Project Facility shall not be included in the definition and calculation of jobs.

Note: There is no minimum job creation requirement, however, the number and quality of jobs will be important criteria in the assessment. For instance, higher paid and higher value jobs such as skilled trades will be more preferred than low skilled, general labour positions. Other information about the supply/value chain and indirect jobs will also be considered. For example, indirect jobs in harvesting/hauling that may be created as a result of the project.

Appendix C: Clawback and payment calculations

As further described in Section 6 funding agreements

, the agreements for approved projects will include commitments and associated clawbacks.

The formulas for these clawbacks, and examples of how they would be calculated, are provided below for illustrative purposes.

Clawbacks in grant agreements:

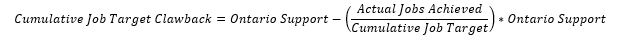

Cumulative job target clawback. If by the project completion date, the cumulative job target is not met, the recipient shall repay a cash amount to Ontario in accordance with the following formula:

Cumulative job target clawback = Ontario support - (Actual jobs achieved ÷ Cumulative job target) × Ontario support

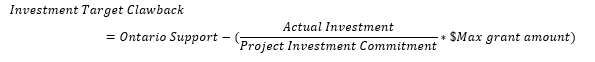

Investment target clawback. If the project investment commitment is not achieved on or before the project completion date, the recipient shall repay a cash amount to Ontario in accordance with the following formula:

Investment Target Clawback = Ontario Support - (Actual Investment ÷ Project Investment Commitment)× $Max grant amount)

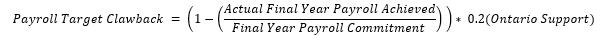

Payroll target clawback. If by the project completion date, the final year payroll commitment is not met, the recipient shall repay a cash amount to Ontario in accordance with the following formula:

Payroll Target Clawback = (1 - (Actual Final Year Payroll Achieved ÷ Final Year Payroll Commitment)) × 0.2 (Ontario Support)

Reductions to the forgivable portion of a loan:

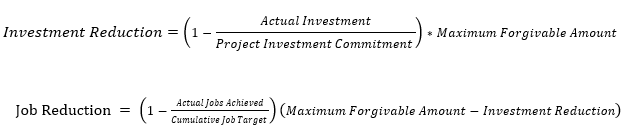

Investment reduction and job reduction. If by the project completion date, the project investment commitment and/or the cumulative job target are not achieved, the amount of the loan forgiven will be reduced as follows:

Investment Reduction = (1 - Actual Investment ÷ Project Investment Commitment) × Maximum Forgivable Amount

Job Reduction = (1 - Actual Jobs Achieved ÷ Cumulative Job Target)(Maximum Forgivable Amount-Investment Reduction)

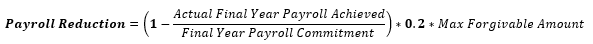

Payroll reduction. If by the project completion date, the payroll commitment is not achieved, the amount of the loan forgiven will be reduced according to the following formula:

Payroll Reduction = (1 - Actual Final Year Payroll Achieved ÷ Final Year Payroll Commitment) × 0.2 × Max Forgivable Amount