Employer Health Tax (EHT)

Find out if you need to pay EHT and how to register for an account, pay instalments and file a return. Find out about the special EHT rules for associated employers.

This online book has multiple pages. Please click on the Table of Contents link above for additional information related to this item.

Information

On April 7, 2025, the Ontario government announced a six-month interest and penalty-free period from April 1, 2025, to October 1, 2025, during which penalties and interest will not apply to any Ontario businesses that miss a payment deadline under select provincial taxes. Learn more.

Help us improve your online experience

Take a 2-minute survey and tell us what you think about this page.

The Ministry of Finance hosts free webinars to help you learn about Ontario taxes, tax credits and benefits.

Overview

The Employer Health Tax (EHT) is a payroll tax on remuneration (for example, salaries, wages, bonuses, taxable benefits, stock options etc.) that employers in Ontario provide to current and former employees.

The purpose of this tax is to assist in providing the government with revenue to fund health care in Ontario.

Who pays EHT

Employers are required to pay EHT on remuneration paid to employees who either:

- physically report for work at your permanent establishment in Ontario

- are attached to your permanent establishment in Ontario

- do not report to work at any of your permanent establishments but are paid from or through your Ontario permanent establishment

If your Ontario payroll is more than your allowable exemption amount, you will have to pay EHT .

You do not have to pay EHT if you are eligible to claim the exemption and your company’s annual Ontario payroll is below your exemption amount.

For detailed information, please visit the dedicated EHT webpages for Remuneration, Permanent Establishments, and Employer-Employee Relationship.

EHT exemption

The exemption amount is currently $ 1 million.

The exemption amount is scheduled for adjustment for inflation on January 1, 2029.

For 2020, the Ontario government increased the exemption amount from $490,000 to $1 million, due to the special circumstances caused by the coronavirus (COVID‑19) in Ontario. This increase was made permanent in 2021. For 2019, the exemption amount was $490,000 and for 2014 – 2018, it was $450,000.

You can claim the tax exemption if:

- you are an eligible employer as defined under the EHT Act

- you pay income taxes

- your Ontario payroll for the year (including the payroll of any associated employers) is less than $5 million or you are a registered charity

- you are not under the control of any level of government (e.g. your board of directors does not include any municipal representatives)

Eligible employers who are members of an associated group are required to enter into an agreement to share the tax exemption for the year using the Associated Employer Exemption Allocation form.

EHT tax exemption example

If you are an eligible employer with a total Ontario payroll of $1,800,000 per year, you would claim the exemption on the first $1,000,000 and pay EHT on the remaining $800,000 of your payroll for the year. Note that the tax rate you use is based on the level of your Ontario payroll before you have deducted any tax exemption.

Learn more about the EHT tax exemption and eligible employer scenarios.

Associated employers

Eligible employers who are members of an associated group must enter into an agreement to share the tax exemption for the year. Associated employers are connected by ownership or by a combination of ownership and relationships between individuals.

One employer in the group must complete an Associated Employers Exemption Allocation Form form on behalf of the whole group and submit it to the ministry with its annual return. If any associated employer is missing from this form or if the form is not submitted, all of the employers in the associated group will be denied the tax exemption. For 2014 and later years, no exemption can be claimed if the associated group’s combined annual Ontario remuneration (payroll) is over $5 million. Employers are required to complete an annual return for each account that has Taxable Ontario Remuneration.

Visit the Ministry of Finance’s Online Services Page to file and submit your Associated Employers Exemption Allocation Form online.

For detailed information about associated employers and filing rules, visit the Associated Employers webpage and related scenarios.

Registered charities

There are special EHT rules for registered charities. For detailed information, visit the Registered Charities webpage and related scenarios.

Tax rates and how to calculate EHT

Rates

| Total Ontario remuneration | Rate |

|---|---|

| Up to $200,000.00 | 0.98% |

| $200,000.01 to $230,000.00 | 1.101% |

| $230,000.01 to $260,000.00 | 1.223% |

| $260,000.01 to $290,000.00 | 1.344% |

| $290,000.01 to $320,000.00 | 1.465% |

| $320,000.01 to $350,000.00 | 1.586% |

| $350,000.01 to $380,000.00 | 1.708% |

| $380,000.01 to $400,000.00 | 1.829% |

| Over $400,000.00 | 1.95% |

Calculate your EHT

The tax rate you use is based on the level of your Ontario payroll before you have deducted any exemption. The EHT is calculated by deducting your exemption from your total Ontario remuneration and then multiplying that amount by your tax rate.

There is no exemption amount available if you or your associated group of employers has more than $5 million of annual payroll. An employer is not eligible to claim an exemption if associated companies have already claimed the full exemption.

Example (a): An employer has total Ontario remuneration of $1,300,000 before deducting the exemption. They will use a tax rate of 1.95% because the payroll is over $400,000 before the exemption is deducted. The EHT calculation would be:

- $1,300,000 (total Ontario remuneration) minus $1,000,000 (exemption) equals $300,000

- $300,000 (remuneration after deducting exemption) multiplied by 1.95% (tax rate) is $5,850 EHT owing.

Example (b): An employer with $175,000 of Ontario payroll who is not eligible to claim any exemption would use a tax rate of 0.98%. The EHT calculation would be:

- $175,000 (total Ontario remuneration) multiplied by 0.98% (tax rate) is $1,715 EHT owing.

Register for an EHT account

It is your responsibility to register for an EHT account with the Ontario Ministry of Finance if you are an employer who is either:

- not eligible for the exemption

- eligible for the exemption but your payroll exceeds your allowable exemption

Once you register for EHT, we will begin to send you annual returns.

You will be required to register and file a return as an associated employer if any of the following situations apply to you:

- you control, or are controlled, by another employer

- you hold significant influence over another employer, or they hold it over you

- you reported you were associated with another employer on your corporation’s income tax returns

- you opted out of being associated for purposes of the federal small business tax deduction

- you sold or bought another employer during this year

- the total Ontario remuneration for the associated group exceeds the available exemption.

Learn more about associated employers.

Before you register for EHT

You must have the following information for your organization:

- legal name

- trade name

- business address

- mailing address

- telephone and fax numbers

- name of contact person or authorized representative

- payroll start date

- payroll frequency

- federal business number (BN)

- employer type (for example, associated, multiple accounts or public sector employer)

Out-of-province employers

If you are an out-of-province employer, establishing a permanent establishment in Ontario for less than 24 months, it is important that you contact the Ministry. Please call 1-866-668-8297 to discuss requirements for your account registration.

Multiple accounts

An employer may set up separate payrolls for each payroll centre or payroll type and can report them separately by setting up multiple EHT accounts under one BN. A different extension number (e.g., TE0001, TE0002) will be assigned to each account.

A multiple accounts employer must file separate instalments and annual returns for each account. Eligible employers with multiple accounts must allocate the exemption between their accounts.

The tax rate for a multiple account employer is based on the combined Ontario payroll of all the employer’s accounts.

How to register

You can register for an EHT account:

- online

- by calling 1-866-ONT-TAXS (1-866-668-8297)

- using a self-help workstation at a ServiceOntario centre

EHT account inquiries

Online inquiries

Employers can access their EHT accounts anytime by using ONT-TAXS online.

Phone or mail inquiries

When you make account-related inquiries by phone or by mail, you will be required to prove authorization by providing the following information:

- employer’s name, address, and federal Business Number (BN)

- your name, telephone number and position in the employer’s organization, or your position as a representative of the employer.

- Authorizing a Representative Form (for external third parties)

File an EHT return

Who needs to file

You must file an EHT annual return if:

- your annual Ontario payroll is greater than your exemption amount (or prorated portion of your exemption amount for partial year eligible employers)

- you received a personalized return

- you are not eligible for the exemption and have an Ontario payroll, or

- you remitted EHT instalments for the year, or

- you are a member of an associated group and the group’s cumulative Ontario payroll exceeds the EHT exemption amount

How to file and pay EHT

We will mail you a personalized annual return with an addressed return envelope.

Once you receive it, file your EHT annual return and payment on or before March 15th:

- through ONT-TAXS online

- in person at certain ServiceOntario centres

- by mail to:

Ministry of Finance

33 King St W

PO Box 620

Oshawa ON L1H 8E9 - EHT Annual Return Portal (Use this service to file your Employer Health Tax annual return only without making a payment. No user login or password is required)

If you did not receive a return, and your Ontario payroll for the year exceeds your allowable exemption amount, call us at

Keep records and books

Employers must keep records and books of accounts with information confirming you are complying with the EHT Act and Regulations.

Visit ontario.ca/recordretention for more information.

Learn more about EHT filing how-tos

Pay monthly instalments

Starting in the 2021 tax year, the Employer Health Tax Act requires Ontario businesses with payroll over $1,200,000 to pay monthly instalments. Instalment payments may be made:

- through ONT-TAXS online

- in person at certain ServiceOntario centres

- through online banking or in person at participating Ontario financial institutions (check with your bank)

- by mail to:

Ministry of Finance

33 King St W

PO Box 620

Oshawa ON L1H 8E9

If total Ontario remuneration is greater than $1.2 million for 2021 and later

You must pay monthly instalments, and file an annual return on or before March 15th of the following calendar year.

If total Ontario remuneration is less than $1.2 million for 2021 and later years

You do not have to pay monthly instalments. File your annual return and pay EHT on or before March 15th of the following calendar year.

Prior to 2021

Prior to 2021, employers were required to make monthly instalment payments when their annual Ontario payroll exceeded $600,000.

How to calculate the EHT instalment

The requirement for instalment payments is based on the employer’s payroll from the prior year.

If you’re a new employer, in your first or second year of operation, estimate your annual payroll for the current year and use that amount to determine if you will have to make instalment payments. If your estimated annual payroll is over $1.2 million then instalment payments are required as soon as your payroll exceeds the instalment threshold for the year.

Instalment Example for 2021:

If you have regular monthly payroll of $210,000 per month, you will use up your $1,000,000 exemption after 5 months. That means your payroll costs starting in May 2021 will begin to be subject to EHT. However, you do not need to start making monthly instalment payments until your payroll exceeds the instalment threshold of $1,200,000, which would happen in June. By the end of June, there would be $260,000 in taxable payroll ($210,000 monthly payroll x 6 months - $1,000,000 exemption), which should be multiplied by your EHT tax rate (1.95%). The June monthly instalment would be $5,070, due by July 15th. To calculate your instalment for each month from July onwards, take your taxable payroll amount ($210,000) and multiply it by your EHT tax rate (1.95%) for a monthly instalment of $4,095 ($210,000 × 1.95%).

Audits

Auditors may carry out audits at your place of business to ensure that you’re in compliance with the EHT Act and Regulations.

Learn what to expect during an Ontario Ministry of Finance audit.

Penalties, interest and fines

COVID‑19 Relief

Between April 1, 2020 and October 1, 2020, and again between January 1, 2022 and July 1, 2022, Ontario provided interest and penalty relief for Ontario businesses who were unable to file or remit their provincial taxes on time, due to the special circumstances caused by the COVID‑19 in Ontario. During these time periods, penalties and interest did not apply to any late Employer Health Tax instalments, returns, or short-paid payments.

Penalties

Penalties are applied if you do not file, or you do not otherwise meet your obligations under the Employer Health Tax Act. If you do not file your instalment on time, or your annual return by March 15th, you may be charged a penalty.

An instalment is considered delivered either on the date:

- the Ministry of Finance receives it

- it is submitted online in ONT-TAXS online

- a participating financial institution (check with your bank) in Ontario receives it along with your payment (annual, final and special returns are not accepted at financial institutions)

An annual return is considered delivered either on the date:

- the Ministry of Finance receives it

- it is submitted online in ONT-TAXS online

Failure to deliver a return

The penalty for failing to deliver a return on time is calculated as follows:

- 5% of the amount owing on the date the return is due, if the amount owing is $1,000 or more, plus

- 1% of the amount owing multiplied by the number of complete months, to a maximum of 12, from the date the return is due to the date the return is received by the Ministry of Finance.

Repeated failure to deliver returns

The penalty for a repeated failure to deliver returns on time is calculated as follows:

- 10% of the amount owing on the date the return is due, if the amount owing is $1,000 or more, plus

- 2% of the amount owing multiplied by the number of complete months, to a maximum of 20, from the date the return is due to the date the return is received by the Ministry of Finance.

This penalty applies to employers who:

- have received a demand for the return, and

- have been assessed a late-filing penalty for failing to deliver a return on time for any of the previous three years.

Failure to deliver a statement

The penalty for failing to deliver a monthly remittance statement on time is:

- 5% of the instalment owing on the date the statement is due, if the amount owing is $1,000 or more.

Failure to complete information

The penalty for not completing the information required on a return or statement is:

- 1% of either the tax or the instalment owing, or

- $50, whichever is greater, up to a maximum of $200.

The penalty for not completing the information required on any other document is $50.

Making false statements

The penalty for knowingly making or participating in the making of an incorrect statement or an omission in a return, certificate, or other document is 25% of the additional tax found to be payable.

Interest charged

Interest is charged if you do not pay on time. Interest is charged on any outstanding balance on your account at a rate set by the Ministry of Finance.

Interest rates may change every 3 months, at the beginning of January, April, July and October.

Fines

In addition to these penalties, persons convicted of offences under the EHT Act may be liable to substantial fines and/or imprisonment imposed by the courts.

Making false statements etc.

An employer is guilty of an offence if the employer:

- makes, participates in, or agrees to making false or deceptive:

- statements in a return, remittance statement or other document

- entries in records or books of account

- destroys, alters, or otherwise disposes of records or books of account to evade payment of tax

- omits or agrees to the omission of material information in records or books of account, or

- wilfully, in any manner, evades or attempts to evade compliance or payment of tax.

In addition to any other penalty, on conviction, the employer is liable to:

- a fine of at least $500 or 25% of the amount of tax payable, whichever is greater, but not more than double the amount of tax payable

- imprisonment for a term of not more than two years, or

- both a fine and imprisonment.

Obtaining or attempting to obtain a refund by fraudulent means

An employer who obtains or attempts to obtain a refund of tax by deceit or by any other fraudulent means is guilty of an offence.

On conviction, the employer is liable to:

- a fine of at least $500, but not more than double the amount of refund or rebate obtained or sought

- imprisonment for a term of not more than two years, or

- both a fine and imprisonment.

Failure to deliver a return

- An employer who fails to deliver a return or to supply information or produce material as required is guilty of an offence.

- On conviction, the employer is liable to a fine of at least $50, but not more than $500, for each day or partial day on which the offence occurs or continues.

Failure to keep records

- An employer who fails to keep and retain records, books of account and source documents is guilty of an offence.

- On conviction, the employer is liable to a fine of at least $50, but not more than $500, for each day or partial day on which the offence occurs or continues.

Obstructing an auditor

- An employer who obstructs an auditor or withholds any information that is relevant for the purposes of determining compliance is guilty of an offence.

- On first conviction, the employer is liable to a fine of at least $50, but not more than $5,000. On each subsequent conviction, the employer is liable to a fine of at least $100, but not more than $10,000.

Failing to comply with the Act or the regulations

- An employer who contravenes or fails to comply with any provision of this Act or regulations is guilty of an offence.

- On conviction, where no other fine is provided by the Act, the employer is liable to a fine of not more than $5,000 for each day or partial day on which the offence occurs or continues.

Offence by director, officer or agent

- Where a corporation is guilty of any offence, any officer, director, or agent who directed, authorized, or agreed to the commission of the offence is guilty of that offence.

- On conviction, the officer, director or agent is liable to the punishment for the offence, whether or not the corporation has been prosecuted or convicted.

Dissolution of corporations

When a corporation is in default of complying with the Employer Health Tax Act, notice may be sent by registered mail, or by publication in The Ontario Gazette, that an order dissolving the corporation will be issued unless the corporation remedies its default within 90 days.

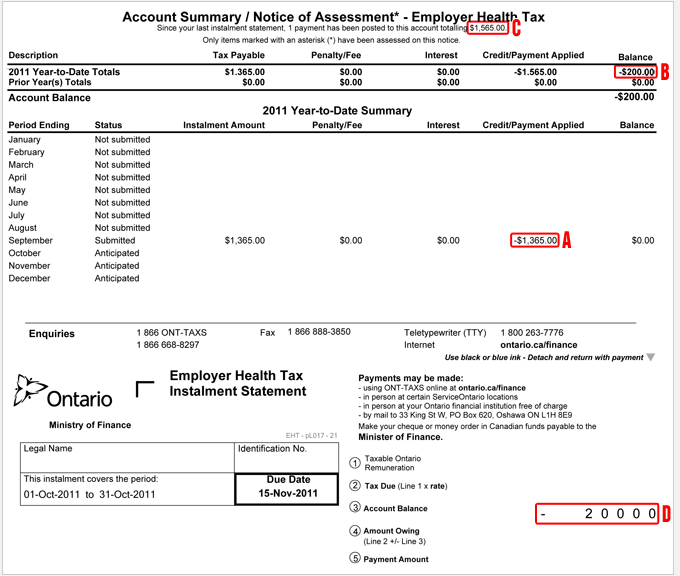

Understanding your Monthly Account Summary/Notice of Assessment

In the Year - to - Date Summary section, payments are displayed in the Credit/Payment Applied column.

If your payment is greater than the Instalment Amount

The amount displayed in the Credit/Payment Applied column (A) will never exceed the Instalment Amount. If the payment amount is greater than the Instalment Amount, the credit will be displayed in the Balance column (B) of the Year-to-Date Totals. The total payment is displayed at the top of the Account Summary/Notice of Assessment (C). The credit will also be noted on line 3 of the Employer Health Tax Instalment Statement (D).

Example 1

September 2011 Instalment Amount is $1,365.00 with a $1,565.00 payment. The October Account Summary/Notice of Assessment will reflect this as follows:

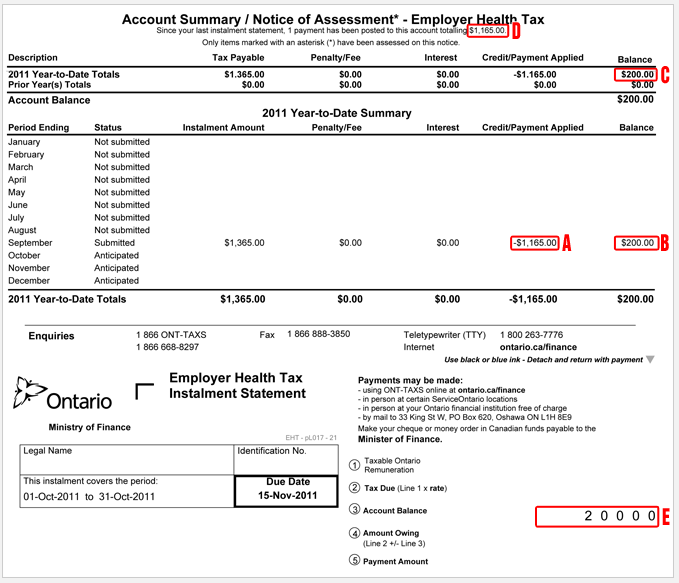

If your payment is less than the Instalment Amount

If the payment amount is less than the Instalment Amount, the total amount paid will be displayed in the Credit/Payment Applied column (A) and the debit balance reflected in the Balance column of the Year - to - Date Summary (B). This debit will also be displayed in the Balance column of the Year - to - Date Totals (C) and the total payment reflected at the top of the Account Summary/Notice Assessment (D). The debit will also be noted on line 3 of the Employer Health Tax Instalment Statement (E).

Example 2

September 2011 Instalment Amount is $1,365.00 with a payment of $1,165.00 and there is not enough credit on account to cover. The October Account Summary/Notice of Assessment will reflect this as follows:

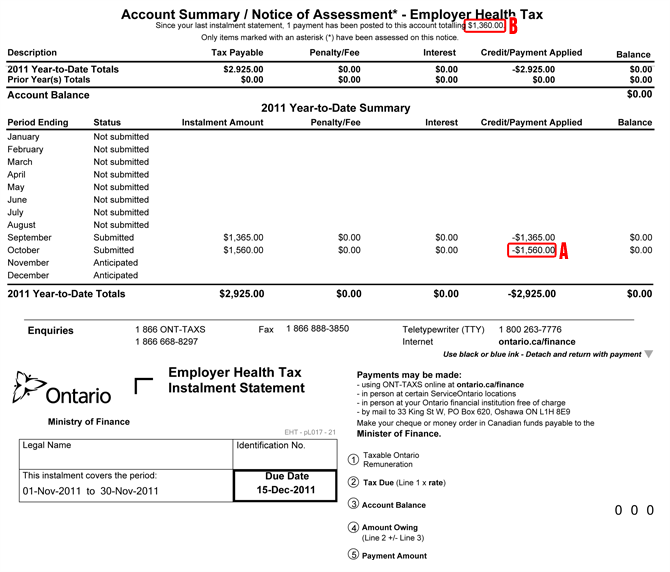

If your payment is less than the Instalment Amount but there is a credit on your account

If the payment amount is less than the Installment Amount and there is a credit on the account as shown in the previous months statement (see Example 1), this credit will be added to the payment and displayed as one total in the Credit/Payment Applied column (A). The total payment amount will be displayed at the top of the Account Summary/Notice of Assessment (B).

Example 3

October 2011 Instalment Amount is $1,560.00 with a payment of $1,360.00 and there is enough credit on the account to cover the $200.00 difference. The November Account Summary/Notice of Assessment will reflect this as follows:

Dispute an EHT assessment

If you receive an EHT assessment and you need an explanation or would like to discuss your assessment, call us at

Once you’ve spoken with Ministry of Finance staff, if you are still dissatisfied with the assessment, you can file a notice of objection.

File a Notice of Objection

- Complete a Notice of Objection form

- Submit the form online – or by mail – within 180 days of the date of the Notice of Assessment or Notice of Re-Assessment

Mailing address:

Ministry of Finance

c/o Director, Advisory, Objections, Appeals and Services Branch

33 King Street West

PO Box 699, Station A

Oshawa ON L1H 8S6 - We will review the objection and notify you of a decision in writing

Please note, even if you file an objection, you still have to pay the amount on your Notice of Assessment/Notice of Re-Assessment, plus any interest.

For more information, refer to the Objection and Appeal Procedures for Ontario Taxes and Programs.

File a Notice of Appeal

If you disagree with the decision from your Notice of Objection, a Notice of Appeal may be submitted to the Ministry of Finance and to the Ontario Superior Court of Justice within 90 days of the mailing date on the Notice of Objection decision. For more information, refer to the Objection and Appeal Procedures for Ontario Taxes and Programs.

Confidential information

The Ministry of Finance is responsible for collecting and maintaining confidential employer information.

The Freedom of Information and Protection of Privacy Act prevents the Ministry of Finance from providing taxpayer information to third parties unless the ministry has the taxpayer’s written consent or is authorized by the taxpayer in ONT-TAXS online. Therefore, when accountants, lawyers or other third parties make enquiries for clients, they must include the client’s authorization in the request or ensure that they have been granted access by the taxpayer in ONT-TAXS online. For a copy of the form, visit Authorizing or Cancelling a Representative. An employer can provide authorization and access to a representative to use ONT-TAXS online on their behalf.

Forms and publications

Access important EHT forms, publications, and related webpages.

For more information

Contact the Ministry of Finance at

Request written interpretations

Some written interpretations are included in this guide to illustrate how the Ministry has made past determinations on complex tax situations.

To request a written interpretation on a specific situation you don’t see in this guide, send your request in writing to:

Email: Advisory Services

Mail:

Ministry of Finance

Advisory, Objections, Appeals and Services Branch

Advisory Section, Employer Health Tax

33 King Street West, 3rd Floor

Oshawa ON L1H 8H5

EHT Annual Return Portal. Use this service to file your Employer Health Tax annual return only without making a payment. No user login or password is required.