We've moved this content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

A Guide for Real Estate Practitioners - Land Transfer Tax and the Electronic Registration of Conveyances of Land in Ontario

Help us improve your online experience

Take a 2-minute survey and tell us what you think about this page.

Introduction

This page has been prepared as a resource for legal and real estate professionals involved in the electronic registration of conveyances of land in Ontario. It is assumed that users of this handbook have a working knowledge of conveyancing and electronic registration. For specific examples and other issues and common problems relating to land transfer tax, please see A Guide for Real Estate Practitioners with respect to Land Transfer Tax and the Registration of Conveyances of Land in Ontario which is available on our website.

This page contains general information and is provided for convenience and guidance for the land transfer tax portion of Teraview only. It is not a substitute for the provisions of the Land Transfer Tax Act (Act) or regulations. Should there be a discrepancy between this document, the Act and its regulations, the provisions of the Act and regulations apply.

Contact us

Documents required under the Act can be submitted by email, fax or mail, as per the contact information noted below.

If this page does not completely address your situation, refer to the Act and related regulations, visit our website at ontario.ca/finance or contact us by:

- Email: LTTGeneral@Ontario.ca

- Fax: 905-433-5770

- Telephone toll free: 1-866-668-8297

- Teletypewriter (TTY): 1-800-263-7776

- Mail: Ministry of Finance Land Taxes Section 33 King Street West Oshawa ON L1H 8H9

Land Transfer Tax

The TAX option in the menu below launches the Land Transfer Tax functions enabling the user to select the tabs required to complete the Land Transfer Tax Statements.

When the TAX function is selected the Land Transfer Tax window opens and the following tabs are presented:

Failure to complete a mandatory tab or field will generate an error message and prevent successful completion of the electronic registration.

In some cases supplementary evidence may be required for presentation to the registry office before certification of title can take place.

Deponents

Completion of this section is mandatory for all electronic conveyances.

Deponents are the individuals who make statements and declare in what capacity they are completing the statements.

- If more than one deponent, and each deponent is not in the same capacity, more than one deponent tab must be completed. To add a deponent, click on the + sign on the toolbar. To delete a deponent, click on the ‑ sign on the toolbar.

- This section may be completed by an agent authorized in writing to act on behalf of a transferee(s), or by a solicitor.

- A corporation cannot be a deponent. If a corporation is a transferee, either paragraph (d) or (e) must be selected.

- Where transferees are spouses, either spouse may complete paragraph (f) on behalf of both of them.

- If any of paragraphs (d), (e), or (f) are selected, a paragraph reference must be made and the individual or corporation being represented must be inserted by clicking the grey box to the right of the text box and selecting the appropriate party.

- The transferor may complete the statements where no tax is payable under the Act and the transferor has sufficient information to enable the transferor to make the statements. The name of the transferor may be inserted manually or by clicking the grey box to the right of the text box and selecting the transferor(s) from the drop down menu, as illustrated below. No further statement should be selected on the Deponent tab, however statement 9120 or 9121 must be selected from the Explanations tab. Note: The Teraview system does not allow for the transferor(s) to make statements if they consist of a combination of a person and a company.

Value of consideration > $400,000

This section must be completed ONLY where the consideration is greater than $400,000.00. A higher rate of tax applies to any consideration over $2,000,000.00 where the lands contain at least one and not more than two single family residences.

Statement 9031 MUST be made together with one of 9032, 9033 or 9038.

Note: Subsection 2(2) of the Act allows for an apportionment of the consideration where the total consideration exceeds $2,000,000 and part of the land being conveyed has a use other than just residential (please note that "vacant" or "no use" is not considered to be another use). This results in a lower tax payable than would normally be calculated had the apportionment not been claimed.

If the value of consideration can be apportioned, statements 9031 and 9038 must be selected and completed. When 9038 is selected you must enter the total consideration attributed to the single family residence only in "AMOUNT" and the use of the remainder of the lands must be described in "TEXT". The system will calculate the appropriate amount of land transfer tax based on the consideration entered on both the consideration tab and the amount entered in statement 9038 for the single family residence.

Note: When completing the "AMOUNT", use only numerical values and do not use any dollar signs, commas or decimal points.

Consideration

By definition, consideration includes the gross sale price paid or to be paid by or on behalf of the transferee, the value expressed in money of any liability assumed by or on behalf of the transferee, and the value of any benefit conferred, either directly or indirectly by the transferee, as part of the arrangement relating to the transfer. The consideration must be allocated to (a) through (f) on the consideration screen.

1 (c) Property transferred in exchange – Statement 9021

- Where the transfer is pursuant to an exchange of lands, the value of the property involved in the exchange must be entered in paragraph (c). After entering an amount in paragraph (c), go to the "Explanations Tab," select statement 9021, and enter a brief legal description of the lands transferred in exchange.

1 (d) Fair market value of the land(s) – Statements 9022 and 9011, 9012, 9013, 9014 or 9015

In certain circumstances, the Act deems the value of consideration to be the fair market value of the land. The fair market value of the land must be entered in paragraph (d). After entering an amount in paragraph (d), go to the "Explanations Tab," select statement 9022, and one of 9011, 9012, 9013, 9014 or 9015.

The following are situations where the value of consideration is deemed to be equal to the fair market value of the land as of the date of registration:

- Statement 9011 – Any transfer to a corporation where shares of the transferee corporation form all or part of the consideration.

- Statement 9012 – Any transfer from a corporation where the transferee is a shareholder of the transferor.

- Statement 9013 – Any transfer of a leasehold interest where the lease can exceed 50 years.

- Statement 9014 – In the case of a final order of foreclosure, the transferee is given the option of setting out as the consideration the lessor of (i) the amounts outstanding on the mortgage being foreclosed together with all prior mortgages and any subsequent mortgages held by the transferee OR (ii) the fair market value of the land as of the date of registration. If the latter is used, then this value should be entered in paragraph (d).

- Statement 9015 – Other. This is a text field that allows the user to provide other explanations such as a transfer to a mortgagee from a mortgagor as a result of a default on the mortgage and the transfer is being made in lieu of a foreclosure.

1 (f) Other valuable consideration subject to land transfer tax – Statement 9023

Where an amount is entered in paragraph (f), you must go to the "Explanations Tab" and select statement 9023 and enter a description of the consideration.

Where a partial exemption is being claimed, the non‑exempt portion of the consideration should be entered here and then you must go to the "Explanations Tab" and select statement 9023 and enter an explanation for the partial exemption.

1 (g) VALUE of land, building, fixtures & goodwill subject to Land Transfer Tax–Statement 9024

The Land Transfer Tax payable will be calculated on the total consideration automatically inserted in paragraph (g). The amount of tax payable will appear on the screen and will be adjusted according to any subsequent claims for exemption.

1 (h) VALUE OF ALL CHATTELS – items of tangible personal property e.g. furniture

1 (i) Other considerations for transaction not included in (g) or (h) – Statement 9024

Where an amount is entered in paragraph (i), you must go to the "Explanations Tab" and select statement 9024 and enter a description of the other consideration. Amounts entered in paragraph (i) must not be taxable under the Land Transfer Tax Act and may include amounts paid for chattels.

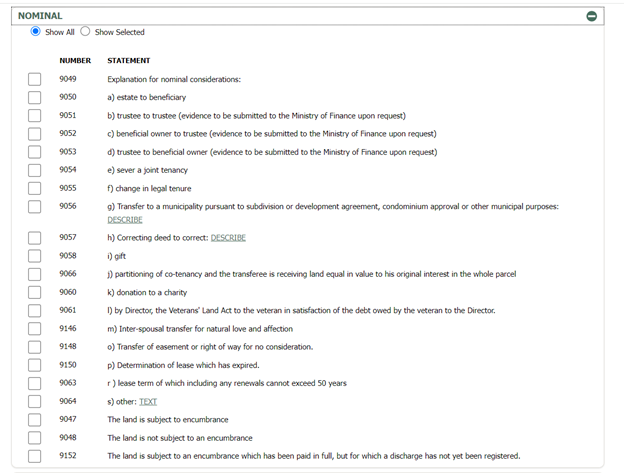

Nominal

Statements may be selected here ONLY in situations where there is NO CONSIDERATION OF ANY KIND OR THE VALUE OF CONSIDERATION IS LESS THAN $200 for the conveyance. This section must not be completed if an exemption is claimed.

Statement 9049 must be chosen together with one of 9050, 9051, 9052, 9053, 9054, 9055, 9056, 9057, 9058, 9066, 9060, 9061, 9063 or 9064. If 9064 is selected then "TEXT" must be entered.

Note: Statements 9051, 9052 or 9053 - the Ministry no longer requires the registrant to provide a supplementary trust affidavit following registration. However, the Ministry can subsequently request the affidavit and other evidence to support the selection of those statements.

If 9058 or 9060 are selected, then either statement 9047 or 9048 or 9152 must be made.

Note: If 9047 is chosen, then the amount of the encumbrance must be entered on line 1(b)(i) of the "Consideration Tab" section and all previously selected statements should be removed from the Nominal Tab. The tax will be calculated accordingly, as there is no exemption available on a transfer that is a gift or a donation to a charity where there is an existing encumbrance on the land.

Explanations

Consideration – explanation required

In certain circumstances, explanations are required where a figure is entered in "c", "d", "f" and "i" on the "Consideration" tab. Please see the Consideration section of this guide for details.

The "Explanation" tab should also be used when a partial exemption is being claimed. Please see the Consideration section of this guide for details.

Land Transfer Tax statements by the transferor

- Statement 9120 Individual(s) – This statement only applies where the transferor(s) is an individual(s) who has sufficient information to complete these statements.

Statement 9121 Corporation – This statement only applies where the transferor is a corporation. The person making the statements must be an officer of the corporation authorized to act for the transferor and who has sufficient information to complete these statements.

Note: The transferor can only make the statements if no tax is payable.

Regulation 700, RRO 1990

- If a reduction in the consideration is being made pursuant to Regulation 700, RRO 1990, then statement 9073 must be completed.

Refund for first‑time homebuyer of an eligible home

Statement selection rules are as follows:

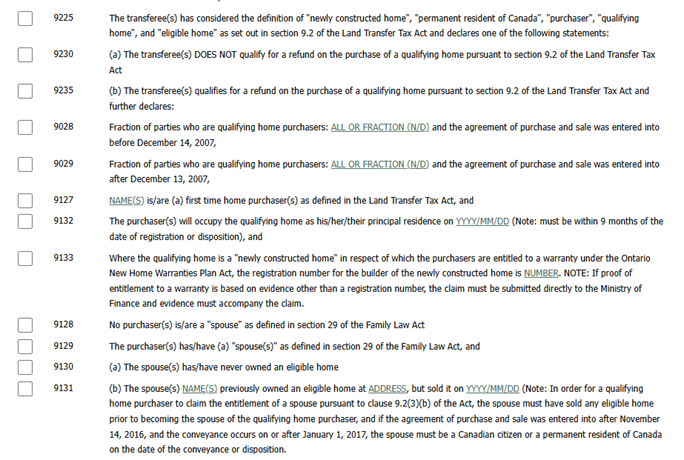

- 9225 and (9230 or 9235)

- If 9235 is selected, then (9028 or 9029) and (9127 and (9128 or (9129 and either 9130 or 9131)) and 9132 and 9133 (if applicable)

- 9225 - The transferee(s) has considered the definition of “newly constructed home”, “permanent resident of Canada”, “purchaser”, “qualifying home”, and “eligible home” as set out in section 9.2 of the Land Transfer Tax Act and declares:

- 9230 - (a) The transferee(s) DOES NOT qualify for a refund on the purchase of a qualifying home pursuant to section 9.2 of the Land Transfer Tax Act

- 9235 - (b) The transferee(s) qualifies for a refund on the purchase of a qualifying home pursuant to section 9.2 of the Land Transfer Tax Act and further declares:

- 9028 ‑ Fraction of parties who are qualifying home owners: "ALL" OR FRACTION (N/D) and the agreement of purchase and sale was entered into before December 14, 2007.

- 9029 – Fraction of parties who are qualifying home purchasers: “ALL” OR FRACTION (N/D) and the agreement of purchase and sale was entered into after December 13, 2007.

- 9127 – NAME[S] is/are [a] first time home purchaser[s] as defined in the Land Transfer Tax Act, and

- 9132 – The purchaser[s] will occupy the qualifying home as his/her/their principal residence on YYYY/MM/DD [Note: must be within 9 months of the date of registration or disposition]

- 9133 – Where the qualifying home is a “newly constructed home” in respect of which the purchasers are entitled to a warranty under the Ontario New Homes Warranties Plan Act, the registration number of the builder of the newly constructed home is NUMBER. NOTE: If proof of entitlement to a warranty is based on evidence other than a registration number, the claim must be submitted directly to the Ministry of Finance and evidence must accompany the claim.

- 9128 – No purchaser[s] is/are a “spouse” as defined in section 29 of the Family Law Act

- 9129 – The purchaser[s] has/have [a] “spouse[s]” as defined in section 29 of the Family Law Act, and

- 9130 – (a) the spouse[s] has/have never owned an eligible home

- 9131 – (b) the spouse[s] NAME[S] previously owned an eligible home at ADDRESS, but sold it on YYYY/MM/DD (Note: In order for a qualifying home purchaser to claim the entitlement of a spouse pursuant to clause 9.2(3)(b) of the Act, the spouse must have sold any eligible home prior to becoming the spouse of the qualifying home purchaser, and if the agreement of purchase and sale was entered into after November 14, 2016, and the conveyance occurs on or after January 1, 2017, the spouse must be a Canadian citizen or a permanent resident of Canada on the date of the conveyance or disposition.)

- Ensure the land transfer tax has been reduced by the refund amount before registering.

Prescribed Information for the Purposes of Section 5.0.1

In order to comply with section 5.0.1 of the Land Transfer Tax Act, registrants must complete statement 9167, 9168 or 9169. If statement 9167 is selected, the registrant must provide the Confirmation Number received when the information was provided.

Non-Resident Speculation Tax (NRST)

If NRST is payable

- 9170 The transferee(s) has considered the definitions of “designated land”, “foreign corporation”, “foreign entity”, “foreign national”, “Greater Golden Horseshoe Region”, “specified region”, “spouse” and “taxable trustee” as set out in subsection 1(1) of the Land Transfer Tax Act and O.Reg 182/17, and declare one of the following statements:

- 9171 This conveyance is subject to additional tax as set out in subsection 2(2.1) of the Act AND

- 9189 (a) This is a conveyance of land located within the Greater Golden Horseshoe Region and is pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into ON OR BEFORE March 29, 2022, AND THE LAND IS NOT BEING CONVEYED to any foreign corporation that is not a purchaser under the agreement of purchase and sale or a corporation to which the agreement of purchase and sale was assigned, or to any foreign national or taxable trustee other than a purchaser, or the spouse of a purchaser, under the agreement of purchase and sale, or a person, or the spouse of a person, to whom the agreement of purchase and sale was assigned.

- 9190 (b) This is a conveyance of land pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into AFTER March 29, 2022 BUT ON OR BEFORE October 24, 2022 AND THE LAND IS NOT BEING CONVEYED to any foreign national that is not a purchaser under the agreement of purchase and sale or a corporation to which the agreement of purchase and sale was assigned, or to any foreign national or taxable trustee other than a purchaser, or the spouse of a purchaser, under the agreement of purchase and sale, or a person, or the spouse of a person, to whom the agreement of purchase and sale was assigned.

- 9191 (c) This is a conveyance of land pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into ON OR BEFORE October 24, 2022 AND THE LAND IS BEING CONVEYED to any foreign corporation that is not a purchaser under the agreement of purchase and sale or a corporation to which the agreement of purchase and sale was assigned, or to any foreign national or taxable trustee other than a purchaser, or the spouse of a purchaser, under the agreement of purchase and sale or a person, or the spouse of a person, to whom the agreement of purchase and sale was assigned.

- 9202 (d) This is a conveyance of land pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into AFTER October 24, 2022.

- 9172 This conveyance is subject to additional tax as set out in subsection 2(2.1) of the Act. This is a combination of “designated land” and land that is not designated land. The transferee(s) has accordingly apportioned the value of the consideration on the basis that the consideration attributable to the conveyance of the designated land is AMOUNT and the remainder of land is used for TEXT purposes, AND

- 9193 (a) This is a conveyance of land located within the Greater Golden Horseshoe Region and is pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into ON OR BEFORE March 29, 2022, AND THE LAND IS NOT BEING CONVEYED to any foreign corporation that is not a purchaser under the agreement of purchase and sale or a corporation to which the agreement of purchase and sale was assigned, or to any foreign national or taxable trustee other than a purchaser, or the spouse of a purchaser, under the agreement of purchase and sale, or a person, or the spouse of a person, to whom the agreement of purchase and sale was assigned.

- 9194 (b) This is a conveyance of land pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into AFTER March 29, 2022 BUT ON OR BEFORE October 24, 2022 AND THE LAND IS NOT BEING CONVEYED to any foreign national that is not a purchaser under the agreement of purchase and sale or a corporation to which the agreement of purchase and sale was assigned, or to any foreign national or taxable trustee other than a purchaser, or the spouse of a purchaser, under the agreement of purchase and sale, or a person, or the spouse of a person, to whom the agreement of purchase and sale was assigned.

- 9195 (c) This is a conveyance of land pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into ON OR BEFORE October 24, 2022 AND THE LAND IS BEING CONVEYED to any foreign corporation that is not a purchaser under the agreement of purchase and sale or a corporation to which the agreement of purchase and sale was assigned, or to any foreign national or taxable trustee other than a purchaser, or the spouse of a purchaser, under the agreement of purchase and sale or a person, or the spouse of a person, to whom the agreement of purchase and sale was assigned.

- 9203 (d) This is a conveyance of land pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into AFTER October 24, 2022.

All transfers of land in Ontario must include statements about whether the NRST (additional tax: subsection 2(2.1) of the Act) applies to the transfer.

NRST is computed at the rate of 25 per cent of the value of the consideration for the transfer, if it is a purchase or acquisition of land that contains at least one and not more than six single family residences ("designated land") located anywhere in Ontario by individuals who are not citizens or permanent residents of Canada or by foreign corporations ("foreign entities") and taxable trustees. However, if part of the land being transferred is used for a purpose other than residential purposes, NRST is payable only on the amount of the consideration that is reasonably attributable to the land used in connection with single family residence(s).

Note that transitional provisions apply for certain agreements entered into on or before October 24, 2022. Read on: Non-Resident Speculation Tax webpage.

If NRST is payable, the registrant must select statements 9170 AND:

- 9171 and (9189 or 9190 or 9191 or 9202), OR

- 9172 and (9193 or 9194 or 9195 or 9203)

If there is no apportionment for NRST purposes, select statements 9170 and 9171. Also select one of 9189, 9190, 9191 or 9202. These four statements determine whether a transitional tax rate will apply.

If apportionment for NRST purposes is allowed, select statements 9170 and 9172. Also select one of 9193, 9194, 9195 or 9203. These four statements determine whether a transitional tax rate will apply.

Note: Subsection 2.1(6) of the Act allows for an apportionment of the value of the consideration where part of the land being conveyed has a use other than just residential (please note that "vacant" or "no use" is not considered to be another use). This results in a lower NRST payable than would normally be calculated had the apportionment not been claimed.

- If the value of the consideration can be apportioned, statements 9170 and 9172 must be selected and completed. When 9172 is selected you must enter the total consideration attributed to the single family residence(s) only in "AMOUNT" and the use of the remainder of the lands must be described in "TEXT". The system will calculate the appropriate amount of NRST based on the consideration entered in statement 9172 for the single family residence(s).

Note: When completing the "AMOUNT", use only numerical values and do not use any dollar signs, commas or decimal points.

NRST may be paid at the time of registration. However, if the registrant chooses to prepay NRST and land transfer tax to the ministry, in addition to completing the above statements, registrants must complete statement 9089. After pre-paying the land transfer tax and the NRST, registrants will receive a receipt number for insertion into statement 9089.

If no NRST is payable

- 9173 The transferee(s) has read and considered the definitions of “designated land”, “foreign corporation”, “foreign entity”, “foreign national”, “Greater Golden Horseshoe Region”, “specified region”, “spouse” and “taxable trustee” as set out in subsection 1(1) of the Land Transfer Tax Act and O.Reg 182/17. The transferee(s) declare that this conveyance is not subject to additional tax as set out in subsection 2(2.1) of the Act because:

- 9197 (a) This is a conveyance of land located outside of the Greater Golden Horseshoe Region pursuant to an agreement of purchase and sale or an assignment of an agreement of purchase and sale that was entered into ON OR BEFORE March 29, 2022, AND THE LAND IS NOT BEING CONVEYED to any foreign corporation that is not a purchaser under the agreement of purchase and sale or a corporation to which the agreement of purchase and sale was assigned, or to any foreign national or taxable trustee other than a purchaser, or the spouse of a purchaser, under the agreement of purchase and sale or a person, or the spouse of a person, to whom the agreement was assigned.

- 9175 (b) This is not a conveyance of “designated land”.

- 9176 (c) The transferee(s) is not a "foreign entity" or a "taxable trustee".

- 9177 (d) Subsection 2.1(3) of the Act applies to this conveyance (the land has been conveyed pursuant to an agreement of purchase and sale entered into on or before April 20, 2017, and any assignment of the agreement of purchase and sale to any other person was entered into on or before April 20, 2017).

- 9178 (e) Subsection 2.1(4) of the Act applies to this conveyance in that the land is being conveyed to a "nominee" as defined in Ontario Regulation 182/17 and the conveyance satisfies the requirements of section 2 of the Regulation.

- 9179 (f) Subsection 2.1 (4) of the Act applies to this conveyance in that the land is being conveyed to a "protected person" as defined in Ontario Regulation 182/17 and the conveyance satisfies the requirements of section 3 of the Regulation.

- 9180 (g) Subsection 2.1 (4) of the Act applies to this conveyance in that the land is being conveyed to a "foreign national" and the foreign national’s "spouse" as defined in subsection 1(1) of the Act, and the conveyance satisfies the requirements of section 4 of the Regulation.

- 9181 (h) OTHER INSERT TEXT

If a registration is not subject to NRST, statement 9173 and one of statements 9197, 9175 to 9181 must be selected.

Statement 9173 advises that NRST is not payable. One of the statements numbered 9197 and 9175 through 9181 must be selected to explain why the NRST is not payable. For conveyances registered after March 29, 2022, the specified region exemption in statement 9174 can no longer be claimed as the specified region includes all of Ontario. Statement 0174 has been removed.

Record Keeping Obligations

All persons registering a conveyance have an obligation to keep, in Ontario, all documents, records and accounts in such form and containing such information as will enable an accurate determination of taxes payable. The records are to be kept for a period of at least seven years after the date on which the conveyance is registered or the information to which they relate is given to the minister (as the case may be).

Transferees must expressly acknowledge this obligation. New statements are being added to Teraview. After December 30, 2017, completion of statements (9182 or 9183) and 9184 will be mandatory.

Exemptions

This section is to be completed only where consideration is paid but an exemption is claimed and therefore no tax is payable.

- Transfer of an Easement to Oil or Gas Pipeline Company – Statement 9071 – This conveyance qualifies for an exemption from tax under Regulation 695 RRO 1990 for certain transfers of easements to an oil or gas pipeline company.

- Transfer between Spouses – Statement 9085 must be chosen together with one of 9086, 9087 or 9088 – These statements only apply to inter‑spousal transfers that qualify for exemption under Regulation 696 RRO 1990 and should not be used if other statements have been selected from the Nominal tab.

- Transfer to or in trust for or vested in a dependant of their transferor under section 34 of the Family Law Act – select Statement 9137.

- Note: Statements 9089 and 9090 (Ministry pre-approval of land transfer tax liability prior to registration) – the Ministry requires a minimum of 15 business days to process pre-approval of land transfer tax liability prior to registration.

Tax Previously Paid ‑ Statement 9126 ‑ Where a transfer document is being registered and tax was previously paid, the “document type” should be described as either a notice or caution and the instrument number attached to the notice or caution should be entered.

Notes:

- The value of consideration must be entered on the consideration screen.

- Taxpayers are reminded that when registering a caution, they are obligated to declare the value of consideration as would be declared when registering a transfer.

- Acquisition and Reversion of a life lease interest ‑ Statements 9124 and 9125 ‑ Where a document is being registered that conveys a life lease interest to a purchaser or the reversion of a life lease interest back to the owner of the life lease development, select whichever statement is applicable.

- Family Farm Exemption ‑ Statements 9123, 9078, 9079, 9080

This conveyance qualifies for an exemption from tax under Regulation 697, RRO 1990, for the Family Farm Exemption. Statement 9123 must be selected along with either statement 9078 (family farm corporation or individual to an individual) or 9079 (Personal Representative of the Estate to an Individual) or 9080 (individual to a family farm corporation).

Note that the exemption is not available for transfer from a corporation to another corporation.

Note: The exemption for a conveyance to a family business corporation cannot be claimed electronically. The proper documentation to claim this exemption must be submitted directly to the Ministry of Finance and the applicable endorsement obtained.

- Hospital Restructuring – Statement 9099 – This conveyance qualifies for an exemption from tax under Regulation 676 RRO 1998 for certain hospital restructuring.

Exemption - Charity Reorganization

In order to claim the exemption under Ontario Regulation 386/10, registrants must complete statements 9159 to 9163.

Assessment number

The Assessment Roll Number is vital for purposes of accurately determining municipal property tax.

School tax

If no statement is selected on the School Tax tab, the system will default to English‑Public.