Government Notices Respecting Corporations

Notice of Default in Complying with the Corporations Tax Act

The Director has been notified by the Minister of Finance that the following corporations are in default in complying with the Corporations Tax Act.

Notice Is Hereby Given under subsection 241(1) of the Business Corporations Act, that unless the corporations listed hereunder comply with the requirements of the Corporations Tax Act within 90 days of this notice, orders will be made dissolving the defaulting corporations. All enquiries concerning this notice are to be directed to Ministry of Finance, Corporations Tax, 33 King Street West, Oshawa, Ontario L1H 8H6.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-07-16 |

A & A Appraisals Inc. |

000996697 |

|

2011-07-16 |

Alma Real Estate Ltd. |

000330106 |

|

2011-07-16 |

Amarbir & Associates Inc. |

002012630 |

|

2011-07-16 |

Artess International Employment Services Ltd. |

001697282 |

|

2011-07-16 |

Astra Lock & Safe Inc. |

001470412 |

|

2011-07-16 |

Atis Marketing Corporation |

001549423 |

|

2011-07-16 |

B.G. Gardening Ltd. |

001654094 |

|

2011-07-16 |

Bakery Hollywood Inc. |

001238051 |

|

2011-07-16 |

Barry Mcarthur Trucking Ltd. |

000883181 |

|

2011-07-16 |

Black Hand Technologies Inc. |

001384817 |

|

2011-07-16 |

Blue Sky Inc. |

001480349 |

|

2011-07-16 |

Brookstone Associates Ltd. |

000887213 |

|

2011-07-16 |

Calcom Inc. |

002030427 |

|

2011-07-16 |

Commercial Hotel (Brockville) Limited |

000570058 |

|

2011-07-16 |

Contract Textiles Inc. |

000868453 |

|

2011-07-16 |

Cozy Home Furniture Inc. |

001015577 |

|

2011-07-16 |

Creek Mill Meadows Inc. |

001011240 |

|

2011-07-16 |

Dupont Square Limited |

000878256 |

|

2011-07-16 |

Electronic Hardware Specialties Limited |

000202021 |

|

2011-07-16 |

European General Contracting Inc. |

001527341 |

|

2011-07-16 |

E3 Adjustable Workstations Inc. |

002073748 |

|

2011-07-16 |

Faraway Enterprises Limited |

000105351 |

|

2011-07-16 |

Four Corners Developments Inc. |

001293793 |

|

2011-07-16 |

Frontline Computers Inc. |

001503714 |

|

2011-07-16 |

Frontline Investigations & Security Team Inc. |

001376892 |

|

2011-07-16 |

Galtak Houseware Limited |

000918271 |

|

2011-07-16 |

Gem Security Systems Inc. |

000282632 |

|

2011-07-16 |

General Mercantile Corporation |

000828691 |

|

2011-07-16 |

Great Ideas Bgb Inc. |

001637632 |

|

2011-07-16 |

Green Lake Investments Inc. |

001476717 |

|

2011-07-16 |

Guiomara Holdings Inc. |

001632302 |

|

2011-07-16 |

H.D.S. Investments Limited |

000488997 |

|

2011-07-16 |

Hamel Communication Group Inc. |

001097949 |

|

2011-07-16 |

Hawthorne Properties Ltd. |

000598817 |

|

2011-07-16 |

Howard Street Limited |

001546397 |

|

2011-07-16 |

Interact Rehabilitation Management Inc. |

001067160 |

|

2011-07-16 |

Irie Auto Parts Ltd. |

001383409 |

|

2011-07-16 |

J. & G. Landscaping And Snow Removal Inc. |

000908590 |

|

2011-07-16 |

J.S.P Transport Inc. |

002078728 |

|

2011-07-16 |

Jack’s Wrecker Service Inc. |

001597528 |

|

2011-07-16 |

Kan Z. Trading Company Ltd. |

001048945 |

|

2011-07-16 |

Karjama Design Inc. |

001680970 |

|

2011-07-16 |

Le Petit Quebec Hotel Limited |

000647449 |

|

2011-07-16 |

Life Breath Home Care Services Ltd. |

001639187 |

|

2011-07-16 |

Lincoln Shores Estates Limited |

001631059 |

|

2011-07-16 |

Lwh International Inc. |

001612085 |

|

2011-07-16 |

Mangico Inc. |

001102309 |

|

2011-07-16 |

Maple Royal Entertainment Inc. |

002077791 |

|

2011-07-16 |

Matrix Health Network Inc. |

001077933 |

|

2011-07-16 |

Metal-Lee Recycling Inc. |

001694424 |

|

2011-07-16 |

Nmk Productions Inc. |

001384095 |

|

2011-07-16 |

Northwind Building Services Group Ltd. |

001569380 |

|

2011-07-16 |

P M Manov Flooring Inc. |

001648654 |

|

2011-07-16 |

Port Albert Developments Limited |

000106654 |

|

2011-07-16 |

Race Buffs Inc. |

001359684 |

|

2011-07-16 |

Ray Com Forest Canada Inc. |

001140605 |

|

2011-07-16 |

Rivard Park Inc. |

001147194 |

|

2011-07-16 |

Sci-Fi World Corporation |

001043448 |

|

2011-07-16 |

Shahi Palace Restaurant Inc. |

001023752 |

|

2011-07-16 |

Solid Masonry Inc. |

001071229 |

|

2011-07-16 |

Solutions Centrum - Consultants Inc. |

001360226 |

|

2011-07-16 |

Spierak Holdings Corp. |

000985265 |

|

2011-07-16 |

Systematic Property Investments Inc. |

002047946 |

|

2011-07-16 |

T.J.C. Inc. |

001084729 |

|

2011-07-16 |

The General Construction And Renovation Co . Ltd. |

001627499 |

|

2011-07-16 |

The Parking Place Company Limited |

000874463 |

|

2011-07-16 |

The Sifton Capital Corporation |

000906881 |

|

2011-07-16 |

The Tire Network Inc. |

001197048 |

|

2011-07-16 |

Travels “R” Us Inc. |

001203515 |

|

2011-07-16 |

Universal Power Contractors Ltd. |

001629337 |

|

2011-07-16 |

V.I.P. Bookstore & Gift Inc. |

001027309 |

|

2011-07-16 |

Wayne Dempsey Inc. |

001194211 |

|

2011-07-16 |

We Come To You Storage Inc. |

002066287 |

|

2011-07-16 |

Willsie Sunnyview Farms Limited |

000243278 |

|

2011-07-16 |

Young Thailand Restaurant Limited |

000942589 |

|

2011-07-16 |

Youth Sciences Laboratories Ltd. |

001654031 |

|

2011-07-16 |

1022306 Ontario Ltd. |

001022306 |

|

2011-07-16 |

1022437 Ontario Inc. |

001022437 |

|

2011-07-16 |

1023905 Ontario Limited |

001023905 |

|

2011-07-16 |

1028816 Ontario Inc. |

001028816 |

|

2011-07-16 |

1032160 Ontario Inc. |

001032160 |

|

2011-07-16 |

1032536 Ontario Ltd. |

001032536 |

|

2011-07-16 |

1079393 Ontario Inc. |

001079393 |

|

2011-07-16 |

1123225 Ontario Limited |

001123225 |

|

2011-07-16 |

1129660 Ontario Inc. |

001129660 |

|

2011-07-16 |

1141697 Ontario Limited |

001141697 |

|

2011-07-16 |

1144725 Ontario Limited |

001144725 |

|

2011-07-16 |

1149491 Ontario Inc. |

001149491 |

|

2011-07-16 |

1171856 Ontario Limited |

001171856 |

|

2011-07-16 |

1263405 Ontario Inc. |

001263405 |

|

2011-07-16 |

1265194 Ontario Limited |

001265194 |

|

2011-07-16 |

1296346 Ontario Inc. |

001296346 |

|

2011-07-16 |

1338690 Ontario Ltd. |

001338690 |

|

2011-07-16 |

1366923 Ontario Inc. |

001366923 |

|

2011-07-16 |

1374083 Ontario Limited |

001374083 |

|

2011-07-16 |

1399576 Ontario Inc. |

001399576 |

|

2011-07-16 |

1409573 Ontario Limited |

001409573 |

|

2011-07-16 |

1491489 Ontario Inc. |

001491489 |

|

2011-07-16 |

1503355 Ontario Inc. |

001503355 |

|

2011-07-16 |

1507341 Ontario Inc. |

001507341 |

|

2011-07-16 |

1553762 Ontario Ltd. |

001553762 |

|

2011-07-16 |

1578036 Ontario Inc. |

001578036 |

|

2011-07-16 |

1582717 Ontario Ltd. |

001582717 |

|

2011-07-16 |

1597295 Ontario Inc. |

001597295 |

|

2011-07-16 |

1627194 Ontario Inc. |

001627194 |

|

2011-07-16 |

1663768 Ontario Inc. |

001663768 |

|

2011-07-16 |

1701845 Ontario Ltd. |

001701845 |

|

2011-07-16 |

2000215 Ontario Inc. |

002000215 |

|

2011-07-16 |

2016580 Ontario Incorporated |

002016580 |

|

2011-07-16 |

2029981 Ontario Inc. |

002029981 |

|

2011-07-16 |

2043218 Ontario Limited |

002043218 |

|

2011-07-16 |

2056723 Ontario Limited |

002056723 |

|

2011-07-16 |

2056942 Ontario Ltd. |

002056942 |

|

2011-07-16 |

2101059 Ontario Ltd. |

002101059 |

|

2011-07-16 |

728697 Ontario Limited |

000728697 |

|

2011-07-16 |

786456 Ontario Limited |

000786456 |

|

2011-07-16 |

789041 Ontario Limited |

000789041 |

|

2011-07-16 |

801800 Ontario Limited |

000801800 |

|

2011-07-16 |

836820 Ontario Inc. |

000836820 |

|

2011-07-16 |

982681 Ontario Ltd. |

000982681 |

Katherine M. Murray

Director, Ministry of Government Services

(144-G347)

Cancellation of Certificate of Incorporation (Corporations Tax Act Defaulters)

Notice Is Hereby Given that, under subsection 241(4) of the Business Corporations Act, the Certificate of Incorporation of the corporations named hereunder have been cancelled by an Order for default in complying with the provisions of the Corporations Tax Act, and the said corporations have been dissolved on that date.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-06-20 |

A & L Metal Products Limited |

000272881 |

|

2011-06-20 |

A. Dale Well & Pump Service Ltd. |

000869788 |

|

2011-06-20 |

A.C. Summit Industrial Supply Limited |

000813467 |

|

2011-06-20 |

A.J.D. Investments Limited |

000576092 |

|

2011-06-20 |

A&A Aluminum Co. Ltd. |

000914641 |

|

2011-06-20 |

Aaa Trucking Inc. |

001667274 |

|

2011-06-20 |

Adrenacrome Media Group Inc. |

002036729 |

|

2011-06-20 |

Adventure Trading Corp. |

001025705 |

|

2011-06-20 |

Aec Equipment Systems Ltd. |

001662680 |

|

2011-06-20 |

Ag-Tuff Ltd. |

001099084 |

|

2011-06-20 |

Aggett Limited |

000765031 |

|

2011-06-20 |

Ahmed Trading Corporation |

001554462 |

|

2011-06-20 |

Alcor Metal Fabricating Ltd. |

001407606 |

|

2011-06-20 |

Alexis Door Mfg. Ltd. |

000951274 |

|

2011-06-20 |

Allcrete Property & Road Services Inc. |

001606042 |

|

2011-06-20 |

Alterknit Inc. |

001704976 |

|

2011-06-20 |

Annuity Analysts & Retirement Planners Inc. |

000599093 |

|

2011-06-20 |

Apex Business Group Inc. |

001584618 |

|

2011-06-20 |

Apollo Publication Corporation |

001659418 |

|

2011-06-20 |

Arbor Inc. |

002094441 |

|

2011-06-20 |

Associates Towing & Storage Inc. |

001387273 |

|

2011-06-20 |

Ball And Associates, Inc. |

000952845 |

|

2011-06-20 |

Barmar Coffee Ltd. |

001577199 |

|

2011-06-20 |

Barrier Insulators Ltd. |

001288346 |

|

2011-06-20 |

Bayshore Plb Specialties International Ltd. |

001392208 |

|

2011-06-20 |

Beanies Cafe Inc. |

002104232 |

|

2011-06-20 |

Better Built Tooling Ltd. |

001275980 |

|

2011-06-20 |

Billion Financial Corporation |

001285117 |

|

2011-06-20 |

Blakare Limited |

000486087 |

|

2011-06-20 |

Blubarrie Hill Inc. |

001580537 |

|

2011-06-20 |

Bluepro Inc. |

001441883 |

|

2011-06-20 |

Bluerock Media Inc. |

001680164 |

|

2011-06-20 |

Both Industries Ltd. |

001059532 |

|

2011-06-20 |

Boxxe Inc. |

001605028 |

|

2011-06-20 |

Bpm Outsourcing Inc. |

001672188 |

|

2011-06-20 |

Brant Artscapes Inc. |

001528816 |

|

2011-06-20 |

Brincad Technologies Inc. |

001060305 |

|

2011-06-20 |

Burgato Co. Inc. |

000766205 |

|

2011-06-20 |

C & R Bloor St. Inc. |

000879721 |

|

2011-06-20 |

C. G. Tech (Ontario) Ltd. |

000644551 |

|

2011-06-20 |

Cabroe Commercial Masonry Ltd. |

001654205 |

|

2011-06-20 |

Callmarkss Inc. |

001156243 |

|

2011-06-20 |

Canada Green Forest Trading Co. Ltd. |

001040189 |

|

2011-06-20 |

Canadian Green Lanka Inc. |

001634941 |

|

2011-06-20 |

Canadian Oceanic Fisheries Ltd. |

001037401 |

|

2011-06-20 |

Cane Engineering Inc. |

001104981 |

|

2011-06-20 |

Canmol International 2002 Inc. |

001535562 |

|

2011-06-20 |

Cantex Trading Company Inc. |

001541703 |

|

2011-06-20 |

Cardinal Greenhouse.Com Inc. |

001394070 |

|

2011-06-20 |

Care Support Inc. |

001684173 |

|

2011-06-20 |

Carlton Haviland Energy Inc. |

002080559 |

|

2011-06-20 |

Caruba Coatings Inc. |

001082376 |

|

2011-06-20 |

Casa Bella Interiors Inc. |

001334590 |

|

2011-06-20 |

Chonkan Canada Inc. |

001010041 |

|

2011-06-20 |

Circa News World Limited |

001015093 |

|

2011-06-20 |

City Properties Management Corp. |

002007836 |

|

2011-06-20 |

Claus Press Limited |

000155257 |

|

2011-06-20 |

Clientnet Inc. |

001149351 |

|

2011-06-20 |

Computer Hut Inc. |

002074963 |

|

2011-06-20 |

Connect-R-Us Inc. |

002047178 |

|

2011-06-20 |

Connie & Wesley Chinese Arts & Crafts Limited |

001063833 |

|

2011-06-20 |

Correia Curbs & Construction Inc. |

001504272 |

|

2011-06-20 |

Craig Martin Enterprises Inc. |

000664461 |

|

2011-06-20 |

Currie Technologies Inc. |

001007505 |

|

2011-06-20 |

Custom Computer Programming Inc. |

000470233 |

|

2011-06-20 |

Cynthia’s Chinese Restaurant Limited |

001255253 |

|

2011-06-20 |

D. L. Genner Inc. |

001042012 |

|

2011-06-20 |

Dalcon General Contracting Ltd. |

001307674 |

|

2011-06-20 |

Dalip Singh & Sons Inc. |

000858581 |

|

2011-06-20 |

Database Marketing Solutions Inc. |

001482548 |

|

2011-06-20 |

Davcal Limited |

000213285 |

|

2011-06-20 |

Davidson Associates Inc. |

001438325 |

|

2011-06-20 |

Dearie Contractors Ltd. |

000261144 |

|

2011-06-20 |

Deli Time Foods Inc. |

000921577 |

|

2011-06-20 |

Delos-Global Enterprises Inc. |

000775837 |

|

2011-06-20 |

Delta Security Solutions Inc. |

002031622 |

|

2011-06-20 |

Digital Roof Corporation |

001215038 |

|

2011-06-20 |

Dissent Clubs Inc. |

002071473 |

|

2011-06-20 |

Doran’s Beverages Inc. |

000331760 |

|

2011-06-20 |

Douglas Leier Enterprises Inc. |

000757689 |

|

2011-06-20 |

Dycin Holdings Inc. |

000625818 |

|

2011-06-20 |

E. & L. Cement Works Ltd. |

000893007 |

|

2011-06-20 |

E.J. Industrial Management Inc. |

001477947 |

|

2011-06-20 |

Earth-Con Underground Limited Edwin Holdings Inc. |

002067336 |

|

2011-06-20 |

Eileen Universal Inc. |

001423089 |

|

2011-06-20 |

Electricmustard Inc. |

002080606 |

|

2011-06-20 |

Elite B. Tech Inc. |

002102989 |

|

2011-06-20 |

Em Broadbased Group Inc. |

001697730 |

|

2011-06-20 |

Embersoft Inc. |

000705292 |

|

2011-06-20 |

Embryonic Solutions Inc. |

002008698 |

|

2011-06-20 |

Enviro Tire Recycling Ltd. |

001523717 |

|

2011-06-20 |

Envirocare Investments Inc. |

000918664 |

|

2011-06-20 |

Ericon Care Services Inc. |

000991585 |

|

2011-06-20 |

Essor Assets Management Inc. |

001586878 |

|

2011-06-20 |

Eurocan Plumbing Inc. |

001140254 |

|

2011-06-20 |

Evercorp Inc. |

001647274 |

|

2011-06-20 |

Exclusive Optical Ltd. |

000296897 |

|

2011-06-20 |

Exporcanada Ltd. |

000907089 |

|

2011-06-20 |

Extreme Auto Centre Inc. |

000993384 |

|

2011-06-20 |

F.T.G. Heating Ltd. |

002097999 |

|

2011-06-20 |

First Aid Online Inc. |

002077320 |

|

2011-06-20 |

Five Seasons Transit Service Inc. |

001378670 |

|

2011-06-20 |

Fly Free Canada Inc. |

002029987 |

|

2011-06-20 |

Fodor & Cicman Electrical Service Inc. |

001424912 |

|

2011-06-20 |

Fong Tsui Company Limited |

001049341 |

|

2011-06-20 |

Foppish Inc. |

001680034 |

|

2011-06-20 |

Fregonese Construction Inc. |

000481933 |

|

2011-06-20 |

G & G Vallati Holdings Inc. |

001497499 |

|

2011-06-20 |

G.A. Heggarty Mfg. Limited |

000571373 |

|

2011-06-20 |

G.R.A.P.E. Inc. |

001080608 |

|

2011-06-20 |

G-Force Transport Inc. (Gti) |

002101444 |

|

2011-06-20 |

Garry Pryshlak Ltd. |

000257857 |

|

2011-06-20 |

Genesis Direct Marketing Inc. |

001662666 |

|

2011-06-20 |

Genesis Product & Market Development Limited |

001037363 |

|

2011-06-20 |

Global Business Alliance Inc. |

001062450 |

|

2011-06-20 |

Golden Land Realty Inc. |

000987917 |

|

2011-06-20 |

Good Buddy Services Ltd. |

000487025 |

|

2011-06-20 |

Grant’s Satellite Connections Ltd. |

001180677 |

|

2011-06-20 |

Green Star Contracting Ltd. |

001056193 |

|

2011-06-20 |

Greg Duval Contracting Ltd. |

000521549 |

|

2011-06-20 |

Gta Custom Eavestrough Inc. |

001575057 |

|

2011-06-20 |

Gulfbreeze Contracting Limited |

001045456 |

|

2011-06-20 |

Half Price Video Distributors Inc. |

001321383 |

|

2011-06-20 |

Hdl Inc. |

002091522 |

|

2011-06-20 |

Hg Automotive Inc. |

002051237 |

|

2011-06-20 |

Hi-Rise Communications Promotional Products Inc. |

001649229 |

|

2011-06-20 |

Homelife Georgian Heights Realty Inc. |

001693223 |

|

2011-06-20 |

Hon Ping Investments Limited |

000537809 |

|

2011-06-20 |

Houghdall Limited |

000695260 |

|

2011-06-20 |

Hui Mei International Trading Inc. |

001423778 |

|

2011-06-20 |

I B O Transport Inc. |

002051364 |

|

2011-06-20 |

I.C.C.A. & Oriental Medicine Ltd. |

001438491 |

|

2011-06-20 |

Icon Cheque Cashing Services Inc. |

001338655 |

|

2011-06-20 |

Id Merchandising Group Inc. |

001494180 |

|

2011-06-20 |

Ilivebands.Com Ltd. |

001408888 |

|

2011-06-20 |

Imeanbiz.Com Inc. |

001646678 |

|

2011-06-20 |

Impressions Concrete Developments Limited |

001401048 |

|

2011-06-20 |

Industrial Development & Manufacturing Inc. |

000649821 |

|

2011-06-20 |

Instant Replay Vending Promotions Inc. |

001096356 |

|

2011-06-20 |

Interior Modular Systems Limited |

001584025 |

|

2011-06-20 |

International M & T Spa Salon Ltd. |

002092468 |

|

2011-06-20 |

International Match Network (Canada) Inc. |

001194414 |

|

2011-06-20 |

International Saudi-Canadian Company Inc. |

002079468 |

|

2011-06-20 |

In2It Productions Entertainment Inc. |

001412638 |

|

2011-06-20 |

Isgro Fruit Market Limited |

000231385 |

|

2011-06-20 |

Island Weaver Wilderness Tours Inc. |

001267881 |

|

2011-06-20 |

It Source Solutions Inc. |

002090518 |

|

2011-06-20 |

Jackbar Enterprises Limited |

000272197 |

|

2011-06-20 |

Jamm Entertainment Inc. |

001599453 |

|

2011-06-20 |

Jammys International Limited |

001685591 |

|

2011-06-20 |

Jeanne Grierson Fashion Promotions Inc. |

000732645 |

|

2011-06-20 |

Jeff Marshall & Associates Casting Inc. |

000755468 |

|

2011-06-20 |

Jiaren Corporation |

001532225 |

|

2011-06-20 |

Jkl Advertising Inc. |

001209834 |

|

2011-06-20 |

Jl Mediamix Holdings Inc. |

001273160 |

|

2011-06-20 |

Joda Holdings Limited |

000246864 |

|

2011-06-20 |

John F. Santos Real Estate Limited |

000265212 |

|

2011-06-20 |

Johnmar Electric Inc. |

001418085 |

|

2011-06-20 |

Johnson’s Fine Furniture Inc. |

000834756 |

|

2011-06-20 |

Jules Gross Holdings Limited |

000819637 |

|

2011-06-20 |

K.A.M.P. Inc. |

001163966 |

|

2011-06-20 |

K-Art Super Ceramics Inc. |

000757384 |

|

2011-06-20 |

Kabodoxa Inc. |

001121829 |

|

2011-06-20 |

Kanv International Inc. |

001675350 |

|

2011-06-20 |

Kee-Lawr Restaurants Limited |

000148637 |

|

2011-06-20 |

Kendata Electronics Limited |

000300608 |

|

2011-06-20 |

Kensington Patty Palace Limited |

000360032 |

|

2011-06-20 |

Kevin J Carpentry Ltd. |

001695896 |

|

2011-06-20 |

Kielau Enterprises Limited |

000419321 |

|

2011-06-20 |

Kipling Guardian Pharmacy Inc. |

001543693 |

|

2011-06-20 |

Krplink Inc. |

000434970 |

|

2011-06-20 |

Kyle’s Carpentry Ltd. |

001413966 |

|

2011-06-20 |

Lakeshore Soils Inc. |

001156658 |

|

2011-06-20 |

Land Effects Landscape & Design Ltd. |

000871704 |

|

2011-06-20 |

Lasell Home Hotlines Ltd. |

000979041 |

|

2011-06-20 |

Layland Transport Inc. |

001624875 |

|

2011-06-20 |

Leal Masonry Ltd. |

001576904 |

|

2011-06-20 |

Lesstatic Inc. |

000774261 |

|

2011-06-20 |

Lifestyle Vacations Inc. |

001689464 |

|

2011-06-20 |

Little Folks Children’s Centre Inc. |

001651374 |

|

2011-06-20 |

Lizcar Merchandising Industries Ltd. |

000971210 |

|

2011-06-20 |

Lorron Foods International Inc. |

000941117 |

|

2011-06-20 |

Lux Group Inc. |

002033719 |

|

2011-06-20 |

M & F Livestock Ltd. |

001659856 |

|

2011-06-20 |

M & R Timber Limited |

001333564 |

|

2011-06-20 |

M.C.M. Roofing And Sheet Metal Ltd. |

001510075 |

|

2011-06-20 |

Macoste Business & Culture (Canada) Inc. |

000986065 |

|

2011-06-20 |

Mageor Recycling Corp. |

001590382 |

|

2011-06-20 |

Magic Carpet Media Inc. (Bessat-Erreeh) |

001125105 |

|

2011-06-20 |

Maldx Inc. |

001689992 |

|

2011-06-20 |

Manilise Limited |

000130614 |

|

2011-06-20 |

Manning & College X-Ray And Ultrasound Ltd. |

000792925 |

|

2011-06-20 |

Mapcomm Canada Inc. |

001395414 |

|

2011-06-20 |

Maple Leaf Mechanical Corp. |

001343745 |

|

2011-06-20 |

Markham Spicy Mart Inc. |

002092557 |

|

2011-06-20 |

Marquardson Holdings Ltd. |

000603541 |

|

2011-06-20 |

Maspro Manufacturing & Marketing Inc. |

001187145 |

|

2011-06-20 |

Mass Prototype Inc. |

001186231 |

|

2011-06-20 |

Mcglynn Marketing Inc. |

001341548 |

|

2011-06-20 |

Mdc Group Inc. |

000991729 |

|

2011-06-20 |

Med-Op Canada Ltd. |

001695967 |

|

2011-06-20 |

Medala Marble & Tile Co. Ltd. |

001593105 |

|

2011-06-20 |

Megacity Auto Spa Inc. |

001398502 |

|

2011-06-20 |

Melincor Enterprises Ltd. |

001070665 |

|

2011-06-20 |

Microlink Consulting Services Inc. |

001018521 |

|

2011-06-20 |

Miller Heating And Air Conditioning Limited |

000643277 |

|

2011-06-20 |

Mona Express Inc. |

001666495 |

|

2011-06-20 |

Moneyplus International Investments Inc. |

001628700 |

|

2011-06-20 |

Multicorp Management Inc. |

001662983 |

|

2011-06-20 |

Mur. Co. Ltd. |

001544382 |

|

2011-06-20 |

Musonic Limited |

000227657 |

|

2011-06-20 |

My Way R.X. Ltd. |

001650256 |

|

2011-06-20 |

M27 Qq Acquisitions Inc. |

002077878 |

|

2011-06-20 |

Nanavati Associates Inc. |

002075765 |

|

2011-06-20 |

National Community Network Inc. |

001660992 |

|

2011-06-20 |

National Sign & Awning Group Inc. |

001123650 |

|

2011-06-20 |

New City Bricklayers Limited |

000664937 |

|

2011-06-20 |

New Era Construction Services Ltd. |

001370793 |

|

2011-06-20 |

Nft Marketing Inc. |

001091135 |

|

2011-06-20 |

Niagara Home & Tool Depot Inc. |

002103352 |

|

2011-06-20 |

Nice Cars (Chatham) Limited |

001571699 |

|

2011-06-20 |

Northern Nebula Productions Inc. |

000969856 |

|

2011-06-20 |

Old Fort Mall Inc. |

000903233 |

|

2011-06-20 |

Omnium Medical Devices Of Canada Inc. |

000948787 |

|

2011-06-20 |

Ontario Dance Competition Inc. |

002101558 |

|

2011-06-20 |

Ontario Financial Group Limited |

001689494 |

|

2011-06-20 |

Orange Realty Corporation |

002073825 |

|

2011-06-20 |

Oscar Management Inc. |

001096869 |

|

2011-06-20 |

Ottawa-Valley Bathtub Liners Inc. |

002102658 |

|

2011-06-20 |

P.J.Murphy Enterprises Corp. |

001682349 |

|

2011-06-20 |

P.S.E. Contracting Ltd. |

001285037 |

|

2011-06-20 |

Parker Vending Inc. |

001679904 |

|

2011-06-20 |

Parmar Transport Refrigeration Inc. |

000492570 |

|

2011-06-20 |

Pars Service Technology Inc. |

001212235 |

|

2011-06-20 |

Paul Dick Custom Building Inc. |

000838373 |

|

2011-06-20 |

Pentagon Insurance Holdings Ltd. |

001099699 |

|

2011-06-20 |

Perk’s Fine Cars Limited |

001214026 |

|

2011-06-20 |

Peter Van Paassen Farms Limited |

000583973 |

|

2011-06-20 |

Peterine Enterprises Limited |

000232641 |

|

2011-06-20 |

Piazza Panini & Espresso Bar Inc. |

001418981 |

|

2011-06-20 |

Pine Valley Collision Centre Inc. |

001247627 |

|

2011-06-20 |

Piper Telecom Marketing Group Inc. |

001252914 |

|

2011-06-20 |

Planet Contracting Inc. |

001620183 |

|

2011-06-20 |

Point To Point Express Ltd. |

001651921 |

|

2011-06-20 |

Precise Corp. |

001658418 |

|

2011-06-20 |

Pro-C Holdings Corporation |

000953505 |

|

2011-06-20 |

Pro-Care Property Maintenance Inc. |

001649694 |

|

2011-06-20 |

Proactive Techservices Ltd. |

001080277 |

|

2011-06-20 |

Promax Promotions Inc. |

000941352 |

|

2011-06-20 |

Pure Muscle & Performance Ltd. |

001533396 |

|

2011-06-20 |

Quest Fine Cars Ltd. |

001031317 |

|

2011-06-20 |

Quest Warehousing & Distribution Inc. |

001595620 |

|

2011-06-20 |

R.B.C. Consulting Inc. |

001333968 |

|

2011-06-20 |

Rapid Auto Sound Ltd. |

000466625 |

|

2011-06-20 |

Raymond Kerr Contracting Ltd. |

001631679 |

|

2011-06-20 |

Realex Backhoe Rental Limited |

002110844 |

|

2011-06-20 |

Recol Aluminum Railings & Windows Inc. |

001483437 |

|

2011-06-20 |

Recorded Picture Company (Toronto) Inc. |

000952099 |

|

2011-06-20 |

Regal Crest Leasing Inc. |

001439672 |

|

2011-06-20 |

Regional Driver Services Inc. |

001675886 |

|

2011-06-20 |

Reliable Banners Inc. |

001687541 |

|

2011-06-20 |

Renew Foundry Equipment Limited |

000776477 |

|

2011-06-20 |

Rhino Developments Inc. |

000828988 |

|

2011-06-20 |

Richland Property Maintenance Inc. |

001397142 |

|

2011-06-20 |

Roadrunner Express Limited |

001640109 |

|

2011-06-20 |

Ron Koppes Holdings Inc. |

000816552 |

|

2011-06-20 |

Rooms International Home Furnishings Inc. |

001155228 |

|

2011-06-20 |

Ros & Ross Inc. |

001298241 |

|

2011-06-20 |

Ross Clydesdale Holdings Inc. |

000718444 |

|

2011-06-20 |

Russ Blundell Haulage Ltd. |

000950252 |

|

2011-06-20 |

S.E.R. Weir Enterprises Inc. |

000576617 |

|

2011-06-20 |

Sak Instruments Inc. |

001063308 |

|

2011-06-20 |

Sales Builders Inc. |

000967449 |

|

2011-06-20 |

Samlal & Associates Inc. |

001576107 |

|

2011-06-20 |

Saverio Melia Investments Limited |

000659000 |

|

2011-06-20 |

Savvas Transport Inc. |

001198683 |

|

2011-06-20 |

Sawdo Timber Ltd. |

000988428 |

|

2011-06-20 |

Schild Holdings Limited |

002082558 |

|

2011-06-20 |

Semcoat Technologies Inc. |

001032781 |

|

2011-06-20 |

Seniors Benefits Inc. |

002056470 |

|

2011-06-20 |

Sga Technologies Inc. |

001430671 |

|

2011-06-20 |

Sharp Floors Inc. |

002058267 |

|

2011-06-20 |

Shekinah Construction Ltd. |

001668491 |

|

2011-06-20 |

Sheldon N. Caplan Professional Corporation |

001693437 |

|

2011-06-20 |

Sher-Ron Motor Inn Ltd. |

000390063 |

|

2011-06-20 |

Shield Auto Glass (Downtown) Ltd. |

000918138 |

|

2011-06-20 |

Simmram Inc. |

001131801 |

|

2011-06-20 |

Skvp Holdings Corp. |

001079925 |

|

2011-06-20 |

Slk Management Services Limited |

000371057 |

|

2011-06-20 |

Sly’s Contracting Limited |

002100928 |

|

2011-06-20 |

Smac Supermarket Ltd. |

001685881 |

|

2011-06-20 |

Socrates Enterprises Inc. |

000557316 |

|

2011-06-20 |

Softbiz Consulting Ltd. |

000708842 |

|

2011-06-20 |

Soufra Daimeh Inc. |

001668999 |

|

2011-06-20 |

South Central Transport Ltd. |

001121301 |

|

2011-06-20 |

Southdown Truck Lube & Wash Inc. |

000500237 |

|

2011-06-20 |

Southlea Farms Ltd. |

000476327 |

|

2011-06-20 |

Sparklean Janitorial Services Inc. |

001593078 |

|

2011-06-20 |

St. James Properties Inc. |

002073339 |

|

2011-06-20 |

Stainless Steel Specialties Ltd. |

002011631 |

|

2011-06-20 |

Stanco Properties Limited |

000269857 |

|

2011-06-20 |

Stetson Designs Inc. |

001687559 |

|

2011-06-20 |

Strategic Information Systems Corporation |

000931864 |

|

2011-06-20 |

Stricon Ltd. |

001046882 |

|

2011-06-20 |

Strictly Roots Inc. |

001675358 |

|

2011-06-20 |

Struja Drywall Inc. |

001356251 |

|

2011-06-20 |

Sumtyme Corporation |

001418513 |

|

2011-06-20 |

Sweet Surprises Limited |

001667758 |

|

2011-06-20 |

T. Edwards Interiors Inc. |

001558622 |

|

2011-06-20 |

Taco Villa Inc. |

001175252 |

|

2011-06-20 |

Tajpur Express Inc. |

002097307 |

|

2011-06-20 |

Tansini Enterprises Limited |

001105857 |

|

2011-06-20 |

Tari-Tec Electric Ltd. |

001266096 |

|

2011-06-20 |

Tate Andale Canada Inc. |

000489426 |

|

2011-06-20 |

Thai Kee Oriental Supermarket Inc. |

001625897 |

|

2011-06-20 |

Tharan Inc. |

002094473 |

|

2011-06-20 |

The Alstram Group Inc. |

000929893 |

|

2011-06-20 |

The Beavis Learning Group Inc. |

001381525 |

|

2011-06-20 |

The Cartier Place Apartments Ltd. |

000842505 |

|

2011-06-20 |

The Dance Corps Inc. |

002003373 |

|

2011-06-20 |

The Gallery Of The Kanadas Ltd./ Les Galeries Des Kanadas Ltee. |

001550854 |

|

2011-06-20 |

The Karp Restaurant Inc. |

001709948 |

|

2011-06-20 |

The Parlour Inc. |

001433770 |

|

2011-06-20 |

The Rainbow Ragz Co. Ltd. |

001034549 |

|

2011-06-20 |

The Reasonable Brothers Inc. |

000940521 |

|

2011-06-20 |

The Rehabilitation Training Group Inc. |

000983189 |

|

2011-06-20 |

The Renton Group Inc. |

002054600 |

|

2011-06-20 |

The Scrapbook Centre Inc. |

001505802 |

|

2011-06-20 |

The Standard Bath Company Inc. |

001543255 |

|

2011-06-20 |

Three’s Company Auto Inc. |

001020669 |

|

2011-06-20 |

Thunder Mug Inc. |

002091066 |

|

2011-06-20 |

Timmerton Productions Limited |

000340041 |

|

2011-06-20 |

Total Plastic Solutions Inc. |

002065150 |

|

2011-06-20 |

Tremaine Trucking Ltd. |

000717965 |

|

2011-06-20 |

Trs Legend Group Inc. |

002095069 |

|

2011-06-20 |

Trulsen Corporation |

001483611 |

|

2011-06-20 |

Trumpour & Sons Construction Ltd. |

000226456 |

|

2011-06-20 |

Turnpoint Inc. |

001552736 |

|

2011-06-20 |

Two Cities Investments Inc. |

000646028 |

|

2011-06-20 |

Union Haulage Limited |

000481501 |

|

2011-06-20 |

Universal Marketing Intelligence Corp. |

001657479 |

|

2011-06-20 |

V&V Marketing Inc. |

001556741 |

|

2011-06-20 |

Valer Group Inc. |

002032837 |

|

2011-06-20 |

Valley Equipment Rentals Limited |

001159208 |

|

2011-06-20 |

Veltronix Incorporated |

000580909 |

|

2011-06-20 |

Vietnam Garden Restaurant Inc. |

000929358 |

|

2011-06-20 |

Vinor Manufacturing Inc. |

000918365 |

|

2011-06-20 |

Wards Farm Equipment (2004) Inc. |

001596179 |

|

2011-06-20 |

Warrengate Corporation |

000588097 |

|

2011-06-20 |

Watch-Art Imports Inc. |

000419044 |

|

2011-06-20 |

Waterloo County Reproductions Inc. |

000822785 |

|

2011-06-20 |

Webworx Inc. |

001428673 |

|

2011-06-20 |

Wig City Inc. |

002093865 |

|

2011-06-20 |

Windsor Technical Services Inc. |

001220064 |

|

2011-06-20 |

Workplace Enhancements Canada Inc. |

001715041 |

|

2011-06-20 |

World Music Sales Inc. |

000901285 |

|

2011-06-20 |

Wynn Systems Development Group Ltd. |

000980704 |

|

2011-06-20 |

Xybx Inc. |

000824655 |

|

2011-06-20 |

Yummy House A Taste Of Noodles Inc. |

001462487 |

|

2011-06-20 |

1St Choice Industries Inc. |

002005854 |

|

2011-06-20 |

1008616 Ontario Ltd. |

001008616 |

|

2011-06-20 |

1011874 Ontario Inc. |

001011874 |

|

2011-06-20 |

1014389 Ontario Limited |

001014389 |

|

2011-06-20 |

1014741 Ontario Limited |

001014741 |

|

2011-06-20 |

1027501 Ontario Ltd. |

001027501 |

|

2011-06-20 |

1028856 Ontario Inc. |

001028856 |

|

2011-06-20 |

1039877 Ontario Limited |

001039877 |

|

2011-06-20 |

1042620 Ontario Ltd. |

001042620 |

|

2011-06-20 |

1046152 Ontario Ltd. |

001046152 |

|

2011-06-20 |

1053277 Ontario Limited |

001053277 |

|

2011-06-20 |

1055080 Ontario Inc. |

001055080 |

|

2011-06-20 |

1060429 Ontario Inc. |

001060429 |

|

2011-06-20 |

1061449 Ontario Inc. |

001061449 |

|

2011-06-20 |

1066268 Ontario Inc. |

001066268 |

|

2011-06-20 |

1068288 Ontario Limited |

001068288 |

|

2011-06-20 |

1075632 Ontario Inc. |

001075632 |

|

2011-06-20 |

1083273 Ontario Inc. |

001083273 |

|

2011-06-20 |

1083973 Ontario Inc. |

001083973 |

|

2011-06-20 |

1088473 Ontario Limited |

001088473 |

|

2011-06-20 |

1090497 Ontario Ltd. |

001090497 |

|

2011-06-20 |

1103772 Ontario Inc. |

001103772 |

|

2011-06-20 |

1107624 Ontario Limited |

001107624 |

|

2011-06-20 |

1111353 Ontario Ltd. |

001111353 |

|

2011-06-20 |

1112524 Ontario Limited |

001112524 |

|

2011-06-20 |

1122645 Ontario Ltd. |

001122645 |

|

2011-06-20 |

1126539 Ontario Limited |

001126539 |

|

2011-06-20 |

1130437 Ontario Inc. |

001130437 |

|

2011-06-20 |

1133686 Ontario Inc. |

001133686 |

|

2011-06-20 |

1142861 Ontario Inc. |

001142861 |

|

2011-06-20 |

1160277 Ontario Inc. |

001160277 |

|

2011-06-20 |

1160430 Ontario Inc. |

001160430 |

|

2011-06-20 |

1161641 Ontario Inc. |

001161641 |

|

2011-06-20 |

1164457 Ontario Ltd. |

001164457 |

|

2011-06-20 |

1165671 Ontario Ltd. |

001165671 |

|

2011-06-20 |

1187191 Ontario Ltd. |

001187191 |

|

2011-06-20 |

1188582 Ontario Inc. |

001188582 |

|

2011-06-20 |

1200037 Ontario Inc. |

001200037 |

|

2011-06-20 |

1210439 Ontario Inc. |

001210439 |

|

2011-06-20 |

1223451 Ontario Limited |

001223451 |

|

2011-06-20 |

1235252 Ontario Limited |

001235252 |

|

2011-06-20 |

1236237 Ontario Inc. |

001236237 |

|

2011-06-20 |

1242262 Ontario Inc. |

001242262 |

|

2011-06-20 |

1262107 Ontario Ltd. |

001262107 |

|

2011-06-20 |

1268446 Ontario Inc. |

001268446 |

|

2011-06-20 |

1273976 Ontario Inc. |

001273976 |

|

2011-06-20 |

1296445 Ontario Ltd. |

001296445 |

|

2011-06-20 |

1296744 Ontario Ltd. |

001296744 |

|

2011-06-20 |

1310400 Ontario Inc. |

001310400 |

|

2011-06-20 |

1313379 Ontario Inc. |

001313379 |

|

2011-06-20 |

1322157 Ontario Inc. |

001322157 |

|

2011-06-20 |

1323892 Ontario Inc. |

001323892 |

|

2011-06-20 |

1332926 Ontario Inc. |

001332926 |

|

2011-06-20 |

1348198 Ontario Inc. |

001348198 |

|

2011-06-20 |

1350789 Ontario Limited |

001350789 |

|

2011-06-20 |

1357143 Ontario Inc. |

001357143 |

|

2011-06-20 |

1362345 Ontario Limited |

001362345 |

|

2011-06-20 |

1368023 Ontario Inc. |

001368023 |

|

2011-06-20 |

1371110 Ontario Inc. |

001371110 |

|

2011-06-20 |

1382156 Ontario Limited |

001382156 |

|

2011-06-20 |

1383284 Ontario Inc. |

001383284 |

|

2011-06-20 |

1403219 Ontario Inc. |

001403219 |

|

2011-06-20 |

1403779 Ontario Ltd. |

001403779 |

|

2011-06-20 |

1412856 Ontario Inc. |

001412856 |

|

2011-06-20 |

1420795 Ontario Inc. |

001420795 |

|

2011-06-20 |

1423671 Ontario Inc. |

001423671 |

|

2011-06-20 |

1441023 Ontario Limited |

001441023 |

|

2011-06-20 |

1450018 Ontario Inc. |

001450018 |

|

2011-06-20 |

1450996 Ontario Inc. |

001450996 |

|

2011-06-20 |

1465134 Ontario Limited |

001465134 |

|

2011-06-20 |

1465580 Ontario Inc. |

001465580 |

|

2011-06-20 |

1468146 Ontario Ltd. |

001468146 |

|

2011-06-20 |

1470036 Ontario Inc. |

001470036 |

|

2011-06-20 |

1473504 Ontario Inc. |

001473504 |

|

2011-06-20 |

1477148 Ontario Ltd. |

001477148 |

|

2011-06-20 |

1490339 Ontario Limited |

001490339 |

|

2011-06-20 |

1491058 Ontario Inc. |

001491058 |

|

2011-06-20 |

1491064 Ontario Inc. |

001491064 |

|

2011-06-20 |

1499547 Ontario Inc. |

001499547 |

|

2011-06-20 |

1499635 Ontario Inc. |

001499635 |

|

2011-06-20 |

1508669 Ontario Limited |

001508669 |

|

2011-06-20 |

1510824 Ontario Ltd. |

001510824 |

|

2011-06-20 |

1520886 Ontario Ltd. |

001520886 |

|

2011-06-20 |

1521180 Ontario Inc. |

001521180 |

|

2011-06-20 |

1525005 Ontario Inc. |

001525005 |

|

2011-06-20 |

1529131 Ontario Incorporated |

001529131 |

|

2011-06-20 |

1537521 Ontario Inc. |

001537521 |

|

2011-06-20 |

1544442 Ontario Inc. |

001544442 |

|

2011-06-20 |

1554441 Ontario Inc. |

001554441 |

|

2011-06-20 |

1562815 Ontario Ltd. |

001562815 |

|

2011-06-20 |

1564709 Ontario Inc. |

001564709 |

|

2011-06-20 |

1568020 Ontario Ltd. |

001568020 |

|

2011-06-20 |

1569175 Ontario Limited |

001569175 |

|

2011-06-20 |

1576287 Ontario Incorporated |

001576287 |

|

2011-06-20 |

1577841 Ontario Inc. |

001577841 |

|

2011-06-20 |

1578115 Ontario Inc. |

001578115 |

|

2011-06-20 |

1578841 Ontario Inc. |

001578841 |

|

2011-06-20 |

1579961 Ontario Inc. |

001579961 |

|

2011-06-20 |

1586116 Ontario Inc. |

001586116 |

|

2011-06-20 |

1606164 Ontario Inc. |

001606164 |

|

2011-06-20 |

1611482 Ontario Limited |

001611482 |

|

2011-06-20 |

1612004 Ontario Inc. |

001612004 |

|

2011-06-20 |

1616317 Ontario Inc. |

001616317 |

|

2011-06-20 |

1622304 Ontario Limited |

001622304 |

|

2011-06-20 |

1623309 Ontario Inc. |

001623309 |

|

2011-06-20 |

1631425 Ontario Inc. |

001631425 |

|

2011-06-20 |

1639879 Ontario Inc. |

001639879 |

|

2011-06-20 |

1639911 Ontario Ltd. |

001639911 |

|

2011-06-20 |

1641405 Ontario Inc. |

001641405 |

|

2011-06-20 |

1655129 Ontario Ltd. |

001655129 |

|

2011-06-20 |

1660632 Ontario Limited |

001660632 |

|

2011-06-20 |

1668425 Ontario Limited |

001668425 |

|

2011-06-20 |

1669943 Ontario Limited |

001669943 |

|

2011-06-20 |

1670855 Ontario Inc. |

001670855 |

|

2011-06-20 |

1671226 Ontario Inc. |

001671226 |

|

2011-06-20 |

1673150 Ontario Incorporated |

001673150 |

|

2011-06-20 |

1674545 Ontario Ltd. |

001674545 |

|

2011-06-20 |

1675162 Ontario Incorporated |

001675162 |

|

2011-06-20 |

1676527 Ontario Inc. |

001676527 |

|

2011-06-20 |

1685163 Ontario Inc. |

001685163 |

|

2011-06-20 |

1685337 Ontario Inc. |

001685337 |

|

2011-06-20 |

1685693 Ontario Limited |

001685693 |

|

2011-06-20 |

1688897 Ontario Limited |

001688897 |

|

2011-06-20 |

1691065 Ontario Inc. |

001691065 |

|

2011-06-20 |

1691781 Ontario Inc. |

001691781 |

|

2011-06-20 |

1696248 Ontario Corp. |

001696248 |

|

2011-06-20 |

1698411 Ontario Inc. |

001698411 |

|

2011-06-20 |

1699928 Ontario Inc. |

001699928 |

|

2011-06-20 |

2003307 Ontario Inc. |

002003307 |

|

2011-06-20 |

2008897 Ontario Limited |

002008897 |

|

2011-06-20 |

2010325 Ontario Inc. |

002010325 |

|

2011-06-20 |

2011454 Ontario Ltd. |

002011454 |

|

2011-06-20 |

2015201 Ontario Inc. |

002015201 |

|

2011-06-20 |

2022792 Ontario Inc. |

002022792 |

|

2011-06-20 |

2027021 Ontario Inc. |

002027021 |

|

2011-06-20 |

2036342 Ontario Inc. |

002036342 |

|

2011-06-20 |

2038751 Ontario Limited |

002038751 |

|

2011-06-20 |

2042726 Ontario Inc. |

002042726 |

|

2011-06-20 |

2055695 Ontario Inc. |

002055695 |

|

2011-06-20 |

2060580 Ontario Inc. |

002060580 |

|

2011-06-20 |

2063005 Ontario Inc. |

002063005 |

|

2011-06-20 |

2067001 Ontario Inc. |

002067001 |

|

2011-06-20 |

2067103 Ontario Inc. |

002067103 |

|

2011-06-20 |

2069209 Ontario Inc. |

002069209 |

|

2011-06-20 |

2074048 Ontario Inc. |

002074048 |

|

2011-06-20 |

2074495 Ontario Incorporated |

002074495 |

|

2011-06-20 |

2074582 Ontario Inc. |

002074582 |

|

2011-06-20 |

2074613 Ontario Inc. |

002074613 |

|

2011-06-20 |

2074846 Ontario Inc. |

002074846 |

|

2011-06-20 |

2077363 Ontario Corporation |

002077363 |

|

2011-06-20 |

2079375 Ontario Inc. |

002079375 |

|

2011-06-20 |

2086542 Ontario Inc. |

002086542 |

|

2011-06-20 |

2089441 Ontario Inc. |

002089441 |

|

2011-06-20 |

2090554 Ontario Ltd. |

002090554 |

|

2011-06-20 |

2090687 Ontario Inc. |

002090687 |

|

2011-06-20 |

2090875 Ontario Limited |

002090875 |

|

2011-06-20 |

2092796 Ontario Inc. |

002092796 |

|

2011-06-20 |

2093588 Ontario Inc. |

002093588 |

|

2011-06-20 |

2094711 Ontario Limited |

002094711 |

|

2011-06-20 |

2095187 Ontario Ltd. |

002095187 |

|

2011-06-20 |

2099295 Ontario Inc. |

002099295 |

|

2011-06-20 |

2099388 Ontario Inc. |

002099388 |

|

2011-06-20 |

2100168 Ontario Corporation |

002100168 |

|

2011-06-20 |

2101693 Ontario Inc. |

002101693 |

|

2011-06-20 |

2118936 Ontario Inc. |

002118936 |

|

2011-06-20 |

2119199 Ontario Limited |

002119199 |

|

2011-06-20 |

2136387 Ontario Inc. |

002136387 |

|

2011-06-20 |

338853 Ontario Incorporated |

000338853 |

|

2011-06-20 |

462796 Ontario Limited |

000462796 |

|

2011-06-20 |

506877 Ontario Limited |

000506877 |

|

2011-06-20 |

510597 Ontario Ltd. |

000510597 |

|

2011-06-20 |

527489 Ontario Limited |

000527489 |

|

2011-06-20 |

561201 Ontario Ltd. |

000561201 |

|

2011-06-20 |

562273 Ontario Inc. |

000562273 |

|

2011-06-20 |

590032 Ontario Inc. |

000590032 |

|

2011-06-20 |

605409 Ontario Limited |

000605409 |

|

2011-06-20 |

621461 Ontario Inc. |

000621461 |

|

2011-06-20 |

642784 Ontario Limited |

000642784 |

|

2011-06-20 |

653137 Ontario Limited |

000653137 |

|

2011-06-20 |

684884 Ontario,Inc. |

000684884 |

|

2011-06-20 |

720497 Ontario Inc. |

000720497 |

|

2011-06-20 |

723013 Ontario Limited |

000723013 |

|

2011-06-20 |

813179 Ontario Inc. |

000813179 |

|

2011-06-20 |

814937 Ontario Limited |

000814937 |

|

2011-06-20 |

822476 Ontario Inc. |

000822476 |

|

2011-06-20 |

825501 Ontario Inc. |

000825501 |

|

2011-06-20 |

833397 Ontario Inc. |

000833397 |

|

2011-06-20 |

840397 Ontario Inc. |

000840397 |

|

2011-06-20 |

861268 Ontario Limited |

000861268 |

|

2011-06-20 |

870213 Ontario Limited |

000870213 |

|

2011-06-20 |

870366 Ontario Limited |

000870366 |

|

2011-06-20 |

872604 Ontario Limited |

000872604 |

|

2011-06-20 |

878905 Ontario Inc. |

000878905 |

|

2011-06-20 |

893574 Ontario Limited |

000893574 |

|

2011-06-20 |

912561 Ontario Limited |

000912561 |

|

2011-06-20 |

926649 Ontario Inc. |

000926649 |

|

2011-06-20 |

937305 Ontario Inc. |

000937305 |

|

2011-06-20 |

941388 Ontario Inc. |

000941388 |

|

2011-06-20 |

943368 Ontario Ltd. |

000943368 |

|

2011-06-20 |

980949 Ontario Ltd. |

000980949 |

|

2011-06-20 |

985977 Ontario Inc. |

000985977 |

|

2011-06-20 |

986437 Ontario Ltd. |

000986437 |

|

2011-06-20 |

989801 Ontario Inc. |

000989801 |

|

2011-06-20 |

994534 Ontario Ltd. |

000994534 |

Katherine M. Murray

Director, Ministry of Government Services

(144-G348)

Certificate of Dissolution

Notice Is Hereby Given that a certificate of dissolution under the Business Corporations Act, has been endorsed. The effective date of dissolution precedes the corporation listings.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-06-03 |

Fitness Warehouse Pinecrest Inc. |

001534315 |

|

2011-06-03 |

L & G Matthew’s Painting Ltd. |

002119609 |

|

2011-06-03 |

Nypi North York Personnel Inc. |

000678138 |

|

2011-06-03 |

Prayosha Jewels Inc. |

001740207 |

|

2011-06-03 |

Rebonding Inc. |

002074771 |

|

2011-06-03 |

Tdq Contracting Inc. |

002172420 |

|

2011-06-03 |

1722313 Ontario Ltd. |

001722313 |

|

2011-06-03 |

1722680 Ontario Ltd. |

001722680 |

|

2011-06-03 |

2049215 Ontario Ltd. |

002049215 |

|

2011-06-03 |

2075293 Ontario Inc. |

002075293 |

|

2011-06-03 |

2085019 Ontario Inc. |

002085019 |

|

2011-06-03 |

2177009 Ontario Ltd. |

002177009 |

|

2011-06-06 |

Boston Pier Real Estate Limited |

001640572 |

|

2011-06-06 |

Dr. Joseph Hew Medicine Professional Corporation |

002140454 |

|

2011-06-06 |

Edulink International Corp. |

002081243 |

|

2011-06-06 |

Mission Pharmacal (Canada) Inc. |

001442808 |

|

2011-06-06 |

Nedcan Auto Ltd. |

001384864 |

|

2011-06-06 |

Optimized Power Solutions Inc. |

000606469 |

|

2011-06-06 |

1032472 Ontario Inc. |

001032472 |

|

2011-06-06 |

1571754 Ontario Inc. |

001571754 |

|

2011-06-06 |

2067178 Ontario Inc. |

002067178 |

|

2011-06-06 |

710219 Ontario Inc. |

000710219 |

|

2011-06-07 |

Larocque Water Supply Inc. |

002181348 |

|

2011-06-07 |

2140344 Ontario Ltd. |

002140344 |

|

2011-06-09 |

Discover Logistics Inc. |

002137524 |

|

2011-06-09 |

Has Enterprise Inc. |

002136541 |

|

2011-06-09 |

M.V. Equine Services Ltd. |

000830046 |

|

2011-06-09 |

1304030 Ontario Ltd. |

001304030 |

|

2011-06-09 |

1657129 Ontario Inc. |

001657129 |

|

2011-06-09 |

1657466 Ontario Inc. |

001657466 |

|

2011-06-09 |

740847 Ontario Inc. |

000740847 |

|

2011-06-20 |

Technalysis Inc. |

000508617 |

|

2011-06-20 |

2186412 Ontario Inc. |

002186412 |

|

2011-06-22 |

Shkoda Electrical Incorporated |

001420265 |

|

2011-06-22 |

2221759 Ontario Inc. |

002221759 |

|

2011-06-23 |

Frantech Sales Inc. |

002011467 |

|

2011-06-23 |

Jade Spa Inc. |

001663527 |

|

2011-06-23 |

Nikolaus Holdings Inc. |

000642446 |

|

2011-06-23 |

Rjm Enterprises Inc. |

002031929 |

|

2011-06-23 |

1745933 Ontario Inc. |

001745933 |

|

2011-06-24 |

Kinetix Living Inc. |

001635861 |

|

2011-06-24 |

Right Automotive Ltd. |

001243806 |

|

2011-06-24 |

Sidewalk Studios Inc. |

002065845 |

|

2011-06-24 |

663683 Ontario Limited |

000663683 |

|

2011-06-27 |

Brithi Kitchen And Bath Ltd. |

002117761 |

|

2011-06-27 |

J.M.C. Technical Services Inc. |

000704303 |

|

2011-06-27 |

Makols Tax & More Inc. |

001795553 |

|

2011-06-28 |

Bw Gp Inc. |

002116394 |

|

2011-06-29 |

M & M Fine Auto Inc. |

001704811 |

Katherine M. Murray

Director, Ministry of Government Services

(144-G349)

Cancellation for Cause (Business Corporations Act)

Notice Is Hereby Given that by orders under section 240 of the Business Corporation Act, the certificates set out hereunder have been cancelled for cause and in the case of certificates of incorporation the corporations have been dissolved. The effective date of cancellation precedes the corporation listing.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2011-06-30 |

2205638 Ontario Inc. |

2205638 |

Katherine M. Murray

Director

(144-G350)

Co-operative Corporations Act Certificate of Incorporation Issued

Notice Is Hereby Given that, under the Co-operative Corporations Act, a certificate of incorporation has been issued to:

|

Name of Co-operative |

Date of Incorporation |

Head Office |

|---|---|---|

|

Community of Fenelon East Co-operative Inc. |

April 12, 2011 |

fenelon falls |

|

Pen Farm Herd Co-operative Limited |

April 28, 2011 |

kingston |

|

hall’s pond solar co-operative Corporation |

april26, 2011 |

toronto |

|

zooshare biogas co-operative Inc. |

april 26, 2011 |

toronto |

|

résidence coopérative du centre multiservice francophone de l’ouest d’ottawa Inc. |

may 2, 2011 |

ottawa |

|

sexsmith farm co-operative Inc. |

may 3, 2011 |

ridgeway |

|

bidya learning centre co-operative Inc. |

may 17, 2011 |

ajax |

|

fenestra purchasing co-operative Ltd. |

may 17, 2011 |

london |

|

bayview narrows co-operative development corporation |

may 17, 2011 |

toronto |

|

brightsky power community solar co-operative Inc. |

may 25, 2011 |

burlington |

|

your local market co-operative Inc. |

may 25, 2011 |

perth county |

|

coopérative sofifran Inc. |

may 30, 2011 |

welland |

|

hope artisan dairy co-operative Ltd. |

june 15, 2011 |

Aylmer |

|

guelph solar community co-operative Inc. |

june 15, 2011 |

guelph |

|

Guelph Energy Co-operative Inc. |

june 15, 2011 |

guelph |

|

tricounty renewable energy co-operative Inc. |

june 15, 2011 |

sT. gEorge |

Grant Swanson

Executive Director

Licensing and Market Conduct Division

Financial Services Commission of Ontario

by delegated authority from the Superintendent of Financial Services

(144-G351)

Co-operative Corporations Act Certificate of Amendment Issued

Notice Is Hereby Given that, under the Co-operative Corporations Act, a certificate of amendment has been effected as follows:

|

Name of Corporation |

Date of Incorporation |

Effective Date |

|---|---|---|

|

October 8, 1981 |

Alliance Housing Co-Operative, Inc. |

May 20, 2011 |

|

March 1, 1945 |

Durham Growers Co-Operative Storage Limited Converting to the name Obca with the Durham Growers Storage Ltd. |

May 12, 2011 |

|

September 30, 1994 |

West Bruce Feeder Finance Co-Operative Inc. |

June 30, 2011 |

Grant Swanson

Executive Director

Licensing and Market Conduct Division

Financial Services Commission of Ontario

by delegated authority from the Superintendent of Financial Services

(144-G352)

Co-operative Corporations Act Certificate of Dissolution Issued

Notice Is Hereby Given that, under the Co-operative Corporations Act, a certificate of dissolution has been issued to:

|

Name of Co-operative |

Date of Incorporation |

Effective Date |

|---|---|---|

|

Elgin Co-Operative Services |

April 21, 1944 |

April 26, 2011 |

Grant Swanson

Executive Director

Licensing and Market Conduct Division

Financial Services Commission of Ontario

by delegated authority from the Superintendent of Financial Services

(143-G353)

Credit Unions and Caisses Populaires Act, Certificate of Amalgamation Issued

Notice Is Hereby Given that, under the Credit Unions and Caisses Populaires Act, 1994 a Dissolution Order has been issued to:

|

Name of Co-operative |

Ontario Incorporation Number |

Effective Date |

|---|---|---|

|

Meridian Credit Union Limited (Meridian Credit Union Limited andDesjardins Credit Union Inc.) |

1613597 |

2011 -06-01 |

Philip Howell

Chief Executive Officer and

Superintendent of Financial Services

Financial Services Commission of Ontario

(144-G354)

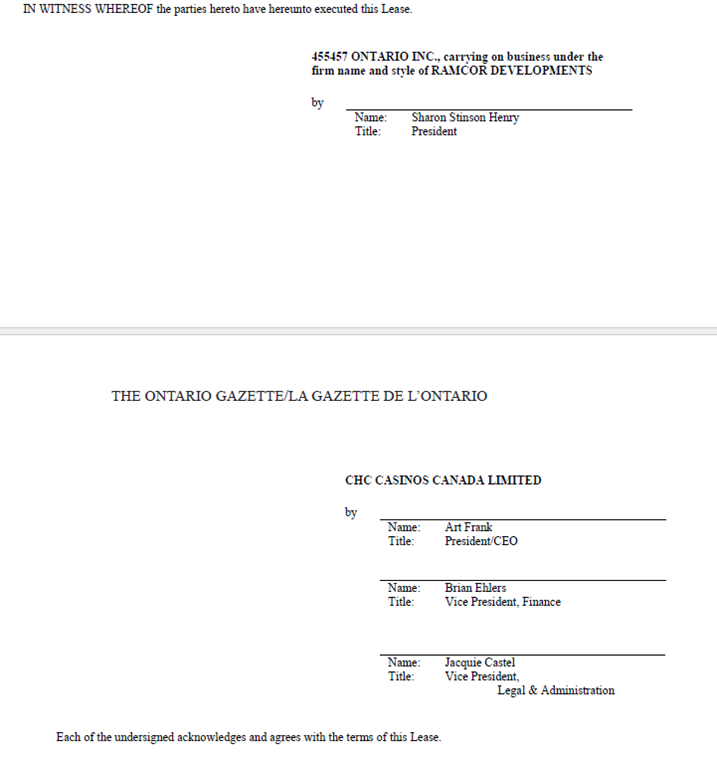

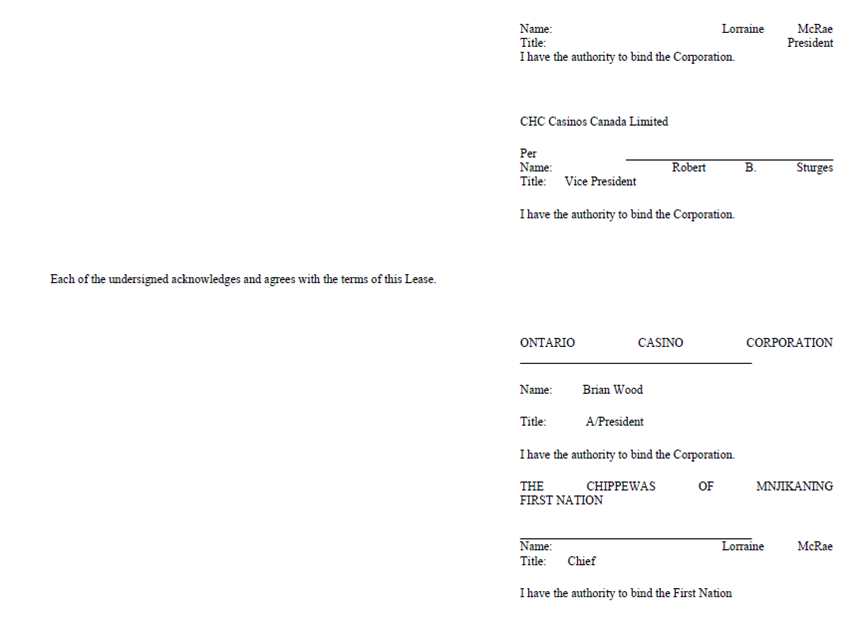

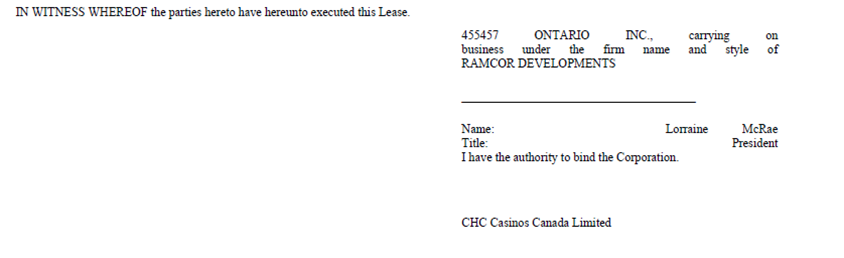

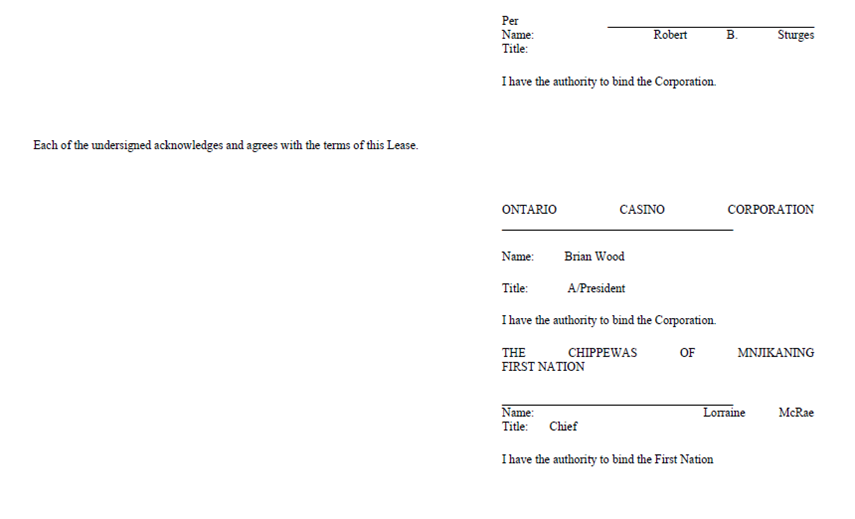

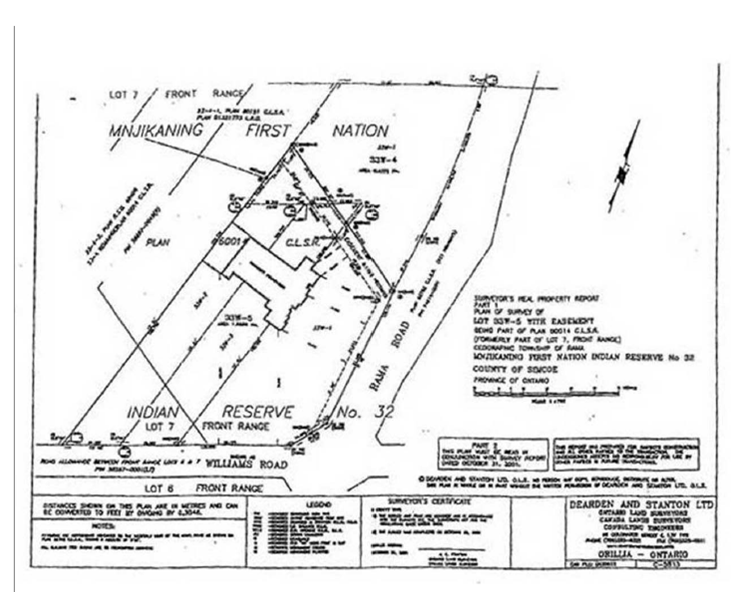

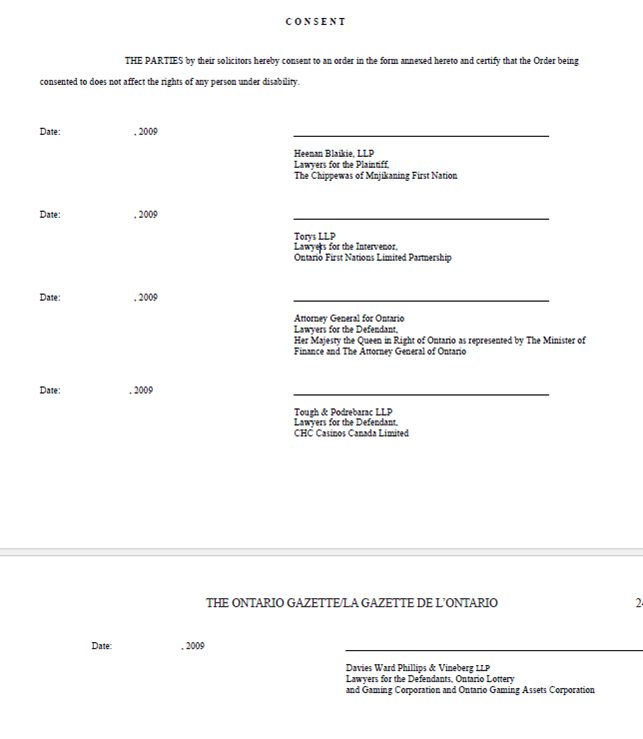

Post-2011 Contract Relating To Casino Rama For The 20-Year Period Commencing August 1, 2011 And Relating To Possible Future Development

Memorandum Of Agreement made the 17th day of July, 2009.

Between:

Ontario Lottery And Gaming Corporation, a Crown agency established pursuant to

the Ontario Lottery and Gaming Corporation Act, 1999,

Of The First Part,

- and -

Chippewas Of Rama First Nation, also known as the Chippewas Of Mnjikaning

First Nation, as represented by The Chief,

Of The Second Part,

- and -

Casino Rama Inc., a corporation incorporated pursuant to the laws of the Province of Ontario, as bare trustee for the Chippewas Of Rama First Nation,

Of The Third Part,

- and -

Rama Access Inc., a corporation incorporated pursuant to the laws of the Province of Ontario,

Of The Fourth Part,

- and -

455457 Ontario Inc., a corporation incorporated pursuant to the laws of the Province of Ontario,

Of The Fifth Part.

Whereas the capitalized terms used herein have the respective meanings ascribed thereto in Section 1.1 unless the context otherwise requires;

And Whereas on March 18, 1996, OLG (then its statutory predecessor, Ontario Casino Corporation), Rama, Chc and several other parties entered into the Development and Operating Agreement, which Development and Operating Agreement provided for the design, development and construction of the Project by Rama with advice and financial assistance from OLG and the operation of the Complex by Chc Canada, a Canadian subsidiary of Chc;

And Whereas Chc Canada, by a Consent and Acknowledgement from OLG dated March 26, 2001, became controlled by Penn National Gaming Inc.;

And Whereas Weat Access Inc., Weat Holdings Inc. and Weat Parking Inc., by Articles of Amendment dated May 20, 2009, changed their names, respectively, to Rama Access Inc., Rama Holdings Inc. and Rama Parking Inc.;

And Whereas the Development and Operating Agreement terminates on July 31, 2011 and Rama and OLG wish to agree as of the date hereof as to the basis on which their relationship respecting the Complex will be governed commencing on August 1, 2011 immediately after such termination and continuing until July 31, 2031 unless earlier terminated or further extended pursuant to the terms of this Agreement;

And Whereas Rama and OLG wish to agree as to the basis on which they will consider at this time short-term and long-term developments related to the Complex;

Now Therefore, in consideration of the respective covenants, agreements, representations, warranties and indemnities herein contained and other good and valuable consideration (the receipt and sufficiency of which are acknowledged by each party hereto), the Parties agree as follows:

-

Article 1 Interpretation

-

Definitions

indicated below:

As used herein, including the recitals and Schedules hereto, the following terms shall have the respective meanings

"Additional Parking Lands Permits" – the meaning ascribed thereto in the Expansion Project Development Agreement; "Additional Surface Parking" – the meaning ascribed thereto in the Expansion Project Development Agreement; "Administration Centre" – the meaning ascribed thereto in Section 7.2 of this Agreement;

"Administration Subleases" – means two subleases of space from 455457 Ontario Inc. to Chc Canada, each dated December 11, 1997 and related to space in buildings located in the Chippewas of Rama Industrial Park located on Lot 31-8, Clsr Plan 79146, as amended, modified, supplemented, replaced or restated from time to time;

"Affiliate" – means any Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified;

"Agreement" – this Post-2011 Contract as amended, modified or supplemented from time to time;

"Applicable Agreements" means this Agreement and each of the agreements referred to in Subsections 2.3(a)(i) through (v);

"Applicable Law" – all public laws, statutes, ordinances, codes, acts, orders, by-laws, rules, regulations, Governmental Consents, permits, binding policies and guidelines, and requirements of all Governmental Authorities, which now or hereafter may be lawfully applicable to and enforceable against the Complex or any part thereof, including without limitation those relating to employment, zoning, building, life/safety, occupancy or possession of land, environment and health;

"Applicable Period" – the period from and including August 1, 2011 until and including the date of termination of this Agreement (which will be July 31, 2031, subject to any extensions of the term of this Agreement made in accordance with Section 15.2 or to any early termination of this Agreement in accordance with the provisions hereof);

"Buffer Zone Lands Permits" – the meaning ascribed thereto in the Expansion Project Development Agreement;

"Business Day" – any day which is not a Saturday, Sunday or day observed as a holiday under the laws of the Province of Ontario or the federal laws of Canada applicable therein;

"Capital Renewals" – additions or improvements to the Complex, including the acquisition, by way of purchase, lease or otherwise, on behalf of OLG of Ff&E, by way of replacement, addition, construction or repair of property which under generally accepted accounting principles would be classified as a capital asset and, for greater certainty, including the lease of such items where the payments under such lease would constitute a capital lease under generally accepted accounting principles but excluding items with a cost of $500 or less;

"Capital Renewals Reserve" – any reserve established by OLG during the Applicable Period for Capital Renewals;

"Casino" – those areas in the Complex which are intended to be used or are used for the purpose of playing or operating a Game of Chance together with all support facilities relating to gaming;

"Casino Rama Financial Statements" – the meaning ascribed thereto in Section 6.6 of this Agreement;

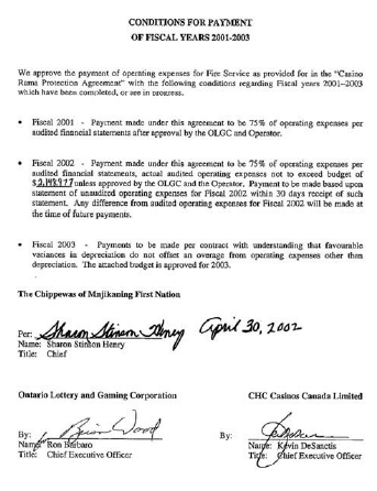

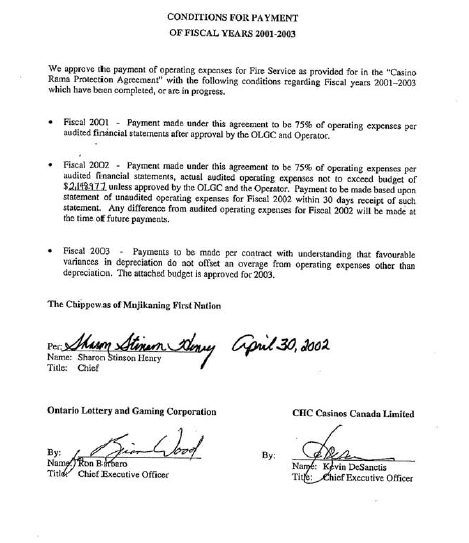

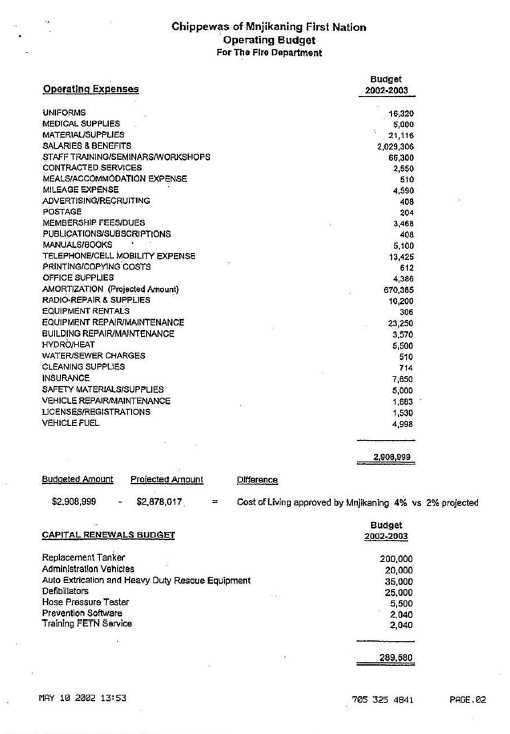

"Casino Rama Fire Protection Agreement" – the Casino Rama Fire Protection Agreement dated April 30, 2002 among Rama, OLG and CHC Canada pursuant to which Rama provides fire protection services to the Complex, as amended, modified, supplemented or restated from time to time;

"Casino Rama Revenue Agreement" – the Casino Rama Revenue Agreement dated June 9, 2000 among the Province, OLG, Ofnlp and Mnjikaning First Nation Limited Partnership, as amended, modified, supplemented or restated from time to time;

"CHC" – CHC Holdings, Inc., being the successor corporation to the gaming interests and obligations of CHC International, Inc.; "CHC Canada" – CHC Casinos Canada Limited, its successors and permitted assigns;

"Chcccl" – the meaning ascribed thereto in Subsection 14.1(a) of this Agreement;

"Clsr" – Canada Lands Survey Records;

"Community Centre" – the facilities consisting of an arena, basketball court, weight room and youth facilities in a structure of approximately 60,000 square feet located on the Reserve but not on the Complex Lands;

"Community Facilities" – the Community Centre and the Seniors Centre;

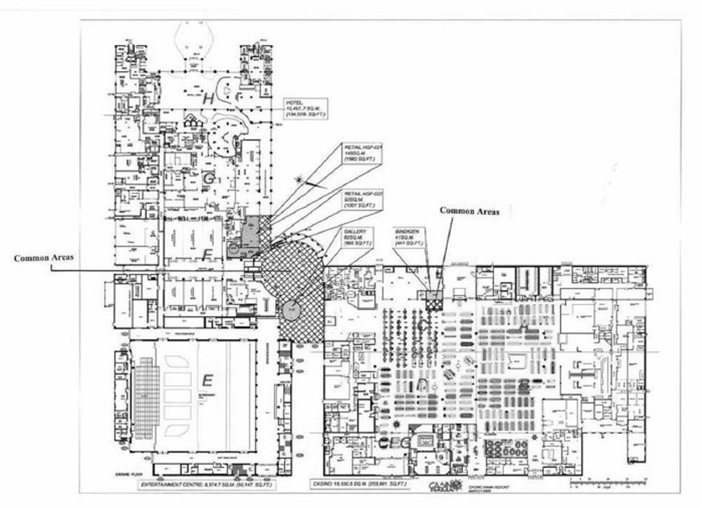

"Complex" – the Complex Lands and all Improvements thereon, including the Casino, Hotel, Entertainment Centre, Additional Surface Parking and any Future Developments and together with all related parking improvements, food and beverage businesses, shuttle and bus services, parking businesses, amenities and any other businesses that are integrated, physically or operationally, with the Casino regardless of whether such related Improvements are located on the Complex Lands including, without limiting the generality of the foregoing, the facility constructed on lot 98 Clsr Plan 78406 made up of approximately 728,071 square feet, three access roads providing for access to the Complex Lands (on lots 101 and 102, lot 103 and lot 105 Clsr Plan 78406, respectively) and extensive parking on lot 104 Clsr Plan 78406, lot 107 Clsr Plan 80801, lot 121 Clsr Plan 83863, part 1 on Plan 51R-29344 and lot 122 Clsr Plan 83864 but excluding, for greater certainty, the Community Facilities, the Off-Site Infrastructure Facilities (other than off-site parking integrated with the Complex) and the GED Training Centre;

"Complex Lands" – all lands described in Schedule 1 hereto as well as any lands leased by OLG in respect of Future Developments;

"Complex Sublease" – the sublease dated April 15, 1996 between Casino Rama Inc. as sublessor and OLG (then its statutory predecessor, Ontario Casino Corporation) as sublessee with respect to those lands identified as Complex Sublease Lands in Schedule 1 hereto, as amended, modified, supplemented, replaced or restated from time to time;

"Complimentaries" – means goods and services that are accounted for as revenue and included in Gross Revenues (as set out in the Casino Rama Financial Statements), which OLG gives to customers and potential customers as an inducement to play Games of Chance at the Complex;

"Construction Delay Claim" – the meaning ascribed thereto in Subsection 14.1(b) of this Agreement;

"Control" (including the terms "Controlling", "Controlled by" and "under common Control with") – the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of voting securities, by contract or otherwise;

"COO" – the meaning ascribed thereto in Subsection 14.1(e) of this Agreement;

"CPI" – the Consumer Price Index prepared by Statistics Canada (base year 2002 = 100) or its successor or successors for Ontario (all items) or any successor index or compilation prepared by Statistics Canada, its successor or successors; in the event that there ceases to be such an index or compilation, a similar measure selected by OLG and approved by Rama, in writing;

"CPI-Adjusted Rental Rate" – (i) with respect to any lands located on the Territory as of the date of this Agreement, an amount equal to

$125,000 per acre for the approximately twelve month period ending on the last day of the month in which the first anniversary date of the date of this Agreement occurs, which amount shall be adjusted for each successive twelve month period thereafter to be the number obtained by multiplying the amount for the previous twelve month period by a fraction the numerator of which is the CPI for the first month in the twelve month period for which the CPI-Adjusted Rental Rate is being determined and the denominator of which is the CPI for the first month in the immediately preceding twelve month period; and (ii) with respect to any other lands, the rental rate as agreed between Rama and OLG;

"Credit Agreement" – any credit agreement related to the Complex which has been approved by each of Rama and OLG;

"Debt" – all indebtedness other than any indebtedness for trade payables, accounts payable, accruals or liabilities incurred or arising in the ordinary course of business but including all indebtedness for borrowed money;

"Development and Operating Agreement" – the Agreement among OLG (then its statutory predecessor, Ontario Casino Corporation), Rama, Casino Rama Inc., Casino Rama Holdings Inc., Casino Rama Services Inc., Rama Access Inc., Rama Holdings Inc., Rama Parking Inc., CHC International, Inc. (CHC being the successor corporation to the gaming interests and obligations of CHC International, Inc.) and CHC Canada dated March 18, 1996, as amended by agreements dated as of April 15, 1996 and June 12, 2000, as amended, modified, supplemented or restated from time to time;

"Dispute" – the meaning ascribed thereto in Section 20.1 of this Agreement; "Dollars" or "$" – unless otherwise noted, Canadian Dollars;

"Draft Casino Rama Police Services Agreement" – the draft Casino Rama Police Service Agreement attached as Schedule 2; "Employee Parking Lot" – the meaning ascribed thereto in Section 7.1 of this Agreement;

"Employee Parking Lot Lease" – the meaning ascribed thereto in Section 7.1 of this Agreement;

"Enabling Legislation" – the Ontario Lottery and Gaming Corporation Act, 1999 and the regulations made thereunder, as the same may be modified, amended or replaced from time to time;

"Entertainment Centre" – the multi-purpose entertainment facility located on the Complex Lands;

"Environmental Claim" – with respect to any Person, any written notice, claim, demand or other written communication alleging or asserting liability for investigatory costs, cleanup costs, Governmental Authority response costs, damages to natural resources or other property, personal injuries, fines or penalties arising out of, based on or resulting from (i) the presence, or release into the environment, of any hazardous material, or (ii) any violation, or alleged violation, of any lawfully applicable Environmental Law;

"Environmental Law" – any law or order relating to the regulation or protection of human health or the environment, including without limitation, laws or orders relating to emissions, discharges, releases or threatened releases of pollutants, contaminants or toxic or hazardous substances or wastes into the environment or otherwise relating to the treatment, storage, disposal, transport or handling of pollutants, contaminants or toxic or hazardous substances or wastes;

"Event of Insolvency" – with respect to a Person the occurrence of any one of the following events: