Appendix C: Key terms of funding agreements

Overview

In order to obtain funding, the company will be required to enter into a funding agreement with the Province of Ontario.

Timing of funding payments

No payments will be made to you until the funding agreement has been signed and any conditions for disbursement have been fulfilled.

You must have sources of project financing and proof of insurance (minimum of $2 million) in place before any disbursements can be made. Other conditions may be required before disbursements are made.

Disbursements will be made in arrears for each fiscal year and paid in annual instalments which shall not exceed the annual cap set by Government of Ontario. The annual cap is the maximum amount of disbursement for each fiscal year. It is solely determined by the province, taking into consideration factors such as rate of investment, job creation and milestones.

At Ontario’s sole discretion, an initial payment of up to 20% of the support may be made once conditions of disbursement have been met. If your application is approved, ministry staff will explain how the annual caps for the project have been set.

For grants, a performance payment, usually 20% or more of the total funding, will be disbursed after the project has been completed and all final reporting requirements have been received to Ontario’s satisfaction.

Commitments and clawbacks

Within the funding agreement, recipients will be required to make commitments related to project investment, jobs and payroll.

In the case of grants, to the extent that each of these commitments is separately not achieved by the date set out, the recipient will be required to pay pro rata clawbacks (payments based on formulas set out in the funding agreement).

In the case of loans, to the extent that each commitment is separately not achieved by the date set out, the forgivable portion, if any, will be reduced based on formulas set out in the funding agreement.

Clawbacks in grant agreements

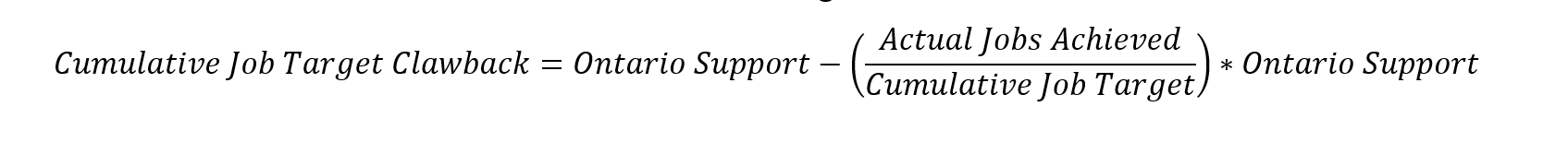

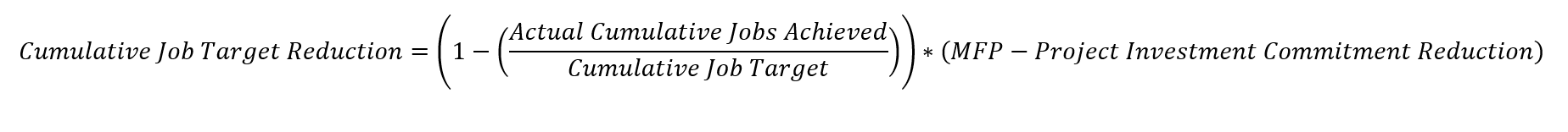

Cumulative job target clawback

If by the Project Completion Date, the cumulative job target is not met, the recipient shall repay a cash amount to Ontario in accordance with the following formula:

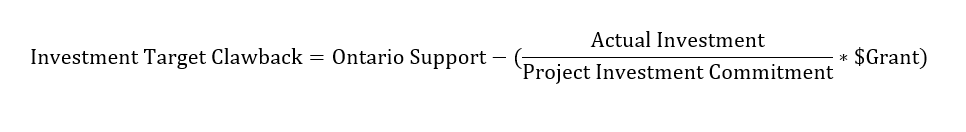

Investment target clawback

If the project investment commitment is not achieved on or before the Project Completion Date, the recipient shall repay a cash amount to Ontario in accordance with the following formula:

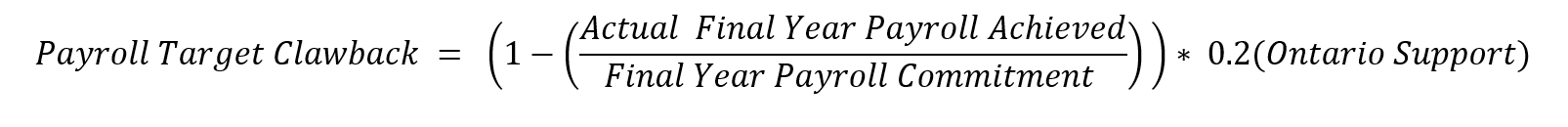

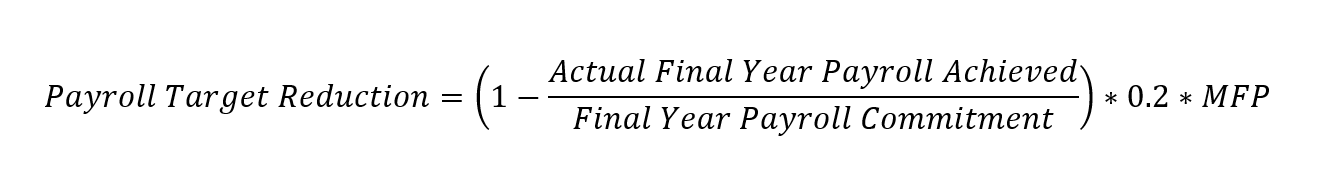

Payroll target clawback

If by the Project Completion Date, the final year payroll commitment is not met, the recipient shall repay a cash amount to Ontario in accordance with the following formula:

Reductions to the forgivable portion of a loan

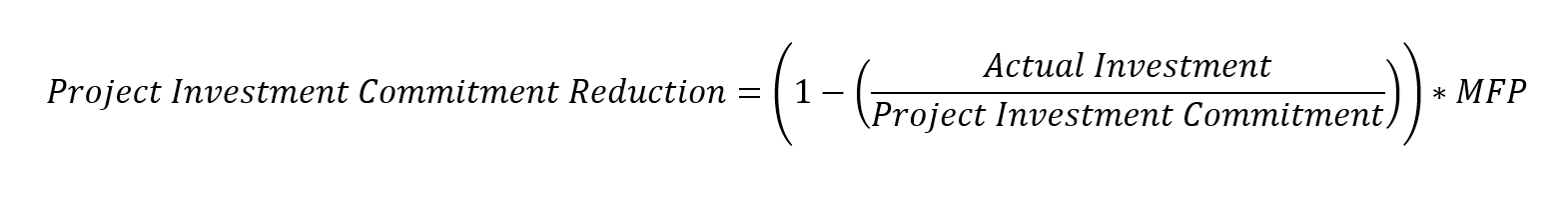

In the three formulas, MFP means the maximum forgivable portion of the loan.

Investment reduction and job reduction

If by the Project Completion Date, the project investment commitment and/or the cumulative job target are not achieved, the amount of the loan forgiven will be reduced as follows:

Payroll reduction

If by the Project Completion Date, the payroll commitment is not achieved, the amount of the loan forgiven will be reduced according to the following formula:

Footprint and closure

Funding agreements require recipients to make commitments related to maintaining their Ontario footprint (the company’s jobs and facilities in Ontario).

Closure of any Ontario facility and failure to maintain an agreed employment footprint for all facilities in Ontario are each events of default.

Other key terms

The terms of the funding agreement will also contain provisions in favour of Ontario including but not limited to:

- conditions of disbursement; subject to annual funding allocation

- representations and warranties

- positive and negative covenants

- reporting requirements including annual financial statements and project status reports—as needed, additional reporting may also be required

- documentation, which may require the provision of a third-party auditor’s certificate at the recipient’s expense, to verify a company’s investment in eligible costs, jobs and payroll at the project completion date

- provisions relating to non-arm’s length transactions

- insurance and indemnities in favour of the Government of Ontario

- events of default and remedies for default, including but not limited to repayment of funds

- depending on the nature of support provided, a guarantee or security in a form acceptable to Ontario

These terms are subject to change.