2021-22 First Quarter Finances

The First Quarter Finances report contains information about Ontario’s 2021–2022 fiscal outlook as of June 30, 2021.

Highlights

- As vaccination rates continue to increase and the province’s economy continues to reopen, optimism about economic recovery is growing stronger in Ontario. The government’s focus remains on protecting people today, while ensuring preparedness for future impacts of the virus and enabling the strong economic growth necessary for recovery from .

- While the pandemic resulted in sudden and substantial impacts on economies around the world, key economic indicators show that a significant economic rebound has occurred since the first half of 2020.

- Ontario’s real gross domestic product (GDP) increased 1.2 per cent in the first quarter of 2021, following a 2.0 per cent gain in the fourth quarter of 2020. Real GDP in the quarter was only 1.8 per cent below the pre-pandemic level in the fourth quarter of 2019.

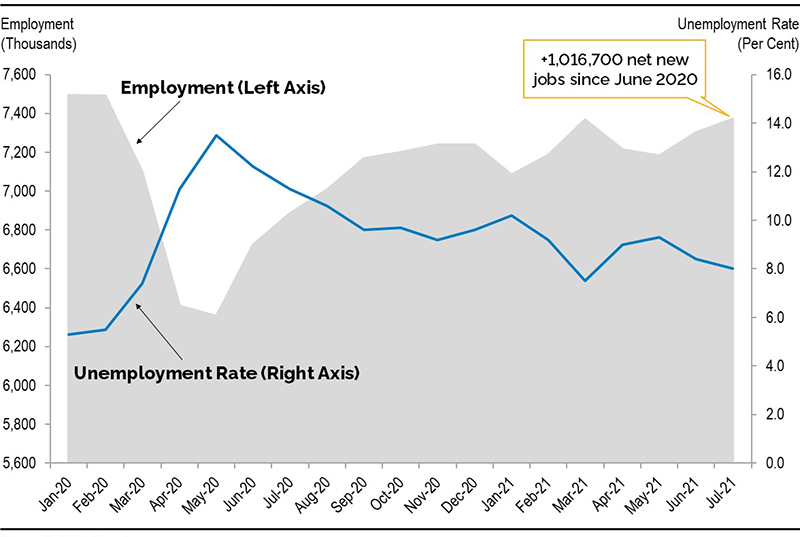

- Between May 2020 and July 2021, Ontario employment has risen by over one million net jobs and the unemployment rate declined to 8.0 per cent from a high of 13.5 per cent in May 2020. As of July 2021, Ontario employment was 118,000 (−1.6 per cent) below the pre-pandemic level in February 2020.

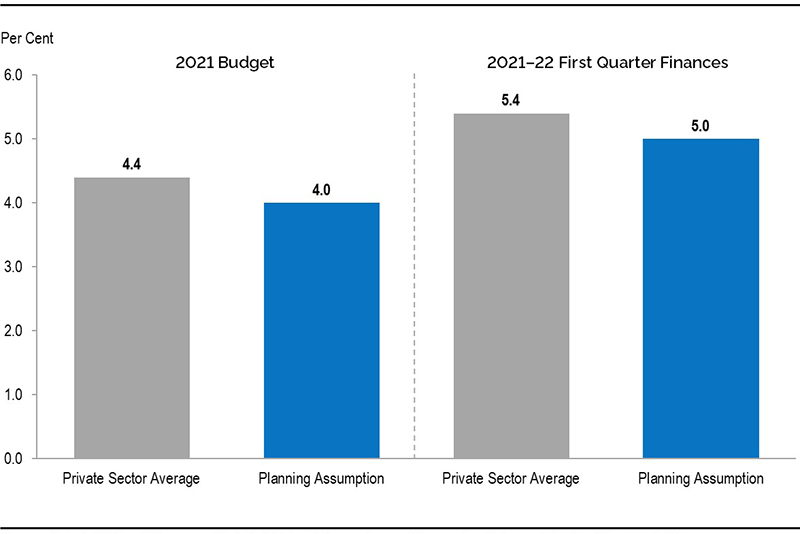

- Since the 2021 Budget, private sector real GDP forecasts for 2021 have been revised significantly upwards, reflecting a resilient and rebounding domestic economy, significant progress on vaccinations and stronger than expected United States and global growth. Still, significant global economic uncertainty remains regarding the evolution of the pandemic and the future pace of economic recovery.

- As of the 2021–22 First Quarter Finances, the government is projecting a deficit of $32.4 billion in 2021–22, an improvement of nearly $700 million from the outlook presented in the 2021 Budget.

- Revenues in 2021–22 are projected to be $2.9 billion higher than forecast in the 2021 Budget. The increase in the revenue forecast is due to increased Government of Canada transfers and higher projected taxation revenues related to a stronger 2021 economic growth forecast.

- Program expenses are projected to be $2.2 billion higher than forecast in the 2021 Budget, primarily due to funding allocated towards the Time-Limited Fund, which will ensure the Province continues to maintain the flexibility necessary given the ongoing uncertainty related to the pandemic and the future pace of economic recovery.

- Interest on debt is projected to remain unchanged from the $13.1 billion forecast in the 2021 Budget.

- As of August 4, 2021, the Province has borrowed $21.0 billion, completing 40 per cent of its long-term borrowing program for 2021–22.

Introduction

Since the beginning of the pandemic, the government’s response to has been supported by Ontario’s Action Plan, a flexible and clear framework to protect people and jobs. This was important for two reasons:

First, this approach ensured transparency and accountability, even amidst the significant economic uncertainty caused by the pandemic.

The government has a mandate to manage the public finances in a responsible, transparent and accountable manner. Ontario demonstrated leadership by being the first jurisdiction in Canada to release a fiscal plan that reflected the potential impacts of . The public has had confidence that the government would provide regular updates on the Province’s fiscal and economic outlook based on the latest information available — including this update, which is the sixth since the beginning of the pandemic.

Second, this approach ensured that the necessary funds were available and that a lack of resources was never an obstacle in the Province’s response to .

In the early days of the pandemic, no one could predict exactly how would unfold. What was certain, however, was that fighting the virus would require additional investments in the health care system, in economic supports and in recovery initiatives. Recognizing that provincial governments do not have access to unlimited resources, Ontario’s Action Plan directed these investments where they were needed most, while setting aside further funding in targeted contingencies to be directed at urgently evolving needs, including vaccine distribution and support for small businesses.

While the pandemic isn’t over, this approach has paid off — and it will continue. The government remains unwavering in its commitment to protect people’s health and jobs, and as a result it will continue to maintain the fiscal flexibility to support Ontario’s recovery and combat the pandemic.

In the 2021–22 First Quarter Finances, Ontario is reporting that the economy is expected to grow faster in 2021 than anticipated, compared to when the 2021 Budget was released. This is good news. Along with recent federal one-time funding, the government’s 2021–22 revenue forecast is $2.9 billion higher than originally projected as a result.

Under normal circumstances, and all other factors remaining the same, higher than projected revenue directly improves the Province’s fiscal outlook. However, there remains continued uncertainty about variants of concern, the risk of surges and future waves of the pandemic and the need to target future investments to spur economic recovery.

As a result, the government is taking the prudent step of setting aside $2.2 billion of this revenue for the Time-Limited Fund. This will ensure the Province continues to maintain the flexibility necessary given the ongoing uncertainty related to the pandemic and the future pace of economic recovery. Overall, the government is projecting a deficit of $32.4 billion in 2021–22, an improvement of nearly $700 million from the outlook presented in the 2021 Budget.

As the government has previously stated, Ontario’s fiscal recovery will be driven by economic growth — the continued recovery in employment and the modest deficit improvement projected in the 2021–22 First Quarter Finances are evidence of that.

Ontario remains committed to creating an environment for growth, which will ensure that the people and employers of the province benefit from jobs, prosperity and opportunity. The next step in the government’s plan will be outlined in the 2021 Ontario Economic Outlook and Fiscal Review, to be released by November 15, 2021.

Section A: Ontario’s 2021–22 fiscal outlook

The Province’s 2021–22 deficit is projected to be $32.4 billion — nearly $700 million lower than the outlook published in the 2021 Budget.

Revenues in 2021–22 are projected to be $156.9 billion, $2.9 billion higher than forecast in the 2021 Budget. The increase in the revenue forecast is due to increased Government of Canada transfers and higher projected taxation revenues related to a stronger 2021 economic growth forecast.

Program expense in 2021–22 is projected to be $175.2 billion, $2.2 billion higher than forecast in the 2021 Budget, largely due to new funding allocated to time-limited resources. Other new initiatives in response to the impacts of the pandemic have been accommodated through the existing fiscal framework.

As reported in the 2021 Budget, the government fully allocated all of its time-limited pandemic response funding and extraordinary contingencies for 2021–22. As the first jurisdiction in Canada to release a fiscal plan that reflected the potential impacts of , Ontario has been successful in providing the fiscal flexibility to respond to a rapidly changing and uncertain situation. This has proven to be the prudent approach, including when the province faced the second and third lockdowns and as vaccines became available to be deployed through Ontario’s comprehensive vaccination program.

Given the ongoing risks — including the rise of the Delta variant and continued uncertainty regarding the evolution of the public health and economic situation, Ontario will continue to employ this flexible approach by allocating $2.2 billion in new funding towards the Time-Limited Fund. Relative to the heightened level of support provided at the peak of the pandemic, this prudent level of funding is appropriate, given the progress made on vaccinations and economic recovery. This approach will ensure the Province continues to maintain the necessary flexibility going forward.

As a result of faster than expected economic growth and the lower deficit forecast than at the time of the 2021 Budget, the net debt-to-GDP ratio is projected to be 48.1 per cent in 2021–22, 0.7 percentage points lower than the 48.8 per cent forecast in the 2021 Budget.

The 2021 Budget included a $1.0 billion reserve in 2021–22 to protect the fiscal outlook against any unforeseen adverse changes in the Province’s revenue and expense forecasts. The $1.0 billion reserve has been maintained as part of the current fiscal outlook. The reserve provides additional prudence in the government’s fiscal framework and is distinct from contingency funds that set aside dedicated funding to be allocated in response to emerging needs.

2021–22 In-year fiscal performance

| Item | 2021 Budget | Current Outlook1 | In-Year Change |

|---|---|---|---|

| Revenue | 154,012 | 156,897 | 2,885 |

| Expense — Programs | 172,989 | 175,198 | 2,208 |

| Expense — Interest on Debt | 13,130 | 13,130 | – |

| Total Expense | 186,120 | 188,328 | 2,208 |

| Surplus/(Deficit) Before Reserve | (32,108) | (31,431) | 676 |

| Reserve | 1,000 | 1,000 | – |

| Surplus/(Deficit) | (33,108) | (32,431) | 676 |

[1] Current outlook primarily reflects information available as of June 30, 2021.

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Revenue

Revenues in 2021–22 are projected to be $2.9 billion higher than forecast in the 2021 Budget.

The forecast for Total Taxation Revenue has increased by $950 million compared to the 2021 Budget, due to stronger economic growth projected in 2021. Corporate profits and the housing market represent the most significant increases in the components of 2021 private sector economic growth forecasts. As a result, the revenue projection for Corporations Tax has increased by $550 million (3.8 per cent) and Land Transfer Tax has increased by $400 million (10.3 per cent).

Projected Government of Canada Transfers increased by $1.9 billion since the 2021 Budget, mainly due to additional one-time funding through the Federal Budget Implementation Act (Bill C-30) and amendments to the Federal-Provincial Fiscal Arrangements Act to support recovery. Additional federal transfers also include support for small air carriers serving remote First Nations communities in Northern Ontario.

Other Non-Tax Revenues combined are projected to decrease by $12 million, largely due to the cancellation of scheduled vehicle and carrier fee increases to provide further financial relief for the people of Ontario in response to .

Key changes to 2021–22 revenue projections

| Item | 2021–22 |

|---|---|

| 2021 Budget Total Revenue Outlook | 154,012 |

| Revenue Changes Since the 2021 Budget — Corporations Tax | 550 |

| Revenue Changes Since the 2021 Budget — Land Transfer Tax | 400 |

| Total Taxation Revenue | 950 |

| Government of Canada Transfers | 1,947 |

| Other Non-Tax Revenue | (12) |

| Total Revenue Changes Since the 2021 Budget | 2,885 |

| 2021–22 First Quarter Finances Total Revenue Outlook | 156,897 |

Note: Numbers may not add due to rounding.

Source: Ontario Ministry of Finance.

There are further notable risks that could materially affect the 2021–22 revenue outlook. These include changes to the economic growth outlook, the results from 2020 tax return processing, revenue collections from Ontario-administered taxes and the earnings of government business enterprises. The government will monitor these developments and will provide further details in future fiscal updates.

Expense

Total expense, including interest on debt, is projected to be $188.3 billion, $2.2 billion higher than the 2021 Budget projection, primarily due to funding allocated to the Time-Limited Fund, which will ensure the Province maintains the flexibility necessary given the ongoing uncertainty related to the pandemic and the future pace of economic recovery.

Key changes to 2021–22 total expense projections

| Item | 2021–22 |

|---|---|

| 2021 Budget Total Expense Outlook | 186,120 |

| Program Expense Changes Since the 2021 Budget — Property Tax and Energy Cost Rebate Grants | 235 |

| Program Expense Changes Since the 2021 Budget — Ontario Worker Income Protection Benefit | 216 |

| Program Expense Changes Since the 2021 Budget — Ontario Small Business Support Grant Extension | 50 |

| Program Expense Changes Since the 2021 Budget — Provincial Tourism, Culture and Heritage Entity Support | 33 |

| Program Expense Changes Since the 2021 Budget — Air Carrier Support Program | 8 |

| Program Expense Changes Since the 2021 Budget — Support for Response in India | 2 |

| Program Expense Changes Since the 2021 Budget — All Other Changes | 2 |

| Total Program Expense Changes | 546 |

| Drawdown of the Standard Contingency Fund to Offset New Spending | (538) |

| Time-Limited Fund | 2,200 |

| Total Net Program Expense Changes Since the 2021 Budget | 2,208 |

| Interest on Debt Change Since the 2021 Budget | – |

| Total Expense Changes Since the 2021 Budget | 2,208 |

| 2021–22 First Quarter Finances Total Expense Outlook | 188,328 |

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Program expense update

The outlook for program expense in 2021–22 is projected to be $175.2 billion, an increase of approximately $2.2 billion compared to the 2021 Budget.

Investments to support the recovery of the province from the pandemic, primarily offset from the standard Contingency Fund, include:

- $235 million in additional support made available for property tax and energy cost relief to eligible businesses that were required to close or significantly restrict services due to provincial public health measures;

- $216 million made available for the potential costs of the time-limited Ontario Worker Income Protection Benefit until September 25, 2021. Program costs are regularly monitored and updates will be provided as claims are received and reviewed. The program reimburses eligible employers for the amount of infectious disease emergency leave pay that they paid to their employees, up to $200 per employee per day taken. Eligible employers have up to 120 days to submit their application for reimbursement from the date the employer paid the employee;

- $50 million to extend the application deadline for the Ontario Small Business Support Grant until April 7, 2021, which provided support to eligible small businesses that were impacted by the pandemic;

- $33 million to provide funding support for provincial tourism, culture and heritage entities that had to temporarily limit or close their operations due to ;

- $8 million for the Remote Air Carrier Support Program to ensure that eligible air carriers to remote Northern Ontario communities maintain operations and provide access to critical services during the pandemic;

- $2 million to support transport of 5,000 ventilators and help to coordinate other critical medical equipment donated by the private sector and community organizations to the Indian Red Cross in response to the crisis in India; and

- $2 million for all other changes.

In addition, the government has allocated $2.2 billion to the Time-Limited Fund, which will ensure the Province continues to maintain the flexibility necessary given the ongoing uncertainty related to the pandemic and the future pace of economic recovery.

Interest on debt expense update

Interest on debt expense is projected to be $13.1 billion, unchanged from the forecast in the 2021 Budget.

Fiscal prudence

The Fiscal Sustainability, Transparency and Accountability Act, 2019 requires Ontario’s fiscal plan to incorporate prudence in the form of a reserve to protect the fiscal outlook against unforeseen adverse changes in the Province’s revenue and expense, including those resulting from changes in Ontario’s economic performance. The 2021 Budget included a reserve of $1.0 billion in 2021–22, which has been maintained as part of the current fiscal outlook. In addition, the standard Contingency Fund is maintained to help mitigate expense risks — for example, in cases where health and safety may be compromised, and which may otherwise adversely affect Ontario’s fiscal performance. After projected drawdowns in the 2021–22 First Quarter Finances, the remaining standard Contingency Fund for 2021–22 is $1.5 billion.

To protect the health of the people of Ontario and support families, employers and jobs during the pandemic, the Province also made extraordinary contingencies available in 2021–22. As reported in the 2021 Budget, the government fully allocated these contingencies for 2021–22. Maintaining this flexibility since the beginning of the pandemic allowed Ontario to respond to emerging challenges and priorities during this unpredictable and uncertain period.

Despite positive signs and a sense of optimism in the province, continues to pose risks and create uncertainty. As a result, through the 2021–22 First Quarter Finances, the Province has allocated $2.2 billion to the Time-Limited Fund in 2021–22 to support preparedness for a range of possible eventualities for fall and winter and to help deploy resources where they are needed most. As vaccination rates increase and the province fully reopens, the funding will also be available to support further recovery initiatives.

Section B: Ontario’s recent economic performance and outlook

Recent economic performance

The pandemic led to sudden and substantial economic contractions around the world. All G7 countries, including Canada, posted steep declines in real GDP in the first half of 2020. While there has been a significant rebound in economic activity, most advanced economies have not yet returned to pre‑pandemic levels as of the first quarter of 2021.

Ontario real GDP increased 1.2 per cent in the first quarter of 2021, following a 2.0 per cent gain in the fourth quarter of 2020. First quarter growth was driven by higher investment in residential structures and more modest gains in non-residential construction and household spending. Real GDP in the quarter was only 1.8 per cent below the level in the fourth quarter of 2019.

Between February and May 2020, Ontario employment declined by 1,134,700 (−15.1 per cent). Since June 2020, employment has rebounded by 1,016,700 net jobs. As of July 2021, employment was 118,000 (−1.6 per cent) below the February 2020 level and the unemployment rate was 8.0 per cent, down from a high of 13.5 per cent in May 2020.

Chart 1: Ontario labour market

Source: Statistics Canada.

Accessible description of chartEconomic outlook

In recent months, global economic activity has remained resilient, supported by increasing vaccination rates, easing public health restrictions and supportive monetary and fiscal policy. The International Monetary Fund projects global real GDP to rise by 6.0 per cent in 2021, up from a projected increase of 5.5 per cent at the time of the 2021 Budget. In the United States, additional fiscal stimulus has boosted economic growth forecasts. According to the latest Blue Chip Economic Indicators survey, forecasters anticipate U.S. real GDP to increase by 6.6 per cent in 2021, compared to 4.9 per cent growth at the time of the 2021 Budget.

Stronger-than-expected U.S. and global growth, a resilient domestic economy and significant progress on vaccinations have resulted in faster economic growth projected in Ontario. Private sector forecasters, on average, project Ontario real GDP to rise by 5.4 per cent in 2021, higher than the average of 4.4 per cent at the time of the 2021 Budget and the prudent 2021 Budget planning assumption of 4.0 per cent. Accordingly, the 2021–22 First Quarter Finances planning assumption for real GDP growth has been increased to 5.0 per cent in 2021, while maintaining the prudence applied in the 2021 Budget.

Chart 2: Ontario 2021 real GDP growth

Sources: Ontario Ministry of Finance and Ontario Ministry of Finance Survey of Forecasters (February 3, 2021 and June 30, 2021).

Accessible description of chartWidespread vaccination presents an opportunity to further improve business and consumer confidence and support stronger economic activity. However, significant uncertainty remains regarding the global evolution of the pandemic, including risks related to the emergence of new variants.

The reopening of economies around the world has been accompanied by supply chain disruptions, which have made it difficult for businesses to source inputs. The persistence of these supply chain pressures pose an additional risk to Ontario’s economic recovery.

In recent months, CPI inflation has accelerated and the Bank of Canada now expects CPI inflation to temporarily remain at or above 3 per cent for the remainder of 2021. If sustained and faster inflation occurs, interest rates could rise sooner than expected and dampen economic activity.

Section C: Details of Ontario’s finances

Revenue

| Item | 2021–22 2021 Budget |

2021–22 Current Outlook |

2021–22 In-Year Change |

|---|---|---|---|

| Taxation Revenue — Personal Income Tax | 36,351 | 36,351 | – |

| Taxation Revenue — Sales Tax | 27,632 | 27,632 | – |

| Taxation Revenue — Corporations Tax | 14,389 | 14,939 | 550 |

| Taxation Revenue — Education Property Tax | 5,754 | 5,754 | – |

| Taxation Revenue — Employer Health Tax | 6,445 | 6,445 | – |

| Taxation Revenue — Ontario Health Premium | 4,141 | 4,141 | – |

| Taxation Revenue — Gasoline Tax | 2,421 | 2,421 | – |

| Taxation Revenue — Land Transfer Tax | 3,890 | 4,290 | 400 |

| Taxation Revenue — Tobacco Tax | 1,060 | 1,060 | – |

| Taxation Revenue — Fuel Tax | 814 | 814 | – |

| Taxation Revenue — Beer, Wine and Spirits Taxes | 618 | 618 | – |

| Taxation Revenue — Electricity Payments in Lieu of Taxes | 454 | 454 | – |

| Taxation Revenue — Ontario Portion of the Federal Cannabis Excise Duty | 245 | 245 | – |

| Taxation Revenue — Other Taxes | 605 | 605 | – |

| Taxation Revenue — Total | 104,819 | 105,769 | 950 |

| Government of Canada — Canada Health Transfer | 16,737 | 16,737 | – |

| Government of Canada — Canada Social Transfer | 6,005 | 6,005 | – |

| Government of Canada — Equalization | – | – | – |

| Government of Canada — Infrastructure Programs | 1,086 | 1,086 | – |

| Government of Canada — Labour Market Programs | 1,316 | 1,316 | – |

| Government of Canada — Social Housing Agreement | 299 | 299 | – |

| Government of Canada — Other Federal Payments | 1,577 | 3,524 | 1,947 |

| Government of Canada — Direct Transfers to Broader Public-Sector Organizations | 424 | 424 | – |

| Government of Canada — Total | 27,444 | 29,391 | 1,947 |

| Income from Government Business Enterprises — Liquor Control Board of Ontario | 2,435 | 2,435 | – |

| Income from Government Business Enterprises — Ontario Power Generation Inc./Hydro One Ltd. | 670 | 670 | – |

| Income from Government Business Enterprises — Ontario Lottery and Gaming Corporation | 1,266 | 1,266 | – |

| Income from Government Business Enterprises — Ontario Cannabis Store | 170 | 170 | – |

| Income from Government Business Enterprises — Total | 4,541 | 4,541 | – |

| Other Non-Tax Revenue — Fees, Donations and Other Revenues from Hospitals, School Boards and Colleges | 9,758 | 9,758 | – |

| Other Non-Tax Revenue — Vehicle and Driver Registration Fees | 2,096 | 2,085 | (11) |

| Other Non-Tax Revenue — Miscellaneous Other Non-Tax Revenue | 1,322 | 1,322 | – |

| Other Non-Tax Revenue — Other Fees and Licences | 1,208 | 1,206 | (2) |

| Other Non-Tax Revenue — Sales and Rentals | 1,402 | 1,402 | – |

| Other Non-Tax Revenue — Reimbursements | 1,031 | 1,031 | – |

| Other Non-Tax Revenue — Royalties | 284 | 284 | – |

| Other Non-Tax Revenue — Power Supply Contract Recoveries | 102 | 102 | – |

| Other Non-Tax Revenue — Net Reduction of Power Purchase Contracts | 5 | 5 | – |

| Other Non-Tax Revenue — Total | 17,208 | 17,196 | (12) |

| Total Revenue | 154,012 | 156,897 | 2,885 |

Note: Numbers may not add due to rounding.

Source: Ontario Ministry of Finance.

Total expense1

| Ministry Expense | 2021–22 2021 Budget |

2021–22 Current Outlook |

2021–22 In-Year Change |

|---|---|---|---|

| Agriculture, Food and Rural Affairs (Base) | 310.9 | 310.9 | – |

| Agriculture, Food and Rural Affairs — Demand-Driven Risk Management and Time-Limited Programs | 417.2 | 417.6 | 0.3 |

| Agriculture, Food and Rural Affairs — Time-Limited Funding2 | 26.2 | 26.2 | – |

| Agriculture, Food and Rural Affairs (Total) | 754.3 | 754.6 | 0.3 |

| Attorney General (Base) | 1,675.0 | 1,675.0 | – |

| Attorney General — Statutory Appropriations – Crown Liability and Proceedings Act, 2019 | – | – | – |

| Attorney General (Total) | 1,675.0 | 1,675.0 | – |

| Board of Internal Economy (Total) | 273.0 | 273.0 | – |

| Children, Community and Social Services (Base) | 17,841.5 | 17,841.5 | – |

| Children, Community and Social Services — Time-Limited Funding3 | 69.1 | 69.1 | – |

| Children, Community and Social Services (Total) | 17,910.6 | 17,910.6 | – |

| Colleges and Universities (Base) | 9,312.8 | 9,312.8 | – |

| Colleges and Universities — Student Financial Assistance | 1,352.4 | 1,352.4 | – |

| Colleges and Universities — Time-Limited Funding4 | 12.7 | 12.7 | – |

| Colleges and Universities (Total) | 10,677.9 | 10,677.9 | – |

| Economic Development, Job Creation and Trade (Base) | 377.5 | 377.5 | – |

| Economic Development, Job Creation and Trade — Time-Limited Investments | 214.1 | 214.1 | – |

| Economic Development, Job Creation and Trade — Time-Limited Funding5 | 293.7 | 343.7 | 50.0 |

| Economic Development, Job Creation and Trade (Total) | 885.3 | 935.3 | 50.0 |

| Education (Base) | 31,263.0 | 31,263.0 | – |

| Education — Teachers’ Pension Plan6 | 1,630.9 | 1,630.9 | – |

| Education — Time-Limited Funding7 | 59.3 | 59.3 | – |

| Education (Total) | 32,953.2 | 32,953.2 | – |

| Energy, Northern Development and Mines (Base) | 1,083.8 | 1,083.8 | – |

| Energy, Northern Development and Mines — Electricity Cost Relief Programs | 6,493.6 | 6,493.6 | – |

| Energy, Northern Development and Mines — Time-Limited Funding8 | 62.0 | 170.2 | 108.2 |

| Energy, Northern Development and Mines (Total)9 | 7,639.5 | 7,747.6 | 108.2 |

| Environment, Conservation and Parks (Base) | 684.3 | 684.3 | – |

| Environment, Conservation and Parks — Time-Limited Funding10 | 2.3 | 2.3 | – |

| Environment, Conservation and Parks (Total) | 686.6 | 686.6 | – |

| Executive Offices (Base) | 39.9 | 40.4 | 0.5 |

| Executive Offices — Time-Limited Funding11 | – | 3.0 | 3.0 |

| Executive Offices (Total) | 39.9 | 43.4 | 3.5 |

| Finance (Base) | 850.9 | 850.9 | – |

| Finance — Investment Management Corporation of Ontario12 | 185.4 | 185.4 | – |

| Finance — Ontario Municipal Partnership Fund | 501.9 | 501.9 | – |

| Finance — Power Supply Contract Costs | 102.2 | 102.2 | – |

| Finance — Time-Limited Fund13 | – | 2,200.0 | 2,200.0 |

| Finance — Time-Limited Funding14 | 35.0 | 170.0 | 135.0 |

| Finance (Total)15 | 1,675.4 | 4,010.4 | 2,335.0 |

| Francophone Affairs (Base) | 6.5 | 6.5 | – |

| Francophone Affairs — Time-Limited Funding16 | 2.3 | 2.3 | – |

| Francophone Affairs (Total) | 8.8 | 8.8 | – |

| Government and Consumer Services (Base) | 743.4 | 743.4 | – |

| Government and Consumer Services — Realty | 1,144.6 | 1,144.6 | – |

| Government and Consumer Services (Total) | 1,887.9 | 1,887.9 | – |

| Health (Total) | 64,016.7 | 64,016.7 | – |

| Health Response17 | 5,144.1 | 5,144.1 | – |

| Heritage, Sport, Tourism and Culture Industries (Base) | 1,016.2 | 1,016.2 | – |

| Heritage, Sport, Tourism and Culture Industries — Ontario Cultural Media Tax Credits | 602.1 | 602.1 | – |

| Heritage, Sport, Tourism and Culture Industries — Time-Limited Funding18 | 205.4 | 238.3 | 32.9 |

| Heritage, Sport, Tourism and Culture Industries (Total) | 1,823.8 | 1,856.7 | 32.9 |

| Indigenous Affairs (Base) | 85.5 | 85.5 | – |

| Time-Limited Funding19 | 4.0 | 4.0 | – |

| Indigenous Affairs (Total) | 89.5 | 89.5 | – |

| Infrastructure (Base) | 365.4 | 365.4 | – |

| Infrastructure — Federal–Provincial Infrastructure Programs | 590.0 | 590.0 | – |

| Infrastructure — Waterfront Toronto Revitalization (Port Lands Flood Protection) | 155.6 | 155.6 | – |

| Infrastructure — Municipal Infrastructure Program Investments | 200.0 | 200.0 | – |

| Infrastructure — Time-Limited Funding20 | 233.5 | 233.5 | – |

| Infrastructure (Total) | 1,544.5 | 1,544.5 | – |

| Labour, Training and Skills Development (Base) | 175.1 | 175.1 | – |

| Labour, Training and Skills Development — Training Tax Credits (Co-operative Education and Apprenticeship Training)21 | 88.9 | 88.9 | – |

| Labour, Training and Skills Development — Demand-Driven Employment and Training Programs | 1,169.3 | 1,169.3 | – |

| Labour, Training and Skills Development — Time-Limited Funding22 | 288.0 | 504.2 | 216.2 |

| Labour, Training and Skills Development (Total) | 1,721.3 | 1,937.5 | 216.2 |

| Long-Term Care (Total) 23 | 5,764.0 | 5,764.0 | – |

| Municipal Affairs and Housing (Base) | 512.3 | 512.3 | – |

| Municipal Affairs and Housing — Time-Limited Investments | 349.2 | 349.2 | – |

| Municipal Affairs and Housing — Social Housing Agreement – Payments to Service Managers | 284.5 | 284.5 | – |

| Municipal Affairs and Housing — Time-Limited Funding24 | 286.3 | 286.3 | – |

| Municipal Affairs and Housing (Total) | 1,432.3 | 1,432.3 | – |

| Natural Resources and Forestry (Base) | 573.4 | 573.4 | – |

| Natural Resources and Forestry — Emergency Forest Firefighting | 100.0 | 100.0 | – |

| Natural Resources and Forestry (Total)25 | 673.3 | 673.3 | – |

| Seniors and Accessibility (Base) | 66.5 | 66.5 | – |

| Seniors and Accessibility — Time-Limited Investments | 9.1 | 9.1 | – |

| Seniors and Accessibility — Time-Limited Funding26 | 6.0 | 6.0 | – |

| Seniors and Accessibility (Total) | 81.7 | 81.7 | – |

| Solicitor General (Total) | 3,096.4 | 3,096.4 | – |

| Transportation (Base) | 5,529.9 | 5,529.9 | – |

| Transportation — Federal–Provincial Infrastructure Programs | 702.9 | 702.9 | – |

| Transportation (Total) | 6,232.8 | 6,232.8 | – |

| Treasury Board Secretariat (Base) | 454.8 | 454.8 | – |

| Treasury Board Secretariat — Employee and Pensioner Benefits27 | 1,766.5 | 1,766.5 | – |

| Treasury Board Secretariat — Operating Contingency Fund | 1,915.1 | 1,377.5 | (537.5) |

| Treasury Board Secretariat — Capital Contingency Fund | 165.3 | 165.3 | – |

| Treasury Board Secretariat (Total)28 | 4,301.7 | 3,764.2 | (537.5) |

| Interest on Debt29 | 13,130.1 | 13,130.1 | – |

| Total Expense | 186,119.5 | 188,328.0 | 2,208.5 |

[1], [9], [15], [25], [28] On June 18, 2021 the government announced that the Ministry of Energy, Northern Development and Mines and the Ministry of Natural Resources and Forestry will become the Ministry of Energy and the Ministry of Northern Development, Mines, Natural Resources and Forestry. Additionally, Ontario’s Digital Strategy will transfer to the Ministry of Finance from Treasury Board Secretariat. Reporting changes to these ministries will be reflected in future updates.

[2], [3], [4], [5], [7], [8], [10], [11], [13], [14], [16], [18], [19], [20], [22], [24], [26] In the 2021 Budget, the government made available Time‐Limited Funding. This funding continues to be presented separately in order to transparently capture the temporary nature of these investments.

[6], [27] Numbers reflect the pension expense that was calculated based on recommendations of the Independent Financial Commission of Inquiry, as described in Note 19 to the Consolidated Financial Statements in Public Accounts of Ontario 2017–2018.

[12] Based on the requirements of Public Sector Accounting Standards, the Province consolidated the Investment Management Corporation of Ontario into the Ministry of Finance.

[17] For presentation purposes in the 2021–22 First Quarter Finances, time-limited related spending has been included separately instead of within the Ministry of Health and Ministry of Long-Term Care. This change in presentation does not impact ministry allocations, which reflect the ministry structure(s) presented in the 2021–22 Expenditure Estimates.

[21] The Co-operative Education Tax Credit remains in effect. The Apprenticeship Training Tax Credit is eliminated for eligible apprenticeship programs that commenced on or after November 15, 2017.

[23] The Ontario Ministry of Long-Term Care total includes expenses incurred by Ontario Health for funding for long-term care. These amounts will be consolidated in the total expense of the Ontario Ministry of Health, including $4.2 billion in 2020–21 and $5.6 billion in 2021–22.

[29] Interest on debt is net of interest capitalized during construction of tangible capital assets of $236 million in 2021–22.

Note: Numbers may not add due to rounding.

Sources: Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Infrastructure expenditures

| Sector | 2021–22 Current Outlook Investment in Capital Assets1, 2 |

2021–22 Current Outlook Transfers and Other Infrastructure Expenditures3 |

2021–22 Current Outlook Total Infrastructure Expenditures |

|---|---|---|---|

| Transportation — Transit | 4,216 | 1,426 | 5,642 |

| Transportation — Provincial Highways | 2,406 | 186 | 2,592 |

| Transportation — Other Transportation, Property and Planning | 107 | 75 | 182 |

| Health — Hospitals | 1,616 | 3 | 1,619 |

| Health — Other Health | 60 | 244 | 304 |

| Education | 3,285 | 10 | 3,295 |

| Postsecondary Education — Colleges and Other | 829 | 64 | 893 |

| Postsecondary Education — Universities | – | 93 | 93 |

| Social | 18 | 310 | 328 |

| Justice | 877 | 105 | 983 |

| Other Sectors4 | 1,027 | 1,664 | 2,691 |

| Total Infrastructure Expenditures | 14,442 | 4,181 | 18,623 |

| Less: Other Partner Funding5 | 1,765 | – | 1,765 |

| Total6 | 12,677 | 4,181 | 16,858 |

[1] Includes $236 million in interest capitalized during construction.

[2] Includes provincial investment in capital assets of $11.8 billion.

[3] Includes transfers to municipalities, universities and non-consolidated agencies.

[4] Includes government administration, natural resources and the culture and tourism industries.

[5] Other Partner Funding refers to third-party investments, primarily in hospitals, colleges and schools.

[6] Includes Federal/Municipal contributions to provincial infrastructure investments.

Note: Numbers may not add due to rounding.

Source: Ontario Treasury Board Secretariat.

Five-year review of selected financial and economic statistics1

| Item | 2017–18 | 2018–19 | Actual 2019–20 |

Interim2 2020–21 |

Current Outlook 2021–22 |

|---|---|---|---|---|---|

| Revenue | 150,594 | 153,700 | 156,096 | 151,813 | 156,897 |

| Expense — Programs | 142,363 | 148,751 | 152,273 | 177,825 | 175,198 |

| Expense — Interest on Debt3 | 11,903 | 12,384 | 12,495 | 12,456 | 13,130 |

| Total Expense | 154,266 | 161,135 | 164,768 | 190,281 | 188,328 |

| Reserve | – | – | – | – | 1,000 |

| Surplus/(Deficit) | (3,672) | (7,435) | (8,672) | (38,468) | (32,431) |

| Net Debt | 323,834 | 338,496 | 353,332 | 399,463 | 439,167 |

| Accumulated Deficit | 209,023 | 216,642 | 225,764 | 264,232 | 296,663 |

| Gross Domestic Product (GDP) at Market Prices | 824,979 | 859,079 | 891,811 | 851,176 | 912,461 |

| Primary Household Income | 541,501 | 567,492 | 591,527 | 588,381 | 606,032 |

| Population — July (000s)4 | 14,070 | 14,309 | 14,545 | 14,734 | 14,822 |

| Net Debt Per Capita (dollars) | 23,016 | 23,657 | 24,293 | 27,112 | 29,629 |

| Household Income Per Capita (dollars) | 38,486 | 39,661 | 40,670 | 39,934 | 40,887 |

| Net Debt as a Per Cent of Revenue | 215.0% | 220.2% | 226.4% | 263.1% | 279.9% |

| Interest on Debt as a Per Cent of Revenue | 7.9% | 8.1% | 8.0% | 8.2% | 8.4% |

| Net Debt as a Per Cent of GDP | 39.3% | 39.4% | 39.6% | 46.9% | 48.1% |

| Accumulated Deficit as a Per Cent of GDP | 25.3% | 25.2% | 25.3% | 31.0% | 32.5% |

[1] Amounts reflect a change in pension expense that was calculated based on recommendations of the Independent Financial Commission of Inquiry, as described in Note 19 to the Consolidated Financial Statements, in Public Accounts of Ontario 2017–2018. Amounts for net debt and accumulated deficit also reflect this change.

[2] Interim represents the 2021 Budget projection for the 2020–21 fiscal year.

[3] Interest on debt is net of interest capitalized during construction of tangible capital assets of $157 million in 2017–18, $175 million in 2018–19, $245 million in 2019–20, $234 million in 2020–21 and $236 million in 2021–22.

[4] Population figures are for July 1 of the fiscal year indicated (i.e., for 2017–18, the population on July 1, 2017 is shown).

Note: Numbers may not add due to rounding.

Sources: Statistics Canada, Ontario Treasury Board Secretariat and Ontario Ministry of Finance.

Section D: Ontario’s 2021–22 borrowing program

Ontario’s 2021–22 borrowing program

| Item | 2021–22 2021 Budget |

2021–22 Current Outlook1 |

2021–22 Change from 2021 Budget |

|---|---|---|---|

| Deficit/(Surplus) | 33.1 | 32.4 | (0.7) |

| Investment in Capital Assets | 11.8 | 11.8 | – |

| Non-Cash Adjustments | (9.5) | (9.5) | – |

| Loans to Infrastructure Ontario | 0.2 | 0.2 | – |

| Other Net Loans/Investments | 1.3 | 1.1 | (0.1) |

| Debt Maturities/Redemptions | 25.0 | 25.0 | – |

| Total Funding Requirement | 61.9 | 61.1 | (0.8) |

| Decrease/(Increase) in Short-Term Borrowing | (6.0) | (6.0) | – |

| Increase/(Decrease) in Cash and Cash Equivalents | 4.0 | 4.0 | – |

| Pre-Borrowing for 2021–22 | (5.2) | (6.1) | (0.8) |

| Total Long-Term Public Borrowing | 54.7 | 53.0 | (1.6) |

[1] The Current Outlook reflects additional pre-borrowing completed between the release of the 2021 Budget and fiscal year end.

Note: Numbers may not add due to rounding.

Source: Ontario Financing Authority.

The Province’s funding requirements for 2021–22 are projected to decrease by $0.8 billion compared to the forecast in the 2021 Budget, reflecting a decrease of $0.7 billion in the projected deficit and a $0.1 billion reduction in net loans and investments. The Province’s long-term borrowing program for 2021–22 is forecast to decrease by $1.6 billion, reflecting the decrease in the funding requirements and the increase in pre-borrowing for 2021–22. Short-term borrowing for the fiscal year is projected to remain unchanged.

As of August 4, 2021, Ontario had completed $21.0 billion or 40 per cent of its $53.0 billion 2021–22 long‑term borrowing program. Approximately $15.4 billion or 73 per cent was completed in Canadian dollars, with the remaining $5.6 billion or 27 per cent completed primarily in U.S. dollars, euros and Swiss francs.

Green Bonds remain a core component of Ontario’s borrowing program and are an important tool to help finance public transit initiatives, extreme weather-resistant infrastructure and energy efficiency and conservation projects. On July 27, 2021, the Province issued its tenth and largest Green Bond to date, of $2.75 billion. This transaction was also the largest ever Green Bond offering in Canada. Ontario remains the largest issuer of Canadian dollar Green Bonds, with ten green issues totalling $10.75 billion since 2014–15. Eight projects have been selected and are expected to receive funding from the latest Green Bond. This includes five clean transportation projects, two energy efficiency and conservation projects and one climate adaptation and resilience project. Subject to market conditions, Ontario plans to continue to issue multiple Green Bonds each fiscal year, including 2021–22.

Financial markets and longer-term interest rates have exhibited volatility from the outset of the pandemic. Current interest rate fluctuations have primarily arisen from differing interpretations of the path of inflation. Many market participants are concerned about the recent increases in inflation to its highest level in over a decade, while the Bank of Canada and other central banks have cautioned that any spike in inflation will be transitory. The Province will continue to monitor movements in longer-term interest rates and reflect any changes and their impact on interest on debt costs in future fiscal updates.

2021–22 Long-term borrowing

| Item | ($ Billions) |

|---|---|

| Canadian Dollar Issues | 15.4 |

| Foreign Currency Issues | 5.6 |

| Total | 21.0 |

Note: Numbers may not add due to rounding.

Source: Ontario Financing Authority.

Ministry of Finance: www.ontario.ca/finance

For general inquiries regarding the 2021–22 First Quarter Finances, please call or email:

Toll-free English and French inquiries: 1-800-337-7222

Teletypewriter (TTY): 1-800-263-7776

Email: FinanceCommunications.fin@ontario.ca

© Queen’s Printer for Ontario, 2021

Accessible chart descriptions:

Chart 1: Ontario Labour Market

The chart shows Ontario’s monthly employment level as a shaded area and unemployment rate as a line from January 2020 to July 2021. The unemployment rate increased from 5.5 per cent in February 2020 to 13.5 per cent in May 2020, and has since declined to 8.0 per cent in July 2021. Employment declined from 7.5 million in February 2020 to 6.4 million in May 2020. Employment has since risen to almost 7.4 million in July 2021. There is a call-out box that states “+1,016,700 net new jobs since June 2020.”

Chart 2: Ontario 2021 Real GDP Growth

The bar chart shows the private sector average forecast and Ministry of Finance’s planning assumption for Ontario 2021 real GDP growth at the time of the 2021 Budget and 2021–22 First Quarter Finances. At the time of the 2021 Budget, the private sector average forecast was for 2021 real GDP to grow by 4.4 per cent and the Ministry of Finance’s planning assumption was an increase of 4.0 per cent. At the time of the 2021–22 First Quarter Finances, the private sector average forecast for 2021 real GDP was an increase of 5.4 per cent and the Ministry of Finance’s planning assumption was for growth of 5.0 per cent.