The case for change: Increasing choice and expanding opportunity in Ontario’s alcohol sector

Read the 2019 report to the Minister of Finance by Ken Hughes, Ontario Special Advisor for the Beverage Alcohol Review.

May 2019

Letter to the Minister of Finance

The Honourable Victor Fedeli

Minister of Finance and Chair of Cabinet

Frost Building South

7th Floor

7 Queen's Park Cres.

Toronto, ON M7A 1Y7

May 24, 2019

Dear Minister,

Ontario has a once in a generation opportunity to make meaningful change that will allow small businesses to flourish and create jobs while providing choice and convenience for the purchase of beverage alcohol. Over the past 92 years, successive governments have incrementally let rules, loopholes, institutions, and special interests develop a near-monopoly beer distribution system that primarily benefits a few larger brewers. Now is the chance to create a system built for the consumer, for the citizen, for the people.

First, in the short term, we must create as many opportunities as possible using the flexibility we already have to allow businesses to provide choice and convenience by expanding the number of LCBO agency stores and allowing beverage alcohol to be sold in more grocery stores.

Second, the citizens of Ontario have long suffered under an anti-competitive, anti-consumer beer distribution system controlled by some of the largest beer companies in the world. Nowhere else in the world is a consortium of the largest global brewers given effective control over 70% of the beer retail market, including the exclusive right to sell 12 and 24 packs. The system has been so advantageous to the big brewers that their Canadian subsidiaries, Molson and Labatt, have become integral and highly profitable parts of these global companies. However, that near-monopoly has come at a cost to consumers in Ontario. It has severely restricted choice and convenience for consumers, and in fact, Ontario currently has the fewest number of outlets per capita selling beverage alcohol of any province in Canada. The current situation is not fair to consumers, or to our smaller craft beer entrepreneurs, innovators and job creators.

The government has been negotiating with the Beer Store and its owners in good faith on behalf of the people to provide consumer choice and convenience and to support small business growth. While there have been some expressions of good will, more progress needs to be made and the government should consider all available options within its powers that would provide routes to expand retail sales should negotiations with the Beer Store and its owners prove unsuccessful.

Third, the health and safety of Ontario citizens in a socially responsible beverage alcohol retail context is paramount. As the former Chair of the Board of one of Canada's largest healthcare delivery services, I will continue working with stakeholders and advising the government on this very important topic.

Fourth, we have a great opportunity to celebrate, enhance and encourage the craft beer, wine, cider and spirits businesses that are emerging and growing across this province. These businesses help build Ontario's identity and create jobs in many smaller communities. Together, these businesses are becoming a new powerhouse in many communities, right across the province.

Thank you for the opportunity to work with you on this important initiative to modernize the alcohol beverage industry in Ontario. As it should, Ontario can provide real leadership within Canada.

Yours sincerely,

Ken Hughes

Ontario Special Advisor for the Beverage Alcohol Review

Section 1: Executive Summary

Ontario's Archaic and Inconvenient Alcohol Retail Landscape

Buying alcohol has been a source of continual frustration for everyday Ontarians for the past 92 years. Since the 1960s there have been no less than seven special reviews trying to fix it. Ontario's Government for the People has a unique mandate to take bold steps and finally improve convenience and fairness for Ontario consumers and businesses.

The alcohol retail landscape is diverse and complex. The largest retailer, the LCBO, is government-owned and provides a significant annual contribution to the provincial treasury – $2.12 billion in 2017–18. Beer sales are dominated by The Beer Store (TBS), a near-monopoly primarily owned by three of the biggest multinational brewing companies. While most Ontarians view the retail experience at the LCBO favourably, shopping at most TBS locations has changed very little over the past century.

| Comparing Alcohol Retail | Ontario | Québec | Alberta |

|---|---|---|---|

| Number of Retail Outlets Per 10,000 People | 2.4 | 12.2 | 6.4 |

| How Retail Prices Are Set | Retailers must comply with uniform pricing requirements; Retail prices are set by producers | Competitive prices set by retailers | Competitive prices set by retailers |

|

Diversity of Retail Outlets |

|

|

|

Ontario currently has the lowest alcohol retail density of any Canadian province. This is an issue of fairness – especially for Ontarians who don't live in large cities or have access to a vehicle. Except for LCBO Agency Stores and a select few grocery stores, small businesses are largely shut out of alcohol retail. Reaching the national average retail density would mean authorizing an additional 4,000 retail outlets. It would take 11,500 new outlets for Ontario to reach Québec's retail density or 4,500 new outlets to reach Alberta's retail density.

Barrier to Change: The Unfair Master Framework Agreement

Many of the current challenges with alcohol retail in Ontario stem from the 2015 Master Framework Agreement (MFA), signed by the previous Ontario government, TBS and the three large global brewers (Molson, Labatt, Sleeman) who own TBS. The MFA gives TBS exclusivity on beer sales in 12 and 24 packs in its local markets until 2025 and limits the number of new retail stores that can be authorized. This is a bad deal for Ontarians because it gives control over the beer market to three dominant beer companies. This stifles competition, keeps prices artificially high, and prevents new craft beer entrepreneurs from getting a strong foothold in the market. It also limits real choice.

The TBS near-monopoly is made worse by the fact that in most TBS locations the shopping experience is virtually the same as it was nearly a century ago – the product is kept behind a wall and customers select from logos. Despite TBS investing $100 million since 2015, the overall customer experience remains virtually unchanged. Despite the shopping experience, consumers must go to TBS locations to return their empties and get their deposit back. Their exclusive right to collect empties is inconvenient for consumers.

Nowhere else in the world does a government give the biggest beer companies special privileges at the expense of consumers and the rest of the industry. The existing MFA negotiated by the previous government is a terrible deal for Ontario consumers and small businesses. Left alone, it will continue the unfairness of the current system for the next six years.

Building a System That's Fair for Everyday Ontarians

Modernizing alcohol retail holds the potential to deliver significant economic benefits to Ontarians. The Retail Council of Canada estimates, based on the experience of British Columbia, that it could increase Ontario's GDP by $3.5 billion and generate up to 9,100 jobs.1 It could also save Ontarians hundreds of millions of dollars every year by creating more opportunities for one-stop shopping. The Ministry of Finance estimates the value of time saved by being able to buy alcohol while shopping for other items could be up to $250 million per year. Opening additional retail outlets would also make it easier for craft beverage manufacturers to connect with consumers and create jobs.

The Convenience Industry Council of Canada reports that 7 in 10 Ontarians who regularly consume beverage alcohol support the expansion of alcohol sales into convenience stores.2 The Retail Council of Canada reports 73% of Ontarians support the sale of 12 and 24 packs in grocery stores, and 68% support the sale of alcohol at all grocery stores in Ontario.3

To develop a path forward, the government met with over 30 retailers, public health and safety organizations, and beverage alcohol manufacturers and received written submissions from over 50 groups to discuss potential opportunities, risks and challenges. The government also heard from over 33,000 consumers and businesses through online consultations. Any steps to improve consumer convenience should maintain Ontario's strong record on social responsibility.

This report brings forward nine recommended steps the government can take to create a fairer and more convenient alcohol retail system for Ontario. The government should:

- Do everything possible under the Master Framework Agreement to authorize additional alcohol retail outlets.

- Consider other available options within its powers that would provide ways to expand retail sales should negotiations with TBS and its owners prove unsuccessful.

- Take a phased approach toward authorizing new retailers and beverage alcohol products available for sale.

- Enable price competition between retailers.

- Continue to consult with Ontario winemakers and grape growers to determine how Ontario's wine industry will be best supported in an expanded retail environment in a manner that respects international trade obligations.

- Continue to engage Ontario's important spirits industry.

- Maintain the LCBO as a valuable government asset.

- Work with retailers, beverage alcohol manufacturers, and public health experts to ensure that increasing convenience does not lead to increased social costs related to alcohol.

- Reduce unnecessary regulatory burden and address inefficiencies that increase costs to the industry.

Section 2: The Case for Change – Key Objectives of the Alcohol Review

When prohibition ended in Ontario in 1927, the government of the time put in place a strict regime to control the sale and consumption of alcohol. Citizens over the age of 21 had to purchase and carry an Individual Liquor Permit – like a driver's licence – for alcohol purchases. In the 1960s, all purchases required Purchase Order Forms that included the purchaser's name, address and signature. The LCBO stored all products behind a wall and handed purchases to customers in a brown paper bag. By the late 1960s Ontarians were fed up with a retail system that treated them like criminals.

In 1969, the system slowly started to change. The LCBO opened its first "self-serve" locations and finally got rid of Purchase Order Forms. Other proposals at the time, like allowing the sale of beer in grocery stores, would take another 47 years to come to pass.

While Ontario no longer requires Individual Liquor Permits and alcohol is no longer stored behind a wall (at least in LCBO outlets), Ontario's beverage alcohol system remains a continued source of frustration for ordinary Ontarians. Since the mid-1960s there have been no less than seven comprehensive reviews and expert committees formed to try to fix it.4 Most of these reviews have recommended modest or incremental change – and generally only the very mildest reforms were ever put in place.

The continued inconvenience and unfairness of Ontario's beverage alcohol system is by design. For 92 years, Ontario's system has been based on three fundamental beliefs: first, that the best way to reduce and prevent social harm and health risks related to alcohol consumption is to make purchasing and consuming alcohol awkward or inconvenient; second, a belief that adults can't be trusted to make their own decisions around responsible alcohol consumption; and third, that private sector retailers, with the exception of a small group of insiders, do not have the capacity to balance market competition and social responsibility.

In June 2018, the newly elected Ontario government was given a mandate by the people to make bold change. The new government believes that Ontario is mature enough to join other jurisdictions across the country and around the world that treat adults like adults. They believe that the role of government isn't to inconvenience the public and force everyday Ontarians to drive long distances to buy legal products that should be available closer to home. They believe that competition leads to healthier markets, and that the private sector has just as deep an interest in social responsibility as everyone else. They understand that in 2019 there are better ways for governments to reduce the harm of alcohol consumption than giving a retail monopoly to a select few.

In November's Ontario Economic Outlook and Fiscal Review, the Minister of Finance announced that the government is committed to modernizing the rules for the retail and consumption of beverage alcohol. To inform this plan, the Minister launched a comprehensive review of the beverage alcohol sector.

The Beverage Alcohol review was launched with a mandate to provide the Minister of Finance with recommendations on how to modernize the beverage alcohol system in two fundamental areas:

- Opportunities to provide more choice and convenience to consumers, and

- Options for government to allow more private businesses to compete in the sale and distribution of alcohol.

As Special Advisor, I have conducted this review with the firm understanding that alcohol is not an ordinary consumer product. It is the role of the government to closely monitor its sale and protect against social harms. While considering ways to modernize Ontario's retail landscape and improve convenience, it is important for social responsibility to remain at the core of this review and its recommendations.

This review also begins with an understanding that bold action is not easy – but it is necessary. In 1969 when the LCBO first introduced self-service stores, there were critics who said it would cause social harms to skyrocket. Of course, these fears were not realized and society adapted. I am confident this will also be the case with the bold reforms recommended in this report. The track record of Ontario's endless alcohol reviews demonstrate that modest tweaks and half-measures will only extend consumer frustrations into the future and inevitably result in another beverage alcohol review in 5 or 10 years discussing the same fundamental issues.

My belief is that right now the Ontario Government has the unique mandate and ability to put the interests of ordinary Ontarians ahead of entrenched interests and deliver the bold changes Ontarians have been waiting for, for nearly a century.

Section 3: Current Retail Landscape

Ontario's beverage alcohol retail landscape includes a range of retail outlets.

| Publicly Owned | Privately Owned – Off-Site Retail Stores | Privately Owned – On-Site Manufacturer Stores |

|---|---|---|

|

LCBO

|

The Beer Store

Grocery Stores

LCBO Agency Stores

Off-Site Winery Stores

Duty Free Stores

|

On-Site Retail Stores

|

Accessible description of Chart 1

Accessible description of Chart 2

Accessible description of Chart 3

Publicly Owned: Liquor Control Board of Ontario (LCBO)

Operating Model:

- LCBO – a government owned retailer and wholesaler.

- With 663 retail locations and $6.24 billion in annual sales, LCBO is one of the world's largest buyers and retailers of beverage alcohol.

- As a government-owned enterprise, LCBO transfers annual dividends to the province - $2.12 billion in 2017-2018 – which are reinvested in provincial priorities like health, education and infrastructure.

How Common is the LCBO Model?

Most North American jurisdictions have some government involvement in the distribution and retail sale of beverage alcohol.

Sub-national governments that operate retail liquor stores similar to the LCBO include most Canadian provinces (BC, SK, MN, QC, NB, NS, PEI, NFLD, YK) and some U.S. states (Alabama, Idaho, New Hampshire, North Carolina, Pennsylvania, Utah, Virginia).

Consumer Experience:

- Studies show Ontarians are generally very satisfied with the LCBO - particularly its selection, overall shopping experience and highly knowledgeable staff.5

- LCBO's online platform offers same-day pick up and next day delivery for online orders, and is piloting On-Demand Delivery with Foodora. LCBO's mobile app has more than 450,000 active users and includes the ability to scan bar codes and search for products based on nearest location.

- LCBO's promotional Food and Drink magazine, has a deep following reaching an estimated 2.25 million readers.6

Privately Owned: The Beer Store (TBS)

Operating Model:

- TBS dominates Ontario's retail landscape for beer. With 450 stores, TBS accounts for 70% of volume beer sales across the province.

- Under the Master Framework Agreement signed by the previous Ontario government, TBS enjoys almost exclusive rights to:

- Sell beer in sizes larger than a six-pack;

- Sell beer to licensed bars and restaurants; and

- Collect empties under the Ontario Deposit Return Program.

The MFA limits the total number of new beverage alcohol outlets to 450.

How Common is The Beer Store Model?

Nowhere else in the world is a group of the largest global brewers given a near-monopoly and effective control over 70% of the beer retail market. This arrangement is highly profitable for large brewers, but bad for consumers and the rest of the brewing and retail industry.

Consumer Experience:

- Ontario's 2015 review of Beer Retailing described the TBS customer experience as "basic."7 The Washington Post recently described TBS as having "all the charm of a cold-storage warehouse."8

- In most TBS locations, the shopping experience is virtually the same as it was a century ago where the product is kept behind a wall and customers select from logos. Despite investing $100 million since 2015, the overall customer experience remains virtually unchanged.

- In 2017 TBS launched an online and home delivery option, but in 2019 this service is still restricted to just a handful of communities.

- TBS does operate some self-service locations where customers can browse, but most locations only allow for the promotion of top selling products, which also happen to be brands from the owners.

Accessible description of Chart 4

Privately Owned: Off-Site Winery Retail Stores (WRS)

- Off-site WRS create an important retail channel for Ontario grown grapes – both in Ontario Vintners Quality Alliance or other 100% Ontario wines, or as part of International Canadian blended wines that must include at least 25% Ontario content in each bottle.

- Currently 292 off-site stores are in operation – about 220 of which are located inside grocery stores.

Privately Owned: LCBO Agency Stores

- Established in 1962, the LCBO Agency Store program lets private retailers sell alcohol in communities that are typically too small to have a full LCBO location.

- There are currently 209 Agency Stores – usually a grocery store, general store, gas station or tourist outfitter.

- LCBO provides commercial and regulatory oversight of Agency Stores, and they purchase wholesale from both LCBO and TBS.

Privately Owned: Grocery Stores

- In 2015, Ontario began allowing private grocery stores to sell beer and cider. In 2016 this was expanded to include wine sales in some locations.

- There are 364 grocery stores currently authorized to sell beverage alcohol. Grocery stores must meet certain eligibility criteria, such as minimum square footage, and must sell a full line of food products.

- Authorized grocery stores purchase beer wholesale from the LCBO.

Privately Owned: Manufacturer Retail Stores

- Under Alcohol and Gaming Commission of Ontario (AGCO) licensing provisions, all breweries, wineries, cideries and distilleries are entitled to operate retail stores at points of production. As the craft alcohol industry has boomed in the past decade, this category has been growing rapidly.

- Most of these beverage alcohol producers are small businesses.

- There is considerable variety in consumer experience – some stores are located in industrial areas; many are central attractions for the local tourism/hospitality industry, generating significant economic benefits for the surrounding community.

Privately Owned: Duty Free Stores

- Ontario licenses a network of 15 private Duty Free Stores at airports and border crossings. These outlets sell beer, wine, and spirits to travelers exiting the country.

- Duty Free Stores are the only private retailers allowed to sell distilled spirits, other than manufacturer stores.

Section 4: Early Observations

1. The Retail Landscape is Complex

Ontario's alcohol retail landscape has been cobbled together over generations with complex rules, loopholes and special privileges. Changing one piece can have implications and unintended consequences for other areas, like consumer prices, provincial revenues or the viability of important economic sectors (e.g., agriculture and tourism). While this complexity should not stop the government from fulfilling their mandate to deliver convenience for consumers, the government should phase its approach and leave policy flexibility to address unintended developments.

2. Beer Sales are Dominated by a Small Number of Large Corporations

Ontario's beer market is dominated by the Beer Store, a huge organization primarily owned by three multinational conglomerates. Unsurprisingly, most of the beer sold at TBS is from its three main owners. Nowhere else in the world does a government give the biggest beer companies special privileges at the expense of the rest of the industry. This situation needs to be addressed. Polling has shown that 73% of Ontarians support the sale of 12 and 24 packs of beer in grocery stores and 68% support allowing all grocery stores to sell beverage alcohol.9

3. Small Businesses are Largely Shut Out of Alcohol Retail Sales

Under the current system there is very limited space for small businesses to benefit from the retail sale of beverage alcohol. LCBO Agency Stores and select grocery stores are the exception, and the success of this model proves that there is no reason why small retailers cannot be trusted to sell alcohol. The focus on large retailers also limits potential small business innovations that could improve convenience, reduce cost or improve consumer choice and experience. Ontario is one of the most diverse places in the world, and the beverage alcohol landscape should be allowed to reflect this.

4. Missing Opportunities to Spur Economic Growth and Create Jobs

Most jurisdictional studies find that increasing alcohol retail outlets can support economic growth and job creation.10 A recent study by the Retail Council of Canada (RCC) found that when British Columbia expanded retail alcohol outlets, retailers saw an average sales increase of $880,000.11 With a similar trend in Ontario, the net impact would increase the provincial GDP by $3.5 billion annually. RCC further estimates that increasing retail outlets could potentially create up to 9,100 new jobs – or 2.3 jobs per licensed store.

Ontario's fast-growing craft beer and cider industries are also being artificially constrained by the existing system. Access to retail channels is the biggest challenge many small manufacturers face. While TBS does offer open listing for any brewer that pays the listing fees, it is expensive for a small business to access the channel at scale, and there are limited promotional opportunities within the retail environment. Opening additional retail outlets would make it easier for craft beverage manufacturers to connect with consumers and create jobs.

5. Low Retail Outlet Density Compared to Other Provinces

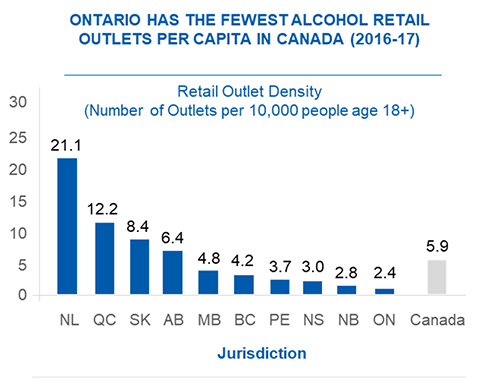

Ontario currently sits last in Canada for consumer convenience when it comes to the density of alcohol retail outlets, with only 2.4 outlets per 10,000 persons, well behind the national average of 5.9. Bringing Ontario up to the national average would mean authorizing an additional 4,000 new retail outlets. It would take 11,500 new retail outlets to bring Ontario to the same level of convenience as Québec.

Accessible description of Chart 5

Increasing retail density is about fairness. For Ontarians who don't live in a large city or don't have access to a vehicle or reliable public transit, traveling to TBS or LCBO stores can be a challenge. The government shouldn't force individuals to travel far out of their way to purchase a product they should reasonably have access to closer to home.

6. Hidden Distribution Costs Shifted onto Everyday Consumers

TBS frequently points to the efficiency of its distribution network, with centralized delivery to a relatively small number of stores, as something that saves consumers money. But this system only saves money for the brewers and shifts the costs of distribution to the consumers who often have to travel considerable distances to the nearest TBS outlet. The costs of this inconvenience can be estimated at hundreds of millions of dollars a year for consumers.12 Creating more opportunities for one-stop shopping would reduce these hidden costs for consumers.

7. LCBO Remains a Valuable Government Asset

The LCBO is Ontario's main provincial retailer of wine – with 83% of all retail sales. The LCBO is also the main retailer and wholesaler of spirits. Spirits, including Ontario's craft distillers, represent an important part of Ontario's beverage alcohol market with over $2.4 billion in annual sales almost exclusively through the LCBO.

LCBO consistently receives high marks from Ontarians. Provincial dividends also play an important role in funding Ontario's hospitals, schools and infrastructure. The government should not privatize the LCBO. Expanding the number of private retail outlets will create new opportunities for the LCBO to expand its role as a wholesaler to retailers and licensees, and help deliver even greater value to Ontarians.

Section 5: Master Framework Agreement

In 2015, the previous Ontario government signed an agreement with the Beer Store and the three large global brewers who own it (Molson, Labatt, Sleeman) that set Ontario's beer retail policy until 2025. Dubbed the Master Framework Agreement (MFA), this agreement gives TBS – a private, multinational-owned company – a 10-year near-monopoly on many elements of beer sales in Ontario. Such an arrangement, that shuts out small business and ultimately harms consumers, is the only deal of its kind in the world. Such an arrangement, that shuts out small business and ultimately harms consumers, is the only deal of its kind in the world.

My assessment is that the MFA puts private, corporate interests ahead of Ontario consumers, taxpayers, and small businesses. It is a terrible deal for the people of Ontario that will hold back consumer convenience, fair competition and small business growth for the next six years.

Why the MFA is Bad for Ontario Consumers

- Constrains Price Competition: The MFA requires uniform pricing to be maintained, which means that all retailers in Ontario must sell the same product for the same price ("uniform price"). This is a policy of the prior government and appears to be anticompetitive and robs consumers of opportunities to save and retailers of opportunities to compete.

- Exclusive Rights to 12 and 24 Pack Sales: The MFA gives TBS the exclusive right to sell 12 and 24 packs in most of their local markets – forcing consumers to buy from TBS if they want to purchase beer in bulk at a lower per unit cost. The price advantage on 12 and 24 packs drives volume in TBS, when consumers purchase these larger formats.

- Limits on New Stores: The MFA limits the total number of new beverage alcohol outlets to 450 and does not allow convenience stores to sell beer at all. Once the government reaches that limit, additional stores cannot be authorized to sell beer until after 2025.

- Retail Experience: In the MFA, TBS agreed to invest $100 million before 2018 in capital upgrades to their stores. Despite these investments, the retail experience in most TBS locations is largely the same as it has been for the past 92 years. Now that this MFA commitment has passed, TBS is not required to do anything to improve the retail experience until after 2025. This allows the big three to market their own products almost exclusively.

Why the MFA is Bad for Non-Owner Brewers

- Challenges in Growing Market Share: Craft beer sales account for less than 2% of sales at TBS, whereas they make up a much larger share at the LCBO (10%+) and grocery stores (15%+). The MFA included several provisions aimed at helping craft brewers benefit more from TBS, but these changes have not resulted in a comparative increase in market share.

- Disadvantageous Retail Format: Craft brewers do well in an open-format, competitive retail environment. The basic retail format of most TBS locations provides limited opportunities for craft brewers to market their product.

- Molson and Labatt have a Majority of TBS Board Seats: While the MFA introduced measures to provide small brewers with a greater voice in how TBS operates – including independent directors, a Beer Ombudsman and special minority shares for small brewers – the majority of board seats are held by the two largest shareholders, Molson and Labatt.

In Ontario, you cannot get what you want, where you want at a price you expect solely because of the MFA. Ontarians are ready for change. We hope TBS will embrace this and transition into the new more dynamic, convenient and competitive landscape.

Section 6: What We've Heard

Following the announcement in the 2018 Ontario Economic Outlook and Fiscal Review, the government launched a comprehensive consultation process to ensure the perspectives, recommendations and concerns of Ontarians fed into the recommendations brought forward by the review.

Our consultation heard directly from more Ontarians than any previous review of the beverage alcohol system. It was truly a process that worked for the people.

The consultation included a broad public consultation as well as a series of intensive roundtables with implicated business sectors, stakeholder groups and public health and safety organizations.

Listening to the people

"In Europe you can buy everything at a grocery store and chaos isn't unleashed. It's beyond me that we're not treated like grown ups." – Public survey respondent

"Would be great to be able to buy an Italian wine when I am shopping in an Italian food store (or any other ethnic retailer for that matter)." – Public survey respondent

"As a mother with children it's a hassle to have to unload the kids and pack them all back up a separate time in order to grab a nice bottle of wine for the occasional dinner. It would be much more convenient to have alcohol in grocery or convenience stores." – Public survey respondent

Public Consultation

The first phase of this review included a public consultation to provide consumers and businesses with the opportunity to provide input on increasing choice and convenience around the sale and consumption of beverage alcohol.

Businesses and consumers over the legal drinking age of 19 were invited to share their views by visiting Ontario.ca/AlcoholConsultations and providing input between December 13, 2018 and February 1, 2019.

The portal sought the views of ordinary Ontarians on a range of issues, including:

- Improving the rules for how beer, cider, wine and spirits are sold and consumed

- Allowing new types of stores, including corner stores and big-box stores, and more grocery stores, to sell these products

- Creating more opportunities for private sector sellers and distributors

- Ensuring communities are kept safe and healthy.

Over the course of the consultation, the government received over 33,000 responses from across the province. Of these, 86% identified themselves as beverage alcohol consumers. Most respondents said the LCBO is the most important alcohol retailer. When asked what key changes people would like to see respondents wanted more private sector retailers, and more opportunities to buy alcohol when shopping for other items.

Roundtable Consultations with Industry and Other Stakeholders

In the second phase of consultations, the government invited key groups to participate in roundtable discussions to ensure their valuable advice helps inform this review, including those representing beverage alcohol producers, public health and safety organizations, retailers, consumer groups, and the hospitality sector (restaurants and bars).

This process included three roundtables in March 2019 and a series of subsequent individual consultations. In total, the review met with over 30 organizations, and received written submissions from over 50 companies, NGOs or industry associations.

Listening to the people

"Ontario Craft Brewers… support the government's goal to modernize Ontario's alcohol sector… to ensure beer drinkers can enjoy greater access to Ontario craft beer."

Scott Simmons, President,

Ontario Craft Brewers Association

I have continued to meet extensively with stakeholders from all parts of the sector. I am impressed with the passion producers show for their craft and the deep knowledge of the sector demonstrated by all who have so far offered their time and advice. As can be expected, there was a range of different perspectives but also many areas of consensus. In general, most organizations agreed Ontario's beverage alcohol system is out of date and supported the government review.

Participants also agreed that encouraging the safe consumption of alcohol and ensuring social responsibility throughout the alcohol manufacturing and retail system is in everyone's interests. Most participants also supported a phased approach to any changes, to ensure communities and the market have time to adapt.

There were also several areas where stakeholders have varied opinions on the approach government should take:

New Points of Sale: Manufacturers and retailers broadly support expanding points of sale. Smaller retailers expressed the importance of ensuring that the new system includes small businesses and does not exclusively reward large retail chains. Craft producers supported licensing specialized boutiques that could specialize in their products. Representatives of the hospitality industry recommended permitting licensed hotels and restaurants to sell alcohol for off-site consumption. Many participants also supported expanding opportunities for online sales.

Producer – Retailer Relationships: Many manufacturers felt the government should prohibit retailers from accepting any inducements from manufacturers. A similar model has recently been adopted for Ontario's cannabis retailers – with retailers risking losing their licence if found accepting inducements. Many retailers were interested in freedom to cross-promote products with alcohol and fewer rules on product display and merchandising practices.

Product Specifications: Many retailers felt that there should be equality across all retailers – without special privileges (e.g. The Beer Store's exclusivity to sell 12 or 24 packs of beer). Some retailers and manufacturers supported the sale of any beverage alcohol product based on customer demand, while others suggested expansion be limited to beer, wine, cider and coolers, with spirits remaining exclusively at the LCBO and Duty Free Stores.

Minimum Price: Many participants agreed that some level of minimum pricing should be maintained for social responsibility. However, there was no consensus around how much retailers should be able to compete on price.

Wholesale and Distribution:Many producers and retailers supported maintaining LCBO's role as a wholesaler, although with options for licensed third parties to participate in delivery or warehousing. Other retailers were interested in independent warehousing options so alcohol can be tied into existing distribution networks.

Section 7: Social Responsibility

A core element of any reforms to Ontario's beverage alcohol retail system needs to be maintaining the high standards for social responsibility that exist today and not encouraging irresponsible consumption.

Through our consultations, this review has engaged experts across the public health, addictions, and policing communities. The review takes seriously the health consequences of alcohol, including chronic disease, violence and health-related costs. Some stakeholders have raised concerns that increasing points of sale will increase these social costs.

While the review is considering opportunities to increase consumer choice and convenience, there is a clear understanding that alcohol is not just another retail product and a balance must be struck.

Ontario is a Leader in Social Responsibility

Ontario has put in place a range of successful policies to reduce the harm of alcohol consumption. There are restrictions around how alcohol can be marketed and advertised. Ontario's graduated licensing program has a zero-blood alcohol concentration (BAC) limit for young and novice drivers and mandatory licence suspension for all drivers with a 0.05% BAC. Ontario requires the completion of an ignition interlock program as a condition of relicensing for all alcohol-related criminal driving offenders. A report found that in 2014 the per capita cost attributable to substance use is the second-lowest in Ontario (BC had the lowest),13 and recent Statistics Canada data shows Ontario has among the lowest rates of impaired driving incidents. Ontario is also one of the few Canadian jurisdictions to require messaging about the risks of consuming alcohol during pregnancy to be displayed where alcohol is sold.

Balancing Expansion with Social Responsibility

The approach of previous governments to preventing social harm too often resulted in hassle, inconvenience and limited choice for responsible adults. But this government believes that adults should be treated like adults, and that in 2019 it is possible to increase convenience while promoting a culture of responsible consumption and preventing underage drinking.

As part of my review, I have looked at how other jurisdictions balance social responsibility with increased convenience. Many jurisdictions provide citizens with guidelines for responsible consumption on the product package. Others are experimenting with digital tools and targeted social media to encourage responsible alcohol consumption in high-risk populations. I am heartened by Ontario's commitment to invest $3.8 billion over ten years to develop and implement a comprehensive mental health and addictions strategy. Based on my experience as Chair of the Alberta Health Services, I have experienced first-hand the toll that addictions can take on individuals and families. Alcohol and other addictions are complex challenges that should be addressed holistically, so Ontario's strategy is the right approach. As Ontario increases convenience, the government should work with retail, beverage alcohol and public health stakeholders to pursue strategies to continue Ontario's strong record around social responsibility.

Social Responsibility and Private Retail

Ontario already trusts private retailers to uphold social responsibility requirements for the sale of a range of age-restricted products, including alcohol. Compliance results show that private retailers take this responsibility seriously. Of the 1,541 inspections the AGCO has conducted of grocery stores authorized to sell beverage alcohol, it found only 159 minor infractions (e.g. failing to post an authorization), and only a single infraction related to selling/serving an individual that appeared to be intoxicated. Convenience stores were recently found to be 95.7% successful at denying the sale of tobacco products to those under 19. Provided training and guardrails are put in place, there is no credible evidence that allowing additional private retailers to sell alcohol will increase underage access to alcohol.

Section 8: Recommendations

Ontario has a complex regulatory and retail landscape for beverage alcohol. The controlling rules, institutions, loopholes, and vested interests have been knotted together over generations. It is time for Ontario to take bold action to cut through this knot and create a more convenient and fair system for Ontarians.

Recommendations:

- As an interim step, the government should do everything possible under the Master Framework Agreement to authorize additional alcohol retail outlets.

-

- It is time to bring Ontario in line with other jurisdictions in Canada and around the world and make purchasing alcohol more convenient for consumers.

- While the review has not set a target number of new outlets that should be authorized, the government should aim to bring Ontario closer in line with the national average for retail density.

-

- The government should consider other available options within its powers that would provide routes to expand retail sales should negotiations with TBS and its owners prove unsuccessful.

- The MFA as it stands is a bad deal for Ontario consumers and non-owner brewers.

- While a mutually agreeable solution would be the best outcome for Ontario, the government should consider other available options within its powers if a compromise cannot be reached that fulfills the government's commitment to increase choice and convenience for consumers.

- Increasing convenience and opportunity for business is part of the mandate the government was democratically elected on by the people of Ontario. The government should do its utmost to fulfill this promise.

- The government should take a phased approach toward authorizing new retailers and beverage alcohol products available for sale.

- The expansion of retail outlets should take a phased approach to allow industry and communities to adapt. Expansion should first prioritize communities that are underserviced for alcohol retail.

- The beverage alcohol products available for sale by new retailers could also be phased, with beer, wine, cider and coolers becoming available at different points in time.

- During the phase in period, the government should work with manufacturers, retailers and the public health community to consider options for the sale of spirits.

- The government should enable price competition between retailers.

- The government should end the anti-competitive practice of uniform pricing across Ontario alcohol retailers and enable price competition at the retail level.

- Guardrails, like minimum prices, should remain in place to ensure that beverage alcohol is sold in a socially responsible manner.

- The government should consider maintaining uniform pricing across the LCBO network to ensure fairness for rural and Northern customers.

- The government should continue to consult with Ontario winemakers and grape growers to determine how Ontario's wine industry will be best supported in an expanded retail environment in a manner that respects international trade obligations.

- Ontario's award-winning wine industry is both a source of pride and important agricultural jobs across the province. Ontario wine, including VQA, 100% Ontario and International Canadian Blends are an important market for Ontario agricultural products.

- The impacts of expanding wine sales into new retail outlets are generally much more complex than for other beverage alcohol products.

- As alcohol sales are being expanded, the government should consult wine makers and grape growers to find a way forward that increases convenience and supports Ontario's wine industry while respecting international trade obligations.

- The government should continue to engage Ontario's important spirits industry.

-

- The spirits industry, including the craft spirits sector, are an important and growing part of Ontario's beverage alcohol landscape.

- The government should continue engaging this sector to support its continued growth, while respecting international trade obligations.

-

- The Government should maintain the LCBO as a valuable government asset.

- Ontarians feel the LCBO delivers significant benefits to consumers and the provincial treasury. The LCBO should not be privatized.

- The government should work with the LCBO to help it deliver greater value in a more competitive marketplace, including expanding its role as a wholesaler.

- The government should work with retailers, beverage alcohol manufacturers and public health experts to ensure increasing convenience does not lead to increased social costs related to alcohol.

- Jurisdictions around the world have found ways to balance convenience for consumers with social responsibility and preventing underage drinking.

- Ontario should engage partners in other jurisdictions as well as experts at home to ensure Ontario maintains a culture of responsible alcohol consumption that also discourages underage drinking.

- As the government rolls out its $3.8 billion mental health and addictions strategy and new Ontario Health Agency, it should consider opportunities to remain a leader in social responsibility, discouraging underage drinking, and preventing impaired driving.

- The government should reduce unnecessary regulatory burden and address inefficiencies that increase costs for industry.

- There are several opportunities to streamline distribution and wholesale in the province to the benefit of alcohol producers, distributors, retailers, and consumers, and make it more business friendly.

- As part of changing the system, all efforts should be made to eliminate inefficiencies and unnecessary rules and regulations.

Footnotes

[1] Retail Council of Canada, Alcohol in Ontario: Choice and Convenience means Jobs and Growth, 2019.

[2] Abacus Data Poll for Convenience Industry Council of Canada, April 10, 2019.

[3] Retail Council of Canada, Alcohol in Ontario: Choice and Convenience means Jobs and Growth, 2019.

[4] Previous reviews or expert committees were launched in 1968, 1973, 1977, 1983, 1986, 2005, and 2015 (In 2015 three reports were issued – an initial report, and subsequent reports on modernizing beer retailing and distribution, and modernizing wine and spirits retailing).

[5] Abacus Data, Beyond the LCBO? Strong Support for Liberalizing Alcohol Sales in Ontario. February 2019. https://abacusdata.ca/beyond-the-lcbo-broad-support-for-liberalizing-alcohol-sales-in-ontario/

[6] Food and Drink Magazine Circulation Numbers at: http://www.doingbusinesswithlcbo.com/tro/Promotional-Programs/LCBO-Programs/Advertising/FOOD-DRINK-Magazine.shtml

[7] Premier's Advisory Council on Government Assets, Striking the Right Balance: Modernizing Beer Retailing and Distribution in Ontario. April 16, 2015.

[8]The Washington Post, Marijuana vs. beer: The new divide in Canadian politics. May 3, 2019 https://www.washingtonpost.com/world/the_americas/marijuana-vs-beer-the-new-divide-in-canadian-politics/2019/05/02/740e4360-6ac0-11e9-bbe7-1c798fb80536_story.html?utm_term=.719d022464e9

[9] Statistics from: Retail Council of Canada, Alcohol in Ontario: Choice and Convenience means Jobs and Growth, 2019.

[10] For examples see: The Fraser Institute, The Privatization of Liquor Retailing in Alberta, January 2003; and: Katja Siem and Joel Waldfogel, "Public Monopoly and Economic Efficiency: Evidence from the Pennsylvania liquor Control Board's Entry Decisions," American Economic Review, 103(2), 2013.

[11] Retail Council of Canada, Alcohol in Ontario: Choice and Convenience means Jobs and Growth, 2019.

[12] The Ministry of Finance estimates the value of time saved by being able to buy alcohol while shopping for other items could be up to $250 million per year.

[13] See: Canadian Substance Use Costs and Harms Project, Canadian Substance Use Cost and Harms in the Provinces and Territories (2007-2014). https://csuch.ca/resources/provincial-territorial/

Accessibility Descriptions

Chart 1: All Alcohol Sales by Product (2017-18)

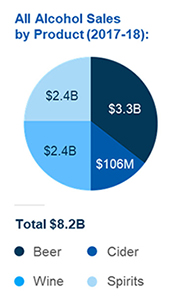

This pie chart shows all alcohol sales in Ontario in 2017-18. Beer sales were $3.3 billion, wine sales were $2.4 billion, spirits sales were $2.4 billion, and cider sales were $106 million.

Chart 2: Beer Sales by Channel

This pie chart shows the distribution of beer sales in Ontario among retail outlets. The Beer Store / On-Site Brewery Retail Stores account for 68% of beer sales. The LCBO accounts for 29% of beer sales, and grocery stores account for 3% of beer sales.

Chart 3: Wine Sales by Channel

This pie chart shows the distribution of wine sales in Ontario among retail outlets. The LCBO accounts for 83% of wine sales. Winery Retail Stores account for 13% of wine sales, direct delivery accounts for 3% of wine sales, and grocery stores account for 1% of wine sales.

Chart 4: The Beer Store Ownership

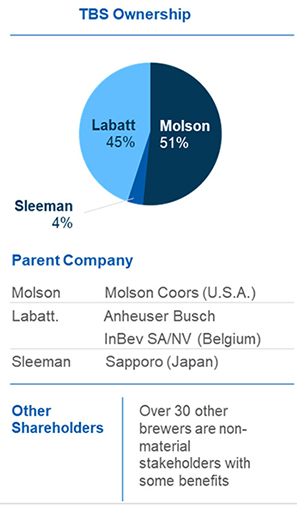

This pie chart shows the breakdown of Beer Store ownership by brewer. Molson, whose parent company is Molson Coors, owns 51% of the Beer Store. Labatt, whose parent company is Anheuser Busch InBev SA/NV, owns 45% of the Beer Store. Sleeman, whose parent company is Sapporo, owns 4% of the Beer Store. There are also other shareholders, as approximately 34 other brewers are non-material shareholders with some benefits.

Chart 5: Alcohol Retail Outlets per Capita in Canada (2016-17)

This bar graph shows the alcohol retail outlet density for all provinces in Canada in 2016–17, compared to the Canadian average. The chart shows the number of retail outlets per 10,000 people age 18+. The chart does not include the territories. The lowest alcohol retail outlet density is in Ontario with 2.4 retail outlets per 10,000 people. Full details of the retail outlet density for each province are provided in the table below.

| Jurisdiction | Number of Retail Outlets per 10,000 people age 18+ |

|---|---|

| Newfoundland and Labrador | 21.1 |

| Québec | 12.2 |

| Saskatchewan | 8.4 |

| Alberta | 6.4 |

| Manitoba | 4.8 |

| British Columbia | 4.2 |

| Prince Edward Island | 3.7 |

| Nova Scotia | 3.0 |

| New Brunswick | 2.8 |

| Ontario | 2.4 |

| Canada | 5.9 |