Eastern Ontario Development Fund: Business stream – applicant guide

Eligibility guidelines and how to apply for the Eastern Ontario Development Fund: Business stream.

As of 11:59 p.m. on May 31, 2019, the Eastern Ontario Development Fund is no longer accepting applications while we work to modernize the province’s business support programs to better support regional economic development.

Please check back here for updates.

Purpose of the EODF

The purpose of Eastern Ontario Development Fund is to provide financial assistance and incentives to promote regional economic development in Eastern Ontario and thereby enhance Ontario’s overall economic competitiveness and opportunities for the Ontario labour force. The promotion of regional economic development includes: (1) attracting and retaining investment, (2) creating and retaining jobs, and (3) promoting innovation, collaboration and cluster development. Specifically, the Fund will provide financial assistance to promote the expansion and attraction of investment/business in Eastern Ontario through support for capital spending, skills development, productivity enhancements, infrastructure needs and other similar economic development initiatives.

Through the Business Stream of the Eastern Ontario Development Fund, the Province of Ontario will provide up to 15% of eligible costs for projects that support business investment and economic development in the region. Eastern Ontario communities will benefit from innovative and collaborative initiatives to support key sectors.

We are committed to providing accessible customer service.

If you need accessible formats or communications supports, please contact us.

The Eastern Ontario Region

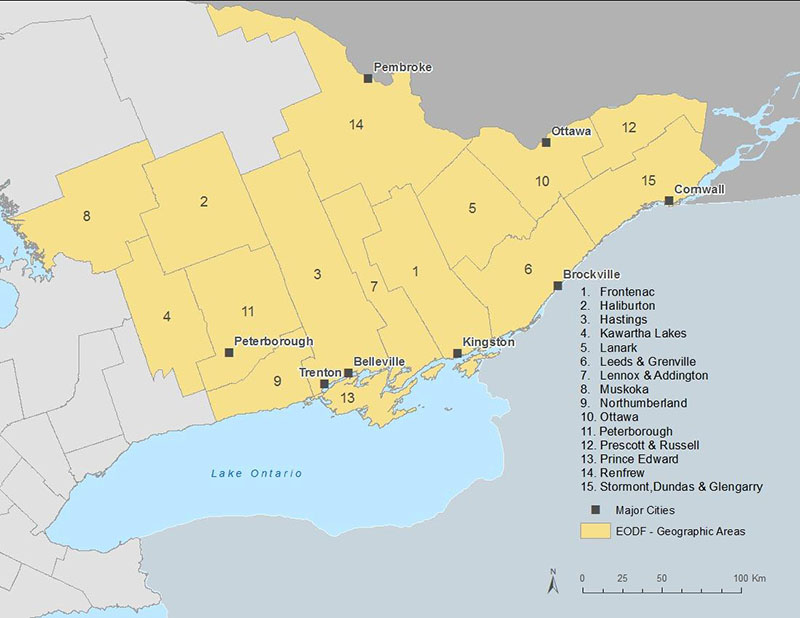

For the purposes of the EODF program, “Eastern Ontario” is defined as the area comprising the following 15 geographic areas under the Territorial Division Act, 2002: Frontenac; Haliburton; Hastings; Kawartha Lakes; Lanark; Leeds and Grenville; Lennox and Addington; Muskoka; Northumberland; Ottawa; Peterborough; Prescott and Russell; Prince Edward; Renfrew and Stormont, Dundas and Glengarry.

Figure 1 – Eastern Ontario – Geographic Areas

Objectives of the EODF – Business Stream

The objectives of the EODF – Business Stream funding are to:

- Create jobs in Eastern Ontario

- Stimulate private sector investment in business enterprises in Eastern Ontario

- Encourage the introduction of new, innovative approaches, including the use of new technologies, to private sector business

- Assist private sector firms in improving their competitive position, enhancing productivity, and pursuing growth

- Contribute to the diversification of the economy of Eastern Ontario

Assessment Criteria – Business Stream

All applications made to the EODF – Business Stream will be assessed on the following criteria:

- Prospects for the proposed project to help the business grow, move forward or transition to new markets/lines of business

- Quality of business plan – understanding/assessment of business environment and plan to address it, prospects for ongoing business success

- Feasibility/viability of project – technical, market-related, degree of innovation

- Indirect impacts on area/region/sector

- Project budget

- Costs reasonable, within accepted industry norms, within EODF limits

- Proportion of support consistent with EODF criteria – EODF support will not exceed 15% of eligible costs

- Financial feasibility/viability of project

- Prospects for the proposed project to meet performance measures related to

- New investment in the business/local economy

- Number of jobs created

- Risk Assessment

- Technical, managerial, financial expertise to carry out the project

- Solvency/stability of business

- Attestations from corporate officer of correctness and completeness of the application materials

- Disclosure of legal or other impediments to successful project implementation

EODF Application Process

The EODF provides project-based financial support to both the private sector and to public sector organisations undertaking economic development initiatives in the region, where those projects and the sponsoring organisations meet specific eligibility criteria.

The EODF program is a discretionary, non-entitlement program. Even if an application meets all of the EODF program objectives and eligibility criteria, the Government of Ontario is under no obligation to approve funding.

The steps in the application process are:

- Complete the eligibility checklist found on our website.

- Discuss your project with one of the program contacts found on our website.

- Complete the full application form found on our website.

Are You Eligible to Apply?

Check the following conditions to determine if your business may be eligible to apply to the EODF Business- Stream:

- Your firm must be a for profit business registered to carry out business in Ontario. (Note: Industry/sectoral associations, municipalities, non-governmental organisations, and other public organisations may be eligible for funding under the EODF Regional Stream; please see the Applicant Guide for that stream to determine eligibility).

- Your firm must be located in Eastern Ontario (see page 1 of the guidebook) or will be locating in Eastern Ontario by the time the project starts.

- Your firm must have a minimum of three years of operating experience in an eligible industry/sector supported by three years of financial statements (audited financial statements are preferred). Companies should have a track record of sales of a product or service and are at a stage where they are expanding their product/service offerings.

- Your firm must either

- employ at least 10 full-time equivalent (FTE) employees at the time of the application. All employees must be issued a T4. See section B.3 in this guide for further information about calculating FTEs, or

- Fit the requirements of the Small Community Pilot. Eligible businesses must have 5-10 FTEs and be located in a municipality with either a population of less than 20,000 (as defined by Statistics Canada 2011 Census data) or a population density of less than 100 persons per square kilometre (as defined by Statistics Canada 2011 Census data).

- Your firm must be in substantial compliance with all applicable laws. Furthermore, you must be free of any fees, levies or taxes owed to Her Majesty the Queen in right of Ontario or her agencies.

- If your business has previously been approved for a project under the EODF, it must have successfully completed this project before a subsequent project will be considered. In addition, you must not have more than two approved projects within a four-year period.

- Your organization is not an academic/research institution or a federal or provincial government agency.

Applicants are strongly advised to check with EODF staff to ensure potential eligibility before submitting an application to the Fund.

Note: Projects are funded under EODF to achieve job creation and investment objectives. As a result, you should assess the prospects for achieving these objectives through your project:

- If your firm has 20 or more FTEs at the time of application, your project must result in the creation of at least 10 net new FTEs by the end of the project.

- For firms with between 5 and 20 FTEs, your project must result in a 50% increase in the size of your workforce by the end of the project.

Which Sectors Are Eligible for Funding?

Priority sectors for EODF funds include:

- Advanced Manufacturing (automotive, aerospace, plastics, clean technologies, etc.)

- Life Sciences

- Processing (primary and secondary)

- Tourism

- Information and Communication Technology

- Cultural Industries

Are There Sectors That Are Ineligible for Funding?

Projects in the following sectors are not eligible for funding support from EODF:

- Primary Production (agriculture, forestry, and mining)

- Retail Services

- Construction

- Personal Services, e.g. personal grooming or care centres

- Professional Services, e.g. accounting, legal

- Free-standing Restaurants and Golf Courses

- Electricity Generation

- Recycling

- Residential Development, including condominiums and fractional ownership units

- Consulting

Key Funding Conditions

- Level of support. The Eastern Ontario Development Fund–Business Stream will fund up to 15 per cent of eligible project costs for approved projects. Successful applicants are expected to contribute at least 50 per cent of eligible project costs from their own business resources or through private financing. The balance can come from other funding sources; however combining EODF assistance with funding from other provincial programs/agencies will not be permitted.

- Minimum project investment.

- If your firm has 10 or more full-time equivalent (FTE) employees, only projects with total eligible project costs of $500,000 or more are eligible for funding consideration by EODF’s business stream.

- As part of the Small Community Pilot, eligible firms with between 5 and 10 FTEs must have projects with total eligible project costs of at least $200,000.

- All projects must be between two and four years in length. Investment and job creation targets must be met within the project time period.

- Funding Agreements

- Applicants will be required to enter funding agreements on terms and conditions satisfactory to the Ministry.

- The agreements will contain provisions that the funds must be repaid if performance measures, including job and investment commitments and other terms and conditions of the funding agreement, are not met.

- Approved projects may be eligible to receive up to 20 per cent of the total approved EODF funding at the start of the project following completion of the pre-disbursement requirements, with subsequent, negotiated fixed annual payments on the basis of the project schedule. At no point in time will the government contribution exceed 25% of total eligible project expenditures as of the payment date.

- Type of support.

- Conditional Grant

- For approved projects with total eligible investments of up to $10 million, EODF funding in the amount of up to 15% of eligible project expenditures will be offered as a conditional grant to a maximum $1.5 million if project milestones and deliverables are met. Applicants will be required to enter into a funding agreement satisfactory to the Ministry that will contain clawbacks in the event that performance targets are not met.

- Up to 20% of the contribution will be held back and advanced as a final performance payment based on project completion, achievement of jobs and final reconciliation of the total project costs.

- Loan

- For approved projects with total eligible investments greater than $10 million, funding in the amount of up to 15% of eligible project expenditures to a maximum principal amount of $5.0M will be offered as a loan.

- $1.5 million of the principal and interest of the loan may be forgiven based on the achievement of performance targets.

- The balance of the principal and interest on the loan is repayable as set out below.

- A loan will only be provided if the project creates 50 or more jobs.

- If applying for a loan, please list the assets available as security for the EODF Loan. See Section D.5 in the application form for further information.

- If selected for funding, loan terms will be subject to the following conditions:

- Interest rates will be set at the loan approval stage at the Province’s cost of borrowing for a comparable term plus 1%.

- The Province will take security on loans.

- Interest may be forgiven for up to 4 years based on the length of the project, if project milestones and deliverables are met. Any portion of the loan that has not been forgiven will be repayable in equal instalments with interest over the remainder of the loan term.

- Depending on the length of the project, loan terms will not exceed 9 years – the project completion period plus up to an additional five years.

- If selected for funding, loan terms will be subject to the following conditions:

- For approved projects with total eligible investments greater than $10 million, funding in the amount of up to 15% of eligible project expenditures to a maximum principal amount of $5.0M will be offered as a loan.

- Applicants will be required to enter into a loan agreement and provide security satisfactory to the Province.

- Conditional Grant

What Types of Projects are Eligible for Funding?

The following are examples of projects eligible for funding under the EODF Business Stream:

- New investment in new operations in Eastern Ontario

- Investment in existing operations to improve competitiveness, productivity and pursue new markets or business expansions involving the introduction of new products or services (examples: new/modified offerings to the market place to better meet customer/client needs, entirely new product lines/mandates from within corporate group)

- Priority will be given to projects that lead to high value-added, sustainable jobs; increased exports with a global focus; a highly skilled work force; and a culture of innovation

What Types of Projects are Ineligible for Funding?

The following types of projects are not eligible for EODF funding:

- Ongoing operations including maintenance and capital replacement

- Refinancing of existing business operations

- Acquisitions and buyouts

- Restructurings, or relocations to other jurisdictions within Ontario

What Project Costs Are Eligible for Funding?

Eligible costs relate to one-time expenditures (e.g. non-recurring, one-time project initiation costs) to implement a specific project that will expand your business, drive innovation, increase productivity and lead to job creation. Eligible costs are actual costs directly attributable to and necessary for the completion of the project. These costs are incurred for this project only, and are not associated – in whole or in part – with any other purpose.

The following costs are eligible for funding consideration:

- Project facility modifications/upgrades required for the project (e.g. construction costs/retrofits associated with an expansion to a facility on land already owned by the business, site servicing, power service upgrades, HVAC, new requirements for fire-detection and suppression, embedded energy generation systems, ICT used internally for business/operations integration or to meet specialized customer/client needs)

- Equipment and Machinery required for the project (e.g. new technology, new high performance equipment and machinery, maintenance equipment associated with new technologies or systems)

- One-time internal labour, including costs to set up/commission new equipment, technology or systems for the project

- One-time materials, including materials used for configuring and testing production processes for the project and systems, and materials used for training employees for the project

- Specialized Expertise required for the project (e.g. third-party engineering services, software development, project management, etc.)

- Skills training, including employer-provided training, related to the project

- Project-related permits, fees and other similar charges

What Project Costs Are Ineligible For Funding?

In general, project costs that are associated with regular operations of your business or those that cannot be directly linked to a project to advance your business are ineligible for EODF funding. Only costs incurred after a conditional grant agreement is fully executed (signed by authorized representatives of the business and Ministry) are considered eligible. Costs incurred before that date or after the project is complete (a maximum of four years) are ineligible for EODF funding.

Note that the following costs are ineligible for EODF support:

- Ongoing operational labour costs, e.g. salaries, wages, including those that are not directly related to the project or are incurred either before the project begins or after the project is complete (a maximum of four years after the project starts)

- Costs for in-kind contributions

- Overhead costs

- Lease costs

- Any marketing, sales or distribution/shipping costs (e.g. website development, creative development, etc.)

- Debt service costs, federal or provincial income taxes, surtaxes and special expenses (e.g. legal fees)

- Working capital costs for regular production or operations (e.g. inventory or materials)

- Costs associated with the preparation and submission of an application to EODF, such as success fees, third party government relations services, legal, accounting and consulting services

- Vehicles and off-site equipment, including costs associated with the purchase/lease or operation of vehicles or off-site equipment

- Costs not incurred in Ontario, except when the only supplier(s) of services or equipment are outside of Ontario

- Replacement capital equipment, including office technology used for regular administration

- Purchase of land or buildings, or construction costs of a building, except where the construction is an extension of or expansion to a facility on land already owned by the business

- Travel, conferences, meals, hospitality, memberships

Public Availability of the Agreements

Please note that each agreement under the EODF must be available for inspection by the public. However, commercially-sensitive information contained in the agreement will be redacted.

Completing the Application Form – Business Stream

Applications may be made to EODF at any time; the intake process is continuous. Ontario has committed to assessing and making a decision on any EODF application within 60 days of confirming receipt of a fully complete application package. To expedite the processing of your application, please make sure you have completed ALL sections of the application form and attached all requested materials.

Additional Guidance for Section A – Business Information

- Legal name of applicant/business

- Trade/operating name of applicant/business

- Business contact information

- Form of business entity

- Publicly traded corporation

- Privately held corporation

- Other (describe)

Registration business number. Please attach copy of the certificate to application.

- Place and date of business formation. Please attach copy of articles of incorporation/letters patent/partnership agreement to application.

- General description of your business – In 100 words or less, identify:

- the business you are in

- the types of services or products your business sells right now

- your key customers and their location

- your annual revenues and what share (if any) comes from international sales/exports

Example: ABC Incorporated is a plastics company specializing in injection-moulded products for the automotive and consumer goods marketplace. We make six moulded products for a Tier 2 company supplying General Motors and Honda. We also make casings for small electronic products such as cellular phones and memory sticks for computers. Although our orders come through the head offices of companies in the U.S., Japan and Europe, we ship to customers based in Ontario and U.S. states bordering the Great Lakes. As a result, 75 per cent of our $7.5 million in annual production is sold into the international marketplace.

- Website URL for your business.

- Head office business address.

- Application contact information. Provide the name and contact information for our primary contact regarding this application.

- Provincial government staff contact. If you are working with someone from the provincial government to develop this application, provide his/her name here.

- Number of people currently employed in Ontario. Provide the number of full-time and part-time/casual employees your business has at the time of application. For the purposes of this application, the definition of an “employee” is one for whom a T4 would be issued. If you have questions about whether persons working for you are employees or not, please review the information at: cra-arc.gc.ca/E/pub/tg/rc4110/rc4110-e.html.

Total number of existing business locations in Ontario. - Principals (Shareholders/Officers/Partners/Directors). Provide a list of those individuals with ownership or fiduciary responsibilities for your business. Sometimes a corporation, rather than an individual, owns shares or is partner in another business. In that case, your list must show the individual principals of the corporation that owns shares, or is a partner in your business. To clarify relationships between corporate or business entities, you will also be asked to provide a corporate structure or “family tree” that shows how various companies or businesses are related to the applicant.

- Additional contact information. Provide the name and contact information of your bank, accountant and solicitor for your business.

- Previous Ontario provincial funding to business for any purpose. Check “no” if the business has not received provincial funding for any purpose in the past. If the business has obtained funding from any provincial program in the last 5 years, please check “yes” and provide details of the year, the source, the amount, and the purpose.

- Tax credits. Provide details regarding any tax credits received in the last three years and tax credits anticipated as part of this proposal.

Additional Guidance for Section B - Project Description

- Project title

- Project location

- Current full-time equivalent employment at project location. Calculate the full-time equivalent employment (“Jobs”) at the project location at the time of application using the following criteria as a guide. This is the number that will be used as the basis for determining job creation/retention outcomes in section E.1. Note: An employee is defined as a person for whom a T4 would be issued.

Hourly employees. A “job” for an hourly paid employee means in respect of any calendar year, x,

where x = a / 2000

where a = the total number of hours worked during each calendar year by employees employed by the Applicant, including hours taken as a paid vacation, sick leave, and for other similar reasons, and hours for which pay is provided in lieu of notice at the Project Location.

Salaried employees. A “job” for a salaried employee means a full-time salaried job working for the Applicant during one entire calendar year. If a salaried employee is employed for fewer than 12 months over a calendar year, each full month that the employee is actually employed shall be considered 1/12th of a job.

Notwithstanding anything to the contrary, any jobs that may be outsourced from the Project Location shall not be included in the definition and calculation of jobs.

- Project purpose and outcomes. In 100 words or less, summarize the role the project will play in helping the business grow, and transition to new markets or lines of business. Examples are new products or services, penetration of new markets, increased efficiency, increased productivity etc. Describe how this project helps you implement a longer-term/ strategic plan for your business.

- Proposed project timelines. Note that project job creation and investment targets must be achieved by the project end date. EODF projects must be between 2-4 years in length. Failure to meet job and investment targets will result in a pro rata repayment of conditional grants and secured, repayable loans, including interest incentives.

- Project description. Describe, in 100 words or less, what the high level project activities will be. Explain what actions you must take to achieve the outcomes described in Section B.4. For example, explain how the project will increase production, bring new services or products to the market, and add new capabilities/enable the firm to undertake work that you cannot do now. Will your business use new/different technology or introduce other innovations that will enhance your competitive position in the marketplace? What, specifically, are you investing in to achieve the project outcomes?

- Project milestones. Fill in the Excel spreadsheet tab labelled B.7 Project Milestones which shows how, over time, you will implement your project, the key deliverables, the job creation totals, and eligible expenses associated with each milestone. For the purposes of EODF, the milestones are based on the fiscal year end for your company and on the anticipated project start and end dates. These milestones will be used as the basis for submitting annual claims for EODF reimbursement of expenses. The table that follows shows an example for a company with a fiscal year end of March, 76 full-time equivalent staff at the start of the project, 88 full-time equivalent staff at the end of the project (for a net gain of 12 new full-time positions), and total eligible expenses of $1,295,000. Note that the jobs reported for each period are cumulative, but that the costs reported are those incurred within the associated fiscal year.

Milestone Date Deliverables Total FTE Jobs at Project Facility Eligible Costs by Period Project Start 2012/11/01 76 Year 1

Company Fiscal Year End2013/03/31 Design complete, signed off

Permit applications in, permits secured RFP(s) for equipment/ materials/services issued

Vendors selected

2 new jobs created78 $50,000 Year 2

Company Fiscal Year End2014/03/31 Interior space retrofits complete

Additional water & sewer and electrical capacity installed

3 new jobs created81 $800,000 Year 3

Company Fiscal Year End2015/03/31 Equipment X,Y,Z procured and on-site

X,Y, and Z set-up/ installation complete

3 new jobs created84 $400,000 Year 4

Company Fiscal Year End2016/03/31 X existing staff trained

12 new staff recruited and trained

4 new jobs created88 $30,000 Project End 2016/06/01 All equipment fully commissioned

New operation in commercial mode

All documentation submitted to EODF88 $15,000 Net new jobs

88-76=12Net Investment

$1,295,000Note also that the expectations for job creation or retention are based on the size of your firm. If your firm has 20 or more FTEs at the time of application, your project must create at least 10 net new jobs (FTEs) by the end of a four-year period. For firms with between 10 and 20 FTEs, or for firms that qualify under the Small Community Pilot, your project must create net new jobs equal to 50% of your existing workforce by the end of the project.

Additional Guidance for Section C – Project Business Plan

This section of the application asks for the key elements of the business plan you would likely have developed for the proposed project:

- Brief history of the business. In 100 words or less, tell us when your business started, how it may have changed over the years, including any changes in ownership, strategic direction – what your business does and for whom, any expansion, relocations, consolidations of physical space/facilities, and any major changes in the products or services your business offers. For instance, a decision to sell and repair farm equipment rather than automobiles would constitute a change in strategic direction.

- Description of all existing facilities in Ontario. Provide the full street address, number of employees and the nature of business activity – for example: 123 Main Street, Harrowsmith – distribution facility employing 23 full-time equivalents.

- Products and/or services. In 150 words or less, tell us what kinds of products and services your business offers now and any changes to those offerings as a result of this project. For example, perhaps you are going to upgrade the quality of the accommodations you offer at your resort, add meeting/ conference space, or introduce on-site programming to capitalize on the surrounding natural environment. Perhaps you are going to add new production capacity for new products for an entirely new business sector, or add in-house capabilities to replace a service you must now procure in another jurisdiction.

- Role of innovation in current and proposed operations. In 100 words or less, please describe the role of innovation in the current and proposed operations of your business. For instance, are you using technology to serve clients in ways that your competitors do not? Are you bringing new products or services to market to meet unsatisfied customer needs? Are you changing the way your business operates to make it more efficient, or focusing on achieving higher quality standards (ex. ISO, grading programs for particular industries/sectors)? If you are doing – or proposing to do – something that is a “first” for your company, for Ontario, or for your industry, please tell us.

- Market segments. In 100 words or less, please describe the markets currently served by your business and any proposed/new markets your business would pursue through this project. Please provide share- of-market estimates, supported by third-party data (ex. analyst reports, industry publications) whenever possible. For example, do you serve particular industries, businesses with a need for particular specialized services, consumers in particular income ranges or with specific interests?

- Market drivers which led to this project. In 100 words or less, please describe the forces affecting particular markets or customers that you serve, and the impacts of those forces on your business. For example, is demographic change affecting your business? If so, how? Are customer expectations changing? If so, how? Are customers asking for different performance standards from your products? What will it take to meet those standards? What impact is the changing price of energy having? Do you see new opportunities or new costs? Please describe your overall strategy to respond to/capitalize on the drivers that will have the greatest impact on your future business success.

- Major competitors. In 150 words or less, please describe the major competitors for your business, indicating their location, whether within or outside Ontario. Identify your business’ competitive advantage in this marketplace or how this project will secure a competitive advantage. Differentiate your offerings relative to the competition.

- Major suppliers. In 100 words or less, identify any major suppliers within Ontario and within your local region that would be affected by this project, and describe the impact of the project on those organisations. For example: tying suppliers more tightly into a highly efficient supply chain, generating additional business for your suppliers, providing them with opportunities to upgrade their business operations to remain/enhance their own competitiveness.

- Marketing strategy. In 100 words or less, provide a general description of how you are going to market your business to make this investment pay off. For instance, will you market to your existing customer base, or pursue potential new business with those who are currently not your clients/customers but could be due to specific needs and interests? Will you market new capabilities directly to your new/potential customers or indirectly (by referral)? How will you “deliver” your product or service to your customers?

- Management team responsible for successful execution of proposed project and previous experience with similar projects. You will be asked to complete a chart similar to the one shown below.

Name and Title Project Role Experience and Education Bob Smith

VP OperationsOverall project management responsibilities, 2000- present

- VP Operations, Our Company1997-2000

- General Manager, Company X, Belleville

B.Eng.Jane Doe

VP FinanceFinancial oversight and procurement 2005 – present

-VP Finance, Our company1998-2005

-Controller, Company Y, Pembroke

B.Sc., MBA - Human resource strategy. In 100 words or less, explain how you will recruit new employees or retain existing staff. Comment on the ability of the local/regional labour force to supply required staff. Tell us how you will secure any required intellectual capital/specialized resources. Describe the nature and skill level of the jobs being created through the project and their associated salary levels.

- Risk management strategy. In 100 words or less, describe what you consider to be the two or three most significant challenges associated with your project and how you will address them (examples: project management/execution, market changes, challenges with suppliers/collaborators, changes in financing, cash flow pressures, and human resources).

- Plan for sustainability. In 100 words or less, describe the key aspects of your plan that will ensure ongoing business success as a result of this project. For instance, tell us why your project plan should lead to increased competitiveness, productivity, and growth or long-term sustainability for your business.

Additional Guidance for Section D – Project Budget and Funding Request

Please use the blank Excel spreadsheets provided to work up the details of your project budget and the resulting funding request. Spreadsheets can be downloaded from our website.

- Eligible project costs, by type and year. Begin with the spreadsheet tab labelled D.1 Monthly Expenses. For each cost category, break out the anticipated costs by type and the month in which the expense is expected to be incurred. Depending on the nature of the project, you may not use all available line items shown. Before you develop your project budget, please take note of the EODF eligible costs highlighted on page 6 of this guide.

Use the downloadable Excel spreadsheets to work up the project financials. Note that the spreadsheets are organized in calendar years (January 1 - December 31). Depending on the project start date and project end date, the first year and last year may not require entries for the full 12-month period.

SAMPLE CHART

Eligible Cost Year 1 Year 2 Year 3 Year 4 Year 5 Multi-Year Total Project facility modifications/upgrades $150,000 $500,000 $650,000 Equipment and Machinery $825,275 $825,275 One-time labour (internal) $87,375 $87,375 One-time materials $67,500 $33,000 $100,500 Specialized Expertise $29,750 $29,750 Skills Training $27,500 $27,500 Project-related permits, fees and other charges $31,000 $18,250 $49,250 Total EODF-Eligible Costs (A) $150,000 $1,356,275 $200,625 $62,750 $1,769,650 Other Costs (not eligible for EODF funding) (B) $27,500 $36,000 $58,375 $8,250 $130,125 Total Project Costs (A) + (B) =(C) $177,500 $1,392,275 $259,000 $71,000 $1,899,775 - Budget justification. In 100 words or less, justify your confidence in the accuracy of the budget you have submitted. For instance, you may have used outside services to prepare/validate cost estimates, or the costs may be based on firm quotes.

- Project financing/funding. Compete the Excel spreadsheet tab labelled D.3 Project Financing-Funding.

Please list all sources of financing/funding – whether they are expected to come from private or public sources. See the sample chart below for descriptions and level of detail required.

Keep in mind that your project financing/funding plan must demonstrate your business’s ability to provide at least 50 per cent of the total eligible project costs, either from your own business resources (such as equity or cash flow) or outside financing. The remaining share of financing required (as much as 50 per cent) can come from any combination of public funding programs. Note that combining EODF with other provincial funding sources is not permitted.

Please indicate the status of all project financing/funding at the time of application. You do not have to have all project financing/funding confirmed to be considered for EODF funding; however, all sources of project financing (and proof of insurance – minimum of $2 million) must be in place before any disbursements can be made.

At the end of the project, the applicant will be required to provide an auditor’s certificate, certifying that eligible costs have been incurred and paid by the applicant.

SAMPLE CHART

Financing/Funding Source Amount Status Internal business financing (equity) $375,000 Committed Internal business financing (cash flow) $80,000 Committed, subject to meeting revenue/profit forecasts Private financing (bank) $150,000 Approved in-principle, subject to EODF approval Federal funding (name program) $75,000 Application made/no decision at time of application EODF $120,000 Subject of this application Total Financing/Funding: $800,000 - Cash flow forecast. Applicants are required to submit a high level cash flow forecast extending over the duration of the project. Complete the Excel Spreadsheet tab labelled D.4 Cash Flow Forecast. Depending on the nature of the project, applicants may be asked to provide a more detailed cash flow forecast as part of the application process.

- Security. If applying for a secured repayable loan, please set out the assets available to support the loan, together with the amount of prior encumbrances.

Additional Guidance for Section E – Regional Outcomes

- Other impacts on area/region/sector beyond the applicant organisation. In 200 words or less, describe the impacts of this project on the area/region/sector. (Where possible, include a statement/endorsement from a local/regional economic development organisation.) Possible impacts might include:

- Contributing to building an industry/sectoral strength in a particular geographic area

- Generating additional economic activity through supplier relationships

- Filling a gap in the regional supply chain

- Serving as an anchor/keystone organisation around which other businesses can develop

Additional Guidance for Section F – Checklist of attachments

Additional Guidance for Section G – Authorization and Certification

An officer of the company to review and sign.

For More Information

Visit our website.

Call the EODF office at: 1 866 909-9951 or 613-542-7266

Contact OPS regional economic development staff. The contact list can be found on our website.

Submitting Your Application

Submit your application form, attachments and spreadsheets

Electronically via email at: eodf@ontario.ca

OR mail hard copy to:

Eastern Ontario Development Fund

Ministry of Economic Development, Trade and Employment

366 King Street East, Suite 340

Kingston ON K7K 6Y3