Ontario energy snapshot

Learn about Ontario’s energy sector and the data that the Ministry of Energy and Electrification and our agencies publish, including data on electricity generation, emissions and prices. Visit the Ontario Data Catalogue for more information.

Overview

Energy plays a critical role in supporting Ontario’s economy and modern society. The three main energy types in Ontario are:

- electricity

- natural gas

- petroleum products

These forms of energy heat and power our:

- homes

- schools

- offices

- hospitals

- other critical systems such as water and wastewater

They also power our transportation systems and provide critical supports to our province’s industry.

| Fuel type | % |

|---|---|

| Electricity | 21.9 |

| Natural Gas | 38.75 |

| Petroleum products and coal | 39.33 |

Source: CANSIM Table 25-10-0029-01 (formerly 128-0016)

Note: In industrial processes, coal is used to heat furnaces and boilers, primarily in the steel and cement sectors. Natural gas includes natural gas liquids.

Electricity

Ontario’s electricity system is designed to support the needs of approximately:

- 5.25 million residential and small business customers

- 53,000 commercial consumers

- 1,400 industrial consumers

To meet the province’s needs, Ontario has over 30,000 km of transmission lines and over 260,000 km of distribution lines.

Generation

Ontario’s nuclear and hydroelectric fleet provide ‘baseload’ power that runs 24/7, year-round. This is often enough electricity to meet low-demand periods such as overnight, weekends and during mild spring and fall weather.

When demand rises, other types of generation are activated, including:

- natural gas

- wind

- solar

- biomass

The below chart shows more detail on the supply types that make up Ontario’s annual grid output.

| Generation (2023) | TWh | % |

|---|---|---|

| Natural gas | 19.09 | 12.65 |

| Coal | 0 | 0 |

| Nuclear | 79.31 | 53.27 |

| Hydroelectric | 37.37 | 25.13 |

| Wind | 12.18 | 8.21 |

| Solar | 0.74 | 0.49 |

| Bioenergy | 0.36 | 0.23 |

Source: Independent Electricity System Operator

Notes: Reflects transmission and distribution-connection generation and figures may not add to 100% due to rounding.

Importing and exporting electricity

When necessary, Ontario imports electricity to provide energy at the best possible price to support the province’s needs during periods of high demand.

Ontario also exports energy to neighbouring jurisdictions when it makes sense economically. This helps bring in revenue and maintain system reliability.

Find out more by visiting:

Transmission

Transmission lines provide the backbone of Ontario’s electricity system. Ontario is connected to a large, stable network of transmission systems across North America, which supports system reliability and economic efficiency.

Current transmission system and planned future transmission lines

Learn more about the components that make up Ontario’s electricity system and where they are located by visiting the IESOs interactive map.

Distribution

Ontario electricity consumers are served by local distribution companies that deliver electricity from the high-voltage transmission system to homes and businesses. They are often the first place of contact for Ontario’s electricity customers.

Local distribution companies are regulated by the Ontario Energy Board (OEB). One of the OEBs objectives is to protect consumer interests, including pricing, reliability and quality of electricity service. The OEB must also approve any distribution rate increases through a transparent hearing process.

Demand

Ontario must have a reliable, affordable and clean supply of electricity to meet its diverse and growing demand.

Across the province, electricity demand is always changing over the course of a day. While most of Ontario’s electricity is consumed the moment it is generated, a small amount exists in storage to help respond instantly to changes in demand.

The table below displays the monthly highs and lows of electricity demand in Ontario by season, highlighting higher demand in the summer compared to the winter months.

| Year | Quantity | MW | EST | Date |

|---|---|---|---|---|

| 2022 | Ontario Peak Demand | 22,607 | 6:00 p.m. | 2022-07-19 |

| 2022 | Ontario Minimum Demand | 10,485 | 5:00 a.m. | 2022-05-22 |

| 2022 | Q1 Ontario Peak Demand | 21,349 | 6:00 p.m. | 2022-01-20 |

| 2022 | Q2 Ontario Peak Demand | 21,954 | 5:00 p.m. | 2022-06-22 |

| 2022 | Q3 Ontario Peak Demand | 22,607 | 6:00 p.m. | 2022-07-19 |

| 2022 | Q4 Ontario Peak Demand | 20,326 | 6:00 p.m. | 2022-12-19 |

| 2022 | Q1 Ontario Minimum Demand | 12,285 | 3:00 a.m. | 2022-03-19 |

| 2022 | Q2 Ontario Minimum Demand | 10,485 | 5:00 a.m. | 2022-05-22 |

| 2022 | Q3 Ontario Minimum Demand | 11,082 | 4:00 a.m. | 2022-09-25 |

| 2022 | Q4 Ontario Minimum Demand | 10,820 | 3:00 a.m. | 2022-10-23 |

Ontario’s electricity system also uses tools to reduce electricity demand and the need for more generation. Options include:

- conservation

- demand management

- load shifting — delaying consumption until lower-demand periods

You can find more information on the current Conservation and Demand Management (CDM) Framework, including budget and savings targets, on IESOs website.

Find more details on currently available CDM programs in Ontario by visiting:

We also encourage large industrial and commercial customers to shift their energy use away from system-wide peaks by participating in the Industrial Conservation Initiative (ICI). Eligible customers who choose to participate in the ICI program can cut some of their costs by reducing their consumption during the top 5 peak hours.

Electricity sector emissions

Ontario has one of the cleanest electricity systems in the world.

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|

| Electricity Sector Emissions (Mt CO2e) | 2.6 | 4.2 | 4 | 3.7 | 3.9 | 6.1 | 7.5 |

Source: ECCC NIR 2022, *IESO

When compared to neighbouring Great Lakes states, Ontario has the lowest amount of CO2 emitted for every unit of electricity generated.

| CO2e (g/kWh) | 2021 |

|---|---|

| Ontario | 28 |

| New York | 210 |

| Pennsylvania | 290 |

| Illinois | 324 |

| Michigan | 475 |

| Ohio | 559 |

| Wisconsin | 563 |

| Indiana | 730 |

Source: U.S. EPA, U.S. EIA, ECCC, IESO

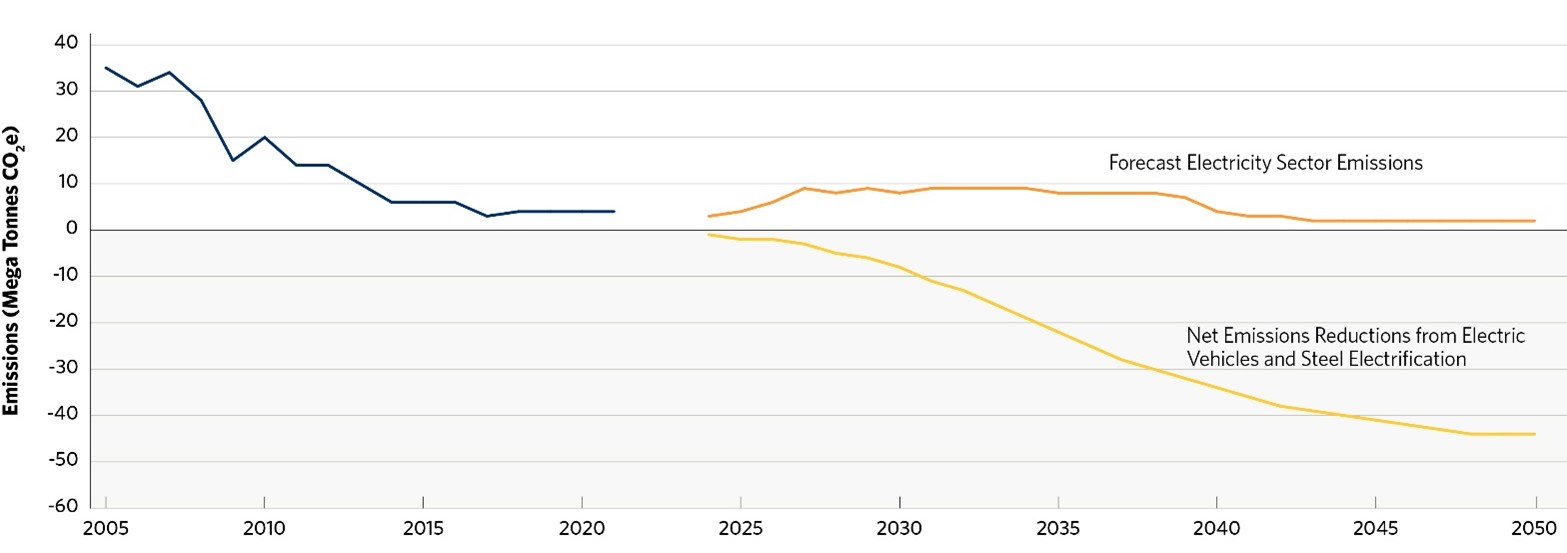

Ontario electricity sector emissions - historical and forecast

Natural gas-fired electricity generation will be needed over the next decade while nuclear generating stations are being refurbished.

By 2030, emissions from Ontario’s electricity system are forecast to level out. Ontario will continue using natural gas to:

- generate electricity for reliability

- support the decarbonization of other sectors

Reductions to province-wide emissions through the electrification of the transportation and steel manufacturing industries will offset emissions produced by using natural gas for electricity.

By 2035, Ontario’s electricity sector will reduce emissions by at least 3 times the amount it produces.

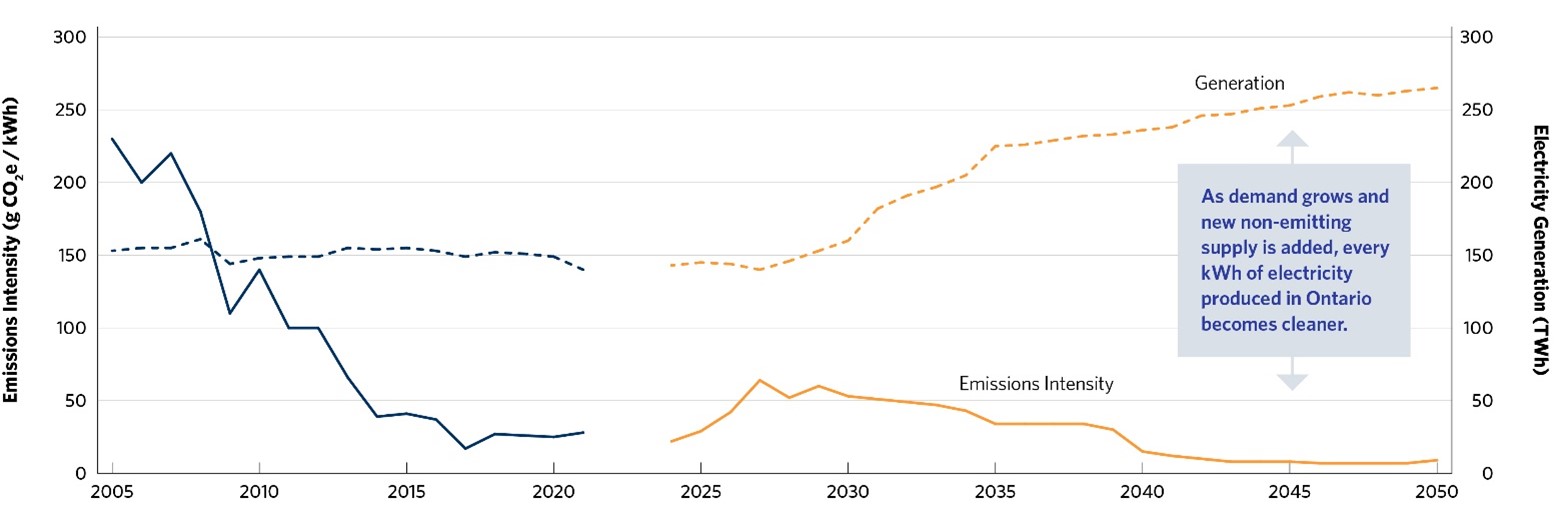

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Generation (TWh) | 153 | 155 | 155 | 161 | 144 | 148 | 149 | 149 | 155 | 154 | 155 | 153 | 149 | 152 | 151 | 149 | 140 |

| Emissions intensity (g CO2e/kWh) | 230 | 200 | 220 | 180 | 110 | 140 | 100 | 100 | 66 | 39 | 41 | 37 | 17 | 27 | 26 | 25 | 28 |

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Generation (TWh) | 143 | 145 | 144 | 140 | 146 | 153 | 160 | 182 | 191 | 197 | 205 | 225 | 226 | 229 | 232 | 233 | 236 | 238 | 246 |

| Emissions intensity (g CO2e/kWh) | 22 | 29 | 42 | 64 | 52 | 60 | 53 | 51 | 49 | 47 | 43 | 34 | 34 | 34 | 34 | 30 | 15 | 12 | 10 |

Carbon emissions intensity - historical and forecast

As demand increases and more non-emitting supply comes online, every kilowatt-hour used to power a vehicle, home, or factory will be less emissions-intensive.

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Emissions (mega tonnes CO2e) | 35 | 31 | 34 | 28 | 15 | 20 | 14 | 14 | 10 | 6 | 6 | 6 | 3 | 4 | 4 | 4 | 4 |

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | 2043 | 2044 | 2045 | 2046 | 2047 | 2048 | 2049 | 2050 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Emissions (mega tonnes CO2e) | 3 | 4 | 6 | 9 | 8 | 9 | 8 | 9 | 9 | 9 | 9 | 8 | 8 | 8 | 8 | 7 | 4 | 3 | 3 | 2 | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | 2037 | 2038 | 2039 | 2040 | 2041 | 2042 | 2043 | 2044 | 2045 | 2046 | 2047 | 2048 | 2049 | 2050 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Emissions (mega tonnes CO2e) | 1 | 1 | 0 | 2 | -1 | -2 | -5 | -6 | -9 | -12 | -15 | -19 | -22 | -25 | -27 | -30 | -36 | -38 | -40 | -42 | -43 | -44 | -45 | -46 | -47 | -47 | -47 |

Electricity prices

Residential and small business consumers

The province’s Regulated Price Plan (RPP) provides residential and small business consumers with stable and predictable electricity pricing while encouraging conservation.

Learn about the types of electricity price plans you can choose from in Ontario, including:

- time-of-use (TOU) rates

- tiered rates

- ultra-low overnight rates

Large and mid-sized industrial and commercial businesses

Electricity rates for large and mid-sized industrial and commercial businesses in Ontario are supported through the Comprehensive Electricity Plan. Rates for the largest industrial consumers further vary by customer, as they are determined by individual consumption patterns.

Generally, the less energy a large industrial customer uses during peak hours, the more these customers reduce their impact on the provincial power system as well as their electricity costs.

As a result, Ontario has very competitive electricity rates for larger industrial consumers — at or below the equivalent rates in neighbouring Great Lakes states. Visit the Ontario Data Catalogue to learn more.

| All-in rates (C$/MWh) | 2023 |

|---|---|

| Ontario — North | 6.4 |

| Ontario — South | 8.4 |

| New York | 9.5 |

| Ohio | 9.9 |

| Pennsylvania | 10.6 |

| Michigan | 11.2 |

| Indiana | 11.4 |

| Illinois | 11.6 |

| Wisconsin | 11.9 |

Source: U.S. Energy Information Administration (EIA), IESO, Bank of Canada.

Notes: Ontario illustrative prices reflect average year-to-date September 2022. U.S. illustrative prices reflect average year-to-date August 2022. Ontario North includes Northern Energy Advantage Program (NEAP) rebate.

Natural gas

About 3.8 million residential customers in Ontario use natural gas for home heating, water heating and cooking. Their needs are met with 114,000 km of transmission and distribution pipelines across the province.

In Ontario, most consumers’ natural gas rates are set on a quarterly basis by the Ontario Energy Board (OEB), the independent regulator of the province’s natural gas and electricity distributors.

Enbridge Gas Inc. is the main natural gas service provider in Ontario, covering more than 99% of all natural gas customers. It is rate-regulated by the OEB. The only other OEB rate-regulated natural gas service provider in Ontario is EPCOR.

The OEB has a mandate to protect the interests of consumers. It does not allow natural gas utilities to earn a profit from the sale of the natural gas commodity to their customers. Utilities are only permitted to pass through the cost of obtaining natural gas on the open market to the customer with no markup. The price that utilities pay for natural gas is determined in a competitive North American wholesale market, which is in turn influenced by global factors.

The OEBs process for setting natural gas rates also includes measures to mitigate the impact of short-term price fluctuations. You can view the most recent rates on OEBs website.

A natural gas bill is made up of many components, including:

- the market price of the commodity

- costs of transportation to the customer

- distribution charges

- Federal Carbon Charge

- Harmonized Sales Tax (HST)

Enbridge Gas offers Demand Side Management (DSM) programs to help customers reduce natural gas consumption and their energy bills.

Learn more about the DSM program budgets and savings targets on OEBs website, Find details on the available DSM programs on Enbridge Gas’ website.

Visit the Ontario Data Catalogue for:

- average monthly gas data by rate zone

- average bill information

Other fuels

Ontarians use a wide range of other fuel types, mainly to run their cars and heat their homes.

Total petroleum product demand (for gasoline, diesel, heating oil, jet fuel and other products) is about 560,000 barrels per day. Gasoline is widely available, with over 3,265 gasoline retail sites across Ontario.

The province’s gasoline and diesel prices are impacted by world crude oil prices, local retail competition, and North American wholesale benchmarks — such as the:

- New York Harbor market price for Toronto

- Edmonton market price for Thunder Bay

The Ministry of Energy and Electrification monitors gasoline and diesel supply and pricing on an ongoing basis.

Propane distributors compete for customers and retail prices are based on a number of factors including local supply and demand, time of year and transportation costs.

Ontario’s gasoline, diesel and propane markets are not subject to economic regulation or oversight by the Ontario Energy Board.

Energy reporting and benchmarking

A key step toward continuously improving the energy efficiency of buildings is to measure and track their energy performance.

Energy reporting and benchmarking initiatives give building owners the tools and data needed to understand the energy usage patterns of their buildings.

Building owners can use this information to manage their usage and costs, compare themselves with similar buildings and identify opportunities to improve their building performance. Greater access to data enables market actors to make smarter investments.

Ontario has reporting initiatives in place for:

- Broader public sector organizations (municipalities, municipal service boards, universities, colleges, school boards, and hospitals) to report annually to the ministry by July 1 on their energy use and greenhouse gas emissions

- Private sector owners of large buildings (such as commercial, industrial and multi-unit residential) that are 50,000 sq. ft. or larger to report energy and water consumption and greenhouse gas emissions data annually by July 1 to the ministry

Each year, we post the annual submitted reports on the Ontario Data Catalogue.

Footnotes

- footnote[1] Back to paragraph Historical data sourced from Environment and Climate Change Canada's Greenhouse Gas Inventory Report. 2022 and 2023 historical data was not available at time of IESOanalysis.

- footnote[2] Back to paragraph This represents a future provincial electricity system forecast based in part on the development of the new non-emitting resources outlined in the province’s Powering Ontario Growth plan, and other new resources needed to meet system demand. It reflects the federal draft Clean Energy Regulation (CER), Canadian Gazette 1, assuming existing natural gas generators operate with a 30-year end of prescribed life. There is high uncertainty beyond 2035 as it is highly dependent on the CER and the pace at which non-emitting resources can be built to replace retiring gas plants. This emissions scenario was not included in the 2024 Annual Planning Outlook as it was conducted for assessing potential impacts of the proposed CER on Ontario’s electricity system and is not a scenario to plan to. In this scenario, IESO excluded gas as a potential new resource for meeting future