Ontario Together Trade Fund Program Guidelines

Read the full program guidelines before submitting your application to the Ontario Together Trade Fund.

Program overview

The Ontario Together Trade Fund (OTTF) provides financial support to businesses looking to make near-term investments so they can serve more interprovincial customers, develop new markets and re-shore critical supply chains in the face of U.S. tariffs. With a focus on small and medium enterprises (SMEs), the program will help businesses, build local capacity, enhance trade resiliency, and make the necessary investments to successfully expand into new markets.

Projects must address the impacts of U.S. trade disruptions and align with Ontario’s key economic priorities, including:

Trade diversity:

- diversifying sales portfolios: Expanding market reach to new markets, with a focus on interprovincial trade

Trade security:

- enhancing competitiveness: Increasing manufacturing capacity and capabilities and increasing profitability through investments in advanced technology and innovative processes

- creating and retaining jobs

- contributing to regional and sectoral clusters: Strengthening Ontario’s supply chains through reshoring and efforts to procure more equipment and supplies from Ontario and Canada

For the purposes of this program, reshoring is defined as:

- a company bringing manufacturing (for example, a full line or component) in house that is currently manufactured/outsourced/subcontracted outside of Canada

- manufacturing a product/component in Ontario to supply a Canadian manufacturer that currently sources the component from outside of Canada

Examples of eligible projects

- XYZ manufactures automotive fasteners for the US market. This project will invest in pivoting production, capacity and sales towards construction fasteners. XYZ will focus on developing new sales channels in Ontario’s construction industry and create two new jobs to support these efforts.

- ABC produces vitamins and health supplements for the US market. This project will invest in reformulating the products and reshoring the manufacturing processes for filling and sealing vitamin capsules from a U.S. contractor to its Ontario facility. ABC will also shift to use local Ontario suppliers of capsule containers for the supplement filling line. These efforts will help to increase sales in the Canadian market and create new jobs at the Ontario facility.

- 123 Inc. exports baked goods to major US retailers. This project will invest in reconfiguring the production line and invest in hiring a sales manager with experience and connections to buyers in other Canadian provinces; and reconfiguring the production line to accommodate new customers.

Eligible applicants and criteria

Funding is available to for-profit businesses operating within Ontario, that:

- have at least three years of operations/financial statements (refer to Operating Experience to determine financial statement requirements )

- employ at least 5 people

- demonstrate any of the following impacts due to the imposition of U.S. tariffs:

- operates in a sector extensively targeted by U.S. tariffs (for example, steel sector, auto sector, aluminum)

- significant exposure to trade risk (for example, revenue loss of 30% or higher), or pivoting operations to supply a customer that is looking to replace a current supplier due to tariffs

In exceptional circumstances and on a case-by-case basis, applicants that do not meet the eligibility parameters may be considered if they have supporting evidence of a project demonstrating exceptional benefit to Ontario and aligned with Ontario government priorities.

Type of business

Applicants must be for-profit businesses (legal entity or limited partnership) registered to carry out business in Ontario.

Eligible projects

To qualify for funding, a project must fulfill the following requirements:

- make an investment to:

- enhance domestic competitiveness, and/or

- build capacity and local supply chain in Ontario or reshoring, and/or

- pivot operations to manufacture less trade exposed goods, and/or

- creating and securing jobs in Ontario, and/or

- other activities required to diversify revenue streams

- invest at least $200,000 in eligible project costs

- locate in a community in Ontario during the project period

- complete project within two years

- demonstrate all financing will be in place by the project start date

A project is a distinct undertaking, separate from ongoing operations and that will result in benefits to the organization such as access to new markets.

Priority will be given to projects that aim to capitalize on domestic market opportunities and address gaps in Ontario’s supply chain caused by potential trade barriers and supply disruptions.

Ineligible projects

Ineligible projects include:

- ongoing operations including maintenance and capital replacement (exact replacements are not eligible, upgraded technology/equipment would be considered eligible)

- refinancing of existing business operations

- acquisitions and buyouts

- restructuring, or relocating to other jurisdictions within Ontario

- electricity projects

- waste management/primary recycling

- hospitality projects (hotels and restaurants)

Ineligible applicants include:

- not-for-profit organizations/associations/charities

- sole proprietors

- retail

- construction companies providing primary construction services (production of construction products is eligible)

- providers of personal services

- consulting firms

Types of support

Funding

The Province of Ontario may provide a grant or loan up to 75% of eligible project costs (to a maximum of $5 million).

At Ontario’s discretion, loans may be considered in place of any grant funding.

Funding levels will be based on an assessment of the project impact.

Note that projects will only be considered for the maximum funding of 75% of eligible costs (to a maximum of $5 million), if the project can demonstrate exceptional benefits to Ontario and is aligned with government priorities.

Loans will be interest free during the project period (up to two years) typically with a 4 year pay-back period. If you achieve your investment and job targets, up to 30% of the loan (to a maximum of $1.5 million) may be forgiven. Applicants will be required to enter into a loan agreement and provide security satisfactory to Ontario.

OTTF offers conditional funding to support eligible project activities, including:

- business development, such as market diversification and sales expansion

- increasing capacity and creating and securing jobs in Ontario

- procurement of advanced equipment and facility modifications to enhance domestic manufacturing and support Ontario’s supply chain and/or reshoring production to Ontario

- development of innovative technologies to boost the competitiveness of Ontario’s production and manufacturing capacity

- localization for new markets (for example, certification, legal, labeling, testing costs)

- modification of existing products to enter new sectors (for example, pivoting production from automotive fasteners to construction fasteners)

- increasing the resiliency of Ontario’s economy in response to trade-related challenges, such as purchasing equipment and materials from local suppliers or shifting sales to non-U.S. markets

Complementary supports and services

In addition to financial support, projects may also qualify for non-financial supports, which include:

- Advisory services: Access to expert guidance and support to navigate government programs and services.

- Assistance with compliance approvals: Support for processes such as obtaining necessary Ontario approvals and Ontario compliance certifications.

- Accessing skills and talent: Access to programs, services and information that facilitate the acquisition of skilled personnel and talent that are crucial for the project's success.

For instance, if a project involves a facility expansion, applicants may be eligible for expedited environmental compliance approvals, significantly reducing the time and effort required to secure necessary permits and approvals. This non-financial support is designed to enhance the project's feasibility and efficiency, ensuring that projects can move forward with minimal delays and obstacles.

Assessment criteria

Jobs

Companies must commit to the jobs outlined in the application submitted.

See Appendix B for details on key definitions of jobs.

Operating experience

Applicants must have a minimum of three years of substantive operating experience supported by three years of financial statements. Applicants should also have a track record of sales of a product or service and be at a stage where they are expanding their product or service offerings.

Financial statements must:

- meet GAAP standards and must comprise of a balance sheet, income statement, and cashflow statement, and,

- be Audited in accordance with International and Canadian Audit Standards (IAS/CAS) (preferred), or,

- be Review Engagement financial statements prepared in accordance with the Canadian Standard on Review Engagements (CSRE) 2400

- internal financial statements will only be accepted at application stage, if accompanied by Audited or Review Engagement financial statements of a parent company. In such instances, a project guarantee will also be required from the parent company

- applicants with revenues under $5 million and seeking a grant may submit compilation engagements financial statements prepared in accordance with the Canadian Standard on Related Services CSRS 4200 (formerly known as notice to reader) at the application stage, but should the project be approved for funding, the applicant would be required to provide a minimum of Review Engagement financial statements for the duration of the project.

Project start date

The project start date cannot be earlier than the date the application is submitted.

Length of project

Projects must be completed within two years.

Compliance

Applicants must be compliant with all applicable laws and not owing any fees, levies or taxes to His Majesty the King in right of Ontario or his agencies.

Stacking/Previous funding

Applicants cannot stack funding with other provincial programs for the same project, except for support from Company-wide Programs. “Company-wide Programs” (for example electricity support programs) means provincial programs where the decision to provide funding support is not discretionary and a Recipient is entitled to funding support based solely upon meeting eligibility criteria.

Additionally, the total amount of government support: provincial, federal and municipal assistance (collectively, “Government Assistance”) cannot exceed 75% of the Eligible Project Costs. For the purposes of the Agreement, Tax credits from any level of government do not count as Government Assistance and are not counted towards the stacking limit.

Prior to project start, Applicants need to demonstrate that all financing for the project is secured, to the satisfaction of Ontario.

Application process

Overview

Applicants are required to speak with an Ontario Advisor prior to applying to the Ontario Together Trade Fund (OTTF). The Ontario Advisor will help determine program eligibility and strength of the application. Refer to self-screener form to connect with an Ontario Advisor.

The application form can only be accessed through the Transfer Payment Ontario (TPON) website.

Application form

The application form and required supplementary documents must be submitted during the application intake period, which is outlined on the program webpage. Applications will be accepted continuously during this period.

Only applications that are deemed eligible and complete will be evaluated.

How to submit

- Determine if you are eligible by completing the mandatory online self-assessment tool. If your self-assessment suggests you might qualify for funding, reach out to an Ontario Advisor to review your project as instructed in the self-assessment tool. This is a required step.

- Register for TPON and follow the prompts to find the program under the “Submit for Funding” section. Learn more about detailed instructions for accessing TPON and steps to submitting an application.

- Download the application form and complete each section, as required. The application form includes Part 1: Eligibility Checklist and Part 2: Application Form. Part 1 assesses an applicant’s eligibility for the program and an applicant should not complete Part 2 unless they are eligible. If an application that is not eligible is submitted, it will not be considered for assessment.

- If you are eligible according to Part 1, complete the application and upload the completed form and all your supporting documents on TPON. This includes:

- a projected cash flow that provides sufficient detail on projected receipts and payments during the project period

- copy of articles of incorporation or limited partnership agreement and declaration

- corporate family tree that sets out the corporate structure showing the parent, affiliates and related entities of the applicant and their relationships with one another

- financial statements from the last three fiscal years—Audited or Review Engagement

The application form must be authorized by an individual with authority to bind the business.

The Ministry will notify applicants of a funding decision upon completion of the assessment process.

Note that a recommendation to apply or applying to the program does not guarantee funding. OTTF is a discretionary, non-entitlement program. Even if an application meets all program objectives and eligibility criteria, the Government of Ontario is under no obligation to approve funding or services.

Key items to note

Working with an external firm

Working with an external firm for the purposes of preparing an application has no bearing on the success rate of an applicant.

Applications may only be submitted by the prospective recipients, and any applications submitted by a third party on behalf of an applicant will not be considered. The primary contact on the application form must be an employee of the applicant business.

Any costs associated with the use of a consultant for a funding application are not eligible under project costs.

Tax compliance verification

Applicants are required to provide evidence of compliance with federal and provincial taxes. As part of the application package, applicants are to submit a Tax Compliance Verification (TCV) number and a Tax Compliance Certificate. Learn how to generate a TCV number.

Funding agreement

If approved, applicants will be required to enter into a funding agreement, including terms and conditions satisfactory to the Government of Ontario.

Before funding is disbursed, applicants are required to meet disbursement conditions including evidence of project financing and insurance.

Applicants will need to meet all reporting requirements including providing financial statements.

The agreements will contain provisions for full or partial repayment of funds if performance measures are not met, including jobs and investment, and other terms and conditions of the funding agreement.

All funding agreements require written assurance that the contracting organization complies with all Ontario laws, including accessibility legislation.

See Appendix C for a list of funding agreement key terms.

How applications are assessed

Assessments will be based on the information provided in the application. Applicants must ensure that the application is as detailed and accurate as possible.

Projects will be assessed based on alignment with provincial priorities such as:

- job creation and retention in Ontario

- building local supply chain capacity in Ontario, including reshoring production to Ontario

- diversification of market reach beyond the U.S., with an emphasis on expanding revenue streams to new markets, particularly through inter-provincial trade

- manufacturing capacity expansion and investment in new technologies

- job creation or retention

- training

- development of economic clusters/supply-chains

- extent to which government support improves project outcomes and/or impacts the project’s scope or timelines

- increased innovation (for example, introducing a new product or process to the province/country/industry, resulting in new intellectual property, etc.)

- project risks (for example, management, financial and market risks)

If the application is deemed incomplete or there is material change to the project after the application is submitted, the Government of Ontario may defer review of the application until a revised application is submitted, subject to eligibility requirements.

If, after the assessment phase, an application/project is not successful, a company may not resubmit an application for the same project.

In some cases, the Ministry of Economic Development, Job Creation and Trade may consider projects outside the program parameters provided there is supporting evidence demonstrating exceptional benefit to Ontario.

Confidentiality and public reporting

The Ministry of Economic Development, Job Creation and Trade is subject to the Freedom of Information and Protection of Privacy Act (the “Act”). The Act provides every person with a right to access to information in the custody or under the control of the province, subject to a limited set of exemptions. Section 17 of the Act provides a limited exemption for third party information that reveals a trade secret, or scientific, commercial, technical, financial, or labour relations information supplied in confidence where disclosure of the information could reasonably be expected to result in certain harms. Any trade secret or any scientific, technical, commercial, financial, or labour relations information submitted to the province in confidence should be clearly marked.

The ministry may notify the applicant before granting access to a record that might contain information referred to in section 17 of the Act so that the applicant may make representations to the ministry concerning disclosure. Additionally, all information, statements and documents attached to this form or provided to the ministry in relation to this form may otherwise be subject to disclosure pursuant to the Act as well as any other applicable laws.

Approved projects will be the subject of public announcements. The applicant agrees that any information provided to the province in this application or in its support and in any subsequent project-related discussions or agreements may be shared with:

- other ministries of government, experts and/or authorized agents for the purposes of assessing this application and administering the program and satisfying government accountability and reporting obligations

- Statistics Canada for the purposes of program evaluation

Ministries must publicly report annually on the status of business support programs and strategic investments, including project description and project investment commitment, amount of government support and results achieved to date.

Following submission of a signed application, applicants are subject to compliance checks including:

- Ministry of Labour, Immigration, Training and Skills Development—Health and Safety and Employment Standards

- Ministry of the Environment, Conservation and Parks

- Accessibility Compliance (Accessibility for Ontarians with Disabilities Act)

- Ministry of Finance—Tax Compliance

- Ministry of Municipal Affairs and Housing

Conflicts of interest

Conflicts of interest include, but are not limited to, any situation or circumstance where:

- In relation to the application process, the applicant has an unfair advantage or engages in conduct, directly or indirectly, that may give it an unfair advantage, including:

- having, or having access to, information in the preparation of its application that is confidential to the Government of Ontario and not available to other applicants

- communicating with any person with a view to influencing preferred treatment in the application process, including the giving of a benefit of any kind, by or on behalf of the Applicant to anyone employed by, or otherwise connected with the Government of Ontario

- engaging in conduct that compromises, or could be seen to compromise, the integrity of the funding application process and render that process unfair

- In relation to the performance of its contractual obligations in a contract with the Government of Ontario, the applicant or any person who has the capacity to influence the applicant’s decisions has outside commitments, relationships or financial interests that could, or could be seen by a reasonable person to, interfere with the applicant’s objective, unbiased and impartial judgement relating to the project, the use of the proceeds of the funding, or both

Collection of information

The information the applicant provides will be utilized to assess the project, although the ministry may reach out for additional information as necessary.

The applicant should review the information outlined in our Privacy Statement to understand how the Government will protect and secure the information provided.

Appendix A: Eligible and ineligible cost categories

Eligible project costs

Eligible project costs must be directly attributable to the project and must be incurred and paid on or after the project start date and up to the project completion date, as defined in the funding agreement. The project start date cannot be earlier than the date the application is submitted.

Eligible project costs do not include ongoing costs of production or operations.

Eligible project costs are cash outlays, excluding all applicable harmonized sales tax (HST) and any imposed tariff costs, which must be documented through invoices, receipts, or recipient records acceptable to Ontario. These are all subject to verification by an independent auditor. You must maintain evidence of payment for audit purposes.

Acting reasonably, Ontario’s decisions as to the expenditure eligibility and valuation shall be final and determinative.

Project cost categories

This list of eligible and ineligible cost categories is for reference only. A final determination of eligible and/or ineligible costs will be determined at the discretion of the ministry.

Facilities and infrastructure

Eligible costs

- construction and project facility modifications or upgrades, subject to Ontario’s approval

- site servicing, power service upgrades, etc. required to execute the project

- for projects where an applicant is expanding or relocating to a larger building – for example, increasing from 30,000 sq. ft. to 50,000 sq. ft. of productive space – only the costs associated with the additional 20,000 sq. ft. of productive space would be considered eligible

Ineligible costs

- purchase of land or buildings

- costs associated with landscaping and staff parking lots

Equipment and machinery

Eligible costs

Equipment and machinery necessary for the successful completion of the project. For example:

- advanced technology (equipment and machinery)

- maintenance equipment associated with new technologies or systems acquired as part of the project

Ineligible costs

Purchase/lease or operation of vehicles or off-site equipment.

Labour

Eligible costs

One-time labour directly related to project costs are eligible (for example, costs to set up or commission new equipment, technology, or systems for the project).

Incremental specialized labour that is directly related to the project (for example, a new business development/sales manager with experience in sales to new markets) is eligible up to a maximum of two years.

This would include direct salaries, wages and benefits, paid by the recipient, for employees of the recipient working on the project and in proportion to the amount of time spent working directly on the project. Benefits mean employees’ regular entitlements for payroll-related benefits (Canada Pension Plan, Employment Insurance, employer health tax), medical and dental-related benefits, the actual cost of sick leave, vacation, statutory holidays and pension. Any other benefits must be approved in writing by Ontario.

The recipient is required to maintain timesheets or appropriate records for all employees working directly on the project to verify time spent on project work, to verify expenditures for audit purposes.

Ineligible costs

- ongoing operational and production labour costs

- brokers, agents, consultants

Materials

Eligible costs

Costs of direct materials necessary for—specifically identified and measured as being used for—the completion of the project, including:

- materials used for configuring and testing production processes and systems

- materials used for training employees

- materials used for prototypes

- other materials directly related to the project as approved by Ontario

Ineligible costs

Materials used for the regular production of saleable items.

Specialized expertise

Eligible costs

Costs of specialized expertise required for the project including third-party engineering services, software development, management, etc.

Training and talent costs

Eligible costs

- skills training, including employer-provided training, related to the project

- costs to provide the training (including training materials)

- training infrastructure (for example, building retrofits for training room, equipment)

- with limits, third party costs related to training for owners and/or management, to address specific business needs

- cost to hire external expertise related to development of a human resource (HR) strategy and/or succession planning (or hiring an internal HR professional for a period of up to one year if company did not previously have one employed)

Ineligible costs

- training costs supported by Ministry of Labour, Immigration, Training and Skills Development

- wages of staff for the time they are receiving the training

Permits and fees

Eligible costs

Costs incurred by the recipient for permits, inspections and other fees directly attributable to the project.

Ineligible costs

Fees attributable to ongoing operations.

New Market Access

Eligible costs

- procurement of market research reports that provide guidance on how to access and sell to new markets, except the U.S., from a reliable Canadian or local vendor

- registration and booth costs of exhibiting in recognized trade shows held outside of Ontario and the U.S. and attended by buyers that provide access to new markets. Note: if the applicant is participating in a trade mission within Ontario or Canada, the costs covered through the mission will not be covered through OTTF

- developing localized marketing and packaging materials, including translations

- extending e-commerce reach to new markets, except the U.S.

- certification of made in Ontario products for the purpose of meeting local regulatory/compliance requirements in new markets outside of Ontario and the U.S.

- certification of Ontario production facilities for the purpose of meeting local regulatory/compliance requirements in new markets outside of Ontario and the U.S.

- costs of registering trademarks

- costs of extending existing patent rights to local markets (patent must belong and continue to belong to the Ontario applicant for at least the duration of the project)

Ineligible costs

- any travel and accommodation costs

- meal per diems, hospitality

- shipping costs (marketing materials, samples)

- travel insurance

- marketing costs (for example, cost of advertisements)

General working capital requirements

Ineligible costs

Capital requirements not directly attributable to the project including debt service costs, federal or provincial taxes, surtaxes and special expenses (for example, general legal fees).

Other costs

Ineligible costs

- preparation of funding proposal

- shareholder payments

- costs incurred outside of Ontario, except for purchases from suppliers located outside Ontario and eligible costs related to market development

- mergers and acquisitions

- any travel, hospitality, meal and incidental expenses

- rebates, credit or refund

- debt service costs, federal or provincial income taxes or surtaxes

- shipping costs

- advertisement costs (for example, TV commercials, digital ads or print ads)

Information to help complete project costs in the application form

Not providing detailed descriptions may result in the cost being deemed ineligible.

For all cost categories, provide a clear description of the items included. This will help to determine eligibility.

For any cost category that exceeds $25,000, in a given year, provide a breakdown of the costs.

For example, if the projected eligible cost is $100,000 in the cost category “Equipment & Machinery in Year 1,” then the description should state:

- cutting machine: $35,000

- two drilling machines: $50,000

- cleaning machine: $15,000

For example, If the projected eligible cost is $10,000 for the cost category “Training and Talent Costs in Year 1,” the description should state “required training for five employees on the new CNC machine.”

Appendix B: Job requirements and definitions

Job requirement

Companies must commit to the number of jobs specified in the application form. Jobs will be measured as the number of positions considered full-time equivalent (FTE), at the project’s conclusion.

Applicants should avoid artificially inflating or deflating employee numbers or the count of positions at risk of layoffs for application purposes. A robust rationale must be provided for the number of employees at risk of layoff.

Key definitions

Jobs

“Jobs” are defined as the number of full-time equivalent positions of an “Active Employee” (see definition below) on this page.

Active Employee

“Active Employee” means an employee (or agency contract employee) of the recipient who is actively employed and actively paid.

For greater certainty, a person on lay-off is not considered to be “actively employed” and does not qualify as an “Active Employee” and an employee on a voluntary leave of absence, including parental leave, shall continue to be considered an “Active Employee” but his/her replacement during such absence shall not be considered as an additional active employee.

Jobs Saved

“Jobs Saved” means the number of “Active Employees” at risk of lay-offs prior to the start of the project minus the actual number of “Active Employees” laid off during the project period.

Hourly employees

An FTE “Job” for an hourly paid active employee means in respect of any year, 2,000 hours, by active employees employed by the recipient, including hours taken as paid vacation, sick leave, and for other similar reasons, at the project facility or facilities. An employee in a position that is designated at 1,000 hours per year, would be considered 0.5 of an FTE position. Two 0.5 positions could be combined to count as one FTE position.

For clarity, any individual active employee may not account for more than one Job or 2,000 hours of paid work during each fiscal year.

Salaried employees

A “Job” for a salaried active employee means a full-time position of a salaried active employee of the recipient.

Agency contract employees

“Agency Contract Employees” is defined as those individuals employed by an independent third-party supplier of contract workers (such supplier being approved by the recipient), and who are on an assignment performing work at the project facility or facilities.

Notwithstanding anything to the contrary, any jobs that may be outsourced from the project facility shall not be included in the definition and calculation of “Jobs.”

Information to help complete section F in the application form

This section helps applicants to complete the “jobs” section of the application form. In this section, “ABC Inc.” is a fictional company used for example.

Determine and convert your data

Project length

- Projects must be less than two years and applicants must commit to jobs for the project period.

New jobs

- Determine the number of new full-time positions to be hired, by the end of the project (headcount). Note: New jobs are FTE positions that are net new of the retained jobs at the project facility.

- Example: ABC Inc. has determined the following:

- New Jobs (end of project): four new full-time positions

- Example: ABC Inc. has determined the following:

- Determine the number of new part-time positions to be hired, by the end of the project. For clarity, one part-time position which is equivalent to 1000 hours annually, would be 0.5 positions. Adding two 0.5 positions together could be considered 1 FTE position.

- Example: ABC Inc. has determined the following:

- New Jobs: Two new 0.5 part-time positions = one new full-time position

- Example: ABC Inc. has determined the following:

If you plan to hire any contract or agency employees, please include them as well.

Retained jobs – baseline level of full-time equivalent positions

- Determine the number of existing full-time-equivalent positions at the project facility which will be maintained by the end of the project – these are the retained jobs. Note: if you expect lay-offs during the project period, the retained jobs should reflect the final number of maintained jobs you expect at the end of the project period.

- Example: ABC Inc. expects 28 existing full-time positions at their facility at the end of the project.

- Determine the number of existing part-time positions by the end of the project then convert to a full-time equivalent job at the project facility.

- Example: ABC Inc. expects 4 existing part-time positions working at their facility at the end of the project; each position averages 1,000 paid work hours annually. This converts to 2 existing full-time equivalent positions.

If you employ any contract or agency employees, they will need to be included as well.

Enter your data into the application form

This will be shown by using data from the ABC Inc. example.

Summary data

New full-time equivalent jobs:

- New Jobs: five new jobs (4 FTE and combined two 0.5 positions)

- Retained Jobs: 30 retained jobs (28 from the full-time positions and two from the part-time positions)

Appendix C: Key terms of funding agreements

Overview

To obtain funding, the business will be required to enter into a funding agreement with the Province of Ontario based on the information provided in the application submission.

Timing of funding payments

No payments will be made until the funding agreement has been signed and any conditions for disbursement have been fulfilled.

Sources of project financing and proof of insurance (minimum of $2 million) must be in place before any disbursements can be made. Other conditions may be required before disbursements are made.

Disbursements will be made in arrears (except as described below) and paid in installments which shall not exceed the cap set by the Government of Ontario. It is solely determined by the province, taking into consideration factors such as rate of investment and milestones.

At Ontario’s sole discretion, an initial payment of up to 30% of the support may be made once conditions of disbursement have been met. If the application is approved, ministry staff will explain how the caps for the disbursements have been set.

For grants, a performance payment will be disbursed after the project has been completed and all final reporting requirements have been received to Ontario’s satisfaction.

Commitments and clawbacks

Within the funding agreement, recipients will be required to make commitments related to project investment and jobs.

To the extent that each of these commitments is separately not achieved by the date set out, the recipient will be required to pay pro rata clawbacks (payments based on formulas set out in the funding agreement).

Clawbacks in grant agreements

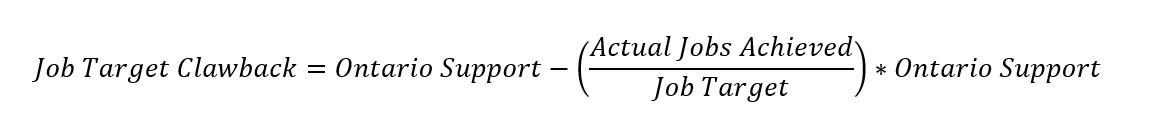

Job target clawback

If by the Project Completion Date, the job target is not met, the recipient shall repay a cash amount to Ontario in accordance with the following formula:

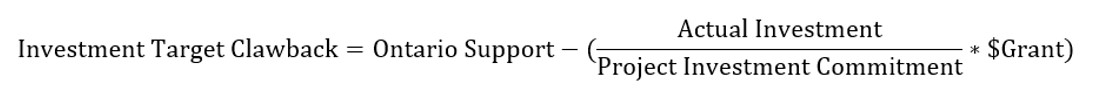

Investment target clawback

If the project investment commitment is not achieved on or before the Project Completion Date, the recipient shall repay a cash amount to Ontario in accordance with the following formula:

Footprint

Funding agreements require recipients to make footprint commitments setting out a minimum number of jobs within Ontario.

Other key terms

The terms of the funding agreement will also contain provisions in favour of Ontario including but not limited to:

- conditions of disbursement; subject to annual funding allocation

- representations and warranties

- positive and negative covenants

- reporting requirements including financial statements and project status reports—as needed, additional reporting may also be required

- documentation, which may require the provision of a third-party auditor’s certificate at the recipient’s expense, to verify a company’s investment in eligible costs and jobs at the project completion date

- provisions relating to non-arm’s length transactions

- insurance and indemnities in favour of the Government of Ontario

- events of default and remedies for default, including but not limited to repayment of funds

- depending on the financial status of the applicant, Ontario may require a guarantee

These terms are subject to change.