Progress report on Jobs and Prosperity Fund and regional business support program 2017

How projects were assessed, supported and evaluated under the Jobs and Prosperity Fund and the regional business support programs from April 1, 2016 to March 31, 2017.

Overview

2016/17 marked another successful year for Ontario’s business support programs. The Jobs and Prosperity Fund (JPF), Eastern Ontario Development Fund (EODF), and Southwestern Ontario Development Fund (SWODF) have helped to grow Ontario’s jobs and ensure strategic private sector investment. These programs have helped Ontario to compete with jurisdictions around the world that offer significant incentives to business and make certain that the investments land in Ontario.

Growing the economy and creating jobs is a priority for Ontario, and is part of the government’s economic plan to build Ontario up. The Jobs and Prosperity Fund and the regional business support programs are crucial parts of this economic plan.

The JPF is a 10-year, $2.7 billion fund that allows the government to partner with businesses to enhance productivity, innovation and exports. The JPF helps secure anchor firms and other strategic investments while creating and retaining jobs in Ontario.

The EODF and SWODF support economic development in targeted geographical regions. The regional funds and the business stream of the Rural Economic Development Fund — previously administered by the Ontario Ministry of Agricultural, Food and Rural Affairs — will be integrated under the JPF to serve regional and rural communities with a one-window approach.

Another key pillar of the Province’s commitment to further enhance Ontario’s global competitiveness is the Business Growth Initiative, which will invest $650 million over five years to support economic growth and job creation by promoting an innovation-based economy. It is designed to help small- and medium-sized firms scale up. It is also focused on modernizing regulations to improve interactions between businesses and government, and save businesses time and money while protecting workers and the environment.

There are currently four JPF streams:

- New Economy Stream

- Food and Beverage Growth Fund

- Strategic Partnerships Stream

- Forestry Growth Fund

Assessment

Each project is assessed using an established methodology to ensure objectivity, transparency and rigour. Recommendations are driven by assessments of return on investment and risk, and include a multi-ministry review process and technical and financial due diligence where required by the program. Performance metrics are utilized to evaluate the effectiveness and long-term impact of business support. Assessments are based on the Province’s Strategic Investment Framework.

To identify the best opportunities for Ontario’s economy, assessment criteria are consistently applied against all investment proposals. Areas of assessment include: economic impact; enhancements to productivity, innovation, and exports; investment incrementality; sector/cluster alignment; and return on investment.

Performance measurement and disbursement

Companies that have received investment support are obligated to report on a number of performance measures as part of each project grant/loan agreement.

Performance measures are designed to indicate how well each project is achieving its commitments as defined by the agreement. The measures also allow continuous improvement in the delivery of effective and targeted Ontario business support programs.

Funding is disbursed to successful projects in stages, and only as the company reaches agreed-upon milestones, such as a specific number of jobs created and a specific amount of private money invested. If the company cannot demonstrate that specific milestones have been met, the Province is under no obligation to disburse any funding to the project.

If performance requirements are not met, there are a number of remedies available, ranging from funding clawbacks to contract termination. These are in place to ensure that projects follow through on their commitments to create jobs and bring investment to Ontario, protecting the Province’s strategic investments in job creation and growth.

JPF Streams

In 2016/17, $39.2 million in total government funding has been committed to 5 projects: $33.5 million to the New Economy Stream, $1.7 million to the Food and Beverage Growth Fund, and $4 million to the Forestry Growth Fund.

For a variety of reasons, including our rigorous assessment process, some project applicants for JPF funding are not successful. In some cases, projects are deemed ineligible for funding based on the specifics of the application, and in others the application is voluntarily withdrawn by the applicant.

New economy stream (NES)

The NES builds partnerships with organizations making strategic investments that strongly correlate to building research and development capacity, improving productivity, boosting competitiveness and increasing global reach.

A total of 3 projects were contracted and announced between April 1, 2016 and March 31, 2017. During this period, the province committed $33.5million in total funding support.

Food and beverage growth fund (FBGF)

The FBGF is designed to support these industries by increasing market access, and strengthening supply chains for food, beverage and bio product projects. One project representing more than $1.7 million in total funding support was contracted and announced between April 1, 2016 and March 31, 2017.

Strategic partnerships stream (SPS)

The SPS increases the adoption of advanced technologies and the creation of next-generation products and services. This stream supports transformative, large-scale projects within an open innovation model that brings together resources of Ontario-based anchor firms, postsecondary institutions, entrepreneurs and SMEs.

Each partnership focuses on an advanced or disruptive technology with the potential to transform a wide range of Ontario’s priority sectors and industries. Adopting disruptive technologies drives increased productivity, innovation and exports to global markets.

During the 2016/17 fiscal year, no SPS projects were at the approval stage.

Forestry growth fund (FGF)

The FGF is a new JPF stream approved in the 2015 Ontario budget. The fund launched in February 2016. Investments are evaluated using the JPF common governance structure, processes/systems and an adapted scorecard.

This fund is available to manufacturers and processors of wood and forest biomass across Ontario, including saw mills, pulp and paper mills, secondary wood manufacturing, and bio-economy projects.

In 2016/17, the FGF has contracted and announced funding for one project, totalling $4 million in provincial support.

Other investments

In 2016/17, the Ministry has also contracted and announced funding for two other investment projects in the automotive industry, totalling $144 million in provincial support, with recipients committing to create and retain approximately 4,800 jobs.

Regional funds

EODF and SWODF support projects that create and retain jobs, encourage the introduction of new technologies, assist private sector firms, communities and sector groups to pursue growth in new markets, improve their competitive position, and ultimately contribute to the diversification of the economy of specific regions of the province. These funds provide grants and loans to businesses and municipalities to support projects that will attract investment and support job creation in the region.

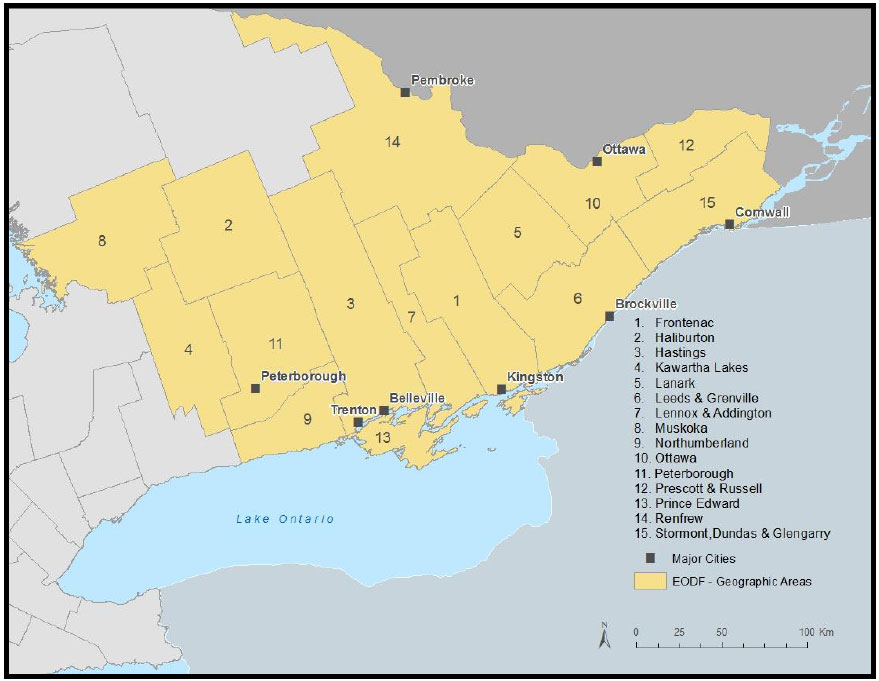

From April 1, 2016 to March 31, 2017, 17 contracts were signed for EODF projects. The $8.4 million in Ontario support will secure more than $67.4M million in private sector investment, amounting to more than $8 of private sector investment for every $1 of Ontario financial support. These projects will result in commitments that support 1,171 total jobs. See Appendix C for geographic boundaries covered by EODF.

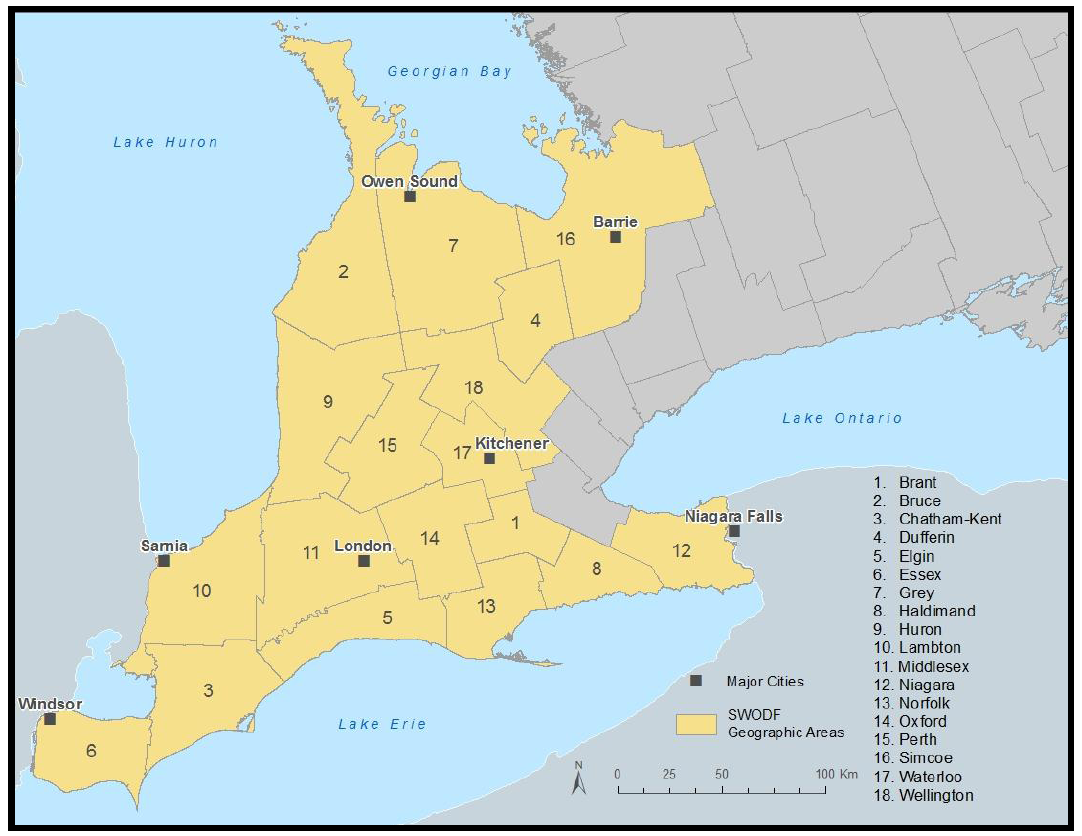

From April 1, 2016 to March 31, 2017, 31 contracts were signed for SWODF projects. The $19.8 million in Ontario support will secure more than $239.4 million in private sector investment; that’s more than $12 of private sector investment for every $1 of Ontario financial support. In addition, these projects will result in commitments to support 5,823 total jobs. See Appendix C for geographic boundaries covered by SWODF.

Independent and third-party review and analysis of MEDG’s regional funds determined that they provide lasting benefits and value for participating firms, as well as the province, with the majority continuing to experience both revenue and job growth after projects have been completed.

Appendix A – JPF and other investments project breakdown

| Funding Program | Company | Location | Fiscal Year Contract Signed | Government Funding Commitment ($M) | Total Project Jobs Created and Retained as in the Contract | Project Description |

|---|---|---|---|---|---|---|

| JPF FBGF | Ippolito Fruit and Produce Limited, The Ippolito Group Inc. Ippolito Produce Limited |

Burlington | 2016/17 | $1.71 | 333 | Installation of state-of-the art imaging technology to make packing operations more efficient. |

| JPF FGF | Lavern Heideman & Sons Limited | Eganville | 2016/17 | $4.00 | 108 | Modernizing infrastructure, purchasing new equipment and consolidating operations. |

| JPF NES | General Electric Canada | Welland | 2016/17 | $26.55 | 220 | Brilliant Factory facility will produce energy-efficient engines and other components that are used all over the world. |

| JPF NES | Polycorp Ltd. | Elora, Waterloo and Toronto | 2016/17 | $2.50 | 172 | Purchasing new equipment, creating a testing laboratory and expanding the manufacturing facility. |

| JPF NES | Stereo D Canada Ltd. | Toronto | 2016/17 | $4.50 | 358 | Expanding digital media operations in Toronto. |

| Other Investments | Honda Canada Inc. | Alliston | 2016/17 | $41.81 | 4,000 | Modernizing assembly operations to ensure the plant remains competitive and to help secure the next generation of vehicle production in Ontario. |

| Other Investments | Ford Motor Company of Canada Limited | Oakville, Windsor, Ottawa and Waterloo | 2016/17 | $102.40 | 795 | Establishing an advanced manufacturing program at the company’s Windsor operations, and establishing a Research and Engineering Centre in Ottawa. |

Notes:

- Discrepancies between job numbers announced and contracted may exist for reasons such as the number of jobs announced are rounded from the contracted number, or the number announced includes only new jobs, where the contract includes new and retained jobs.

- The above list contains only projects that have been announced.

Appendix B – Regional funds project breakdown

| Company | Location | Fiscal Year Contract Signed | Government Funding Commitment ($M) | Total Project Jobs Created and Retained as in the Contract | Project Description |

|---|---|---|---|---|---|

| Amino North America Corporation | St. Thomas | 2016/17 | $0.40 | 55 | Purchasing new equipment that will improve processes and assist R&D. |

| Andrew Peller Limited | Grimsby and Niagara on the Lake | 2016/17 | $0.53 | 116 | Expanding into craft distilling and increasing wine production. |

| Apogee Ceramics Inc. | Brantford | 2016/17 | $0.19 | 28 | Investing in a fully automated kiln system and other equipment to improve energy efficiency and increase productivity. |

| Armo-Tool Ltd. | London | 2016/17 | $0.61 | 160 | Expanding the London facility and upgrading equipment. |

| Atlantic Industries Limited | Ayr | 2016/17 | $0.17 | 47 | Purchasing and installing new equipment and expanding existing facility. |

| Atwood Heritage Processing Inc. | Atwood | 2016/17 | $0.14 | 21 | Building a new facility and purchasing new equipment and machinery. |

| Barry Callebaut Canada Inc. | Chatham | 2016/17 | $0.34 | 41 | Installing new equipment to increase capacity. |

| T.F. Warren Group Inc. (Blastech) | Brantford | 2016/17 | $0.80 | 175 | Establishing a service line for coating and lining rail cars. |

| CR Plastic Products Inc. | Stratford | 2016/17 | $0.79 | 155 | Installing an extruder and manufacturing a continuous assembly line. |

| Elora North Inc. | Ancaster | 2016/17 | $1.50 | 110 | Restoration and renovation of a hotel, spa and conference facility. |

| FPH Group Inc. | London | 2016/17 | $0.18 | 88 | Purchasing advanced production equipment to expand in-house production capability. |

| Greco Aluminum Railings | Windsor | 2016/17 | $0.17 | 77 | Purchasing new equipment to produce additional product lines and expand business. |

| Guelph Manufacturing Group Inc. | Guelph | 2016/17 | $0.87 | 554 | Investing in new equipment and expansion capabilities. |

| H & H Wood Products Inc. | Wheatley, Tilbury and London | 2016/17 | $0.20 | 71 | Investing in new equipment to improve productivity and increase sales. |

| Hayashi Canada Inc. | Stratford | 2016/17 | $0.66 | 160 | Expanding operations, including investment into the local facility and equipment. |

| Integrated Metal Products LTD | Guelph | 2016/17 | $0.26 | 38 | Building a new facility and the purchase, installation and commissioning of new equipment. |

| J.P. Bowman Limited | Brantford | 2016/17 | $0.76 | 81 | Advancing engineering and manufacturing techniques for next generation parts for the global automotive industry. |

| Jesse Garant and Associates Inc. | Windsor | 2016/17 | $0.16 | 23 | Investing in a second facility and purchasing new equipment. |

| KSR International Co. | Ridgetown and Rodney | 2016/17 | $0.68 | 647 | Expanding production capabilities and investing in new equipment. |

| Kuntz Electroplating Inc. | Kitchener | 2016/17 | $1.08 | 433 | Expanding and modernizing equipment to increase precision and improve productivity. |

| Labatt Brewing Company Limited | London | 2016/17 | $1.50 | 360 | Purchasing new equipment and machinery. |

| Miovision Technologies Inc. | Kitchener | 2016/17 | $1.50 | 384 | Purchasing new equipment. |

| Nova Steel Inc. | Woodstock | 2016/17 | $0.60 | 67 | Investing in new equipment and expanding production capabilities. |

| Otter Valley Foods Inc. (Inovata Foods Corp.) | Tillsonburg | 2016/17 | $0.39 | 231 | Expanding operations by adding a new line and investing in new equipment. |

| Proto Manufacturing Limited | Oldcastle | 2016/17 | $0.22 | 50 | Research and development to introduce a new product line to pursue new markets. |

| Ramstar Carbide Tool Inc. | Oldcastle | 2016/17 | $0.31 | 35 | New automated equipment and facility modifications. |

| Sodecia London Inc. | London | 2016/17 | $1.50 | 254 | Expand hot stamping capability. |

| Technical Molding Management Systems Inc. | Tecumseh | 2016/17 | $0.11 | 30 | Purchasing equipment and developing light weight molds to meet increasing demands for light weight auto parts. |

| Toyotetsu Canada Inc. | Simcoe | 2016/17 | $1.18 | 621 | Supporting production of a new product line. |

| TransForm Automotive Canada Limited | London | 2016/17 | $0.50 | 89 | Facility expansion to increase capacity. |

| Ultra Manufacturing / Mitchell Plastics Ltd. | Kitchener | 2016/17 | $1.50 | 622 | Expanding facility to set up a new technical centre. |

Notes:

- Discrepancies between job numbers announced and contracted may exist for reasons such as the number of jobs announced are rounded from the contracted number, or the number announced includes only new jobs, whereas the contract includes new and retained jobs.

- The above list contains projects with signed contracts during this period.

| Company | Location | Fiscal Year Contract Signed | Government Funding Commitment ($M) | Total Project Jobs Created and Retained as in the Contract | Project Description |

|---|---|---|---|---|---|

| Atlantic Braids Ltd. | Chute A Blondeau | 2016/2017 | $0.84 | 27 | Expanding facilities by purchasing a new building and production equipment. |

| Boulangerie Lanthier Ltée | Alexandria | 2016/2017 | $0.61 | 75 | Facility expansion and the purchase and installation of new equipment. |

| 2308073 Ontario Inc. (O/A Coloured Aggregates) | Marmora | 2016/2017 | $0.52 | 14 | Facility upgrades and new product lines. |

| Direct Coil Inc. | Millhaven | 2016/2017 | $0.27 | 93 | Investing in new equipment and expanding business. |

| Dynamo Industries Inc. | Rockland and Plantagenet | 2016/2017 | $0.13 | 48 | Installing new equipment and facility upgrades to increase capacity, improve the speed of production, and generate cost savings. |

| ELPA (Ontario) Incorporated | L'Original | 2016/2017 | $0.22 | 34 | Purchasing new machines and associated software, specialized tools and training, as well as modifying their facility to accommodate the new equipment. |

| Hain-Celestial Canada ULC | Quinte West | 2016/2017 | $1.39 | 26 | Facility upgrades and investment in new equipment in response to growing markets for its products. |

| Johnvince Foods and Canada Candy Company Inc. | Cobourg | 2016/2017 | $1.29 | 29 | Building a state-of-the-art manufacturing plant. |

| Kawartha Dairy Limited | Bobcaygeon | 2016/2017 | $0.31 | 125 | Investing in a state-of-the-art refrigeration facility. |

| Lockheed Martin Canada Inc. | Ottawa | 2016/2017 | $0.45 | 212 | Acquisition, development and set up of new equipment and technology. |

| Prysmian Power Cables and Systems Canada Ltd. | Johnstown | 2016/2017 | $0.62 | 212 | Investing in the purchase and installation of new equipment. |

| Redpath Sugar Ltd. | Belleville | 2016/2017 | $0.62 | 111 | Investing in two new customized packaging lines and equipment. |

| Sport Systems Canada Inc. | Almonte | 2016/2017 | $0.18 | 31 | Facility expansion and the purchase and installation of new equipment. |

| SRB Technologies (Canada) Inc | Pembroke | 2016/2017 | $0.23 | 51 | Investing in new equipment to improve productivity. |

| Township of Edwardsburgh Cardinal (Note 1) |

Edwardsburgh and Cardinal | 2016/2017 | $0.40 | 0 | Facilitating the construction of a new facility. |

| Tri Art Manufacturing Inc. | Kingston | 2016/2017 | $0.14 | 48 | Facility upgrades and the purchasing of equipment to set up new manufacturing processes, and expand production. |

| Triangle Fluid Controls Limited | Belleville | 2016/2017 | $0.19 | 35 | Facility expansion and the purchasing of new production and laboratory testing equipment. |

Notes:

- Note 1: The EODF and SWODF have Regional Streams targeted to municipalities and economic development organizations. The objective is to support investments by municipalities that lead to immediate private sector investment and private sector job creation. There is no contracted job creation requirement because the municipality, who is the grant recipient, is not required to create direct jobs. In the regional stream projects the Ministry is not contracting directly with the entity that is creating the jobs.

- O/A means "Operating as"

- Discrepancies between job numbers announced and contracted may exist for reasons such as the number of jobs announced are rounded from the contracted number, or the number announced includes only new jobs, whereas the contract includes new and retained jobs.

- The above list contains projects with signed contracts during this period.

Appendix C - Program boundaries for EODF & SWODF

The Southwestern Ontario Region

For the purposes of the SWODF program, “Southwestern Ontario” is defined as the following 18 geographic areas under the Territorial Divisions Act, 2002:

- Brant

- Bruce

- Chatham-Kent

- Dufferin

- Elgin

- Essex

- Grey

- Haldimand

- Huron

- Lambton

- Middlesex

- Niagara

- Norfolk

- Oxford

- Perth

- Simcoe

- Waterloo

- Wellington

The Eastern Ontario Region

For the purposes of the EODF program, “Eastern Ontario” is defined as the area comprising the following 15 geographic areas under the Territorial Division Act, 2002:

- Frontenac

- Haliburton

- Hastings

- Kawartha Lakes

- Lanark

- Leeds and Grenville

- Lennox and Addington

- Muskoka

- Northumberland

- Ottawa

- Peterborough

- Prescott and Russell

- Prince Edward

- Renfrew and Stormont

- Dundas and Glengarry