The content on this page is no longer up to date. It will remain on ontario.ca for a limited time before it moves to the Archives of Ontario.

Ontario’s energy mix at the end of 2015

Electricity supply

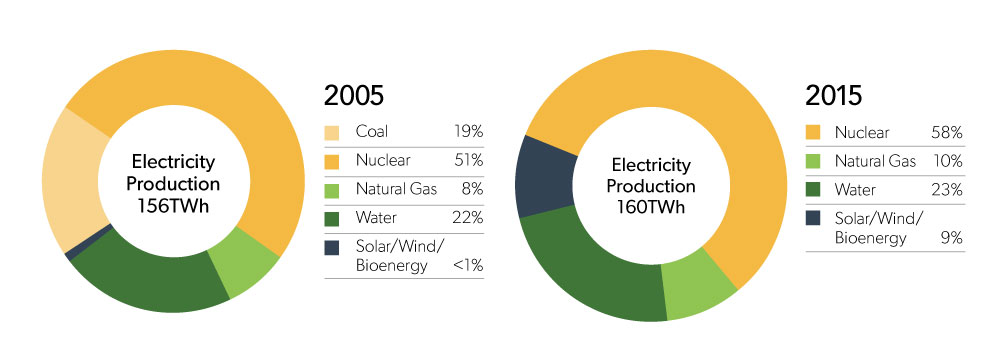

Ontario produced 160 Terawatt-hours (TWh) of electricity in 2015. That electricity does not come from any one type of generation. The province relies on a diverse number of sources to give it a secure and reliable supply of electricity. Nuclear, natural gas and renewable generation, such as hydroelectric, wind, solar and bioenergy, all produce the electricity Ontarians rely on.

The province’s supply mix must also be flexible to respond to the changing priorities of Ontarians. The most significant change over the past decade was the elimination of coal-fired generation. To reduce the GHG emissions that cause climate change and improve to Ontario’s air quality, the province eliminated the use of coal by closing three coal plants and converting the remaining two plants to cleaner biomass plants. It also invested in new and refurbished generating facilities to replace the closed coal plants.

Figure 1: Ontario electricity production (Source: Ontario Planning Outlook, 2016)

| Source | 2005 | 2015 |

|---|---|---|

| Nuclear | 51% | 58% |

| Natural Gas | 8% | 10% |

| Water | 22% | 23% |

| Solar/Wind/Bioenergy | <1% | 9% |

| Coal | 19% | 0 |

Includes electricity produced to meet Ontario demand, including embedded generation (which brings the total to 143 TWh in 2015), and exports (17 TWh in 2015).

Nuclear generation provided the biggest share of Ontario’s electricity in 2015, producing 92.3 TWh of electricity. That was followed by the 37.3 TWh provided by hydroelectric generation, 15.9 TWh generated from natural gas, and non-hydro renewables such as wind, solar and bioenergy that provided 14.2 TWh.

While Ontario generated 160 TWh of electricity last year, it has the ability to produce more. The installed capacity of the province’s generating fleet totals 39,393 MW.

Since the 2013 LTEP, the share of wind, solar and bioenergy capacity in our supply mix has grown from 9% to over 18%. At the end of June 2016, the 4,500 MW of installed wind capacity represents the largest source of our non-hydro renewable generation. Approximately 1,600 MW of additional wind capacity is under contract and under development.

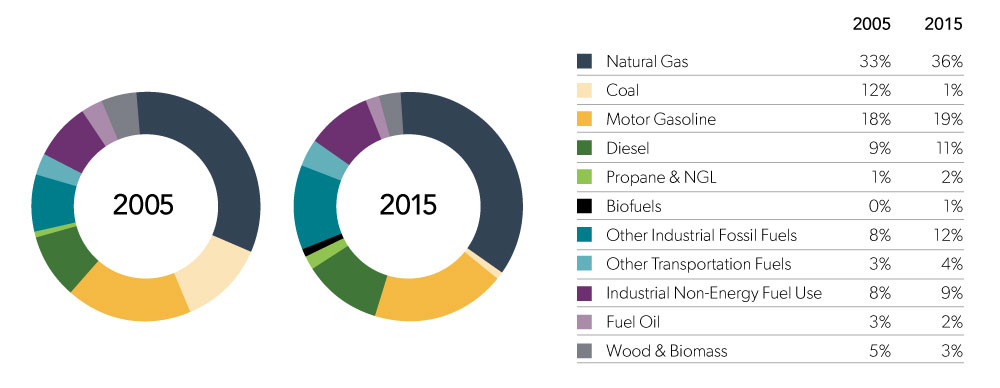

Use of fuels

Ontario consumed approximately 2,700 petajoules (PJ) of fuels in 2015. These types of fuels include gasoline, diesel, natural gas, propane and natural gas liquids. Alternative fuels include renewable and low-carbon fuels like biomass and biofuels. Ontarians use fuels for cooking, heating, transportation, electricity generation and industrial production. Fossil fuels also provide the energy needed to refine petroleum and manufacture pulp and paper, steel and cement. They are the raw materials in the production of plastics, fertilizers and chemicals.

Ontario’s fuel sector underwent considerable change recently, driven by new sources of supply, new technologies and the use of new, low-carbon biofuels such as ethanol and bio-based diesels. The significance of biofuels in the transportation fuel sector has tripled over the past decade, growing from less than 1% of the fuel used in 2005 to nearly 3% in 2015. There is every expectation that the use of biofuels will continue to expand within Ontario.

Figure 2: Ontario fuels demand by fuel type (Source: Fuels Technical Report)

| Fuel Type | 2005 | 2015 |

|---|---|---|

| Natural gas | 33% | 36% |

| Coal | 12% | 1% |

| Motor gasoline | 18% | 19% |

| Diesel | 9% | 11% |

| Propane and Natural Gas Liquid | 1% | 2% |

| Biofuels | 0% | 1% |

| Other Industrial Fossil Fuels | 8% | 12% |

| Other Transportation Fuels | 3% | 4% |

| Industrial Non-Energy Fuel Use | 8% | 9% |

| Fuel Oil | 3% | 2% |

| Wood and Biomass | 5% | 3% |

Ontario’s climate change initiatives will impact the supply and demand for these fuels in the future. Because of the strength and diversity of the existing supply chain of pipelines, refineries, terminals and retail stations, Ontario’s fuel sector is well-positioned to adapt to any changes in the supply and demand for fuels, and contribute positively to Ontario’s GHG emission reduction targets.

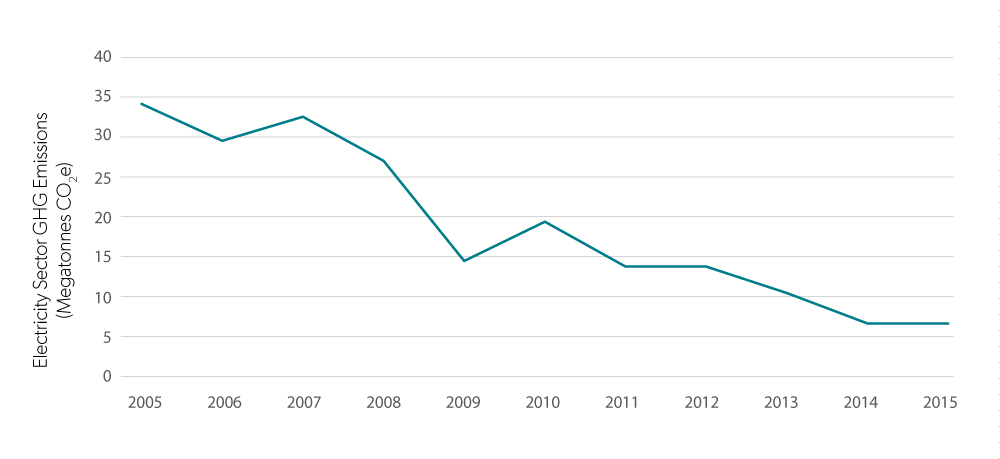

Emissions

Ontario is a North American leader in the reduction of GHG emissions. Closing three of the province’s coal-fired generation plants and converting the remaining two plants to biomass facilities was the continent’s largest single reduction effort, and reduced emissions from the electricity sector by 80%. The success in fighting climate change continues. Since the release of the 2013 LTEP, emissions from electricity production declined to 7.1 megatonnes (Mt), a reduction of 35%.

Figure 3: Electricity sector GHG emissions (Source: Ontario Planning Outlook)

| Mt CO2e | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Electricity Sector GHG Emissions | 34.5 | 29.9 | 32.9 | 27.4 | 14.9 | 19.8 | 14.2 | 14.2 | 10.9 | 7.1 | 7.1 |

Ontario has ambitious targets for reducing its GHG emissions. The Climate Change Mitigation and Low-Carbon Economy Act, 2016 commits the government to reducing emissions to:

- 15% below 1990 levels by 2020

- 37% below 1990 levels by 2030

- 80% below 1990 levels by 2050

Ontario also established a cap and trade program that sets caps on GHG emissions, and allows businesses to buy or sell allowances (credits) if they are over or under those limits.

The cap and trade program covers:

- Facilities that emit more than 25,000 tonnes of CO2 a year

- Distributors and importers of liquid petroleum fuels

- Distributors of natural gas

Ontario expects to generate between $1.8 and $1.9 billion in revenues annually from the sale of allowances during the first four-year compliance period of the cap and trade program. As part of the Western Climate Initiative, Ontario plans to link up in the future with a cap and trade program jointly run by Quebec and California.