We're moving content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

Part 1: Overview

1.1 Message from the Chair

In February 2020, the Ontario government established the Capital Markets Modernization Taskforce and appointed my four fellow Taskforce members and myself to review and modernize Ontario’s capital markets. Unlike other expert panels, this is a Taskforce that reports directly to the Minister of Finance. We are incredibly honoured to be entrusted with this opportunity to propose substantive changes that will benefit Ontario’s capital markets.

A vibrant economy needs vibrant capital markets, driven by innovation, competition and diversity. Since the last securities regulatory framework review in 2003, the financial system globally has undergone systemic changes, particularly in response to the 2008 global financial crisis. More recently, the ongoing COVID-19 pandemic has highlighted the need for modernized capital markets in a post-pandemic economy that would assist businesses raise capital, incubate innovative companies, invigorate large and small intermediaries, and protect investors. The Minister has tasked us with developing bold, innovative recommendations that are not just solving yesterday’s issues but are transformative and forward looking, and we hope to deliver on that mandate.

Over the last few months, including throughout the COVID-19 lockdown period, the Taskforce has been hard at work, listening to over 110 stakeholders about the challenges they face. We have met with some of the largest financial institutions and publicly-listed companies in Canada. We have also listened to independent investment dealers, start-ups, entrepreneurs, investor advocacy groups and academics.

Through our initial consultations, we have heard what is important to stakeholders and what can be improved, including but not limited to:

- streamlining the regulatory governance structure and framework;

- reducing legislative and regulatory burden on the sector;

- encouraging competition between market participants;

- helping businesses grow and attract investment;

- ensuring regulations are adaptive to technological advancements;

- enhancing investor protection;

- aligning regulatory models, and

- enhancing diversity in our capital markets.

On behalf of the Taskforce, I would like to thank the stakeholders who have provided input to us thus far and encourage continued stakeholder feedback as the Taskforce aims to transform the regulatory landscape for the capital markets sector in a post-pandemic economy. To-date, we have formulated over 70 recommendations corresponding to the different areas of focus identified above. At this time, we would benefit from your feedback on the 40+ most high-impact policy proposals in our work so far, outlined in this report. Your continued input is important in the development of our final, prescriptive and more comprehensive list of recommendations to the Minister of Finance on how to help build Ontario’s economy to benefit people across the province.

This report was a result of a dedicated team effort and I extend my greatest gratitude to my fellow Taskforce members, Rupert Duchesne, Wes Hall, Melissa Kennedy and Cindy Tripp, for their tremendous dedication and commitment to public service throughout this process. I would also like to thank Assistant Deputy Minister David Wai, Sunita Chander, Shameez Rabdi, Jeet Chatterjee, Luc Vaillancourt and Diane Yee at the Ministry of Finance, as well as the Ontario Securities Commission for their support in this process. I would also like to thank Heidi Reinhart, Rowan Weaver, Abigail Court and Daniel Weiss from Norton Rose Fulbright Canada for their support to the Taskforce. I would also like to thank members of the Expert Advisory Group for their ongoing support.

Together, we will modernize our capital markets regulatory framework that will support and sustain a healthy and prosperous capital markets ecosystem, making Ontario one of the most attractive capital markets in the world.

[original signed by]

Walied Soliman

Taskforce Chair

1.2 Background

The securities regulatory framework was last reviewed in 2003, well over 15 years ago. The last committee to review Ontario’s capital markets, chaired by Purdy Crawford, was convened in 2000 and released a report three years later. Since this last review, the global financial system has undergone systemic changes, particularly in response to the 2008 global financial crisis. More recently, the ongoing COVID-19 pandemic has highlighted the need for modernized capital markets to assist businesses raise capital, incubate innovative companies, and protect investors.

As part of its commitment to modernize Ontario’s capital markets, the government established the Capital Markets Modernization Taskforce in February 2020 and appointed members to review and make recommendations to modernize Ontario’s capital markets regulation. The Taskforce members include:

Walied Soliman,

Taskforce Chair, Canadian Chair,

Norton Rose Fulbright

Rupert Duchesne

Former CEO and Director,

Aimia

Wesley J. Hall

Founder and Executive Chair,

Kingsdale Advisors

Melissa Kennedy,

Executive Vice President, Chief Legal Officer and Public Affairs,

Sun Life

Cindy Tripp,

Founding Partner, former Managing Director, Co-Head Institutional Trading

GMP Securities L.P.

Appendix A contains the biographies of all Taskforce members.

Over the last few months, the Taskforce met with over 110 stakeholders to elicit preliminary feedback on the challenges businesses and investors face in our capital markets ecosystem. This involved in-person consultations which transitioned to online consultations during the COVID-19 pandemic, as well as some written submissions. These stakeholders have included capital markets regulators, market exchanges, financial institutions, industry associations, independent intermediary firms, law firms, issuers and investor advocacy groups.

This feedback has been instrumental in identifying over 70 key issues and/or proposals with an overarching theme of supplementing the policing function of our capital markets regulatory framework with a public policy imperative of growing the capital markets in Ontario. Our proposals broadly fall into the following categories:

- Governance of regulators;

- Fostering innovation in capital markets by improving the regulatory structure;

- Reducing duplicative regulatory burden;

- Building a competitive economy for Ontarians by ensuring a level playing field between large and small market players; and

- Improving investor protection.

Via this consultation report, the Taskforce is soliciting stakeholder feedback in relation to 47 high-impact policy proposals to further modernize Ontario’s capital markets regulatory framework. These proposals, which are based on initial feedback we have received from stakeholders, are for discussion purposes and may not reflect the final positions of the Taskforce. Your input is important to us. It will be considered carefully as we work towards finalizing our recommendations.

As opposed to previous panel reviews which were spaced over multiple years, we are aiming to deliver our final report to the Minister of Finance by the end of 2020. Our final report will contain a broader set of prescriptive recommendations intended to promote growth and competition in Ontario’s capital markets, while upholding investor protection.

The Taskforce is mindful of the important work being done by all the participating governments and the Capital Markets Authority Implementation Organization to establish the Cooperative Capital Markets Regulatory (CCMR) system. CCMR would increase harmonization in capital markets regulation and enhance investor protection by providing for stronger compliance enforcement. Our proposals may support the work being done currently by Ontario in collaboration with its partners to establish the CCMR.

The Taskforce supports the Ontario Securities Commission’s (OSC) Regulatory Burden Reduction project and would encourage the timely execution of their recommendations to reduce burden and save time and costs for businesses where possible.

1.3 Initial stakeholder feedback

In order to help guide the stakeholder consultations conducted to date, the Taskforce developed a discussion statement which has served as the premise for our work. The discussion statement is as follows:

Ontario needs to attract and grow businesses that support and sustain an innovation economy that can compete for investment and talent worldwide. The purpose of securities regulation is to protect investors in a manner that inspires confidence in the capital markets and limits systemic risk, while creating an environment where enterprising companies choose Ontario as the optimal place to raise capital and establish an active presence. In order to attract these companies, there must be an ecosystem in place that supports new and existing issuers of all sizes in new and emerging industries to efficiently access the capital markets through a robust and diverse intermediary market.

What changes to the current regulatory regime do you see as necessary to modernize this ecosystem in order to make Ontario one of the most attractive capital markets in the world?

In response to the discussion statement, stakeholders highlighted key issues and presented solutions which impact various tenets of our capital markets ecosystem. The issues raised ranged from ensuring a level playing field between independent and institutional market participants to enabling smarter regulation and protecting vulnerable investors. The policy proposals outlined in this document reflect the stakeholder feedback we have benefitted from to-date.

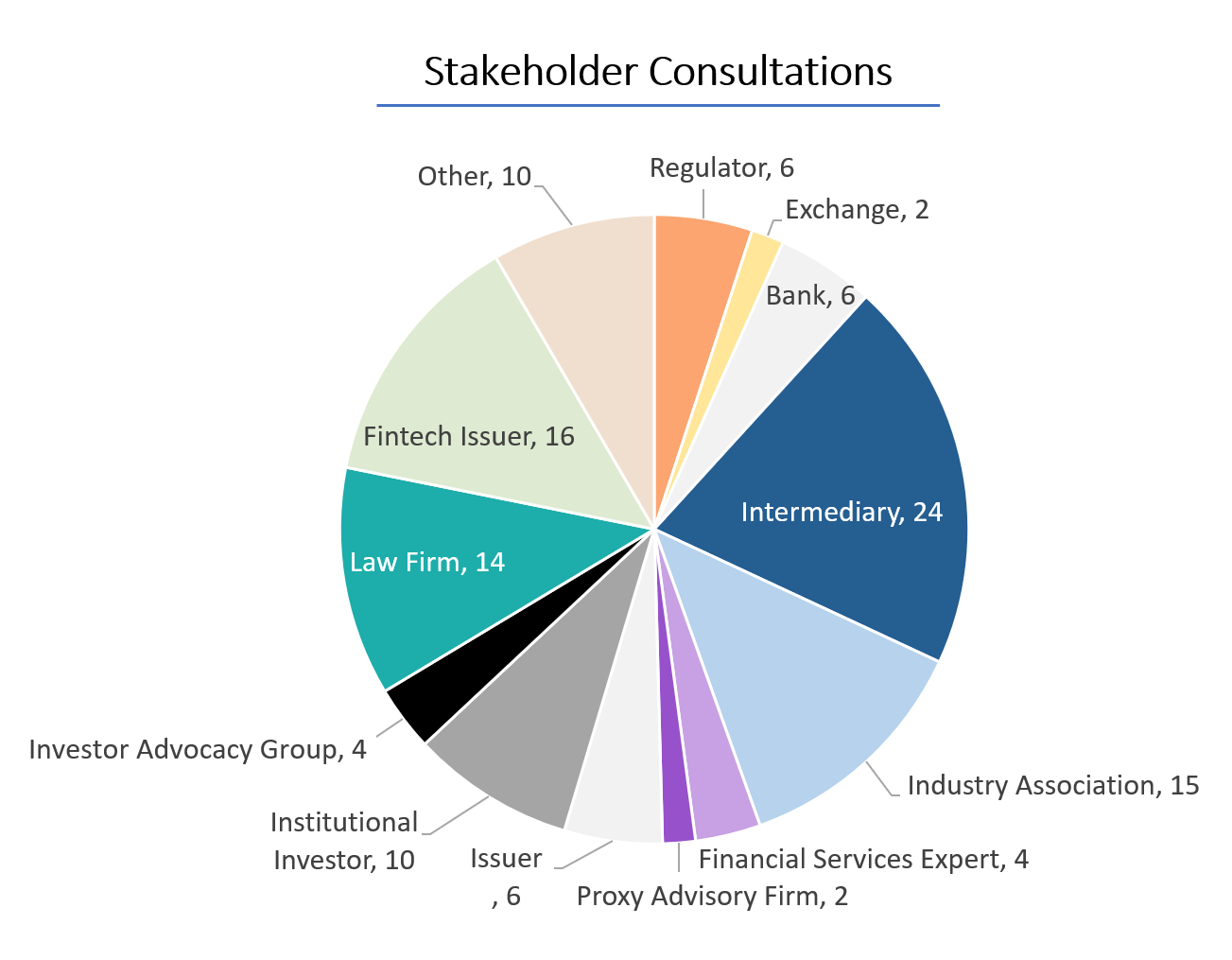

Chart Description

Stakeholder Consultations:

The Taskforce met with the following stakeholders in its preliminary stakeholder consultations:

| Stakeholder group | Number of stakeholders met |

|---|---|

| Intermediary | 24 |

| Fintech Issuer | 16 |

| Industry Association | 15 |

| Law Firm | 14 |

| Institutional Investor | 10 |

| Other | 10 |

| Bank | 6 |

| Issuer | 6 |

| Regulator | 6 |

| Financial Services Expert | 4 |

| Investor Advocacy Group | 4 |

| Exchange | 2 |

| Proxy Advisory Firm | 2 |