Government Notices Respecting Corporations

Certificates of Dissolution

Notice Is Hereby Given that a certificate of dissolution under the Business Corporations Act, has been endorsed. The effective date of dissolution precedes the corporation listings.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2001-10-02 |

Lynvalley Electric Ltd. |

962392 |

|

2001-10-03 |

G. M. Hill Motors Limited |

83882 |

|

2001-10-03 |

Mississippi Lakelands Limited |

114607 |

|

2001-10-03 |

O.A.R. Logistics Inc. |

1257376 |

|

2001-10-04 |

Kudroch Farms Ltd. |

829846 |

|

2001-10-04 |

The Gross Realty Group Inc. |

546567 |

|

2001-10-05 |

Charles A. Newman Drugs Limited |

486884 |

|

2001-10-05 |

Credifinance Realty Corp. |

1105548 |

|

2001-10-05 |

Eastwind Investments Ltd. |

276103 |

|

2001-10-05 |

1001904 Ontario Limited |

1001904 |

|

2001-10-05 |

814569 Ontario Inc. |

814569 |

|

2001-10-09 |

753343 Ontario Inc. |

753343 |

|

2001-10-11 |

Alworth Construction Limited |

554999 |

|

2001-10-11 |

Ardon Farms Limited |

269799 |

|

2001-10-11 |

Formula Trucking Ltd. |

867435 |

|

2001-10-11 |

Frederick Frank Construction (1986) Limited |

653091 |

|

2001-10-11 |

Priene Properties Ltd. |

1010332 |

|

2001-10-11 |

Protech Burlington Ltd. |

839939 |

|

2001-10-12 |

Central Dental Laboratories (Kingston) Limited |

1182696 |

|

2001-10-12 |

R. F. Meilleur Holdings Ltd. |

72478 |

|

2001-10-12 |

Soan-Arcon Ltd. |

1231494 |

|

2001-10-15 |

Baldbore Enterprises Ltd. |

1345551 |

|

2001-10-15 |

Ball Holdings Canada Corporation |

931354 |

|

2001-10-15 |

Celtique Inc..Orporated |

272936 |

|

2001-10-15 |

Columbus Paving & Interlock Inc. |

947651 |

|

2001-10-15 |

Eddvinc.E Investments Inc. |

712803 |

|

2001-10-15 |

Pacirim Trading Inc. |

1204032 |

|

2001-10-15 |

Sangster Business Solutions Inc. |

1442029 |

|

2001-10-15 |

Synergism Consultants Inc. |

1325037 |

|

2001-10-15 |

Wooden Toys ‘N Things Inc. |

2004606 |

|

2001-10-15 |

1351227 Ontario Inc. |

1351227 |

|

2001-10-15 |

1370485 Ontario Limited |

1370485 |

|

2001-10-15 |

1424354 Ontario Inc. |

1424354 |

|

2001-10-15 |

766842 Ontario Inc. |

766842 |

|

2001-10-16 |

Bagshaw Lumber Limited |

66589 |

|

2001-10-16 |

Bitters & Grapes (Brockville) Ltd. |

1278855 |

|

2001-10-16 |

Custom Signal Inc. |

1076816 |

|

2001-10-16 |

El-Ad Hotels Canada Holdings Ltd. |

1241706 |

|

2001-10-16 |

Granite River Holdings Limited |

414812 |

|

2001-10-16 |

Orchard Park Leaseholds Inc. |

1054772 |

|

2001-10-16 |

1258717 Ontario Inc. |

1258717 |

|

2001-10-16 |

356792 Ontario Limited |

356792 |

|

2001-10-17 |

Craig Nuttall Investments Ltd. |

459618 |

|

2001-10-17 |

Daniel Harrison Associates Inc. |

1024355 |

|

2001-10-17 |

Focal-Link (Int’l) Consultants Ltd. |

1093024 |

|

2001-10-17 |

Precision Professional Driver Training Inc. |

1342089 |

|

2001-10-17 |

Wilcox Diversified Inc. |

475585 |

|

2001-10-17 |

1230597 Ontario Inc. |

1230597 |

|

2001-10-18 |

Bar-Ly Concepts Ltd. |

695425 |

|

2001-10-18 |

Delmoro Management Inc. |

961105 |

|

2001-10-18 |

Excel International Trading Co. Ltd. |

1173150 |

|

2001-10-18 |

Harrowston Marlow Investments Inc. |

1440091 |

|

2001-10-18 |

Penfern Investments Inc. |

917180 |

|

2001-10-18 |

Skyline Estates Limited |

1393858 |

|

2001-10-18 |

Smokers’ Haven Inc. |

1475175 |

|

2001-10-18 |

1096952 Ontario Limited |

1096952 |

|

2001-10-18 |

1184337 Ontario Limited |

1184337 |

|

2001-10-18 |

1226354 Ontario Limited |

1226354 |

|

2001-10-18 |

1285782 Ontario Inc. |

1285782 |

|

2001-10-18 |

744568 Ontario Inc. |

744568 |

|

2001-10-18 |

899567 Ontario Inc. |

899567 |

|

2001-10-18 |

900031 Ontario Inc. |

900031 |

B. G. Hawton,

Director (A), Companies Branch

44/01

Cancellation for Cause (Business Corporations Act)

Notice Is Hereby Given that by orders under section 240 of the Business Corporations Act, the certificates set out hereunder have been cancelled for cause and in the case of certificates of incorporation the corporations have been dissolved. The effective date of cancellation precedes the corporation listing.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2001-10-18 |

Display Ad International Inc. |

1027117 |

|

2001-10-18 |

Edge Wholesale Ltd. |

1159989 |

|

2001-10-18 |

999804 Ontario Limited |

999804 |

|

2001-10-19 |

Journeys North Outfitters, Inc. |

1188672 |

B. G. Hawton,

Director (A), Companies Branch

44/01

Cancellation for Filing Default (Corporations Act)

Notice Is Hereby Given that orders under Section 317(9) of the Corporations Act have been made cancelling the Letters Patent of the following corporations and declaring them to be dissolved. The date of the order of dissolution precedes the name of the corporation.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2001-10-18 |

Halqa-E-Arbab-E-Zouq-Urdu Circle Of Canada |

525922 |

|

2001-10-18 |

The Old Girls Association Of Holy Family Convent Jaffna In Toronto |

897026 |

B. G. Hawton,

Director (A), Companies Branch

44/01

Erratum

Vide Ontario Gazette, Vol. 134-41 dated October 13, 2001.

Notice Is Hereby Given that the notice issued under section 241 (4) of the Business Corporations Act set out in the issue of the Ontario Gazette of with respect to the cancellation of the Certificate of Incorporation of 1381411 Ontario Limited was issued in error and is null and void.

B. G. Hawton,

Director (A), Companies Branch

44/01

Cancellation of Certificate of Incorporation (Corporations Tax Act Defaulters)

Notice Is Hereby Given that, under subsection 241(4) of the Business Corporations Act, the Certificates of Incorporation of the corporations named hereunder have been cancelled by an Order dated 8 October, 2001 for default in complying with the provisions of the Corporations Tax Act, and the said corporations have been dissolved on that date.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

8 October, 2001 |

Premium Springs Corporation |

1115249 |

B. G. Hawton,

Director (A), Companies Branch

44/01

Cancellation of Certificate of Incorporation (Business Corporations Act)

Notice Is Hereby Given that by orders under subsection 241 (4) of the Business Corporations Act, the certificates of incorporation set out hereunder have been cancelled and corporation(s) have been dissolved. The effective date of cancellation precedes the corporation listing.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2001-10-19 |

Artistry Custom Upholstery Inc. |

1423382 |

B. G. Hawton,

Director (A), Companies Branch

44/01

The Insurance Act

Clhia Guidelines On Individual Variable Insurance Contracts Relating To Segregated Funds

Approved By The Canadian Council Of Insurance Regulators And Clhia’s Board Of Directors

March 4, 1997 (as amended on March 7, 2001)

Effective Date

January 1, 2002

Clhia Guidelines On Individual Variable Insurance Contracts Relating To Segregated Funds

Foreword

The disclosure guidelines for Individual Variable Insurance Contracts (“Ivics”) established by the Canadian Council of Insurance Regulators (“Ccir”) and the Canadian Life and Health Insurance Association Inc. (“Clhia”), set out in Clhia Guidelines Nos. 23, 24, 86, 87, 88 and The Canadian Code of Advertising Standards (the “Former Guidelines”), have been revised and consolidated, with the applicable legislation, to produce these Clhia Guidelines on Individual Variable Insurance Contracts relating to Segregated Funds.

With the exception of Part Xiii, Audit and Accounting Requirements and the requirement for financial statements on an audited basis under Part E, Financial Disclosure, of Form 1, these Guidelines shall apply as of July 1, 1997, to all Ivics issued on or before that date. These Guidelines come into full force and effect on January 1, 1998. However, Clhia urges all insurers to note that Part XI, Partitioning of Assets Held in Segregated Funds, and Part XII, Merger of Segregated Funds, have yet to receive the benefit of the proposed amendments to the Income Tax Act that would prevent unwanted dispositions occurring in the hands of contractholders.

Revisions

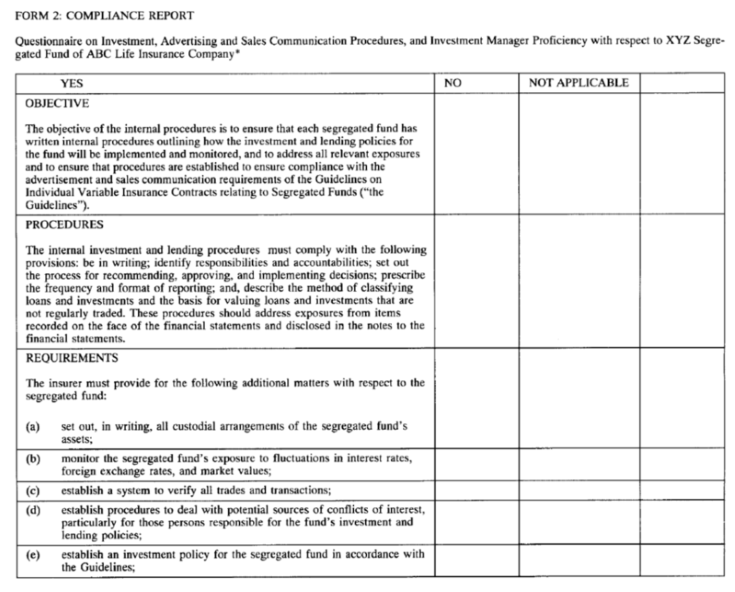

The Guidelines were amended in the following areas: index fund/ concentration limit (ss. 2.1(aa), 2.1(bb), 2.1(nn), 10.1(1)(d), 10.1(2)(b), fundamental changes (ss. 2.1(u), 12.3,Form 1, Item 1 (g)), financial information (ss. 2.1(q), 5.2(b), 5.2(h), 5.4, 5.5, 9.4, Form 1, Item 11, Form 1, Item 21), performance data (ss. 8.13, 8.14, 8.17), manager proficiency (Form 2), fund-of-fund arrangements (ss. 8.11, 8.12, 10.3(2), Form 2 - footnote) and summary fact statement (ss. 2.1(vv)) (the “Guideline Amendments”).

These Guideline Amendments come into full force and effect:

- on December 31, 2001 for individual variable insurance contracts issued pursuant to new and amended Information Folders filed after that date;

- on the first renewal date after December 31, 2001 for contracts issued pursuant to Information Folders re-filed in accordance with Section 4.2 (b); and

- on December 31, 2002 for contracts that are in force but no longer offered by the insurer.

Where the segregated fund is an index funds. 10.1(2)(b) (i) shall be effective April 30, 2001. Section 10.1(1)(d), s. 10.1(2)(b) (ii) and (iii) shall be effective for any new filings after April 30, 2001, or for any re-filings on the normal re-filing date beginning January 1, 2002.

The Guideline Amendments were approved by the Clhia Board of Directors on March 7, 2001.

Non-Application

These Guidelines do not apply to group VICs relating to segregated funds. Matters respecting the training, competence and skill of life insurance agents are not within the scope of these Guidelines.

Part I – Application:

-

-

General:

These Guidelines apply to individual variable insurance contracts that meet the definition provided in Section 2.1 of these Guidelines and, with the exception of Part Xiii, Audit and Accounting Requirements and Part E, Financial Statements, of Form 1, are effective July 1, 1997. From July 1, 1997, until the date the first audited financial statements are due, the financial statements required under Part E, of Form 1, need not be provided on an audited basis. These Guidelines are in full force and effect on January 1, 1998. The first audited financial statements required under Part E, of Form 1, are due four months after the insurer’s fiscal year ending in 1998.

-

Non-Application of Guidelines:

Group variable insurance contracts relating to segregated funds are not subject to the compulsory application of these Guidelines.

In addition, these Guidelines do not apply in respect of individual variable insurance contracts that meet the definition provided in Section 2.1 of these Guidelines, but which are no longer offered for sale to the public on, and after, July 1, 1997, provided that the insurer has ceased all sales of individual variable insurance contracts. In such an instance, the insurer shall, at a minimum, meet the requirements of the former Ccir and Clhia Variable Insurance Contract Guidelines, set out in Clhia Guidelines Nos. 23 and 24, in respect of all existing contracts. Where the insurer continues to sell individual variable insurance contracts generally, but has simply ceased to sell any particular type of its individual variable insurance contracts, the insurer must comply with these new Guidelines for all of its individual variable insurance contracts.

-

Part II – Definitions:

-

-

In these Guidelines,

No sales communication may refer to a segregated fund as a money fund, cash fund or money market fund or imply that a segregated fund is a money market fund unless, at the time the sales communication is used and for each period for which money market fund standard performance data is provided, the segregated fund satisfies the definition of money market fund and it intends to continue to satisfy such a definition;

- “advertisement” includes all printed and electronic:

- descriptive literature produced by, or on behalf of, an insurer in newspapers or magazines, signage, and all radio, television, or electronic messages;

- illustrations, circulars, memoranda, booklets and form letters of all kinds including forwarding and return envelopes or forwarding and return cards mailed by an insurer as a mass advertisement to the public without solicitation; and

- brochures, information folders, summary fact statements or other advertising documents produced for distribution to the public;

- “advisor” means a person(s) or company engaging in or holding himself, herself, themselves or itself out as engaging in advising others as to the investing in or the buying or selling of securities;

- “arm’s length transaction” means a transaction with a non- related party;

- “audit” means the examination of the financial statements of the segregated fund by an independent auditor;

- “auditor” means an accountant who is a member in good standing of an institute or association of accountants incorporated by, or under, an Act of the legislature of a province;

- “Canadian securities” means securities that are not foreign securities;

- “cap” means an agreement obligating the seller to make payments to the buyer, each payment based on the amount by which a reference price or level or the performance or value of one or more underlying interests exceeds a predetermined number, sometimes called the strike rate or price;

- “cash” means:

- cash on deposit at the segregated fund’s custodian, or

- treasury bills or other evidences of indebtedness issued, or fully guaranteed as to principal and interest, by:

-

any of the Federal, Provincial or Territorial Governments of Canada: or

-

the Government of the United States or any political subdivision thereof, the Government of any sovereign state or any supranational agency, provided that such treasury bills or other evidences of indebtedness have an approved credit rating;

all maturing in less than one year; or

-

- an evidence of deposit, maturing in less than one year, issued, or fully guaranteed as to principal and interest, by:

- a bank to which the Bank Act (Canada) applies:

- a loan corporation or trust company registered under applicable federal or provincial legislation; or

- a foreign financial institution; provided that the short term debt instruments of such institution have an approved credit rating;

- “Clhia reviewer” means the person designated by the Canadian Life and Health Insurance Association to review an insurer’s draft individual variable insurance contract documents in accordance with these Guidelines;

- “counterparties” means the party(ies) other than the insurer, on behalf of a segregated fund, to a contract respecting derivatives;

- “counterparty exposure amount” means the net amount of credit risk attributable to a derivative instrument entered into with a business entity other than through a qualified exchange, or cleared through a qualified clearing house (“over-the-counter derivative instrument”). The amount of credit risk equals the following: the potential exposure of the derivative instrument plus:

- the market value of the over-the-counter derivative instrument if the liquidation of the derivative instrument would result in a final cash payment to the insurer; or

- zero if the liquidation of the derivative instrument would not result in a final cash payment to the insurer;

- “covered” means that the insurer owns the underlying interest in order to fulfil or secure its obligations under a call option it has written in an income generation transaction;

- “current yield” means current yield of a money market fund expressed as a percentage and determined by applying the following formula: current yield = [seven day return X 365/7] X 100;

- “derivative” means an agreement, financial option, instrument or any series or combination thereof:

- to make or take delivery of, or assume or relinquish, a specified amount of one or more underlying interests, or to make a cash settlement in lieu thereof; or

- which has a price, performance value or cash flow based primarily upon the actual or expected price, level, performance, value or cash flow of one or more underlying interests.

- “fee option” means any option available to a contractholder under an individual variable insurance contract which results in there being more than one set of fees and charges applicable in respect of a particular segregated fund;

- “fees and charges” means any sales charges, distribution fees, management fees, administrative fees, account set-up or closing charges, surrender charges, transfer fees or any other fees, charges or expenses whether or not contingent or deferred which are or may be payable in connection with the purchase, holding, transferring or redemption of units of a segregated fund;

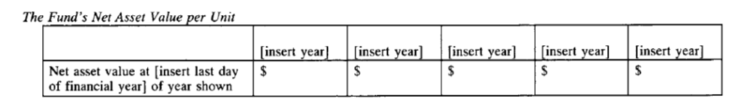

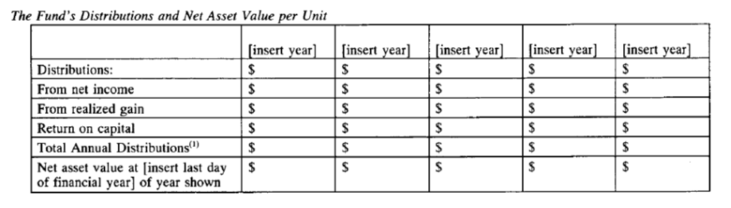

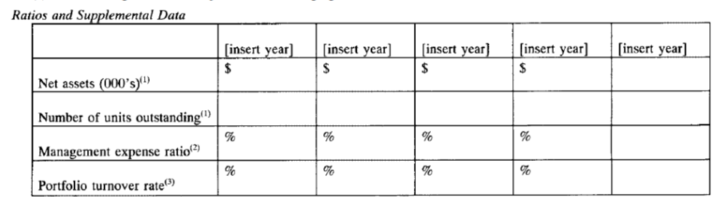

- “financial highlights” means the following information as of the financial year-end of the fund: fund allocations or distributions, net assets of the fund, net asset value per unit, number of units outstanding, management expense ratio and portfolio turnover rate, all as more particularly described in Item 21, Form 1;

- “financial option” means an agreement giving the buyer the right to buy or receive, sell or deliver, enter into, extend or terminate, or effect a cash settlement based on the actual or expected price, level, performance or value of one or more underlying interests;

- “foreign securities” means securities issued by an issuer that is constituted under the laws of a jurisdiction other than Canada or a Province or Territory of Canada and carries on a substantial portion of its activities outside of Canada;

- “forward” means an agreement other than a future to make or take delivery of, or effect a cash settlement based on the actual or expected price, level, performance or value of one or more underlying interests;

- “fundamental investment objectives” means the investment objectives of a segregated fund that define both the fundamental nature of the segregated fund and the fundamental investment features of the segregated fund that distinguish it from other segregated funds;

- “future” means an agreement traded on a qualified exchange, to make or take delivery of or effect a cash settlement based on the actual or expected price, level, performance or value of one or more underlying interests;

- “government securities” means bonds, debentures or other evidences of indebtedness (other than debt-like securities), having a term of one year or more, issued or fully guaranteed as to principal and interest by any of the Federal, Provincial or Territorial Governments of Canada, or the Government of the United States of America, or the bonds, debentures or other evidences of indebtedness (other than debt-like securities) having an approved credit rating and a term of one year or more, issued or guaranteed by the government of any sovereign state or any supranational agency;

- “hedging” means to enter into a transaction, or a series of transactions, the intended effect of which, is the offset or reduction of the risk associated with all or a portion of an existing investment or group of investments. For the transaction to offset or reduce the risk associated with an investment, or group of investments, there must be a high degree of correlation between changes in the market value of the investment, or group of investments, being hedged and the instrument or instruments with which the position is hedged. The term “hedging” shall also include the hedging of all or a portion of the currency exposure of an existing investment or group of investments either directly or by currency cross hedging;

- “illiquid investments” means investments, other than units or shares of a mutual fund or of a segregated fund, which may not be readily disposed of in a marketplace where such investments are normally purchased and sold and public quotations in common use in respect thereof are available;

- “independent qualified appraiser” means a qualified appraiser who:

- has no direct or indirect interest, financial or otherwise, in the real property subject to appraisal or with the party to the real estate-related transaction with whom the insurer is dealing; and

- is not in the full-time employment of the insurer whose segregated fund is being valued, or any associated or affiliated companies of the insurer;

- “index fund” means a segregated fund that has adopted fundamental investment objectives that require the segregated fund to:

- hold the securities that are included in a permitted index or permitted indices of the segregated fund in substantially the same proportion as those securities are reflected in that permitted index or those permitted indices, or

- invest in a manner that causes the segregated fund to substantially replicate the performance of that permitted index or those permitted indices;

- “index participation unit” means a security traded on a stock exchange in Canada or the United States and issued by an issuer the only purpose of which is to:

- hold the securities that are included in a specified widely quoted market index in substantially the same proportion as those securities are reflected in that index, or

- invest in a manner that causes the issuer to replicate the performance of that index;

- “individual variable insurance contract” means an individual contract of life insurance, including an annuity, or an undertaking to provide an annuity, as defined by provincial and territorial insurance statutes and by the Civil Code of Quebec, under which the liabilities vary in amount depending upon the market value of a specified group of assets in a segregated fund, and includes a provision in an individual contract of life insurance under which policy dividends are deposited in a segregated fund;

- “information folder” means a disclosure document in respect of an individual variable insurance contract, the particulars of which are described in Section 5.2 of these Guidelines. No information folder may be forwarded to the applicable insurance regulators unless it has received written pre-clearance from the Clhia, and is in compliance with the provisions of these Guidelines;

- “insurer” means a life insurance company authorized to transact the business of life insurance under the laws of the province or territory in respect of which these Guidelines apply;

- “investment policy” means a written policy of the insurer applying to segregated fund that is the subject of an individual variable insurance contract offered for sale in Canada;

- “listed” means publicly-traded securities listed on a recognized securities exchange;

- “long position”, with respect to:

- clearing corporation financial options, over-the-counter financial options and listed warrants, refers to a segregated fund holding a position which entitles the segregated fund to elect to purchase, sell, receive or deliver the underlying interest (or pay or receive cash in lieu thereof);

- futures and forward contracts, refers to a segregated fund holding a position which obliges the segregated fund to accept delivery of the underlying interest (or pay or receive cash in lieu thereof);

- call financial options on futures, refers to a segregated fund holding a position which entitles the segregated fund to elect to assume a long position in futures; and

- put financial options on futures, refers to a segregated fund holding a position which entitles the segregated fund to elect to assume a short position in futures;

- “manager” means a person(s) or company who has the power or responsibility to direct the affairs of the segregated fund and whose duties include the management of the investment portfolio of the segregated fund(s) and the provision of investment advice in connection therewith;

- “market value”, in Part X on Investments, means:

- as to cash, the amount; and

- as to a security held by a segregated fund, the current price obtained from a generally recognized source, the most recent bid quotation from a generally recognized source, or if no generally recognized source exists, the price for the security as determined by data and assumptions documented by the parties to a transaction, and accrued but unpaid income on the security;

- “material change” means a change in a fact required to be disclosed in the information folder, other than a change in the investments of the segregated fund, that would reasonably be expected to influence or change a decision by a prospective contractholder;

- “maximum credit exposure” means current exposure (mark-to- market) if positive;

- “money market fund” means a segregated fund offered under an investment option under an individual variable insurance contract, and which has and intends to continue to have:

- all of its assets invested in cash or debt obligations maturing in 13 months (25 months for government securities) or less or in floating rate debt obligations where the principal amount of such obligations had a market value of approximately par at the time of each change in the rate to be paid to the holders of such obligations;

- a portfolio with a dollar-weighted average term to maturity not exceeding 180 days;

- not less than 95 percent of its assets invested in cash or securities, which assets are denominated in the same currency as the units of the segregated fund; and

- not less than 95 percent of its assets invested in cash or debt obligations of issuers having an approved credit rating for commercial paper as set out in Schedule 1 attached to these Guidelines.

- “permitted index” means, in relation to a segregated fund, a widely quoted market index that is

- administered by an organization that is not affiliated with the insurer or the manager or advisor of the segregated fund, or

- widely recognized and used;

- “potential exposure” means:

- as to futures positions, or any other such instruments that are traded on recognized exchanges, the amount of initial margin held for such positions;

- as to swaps, collars and forwards, the notional amount times the square root of the remaining years to maturity (residual maturity) times a spread factor of 0.5% for interest rate contracts and 3% for cross currency and equity contracts; or

- for swaps, collars and forward contracts that are structured to settle outstanding exposure following specified payment dates and where the terms are reset so that the market value of the contract is zero on these specified dates, the residual maturity is considered to be the time until the next reset date;

- “qualified appraiser” means an appraiser who has the knowledge, ability, experience and integrity required to complete the assignment competently. Although not requiring the selection of an appraiser with a designated professional qualification, insurers must use appraisers that have the necessary attributes set out below. An insurer’s appraiser selection criteria should ensure that appraisers used to perform an appraisal for the segregated fund are, at a minimum:

- experienced, competent and knowledgeable regarding the real estate market within the area to which the appraisal relates and the type of real estate being appraised; and

- independent of the real estate being appraised and of the person whom the insurer is dealing with in respect to the real estate-related transaction;

- “rating” or “ranking” means the performance rating or ranking of a segregated fund, referred to in a sales communication, as prepared by an independent organization and standard performance data that must be provided for any segregated fund whose rating or ranking is quoted;

- “sales communication” means:

- an advertisement;

- any oral or written communication used by a life insurance agent or insurer to induce the purchase of an individual variable insurance contract; or

- a report to contractholders; but does not include:

- an internal communication between a life insurance agent, portfolio advisor, manager or the insurer which is not designed to be passed onto any contractholder or prospective contractholder; or

- an information folder.

- “secondary fund” means a segregated fund, a mutual fund or other investment fund, including an index participation unit, in which a segregated fund may invest, pursuant to Section 10.3 of these Guidelines;

- “segregated fund” means a separate and distinct segregated fund maintained by an insurer in respect of which the non-guaranteed benefits of an individual variable insurance contract are provided;

- “short position”, with respect to:

- clearing corporation financial options, over-the-counter financial options and listed warrants, refers to a segregated fund having a position which, at the election of another, obliges the segregated fund to purchase, sell, receive or deliver the underlying interest (or pay or receive cash in lieu thereof);

- futures and forward contracts, refers to a segregated fund holding a position which obliges the segregated fund to deliver the underlying interest (or pay or receive cash in lieu thereof);

- call financial options on futures, refers to a segregated fund holding a position which, at the election of another, obliges the segregated fund to assume a short position in futures; and

- put financial options on futures, refers to a segregated fund holding a position which, at the election of another, obliges the segregated fund to assume a long position in futures;

- “summary fact statement” means a brief, narrative summary of a segregated fund’s historical performance, investment policies and the ten largest single holdings;

- “swaps” means a series of forward contracts which obligate two parties to swap or exchange a series of cash flows on specified payment dates. The cash flows are either fixed or calculated by specified reference rates or prices. Interim payments are netted, with the difference being paid by one party to the other;

- “Tips” means the Toronto 35 Index Participations, which are units of a trust created by the Toronto Stock Exchange;

- “unit” means a unit of a segregated fund, attributed to an individual variable insurance contract to measure the participation and corresponding benefits under the contract; and

- “warrant” means financial option to purchase the underlying financial instruments at a given price and time or at a series of prices and times outlined in the warrant agreement. A warrant is issued alone or in connection with the sale of other securities, as part of a merger or recapitalization agreement, and, occasionally, to facilitate divestiture of the securities of another corporation.

- “advertisement” includes all printed and electronic:

-

Part III – Documents To Be Filed With The Clhia

-

-

Preliminary Filing with Clhia:

An insurer that proposes to offer to the public an individual variable insurance contract in any Canadian jurisdiction shall file, in draft form, with the Clhia reviewer,

- the documents evidencing the individual variable insurance contract;

- the summary fact statement for each segregated fund described in the information folder, and other relevant documents, such as any endorsements for registered, individual variable insurance contracts; and

- the information folder, as described in Section 5.2, to be used by the insurer in connection with the sale of that type of individual variable insurance contract including the form of certificate to be signed by any two of the Chief Executive Officer, Chief Investment Officer, Chief Financial Officer or Secretary of the insurer or a director or officer appointed for the purpose.

-

Review for Compliance with Guidelines:

The Clhia reviewer shall examine the original documents or any material change to an information folder previously filed with an Insurance Regulator for compliance with these Guidelines within 30 days from the date of their receipt from the insurer. Any previously-filed information folder and any other previously- filed revised document submitted to the Clhia reviewer must be in draft form and include both a clean copy, and a blackline version setting out the changes.

-

Examination Letter to Insurer:

Where the draft documents do not meet the requirements set out in these Guidelines, or require further changes, the Clhia reviewer shall forward an examination letter to the insurer indicating the nature of the non-compliance.

-

Amendments and Re-Submission:

Upon receiving the letter referred to in Section 3.3, the insurer shall make any necessary changes to the draft documents and re- submit them to the Clhia reviewer for further examination and possible comment.

-

Copies for Submission to Insurance Regulators:

Once the Clhia reviewer is satisfied that the insurer’s draft documents are in compliance with these Guidelines and suitable for filing with the applicable Insurance Regulators, the insurer shall forward to the Clhia reviewer sufficient copies thereof for submission to the applicable Insurance Regulators, in compliance with Part IV of these Guidelines, accompanied by the insurer’s submission letters addressed to each Insurance Regulator. Blackline and clean copy versions should be included in respect of any previously-filed document with material changes. Note that French language versions of the draft documents are required for submission to Quebec and New Brunswick.

-

Filing of Draft Documents with Clhia Comfort Letter:

The Clhia reviewer shall forthwith submit the insurer’s draft documents, along with the Clhia comfort letter, to each applicable Insurance Regulator in compliance with Part IV of these Guidelines, as requested by the insurer.

-

Response by Insurance Regulator:

Any correspondence from an Insurance Regulator regarding the draft documents will be sent directly to the submitting insurer with a copy forwarded by the insurer to the Clhia reviewer. The insurer shall respond directly to any comments received from an Insurance Regulator and forward a copy of the correspondence to the Clhia reviewer.

-

Filing of Final Documents with Clhia Transmittal Letter:

The Clhia reviewer shall forthwith file the final printed versions of the insurer’s documents, together with the Clhia transmittal letter, with the applicable Insurance Regulators upon receipt from the insurer of:

- the final printed versions of the documents with the information folder duly certified by the insurer;

- a copy of the Insurance Regulator’s certificate where such certificate is required to be issued to the insurer under the applicable legislation of a particular jurisdiction; and applicable legislation of a particular jurisdiction; and

- in respect of any jurisdiction where an Insurance Regulator’s certificate is not required to be issued, written confirmation that at least 30 days have elapsed since the date the draft documents were submitted to the Insurance Regulator of a particular jurisdiction in accordance with Section 3.6 and that the insurer has not, in the meantime, received written notice from the Insurance Regulator that the documents are not acceptable for filing.

Once filed, the insurer may offer the individual variable insurance contract for sale in the particular jurisdiction.

-

Part IV – Documents To Be Filed With The Insurance Regulator

-

-

Filing of Draft Documents with Insurance Regulator:

Subject to compliance with the requirements of Part III of these Guidelines, an insurer that proposes to enter into an individual variable insurance contract in a particular jurisdiction shall, at least 30 days before offering to enter into such a contract, file, in draft form, with the Insurance Regulator of the jurisdiction,

- the documents evidencing the individual variable insurance contract; and

- the information folder, as described in Section 5.2, to be used by the insurer in connection with the sale of that type of individual variable insurance contract certified by any two of the Chief Executive Officer, Chief Investment Officer, Chief Financial Officer or Secretary of the insurer or a director or officer appointed for the purpose, and the summary fact statement for each segregated fund described in the information folder.

-

Re-Filing of Information Folder:

Subject to compliance with the requirements of Part III of these Guidelines with respect to a material change, an insurer that has filed an information folder in respect of an individual variable insurance contract shall, as long as it continues to offer to enter into that type of individual variable insurance contract, file with the applicable Insurance Regulator a blackline copy and a clean copy of a new information folder in respect of that type of individual variable insurance contract certified as provided in Section 4.1 and the executed Compliance Report in accordance with Form 2;

- forthwith upon any material change in the latest information folder filed in respect of that type of individual variable insurance contract; and

- within

- one year and one month after the date of filing of the latest information folder, or

- ixteen months of the date of the audited financial statements contained in the latest information folder, whichever is the earlier.

-

Part V – General Disclosure Requirements:

-

-

Contract Disclosure:

The documents evidencing an individual variable insurance contract shall:

-

on the cover or face page of the contract, include the following warning statement in bold, capitalized print:

“Subject To Any Applicable Death And Maturity Guarantee, Any Part Of The Premium Or Other Amount That Is Allocated To A Segregated Fund Is Invested At The Risk Of The Contractholder And May Increase Or Decrease In Value According To Fluctuations In The Market Value Of The Assets Of The Segregated Fund.”

- describe the benefits under the individual variable insurance contract and indicate which benefits are guaranteed and which benefits are not guaranteed but fluctuate with the market value of the assets of the segregated fund supporting them;

- tate,

- the method of determining the benefits related to the market value of the segregated fund and the amount of the surrender value of these benefits, and

- where provision is made for part of the premium to be allocated to provide the benefits related to the market value of the segregated fund, the percentage of the premium so allocated;

- state the times, which shall not be less than once monthly, at which the segregated fund shall be valued and at which the value of the benefits related to the market value of the segregated fund may be determined; and

- describe the fees and charges, or methods of determining the fees and charges, against the segregated fund for taxes, management, or other expenses.

-

-

Information Folder Disclosure:

The information folder relating to an individual variable insurance contract shall,

- present in clear and plain language, without reference to technical terms where possible or to inapplicable items, the information required by Form 1 in an order appropriate to best describe the contract itself and not necessarily in the order provided in Form 1, except with respect to Item 1;

- contain or be accompanied by the Financial Highlights required by Item 21 of Form 1, with a statement that the audited financial statements and notes to the audited financial statements required by Items 16, 17, 18, 19 and 20 of Form 1 are available upon request, both as of a date not earlier than the fiscal year of the fund just ended; if the audited financial statements are available electronically, the contractholder can choose to receive such statements in hard copy format or by electronic transmission;

- contain the title “Information Folder” on the cover or face page with a separate statement that the information folder is not an insurance contract;

-

contain, on the first page immediately following the cover or face page, a one-page executive summary of the folder’s highlights in bullet form. This executive summary is not permitted to be a separate document. This executive summary must advise the reader to review the audited financial statements for the segregated fund and include the following statement informing contractholders of their basic rights:

“A description of the key features of the individual variable insurance contract is contained in this information folder. Subject to any applicable death and maturity guarantee, any part of the premium or other amount that is allocated to a segregated fund is invested at the risk of the contractholder and may increase or decrease in value according to the fluctuations in the market value of the assets of the segregated fund.”;

- contain a brief summary of each segregated fund’s investment policy, as described in Section 10.1 (1) including a statement advising the prospective contractholder that a detailed description of each segregated fund’s investment policy is available upon request from the insurer with specific information as to how it can be accessed or obtained;

- comply with the requirements of Part Viii, Advertising;

- contain or be accompanied by a summary fact statement for each segregated fund; and

- indicate that the semi-annual unaudited financial statements are available upon request, and if available electronically, the contractholder can choose to receive such statements in hard copy format or by electronic transmission.

-

Real Estate Segregated Fund Disclosure:

The information folder offering individual variable insurance contracts relating to a real estate segregated fund shall:

- emphasize the long-term nature of an investment in a real estate segregated fund;

- state that such individual variable insurance contracts can be redeemed only on specified dates and only on a specified number of days prior notice as provided in the contracts and accordingly are not a suitable investment for contractholders who require ready convertibility of their funds into cash;

- state that redemption of individual variable insurance contracts may be suspended during any period that the segregated fund does not have sufficient cash or readily marketable securities to meet requests for redemptions;

- state that the net asset value at which individual variable insurance contracts are issued and redeemed is based upon appraisals of the real property; that for any given real property there is a range of market values; that an appraisal is an opinion only and that there can be no assurance that the appraised value will be equal to the price for which the property is ultimately sold; and

- state that the net asset value per individual variable insurance contract for the purchase or redemption of individual variable insurance contracts may differ from the amounts that would be paid to contractholders on dissolution of the fund.

-

Annual Statement to Contractholder:

The insurer shall furnish to the contractholder, within four months of each successive fiscal year end of the fund insurer, a statement showing the following:

- the information required by Form 1, Item 11;

- the management expense ratio with a brief explanation thereof;

- the value of the benefits under the contractholder’s individual variable insurance contract related to the market value of the segregated fund at the end of the period covered by the statement;

- the amount, if any, allocated under the contractholder’s individual variable insurance contract to a segregated fund during the period covered by the statement;

- the overall rate of return, calculated on a net basis, for the segregated fund for the last 1, 3, 5 and 10 year periods, if applicable;

- the most recent audited financial statements of the fund;

- a statement that semi-annual unaudited financial statements are available upon request; and

- if the insurer specifies an insurance fee limit pursuant to Section 12.3(4)(b), the changes to the insurance fee in accordance with Section 12.3(4)(c).

-

Semi-Annual Financial Statements:

The insurer shall, upon request, make available to each applicable Insurance Regulator copies of the semi-annual unaudited and audited financial statements.

-

Part VI – Delivery Of Documents To Prospective Contractholder:

-

-

Delivery of Information Folder:

Before an application for an individual variable insurance contract is signed by a prospective contractholder, a true copy of the corresponding information folder then on file with the Insurance Regulator of the particular jurisdiction, pursuant to Part IV of these Guidelines, shall be delivered to the prospective contractholder.

Where a contract is not an individual variable insurance contract at issue but is subsequently amended to become an individual variable insurance contract upon application by the contractholder for such amendment, a true copy of the corresponding information folder then on file, pursuant to Part IV of these Guidelines, shall be delivered to the contractholder prior to the effective date of such amendment, if not previously delivered.

-

Acknowledgement of Receipt of Information Folder:

The insurer shall, at the time of delivery, obtain from any person to whom an information folder is delivered in compliance with Section 6.1 of these Guidelines a signed statement in writing acknowledging that he or she has received a copy of such information folder.

-

Provision of Summary Fact Statement:

A summary fact statement in respect of each segregated fund must be given to the prospective contractholder at the time of delivery of the information folder. The summary fact statement may either be a separate document or appear as part of the information folder.

-

Requirements for Other Written Documents:

Where a prospective contractholder is furnished with any other type of written document that is a direct inducement to purchase a particular individual variable insurance contract such document shall:

- be consistent with the relevant provisions of that particular contract and Part Viii, Advertising, of these Guidelines; and

- contain the following warning set out in bold, capitalized print:

‘Subject To Any Applicable Death And Maturity Guarantee, Any Part Of The Premium Or Other Amount That Is Allocated To A Segregated Fund Is Invested At The Risk Of The Contractholder And May Increase Or Decrease In Value According To Fluctuations In The Market Value Of The Assets In The Segregated Fund’.

-

Part VII – Corporate Governance Of Segregated Funds:

-

- An insurer that establishes and maintains a segregated fund as a fund for investment under individual variable insurance contracts shall:

- prepare the segregated fund’s financial statements, described in Part Xiii of these Guidelines, annually;

- appoint an auditor to make such examination as the auditor considers necessary to enable the auditor to report on the segregated fund’s financial statements;

- monitor the quality of internal controls in place for the segregated fund;

- ensure that the segregated fund has an investment policy in accordance with Part X of these Guidelines, and monitor the segregated fund for compliance with that policy;

- review any partitions or mergers of segregated funds as described in Part XI or Part XII of these Guidelines; and

- make available explanatory materials to life agents.

- An insurer that establishes and maintains a segregated fund as a fund for investment under individual variable insurance contracts shall:

Part VIII – Advertising:

-

-

Advertising:

No insurer or agent shall give any undertaking or make any promises as to the future value of a segregated fund, of any interest in a segregated fund, or of any benefit supported by a segregated fund except with respect to a guarantee for the return of all or portion of the premiums on death or at maturity as provided for under the individual variable insurance contract.

-

Unfair and Deceptive Acts and Practices:

No insurer may engage in any unfair or deceptive acts or practices including:

- the issuance of any illustration, circular, memorandum or statement that misrepresents, or omits material information and thus misrepresents, terms, benefits or advantages of any individual variable insurance contract issued or to be issued;

- the giving of any false or misleading statement as to the terms, benefits or advantages of any individual variable insurance contract issued or to be issued;

- he making of any incomplete comparison of an individual variable insurance contract with that of any other insurer for the purpose of inducing, or intending to induce, a contractholder to forfeit or surrender his or her contract;

- the making of any incomplete comparison of an individual variable insurance contract with other investment vehicles, that is so incomplete that it misrepresents the individual variable insurance contract’s terms, benefits or advantages;

- the making of any advertisement which, directly or indirectly, unfairly criticizes the contracts, services or methods of its competitors; or

- the doing of any other activity or the failure to do an act that may be deemed to be an unfair or deceptive act or practice by any applicable legislation of a particular jurisdiction.

-

Words or Sentences Used in Advertisements

The words or sentences regarding life insurance coverage under an individual variable insurance contract must be explained in the advertisement. Expressions commonly used in individual variable insurance contracts must also be used in advertisements respecting such contracts.

-

Clarity of Written Advertisements:

All information in written advertisements must be clearly presented and correspond with the statements relating thereto or be grouped under appropriate headings so that the advertisement is factual and the text of the advertisement is comprehensible and coherent.

-

If Advertisement Lists Advantages, Must Also List Limitations:

When an advertisement mentions any advantage, such as the nature of the coverage, the benefits payable or any other advantage attached to the individual variable insurance contract or to one of its provisions, it must also fairly disclose, in close proximity, and in the same manner, any limitations, exceptions or reductions which affect the nature of the coverage.

-

Advertisements that State Term or Age as a Condition:

An advertisement respecting an individual variable insurance contract, whether purchased as a registered or non-registered policy, shall provide the prospective contractholder with adequate information respecting the issue date of the contract, particularly as it relates to the prospective contractholder’s age.

An advertisement for a Registered Retirement Savings Plan (“Rrsp”) which states a term or age as a condition of the validity of the contract shall indicate that it must convert to an annuity or a Registered Retirement Income Fund (“Rrif”) before the end of the year in which the insured attains the age limit specified in the applicable income tax legislation.

-

Advertisement Referring to Renewal, Cancellation or Termination:

An advertisement which refers to renewal, cancellation or termination of an individual variable insurance contract shall describe the provisions of the contract which are related thereto.

-

Advertisement Not to be Misleading:

No advertisement shall:

- contain false, misleading, unwarranted or exaggerated statements, either directly or by implication;

- make misleading or inaccurate presentations;

- conflict with any information contained in an information folder or in a sales communication;

- contain false or misleading testimonials;

- disparage another company’s product;

- deliberately imitate the text, slogans or illustrations of other advertisers in order to mislead the consumer;

- change or distort the true meaning of statements by actuarial, technical, medical or professional authorities;

- use technical or industry terminology without consideration of the level of comprehension of the public;

- contain statements that appear to have an actuarial or technical basis when, in fact they do not;

- offer guarantees of any kind unless the conditions and limits are fully explained;

- include statements likely to mislead the public to believe that the benefits may be greater than those provided for in the contract;

- include statements likely to mislead as to the amounts of benefits paid, the number of persons insured or other statistical information respecting an insurer or an insurance contract; or

- use statistics without clearly identifying their source.

-

Testimonials:

Testimonials used in an advertisement must be of a general nature, be authentic and express the current opinion of the author of the testimony at that time. Where a testimonial or a recommendation is paid for directly or indirectly by the insurer, or someone on its behalf, the advertisement shall so state. When using a testimonial, the insurer shall be deemed to assume as its own all of the statements contained therein.

-

Advertisement to Establish Real Identity:

An advertisement shall establish the real identity of the insurer and must not mention any device which is misleading in relation to a trade name, service mark, slogan or symbol. It shall also contain the date of its first publication.

-

Advertisement of Fund-of-Fund Arrangements:

All advertisements with respect to fund-of-fund arrangements, as described in Section 10.3, shall prominently state the name of the insurance company that issued the contract.

-

Insurer’s Corporate Name:

The insurer’s corporate name shall be displayed more prominently than any other entity and printed in full in an advertisement and must be prominently shown on any accompanying application for an individual variable insurance contract.

-

Text Requirements and Warnings:

Disclaimers or asterisked information in a written advertisement should be so located and large enough to be clearly visible. All warnings and disclaimers shall be at least 10-point type if contained in a written sales communication, or clearly displayed and audible or visible for a reasonable period of time if broadcast or delivered by way of an electronic medium.

All other text in a written sales communication shall be at least 10-point type.

All sales communications, whether written, or delivered by way of electronic media, shall include the prescribed warning (with appropriate modifications by an insurer selling a life insurance contract or an immediate annuity contract that provides for investment in a segregated fund), as set out Section 5.2(d) except in circumstances where the sales communication does not contain any performance data and the warning would constitute more than 50% of the sales communication.

-

Provisions for Registered and Non-Registered Individual Variable Insurance Contracts:

An insurer shall:

- indicate in the information folder in respect of registered, individual variable insurance contracts that such contracts are one of a number of different vehicles for the accumulation of retirement income;

-

whenever tax saving, as opposed to tax sheltering or deferral, is described as an advantage of a registered, individual variable insurance contract, indicate that ultimately all benefits received shall be added to income for tax purposes;

“Performance data” means any rating, ranking, quotation, discussion or analysis regarding rate of return, yield, volatility or other measurement or description of the investment performance of a segregated fund.

No advertisement may contain performance data unless it complies with the following guidelines:

-

- the segregated fund has been available for investment for at least 12 months; or

- if the segregated fund invests in secondary funds, at least 80% of the number of secondary funds in which it invests have been available for investment for at least 12 months, provided that where all of the underlying funds have not been so available the advertisement clearly states that the indicated performance does not represent all of the underlying funds for the period and indicates which funds are not included; or

- if either (i) or (ii) cannot be complied with, the advertisement may only be sent to contractholders of such segregated fund or contractholders of other segregated funds under common management with the segregated fund;

- no advertisement pertaining to a segregated fund for which there are different classes or series of units available pursuant to an Information Folder shall contain performance data unless:

- the advertisement clearly specifies the class or series of units to which any performance data contained in the advertisement relates; and

- if the advertisement relates to more than one class or series of units and provides performance data, then the advertisement provides performance data for each class or series of units and clearly explains the reasons for different performance data among the classes or series; and

- an advertisement for a new class or series of units of a segregated fund that pertains to the same investment portfolio as an existing class or series of units shall not contain performance data relating to the existing class or series unless the advertisement clearly explains any differences between the new class or series and the existing class or series that could affect performance;

- if there have been any changes during the performance measurement period in the segregated fund’s management, fundamental investment objectives, characterization as a money market fund, or in any portfolio advisor or in the ownership of the insurer or in fees or charges, including the waiving or absorbing of fees or charges, that would or could reasonably be expected to have materially affected the segregated fund’s performance, the advertisement shall contain:

- summary disclosure of the change or a statement to the effect that the segregated fund has undergone changes during the performance measurement period which would or could have [insert as appropriate: affected/increased/decreased] the segregated fund’s performance had those changes been in effect throughout the period; and

- for a money market fund which during the performance measurement period did not pay or accrue the full amount of fees and charges payable by the segregated fund, or any recurring fees and charges that are payable by all contractholders, disclosure of the difference between such full amounts and the amounts actually charged, expressed as an annualized percentage on a basis comparable to current yield; or

- for other than a money market fund, a description of the method used in calculating the performance data during the performance measurement period and a statement that the calculation has been performed on a net basis and indicating any fees and charges that have been deducted in performing the calculation;

- where the advertisement is not a report to contractholders and relates to a money market fund, the standard performance data which is given shall be calculated for the most recent 7 day period for which it is practicable to calculate the standard performance data taking into account publication deadlines, provided that this 7 day period is not more than 3 months prior to the date of the appearance or use of the advertisement in which it is included and not more than 3 months prior to the date of first publication of any other advertisement in which it is used;

- for other than a money market fund, the indicated rate of return shall be the historical annual compound total return including changes in unit value and reinvestment of all dividends or distributions but not taking into account sales, redemption, distribution or optional charges payable by any contractholder which would have reduced returns;

- where performance data is advertised, comply with Section 8.1 and include the prescribed warning set out in Section 5.2(d), and indicate:

- where an illustration of growth rates of a segregated fund is based upon the past performance of a segregated fund itself or of similar funds or of one or more indices, it shall also be made clear that such past results should not be construed as being indicative of the future performance of the segregated fund;

- performance data must be reported, at a minimum, on a 1, 3, 5 and 10 year basis. Where a segregated fund has not been in existence for 10 years, then its performance data should be reported, at minimum, on a 1, 3 and 5 year basis, and since inception, or as is applicable; and

- performance data which is provided must, at a minimum, be for the 1, 3, 5, and 10 year periods, or as is applicable, ending on a calendar month not more than 3 months prior to the date of first publication;

- where performance data is advertised with respect to investments over a stipulated period of time, indicate also any qualification which would prevent redemptions prior to expiry of such period;

- where withdrawal privileges for investments in a segregated fund are advertised, indicate any qualification preventing withdrawal of the redemption request;

- where fees or charges are referred to, include a statement listing all fees and charges which are applicable;

- where costs or commissions on sales of individual variable insurance contracts are referred to as applying or not applying, include a statement listing all fees and charges applicable to those sales. Where a withdrawal charge is applicable, include a statement listing the charge;

- where describing an individual variable insurance contract as suitable for registration (e.g. as an Rrsp), include the following statements:

- if applicable, that certain of its regular contractual benefits may be required to be modified under the terms of an endorsement upon registration;

- that registered life insurance contracts may be more suitable as a means of long duration investment rather than short duration;

- that the prospective contractholder discuss fully all aspects of registration with the insurer or agent before the purchase of any registered, individual variable insurance contract; and

the insurer shall not refer to immediate tax saving as the primary reason for purchasing registered, individual variable insurance contracts, such as RRSPs, nor shall the insurer emphasize deregistration soon after the contract is issued.

-

Performance Comparisons for Segregated Funds:

A sales communication or advertisement that compares the performance of one or more segregated funds to a consumer price index, any stock, bond or other index, average, or any guaranteed investment certificate or other certificate or deposit, real estate or any other investment of any kind or nature, including another segregated fund, shall:

- include all facts that, if disclosed, would likely materially alter conclusions reasonably drawn or implied by the comparison;

- present data for each subject of comparison for the same period(s); and

- where the performance of an index or average is compared, if appropriate in view of the nature of the comparison, describe the index or average, point out if there are material differences between the composition of or calculation of the performance of the index or average and the investment portfolio of the segregated fund and state any other factors to make the comparison fair and not misleading.

-

Illustrations:

An illustration presenting any prospective accumulation of the value of contributions to an individual variable insurance contract shall include a statement that the accumulation may be used at maturity to provide an annuity, or if it is a life insurance product, shall include a statement that the accumulation may provide a death benefit, and, in either case, shall also state the rate of growth assumed in calculating the illustration and shall also state whether or not any guarantee applies in whole or in part, and the nature of such guarantee.

The contents of an illustration must meet the minimum requirements set forth in the Clhia’s Guideline for Life Insurance Illustrations, as may be amended from time to time.

-

Standard Performance Measurement Presentation:

The standard performance data of a segregated fund shall be calculated and disclosed in accordance with the Best Practices Guidelines – Performance Data, such guidelines to be jointly approved by the Ccir and the Clhia.

-

Part IX – Retail Remuneration:

-

-

Insurer Shall Obtain Written Agreement from Agent:

An insurer offering individual variable insurance contracts for sale through agents or brokers shall have a written agreement (the “agent’s agreement”) with each agent or corporate agency authorized to sell individual variable insurance contracts.

-

No Unauthorized Advertisements:

No advertisement shall be published and no pamphlet or booklet concerning or referring to an insurer’s individual variable insurance contracts shall be issued, displayed or circulated by the agent unless prior authorization is obtained in writing from the insurer. The insurer remains bound by the rules pertaining to Advertising as set out in Part VIII of these Guidelines.

-

“Trailer” or Service Fees:

Where an agent is entitled to receive “trailer” or service fees from the insurer or the manager of the segregated fund, and these fees are charged to the assets of the segregated fund, this fact shall be disclosed to prospective contractholders in the information folder, along with an explanation of the services that they can expect to receive as a result.

The insurer shall provide the particulars of such fees in the information folder, in accordance with Form 1, Item 12, if the fees are charged to the assets of the segregated fund.

-

Management Expense Ratio:

- The audited financial statements for a segregated fund shall set out in tabular form the management expense ratio for each fee option under an individual variable insurance contract for each of the last five completed financial years of the segregated fund, together with a brief description of the method of calculating the management expense ratio.

- Where the basis of the calculation of fees and charges and other expenses that are charged to a segregated fund are changed or proposed to be changed and where such change would have a material effect on the management expense ratio for the last completed financial year of the segregated fund if such change had been in effect for such year, the information folder shall disclose the effect of such change.

- Where any financial period referred to in Section 9.4(1) is less than 12 months, the management expense ratio shall be shown on an annualized basis with reference to the period covered and to the fact that the management expense ratio for the period has been annualized.

- The management expense ratio of a segregated fund applicable to a particular fee option under an individual variable insurance contract for any financial year shall be obtained by dividing (i) the aggregate of all fees and charges and other expenses paid or payable by the segregated fund during or in respect of the financial year in question which relate to that particular fee option, by (ii) the amount of the average net asset value of the segregated fund attributable to the particular fee option for the financial year in question and multiplying the quotient by 100. For the purpose of making this calculation:

- the expression “the average net asset value of the segregated fund attributable to the particular fee option for a financial year” means the result obtained by:

- adding together the amounts determined to be the net asset value of the segregated fund attributable to the particular fee option as at the close of business of the segregated fund on each day during the financial year in question on which the net asset value of the segregated fund has been determined in the manner from time to time as described in Item 2 of Form 1;

- dividing the amount resulting from the addition provided for in clause (i) by the number of days during the financial year in question on which the net asset value has been determined;

- or the purposes of Section 9.4, the expression “all fees and charges and other expenses” means all fees and charges paid or payable by the segregated fund and all expenses incurred in the ordinary course of business relating to the organization, management and operation of the segregated fund including interest charges (if any) and all taxes other than income taxes, but excluding commissions and brokerage fees on the purchase and sale of portfolio securities;

- If any fees and expenses otherwise payable by a segregated fund in a financial year were waived or otherwise absorbed by the insurer, the fund shall disclose in a note to the disclosure of its management expense ratio, details of:

- what the management expense ratio would have been without any waivers or absorptions;

- the length of time that the waiver or absorption is expected to continue;

- whether the waiver or absorption can be terminated at any time by the insurer; and

- any other arrangements concerning the waiver or absorption;

- A segregated fund that has separate classes or series of units shall calculate a management expense ratio for each class or series, in the manner required by this section, modified as appropriate; and

- The management expense ratio of a segregated fund for a financial year of less than 12 months shall be annualized.

- the expression “the average net asset value of the segregated fund attributable to the particular fee option for a financial year” means the result obtained by:

- The audited financial statements of the segregated fund shall set out in appropriate detail the amounts of all fees and charges and other expenses, if any, which have been charged to the segregated fund during the period covered by the financial statements.

-

Part X – Investments:

-

-

Investment Policy of the Segregated Fund:

- The insurer shall include a brief statement in the information folder of the investment policy of the segregated fund addressing each of the following matters:

- the objectives of the segregated fund including the investment style or parameters of the investment portfolio;

- use of the segregated fund’s earnings;

- disclosure, at a minimum, of the following principal risks, if applicable to the segregated fund: interest rate risk; foreign currency risk; credit risk; sovereign risk; market risk; special equities risk; real estate risk; and derivative risk. State whether or not the segregated fund uses leverage, and if so, the manner by which it controls the risk related to this leverage (e.g., use of secondary funds, diversification, etc.); and

- where the segregated fund is an index fund, disclosure that as a result of investment decisions for the segregated fund being based on one or more permitted indices, the segregated fund may have more of the net assets of the segregated fund invested in one or more issuers than is usually permitted for segregated funds, and disclosure of the risks associated with that fact, including the possible effect of that fact on the liquidity and diversification of the segregated fund, the ability to satisfy redemption requests and on the volatility of the segregated fund.

- The insurer shall abide by all of the following limits:

- the sum of the segregated fund’s exposures to any one corporate entity may not exceed 10% of the value of the fund. Exposure may take the form of securities issued by the entity, loans to the entity recorded on the face of the financial statements or credit exposure (expressed as “credit equivalent amount”) to the entity;

- Section 10.1(2)(a) above shall not apply to a segregated fund that:

- is an index fund;

- includes the word ‘index’ in the name of the fund; and

- discloses the derivative investment strategy, if the fund employs a derivative investment strategy to match the index;

- as a matter of investment policy, at the time of making an investment, an insurer shall not seek to invest in the securities of a company in order to exercise control or management of it. However, should an insurer ultimately gain control or management of a company due to market forces, such as through realization procedures, such a circumstance is not prohibited;

- where more than 10% of the market value of the segregated fund is or will be invested in mortgages, state the method used to determine the market value of the mortgages. This method must provide for the categorization of mortgages based on risk, and within each category, mortgages are to be valued at a principal amount based on the following: the prevailing rate of return; the duration; the relationship between the current interest rates and the interest rate of the mortgage for that category; and, the statutory requirements relating to wrap-around mortgages, where applicable; and

- where more than 10% of the market value of the fund is or will be invested in real estate for the production of income, state the method used to determine the market value of the real estate. This method must include the following: the initial market value shall be equal to the cost of acquiring the real estate including professional fees and other costs; each parcel of real estate must be appraised by an independent qualified appraiser at least once every 3 years; each parcel of real estate must be appraised at least once a year by a qualified appraiser and may include an updating of previous appraisals; for dates where no appraisal is available, the insurer must provide a monthly market value; all appraisals in any one year must be scheduled at regular intervals over the year; where a material change in the condition of any real estate held in the segregated fund occurs that could materially affect the fund’s market value, the insurer must immediately arrange for an appraisal by an independent qualified appraiser of such real estate and adjust the valuation of it at the next monthly valuation date after the appraisal is made.

- The insurer shall include a brief statement in the information folder of the investment policy of the segregated fund addressing each of the following matters:

-

Derivatives:

- Use of Derivatives Instruments in an Unlevered Portfolio:

- Where the investment policy of a segregated fund states that leverage will not be used, the notional amount of derivatives used by the segregated fund shall not exceed 100% of the value of the net assets of the segregated fund, subject to a short-term 2% variation depending on movements in the foreign exchange value of the currency in which the units of the fund are offered. In those instances, where derivatives add to the market exposure of the segregated fund (e.g., through a long position in a futures contract, swaps, call financial options, or a short position in a put financial option), the segregated fund will hold cash which together with any margin on account are equal to the notional value of any derivative instrument held. Where the derivatives provide negative market exposures to the segregated fund (e.g., a short position in a futures contract, swap, call financial option or a long position in a put financial option), the segregated fund must hold a position in the underlying instrument in the portfolio or an equivalent long position equal to the notional value of the derivatives instrument held.

- Derivatives may be used in hedging positions recorded on the face of the financial statements and positions disclosed in the notes to the financial statements, to generate income (by sale of covered calls) or for replication of an index.