Government Notices Respecting Corporations

Certificates of Dissolution

Notice Is Hereby Given that a certificate of dissolution under the Business Corporations Act, has been endorsed. The effective date of dissolution precedes the corporation listings.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2002-05-21 |

Sylmo Holdings Inc. |

90081 |

|

2002-05-22 |

Frank Thomson And Son, Limited |

105477 |

|

2002-05-22 |

Jewelry In The Box Inc. |

1415132 |

|

2002-05-22 |

Russ Andrus Auto Service Ltd. |

564239 |

|

2002-05-23 |

1017526 Ontario Limited |

1017526 |

|

2002-05-27 |

Peter’s Janitor Service Ltd. |

333564 |

|

2002-05-27 |

262663 Ontario Limited |

262663 |

|

2002-05-28 |

Christine Holdings Incorporated |

635365 |

|

2002-05-28 |

Thrifty Canada Inc. |

1448168 |

|

2002-05-28 |

642919 Ontario Limited |

642919 |

|

2002-05-29 |

Cheyne Global Computerization Ltd. |

967620 |

|

2002-05-29 |

1297921 Ontario Limited |

1297921 |

|

2002-05-29 |

1427499 Ontario Inc. |

1427499 |

|

2002-05-31 |

Aspen Contracting Limited |

884366 |

|

2002-06-03 |

Castleton Products Inc. |

1106084 |

|

2002-06-03 |

H. B. Forfar Construction Limited |

123438 |

|

2002-06-04 |

Murden Metals Company Limited |

603961 |

|

2002-06-05 |

891137 Ontario Limited |

891137 |

|

2002-06-07 |

Lawton Residential Ltd. |

780826 |

|

2002-06-07 |

Mckler Enterprises Inc. |

621796 |

|

2002-06-07 |

Scotus Inc. |

717415 |

|

2002-06-07 |

Tci Oem Services, Inc. |

729766 |

|

2002-06-10 |

Exin Trading Ltd. |

1141210 |

|

2002-06-10 |

Genelco Investments Limited |

205382 |

|

2002-06-10 |

Logicability Inc. |

1002662 |

|

2002-06-10 |

North Star Capital, Corp. |

1053394 |

|

2002-06-10 |

Sunhat Holdings 2002 Inc. |

2008162 |

|

2002-06-10 |

746984 Ontario Inc. |

746984 |

|

2002-06-11 |

G.A. Heating Ltd. |

308200 |

|

2002-06-11 |

H.K. Bergmann Incorporated |

412741 |

|

2002-06-11 |

Hannigan’s Sports & Repair Ltd. |

521677 |

|

2002-06-11 |

Kistar International Ltd. |

1222299 |

|

2002-06-11 |

Martin Barkin Holdings Limited |

479471 |

|

2002-06-11 |

1314332 Ontario Limited |

1314332 |

|

2002-06-11 |

902529 Ontario Inc. |

902529 |

|

2002-06-12 |

Bravo Communications Inc. |

1054705 |

|

2002-06-12 |

Dartwell Corporation |

841952 |

|

2002-06-12 |

Don-Len Plastics Inc. |

968957 |

|

2002-06-12 |

Mayhurst Realty Limited |

236998 |

|

2002-06-12 |

Nortek Design Inc. |

1373602 |

|

2002-06-12 |

Sah Capital Inc. |

1503681 |

|

2002-06-12 |

Uls Acquisition Inc. |

1223937 |

|

2002-06-12 |

1345625 Ontario Inc. |

1345625 |

|

2002-06-12 |

559732 Ontario Inc. |

559732 |

|

2002-06-13 |

Liberty Books Ltd. |

1222906 |

|

2002-06-13 |

Manefato Investments Ltd. |

846744 |

|

2002-06-13 |

1329266 Ontario Ltd. |

1329266 |

|

2002-06-13 |

676096 Ontario Ltd. |

676096 |

|

2002-06-14 |

Da Derd Trading (Canada) Ltd. |

1217400 |

|

2002-06-14 |

Sheng Tai International Ltd. |

1073572 |

|

2002-06-14 |

Tpct Company Limited |

1129673 |

|

2002-06-14 |

1226723 Ontario Inc. |

1226723 |

|

2002-06-14 |

1416989 Ontario Inc. |

1416989 |

B. G. Hawton,

Director, Companies and Personal Property Security Branch

26/02

Erratum Notice

Vide Ontario Gazette, Vol. 134-3 dated January 20, 2001.

Notice Is Hereby Given that the notice issued under section 240 of the Business Corporations Act set out in the issue of the Ontario Gazette of January 20, 2001 with respect to the cancellation of the Certificate of Incorporation of 1287583 Ontario Inc. was issued in error and is null and void.

Vide Ontario Gazette, Vol. 133-20 dated May 13, 2000.

Notice Is Hereby Given that the notice issued under section 240 of the Business Corporations Act set out in the issue of the Ontario Gazette of May 13, 2000 with respect to the cancellation of the Certificate of Incorporation of 1315267 Ontario Inc., was issued in error and is null and void.

B. G. Hawton,

Director, Companies and Personal Property Security Branch

26/02

Co-operative Corporations Act (Certificate of Amendment of Article Issued)

Notice Is Hereby Given that, under the Co-operative Corporations Act, amendment to article have been effected as follows:

|

Date of Incorporation |

Name of Co-operative: |

Effective Date |

|---|---|---|

|

1999-4-16 |

Trec Windpower Co-operative (No. 1) Incorporated |

2002-06-13 |

John M. Harper,

Director, Compliance Branch, Licensing and Compliance Division by delegated authority from the Superintendant of Financial Services

26/02

Orders in Council

O.C./Décret 1266/2002

On the recommendation of the undersigned, the Lieutenant Governor, by and with the advice and concurrence of the Executive Council, orders that:

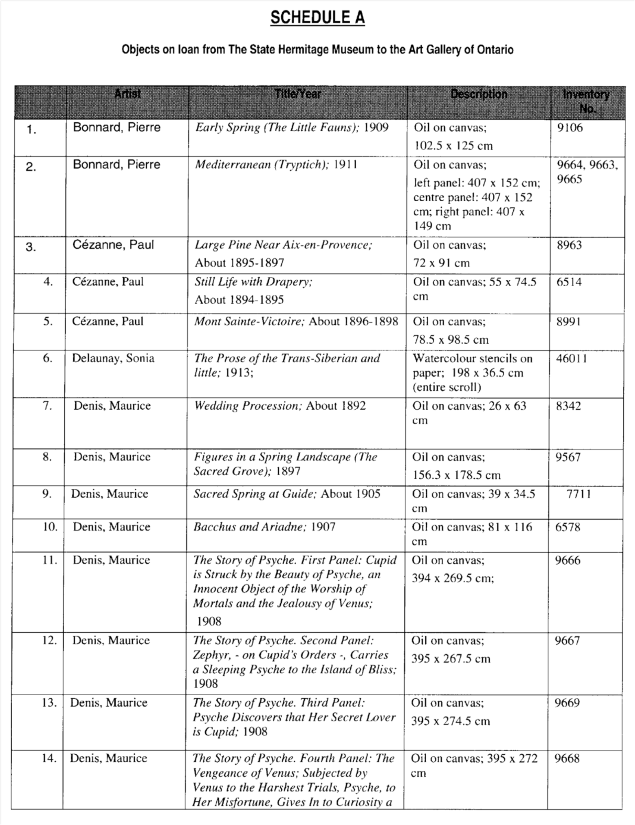

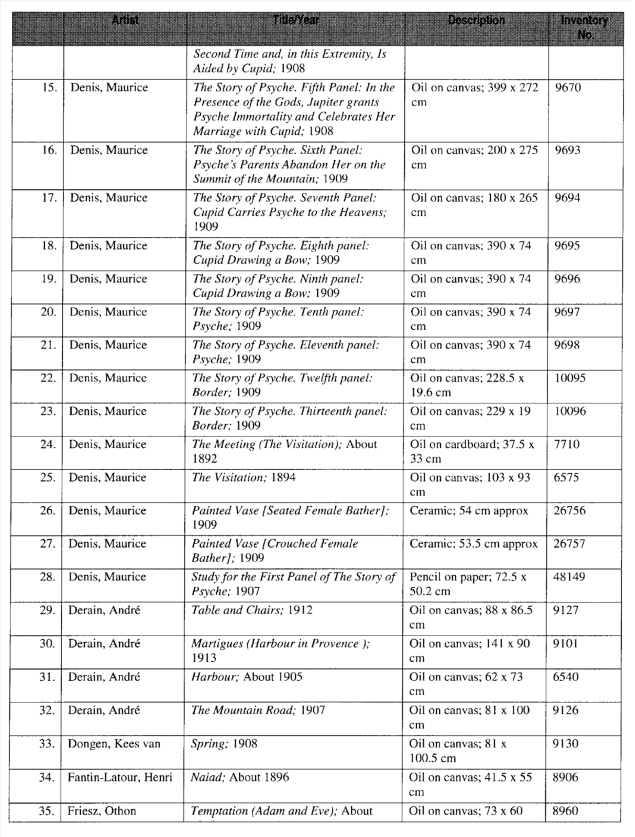

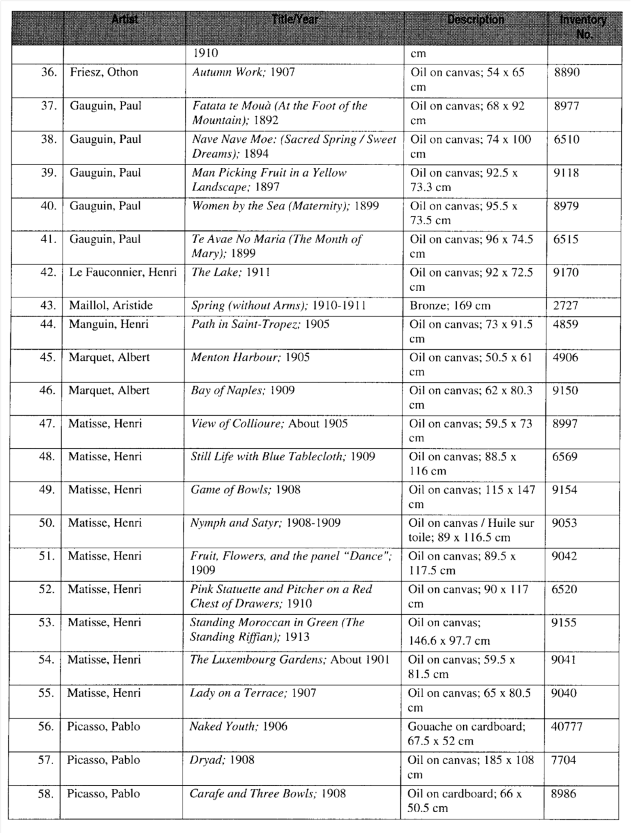

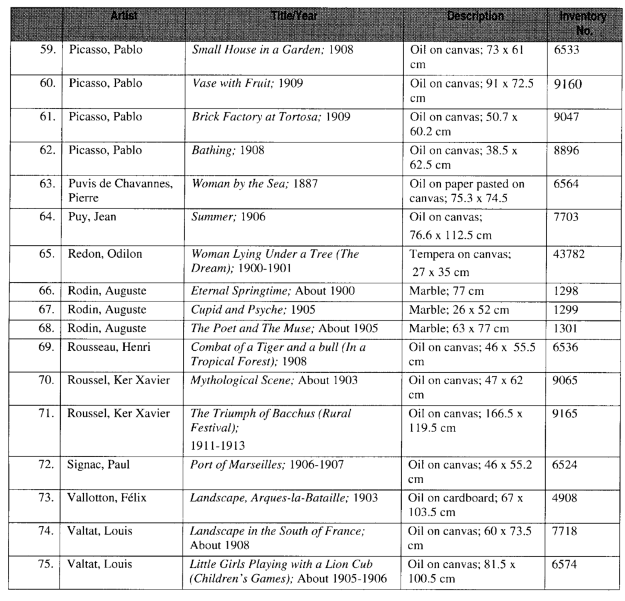

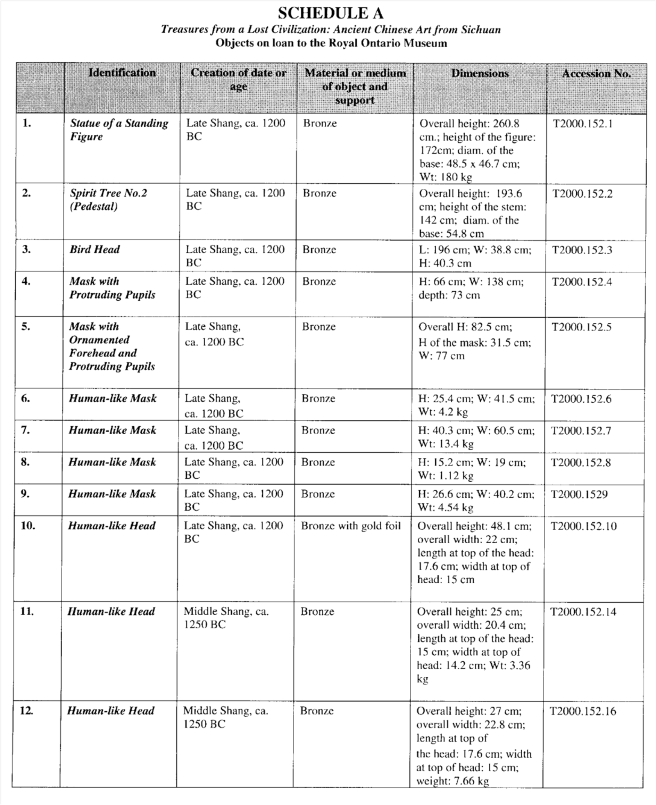

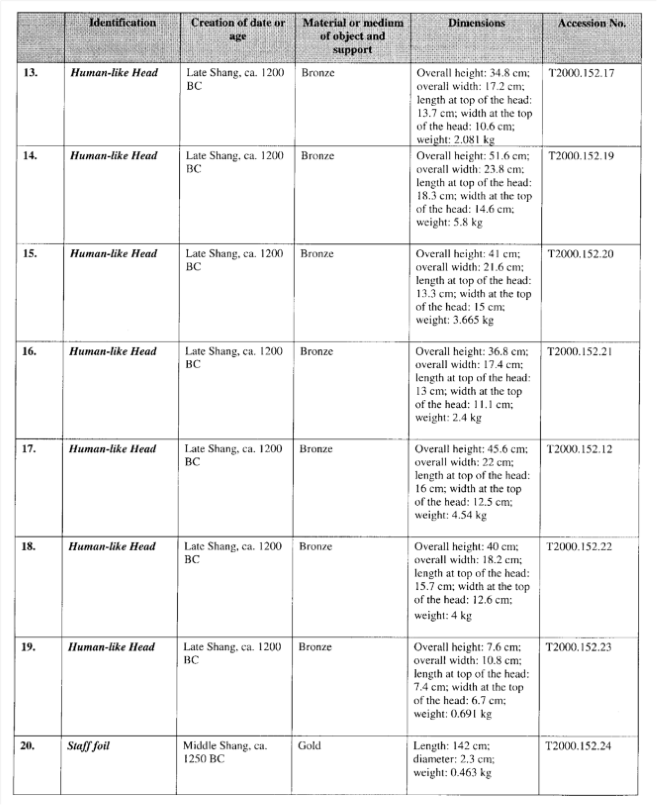

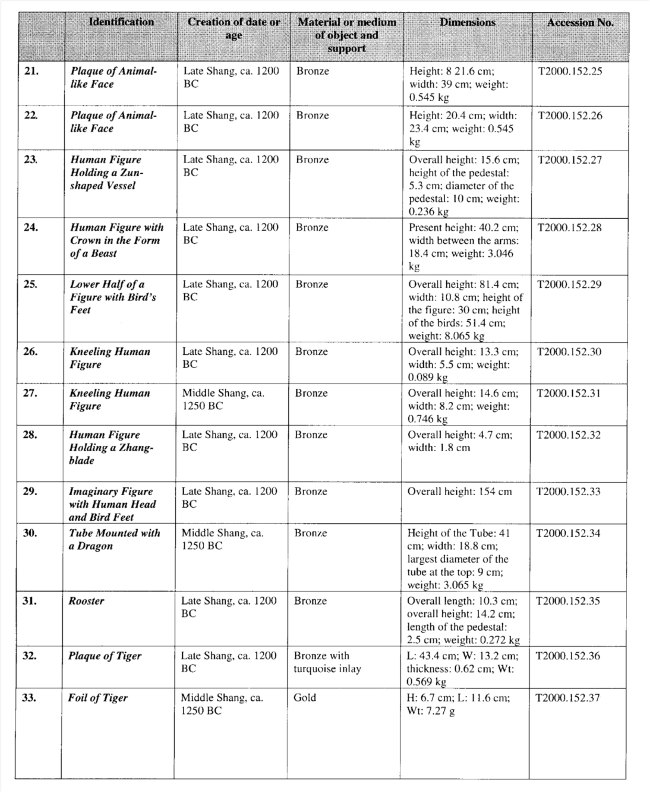

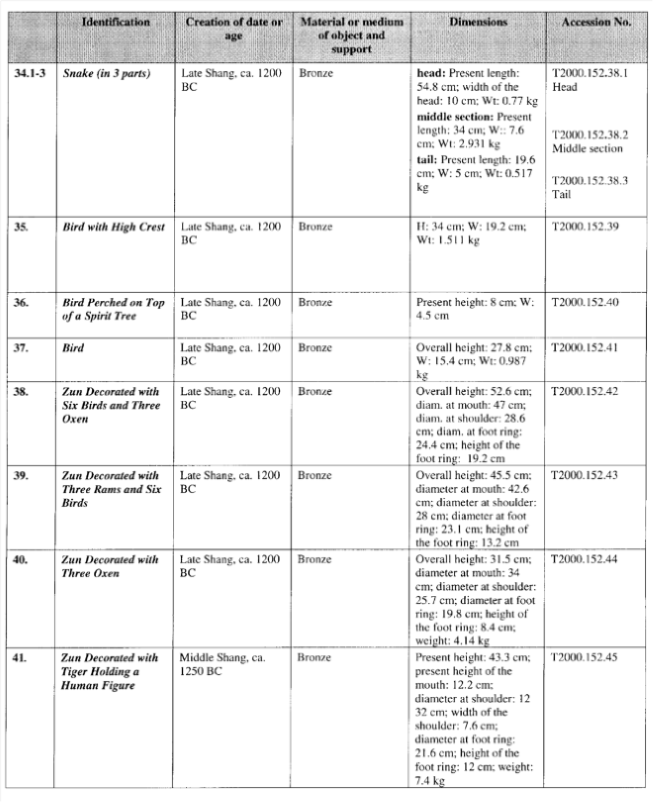

Pursuant To And In Accordance With subsection 1(1) of the Foreign Cultural Objects Immunity from Seizure Act, R.S.O 1990, c.F.23, the works of art or objects of cultural significance listed in Schedule “A” attached hereto, which works or objects are to be on temporary exhibition at the Art Gallery of Ontario in Toronto pursuant to an agreement between the Art Gallery of Ontario and The State Hermitage Museum, St. Petersburg, Russia are hereby determined to be of cultural significance and the temporary exhibition of these works or objects in Ontario to be in the interest of the people of Ontario.

Recommended

David H. Tsubouchi,

Minister of Culture

Concurred

R. W. Runciman,

Chair of Cabinet

Approved and Ordered, June 19, 2002.

James K. Bartleman,

Lieutenant Governor

(6627) 26

Financial Services Commission of Ontario

Statement of Priorities June 2002

Introduction

Under section 11 of the Financial Services Commission of Ontario (FSCO) Act, FSCO is required to deliver to the Minister of Finance and publish by June 30th of each year a statement setting out its proposed priorities for the year ahead. This is FSCO’s fifth Statement of Priorities. It outlines proposed Strategic Priorities, identifies the key challenges facing FSCO, highlights initiatives and notes recent progress on significant FSCO projects. It also identifies how progress on selected priorities will be measured.

FSCO is comprised of three key parts: the Commission or Board; the Financial Services Tribunal (Tribunal); and the Superintendent and staff. FSCO regulates insurance, pension plans, loan and trust companies, credit unions, caisses populaires, mortgage brokers and co-operative corporations in Ontario.

In May 2000, the Minister of Finance announced a proposal to merge FSCO with the Ontario Securities Commission (OSC) to regulate capital markets and financial services sectors in Ontario. The consolidated agency is intended to provide strong protection for consumers, investors and pension plan beneficiaries, implement timely regulatory responses to changing market structures and foster a competitive, healthy financial services industry in Ontario.

Request For Comment

On April 27, 2002, FSCO posted a Request for Comment on the Statement of Priorities on its website and published a notice in the Ontario Gazette. There were 27 written submissions to the statement from across the regulated sectors. The submissions provide us with a wide range of suggested activities stemming from the strategic priorities.

Many of the activities mentioned in the comment letters fall within FSCO’s scope of responsibility, while additional activities cited in the letters are the responsibility of other organizations.

This statement highlights FSCO’s four strategic priorities as well as key initiatives for the next twelve months. It is not designed to describe the numerous activities that FSCO will undertake to support these priori- ties. Nevertheless, FSCO will be undertaking, either by itself, or in cooperation with others, many of the activities mentioned in the comment letters.

Each of the priorities is significant for FSCO and as a result, they are not ranked in any particular order.

Our Mission We are committed to being a vigilant, fair minded and forward looking regulatory agency with a constructive and responsive presence in Ontario’s financial services marketplace.

Our Mandate To protect the public interest and enhance public confidence in the regulated sectors, FSCO provides regulatory services that protect consumers and support a healthy and competitive financial services industry.

Key Challenges

Over the next year, FSCO will focus on a number of key challenges precipitated by the rapidly changing financial services sector.

- Convergence

As the various financial services sectors converge, some financial institutions are developing products and services that cross traditional sectoral boundaries and are becoming almost indistinguishable. However, since the regulatory framework is still largely based on the traditional four financial sector pillars - banks, trust companies, insurers and securities firms - similar products providing similar services may receive different regulatory treatment.

The challenge is to move forward with regulatory harmonization across sectors and across jurisdictions. Harmonization will contribute to eliminating both duplication and overlap in the regulation of financial products.

- The Consumer

Today’s consumer has access to resources and information that were, until a short while ago, limited to the financial services professional. Combined with a significant demographic change as the baby boom generation ages, the financial marketplace is evolving. Consumers increasingly seek wealth management services in addition to traditional financial products. Consumers also want assurances that the person they turn to for increasingly complex financial advice is both competent and knowledgeable.

The challenge is to meet the expectations of the modern consumer by providing relevant consumer protections while ensuring a healthy market environment in a rapidly changing financial services market.

- A Balanced Approach

Sustaining public confidence in the regulated sectors is an ongoing key objective for FSCO. This confidence rests on FSCO’s ability to ensure high standards of consumer protection while maintaining a dynamic and competitive financial services marketplace, and at the same time taking into account the interests of the regulated industries.

The challenge is to provide a fair and balanced regulatory approach, one that strengthens consumer protection while being flexible enough to foster competition and innovation in the regulated sectors.

- New Distribution Channels

Today, financial products are marketed not only face-to-face but also electronically on the Internet, through direct mail and over the telephone. Financial services providers are not only marketing products like insurance and mortgages on-line, but are also dealing with their suppliers and partners electronically. With on-line business-to- business transactions a fact of life in the 21st century marketplace, the financial services industry expects regulators to be capable of dealing with stakeholders electronically.

The challenge is to provide market professionals and consumers in the regulated sectors with access to enhanced electronic communications regarding FSCO’s core activities.

What this means for FSCO

FSCO continues to focus on fostering fair, efficient and effective financial services where consumers are protected and the marketplace thrives. FSCO has established a multi-year strategic plan; the goals contained in this Statement of Priorities are consistent with the focus of that plan.

FSCO’s strategic priorities and associated key initiatives, reflect an achievable, realistic and ongoing commitment to our regulatory responsibilities. Specific FSCO activities will support both the stated priorities and the key initiatives, however, they will not be listed in this document.

We believe that our stakeholders are better served if the discussion on our priorities focuses on achievable outcomes rather than on details surrounding FSCO activities. In the past, we have found that concentrating on the specific activities associated with a particular priority has detracted from the goal of this document, which is to clearly identify what we expect to achieve in the next twelve months.

FSCO has also developed a number of methods for communicating the details of our activities to our stakeholders. These include a website (www.FSCO.gov.on.ca) and sector bulletins. FSCO has also initiated a comprehensive network of committees and advisory groups with the regulated sectors.

In the coming year, we will demonstrate our commitment to sustain public confidence in the regulated sectors through our ongoing support for the following programs and initiatives. The list is not in a particular order:

Improve the Efficiency and Effectiveness of the Regulatory Framework

Promote a Coordinated National Approach to Regulatory Issues and Maintain Confidence in the Regulated Sectors

Promote and Vigorously Enforce Compliance

Deliver a High Standard of Customer Service through Enhanced E-Communication

Our Strategic Priorities

- Improve the Efficiency and Effectiveness of the Regulatory Framework

We will undertake the following key initiatives towards achieving this outcome:

- In cooperation with the Ministry of Finance and interested stakeholder groups, FSCO will:

- continue to develop proposed changes to the auto insurance sys- tem;

- support Government amendments to the Insurance Act that establish the role of the appointed actuary, and develop a flexible prudent portfolio investment approach for insurers;

- implement new legislative requirements for surplus distribution and flexible pension plans, and new government policies resulting from the 2001 consultation on surplus distribution;

- make proposals to modernize the regulatory framework for mort- gage brokers;

- implement a regulatory regime for viatical settlements once the Government proclaims regulations; and

- respond to plans by the credit union system to become more efficient on a national basis; and review Ontario’s liquidity requirements for credit unions.

- Enhance the Designated Assessment Centre (DAC) electronic reporting system to support DAC monitoring and quality assurance initiatives.

We will measure success in achieving this outcome by the following:

- Changes to the automobile insurance system will ensure that it is fair, balanced and cost effective.

- Application decisions will be completed within the time lines set out in legislation/regulation or FSCO policy.

- Promote a Coordinated National Approach to Regulatory Issues and Maintain Confidence in the Regulated Sectors

We will undertake the following key initiatives towards achieving this outcome:

- Work with the Ministry of Finance and the Ontario Securities Com- mission on the creation of the Ontario Financial Services Commission which will be responsible for regulating the financial services sector in Ontario.

- Provide leadership in coordinating the development of harmonized solutions to financial services regulatory issues through participation in the Joint Forum of Financial Market Regulators. The Joint Forum is comprised of the Canadian Association of Pension Supervisory Authorities (Capsa), the Canadian Council of Insurance Regulators (Ccir) and the Canadian Securities Administrators (Csa). The key initiatives in which FSCO will play a significant role through the Joint Forum are:

- enhancing and harmonizing product disclosure in the regulated sectors;

- advancing intermediary proficiency and licensing initiatives;

- proceeding with developing disclosure guidelines for capital accumulation plans;

- harmonizing the regulations for individual variable insurance contracts and mutual funds;

- overseeing the industry’s establishment of the National Financial Services OmbudsNetwork, an integrated, one-stop dispute resolution service for all financial services consumers; and

- establishing a Joint Forum project office.

- Provide leadership in the coordination of regulatory issues in the insurance and pension sectors through participation in Ccir and Capsa. Key initiatives in which FSCO will play a significant role, through Capsa and Ccir, include:

Ccir:

- surveying insurance companies to assess current and future use of e-commerce, to support increased e-commerce delivery;

- enhancing intermediary proficiency through increased entry-level requirements for life insurance agents, and develop a policy governing the consideration of special licensing requirements;

- harmonizing changes to insurance companies financial reporting requirements;

Capsa:

- developing a new agreement to enhance the regulation of multi- jurisdictional pension plans;

- supporting the development of a proposal for a model pension law;

- supporting the development of pension governance guidelines for implementation across Canada; and

- addressing regulatory issues related to pension investment rules.

We will measure success in achieving this outcome by the following:

- Regulatory duplication and conflicts across sectors and jurisdictions will be reduced.

- Promote and Vigorously Enforce Compliance

We will undertake the following key initiatives towards achieving this outcome:

- conduct Phase Two of the Life Insurance Company Market Conduct audit;

- develop a Market Conduct self-assessment questionnaire for property and casualty insurers for use in future audits; and

- apply a risk-based approach to the Pension Plan Examination Pro- gram.

We will measure success in achieving this outcome by the following:

- Regulation of FSCO’s sectors will promote a healthy financial services industry.

- Regulated sector participants will find that monitoring and enforcement activities are consistent and fair.

- Deliver a High Standard of Customer Service through Enhanced E-Communication

We will undertake the following key initiatives towards achieving this outcome:

- improve the FSCO website to enhance access;

- launch Phase Two of the internet licensing system for new life insurance agents via FSCO’s Internet Application System;-

- review all FSCO forms to ensure they are easily accessible and work towards e-filing of all forms;

- introduce a web-based version of the Dispute Resolution Practice Code; and

- launch an electronic filing system for automobile insurance rate applications, underwriting rules, rate manuals and forms.

We will measure success in achieving this outcome by the following:

- Consumers and stakeholders will be able to conduct more business with FSCO through the Internet for these activities.

FSCO Funding

Under Section 25 of the Financial Services Commission of Ontario Act, 1997, the Lieutenant Governor-in-Council may assess all entities that form part of a regulated sector with respect to all expenses and expenditures that the Ministry, the Commission and the Tribunal have incurred. The Minister of Finance is also authorized to establish fees with respect to these regulated sectors for services provided by FSCO.

FSCO collects fees from the regulated sectors [e.g. pension plans and mortgage brokers]. Currently, assessments are made with respect to three of the sectors regulated by FSCO, insurance; credit union/caisses populaires; and loan and trust.

In determining the administration of the funding system, FSCO has established that it will:

- be fair;

- reflect the use of FSCO resources;

- enable reasonable predictability of regulatory costs;

- be simple to administer; and

- be flexible and easily modified.

FSCO has also made a commitment to the following principles in carrying out its funding system:

- revenues will not exceed forecasted expenditures for each sector;

- disruption will be minimized and changes will take into account the effect of fees on the marketplace;

- FSCO will be accountable to its stakeholders for the efficiency and quality of the services delivered; and

- affected sectors will be fully consulted.

2002 Financial Outlook

FSCO is forecasting two workload-based financial pressures in 2002- 2003. One pressure arises from the biennial cycle for life agent licensing (this year, agent renewals will be double last year’s levels). The second pressure pertains to a general increase in the level of applications for dispute resolution services. Life agent licensing and dispute resolution services are both fee generating activities so increased levels of activities will be covered by increased revenues.

Statement of Priorities – 2001

Report on Key Initiatives

- Introduced Phase I of the Internet Licensing System, for agents to renew their licenses over the Internet. The system allows Ontario’s 26,000 life insurance agents to renew their Level II agent licenses, or upgrade their qualifications from a Level I to a Level II license over the Internet 24 hours a day, 7 days a week, in just minutes.

- Updated the “Respond to Market” filing system for approval of automobile insurance rates.

- Authorized the use of a standardized paper billing form for health care providers to bill auto insurers directly for medical and rehabilitation services.

- Launched a web-based, password protected Dispute Resolution Case Directory that provides automobile insurance companies with up- to-date information on the status of their active mediation, arbitration and appeal files.

- Introduced a new version of the Dispute Resolution Practice Code; to reflect amendments to the Statutory Powers Procedure Act, recommendations from stakeholders and the George Adams Report.

- Finalized guidelines through CAPSA for electronic communication in the pension industry.

- Established criteria for an expedited process to wind up defined contribution pension plans.

- Developed and implemented a computerized system to support a risk- based approach to monitoring the funding of defined benefit pension plans.

- Initiated the Pension Plan Examination Program to evaluate registered pension plan compliance and governance.

- Developed regulation amendments on deductibility of Canada Pension Plan disability payments and other prescribed payments from the Statutory Accident Benefits (SAB) and amended procedures for settlement of SAB claims.

- Completed the 2001 Market Conduct Audit for life insurance companies.

- Concluded an agreement with the Office of the Superintendent of Financial Institutions to alternate examinations of Credit Union Central of Ontario, and rely on each other’s work in alternate years.

- Reviewed the Mortgage Brokers Act as per the Red Tape Reduction Act, 1999. The Superintendent’s report was submitted to the Minster of Finance.

The Financial Services Tribunal

The Financial Services Tribunal is an independent, adjudicative body composed of nine to 15 members (currently 13), including the Chair and two Vice-Chairs of the Commission. The Tribunal has exclusive jurisdiction to exercise the powers conferred under the Financial Services Commission of Ontario Act, 1997 and other Acts that confer powers on or assign duties to the Tribunal. It also has exclusive jurisdiction to determine all questions of fact or law that arise in any proceeding before it. As well, the Tribunal has authority to make rules for the practice and procedure to be observed in a proceeding before it; and to order a party to a proceeding before it to pay the costs of another party or the Tribunal’s costs of the proceeding.

For the year ahead the Financial Services Tribunal has identified the following priorities:

- complete the review and revisions to the FST’s Interim Rules of Practice and Procedure;

- review and revise where necessary the forms and practice directions for applications and reconsideration of financial hardship matters;

- develop a code of conduct and guidelines relating to conflict of interest affecting Tribunal members;

- review and update the FST hearing manual; and

- continue to develop FST performance and service standards.

Conclusion

This statement has outlined FSCO’s proposed Strategic Priorities for the coming year. We look forward to working with our many stakeholders to achieve our objectives and thereby sustain a fair, efficient and effective financial services marketplace where consumers are protected and competition thrives.

Philip Howell

Chief Executive Officer

Financial Services Commission of Ontario

Superintendent of Financial Services (Acting)

Martha Milczynski

Chair

Financial Services Commission Of Ontario

Chair

Financial Services Tribunal

(6629) 26