Government Notices Respecting Corporations

Notice of Default in Complying with the Corporations Tax Act

The Director has been notified by the Minister of Finance that the following corporations are in default in complying with the Corporations Tax Act.

Notice Is Hereby Given under subsection 241(1) of the Business Corporations Act, that unless the corporations listed hereunder comply with the requirements of the Corporations Tax Act within 90 days of this notice, orders will be made dissolving the defaulting corporations. All enquiries concerning this notice are to be directed to Ministry of Finance, Corporations Tax, 33 King Street West, Oshawa, Ontario L1H 8H6.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2010-06-26 |

Able Regional Towing & Recovery Inc. |

000793244 |

|

2010-06-26 |

Altair Transport & Travel Ltd. |

001695673 |

|

2010-06-26 |

B.T.E.P. Trading Co. Ltd. |

001609175 |

|

2010-06-26 |

Barber Holdings Inc. |

001477911 |

|

2010-06-26 |

Behruz Brewing Inc. |

001686668 |

|

2010-06-26 |

Best Leather Tiles Inc. |

002110228 |

|

2010-06-26 |

Biogenova Inc. |

001585769 |

|

2010-06-26 |

Bull On The Run Inc. |

001119517 |

|

2010-06-26 |

C.A.M.C. Bookeeping & Income Tax Services Inc. |

000923389 |

|

2010-06-26 |

Cherished Scrapbooks Inc. |

001454462 |

|

2010-06-26 |

Cordan Business Services Inc. |

002111827 |

|

2010-06-26 |

Crazy Lee’s (Richmond Hill) Limited |

000779953 |

|

2010-06-26 |

Daniel Wood Works Limited |

001660540 |

|

2010-06-26 |

Degeneration Reversal Inc. |

000688225 |

|

2010-06-26 |

Eini Real Estate Ltd. |

000389913 |

|

2010-06-26 |

Emmanuel Transport Inc. |

002065898 |

|

2010-06-26 |

Evolve Entertainment, Inc. |

001580282 |

|

2010-06-26 |

First Canadian American Capital Corporation |

002039725 |

|

2010-06-26 |

Geert Van Der Veen Fine Art Inc. |

000400025 |

|

2010-06-26 |

Greenwin Environmental Inc. |

002034425 |

|

2010-06-26 |

Herculean Educational Solutions Inc. |

001628018 |

|

2010-06-26 |

Impulse Energy Canada Inc. |

001665779 |

|

2010-06-26 |

Imsu Group Inc. |

002100417 |

|

2010-06-26 |

Innerview Kitchen & Renovations Inc. |

001595277 |

|

2010-06-26 |

Interworld Cleaning Supplies Inc. |

001706609 |

|

2010-06-26 |

Intimoda Lingerie Inc. |

001623688 |

|

2010-06-26 |

Itam Solutions Ltd. |

001707551 |

|

2010-06-26 |

King View Lettuce Corporation |

000584268 |

|

2010-06-26 |

Lakeridge Media Inc. |

001709155 |

|

2010-06-26 |

Legacy Doors Inc. |

001663000 |

|

2010-06-26 |

Little Empire Artistry & Designers Corp. |

002103877 |

|

2010-06-26 |

Mar-Del Metal Products Inc. |

002030609 |

|

2010-06-26 |

Marmora Investments Inc. |

002110583 |

|

2010-06-26 |

Marquis Courier Service Inc. |

001539112 |

|

2010-06-26 |

Mastermind Graphics&Printing Inc. |

002073764 |

|

2010-06-26 |

Mcguire Hockey Inc. |

001245003 |

|

2010-06-26 |

Mcminn Aggregates Inc. |

001276586 |

|

2010-06-26 |

Merit It Consulting Inc. |

001690339 |

|

2010-06-26 |

Micro Tek Systems Inc. |

001202252 |

|

2010-06-26 |

Min Enterprises Inc. |

001643310 |

|

2010-06-26 |

Mitchell Technologies Ltd. |

000812241 |

|

2010-06-26 |

Mojogin Corporation |

001683574 |

|

2010-06-26 |

Motipalace Inc. |

001601414 |

|

2010-06-26 |

Northwind Investments Ltd. |

000339829 |

|

2010-06-26 |

Omaa Development Corporation |

000652153 |

|

2010-06-26 |

Onward Investments Limited |

000443901 |

|

2010-06-26 |

P.A.S. Professional Audit Services Inc. |

000992709 |

|

2010-06-26 |

Paramount Technologies Inc. |

002065702 |

|

2010-06-26 |

Pentraco Ltd. |

000339828 |

|

2010-06-26 |

Pushkin Private Academy Inc. |

001606937 |

|

2010-06-26 |

Quadrafemme Incorporated |

001636560 |

|

2010-06-26 |

Regnat Holdings Inc. |

000637323 |

|

2010-06-26 |

Risk Diagnostics Inc. |

001617748 |

|

2010-06-26 |

Shapesense Inc. |

002035887 |

|

2010-06-26 |

Softek Computer Technologies Incorporated |

002011949 |

|

2010-06-26 |

Spruce Forest Products Ltd. |

001144934 |

|

2010-06-26 |

Sree Balaaji Management Inc. |

002111695 |

|

2010-06-26 |

Sscg Enterprises Inc. |

002042177 |

|

2010-06-26 |

Super Val-U Foods Ltd. |

001216187 |

|

2010-06-26 |

T. J. Barratt Ltd. |

000429164 |

|

2010-06-26 |

T.S.S. International Incorporated |

001054725 |

|

2010-06-26 |

Techsentinel Inc. |

002073065 |

|

2010-06-26 |

Tecumseh Metal Works Manufacturing Inc. |

002115042 |

|

2010-06-26 |

The Publican’s House Limited |

001601692 |

|

2010-06-26 |

The Seedy Group Inc. |

001674051 |

|

2010-06-26 |

The Sun Factory Inc. |

001419389 |

|

2010-06-26 |

Third And Fifth Financial Group Inc. |

001665438 |

|

2010-06-26 |

Titan Flooring Ltd. |

002030773 |

|

2010-06-26 |

Tom Rheaume Consulting Inc. |

001120965 |

|

2010-06-26 |

Trium-Group Inc. |

001487877 |

|

2010-06-26 |

United Property Holding Inc. |

002071833 |

|

2010-06-26 |

Vista Advanced Technologies Inc. |

002110867 |

|

2010-06-26 |

Vulcan Steel Detailing Inc. |

001570871 |

|

2010-06-26 |

West-Steeles Developments Iv Inc. |

000767089 |

|

2010-06-26 |

Winges Developments Limited |

000663257 |

|

2010-06-26 |

1030121 Ontario Inc. |

001030121 |

|

2010-06-26 |

1058596 Ontario Corp. |

001058596 |

|

2010-06-26 |

1076701 Ontario Inc. |

001076701 |

|

2010-06-26 |

1099261 Ontario Ltd. |

001099261 |

|

2010-06-26 |

1114555 Ontario Inc. |

001114555 |

|

2010-06-26 |

1124846 Ontario Limited |

001124846 |

|

2010-06-26 |

1131337 Ontario Ltd. |

001131337 |

|

2010-06-26 |

1138784 Ontario Inc. |

001138784 |

|

2010-06-26 |

1159587 Ontario Inc. |

001159587 |

|

2010-06-26 |

1198202 Ontario Limited |

001198202 |

|

2010-06-26 |

1231064 Ontario Inc. |

001231064 |

|

2010-06-26 |

1235693 Ontario Inc. |

001235693 |

|

2010-06-26 |

1425976 Ontario Inc. |

001425976 |

|

2010-06-26 |

1438248 Ontario Ltd. |

001438248 |

|

2010-06-26 |

1458973 Ontario Ltd. |

001458973 |

|

2010-06-26 |

1471456 Ontario Ltd. |

001471456 |

|

2010-06-26 |

1492759 Ontario Inc. |

001492759 |

|

2010-06-26 |

1516120 Ontario Limited |

001516120 |

|

2010-06-26 |

1558741 Ontario Ltd. |

001558741 |

|

2010-06-26 |

1582930 Ontario Inc. |

001582930 |

|

2010-06-26 |

1592040 Ontario Inc. |

001592040 |

|

2010-06-26 |

1615441 Ontario Ltd. |

001615441 |

|

2010-06-26 |

1620503 Ontario Inc. |

001620503 |

|

2010-06-26 |

1620511 Ontario Limited |

001620511 |

|

2010-06-26 |

1629377 Ontario Limited |

001629377 |

|

2010-06-26 |

1636858 Ontario Inc. |

001636858 |

|

2010-06-26 |

1642776 Ontario Limited |

001642776 |

|

2010-06-26 |

1659192 Ontario Ltd. |

001659192 |

|

2010-06-26 |

1681160 Ontario Limited |

001681160 |

|

2010-06-26 |

1695689 Ontario Ltd. |

001695689 |

|

2010-06-26 |

2009019 Ontario Inc. |

002009019 |

|

2010-06-26 |

2021796 Ontario Inc. |

002021796 |

|

2010-06-26 |

2035983 Ontario Ltd. |

002035983 |

|

2010-06-26 |

2038745 Ontario Incorporated |

002038745 |

|

2010-06-26 |

2058403 Ontario Ltd. |

002058403 |

|

2010-06-26 |

2068748 Ontario Inc. |

002068748 |

|

2010-06-26 |

2071478 Ontario Limited |

002071478 |

|

2010-06-26 |

2073366 Ontario Inc. |

002073366 |

|

2010-06-26 |

2097669 Ontario Inc. |

002097669 |

|

2010-06-26 |

2105705 Ontario Inc. |

002105705 |

|

2010-06-26 |

2106276 Ontario Inc. |

002106276 |

|

2010-06-26 |

2110612 Ontario Inc. |

002110612 |

|

2010-06-26 |

894369 Ontario Ltd. |

000894369 |

|

2010-06-26 |

925480 Ontario Ltd. |

000925480 |

|

2010-06-26 |

946872 Ontario Limited |

000946872 |

Katherine M. Murray

Director, Ministry of Government Services

(143-G316)

Cancellation of Certificate of Incorporation (Corporations Tax Act Defaulters)

Notice Is Hereby Given that, under subsection 241(4) of the Business Corporations Act, the Certificate of Incorporation of the corporations named hereunder have been cancelled by an Order for default in complying with the provisions of the Corporations Tax Act, and the said corporations have been dissolved on that date.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2010-05-31 |

Acrnum Inc. |

002096566 |

|

2010-05-31 |

All-Way Plumbing Inc. |

001692121 |

|

2010-05-31 |

Ambar Property Care Inc. |

002095993 |

|

2010-05-31 |

Assessment Centres Network Inc. |

002098592 |

|

2010-05-31 |

Atherton Kovacic Marketing Ltd. |

001691024 |

|

2010-05-31 |

Aya Contracting & Trading Ltd. |

002096694 |

|

2010-05-31 |

Bavany Transport Ltd. |

002096505 |

|

2010-05-31 |

Bbws Torres Inc. |

001691594 |

|

2010-05-31 |

Big City Squad Ltd. |

001405929 |

|

2010-05-31 |

Billmar Construction Limited |

002095879 |

|

2010-05-31 |

Bw&W Consulting Inc. |

002095510 |

|

2010-05-31 |

Cafe Toulouse Inc. |

002097660 |

|

2010-05-31 |

Cameo Trading Inc. |

002098015 |

|

2010-05-31 |

Canex International Solutions Inc. |

001691079 |

|

2010-05-31 |

Cdx Acquisition Corp. |

001693664 |

|

2010-05-31 |

Countrywide Leslie & Associates Inc. |

001266954 |

|

2010-05-31 |

Encon Controls Ltd. |

002095738 |

|

2010-05-31 |

Ets Trading Ltd. |

001693655 |

|

2010-05-31 |

European Arches & Shutters Inc. |

001691195 |

|

2010-05-31 |

First Choice International Ltd. |

001693524 |

|

2010-05-31 |

Frank Roy Consulting Inc. |

001693595 |

|

2010-05-31 |

G Source Automotive Inc. |

002095949 |

|

2010-05-31 |

Gold Line Fine Cars Inc. |

002098514 |

|

2010-05-31 |

Greenwood International Inc. |

001692004 |

|

2010-05-31 |

Higher Definition Inc. |

002096813 |

|

2010-05-31 |

Homesource Ontario Ltd. |

001691491 |

|

2010-05-31 |

International General Suppliers Ltd. |

001395280 |

|

2010-05-31 |

Kavana Group Inc. |

002096320 |

|

2010-05-31 |

Kysco Inc. |

002097082 |

|

2010-05-31 |

Liquidation Discount 4:U Inc. |

001691660 |

|

2010-05-31 |

Lnn Holdings Inc. |

002096159 |

|

2010-05-31 |

Mambet Inc. |

001566259 |

|

2010-05-31 |

Midnight Moon Associates Inc. |

002097802 |

|

2010-05-31 |

Mitecc Inc. |

000982920 |

|

2010-05-31 |

Morgan Metal Recyclers Ltd. |

002097172 |

|

2010-05-31 |

National Guard And Patrol Security Inc. |

001653143 |

|

2010-05-31 |

Noorstar Telecommunications Inc. |

001694925 |

|

2010-05-31 |

Novo Tools And Moulds Inc. |

002098319 |

|

2010-05-31 |

Over The Road Logistics Inc. |

002096215 |

|

2010-05-31 |

Pencor Foods Inc. |

001006297 |

|

2010-05-31 |

Primrose Landscaping Inc. |

001693057 |

|

2010-05-31 |

R & B Investments Ontario Inc. |

001691867 |

|

2010-05-31 |

Rafina Hardwood Floors Inc. |

002096345 |

|

2010-05-31 |

Rana Nurseries & Produce Ltd. |

001691164 |

|

2010-05-31 |

Rostrevor Ventures Fund Inc. |

002095507 |

|

2010-05-31 |

Run 7 Enterprises Inc. |

001693746 |

|

2010-05-31 |

Sahara Entertainment Group Inc. |

002096522 |

|

2010-05-31 |

Sandhu Carriers Inc. |

002004693 |

|

2010-05-31 |

Schlichter Transport Inc. |

002096342 |

|

2010-05-31 |

Sci3 Holdings Inc. |

002098440 |

|

2010-05-31 |

Security Boot Camp Inc. |

001691470 |

|

2010-05-31 |

Seriously Screwed And Sanded Inc. |

002096365 |

|

2010-05-31 |

Sibyl International Inc. |

001693093 |

|

2010-05-31 |

Sinjul Nominees Limited. |

001691109 |

|

2010-05-31 |

Skilton Kitchens Inc. |

001109588 |

|

2010-05-31 |

Smbi Consulting Inc. |

001686785 |

|

2010-05-31 |

Somerset Sales Inc. |

001048651 |

|

2010-05-31 |

Springs Of Life Employment Services Inc. |

001693114 |

|

2010-05-31 |

Stanley Transport Inc. |

001692209 |

|

2010-05-31 |

The Realty Shoppe Limited |

000342242 |

|

2010-05-31 |

Two Little Pickneys Inc. |

001691420 |

|

2010-05-31 |

Untouchable Cleaners Inc. |

001536718 |

|

2010-05-31 |

V & K Group Inc. |

002097853 |

|

2010-05-31 |

Val Motors Ltd. |

001691841 |

|

2010-05-31 |

Vitro Insulated Glass Limited |

002096508 |

|

2010-05-31 |

Vivide Enterprise Inc. |

002098357 |

|

2010-05-31 |

Wiki Concepts Inc. |

002096582 |

|

2010-05-31 |

Woojung Canada Incorporated |

001694908 |

|

2010-05-31 |

Yard Works Landscapes Ltd. |

002098257 |

|

2010-05-31 |

1111905 Ontario Inc. |

001111905 |

|

2010-05-31 |

1377174 Ontario Inc. |

001377174 |

|

2010-05-31 |

1467696 Ontario Ltd. |

001467696 |

|

2010-05-31 |

1469245 Ontario Limited |

001469245 |

|

2010-05-31 |

1652652 Ontario Inc. |

001652652 |

|

2010-05-31 |

1687560 Ontario Incorporated |

001687560 |

|

2010-05-31 |

1687627 Ontario Ltd. |

001687627 |

|

2010-05-31 |

1690058 Ontario Ltd. |

001690058 |

|

2010-05-31 |

1691147 Ontario Inc. |

001691147 |

|

2010-05-31 |

1691457 Ontario Inc. |

001691457 |

|

2010-05-31 |

1691558 Ontario Limited |

001691558 |

|

2010-05-31 |

1691760 Ontario Ltd. |

001691760 |

|

2010-05-31 |

1691771 Ontario Inc. |

001691771 |

|

2010-05-31 |

1691809 Ontario Inc. |

001691809 |

|

2010-05-31 |

1691810 Ontario Inc. |

001691810 |

|

2010-05-31 |

1691951 Ontario Limited |

001691951 |

|

2010-05-31 |

1691977 Ontario Inc. |

001691977 |

|

2010-05-31 |

1692008 Ontario Inc. |

001692008 |

|

2010-05-31 |

1692022 Ontario Limited |

001692022 |

|

2010-05-31 |

1692242 Ontario Limited |

001692242 |

|

2010-05-31 |

1692248 Ontario Inc. |

001692248 |

|

2010-05-31 |

1693154 Ontario Inc. |

001693154 |

|

2010-05-31 |

1693499 Ontario Ltd. |

001693499 |

|

2010-05-31 |

1693604 Ontario Inc. |

001693604 |

|

2010-05-31 |

1900 Bayview Limited |

002097086 |

|

2010-05-31 |

2F Steak House Inc. |

001691441 |

|

2010-05-31 |

2024616 Ontario Limited |

002024616 |

|

2010-05-31 |

2070250 Ontario Limited |

002070250 |

|

2010-05-31 |

2095506 Ontario Limited |

002095506 |

|

2010-05-31 |

2095907 Ontario Ltd. |

002095907 |

|

2010-05-31 |

2096229 Ontario Limited |

002096229 |

|

2010-05-31 |

2096475 Ontario Inc. |

002096475 |

|

2010-05-31 |

2096678 Ontario Inc. |

002096678 |

|

2010-05-31 |

2096683 Ontario Limited |

002096683 |

|

2010-05-31 |

2096765 Ontario Inc. |

002096765 |

|

2010-05-31 |

2097048 Ontario Inc. |

002097048 |

|

2010-05-31 |

2097186 Ontario Inc. |

002097186 |

|

2010-05-31 |

2097218 Ontario Inc. |

002097218 |

|

2010-05-31 |

2097486 Ontario Limited |

002097486 |

|

2010-05-31 |

2097654 Ontario Inc. |

002097654 |

|

2010-05-31 |

2097677 Ontario Ltd. |

002097677 |

|

2010-05-31 |

2097922 Ontario Inc. |

002097922 |

|

2010-05-31 |

2098000 Ontario Inc. |

002098000 |

|

2010-05-31 |

656553 Ontario Limited |

000656553 |

|

2010-05-31 |

854032 Ontario Inc. |

000854032 |

Katherine M. Murray

Director, Ministry of Government Services

(143-G317)

Certificate of Dissolution

Notice Is Hereby Given that a certificate of dissolution under the Business Corporations Act, has been endorsed. The effective date of dissolution precedes the corporation listings.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2010-05-19 |

T. Edward Stuckless Enterprises Limited |

000370691 |

|

2010-05-19 |

1552074 Ontario Inc. |

001552074 |

|

2010-05-19 |

1734476 Ontario Inc. |

001734476 |

|

2010-05-19 |

932947 Ontario Limited |

000932947 |

|

2010-05-20 |

Ed Oldford Construction Ltd. |

000654529 |

|

2010-05-20 |

Kipata Inc. |

002122820 |

|

2010-05-28 |

Pyramids Auto Sales Incorporated |

001614856 |

|

2010-05-28 |

1619258 Ontario Inc. |

001619258 |

|

2010-05-28 |

1688962 Ontario Inc. |

001688962 |

|

2010-05-31 |

Apple Valley Homes Ltd. |

002073041 |

|

2010-05-31 |

Apsley Tire Service Limited |

001410791 |

|

2010-05-31 |

Bai & Associates Inc. |

002146771 |

|

2010-05-31 |

Datascape Technologies Inc. |

001026040 |

|

2010-05-31 |

Elspaul Holdings Inc. |

000139210 |

|

2010-05-31 |

Envirofreighter Canada Ltd. |

002146766 |

|

2010-05-31 |

Frank Mann Holdings Limited |

000223845 |

|

2010-05-31 |

Heuvelholm Farms Inc. |

000653556 |

|

2010-05-31 |

Insoft Professionals Inc. |

000964364 |

|

2010-05-31 |

Jejen Home Care Inc. |

001775097 |

|

2010-05-31 |

Mcknight Sales Inc. |

001528095 |

|

2010-05-31 |

Milliard Capital Ltd. |

001206429 |

|

2010-05-31 |

Moony’s Bites Ltd. |

001787410 |

|

2010-05-31 |

Mynton Technology Inc. |

001201981 |

|

2010-05-31 |

Oakland Park Rh Inc. |

001233268 |

|

2010-05-31 |

Owl Films Limited |

000357797 |

|

2010-05-31 |

Prem Taneja Associates Inc. |

001634461 |

|

2010-05-31 |

Preston Paul & Associates Inc. |

001361210 |

|

2010-05-31 |

Renfrew Wholesale Company Limited |

000137268 |

|

2010-05-31 |

Rsd Internet Inc. |

001424240 |

|

2010-05-31 |

Sheppard’s Life Centre Inc. |

001709581 |

|

2010-05-31 |

Southlake Systems Inc. |

000889659 |

|

2010-05-31 |

The Cedar Chest Ltd. |

001256505 |

|

2010-05-31 |

True Serve Tire & Auto Service Ltd. |

001255678 |

|

2010-05-31 |

Vanginhoven Construction Limited |

000262044 |

|

2010-05-31 |

West Brant Iron & Metal Limited |

000115038 |

|

2010-05-31 |

Xperience Plus Transport Inc. |

001737915 |

|

2010-05-31 |

1035272 Ontario Inc. |

001035272 |

|

2010-05-31 |

1066881 Ontario Limited |

001066881 |

|

2010-05-31 |

1124899 Ontario Inc. |

001124899 |

|

2010-05-31 |

1259772 Ontario Inc. |

001259772 |

|

2010-05-31 |

1261158 Ontario Inc. |

001261158 |

|

2010-05-31 |

1353561 Ontario Inc. |

001353561 |

|

2010-05-31 |

1538332 Ontario Inc. |

001538332 |

|

2010-05-31 |

1624460 Ontario Inc. |

001624460 |

|

2010-05-31 |

1640504 Ontario Inc. |

001640504 |

|

2010-05-31 |

1754113 Ontario Inc. |

001754113 |

|

2010-05-31 |

1787364 Ontario Inc. |

001787364 |

|

2010-05-31 |

2060447 Ontario Inc. |

002060447 |

|

2010-05-31 |

2085177 Ontario Limited |

002085177 |

|

2010-05-31 |

2184559 Ontario Inc. |

002184559 |

|

2010-05-31 |

2190785 Ontario Limited |

002190785 |

|

2010-05-31 |

333110 Ontario Limited |

000333110 |

|

2010-05-31 |

428212 Ontario Limited |

000428212 |

|

2010-05-31 |

499188 Ontario Limited |

000499188 |

|

2010-05-31 |

750230 Ontario Limited |

000750230 |

|

2010-05-31 |

915419 Ontario Limited |

000915419 |

|

2010-06-01 |

Goodworld Enterprise Ltd. |

001714592 |

|

2010-06-01 |

Hvorup Enterprises Inc. |

001017053 |

|

2010-06-01 |

International Calendars & Millennium 2000Products Ltd. |

001274196 |

|

2010-06-01 |

Lush Beverages Inc. |

002090553 |

|

2010-06-01 |

Northview Industries Limited |

000369966 |

|

2010-06-01 |

Oak Transportation Services Ltd. |

001078939 |

|

2010-06-01 |

Power Deal Inc. |

001695253 |

|

2010-06-01 |

Robin Hill, Inc. |

001519196 |

|

2010-06-01 |

Shananigans Beanery Inc. |

001554539 |

|

2010-06-01 |

Silverstone Canada Inc. |

001621418 |

|

2010-06-01 |

Spectrumway Consulting Limited |

001203590 |

|

2010-06-01 |

Winnex Import Inc. |

001491967 |

|

2010-06-01 |

Yahia Trading Kingston Inc. |

001178371 |

|

2010-06-01 |

1274771 Ontario Inc. |

001274771 |

|

2010-06-01 |

2101599 Ontario Limited |

002101599 |

|

2010-06-01 |

2183678 Ontario Inc. |

002183678 |

|

2010-06-01 |

801744 Ontario Limited |

000801744 |

|

2010-06-01 |

878505 Ontario Inc. |

000878505 |

|

2010-06-02 |

Alternative Travel Agency Inc. |

001043261 |

|

2010-06-02 |

Atl Automotive Systems Inc. |

001317909 |

|

2010-06-02 |

Capco Environmental & Hydrostatic Testing Inc. |

001528521 |

|

2010-06-02 |

Doppler Tile Ltd. |

000730637 |

|

2010-06-02 |

Dr. Stephan C. Mostowy Medicine Professional Corporation |

001645288 |

|

2010-06-02 |

Faith And Praise Inc. |

001585339 |

|

2010-06-02 |

Iqc Tech Corp. |

001600989 |

|

2010-06-02 |

Krista Transport Inc. |

002084570 |

|

2010-06-02 |

Larry Nickerson Trucking Ltd. |

000825492 |

|

2010-06-02 |

Maroon Bells Polo Inc. |

001150632 |

|

2010-06-02 |

Panda Shoes Ontario Inc. Chaussures Panda Ontario Inc. |

000582660 |

|

2010-06-02 |

Ref-Air Thermal Products Ltd. |

001053841 |

|

2010-06-02 |

Rv-Jv Land Corporation |

001199814 |

|

2010-06-02 |

Shutter Nonsense Inc. |

002131456 |

|

2010-06-02 |

Toronto Eight At Eight Internet Corporation |

001647249 |

|

2010-06-02 |

Tracey’s Kandy Korner Ltd. |

000717702 |

|

2010-06-02 |

Virk Brothers Truck Repair Services Inc. |

002136130 |

|

2010-06-02 |

1684111 Ontario Inc. |

001684111 |

|

2010-06-02 |

2084901 Ontario Inc. |

002084901 |

|

2010-06-02 |

2131557 Ontario Inc. |

002131557 |

|

2010-06-02 |

2139548 Ontario Inc. |

002139548 |

|

2010-06-02 |

268682 Ontario Limited |

000268682 |

|

2010-06-02 |

723364 Ontario Inc. |

000723364 |

|

2010-06-02 |

906354 Ontario Limited |

000906354 |

|

2010-06-03 |

Bmbc Enterprises Inc. |

002173518 |

|

2010-06-03 |

Bros.Mart Holdings Inc. |

001196600 |

|

2010-06-03 |

Canada Jadeland International Ltd. |

001548625 |

|

2010-06-03 |

Canada Metal Investments Limited |

000705634 |

|

2010-06-03 |

Case-Pro Case Management Systems Inc. |

002005223 |

|

2010-06-03 |

Easyhome Mortgages Inc. |

002081792 |

|

2010-06-03 |

Edpo-V International Inc. |

000717924 |

|

2010-06-03 |

Frato Rama Developments Inc. |

002080716 |

|

2010-06-03 |

Gape Promotions & Consultant Ltd. |

001632525 |

|

2010-06-03 |

Hair Removal & Laser Aesthetic Centre Inc. |

001686450 |

|

2010-06-03 |

Howlee Furniture Inc. |

001549701 |

|

2010-06-03 |

Jit Trucking Inc. |

002055776 |

|

2010-06-03 |

Kai-Lee Inc. |

001154486 |

|

2010-06-03 |

Kiru Travel Inc. |

001686896 |

|

2010-06-03 |

Norman Jenkens Investments Limited |

000686965 |

|

2010-06-03 |

R.J.’S Hair Studio Inc. |

001576628 |

|

2010-06-03 |

Rally Energy Gulf Investments Ltd. |

002209168 |

|

2010-06-03 |

Recall Records Canada Inc. |

001685295 |

|

2010-06-03 |

Request Direct Hire Inc. |

002080361 |

|

2010-06-03 |

Richardson Road Inc. |

001577897 |

|

2010-06-03 |

Richardson Road No. 2 Inc. |

001577902 |

|

2010-06-03 |

Sol Electronics Inc. |

002035788 |

|

2010-06-03 |

1062924 Ontario Inc. |

001062924 |

|

2010-06-03 |

1065065 Ontario Inc. |

001065065 |

|

2010-06-03 |

1267831 Ontario Inc. |

001267831 |

|

2010-06-03 |

1442559 Ontario Ltd. |

001442559 |

|

2010-06-03 |

1494456 Ontario Inc. |

001494456 |

|

2010-06-03 |

1530342 Ontario Limited |

001530342 |

|

2010-06-03 |

1632943 Ontario Inc. |

001632943 |

|

2010-06-03 |

1715662 Ontario Ltd. |

001715662 |

|

2010-06-03 |

1763550 Ontario Inc. |

001763550 |

|

2010-06-03 |

2004078 Ontario Inc. |

002004078 |

|

2010-06-03 |

24 Colonnade Road Inc. |

001534258 |

|

2010-06-03 |

807477 Ontario Limited |

000807477 |

|

2010-06-03 |

813817 Ontario Limited |

000813817 |

|

2010-06-03 |

823816 Ontario Inc. |

000823816 |

|

2010-06-03 |

958764 Ontario Inc. |

000958764 |

|

2010-06-03 |

977664 Ontario Inc. |

000977664 |

|

2010-06-04 |

Atok Group Of Co. Ltd. |

001620770 |

|

2010-06-04 |

Captiva Foods Ltd. |

002118810 |

|

2010-06-04 |

Dccw International Trading Inc. |

002158458 |

|

2010-06-04 |

Edr Construction Inc. |

001752741 |

|

2010-06-04 |

Herbert Gerrish Inc. |

002065071 |

|

2010-06-04 |

Hoken Trading Limited |

000378272 |

|

2010-06-04 |

Ia Snacks Inc. |

001722180 |

|

2010-06-04 |

Immediate Placement Network Inc. |

001545995 |

|

2010-06-04 |

Jam Catering Corp. |

001298676 |

|

2010-06-04 |

John Regina & Associates Ltd. |

000559609 |

|

2010-06-04 |

L&A Forum Financial Inc. |

001363772 |

|

2010-06-04 |

Lakeshore Wholesale Party Supplies Limited |

000313522 |

|

2010-06-04 |

Les Entreprises Jacques Briere Inc. |

000499979 |

|

2010-06-04 |

M.J.B. Construction Services Ltd. |

000910360 |

|

2010-06-04 |

Meadowvale Acquisitions I Ltd. |

001289566 |

|

2010-06-04 |

Minialoff Family Holdings Ltd. |

000517720 |

|

2010-06-04 |

Mohawk Plaza Limited |

000201086 |

|

2010-06-04 |

Ontariostar Aircraft Company Incorporated |

000366878 |

|

2010-06-04 |

P&O Global Investments Inc. |

001363773 |

|

2010-06-04 |

Peek-A-Boo-Tique (Port Dover) Ltd. |

001195706 |

|

2010-06-04 |

The Mez Group Inc. |

002203999 |

|

2010-06-04 |

1173592 Ontario Limited |

001173592 |

|

2010-06-04 |

1244775 Ontario Limited |

001244775 |

|

2010-06-04 |

1259591 Ontario Limited |

001259591 |

|

2010-06-04 |

1365987 Ontario Limited |

001365987 |

|

2010-06-04 |

1485243 Ontario Limited |

001485243 |

|

2010-06-04 |

1691518 Ontario Inc. |

001691518 |

|

2010-06-04 |

1738255 Ontario Ltd. |

001738255 |

|

2010-06-04 |

2122168 Ontario Inc. |

002122168 |

|

2010-06-04 |

2122983 Ontario Inc. |

002122983 |

|

2010-06-04 |

2138439 Ontario Limited |

002138439 |

|

2010-06-04 |

2202531 Ontario Inc. |

002202531 |

|

2010-06-04 |

751449 Ontario Inc. |

000751449 |

|

2010-06-07 |

A Tech Real Estate Development Inc. |

000529855 |

|

2010-06-07 |

Ai J. Chen Importing Co. Ltd. |

000436647 |

|

2010-06-07 |

Cruisedocktors Inc. |

000979024 |

|

2010-06-07 |

Danbro Restaurant Equipment Representatives Ltd. |

000403603 |

|

2010-06-07 |

Ho Won Restaurant Inc. |

000923549 |

|

2010-06-07 |

Innovative Internet Products Inc. |

002024913 |

|

2010-06-07 |

Kprm Solutions Inc. |

001706738 |

|

2010-06-07 |

L. P. Holly Developments Inc. |

001326083 |

|

2010-06-07 |

Orbtide Ltd. |

002124477 |

|

2010-06-07 |

Sight & Scents Ltd. |

002071627 |

|

2010-06-07 |

The Beer Man Inc. |

001309960 |

|

2010-06-07 |

Tiger Force Labour Agency Inc. |

001734034 |

|

2010-06-07 |

1096135 Ontario Inc. |

001096135 |

|

2010-06-08 |

Alaira Inc. |

002070550 |

|

2010-06-08 |

Northern Auto Supply Company Limited |

001816186 |

|

2010-06-08 |

Polestar World Enterprises Inc. |

000880421 |

|

2010-06-08 |

Slyfield Oshawa Ltd. |

001534267 |

|

2010-06-08 |

T&T Flooring Inc. |

002006817 |

|

2010-06-08 |

Verrall Holdings Inc. |

001125892 |

|

2010-06-08 |

1161392 Ontario Ltd. |

001161392 |

|

2010-06-08 |

1333787 Ontario Ltd. |

001333787 |

|

2010-06-08 |

1715143 Ontario Ltd. |

001715143 |

|

2010-06-08 |

1717187 Ontario Inc. |

001717187 |

|

2010-06-08 |

2092562 Ontario Inc. |

002092562 |

|

2010-06-08 |

2134702 Ontario Inc. |

002134702 |

|

2010-06-08 |

539439 Ontario Inc. |

000539439 |

|

2010-06-08 |

619213 Ontario Limited |

000619213 |

|

2010-06-09 |

Curran Contracting Inc. |

001664221 |

|

2010-06-09 |

Dmcc Tv Inc. |

002044619 |

|

2010-06-09 |

Dualift Corp. |

000539590 |

|

2010-06-09 |

Hamond Industries Limited |

000095877 |

|

2010-06-09 |

Harry Yip Enterprise Corp. |

002092542 |

|

2010-06-09 |

Hq Technologies Inc. |

001151276 |

|

2010-06-09 |

Jati Trading Company Inc. |

002117069 |

|

2010-06-09 |

Raval 611 Inc. |

002059374 |

|

2010-06-09 |

Technical Welding Inc. |

001342673 |

|

2010-06-09 |

1479350 Ontario Inc. |

001479350 |

|

2010-06-09 |

2010314 Ontario Inc. |

002010314 |

|

2010-06-09 |

2175131 Ontario Inc. |

002175131 |

|

2010-06-09 |

55 Horner Ks Inc. |

002078144 |

Katherine M. Murray

Director, Ministry of Government Services

(143-G318)

Notice of Default in Complying with the Corporations Information Act

Notice Is Hereby Given under subsection 241(3) of the Business Corporations Act that unless the corporations listed hereunder comply with the filing requirements under the Corporations Information Act within 90 days of this notice orders dissolving the corporation(s) will be issued. The effective date precedes the corporation listings.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2010-06-11 |

Bayard Capital Corporation |

2171102 |

|

2010-06-11 |

Dpr Windsor Inc. |

2114481 |

|

2010-06-11 |

Ed'S Purely Organic Lawn And Garden Products Ltd. |

1655627 |

|

2010-06-11 |

Harpers Gardening Centre Ltd. |

597052 |

|

2010-06-11 |

Rci - Store #1 Inc. |

2002172 |

|

2010-06-11 |

Sani-Clean Systems Inc. |

1376834 |

|

2010-06-11 |

Tires And More Inc. |

662432 |

|

2010-06-16 |

Basement Systems Canada Inc. |

1242437 |

|

2010-06-16 |

1340957 Ontario Inc. |

1340957 |

Katherine M. Murray

Director

(143-G319)

Cancellation of Certificate of Incorporation (Business Corporations Act)

Notice Is Hereby Given that by orders under subsection 241(4) of the Business Corporation Act, the certificates of incorporation set out hereunder have been cancelled and corporation(s) have been dissolved. The effective date of cancellation precedes the corporation listing.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2010-06-09 |

J&C Flooring And Renovations Ltd. |

1641205 |

|

2010-06-09 |

1760656 Ontario Inc. |

1760656 |

|

2010-06-09 |

1773626 Ontario Limited |

1773626 |

|

2010-06-09 |

1787662 Ontario Inc. |

1787662 |

|

2010-06-11 |

Barrie Stars Limousine Services Inc. |

2111363 |

|

2010-06-11 |

Broadbelt & Fonte Model Centre Inc. |

887990 |

|

2010-06-11 |

Mccarda Holdings Inc. |

384373 |

|

2010-06-11 |

New Stream Enterprises Inc. |

465160 |

|

2010-06-11 |

Novus-Intersign Engineering Inc. |

798265 |

|

2010-06-11 |

657413 Ontario Limited |

657413 |

|

2010-06-14 |

Ultratech Tool & Gauge Inc. |

1117651 |

|

2010-06-15 |

Cabana-Rama Inc. |

1580977 |

|

2010-06-15 |

Mr. Fine Food (2004) Inc. |

1631525 |

|

2010-06-15 |

1314364 Ontario Inc. |

1314364 |

|

2010-06-15 |

1760443 Ontario Inc. |

1760443 |

Katherine M. Murray

Director

(143-G320)

Cancellation for Cause (Business Corporations Act)

Notice Is Hereby Given that by orders under section 240 of the Business Corporation Act, the certificates set out hereunder have been cancelled for cause and in the case of certificates of incorporation the corporations have been dissolved. The effective date of cancellation precedes the corporation listing.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2010-06-11 |

A.L.C. Manufacturing Inc. |

1058172 |

|

2010-06-11 |

Djp Systems Corporation |

1012416 |

|

2010-06-11 |

Paul Kechnie Ford Sales Ltd. |

706706 |

|

2010-06-11 |

Rich Top Flooring Inc. |

1793663 |

|

2010-06-11 |

Toall Investments Inc. |

2122368 |

|

2010-06-11 |

W. Lam Ltd. |

1793598 |

|

2010-06-15 |

E-Mac Services Inc. |

1683422 |

|

2010-06-15 |

Nouman Ahmed Inc. |

1796479 |

|

2010-06-15 |

Raine Daze Investments Ltd. |

1370219 |

|

2010-06-15 |

2017311 Ontario Inc. |

2017311 |

|

2010-06-15 |

2024827 Ontario Limited |

2024827 |

|

2010-06-15 |

2078248 Ontario Inc. |

2078248 |

Katherine M. Murray

Director

(143-G321)

Cancellation for Filing Default (Corporations Act)

Notice Is Hereby Given that orders under Section 317(9) of the Corporations Act have been made cancelling the Letters Patent of the following corporations and declaring them to be dissolved. The date of the order of dissolution precedes the name of the corporation.

|

Date |

Name of Corporation |

Ontario Corporation Number |

|---|---|---|

|

2010-06-11 |

Cross Cultural Community Centre |

1792482 |

|

2010-06-15 |

Sudbury Cancer Support |

1796865 |

Katherine M. Murray

Director

(143-G322)

Erratum Notice

Ontario Corporation Number 2128037

Vide Ontario Gazette, Vol. 142-19 dated May 9, 2009

Notice Is Hereby Given that the notice issued under section 241(4) of the Business Corporations Act set out in the May 9, 2009 issue of the Ontario Gazette with respect to Tech-Venture International Inc., was issued in error and is null and void.

Katherine M. Murray

Director

(143-G323)

Marriage Act

Certificate Of Permanent Registration as a person authorized to solemnize marriage in Ontario have been issued to the following:

June 7 - June 11

|

Name |

Location |

Effective Date |

|---|---|---|

|

Turner, David Aleksander |

Toronto, ON |

10-Jun-10 |

|

Melby, Eric Kristian |

Ottawa, ON |

10-Jun-10 |

|

Cran, Juliet |

Ottawa, ON |

10-Jun-10 |

|

Park, Kenneth Andrew |

Toronto, ON |

10-Jun-10 |

|

Hawley, Randy |

Kingston, ON |

10-Jun-10 |

|

Skeete, Lionel |

Mississauga, ON |

10-Jun-10 |

|

Maiuri, Darla E |

Keswick, ON |

10-Jun-10 |

|

Punnoose, Chacko K |

London, ON |

10-Jun-10 |

|

Gilbert, Gloria Joyse |

Kingsville, ON |

10-Jun-10 |

|

Benson, Gillian Leigh |

Toronto, ON |

10-Jun-10 |

|

Newman, Judith |

Toronto, ON |

10-Jun-10 |

|

St-Laurent, Louis-Paul |

Ottawa, ON |

10-Jun-10 |

|

Montgomery, Anne |

Ottawa, ON |

10-Jun-10 |

|

Missaghi, Farshid M |

Woodbridge, ON |

10-Jun-10 |

|

Vafi, Rezvan |

Woodbridge, ON |

10-Jun-10 |

|

Denys, Jennifer Lyn |

Parkhill, ON |

10-Jun-10 |

|

Church, Lori |

Orangeville, ON |

10-Jun-10 |

|

Cullen, Robert |

Minden, ON |

10-Jun-10 |

|

South, Doreen K |

Cornwall, ON |

10-Jun-10 |

|

Smith, Levi Theophilus |

Brampton, ON |

10-Jun-10 |

|

Cassanova, Audrey |

Scarborough, ON |

10-Jun-10 |

|

Church, Timothy David |

Georgetown, ON |

10-Jun-10 |

Re-registrations

|

Name |

Location |

Effective Date |

|---|---|---|

|

Stryker, John |

Waterloo, ON |

10-Jun-10 |

|

MacDonald, James |

Moosonee, ON |

10-Jun-10 |

|

Lobban, Donovan |

Pickering, ON |

10-Jun-10 |

Certificates Of Temporary Registration as person authorized to solemnize marriage in Ontario have been issued to the following:

June 7 - June 11

|

Date |

Name |

Location |

Effective Date |

|---|---|---|---|

|

August 12, 2010 to August 16, 2010 |

Biggar, Danny James |

Sydney, NS |

07-Jun-10 |

|

July 1, 2010 to July 5, 2010 |

Sampara, Kamal |

Tantallon, NS |

07-Jun-10 |

|

June 24, 2010 to June 28, 2010 |

Goldsmith, Daniel |

Abbotsford, BC |

07-Jun-10 |

|

June 10, 2010 to June 14, 2010 |

Overland, Jonathan L |

Okotoks, AB |

07-Jun-10 |

|

June 17, 2010 to June 21, 2010 |

McLeod, Donald Angus |

Calgary, AB |

07-Jun-10 |

|

July 1, 2010 to July 5, 2010 |

Beunk, Andrew E |

Burnaby, BC |

07-Jun-10 |

|

July 14, 2010 to July 18, 2010 |

Beunk, Andrew E |

Burnaby, BC |

07-Jun-10 |

|

July 29, 2010 to August 2, 2010 |

D'sa, Denis Alexander |

Kankanady, Mangalore Karnataka |

07-Jun-10 |

|

June 24, 2010 to June 28, 2010 |

Joseph, Johnykutty Kochuchira |

Roma, Italy |

07-Jun-10 |

|

July 1, 2010 to July 5, 2010 |

Francois, Jorel |

Chelmsford, ON |

07-Jun-10 |

|

July 22, 2010 to July 26, 2010 |

Francois, Jorel |

Chelmsford, ON |

07-Jun-10 |

|

August 26, 2010 to August 30, 2010 |

Francois, Jorel |

Chelmsford, ON |

07-Jun-10 |

|

June 17, 2010 to June 21, 2010 |

Mc Farlane, William Murdock |

Beaconsfield, QC |

07-Jun-10 |

|

July 29, 2010 to August 2, 2010 |

Mc Farlane, William Murdock |

Beaconsfield, QC |

07-Jun-10 |

|

July 9, 2010 to July 13, 2010 |

Springett, Judith |

Hanover, ON |

10-Jun-10 |

|

July 8, 2010 to July 12, 2010 |

Novak, Krunoslav |

Rome, Italy |

10-Jun-10 |

|

July 15, 2010 to July 19, 2010 |

Gannett, Ronald George |

Birmingham, AL |

10-Jun-10 |

|

September 29, 2010 to October 3, 2010 |

Gannett, Ronald George |

Birmingham, AL |

10-Jun-10 |

|

June 24, 2010 to June 28, 2010 |

Jansen, Paul Jacob |

Rocky View, AB |

10-Jun-10 |

|

September 10, 2010 to September 14, 2010 |

Matsugu, Ken |

Scarborough, ON |

10-Jun-10 |

|

August 12, 2010 to August 16, 2010 |

Barrett, Harry Bernard |

Vancouver, BC |

10-Jun-10 |

|

July 14, 2010 to July 18, 2010 |

Easterbrook, Ken |

Vauxhall, AB |

10-Jun-10 |

|

July 29, 2010 to August 2, 2010 |

Fletcher, Michael |

Drumheller, AB |

10-Jun-10 |

|

August 5, 2010 to August 9, 2010 |

Crosby, David Douglas |

Corner Brook, NL |

10-Jun-10 |

Certificate Of Cancellation Of Registration as a person authorized to solemnize marriage in Ontario have been issued to the following:

June 7 - June 11

|

Name |

Location |

Effective Date |

|---|---|---|

|

Johnston, Jason |

Jacksonville, KY |

09-Jun-10 |

|

Agyeman, Philip |

North York, ON |

09-Jun-10 |

|

Gill, Todd |

Brampton, ON |

09-Jun-10 |

|

Williams, Octavia |

Mississauga, ON |

09-Jun-10 |

|

Thompson, Susan |

Toronto, ON |

09-Jun-10 |

|

King, Christine |

London, ON |

09-Jun-10 |

|

King, Micheal |

London, ON |

09-Jun-10 |

|

DeGrasperis, Joanne |

Wasaga Beach, ON |

09-Jun-10 |

|

Bland, Gregory T A |

Lively, ON |

11-Jun-10 |

|

Vos, Daniel |

Emo, ON |

11-Jun-10 |

|

Warmington, Paul |

Ottawa, ON |

11-Jun-10 |

|

Watton, Joseph G |

Bradford, ON |

11-Jun-10 |

|

Elertson, Michael John |

Mississauga, ON |

11-Jun-10 |

Judith M. Hartman,

Deputy Registrar General

(143-G324)

Financial Services Commission of Ontario

June 2010

Superintendent’s Guideline No. 02/10

Minor Injury Guideline

-

Introduction

This Guideline is issued pursuant to section 268.3 of the Insurance Act for the purposes of the Statutory Accident Benefits Schedule - Effective September 1, 2010 (Sabs).

As required by section 268.3 (2) of the Insurance Act, this Guideline shall be considered in any determination involving the interpretation of the Sabs.

For the purposes of this Guideline, the terms “injury” and “injuries” have the same meaning as “impairment” and “impairments” respectively as used in the Sabs, and “regulated health professional” and “health practitioner” have the same meanings as in the Sabs.

This Guideline is effective for any Treatment Confirmation Form (Ocf-23) submitted on behalf of an insured person or when the insurer has waived the requirement for an Ocf-23, in respect of an accident that occurred on or after September 1, 2010.

The Pre-approved Framework Guideline for Grade I and Ii Whiplash Associated Disorders (Superintendent’s Guideline No. 02/09) remains in effect for Treatment Confirmation Form (Ocf-23) forms that are submitted on behalf of an insured person, or when an insurer has waived the requirement for a Treatment Confirmation Form (Ocf-23) form, in respect of an accident that occurred before September 1, 2010.

The objectives of this Guideline are to:

- Speed access to rehabilitation for persons who sustain minor injuries in auto accidents;

- Improve utilization of health care resources;

- Provide certainty around cost and payment for insurers and regulated health professionals; and

- Be more inclusive in providing immediate access to treatment without insurer approval for those persons with minor injuries as defined in the Sabs and set out in Part 2 of this Guideline.

Consistent with these objectives, this Guideline sets out the goods and services that will be paid for by the insurer without insurer approval if provided to an insured person who has sustained a minor injury.

This Guideline is focused on the application of a functional restoration approach, in addition to the provision of interventions to reduce or manage pain or disability.

The Sabs and this Guideline are intended to encourage and promote the broadest use of this Guideline, recognizing that most persons injured in car accidents in Ontario sustain minor injuries for which the goods and services provided under this Guideline are appropriate.

Usage of the Guideline by all stakeholders will be monitored on an ongoing basis, with a view to early identification and response to inappropriate application or interpretation of the Sabs and the Guideline.

-

Definitions

This Guideline is focused on the application of a functional restoration approach in the management of minor injuries in the acute and sub-acute phases of the injury.

For the purposes of this Guideline:

- minor injury means a sprain, strain, whiplash associated disorder, contusion, abrasion, laceration or subluxation and any clinically associated sequelae. This term is to be interpreted to apply where a person sustains any one or more of these injuries.

- sprain means an injury to one or more tendons or ligaments or to one or more of each, including a partial but not a complete tear.

- strain means an injury to one or more muscles, including a partial but not a complete tear.

- subluxation means a partial but not a complete dislocation of a joint.

- whiplash injury means an injury that occurs to a person’s neck following a sudden acceleration-deceleration force.

- whiplash associated disorder means a whiplash injury that:

- does not exhibit objective, demonstrable, definable and clinically relevant neurological signs, and

- does not exhibit a fracture in or dislocation of the spine.

- Functional restoration refers to an approach in which the health practitioner is oriented toward function and to the delivery of interventions that help the insured person to reduce or manage his/her pain and associated psycho-social symptoms. Interventions are focused on what the insured person needs to do in order to function at his/her pre-accident level in his/her home and work environment. The insured person is assessed to determine the level of current functioning relative to these critical demands and any functional limitations that have arisen as a result of the injury. The interventions delivered by the health practitioner or by regulated health professionals coordinated or supervised by the health practitioner are then designed to address these areas of limitation such that the individual will be able to maintain and/or resume normal activities at home and at work.

- Recommended interventions refers to interventions that are ideally provided each time the insured person attends the health practitioner’s clinic.

- Discretionary interventions refers to interventions that are provided at the discretion of the health practitioner based upon the specific needs of the insured person. These interventions should not be interpreted to be less important in the treatment of the insured person.

-

Impairments that come within this Guideline

Subject to the exception in Section 4 below, an insured person’s impairment comes within this Guideline if the impairment is predominantly a minor injury.

-

Impairments that do not come within this Guideline

An insured person’s impairment does not come within this Guideline if the insured person’s impairment is predominantly a minor injury but, based on compelling evidence provided by his or her health practitioner, the insured person has a pre-existing medical condition that will prevent the insured person from achieving maximal recovery from the minor injury if he or she is subject to the $3,500 limit referred to in section 18(1) of the Sabs or is limited to the goods and services authorized under this Guideline.

Compelling evidence should be provided using the Treatment and Assessment Plan (Ocf-18) with attached medical documentation, if any, prepared by a health practitioner.

The existence of any pre-existing condition will not automatically exclude a person’s impairment from this Guideline. It is intended and expected that the vast majority of pre-existing conditions will not do so.

Only in extremely limited instances where compelling evidence provided by a health practitioner satisfactorily demonstrates that a pre-existing condition will prevent a person from achieving maximal recovery from the minor injury for the reasons described above is the person’s impairment to be determined not to come within this Guideline. Exclusion of a person from this Guideline based on reasons or evidence falling short of this requirement is inconsistent with the intent of the Sabs and this Guideline.

-

Providers able to deliver services within this Guideline

Providers who are able to deliver services within this Guideline are any health practitioners, as defined by the Sabs, who are authorized by law to treat the injury and who have the ability to deliver the interventions referred to in this Guideline. The health practitioner may also co-ordinate or directly supervise the provision of services to the insured person by other appropriate health care providers.

-

Changing health practitioners within this Guideline

Where insured persons under this Guideline decide to change their health practitioner, the new health practitioner will inform the insurer, who will advise the health practitioner as to what services have already been provided under the Guideline. The health practitioner will then resume delivery of Guideline services. Payment to the new health practitioner will be limited to the balance of the remaining services under this Guideline.

-

The initial visit

-

Timing of the initial visit

The initial visit will ideally occur as soon as possible following the date of accident and health practitioners are encouraged to commence intervention during the initial visit.

-

Components of the initial visit

- Assessment

In assessing the insured person, the health practitioner will be responsible for:

- Undertaking a history, including, but not limited to: demographics;

prior injuries; current injury.

- Completing a physical examination, including, but not limited to:

range of motion determination; neurological examination; assessment of associated injuries.

- Reviewing and documenting functional status and psychosocial risk factors associated with the injury including, but not limited to: changes in functional status; psycho-social issues; other risk factors or barriers to recovery. It is understood that the review and documentation of functional status and psycho-social risk factors is within the scope of practice of the health practitioner and does not involve a formal psychological assessment. While it is recommended that the health practitioner employ standardized tools and instruments in the review of functional status and psychosocial risk factors, the specific tools used are left to the discretion of the individual health practitioner.

- Identifying the diagnosis and/or impairment description, including: the

Primary Diagnosis/Impairment Description (Icd 10 Codes); and the Secondary Diagnosis/Impairment Description (Icd 10 Codes).

- Obtaining and recording the insured person’s informed consent to treatment.

- Reviewing the completed Treatment Confirmation Form (Ocf-23) with the insured person and obtaining the insured person’s signature on the Form unless the insurer has waived the requirement for the form.

- Undertaking a history, including, but not limited to: demographics;

- Recommended interventions during the initial visit

The interventions that are recommended during the initial visit include:

- Activity prescription

Encouraging the insured person, when appropriate, to remain active and maintain normal activities as an important factor in facilitating recovery.

- Reassurance

Providing reassurance, when appropriate, to the insured person regarding his/her injuries and the recovery process.

- Education

Distributing the brochure “Getting the Facts About Whiplash” (attached as Appendix A), when appropriate, and providing education regarding minor injuries, symptoms, the natural healing process and prognosis for recovery.

- Home exercise program

Demonstrating and providing advice, when appropriate, on how the insured person should exercise his/her injury; and customizing an exercise program for the insured person to engage in at home, work or school.

- Activity prescription

- Discretionary interventions during the initial visit

At the discretion of the health practitioner, and to facilitate the insured person’s recovery and return to function, these include:

- Exercise and functional activities

The interventions should be based on the specific needs and functional requirements of the insured person and may include: range of motion exercises; muscle re-education; and low load isometric exercise.

- Mobilization and manipulation

The health practitioner may provide these interventions if the insured person would benefit from mobilization and/or manipulation.

- Diagnostic imaging

X-rays may be undertaken without the prior approval of the insurer under the following circumstances:

- The fees charged do not exceed those listed in Appendix C and any available funding from Ohip or collateral insurance is utilized before the insurer is charged;

- No other comparable x-rays have been taken by another health practitioner or facility since the accident; and

- The insured person displays one or more of the following:

- Suspicion of a bony injury;

- Suspicion of degenerative changes, instability or other conditions of sufficient severity that counter indications to one or more interventions must be ruled out;

- Suspicion of rheumatoid arthritis;

- Suspicion of osteoporosis; or

- History of cancer.

- Other interventions that facilitate pain management, activation and return to function

If the insured person would benefit from other specific interventions to facilitate pain management, activation and return to function, these interventions may be provided during the initial or subsequent visits. These may include, but are not limited to: massage therapy; intervention for psycho-social issues; coping skills education; advice regarding hurt versus harm and maintaining active engagement; energy conservation techniques; etc.

- Exercise and functional activities

- Assessment

-

Recommendations for intervention at the conclusion of the initial visit and Documentation/Invoicing

The health practitioner will determine which of the following statements describes the recommendations for intervention at the conclusion of the initial visit:

- No additional intervention is required. The health practitioner submits an Auto Insurance Standard Invoice (Ocf-21) for the initial visit.

- Additional interventions as described in this Guideline are required and are appropriate as described in Part 3 of this Guideline (i.e., the insured person’s impairment comes within the Guideline). The health practitioner completes the Ocf-23 and submits it to the insurer within 10 business days of the initial visit unless the insurer has waived this requirement. The health practitioner will complete and submit the Ocf-21.

- Additional intervention is required but is not appropriate under this Guideline as described in Part 4 of this Guideline (i.e. the insured person’s impairment does not come within the Guideline). The health practitioner either completes and submits the Ocf-18 providing compelling evidence of the pre-existing medical condition that prevents the insured person from achieving maximal recovery or makes an appropriate referral. The health practitioner submits an Ocf-21 for the initial visit.

-

Fee for the initial visit (see Appendix B - Fee Schedule)

The fee that will be paid for the initial visit is $215.00, inclusive of all assessment and intervention services provided during the initial visit, regardless of the amount or type provided. This fee also includes completion of the Ocf-23.

-

-

The treatment phase

If the health practitioner determines that the Guideline applies to the insured person and that intervention under the Guideline is required to facilitate recovery and return to function, the insured person continues on to the treatment phase.

-

Timing and duration in the treatment phase

The treatment phase sessions are treatments provided in addition to any intervention delivered during the initial visit and will not typically exceed twelve weeks in duration following the date of the initial visit. The appropriate health care provider will deliver treatment sessions based on the needs of the insured person and the health practitioner’s clinical judgement.

- Components of the treatment phase

Recommended and discretionary interventions

- Recommended interventions during the treatment phase

- Continuing clinical review

Regular review of the insured person’s clinical status and progress toward functional restoration, based on which the health practitioner will make any necessary modifications in the approach to intervention.

- Activity prescription; Reassurance; Education; and Home Exercise

Program (as described above under the initial visit)

- Continuing clinical review

- Discretionary interventions during the treatment phase

- Exercise and functional activities; Mobilization and manipulation (as described above under the initial visit)

- Pain management and coping skills education

If the insured person is displaying signs of distress or difficulties coping with the effects of his/her injury, the health practitioner may introduce pain management and coping skills education (a standardized approach is recommended).

- Diagnostic imaging (as described above under the initial visit)

- Other Interventions that will facilitate pain management, activation and return to function (as described above under the initial visit)

Treatment blocks

-

Block 1

During the first four-week block of treatment (beginning immediately following the initial visit), the health care practitioner is expected to provide or oversee the interventions established through the Ocf-23 from the initial visit.

If the insured person reaches maximal recovery during this period, he or she is discharged from the Guideline (see part (e) of this section). If the insured person requires additional intervention(s), the health practitioner continues treatment under Block 2.

The fee for this period is $775.00 for treatment or $200.00 to provide monitoring services under part (c) of this section, but not both.

-

Block 2

During the second four-week block of treatment, the health care practitioner is expected to provide or oversee the interventions established through the Ocf‑23, if applicable, and/or will continue any additional intervention(s) established in Block 1.

If the insured person reaches maximal recovery during this period, he or she is discharged from the Guideline (see part (e) of this section). If the insured person requires additional intervention(s), the health practitioner continues treatment under Block 3.

The fee for this period is $500.00 for treatment or $200.00 to provide monitoring services under part (c) of this section, but not both.

-

Block 3

During the final four-week block of treatment, the health care practitioner is expected to provide or oversee the interventions established through the Ocf‑23, if applicable, and/or will continue any additional intervention(s) established in Block 1 and/or Block 2.

If the insured person reaches maximal recovery during this period, he or she is discharged from the Guideline (see part (e) of this section). If the insured person requires additional intervention(s) beyond Block 3, the insured person must submit an Ocf-18 to the insurer.

The fee for this period is $225.00 for treatment or $200.00 to provide monitoring services under part (c) of this section, but not both.

- Monitoring by health practitioner

The health practitioner may provide guidance, advice, coaching, counselling and or reassurance to the insured person in lieu of the treatment provided in any of the Blocks. A fee for this intervention is not payable if treatment under Block 3 has commenced.

Provision of the monitoring intervention is conditional on the following requirements:

- the monitoring is provided within 12 weeks of the initial visit;

- the insured person is determined to have reached maximal recovery and no longer requires further treatment;

- the insured person has resumed some or all of his or her pre-accident activities (e.g., work, home, school, etc.); and

- no treatment or further monitoring is provided under subsequent Block(s).

The fee for this service is $200.00.

- Supplementary goods and services during the treatment phase

Additional funds are available to provide supplementary goods and additional services to support restoration of functioning and address barriers to recovery. The supplementary goods and services may include but are not limited to:

- Treatment services for the additional minor injuries arising from the same accident.

- Goods required for self-directed exercise and/or pain management such as, but not limited to: theraband; gym ball; hot/cold packs; Obus Forme back support; lumbar roll; etc.

- Assistive devices required to maintain/return to work/school/home or personal activity such as but not limited to: head set; trolley; braces.

- Supportive interventions such as advice/education to deal with accident-related psycho-social issues, such as but not limited to: distress; difficulties coping with the effects of his/her injury; driving problem/stress.

The health practitioner, a regulated health professional or an appropriate health care provider may provide the supplementary goods and/or services that are deemed necessary, up to a maximum cost of $400.00, without approval of the insurer.

- Discharge status during or at the conclusion of the treatment phase and Documentation/Invoicing

The health practitioner will determine which of the following statements describes the insured person’s status when discharged during or at the conclusion of the treatment phase and provide documentation as required:

- No additional intervention is required

- Submit the Minor Injury Guideline Discharge Report (Ocf-24) with all the relevant sections completed and include functional and employment status.

- Submit an Ocf-21C to bill for the goods and services delivered during this phase.

- Additional intervention outside this Guideline is required

- Submit the Ocf-24 with the relevant sections completed and include functional and employment status.

- Submit an Ocf-21C to bill for the goods and services delivered during this phase.

- Inform the insurance company of the intervention outside of this Guideline that is recommended for the insured person via submission of an Ocf-18 or refer the insured person to another health practitioner, as appropriate.

- The insured person has been discharged from treatment under this Guideline because he/she is non-compliant, is not attending sessions or voluntarily withdrew from treatment

- Submit the Ocf-24 with the relevant sections completed and include functional and employment status.

- Submit an Ocf-21C to bill for the goods and services delivered during this phase.

- No additional intervention is required

- Fees for the treatment phase (see Appendix B - Fee Schedule)

The block fees that will be paid during the treatment phase are $775.00 for weeks 1-4, $500.00 for weeks 5-8, and $225.00 for weeks 9-12.

The maximum fee for supplementary goods and services under this Guideline is $400.00. The transfer fee, if an insured person changes his/her health practitioner is $50.00, payable to the health practitioner receiving the file.

- Recommended interventions during the treatment phase

-

Appendix A

Getting the Facts about Whiplash Brochure*

Getting the facts about Whiplash: Grades I and II

People injured in car accidents sometimes experience a strain of the neck muscles and surrounding soft tissue, known commonly as whiplash. This injury often occurs when a vehicle is hit from the rear or the side, causing a sharp and sudden movement of the head and neck. Whiplash may result in tender muscles (Grade I) or limited neck movement (Grade II). This type of injury is usually temporary and most people who experience it make a complete recovery. If you have suffered a whiplash injury, knowing more about the condition can help you participate in your own recovery. This brochure summarizes current scientific research related to Grade I and II whiplash injuries.

Understanding Whiplash

- Most whiplash injuries are not serious and heal fully.

- Signs of serious neck injury, such as fracture, are usually evident in early assessments. Health care professionals trained to treat whiplash are alert for these signs.

- Pain, stiffness and other symptoms of Grades I or II whiplash typically start within the first 2 days after the accident. A later onset of symptoms does not indicate a more serious injury.

- Many people experience no disruption to their normal activities after a whiplash injury. Those who do usually improve after a few days or weeks and return safely to their daily activities.

- Just as the soreness and stiffness of a sprained ankle may linger, a neck strain can also feel achy, stiff or tender for days or weeks. While some patients get better quickly, symptoms can persist over a longer period of time. For most cases of Grades I and II whiplash, these symptoms gradually decrease with a return to activity.

Daily Activity and Whiplash

- Continuing normal activities is very important to recovery.

- Resting for more than a day or two usually does not help the injury and may instead prolong pain and disability. For whiplash injuries, it appears that "rest makes rusty."

- Injured muscles can get stiff and weak when they're not used. This can add to pain and can delay recovery.

- A return to normal activity may be assisted by active treatment and exercises.

- Cervical collars, or "neck braces," prevent motion and may add to stiffness and pain. These devices are generally not recommended, as they have shown little or no benefit.

- Returning to activity maintains the health of soft-tissues and keeps them flexible - speeding recovery. Physical exercise also releases body chemicals that help to reduce pain in a natural way.

- To prevent development of chronic pain, it is important to start moving as soon as possible.

Tips For Return To Activity

- Avoid sitting in one position for long periods.

- Periodically stand and stretch.

- Sit at your workstation so that the upper part of your arm rests close to your body, and your back and feet are well supported.

- Adjust the seat when driving so that your elbows and knees are loosely bent.

- When shopping or carrying items, use a cart or hold things close to the body for support.

- Avoid contact sports or strenuous exercise for the first few weeks to prevent further injury. Ask your health care professional about other sporting or recreational activities.

- Make your sleeping bed comfortable. The pillow should be adjusted to support the neck at a comfortable height.

Treating Whiplash

- Research indicates that successful whiplash treatment requires patient cooperation and active efforts to resume daily activity.

- A treating health care professional will assess your whiplash injuries, and discuss options for treatment and control of pain.

- Although prescription medications are usually unnecessary, temporary use of mild over-the-counter medication may be suggested, in addition to ice or heat.

- Your treating health care professional may recommend appropriate physical treatment.

Avoiding Chronic Pain

- Some whiplash sufferers are reluctant to return to activity, fearing it will make the injury worse. Pain or tenderness may cause them to overestimate the extent of physical damage.

- If your health care professional suggests a return to activity, accept the advice and act on it.

- Stay connected with family, friends and co-workers. Social withdrawal can contribute to depression and the development of chronic pain.

- If you are discouraged or depressed about your recovery, talk to your health care professional.

- Focus on getting on with your life, rather than on the injury!

Preventing Another Whiplash Injury

- Properly adjusting the height of your car seat head restraint (head rest) will help prevent whiplash injury in an accident. In an ideal adjustment, the top of the head should be in line with the top of the head restraint and there should be no more than 2 to 5 cm between the back of the head and the head restraint.

This brochure provides general information about whiplash injuries. It does not replace advice from a qualified health care professional who can properly assess a whiplash injury and recommend treatment.

The information highlights the latest available scientific research on whiplash and has been endorsed by the following groups:

Insurance Bureau of Canada (Ibc)

Ontario Chiropractic Association (Oca)

Ontario Massage Therapist Association (Omta)

Ontario Physiotherapy Association (Opa)

Ontario Society of Occupational Therapists (Osot)

*This brochure was originally released in 2003 and is available at www.ibc.ca.

Appendix B

Minor Injury Guideline Fee Schedule

|

Interventions |

FEE |

|

|---|---|---|

|

1 |

|

$215.00 |

|

2 |

|

$775.00 $500.00 $225.00 |

|

3 |

|

$200.00 |

|

4 |

|

$85.00 |

|

5 |

|

To an aggregate maximum of $400.00 |

|

6 |

|

$50.00 |

|

7 |

|

See Appendix C |

Appendix C

Payment Schedule for X-Rays

|

Description |

FEE |

|

|---|---|---|

|

1 |

Cervical Spine

|

$36.80 $43.91 $50.19 $59.22 |

|

2 |

Thoracic Spine

|

$34.34 $45.20 |

|

3 |

Lumbar or Lumbosacral Spine

|

$36.80 $43.91 $50.19 $58.40 |

(143-G326E)

Financial Services Commission of Ontario

Statement Of Priorities

June 2010

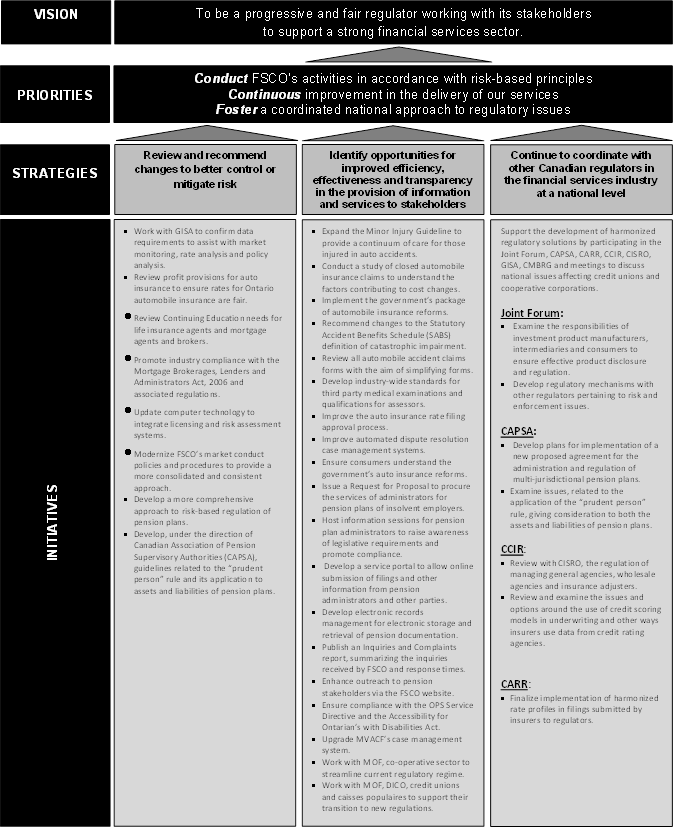

Introduction

The Financial Services Commission of Ontario (FSCO) is a regulatory agency established under the Financial Services Commission of Ontario Act, 1997 (FSCO Act).

Section 11 of the FSCO Act requires that FSCO publish in The Ontario Gazette and deliver to the Minister of Finance by June 30 of each year a statement setting out the proposed priorities of the Commission.