We're moving content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

Regional Opportunities Investment Tax Credit

Learn how you could receive Corporate Income Tax support in Ontario, while investing in growth and job creation.

This online book has multiple pages. Please click on the Table of Contents link above for additional information related to this topic.

Help us improve your online experience

Take a 2-minute survey and tell us what you think about this page.

About the Regional Opportunities Investment Tax Credit

The Regional Opportunities Investment Tax Credit supports business investment, economic growth and job creation in designated regions across the province that lagged in employment growth between 2009 and 2019.

It is a 10% refundable Corporate Income Tax credit for corporations that invest more than $50,000 to construct, renovate or acquire eligible commercial and industrial buildings in these regions. The Regional Opportunities Investment Tax Credit will:

- help address regional disparities by bringing greater opportunities and prosperity to businesses, workers and families in these communities

- help attract investments, boost growth and create jobs by supporting businesses, including those that are recovering from COVID‑19, to expand and grow

Temporary Enhancement of the credit

A temporary enhancement to the credit provides an additional 10 per cent credit for eligible expenditures in excess of $50,000 and up to $500,000 for eligible property that becomes available for use during a qualifying corporation’s taxation year, and in the period beginning on March 24, 2021 and ending before January 1, 2024. The maximum credit in respect of eligible expenditures that meet all of the conditions for the enhanced credit would be $90,000 in a year.

Learn which regions the credit supports.

For more information, read the technical bulletin.

Who is eligible

To be eligible, a corporation must:

- be a Canadian-controlled private corporation throughout the tax year

- have a permanent establishment in Ontario at the time a qualifying investment is made

- make a qualifying investment in a designated region of the province

The corporation can be located anywhere in Ontario, but the investment must be made in a designated region to qualify for the tax credit.

Qualifying investments

Corporations must invest more than $50,000 to qualify and may receive a tax credit of up to $45,000 in respect of its qualifying investments in a year. The tax credit amount applies to expenditures in excess of $50,000 up to a maximum of $500,000.

To qualify for the tax credit, investments must:

- be used to acquire, construct or renovate an eligible property in a designated region

- become available for use on or after March 25, 2020 and in the taxation year in which the tax credit is being claimed

Eligible properties are:

- commercial or industrial buildings (or other structures) that are included in capital cost allowance classes 1 or 6 for income tax purposes

- located in a designated region

Residential buildings are not eligible.

Which regions the credit supports

The Regional Opportunities Investment Tax Credit will support communities that experienced low employment growth between 2009 and 2019.

Investments that qualify for the credit must be made in one of the following designated regions:

Northern Ontario

- District of Algoma

- District of Cochrane

- District of Kenora

- District of Manitoulin

- District of Nipissing

- District of Parry Sound

- District of Rainy River

- District of Sudbury together with the City of Greater Sudbury

- District of Thunder Bay

- District of Timiskaming

Southern Ontario

- City of Kawartha Lakes

- County of Bruce

- County of Elgin together with the City of St. Thomas

- County of Essex together with the City of Windsor and Township of Pelee

- County of Frontenac together with the City of Kingston

- County of Grey

- County of Haliburton

- County of Hastings together with the City of Belleville and City of Quinte West

- County of Huron

- County of Lambton

- County of Lanark together with the Town of Smiths Falls

- County of Lennox and Addington

- County of Middlesex together with the City of London

- County of Northumberland

- County of Oxford

- County of Perth together with the City of Stratford and the Town of St. Marys

- County of Peterborough together with the City of Peterborough

- County of Prince Edward

- County of Renfrew together with the City of Pembroke

- District of Muskoka

- Municipality of Chatham‐Kent

- United Counties of Leeds and Grenville together with the City of Brockville, the Town of Gananoque and the Town of Prescott

- United Counties of Prescott and Russell

- United Counties of Stormont, Dundas and Glengarry together with the City of Cornwall

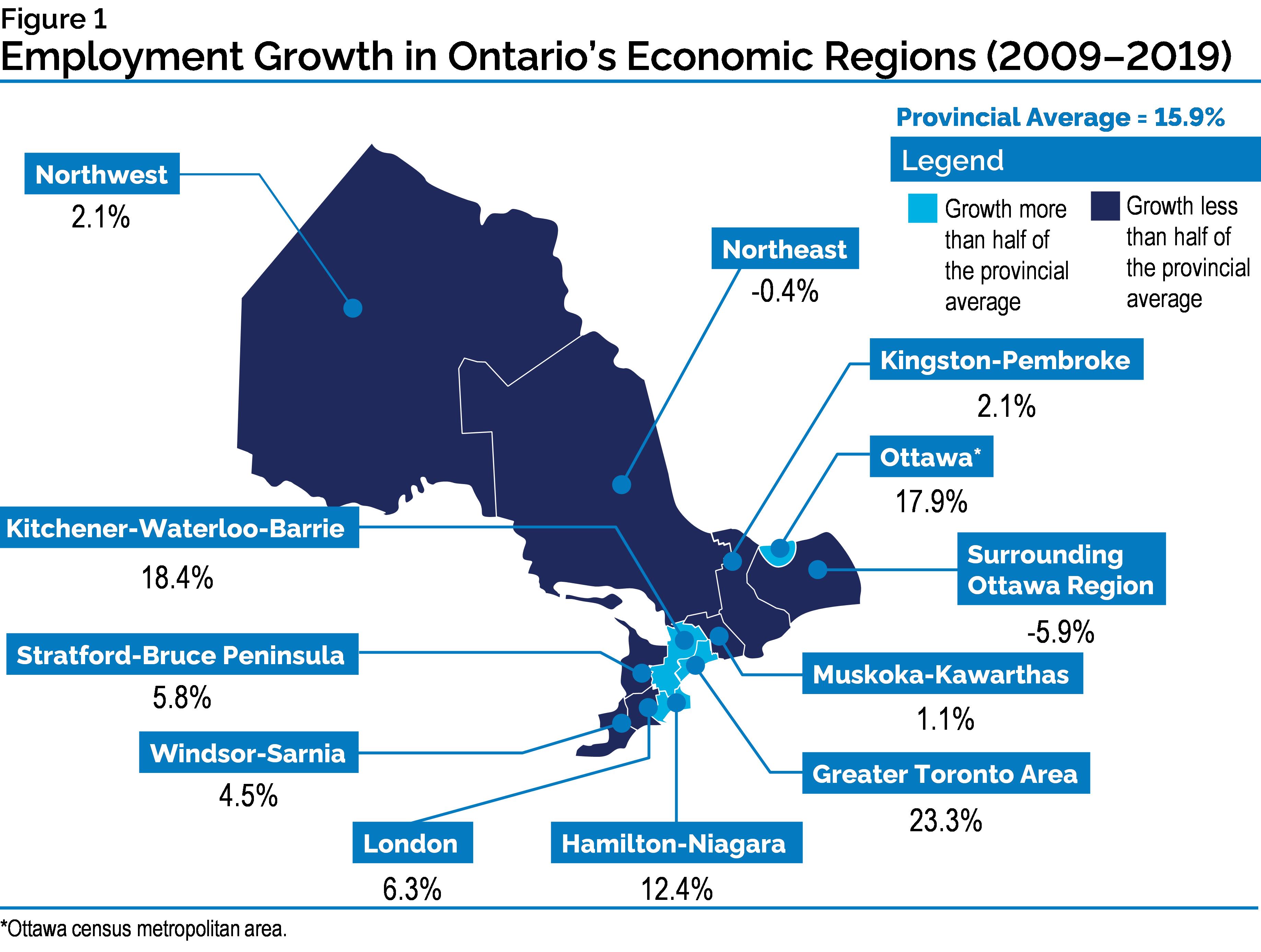

Map of employment growth by region between 2009 and 2019

This map shows how regions' employment growth compared to the provincial average between 2009 and 2019.

How the credit is calculated

The 10% refundable Corporate Income Tax credit is available for expenditures that exceed $50,000 with a limit of $500,000 for qualifying property that becomes available for use in the taxation year.

The maximum tax credit a corporation may receive in a year is $45,000 in respect of all qualifying investments.

It is calculated on the total expenditures incurred by the corporation across all designated regions.

For example, a corporation with eligible expenditures of $200,000 would receive $15,000:

10% of ($200,000 - $50,000)

= 10% of $150,000

= $15,000

How the enhanced credit is calculated

The 20% refundable Corporate Income Tax credit is available for expenditures that exceed $50,000 with a limit of $500,000 for qualifying property that becomes available for use in the taxation year, and in the period beginning on March 24, 2021 and ending before January 1, 2024.

The maximum tax credit a corporation may receive in a year is $90,000 in respect of all qualifying investments.

It is calculated on the total expenditures incurred by the corporation across all designated regions. For example, a corporation with eligible expenditures of $200,000 would receive $30,000, calculated as follows:

20% of ($200,000 - $50,000)

= 20% of $150,000

= $30,000.

How to claim the credit

The Canada Revenue Agency (CRA) administers tax credits on behalf of Ontario and corporations can claim the tax credit on their T2 Corporation Income Tax return.

Read the technical bulletin or Taxation Act, 2007 to determine all the eligibility requirements and conditions that must be met to claim the credit.

Contact us

For general tax enquiries regarding this tax credit, taxpayers may telephone the CRA at:

1 800 959 5525 (English) 1 800 959 7775 (French) 1 800 665 0354 for teletypewriter (TTY)

Or visit the CRA website

Accessible description of Figure

Employment Growth in Ontario's Economic Regions (2009–2019)

The graphic shows a map of Ontario, divided into its economic regions with the exception of the Ottawa economic region. For each economic region, the employment growth rate is shown for the period from 2009 to 2019.

In the Northwest, employment growth is 2.1%. In the Northeast, employment growth is -0.4%. In the Kingston-Pembroke economic region, employment growth is 2.1%. In the Muskoka-Kawarthas economic region, employment growth is 1.1%. In the Greater Toronto Area economic region, employment is 23.3%. In the Hamilton-Niagara economic region, employment growth is 12.4%. In the London economic region, employment growth is 6.3%. In the Windsor-Sarnia economic region, employment growth is 4.5%. In the Stratford-Bruce Peninsula economic region, employment growth is 5.8%. In the Kitchener-Waterloo-Barrie economic region, employment growth is 18.4%. In the Ottawa census metropolitan area, employment growth is 17.9%. In the surrounding Ottawa region, employment growth is – 5.9%. The graphic also displays the provincial average which is 15.9%.

The Ottawa census metropolitan area, Greater Toronto Area, Hamilton-Niagara and Kitchener-Waterloo-Barrie economic regions are shaded a lighter blue than the other economic regions and labelled as employment growth being more than half of the provincial average.