We're moving content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

Technical bulletin: Ontario Regional Opportunities Investment Tax Credit

This bulletin is intended for informational purposes only with respect to the Ontario Regional Opportunities Investment Tax Credit (ROITC). The Taxation Act, 2007 (Ontario) provides full particulars of the ROITC. This bulletin does not constitute legal, technical, business or other advice and should not be relied upon as such. To the extent that this bulletin deviates from the legislation and regulations thereto, the legislation and regulations prevail.

New Refundable Tax Credit

Effective March 25, 2020, Ontario has introduced the ROITC, a 10 per cent refundable tax credit.

Temporary Enhancement of the ROITC

A temporary enhancement to the ROITC provides an additional 10 per cent credit for eligible expenditures for eligible property that becomes available for use during a qualifying corporation’s taxation year, and in the period beginning on March 24, 2021 and ending before January 1, 2024.

Claiming the ROITC

The ROITC is available to corporations that meet certain requirements.

Further information about claiming the credit is provided below under the heading “Claiming the Tax Credit - Eligibility, Amount of Credit and Filing Requirements”.

Spending Requirement

The ROITC is available for eligible expenditures that exceed $50,000 in a taxation year to a maximum of $500,000 in the year. The maximum amount of the credit is capped at $45,000 per year.

When both the ROITC and enhanced ROITC conditions are met, the maximum amount of the credit is $90,000 per year.

The credit is prorated for short taxation years. The unused balance of the ROITC can be carried forward to the following taxation year.

Qualifying Investments

Qualifying investments are limited to eligible expenditures in respect of eligible property.

Eligible Property

Eligible property for the purposes of the ROITC is depreciable property that is listed in Class 1 or 6 of Schedule II to the Income Tax Regulations under the Income Tax Act (Canada) for Capital Cost Allowance (CCA) purposes. However, eligible property does not include depreciable property that is listed in Class 1 as a result of an election made under subsection 1103 (1) of those Regulations, unless the property would otherwise have been listed in Class 6. An election under subsection 1103 (1) pertains to transfers of property from another Class into Class 1.

To qualify for the credit, an eligible property must become “available for use” by the corporation in the taxation year in which the ROITC is being claimed by the corporation and on or after March 25, 2020.

For the purposes of the ROITC, a property is considered to become available for use at the time the property is considered to become available for use under subsection 13 (26) in the Income Tax Act (Canada). The available for use rules vary depending on the type of property. Generally, a property may not be depreciated for income tax purposes until the time that the property is considered to have become available for use by the taxpayer.

Location of the Property

Eligible property includes only property that is wholly located in the qualifying region specified in the Taxation Act, 2007 (Ontario) for purposes of the ROITC. The qualifying region is comprised of geographic areas that are legislated by reference to Schedules 1 and 2 to Regulation 180/03 under the Territorial Division Act, 2002 (Ontario).

Use of the Property

Commercial and industrial buildings generally qualify as eligible property. Residential buildings are not eligible for the credit for purposes of the ROITC.

If the property is a building, or an addition or alteration to a building, at least 90 per cent of the floor space of the building must be used at the end of the taxation year for a non-residential purpose to make the property eligible for the ROITC.

Eligible Expenditures

Eligible expenditures are costs of a capital nature incurred by a qualifying corporation to acquire, renovate or make additions to eligible property. The corporation must be a qualifying corporation with a permanent establishment in Ontario at the time the expenditures are incurred.

Eligible expenditures are the amounts that are part of the capital cost of the eligible property to the qualifying corporation for CCA purposes. The rules in the Income Tax Act (Canada) apply to determine the capital cost of eligible property to a qualifying corporation for the purposes of the ROITC.

Eligible expenditures may be incurred in one or more taxation years, up to and including the year in which the eligible property becomes available for use. Expenditures are not eligible if incurred in a taxation year following the year in which the property is considered to have become available for use.

Expenses incurred by the qualifying corporation under a contract with persons or partnerships with which the qualifying corporation does not deal at arm’s length are not eligible expenditures for purposes of the ROITC.

Claiming the Tax Credit - Eligibility, Amount of Credit and Filing Requirements

Eligibility: Qualifying Corporation

The ROITC is available to a corporation that meets all of the following requirements:

- The corporation is a Canadian-controlled private corporation throughout the taxation year.

- The corporation is not exempt from tax for the taxation year under Part III of the Taxation Act, 2007 (Ontario).

- The corporation carries on business in Ontario in the taxation year through a permanent establishment in Ontario.

The number of employees the corporation has at its permanent establishment in Ontario during the taxation year is not a factor in determining eligibility for the credit.

Eligibility: Location of Corporate Head Office

A qualifying corporation that has a permanent establishment in Ontario that is outside of the qualifying region is eligible to claim the ROITC provided that the property in respect of which the corporation has incurred eligible expenditures is wholly located in the qualifying region and the corporation otherwise meets the criteria for claiming the credit. The location of the corporation’s head office is not relevant for the purposes of the ROITC.

Eligibility: Qualifying Region and Excluded Areas

A list of the areas comprising the qualifying region for the purposes of the ROITC can be found in the Taxation Act, 2007 (Ontario). The geographic areas in the qualifying region are subject to change as described below.

The Ontario Minister of Finance may, by regulation, remove part or all of any geographic area from being in the qualifying region. A qualifying corporation should review the list of geographic areas comprising the qualifying region prior to making a claim for the ROITC for a taxation year to ensure that a particular area has not been excluded.

Amount of Credit: Multiple Eligible Properties in Qualifying Region

A qualifying corporation may have more than one eligible property located in one or more of the geographic areas within the qualifying region. The ROITC is capped at $45,000 in a year for all eligible properties. The enhanced ROITC is capped at $90,000 in a year for all eligible properties.

This means that the qualifying corporation can aggregate its eligible expenditures for all eligible properties that become available for use in the qualifying region in the taxation year, up to a limit of $500,000. The total eligible expenditures in excess of $50,000 would be eligible for the ROITC for the particular taxation year. Two examples are set out below. Both examples assume a 365-day taxation year, no unclaimed expenditure balance, the expenditures are eligible for the credit and that all other eligibility criteria and conditions for the ROITC are met.

Example 1A: qualifying corporation that has eligible expenditures of $40,000 in respect of one eligible property and has eligible expenditures of $360,000 in respect of another eligible property would claim the ROITC in respect of the total of $400,000 of expenditures ($40,000 + $360,000 = $400,000). The amount of the ROITC would be $35,000 for the year calculated as follows: ($400,000 - $50,000) x .10 = $35,000.

Example 1B: All of the criteria in Example 1A are the same, except the eligible properties become available for use on or after March 24, 2021 and before January 1, 2024. The amount of the enhanced ROITC would be $70,000 for the year calculated as follows: ($400,000 - $50,000) x (.10 + .10) = $70,000.

Example 2A: qualifying corporation that has eligible expenditures of $375,000 in respect of one eligible property and eligible expenditures of $225,000 in respect of another eligible property would claim the ROITC in respect of the total of $600,000 of expenditures ($375,000 + $225,000 = $600,000). The ROITC may be claimed on the lesser of the qualifying corporation’s total eligible expenditures ($600,000 in this example) and $500,000. In this example, the maximum amount that may be claimed is $500,000. The amount of the qualifying corporation’s credit would be $45,000 for the year, calculated as follows: ($500,000 - $50,000) x .10 = $45,000.

Example 2B: All of the criteria in Example 2A are the same, except the eligible properties become available for use on or after March 24, 2021 and before January 1, 2024. The amount of the enhanced ROITC would be $90,000 for the year calculated as follows: ($500,000 - $50,000) x (.10 + .10) = $90,000.

Anti-Avoidance Rules

The legislation contains rules to prevent a corporation from artificially creating an entitlement to the ROITC and from increasing or multiplying the amount of the ROITC for which the corporation is otherwise eligible, including limitations for associated corporations and excluded property

Associated Corporations

The ROITC for a qualifying corporation that is associated with one or more other corporations during a particular taxation year is nil unless each of the other corporations has agreed in writing to waive its right to claim the ROITC for any taxation year of the other corporation that overlaps with the particular taxation year.

Corporations that are associated with one or more other corporations must agree that one corporation in the associated group would claim the ROITC for taxation years that overlap the year(s) of the other corporation(s). An ROITC claim must be made by only one of the associated corporations.

When is a corporation associated with another?

For the purposes of the ROITC, the rules in the Income Tax Act (Canada) will apply in determining whether the corporation claiming the ROITC is associated with one or more other corporations. A qualifying corporation claiming the ROITC should review the associated corporation rules in Income Tax Act (Canada) before claiming the credit.

Excluded Property

The ROITC can be claimed only in respect of eligible property. There are certain exceptions to what constitutes eligible property for the purposes of the ROITC. The credit is not available in respect of property that would otherwise be eligible property in any of the following circumstances:

The property was acquired by the corporation from a person or partnership with which the corporation did not deal at arm’s length.

- The property was acquired by the corporation from a person or partnership with which the corporation did not deal at arm’s length.

- The property was acquired in circumstances where the property was previously owned by the corporation or by a person or partnership with which the corporation was not dealing at arm’s length at any time when the property was owned or acquired by the person or partnership.

- The property was acquired from a person or partnership, who has a right or option to acquire all or part of the property in the future, or who has granted a right or option to any other person or partnership to acquire the property in the future.

The rules contained in the Income Tax Act (Canada) in respect of a relationship that is not at arm’s length apply for purposes of the ROITC.

Filing Requirements

The ROITC is a refundable tax credit such that, if the corporation’s tax liability for the year is reduced to nil, the amount of the ROITC to which the corporation is entitled, if any, will become a refund to the corporation.

For taxation years ending in 2009 or later, corporations that have a permanent establishment in Ontario file a harmonized T2 Corporation Income Tax Return with the Canada Revenue Agency (CRA). The harmonized return includes any Ontario refundable tax credits that the corporation is eligible to claim. This means that the CRA will administer the ROITC on behalf of Ontario.

Review of the ROITC

The Ontario Minister of Finance is required to review the effectiveness of the credit every three-year period beginning from March 25, 2020.

More Information

The CRA administers the ROITC on behalf of Ontario through the federal income tax system.

For general tax enquiries regarding this tax credit, taxpayers may telephone the CRA at:

- 1‑800‑959‑5525 (English)

- 1‑800‑959‑7775 (French)

- 1‑800‑665‑0354 for teletypewriter (TTY)

Or visit the CRA website.

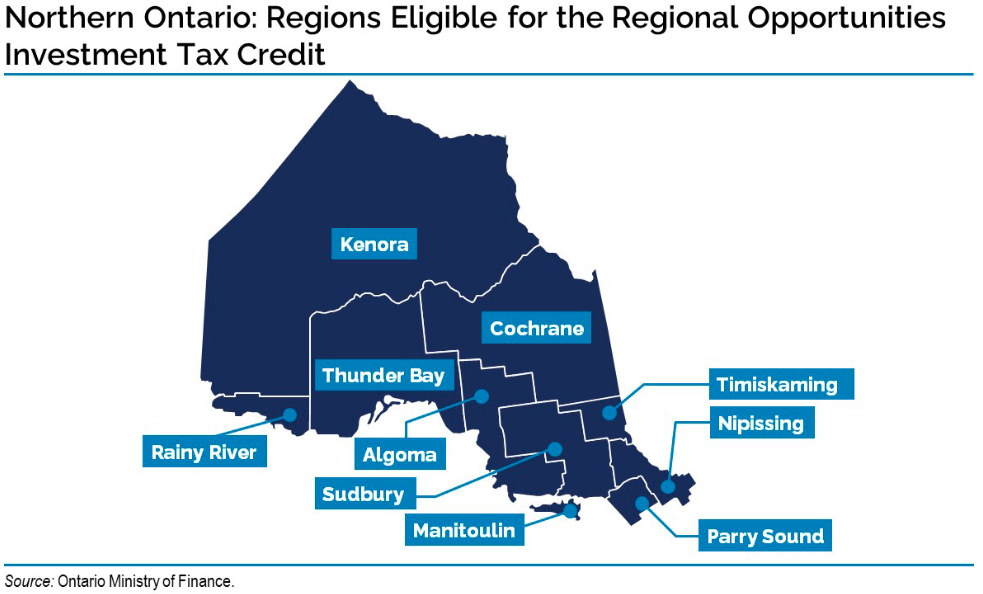

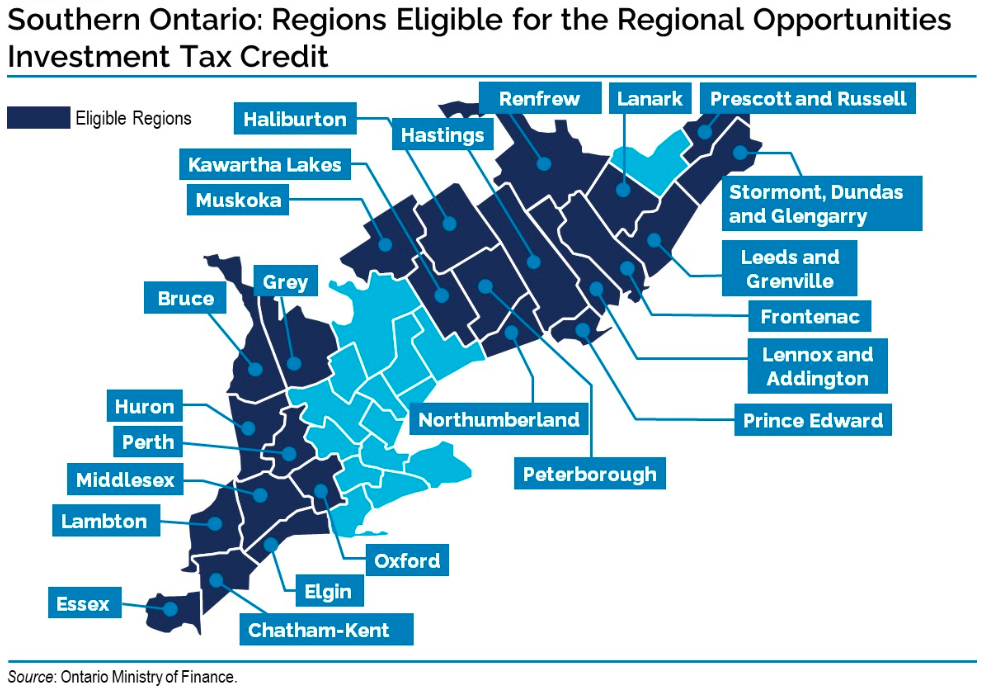

Qualifying Region in Ontario

Property must be wholly located within the qualifying region in Ontario to be eligible for the ROITC. The Taxation Act, 2007 (Ontario) lists the geographic areas that are within the qualifying region. These geographic areas are as named and described in Schedules 1 and 2 to Ontario Regulation 180/03 (Division of Ontario into Geographic Areas) made under the Territorial Division Act, 2002 (Ontario).

The geographic areas in Ontario that form the qualifying region for purposes of the ROITC are set out in the table below and are illustrated in Figures 1 and 2, below.

Table 1. Qualifying Region in Ontario

This table sets out the geographic areas that comprise the qualifying region in respect of which a ROITC is available under the Taxation Act, 2007 (Ontario).

Schedule 1

to Ontario Regulation 180/03

Territorial Division Act, 2002 (Ontario)

- Bruce

- Chatham-Kent

- Elgin

- Essex

- Frontenac

- Grey

- Haliburton

- Hastings

- Huron

- Kawartha Lakes

- Lambton

- Lanark

- Leeds and Grenville

- Lennox and Addington

- Middlesex

- Northumberland

- Oxford

- Perth

- Peterborough

- Prescott and Russell

- Prince Edward

- Renfrew

- Stormont, Dundas and Glengarry

Schedule 2

to Ontario Regulation 180/03

Territorial Division Act, 2002 (Ontario)

- Algoma

- Cochrane

- Kenora

- Manitoulin

- Muskoka

- Nipissing

- Parry Sound

- Rainy River

- Sudbury

- Thunder Bay

- Timiskaming

Accessible description of Table 1. Qualifying Region in Ontario

Table 1 shows the geographic areas comprising the qualifying region eligible for the ROITC by reference to Schedules 1 and 2 to Ontario Regulation 180/03 (Division of Ontario into Geographic Areas) made under the Territorial Division Act, 2002 (Ontario).

The geographic areas in the column for Schedule 1 are as follows: Bruce, Chatham-Kent, Elgin, Essex, Frontenac, Grey, Haliburton, Hastings, Huron, Kawartha Lakes, Lambton, Lanark, Leeds and Grenville, Lennox and Addington, Middlesex, Northumberland, Oxford, Perth, Peterborough, Prescott and Russell, Prince Edward, Renfrew, Stormont, Dundas and Glengarry.

The geographic areas in the column for Schedule 2 are as follows: Algoma, Cochrane, Kenora, Manitoulin, Muskoka, Nipissing, Parry Sound, Rainy River, Sudbury, Thunder Bay and Timiskaming.

Accessible description of Figure 1

Figure 1. Northern Ontario: Geographic Areas Eligible for the Regional Opportunities Investment Tax Credit.

This map shows the areas eligible for the ROITC in Northern Ontario. The areas noted on the map are as follows:

District of Algoma, District of Cochrane, District of Kenora, District of Manitoulin, District of Nipissing, District of Parry Sound, District of Rainy River, District of Sudbury together with the City of Greater Sudbury, District of Thunder Bay, and District of Timiskaming.

Accessible description of Figure 2

Figure 2. Southern Ontario: Geographic Areas Eligible for the Regional Opportunities Investment Tax Credit.

This map shows the areas eligible for the ROITC in Southern Ontario. The areas noted on the map are as follows:

City of Kawartha Lakes; County of Bruce; County of Elgin together with the City of St. Thomas; County of Essex together with the City of Windsor and Township of Pelee; County of Frontenac together with the City of Kingston; County of Grey; County of Haliburton; County of Hastings together with the City of Belleville and City of Quinte West; County of Huron; County of Lambton; County of Lanark together with the Town of Smiths Falls; County of Lennox and Addington; County of Middlesex together with the City of London; County of Northumberland; County of Oxford; County of Perth together with the City of Stratford and the Town of St. Marys; County of Peterborough together with the City of Peterborough; County of Prince Edward; County of Renfrew together with the City of Pembroke; District of Muskoka; Municipality of Chatham-Kent; United Counties of Leeds and Grenville together with the City of Brockville, the Town of Gananoque and the Town of Prescott; United Counties of Prescott and Russell; and United Counties of Stormont, Dundas and Glengarry together with the City of Cornwall.