Hypothetical debt financing case study

Learn about debt as a financing option for long term municipal infrastructure spending through this hypothetical example about rural road capital expenditure.

Municipality of Neutron

- Households: 3,000; Population: 8,000

- Median Household Income: $60,000

- Average Assessment per Residential Household: $180,000

- Average Municipal Taxes per Residential Household: $2,000

- Residential Property Tax Revenue: $6 million.

- Total Reserves: $3 million.

Reasons to invest

- Neutron’s Asset Management Plan (AMP) indicates that the condition of its main road, Proton, is deteriorating

- the gap between the current and desired level of service, as defined by the AMP, continues to grow as required investments are delayed.

- a $5 million capital expenditure would ensure that Proton Rd. remains in good condition and delivers the desired level of service.

- debt financing terms: 10 years at 2.5% (reflective of current Infrastructure Ontario borrowing terms)

- assumes the number of households remain constant over the 10 year period

Financing options for the $5M capital expenditure

This chart shows 4 possible options for financing the $5 million investment, each using a varying mix of debt, reserve and tax dollars.

Option 1 makes the greatest use of debt with $3.5 million of the $5 million being financed by debt, $1 million by reserves and $0.5 million by taxes.

Option 2 uses $2 million of debt, $2 million from taxes and $1 million from reserves.

Option 3 uses $1 million of debt, $1 million from reserves and $3 million from taxes.

Option 4 makes no use of debt and reserves, and finances the entire $5 million using taxes.

Tax increase required to finance the capital expenditure

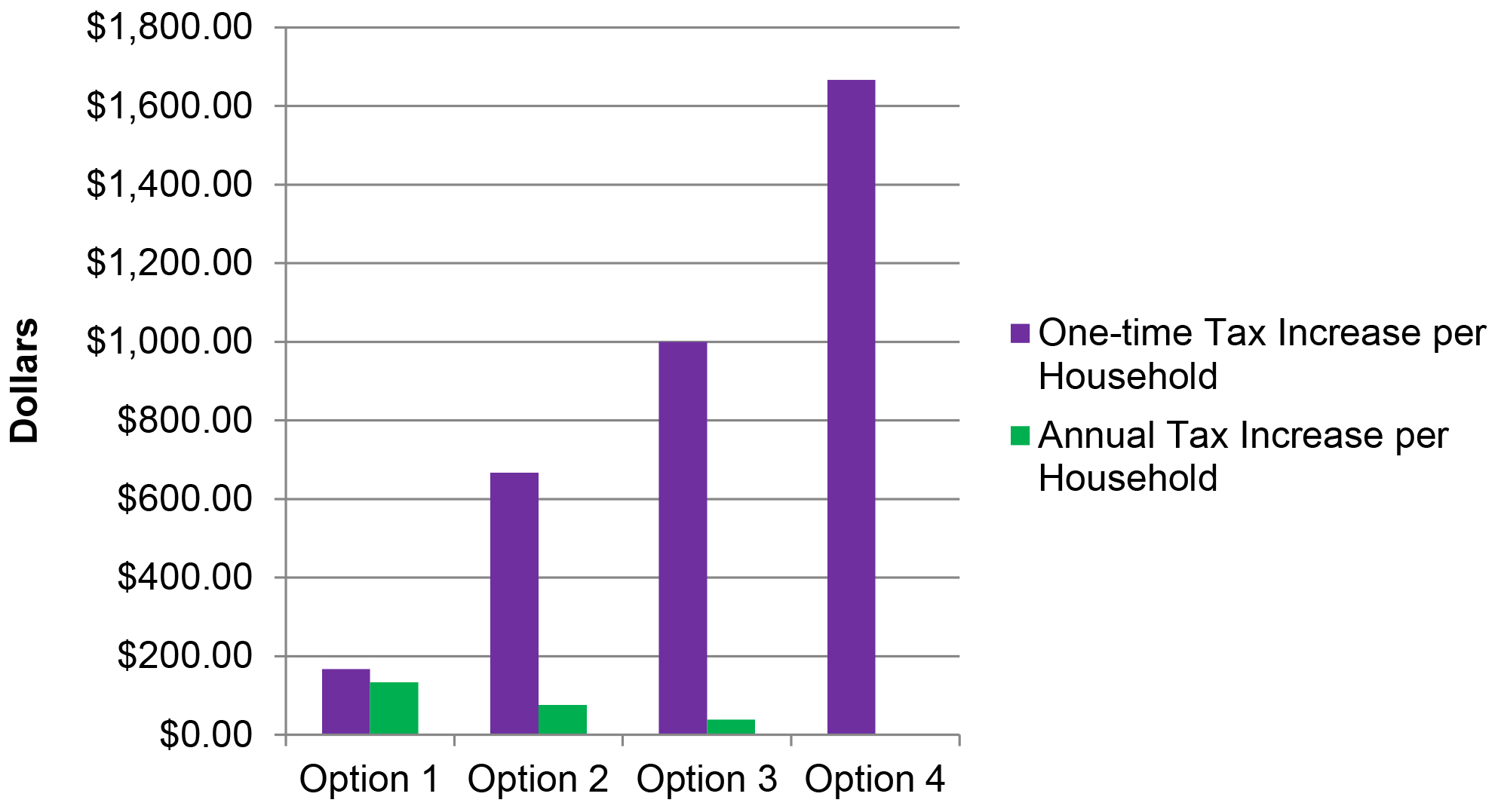

This graph illustrates the amount of tax dollar needed per household to finance the $5 million investment under each option outlined in the previous chart.

Option 1:

- a one-time tax increase equivalent to $167 per household would be required to generate the $0.5 million of tax revenue

- an annual tax increase equivalent to $133 per household would be required to service the $3.5 million debt over 10 years to cover things like annual interest and principal payments

Option 2:

- a one-time tax increase equivalent to $667 per household would be required to generate the $2 million of tax revenue

- an annual tax increase equivalent to $76 per household would be required to service the $2 million debt over 10 years to cover things like annual interest and principal payments

Option 3:

- a one-time tax increase equivalent to $1,000 per household would be required to generate the $3 million of tax revenue

- an annual tax increase equivalent to $38 per household would be required to service the $1 million debt over 10 years to cover things like annual interest and principal payments

Option 4:

- a one-time tax increase equivalent to $1,667 per household would be required to generate the $5 million of tax revenue needed to fund the investment.

Note that for all options using debt, the terms of financing is assumed to be 10 years at an interest rate of 2.5 per cent. Also note that the number of households remains constant over the 10 year period.

Summary

The $5 million capital expenditure could be financed through a mix of sources, each with varying impacts on the tax base. Using a mix of financing sources while making greater use of debt may prevent the need for a substantial one-time increase in property taxes (Option 4) and may allow the per household tax impact in each year to be more evenly spread out over a longer period of time (option 1).

Ultimately, using debt to finance long term capital expenditures is a local decision, driven by the nature of the project, local fiscal flexibility to service that debt, and broader financial market conditions.