Insurance Act

Loi sur les assurances

R.R.O. 1990, REGULATION 672

STATUTORY ACCIDENT BENEFITS SCHEDULE — ACCIDENTS BEFORE JANUARY 1, 1994

Historical version for the period March 4, 2016 to March 31, 2016.

Last amendment: O. Reg. 47/16.

This Regulation is made in English only.

CONTENTS

|

|

|

Sections |

|

GENERAL |

|

|

|

|

1 |

|

|

|

2 |

|

|

|

3 |

|

|

|

4 |

|

|

|

5 |

|

|

SUPPLEMENTARY MEDICAL AND REHABILITATION BENEFITS AND CARE BENEFITS |

|

|

|

|

6 |

|

|

|

7 |

|

|

|

8 |

|

|

|

9 |

|

|

FUNERAL EXPENSES AND DEATH BENEFITS |

|

|

|

|

10 |

|

|

|

11 |

|

|

WEEKLY BENEFITS |

|

|

|

|

12 |

|

|

|

13 |

|

|

|

14 |

|

|

|

15 |

|

|

|

16 |

|

|

|

17 |

|

|

ACCIDENTS IN QUEBEC |

|

|

|

|

18 |

|

|

OPTIONAL BENEFITS |

|

|

|

|

19 |

|

|

WORKERS’ COMPENSATION |

|

|

|

|

20 |

|

|

|

21 |

|

|

MISCELLANEOUS |

|

|

|

|

22 |

|

|

|

23 |

|

|

|

24 |

|

|

|

25 |

|

|

|

25 |

|

|

|

26 |

|

|

|

26 |

|

|

|

27 |

|

|

|

28 |

|

|

|

29 |

|

|

|

29 |

|

|

Statutory accident benefits schedule |

|

|

|

Statutory accident benefits schedule |

|

|

|

Statutory accident benefits schedule |

|

|

|

Statutory accident benefits schedule |

|

1. This Regulation may be cited as the Statutory Accident Benefits Schedule — Accidents Before January 1, 1994. O. Reg. 779/93, s. 3.

2. In this Regulation,

“accident” means an incident in which the use or operation of an automobile causes, directly or indirectly, physical, psychological or mental injury or causes damage to any prosthesis, denture, prescription eyewear, hearing aid or other medical or dental device;

“insured automobile”, in respect of a particular motor vehicle liability policy, means the described automobile and includes a newly-acquired or temporary substitute automobile, all as defined by the policy;

“insured person”, in respect of a particular motor vehicle liability policy, means,

(a) in respect of accidents in Ontario, an occupant of the insured automobile,

(b) in respect of accidents outside Ontario, a person living and ordinarily present in Ontario who is an occupant of the insured automobile,

(c) the named insured, his or her spouse and any dependant of either of them while the occupant of any other automobile,

(d) any person who is not the occupant of an automobile or of rolling stock that runs on rails who is involved in an accident in Ontario involving the insured automobile,

(e) the named insured, his or her spouse and any dependant of either of them who is not the occupant of an automobile or of rolling stock that runs on rails who is involved in an accident,

(f) the named insured, his or her spouse and any dependant of either of them who is not involved in an accident but who suffers psychological or mental injury as the result of an accident involving a physical injury to his or her spouse, child, grandchild, parent, grandparent, brother or sister or a dependant of the named insured or of his or her spouse. R.R.O. 1990, Reg. 672, s. 2; O. Reg. 779/93, s. 2 (1).

3. (1) If the insured automobile is made available for the regular use of an individual, whether or not a resident of Ontario, by a corporation, unincorporated association, partnership, sole proprietorship or other entity or is rented to an individual who is a resident of Ontario, this Regulation applies to the individual and his or her spouse and their dependants as if the individual were a named insured. R.R.O. 1990, Reg. 672, s. 3 (1); O. Reg. 779/93, s. 2 (1).

(2) For the purposes of this Regulation, a person is a dependant of another person if the person is principally dependent for financial support on the other person or the other person’s spouse. R.R.O. 1990, Reg. 672, s. 3 (2); O. Reg. 779/93, s. 2 (1).

4. The benefits set out in this Regulation will be provided under every contract evidenced by a motor vehicle liability policy in respect of accidents occurring after section 266 of the Insurance Act comes into force and before January 1, 1994. R.R.O. 1990, Reg. 672, s. 4; O. Reg. 779/93, ss. 2 (1), 4.

Application Despite Certain Provisions of Insurance Act

5. Subject to section 17, the insurer will pay the benefits under this Regulation despite section 225, subsection 233 (1), section 240, subsection 265 (3) and statutory condition 1 (1) of section 234 of the Insurance Act. R.R.O. 1990, Reg. 672, s. 5; O. Reg. 779/93, s. 2 (1).

PART II

SUPPLEMENTARY MEDICAL AND REHABILITATION BENEFITS AND CARE BENEFITS

Supplementary Medical and Rehabilitation Benefits

6. (1) The insurer will pay with respect to each insured person who sustains physical, psychological or mental injury as a result of an accident all reasonable expenses resulting from the accident within the benefit period set out in subsection (3) for,

(a) medical, psychological, surgical, dental, hospital, chiropractic, nursing and ambulance services and the services of physiotherapists;

(b) prostheses, dentures, prescription eyewear, hearing aids and other medical or dental devices;

(c) rehabilitation, life-skills training and occupational counselling and training;

(d) transportation for the person to and from treatment, counselling and training sessions, including transportation for an assistant;

(e) home renovations to accommodate the needs of the insured person;

(f) other goods and services, whether medical or non-medical in nature, which the insured person requires because of the accident R.R.O. 1990, Reg. 672, s. 6 (1).

(2) The insurer will pay with respect to each insured person who sustains physical, psychological or mental injury as a result of an accident an allowance that is reasonable having regard to all of the circumstances for expenses actually incurred by a spouse, child, grandchild, parent, grandparent, brother or sister of the insured person in visiting the insured person during his or her treatment or recovery. R.R.O. 1990, Reg. 672, s. 6 (2).

(3) For the purposes of this section, the benefit period is the longer of the two following periods calculated from the day of the accident and ending on the anniversary of the accident:

1. Ten years.

2. Twenty years less the age of the insured person on the day of the accident. R.R.O. 1990, Reg. 672, s. 6 (3).

(4) Subject to subsections (5) and (6), the insurer, before making a payment for an expense under subsection (1), may require the insured person to submit a statement signed by the insured person’s qualified medical practitioner or psychological advisor stating that the expense is necessary for the insured person’s treatment or rehabilitation. R.R.O. 1990, Reg. 672, s. 6 (4).

(5) A person qualified to practise as a chiropractor may sign a statement required under subsection (4) in respect of chiropractic services under clause (1) (a). R.R.O. 1990, Reg. 672, s. 6 (5).

(6) A person qualified to practise dentistry may sign a statement required under subsection (4) in respect of dental services and dentures under clauses (1) (a) and (b). R.R.O. 1990, Reg. 672, s. 6 (6).

(7) In case of a dispute concerning an expense described in clause (1) (a), (b) or (d), the insurer will pay the expense pending resolution of the dispute. R.R.O. 1990, Reg. 672, s. 6 (7).

(8) The maximum amount payable under this section is $500,000 with respect to each insured person. R.R.O. 1990, Reg. 672, s. 6 (8).

7. (1) The insurer will pay with respect to each insured person who sustains physical, psychological or mental injury as a result of an accident, for the care, if any, required by the insured person,

(a) the reasonable cost of a professional caregiver or the amount of gross income reasonably lost by a person other than the insured person as a result of the accident in caring for the insured person; and

(b) all reasonable expenses resulting from the accident in caring for the insured person after the accident. R.R.O. 1990, Reg. 672, s. 7 (1).

(2) The maximum amount payable per month under this section is $3,000 a month with respect to each insured person. R.R.O. 1990, Reg. 672, s. 7 (2).

(3) The maximum amount payable under this section is $500,000 with respect to each insured person. R.R.O. 1990, Reg. 672, s. 7 (3).

Damage to Clothing, Glasses, Hearing Aids and Other Devices

8. The insurer will pay an insured person for the reasonable cost of repairing or replacing clothing worn by the insured person at the time of an accident and prostheses, dentures, prescription eyewear, hearing aids and other medical or dental devices that are lost or damaged in an accident. R.R.O. 1990, Reg. 672, s. 8.

9. (1) The insurer will not pay any portion of an expense referred to in subsection 6 (1) or (2) or subsection 7 (1) for a service that is reasonably available to the insured person under any insurance plan or law or under any other plan or law that will pay the expense. R.R.O. 1990, Reg. 672, s. 9 (1).

(2) The insurer will pay benefits under this Part even though the insured person is entitled to or has received benefits under an Act administered by the Ministry of Community and Social Services for Ontario or under similar legislation in another jurisdiction. R.R.O. 1990, Reg. 672, s. 9 (2).

(3) For the purpose of subsection (2), a service, benefit or entitlement provided under an Act, the administration of which was transferred from the Ministry of Community and Social Services to the Ministry of Health by Order-in-Council, shall be deemed to be provided under an Act administered by the Ministry of Community and Social Services for Ontario so long as the nature of the service, benefit or entitlement remains substantially the same as it was before the transfer. O. Reg. 660/93, s. 1.

PART III

FUNERAL EXPENSES AND DEATH BENEFITS

10. The insurer will pay with respect to each insured person who dies as a result of an accident funeral expenses incurred up to $3,000 if Optional Benefit 1 has not been purchased, and up to $7,500 if it has been purchased. R.R.O. 1990, Reg. 672, s. 10.

11. (1) If, as a result of an accident, an insured person dies within the benefit period set out in subsection (3), the insurer will pay with respect to the insured person, if Optional Benefit 1 has not been purchased,

(a) $25,000 to his or her spouse, if the deceased is survived by a spouse who was his or her spouse at the time of the accident;

(b) $25,000 to his or her dependants, if the deceased is survived by any dependant who was a dependant at the time of the accident and is not survived by a spouse who is entitled to a benefit under this section;

(c) $10,000 to each of his or her surviving dependants who was a dependant at the time of the accident; and

(d) if, at the time of the accident, the deceased was a dependant, $10,000,

(i) to the person upon whom the deceased was dependent or, if that person is dead, to the surviving spouse of that person if the surviving spouse was the deceased’s primary caregiver, or

(ii) to the other surviving dependants of the person upon whom the deceased was dependent if that person and his or her spouse are dead. R.R.O. 1990, Reg. 672, s. 11 (1).

(2) If, as a result of an accident, an insured person dies within the benefit period set out in subsection (3), the insurer will pay with respect to the insured person, if Optional Benefit 1 has been purchased,

(a) $50,000 to his or her spouse, if the deceased is survived by a spouse who was his or her spouse at the time of the accident;

(b) $50,000 to his or her dependants, if the deceased is survived by any dependant who was a dependant at the time of the accident and is not survived by a spouse who is entitled to a benefit under this section;

(c) $20,000 to each of his or her surviving dependants who was a dependant at the time of the accident; and

(d) if, at the time of the accident, the deceased was a dependant, $20,000,

(i) to the person upon whom the deceased was dependent or, if that person is dead, to the surviving spouse of that person if the surviving spouse was the deceased’s primary caregiver, or

(ii) to the other surviving dependants of the person upon whom the deceased was dependent if that person and his or her spouse are dead. R.R.O. 1990, Reg. 672, s. 11 (2).

(3) For the purposes of subsections (1) and (2), the benefit period is,

(a) 180 days from the day of the accident unless clause (b) applies; or

(b) 156 weeks from the day of the accident if during that period there has been continuous disability as a result of the accident. R.R.O. 1990, Reg. 672, s. 11 (3).

(4) If at the time of the accident the deceased person had more than one person entitled to claim as his or her spouse, the $25,000 payment under clause (1) (a) or $50,000 under clause (2) (a) will be divided equally between or among such persons who survive the deceased and who at the time of the death were still spouses of the deceased. R.R.O. 1990, Reg. 672, s. 11 (4).

(5) Payments under clauses (1) (b) and (d) and clauses (2) (b) and (d) will be paid in equal shares to the surviving dependants. R.R.O. 1990, Reg. 672, s. 11 (5).

(6) No amount is payable under subsection (1) or (2) to a spouse or dependant unless the spouse or dependant, as the case may be, survives the deceased by thirty days. R.R.O. 1990, Reg. 672, s. 11 (6).

12. (1) The insurer will pay with respect to each insured person who sustains physical, psychological or mental injury as a result of an accident a weekly income benefit during the period in which the insured person suffers substantial inability to perform the essential tasks of his or her occupation or employment if the insured person meets the qualifications set out in subsection (2) or (3). R.R.O. 1990, Reg. 672, s. 12 (1).

(2) The following qualifications apply to an insured person who claims a weekly benefit under subsection (1):

1. He or she must have been at the time of the accident,

i. employed or self-employed,

ii. on a temporary lay-off, or

iii. entitled to start work within one year under a legitimate offer of employment made before the accident and evidenced in writing.

2. He or she as a result of and within two years of the accident must have suffered a substantial inability to perform the essential tasks of his or her occupation or employment. R.R.O. 1990, Reg. 672, s. 12 (2).

(3) A person who was unemployed and who was not self-employed at the time of the accident is qualified to receive a weekly benefit under subsection (1) if he or she was employed or self-employed for any 180 days in the twelve-month period before the accident, and if he or she as a result of and within two years of the accident has suffered a substantial inability to perform the essential tasks of the occupation or employment in which he or she spent the most time during the twelve-month period before the accident. R.R.O. 1990, Reg. 672, s. 12 (3).

(4) Subject to subsection (5), the weekly benefit under subsection (1) will be the lesser of,

(a) $600 plus, if Optional Benefit 2 has been purchased, the amount of the benefit chosen; and

(b) 80 per cent of the insured person’s gross weekly income from his or her occupation or employment, less any payments for loss of income, except Unemployment Insurance benefits,

(i) received by or available to the insured person under the laws of any jurisdiction or under any income continuation benefit plan, or

(ii) received under any sick leave plan. R.R.O. 1990, Reg. 672, s. 12 (4).

(5) The insurer is not required to pay a weekly benefit under subsection (1),

(a) for the first week of the disability;

(b) for any period in excess of 156 weeks unless it has been established that the injury continuously prevents the insured from engaging in any occupation or employment for which he or she is reasonably suited by education, training or experience. R.R.O. 1990, Reg. 672, s. 12 (5).

(6) The insurer is not required to pay a weekly benefit under subsection (1) to a person described in subparagraph iii of paragraph 1 of subsection (2) until the day the person would have been entitled under the contract to begin employment unless before that day the person is qualified for a benefit under another paragraph of that subsection. R.R.O. 1990, Reg. 672, s. 12 (6).

(7) The following rules apply to the calculation of gross weekly income:

1. A person’s gross weekly income shall be deemed to be the greatest of,

i. his or her average gross weekly income from his or her occupation or employment for the four weeks preceding the accident,

ii. his or her average gross weekly income from his or her occupation or employment for the fifty-two weeks preceding the accident,

iii. $232.

2. When a person becomes qualified to receive an income benefit under subparagraph iii of paragraph 1 of subsection (2), the person’s gross weekly income shall be deemed to be the greatest of,

i. if the person was qualified under either subparagraph i or ii of paragraph 1 of subsection (2), his or her gross weekly income as determined under paragraph 1,

ii. the gross weekly income payable under the contract of employment,

iii. $232.

3. Business expenses which cease as a result of the accident shall be deducted from a person’s income from self-employment before calculating his or her gross weekly income. R.R.O. 1990, Reg. 672, s. 12 (7).

13. (1) The insurer will pay with respect to each insured person who sustains physical, psychological or mental injury as a result of an accident, a weekly benefit during the period in which the insured person suffers substantial inability to perform the essential tasks in which he or she would normally engage if he or she meets the qualifications set out in subsection (2). R.R.O. 1990, Reg. 672, s. 13 (1).

(2) The following qualifications apply to an insured person who claims weekly benefits under subsection (1):

1. He or she as a result of and within two years of the accident must have suffered a substantial inability to perform the essential tasks in which he or she would normally engage.

2. He or she must not be entitled to receive a benefit under section 12 at the time of the payment of a benefit under this section or, if entitled to a benefit under that section, he or she must be a primary caregiver as described in subsection (4) and have only income from self-employment from work in his or her home.

3. He or she must attain the age of sixteen years before being eligible to receive the weekly benefit. R.R.O. 1990, Reg. 672, s. 13 (2).

(3) The weekly benefit under subsection (1) will be $185 less any payments for loss of income, except Unemployment Insurance benefits,

(a) received by or available to the insured person under the laws of any jurisdiction or under any income continuation benefit plan; or

(b) received under any sick leave plan. R.R.O. 1990, Reg. 672, s. 13 (3).

(4) The insurer will pay to an insured person who is receiving a weekly benefit under subsection (1), or who but for section 17 would be entitled to the weekly benefit, a benefit of $50 per week if Optional Benefit 3 has not been purchased, or $100 per week if it has been purchased, for each person who at the time of the accident was residing with the insured person and in respect of whom the insured person was the primary caregiver if the person receiving the care was less than sixteen years of age or if the person required the care because of physical or mental incapacity. R.R.O. 1990, Reg. 672, s. 13 (4).

(5) The maximum amount payable under subsection (4) is $200 per week, if Optional Benefit 3 has not been purchased, and $400 per week if it has been purchased. R.R.O. 1990, Reg. 672, s. 13 (5).

(6) A weekly benefit under subsection (4) ceases,

(a) when the person cared for attains age sixteen, unless he or she is incapacitated;

(b) when the incapacity of the person cared for ceases; or

(c) when the insured person ceases to be eligible for a benefit under subsection (1) or when the insured person would cease to be eligible had he or she not been disqualified under section 17. R.R.O. 1990, Reg. 672, s. 13 (6).

(7) A person cannot receive benefits under this section and section 12 at the same time. R.R.O. 1990, Reg. 672, s. 13 (7).

(8) The insurer is not required to pay a weekly benefit under this section,

(a) for the first week of the disability;

(b) for any period in excess of 156 weeks unless it has been established that the injury continuously prevents the insured person from engaging in substantially all of the activities in which the person would normally engage. R.R.O. 1990, Reg. 672, s. 13 (8).

14. (1) The insurer will pay full benefits under this Part until the insured person receives payments that would reduce the insurer’s obligation through the operation of subsection 12 (4) or 13 (3) if the insured person has applied to receive the payments. R.R.O. 1990, Reg. 672, s. 14 (1).

(2) The insurer will pay benefits under this Part even though the insured person is entitled to, or has received, benefits under an Act administered by the Ministry of Community and Social Services for Ontario or under similar legislation in another jurisdiction. R.R.O. 1990, Reg. 672, s. 14 (2).

15. The insurer may deduct from any benefit payable under this Part 80 per cent of any income received or available from any occupation or employment subsequent to the accident. R.R.O. 1990, Reg. 672, s. 15.

Temporary Return to School or Work

16. (1) Subject to section 15 and subsection (3), a person receiving a benefit under this Part may attend school or accept, or return to, work at any time during the first two years following the accident for any period of time without affecting his or her benefits under this Part if, as a result of the accident, he or she is unable to continue at school or in the occupation or employment. R.R.O. 1990, Reg. 672, s. 16 (1).

(2) Subject to section 15 and subsection (3), after the two-year period referred to in subsection (1), a person receiving a benefit under this Part may attend school or accept, or return to, an occupation or employment for periods of up to ninety days without affecting his or her benefits under this Part if he or she, as a result of the injury, is unable to continue at school or in the occupation or employment. R.R.O. 1990, Reg. 672, s. 16 (2).

(3) The insurer is not required to pay weekly benefits under section 13 for any week in which the insured person attends school. R.R.O. 1990, Reg. 672, s. 16 (3).

17. (1) The insurer is not required to pay benefits under subsection 12 (1) or 13 (1) in respect of a driver of an automobile at the time of the accident,

(a) if, as a result of the accident, the driver is convicted of operating the automobile while his or her ability to operate it was impaired by alcohol or a drug, or of driving while his or her blood alcohol level exceeded the limits permitted by law or of an indictable offence related to the operation of the automobile;

(b) if, as a result of the accident, the driver is asked to provide a breath sample and he or she is convicted for failure to provide the sample;

(c) if, as a result of the accident, the driver is convicted of operating the automobile while it was not insured under a motor vehicle liability policy;

(d) if the driver was not authorized by law to drive the automobile;

(e) if the driver is an excluded driver under the contract of automobile insurance; or

(f) if the driver knew or ought reasonably to have known that he or she was operating the automobile without the owner’s consent. R.R.O. 1990, Reg. 672, s. 17 (1).

(2) Clause (1) (d) does not apply to a driver who is not authorized by law to drive an automobile only by reason of a suspension of a licence for failure to pay a fine. R.R.O. 1990, Reg. 672, s. 17 (2).

(3) The insurer is not required to pay benefits under subsection 12 (1) or 13 (1),

(a) in respect of any person who has made, or who knows of, a material misrepresentation which induced the insurer to enter into the contract of automobile insurance or who intentionally failed to notify the insurer of a change in the risk material to the contract; or

(b) in respect of an occupant of an automobile at the time of the accident who knew or ought reasonably to have known that the driver was operating the automobile without the owner’s consent. R.R.O. 1990, Reg. 672, s. 17 (3).

(4) Clause (3) (b) does not prevent an excluded driver or any other occupant of an automobile driven by the excluded driver from recovering statutory accident benefits under a motor vehicle liability policy in respect of which the excluded driver or other occupant is a named insured. R.R.O. 1990, Reg. 672, s. 17 (4); O. Reg. 779/93, s. 2 (2).

18. (1) The insurer will pay with respect to a person insured in Quebec who dies or who sustains physical, psychological or mental injury as a result of an accident in Quebec or who incurs a cost described in section 6, as the person may elect,

(a) benefits as provided in Part II (Supplementary Medical and Rehabilitation Benefits and Care Benefits), Part III (Funeral Expenses and Death Benefits) and Part IV (Weekly Benefits); or

(b) benefits in the same amounts and subject to the same conditions as if the person was a resident of Quebec (as defined in the Automobile Insurance Act (Quebec) and the regulations made under that Act) and was entitled to payments under that Act and those regulations. R.R.O. 1990, Reg. 672, s. 18 (1).

(2) A person who elects to claim a benefit as provided in clause (1) (a) is thereafter eligible only for benefits under Parts II, III and IV. R.R.O. 1990, Reg. 672, s. 18 (2).

(3) A person who elects to claim a benefit as provided in clause (1) (b) is thereafter ineligible for benefits under Parts II, III and IV. R.R.O. 1990, Reg. 672, s. 18 (3).

(4) For the purposes of this Part, a person is insured in Quebec if the person at the time of the accident,

(a) was authorized by law to be or to remain in Canada and was living and ordinarily present in Ontario;

(b) met the criteria prescribed for recovery under the Automobile Insurance Act (Quebec);

(c) was not the owner or driver of, or an occupant of, an automobile registered in Quebec; and

(d) was,

(i) an occupant of the insured automobile,

(ii) the named insured, his or her spouse or a dependant of either of them while the occupant of any other automobile,

(iii) a person who was not the occupant of an automobile and was struck by the insured automobile,

(iv) the named insured, his or her spouse or a dependant of either of them and was struck by any other automobile,

(v) if the named insured is a corporation, unincorporated association, partnership or sole proprietorship, a person for whose regular use the insured automobile was supplied, his or her spouse or a dependant of either of them who was injured,

(A) while the occupant of any other automobile, or

(B) by any other automobile while not the occupant of the automobile, or

(vi) a person struck by an automobile that was driven by a person described in subclause (i), (ii) or (v). R.R.O. 1990, Reg. 672, s. 18 (4).

19. (1) Every insurer shall offer the following optional benefits:

1. Optional Benefit 1: Increased Funeral Expenses and Death Benefits

If this option is purchased,

(a) the maximum amount payable under section 10 (Funeral Expenses) will be $7,500; and

(b) the maximum amount payable under section 11 (Death Benefits) will be the amounts set out in subsection 11 (2).

2. Optional Benefit 2: Increased Weekly Income Benefit

If this option is purchased, the amount referred to in clause 12 (4) (a) will be increased by such amount from the following as may be chosen when purchasing the option:

1. $150.

2. $300.

3. $450.

3. Optional Benefit 3: Increased Primary Caregiver Benefit

If this option is purchased, the amount payable under subsection 13 (4) will be $100 per week per person. R.R.O. 1990, Reg. 672, s. 19 (1).

(2) Optional benefits may be purchased at any time before an accident in respect of which a claim is made. R.R.O. 1990, Reg. 672, s. 19 (2).

PART VII

WORKERS’ COMPENSATION

Effect of Workers’ Compensation Benefits

20. The insurer will not pay benefits under this Regulation in respect of any insured person who, as a result of an accident, is entitled to receive benefits under any workers’ compensation law or plan. R.R.O. 1990, Reg. 672, s. 20; O. Reg. 779/93, s. 2 (1).

21. (1) Despite section 20, the insurer will pay full benefits under this Regulation to a person described in that section until the resolution of any action brought by the person in any court to recover for personal injuries resulting from the accident under which the workers’ compensation claim arose or until the person receives payments under a workers’ compensation law or plan if,

(a) the person makes an assignment to the insurer of any benefits under any workers’ compensation law or plan to which he or she is or may become entitled as a result of the accident; and

(b) the administrator or board responsible for the administration of the workers’ compensation law or plan approves the assignment. R.R.O. 1990, Reg. 672, s. 21 (1); O. Reg. 779/93, s. 2 (1).

(2) The amount of statutory accident benefits recoverable by the insurer under the assignment in subsection (1) shall be determined in accordance with the following formula:

A = T - C

Where,

A = amount recoverable;

T = total compensation for personal injury received by the insured person under all contracts of automobile insurance excluding any amount received as a special award under subsection 282 (10) or 283 (7) of the Insurance Act and any amount received as interest;

Note: On April 1, 2016, the day section 14 of Schedule 3 to the Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014 comes into force, the definition of “T” in subsection 21 (2) of the Regulation is amended by striking out “of the Insurance Act” and substituting “of the Act as it read immediately before the transition date within the meaning of subsection 283 (5) of the Act”. (See: O. Reg. 47/16, s. 1)

C = compensation for personal injury the insured person would have recovered under all contracts of automobile insurance had the statutory accident benefits not been paid.

R.R.O. 1990, Reg. 672, s. 21 (2); O. Reg. 779/93, s. 2 (2).

Notice, Application for Benefits

22. (1) The insured person or the person otherwise entitled to make a claim shall,

(a) give initial notice of a claim to the insurer, in writing, within thirty days from the date of the accident or as soon as practicable thereafter; and

(b) furnish to the insurer within ninety days of the giving of the notice under clause (a) a completed application for statutory accident benefits respecting the accident and the resulting loss. R.R.O. 1990, Reg. 672, s. 22 (1); O. Reg. 779/93, s. 2 (2).

(2) A failure to comply with a time limit set out in subsection (1) does not invalidate a claim if the claimant has a reasonable excuse and so long as there is compliance within two years of the accident. R.R.O. 1990, Reg. 672, s. 22 (2).

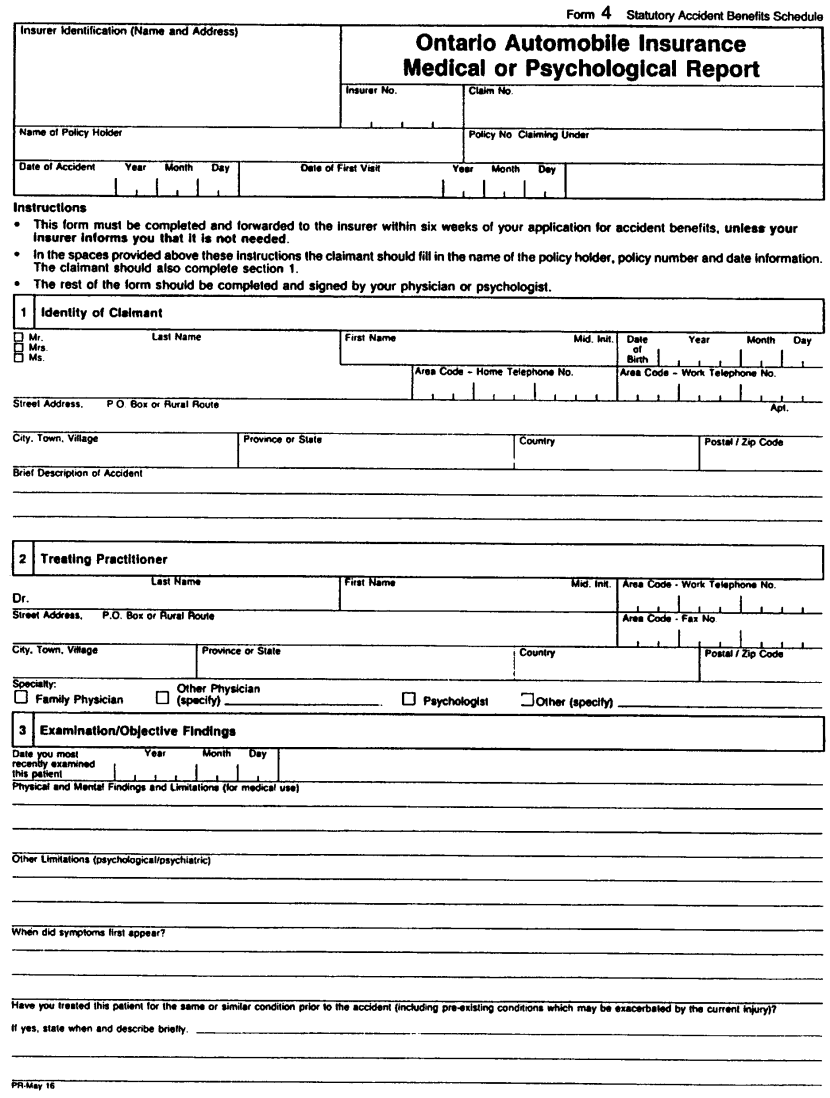

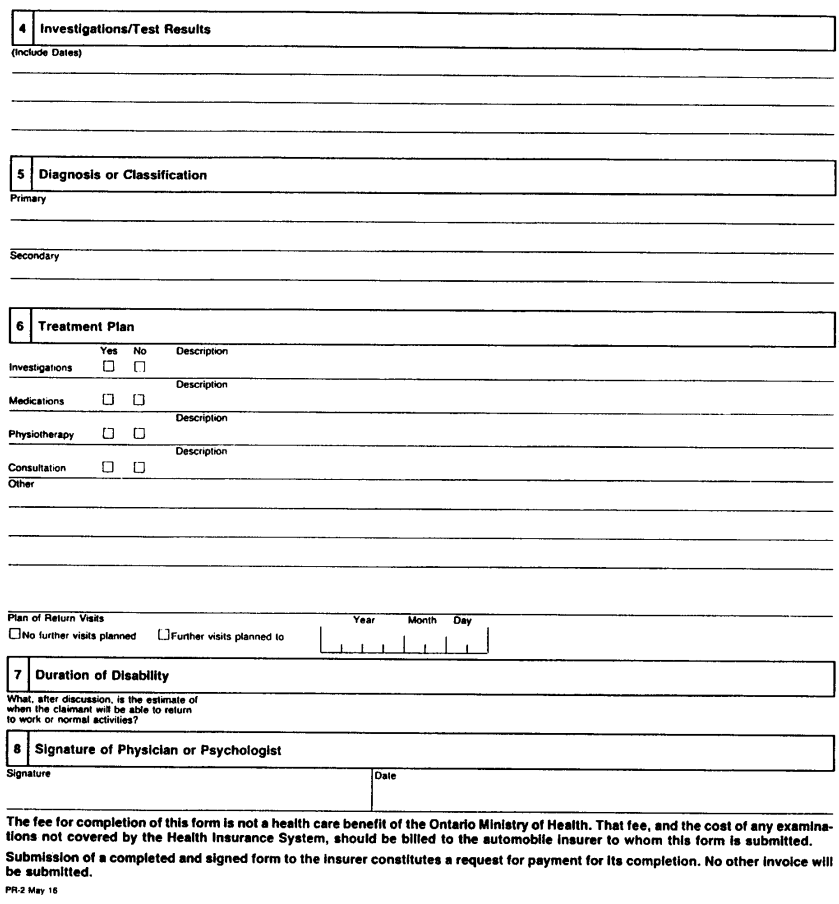

23. (1) Unless waived by the insurer, the insured person or the person otherwise entitled to make a claim under Part IV shall furnish a certificate from a qualified medical practitioner or psychological advisor of the insured person’s choice as to the cause and nature of the injury for which the claim is made, an estimate of the duration of the disability caused by the accident and a treatment plan. R.R.O. 1990, Reg. 672, s. 23 (1).

(2) In respect of claims under Part IV, the insurer may, on reasonable notice, require an examination of the insured person by a qualified medical practitioner, psychological advisor or chiropractor as often as it reasonably requires, and require an autopsy of a deceased insured person in accordance with the law relating to autopsies. R.R.O. 1990, Reg. 672, s. 23 (2).

(3) The insurer will pay the reasonable cost of examinations under subsection (1) if the cost is not payable under any insurance plan or law or under any other plan or law. R.R.O. 1990, Reg. 672, s. 23 (3).

(4) The insurer will pay the cost of all certificates under subsection (1) and for all examinations and certificates under subsection (2). R.R.O. 1990, Reg. 672, s. 23 (4).

Payment of Claims, Refusal to Pay

24. (1) Amounts payable under Parts II, III and V are overdue if not mailed or otherwise delivered by the insurer within thirty days after it has received a completed application for statutory accident benefits. R.R.O. 1990, Reg. 672, s. 24 (1); O. Reg. 779/93, s. 2 (2).

(2) Amounts payable under Part IV are overdue if not mailed or otherwise delivered by the insurer within ten days after it has received a completed application for statutory accident benefits or if the insurer fails to make a payment required by subsection (3). R.R.O. 1990, Reg. 672, s. 24 (2); O. Reg. 779/93, s. 2 (2).

(3) Payments under Parts IV and V shall be mailed or otherwise delivered at least once every second week while the insurer remains liable to the insured person. R.R.O. 1990, Reg. 672, s. 24 (3).

(4) The insurer will pay interest on overdue payments from the date they become overdue at the rate of 2 per cent per month. R.R.O. 1990, Reg. 672, s. 24 (4).

(5) Subsection (3) does not apply if the insurer prepays benefits owing. R.R.O. 1990, Reg. 672, s. 24 (5).

(6) Despite subsections (1), (2) and (3), a payment is not overdue if, at the time it would have become payable, the certificate required by subsection 23 (1) has not been received by the insurer, six weeks have passed since the insurer received the completed application for statutory accident benefits and the insurer has not waived the requirement that the certificate be supplied. R.R.O. 1990, Reg. 672, s. 24 (6); O. Reg. 779/93, s. 2 (2).

(7) If subsection (6) applies, the payment becomes overdue if the amount payable is not mailed or otherwise delivered by the insurer within ten days after the insurer has received the certificate. R.R.O. 1990, Reg. 672, s. 24 (7).

(8) If the insurer refuses to pay an amount claimed in an application for statutory accident benefits, the insurer shall forthwith give written notice to the insured person giving the reasons for the refusal. R.R.O. 1990, Reg. 672, s. 24 (8); O. Reg. 779/93, s. 2 (2).

25. No person may commence a mediation proceeding under section 280 of the Insurance Act in respect of benefits under this Regulation unless the requirements of section 22 have been satisfied and the insured person has made himself or herself reasonably available for any examination required under section 23. R.R.O. 1990, Reg. 672, s. 25; O. Reg. 779/93, s. 2 (1).

Note: On April 1, 2016, the day section 14 of Schedule 3 to the Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014 comes into force, section 25 of the Regulation is revoked and the following substituted: (See: O. Reg. 47/16, s. 2)

25. (1) Subject to subsection (2), an insured person shall not apply to the Licence Appeal Tribunal under subsection 280 (2) of the Act if any of the following circumstances exist:

1. The requirements of section 22 have not been satisfied.

2. The insured person has not made themselves reasonably available for any examination required under section 23. O. Reg. 47/16, s. 2.

(2) The Licence Appeal Tribunal may permit an insured person to apply despite paragraph 2 of subsection (1). O. Reg. 47/16, s. 2.

(3) The Licence Appeal Tribunal may impose terms and conditions on a permission granted under subsection (2) of this section. O. Reg. 47/16, s. 2.

26. (1) A mediation proceeding under section 280 of the Insurance Act or an arbitration or court proceeding under section 281 of the Act in respect of benefits under this Regulation must be commenced within two years from the insurer’s refusal to pay the amount claimed in the application for statutory accident benefits or, if the person has attended school or accepted, or returned to, an occupation or employment, as permitted by section 16, within two years of the insurer’s refusal to pay further benefits. R.R.O. 1990, Reg. 672, s. 26; O. Reg. 779/93, ss. 2, 5 (1).

(2) Despite subsection (1), an arbitration or court proceeding under section 281 of the Insurance Act may be commenced within ninety days after the mediator reports to the parties under subsection 280 (8) of the Act. O. Reg. 779/93, s. 5 (2).

Note: On April 1, 2016, the day section 14 of Schedule 3 to the Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014 comes into force, section 26 of the Regulation is revoked and the following substituted: (See: O. Reg. 47/16, s. 2)

26. An application under subsection 280 (2) of the Act in respect of a benefit shall be commenced within two years after the insurer’s refusal to pay the amount claimed or, if the person has attended school or accepted, or returned to, an occupation or employment, as permitted by section 16, within two years after the insurer’s refusal to pay further benefits. O. Reg. 47/16, s. 2.

27. (1) A person must repay to the insurer any benefit received under this Regulation that is paid to the person through error or fraud. R.R.O. 1990, Reg. 672, s. 27 (1); O. Reg. 779/93, s. 2 (1).

(2) A person must repay to the insurer any benefit received under sections 12 and 13 that is paid to him or her if the person or the person in respect of whom the payment was made was disqualified from payment under section 17. R.R.O. 1990, Reg. 672, s. 27 (2).

(3) A person must repay to the insurer any benefit received under sections 12 and 13 to the extent of any payments received by the person that are deductible from benefits under subsection 12 (4) or 13 (3). R.R.O. 1990, Reg. 672, s. 27 (3).

(4) The insurer may charge interest from the day the amount owing to the insurer under this section is determined at the bank rate on that day. R.R.O. 1990, Reg. 672, s. 27 (4).

(5) In subsection (4),

“bank rate” means the bank rate established by the Bank of Canada as the minimum rate at which the Bank of Canada makes short term advances to the banks listed in Schedule I to the Bank Act (Canada). R.R.O. 1990, Reg. 672, s. 27 (5).

28. The insurer, at a named insured person’s request, will provide a copy of this Regulation to the person without charge. R.R.O. 1990, Reg. 672, s. 28; O. Reg. 779/93, s. 2 (1).

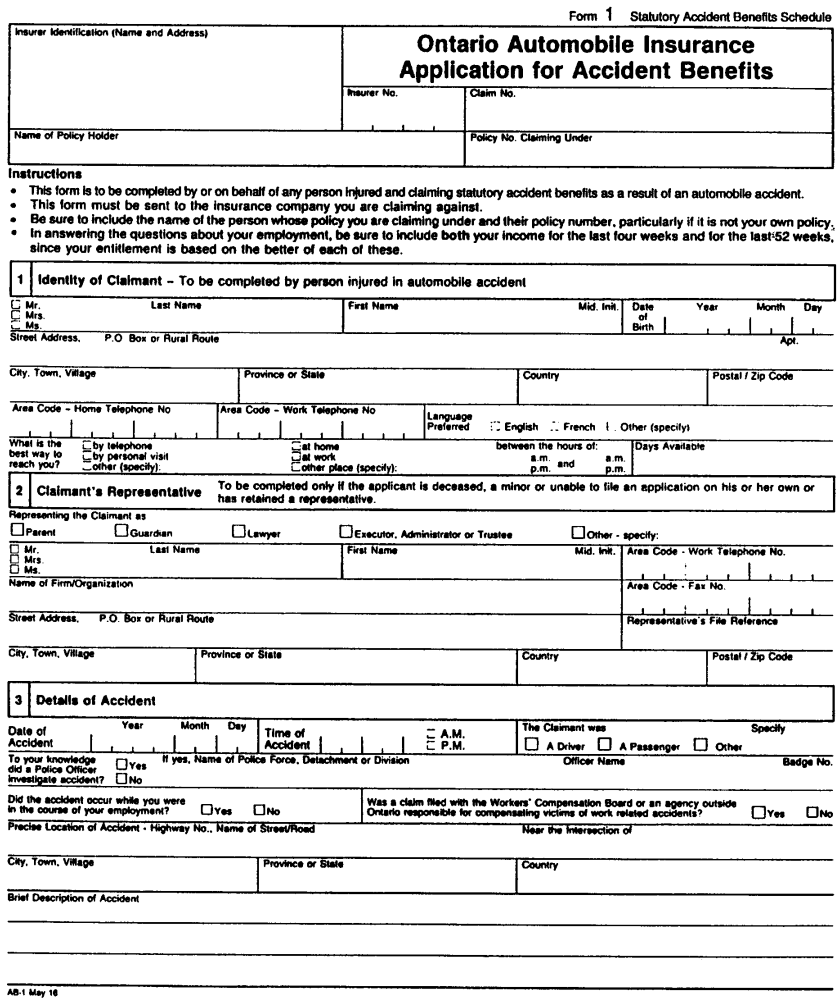

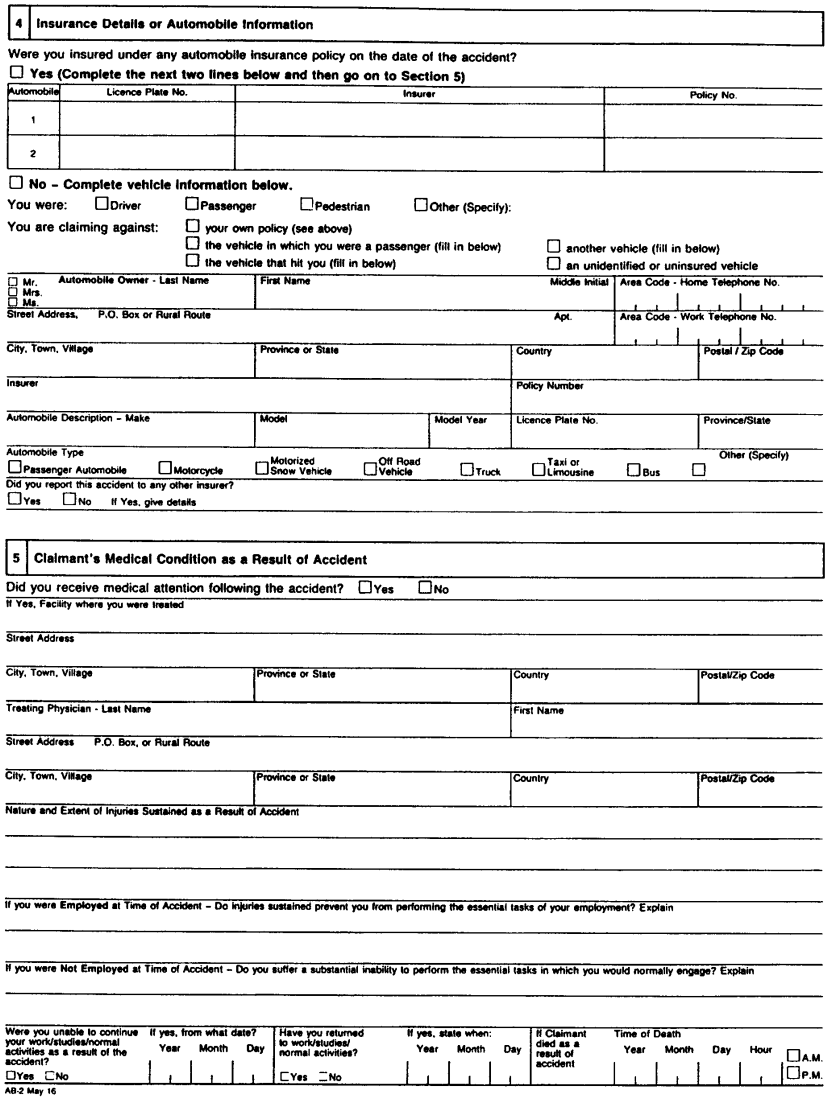

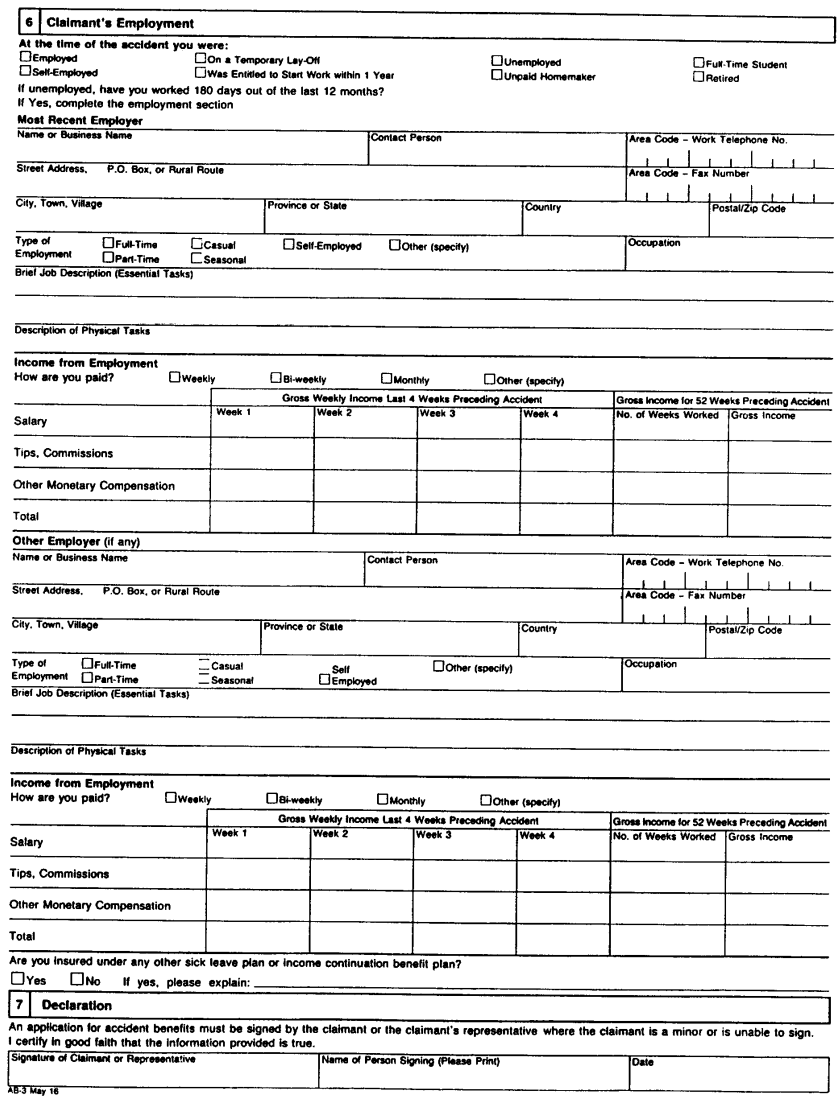

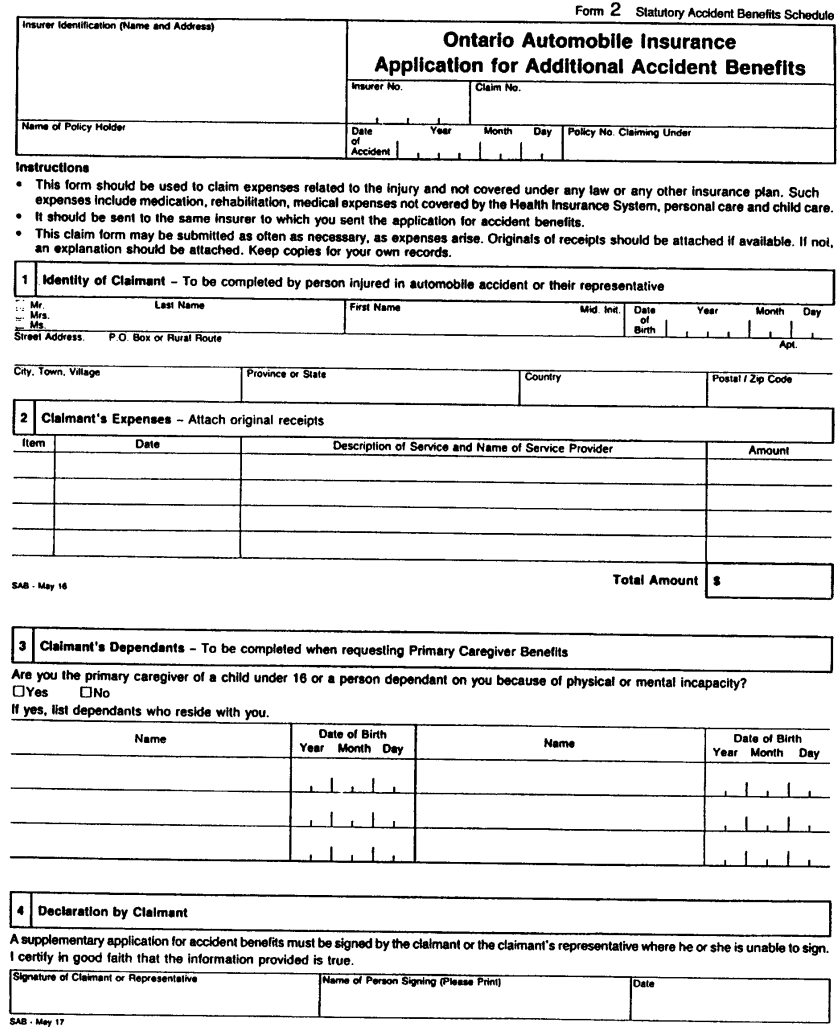

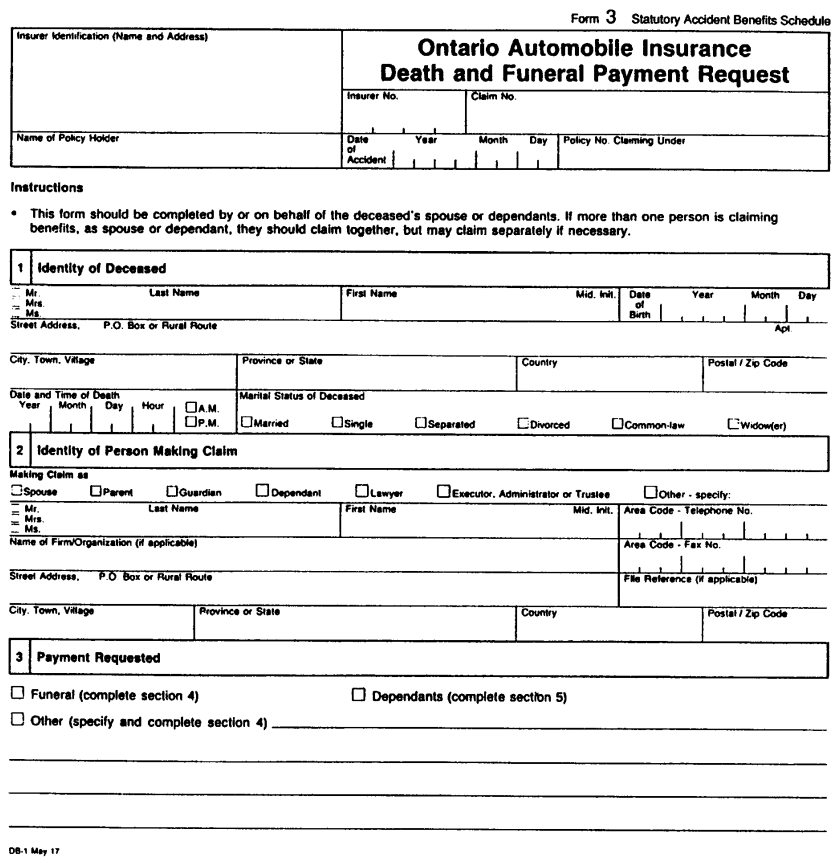

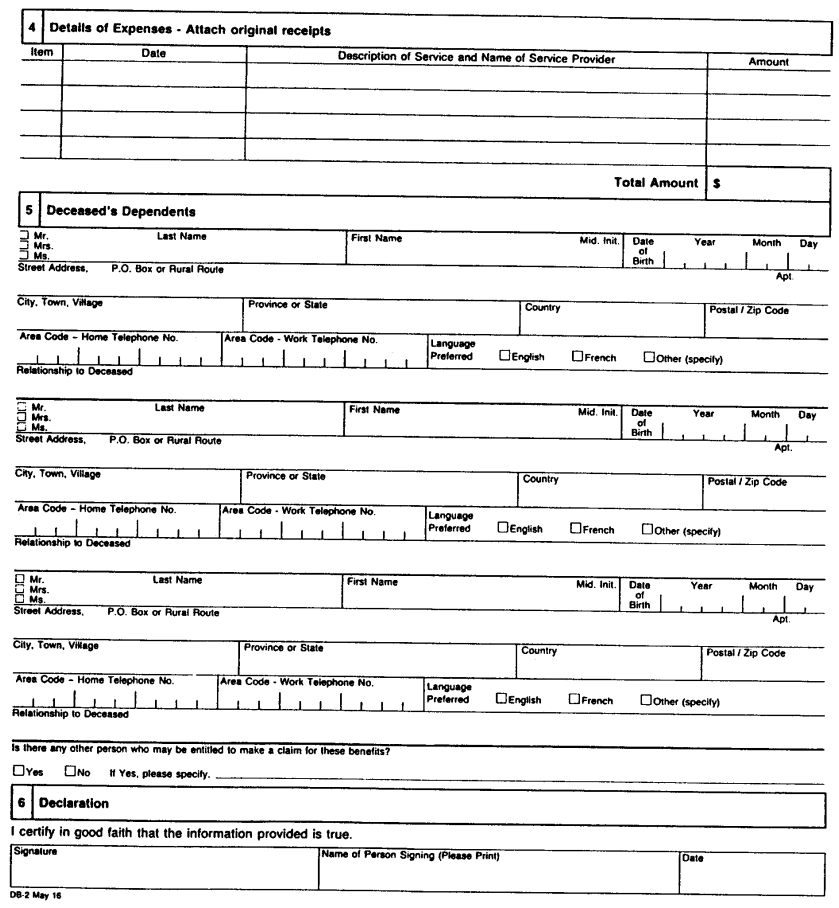

29. (1) An initial application for benefits under Part II, IV or V shall be in Form 1 and an application for additional benefits shall be in Form 2. R.R.O. 1990, Reg. 672, s. 29 (1).

(2) An application for benefits under Part III shall be in Form 3. R.R.O. 1990, Reg. 672, s. 29 (2).

(3) A certificate required by subsection 23 (1) shall be in Form 4. R.R.O. 1990, Reg. 672, s. 29 (3).

Note: On April 1, 2016, the day section 14 of Schedule 3 to the Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014 comes into force, section 29 of the Regulation is revoked and the following substituted: (See: O. Reg. 47/16, s. 3)

29. Each of the following documents shall be in a form approved by the Superintendent:

1. An initial application for benefits under Part II, IV or V.

2. An application for additional benefits under Part II, IV or V.

3. An application for benefits under Part III.

4. A certificate required by subsection 23 (1). O. Reg. 47/16, s. 3.

Form 1

Statutory Accident Benefits Schedule

Insurance Act

Insert regs\graphics\1990\672\672001au.tif

Insert regs\graphics\1990\672\672001bu.tif

Insert regs\graphics\1990\672\672001cu.tif

R.R.O. 1990, Reg. 672, Form 1; O. Reg. 779/93, s. 2 (2).

Note: On April 1, 2016, the day section 14 of Schedule 3 to the Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014 comes into force, Form 1 of the Regulation is revoked. (See: O. Reg. 47/16, s. 4)

Form 2

Statutory Accident Benefits Schedule

Insurance Act

Insert regs\graphics\1990\672\672002au.tif

R.R.O. 1990, Reg. 672, Form 2; O. Reg. 779/93, s. 2 (2).

Note: On April 1, 2016, the day section 14 of Schedule 3 to the Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014 comes into force, Form 2 of the Regulation is revoked. (See: O. Reg. 47/16, s. 4)

Form 3

Statutory Accident Benefits Schedule

Insurance Act

Insert regs\graphics\1990\672\672003au.tif

Insert regs\graphics\1990\672\672003bu.tif

R.R.O. 1990, Reg. 672, Form 3; O. Reg. 779/93, s. 2 (2).

Note: On April 1, 2016, the day section 14 of Schedule 3 to the Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014 comes into force, Form 3 of the Regulation is revoked. (See: O. Reg. 47/16, s. 4)

Form 4

Statutory Accident Benefits Schedule

Insurance Act

Insert regs\graphics\1990\672\672004au.tif

Insert regs\graphics\1990\672\672004bu.tif

R.R.O. 1990, Reg. 672, Form 4; O. Reg. 779/93, s. 2 (2).

Note: On April 1, 2016, the day section 14 of Schedule 3 to the Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014 comes into force, Form 4 of the Regulation is revoked. (See: O. Reg. 47/16, s. 4)