O. Reg. 171/01: TAX MATTERS - PART XXII.3 OF THE ACT - 2001 TAXATION YEAR, Filed May 16, 2001 under Municipal Act, R.S.O. 1990, c. M.45

ONTARIO regulation 171/01

made under the

municipal Act

Made: May 15, 2001

Filed: May 16, 2001

Printed in The Ontario Gazette: June 2, 2001

Tax Matters — Part xxii.3 of the Act — 2001 taxation year

PART I

ADJUSTMENT TO TAXES IN RESPECT OF CHANGES IN TAXES FOR MUNICIPAL PURPOSES

(SUBSECTION 447.65 (1), PARAGRAPH 3 OF THE ACT)

Application of Part

1. This Part provides for the adjustments to be made under paragraph 3 of subsection 447.65 (1) of the Act in respect of changes in taxes for municipal purposes.

Adjustment

2. (1) The amount determined under paragraph 2 of subsection 447.65 (1) of the Act shall be adjusted,

(a) by increasing it by the amount determined in accordance with subsection (2) if that amount is positive; or

(b) by decreasing it by the amount determined in accordance with subsection (2) if that amount is negative.

(2) The amount referred to in clauses (1) (a) and (b) is equal to the amount determined under paragraph 2 of subsection 447.65 (1) of the Act multiplied by the 2001 adjustment fraction determined under subsection (3).

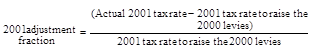

(3) The 2001 adjustment fraction referred to in subsection (2) shall be determined in accordance with the following:

where,

“Actual 2001 tax rate” means the number determined under section 3,

“2001 tax rate to raise the 2000 levies” means the number determined under section 4.

Actual 2001 tax rate

3. For the purposes of subsection 2 (3), the Actual 2001 tax rate means a sum determined, in accordance with the following, for the property class and local municipality the property is in:

1. Identify each 2001 tax rate for municipal or school purposes on property in the property class in the local municipality.

2. A tax rate for the purposes of a special local municipality levy or a special upper-tier levy shall be identified under paragraph 1 only if it applies to at least 50 per cent of the total assessment of property in the property class in the local municipality taxable for municipal purposes.

3. For the purposes of paragraph 1, the 2001 tax rate for school purposes means the tax rate prescribed under section 257.12 of the Education Act.

4. The Actual 2001 tax rate is the sum of the tax rates identified under paragraph 1.

2001 tax rate to raise the 2000 levies

4. (1) For the purposes of subsection 2 (3), the 2001 tax rate to raise the 2000 levies means a sum determined, in accordance with the following, for the property class and local municipality the property is in:

1. For each general or special municipal levy for 2000 that applied to property in the local municipality, determine the 2000 levy amount in accordance with subsection (2).

2. For each levy, determine the weighted assessment, in accordance with subsection (3), for each property class with respect to which the levy applies.

3. For each levy, determine the 2000 residential rate by dividing the 2000 levy amount, determined under paragraph 1, by the sum of the weighted assessments determined for each property class under paragraph 2.

4. For each levy, determine a property class rate for each property class by multiplying the 2000 residential rate determined under paragraph 3 times the tax ratio for the property class for 2001.

5. For each property class, the 2001 tax rate to raise the 2000 levies is the sum of the property class rates determined under paragraph 4 for the property class and the 2001 tax rate for school purposes.

6. A property class rate for a levy shall not be included in the calculation under paragraph 5 if the total assessment, as set out in the assessment roll for 2001, as returned, for property in the property class in the local municipality with respect to which the levy applies is less than 50 per cent of the total assessment, as set out in the assessment roll for 2001, as returned, for property in the property class in the local municipality taxable for municipal purposes.

7. For the purposes of paragraph 6, the assessment for a property includes any adjustments under section 33, 34, 39.1 or 40 of the Assessment Act that have been made on the collector’s roll prior to the issuance of the final 2001 tax notice under section 392 or 393 of the Act.

(2) For the purposes of paragraph 1 of subsection (1), the 2000 levy amount for a levy shall be determined in accordance with the following:

1. Apply the 2000 tax rate for the levy for each property class to the total assessment for property in the property class to which the levy applied.

2. If the property class is not subject to Part XXII.3 of the Act, the assessment, for the purposes of paragraph 1, is the assessment set out in the assessment roll for 2000, as returned, with the changes in assessment that would produce the changes in taxes referred to in paragraphs 2 and 3 of subsection 372.2 (6) of the Act.

3. If the property class is subject to Part XXII.3 of the Act, the assessment, for the purposes of paragraph 1, is the assessment set out in the assessment roll for 2000, as returned, with the changes in assessment that would produce the changes in taxes referred to in paragraphs 2, 3, 5 and 6 of subsection 447.65 (2) of the Act.

4. The 2000 levy amount for a levy is the sum of the amounts determined under paragraph 1 for each property class.

(3) For the purposes of paragraph 2 of subsection (1), the weighted assessment for each property class with respect to which the levy applies shall be determined in accordance with the following:

1. Multiply the assessment for the properties in the property class to which the levy applied, as set out in the assessment roll for 2001, as returned, by the tax ratio for the property class for 2001.

2. For the purposes of paragraph 1, the assessment for a property includes any adjustments under section 33, 34, 39.1 or 40 of the Assessment Act that have been made on the collector’s roll prior to the issuance of the final 2001 tax notice under section 392 or 393 of the Act.

3. For the purposes of paragraph 1, the assessment for a property with respect to which section 368.1 of the Act applies shall be reduced by an amount equal to the assessment with respect to which the percentage reduction in subsection 368.1 (1) of the Act applies multiplied by the percentage reduction.

Graduated tax rates

5. For the purposes of this Part, the tax rate for a property with respect to which a by-law under section 368.2 of the Act applies is the tax rate that would have applied if section 368.2 of the Act did not apply.

Previously unorganized territory

6. The following apply with respect to a property that was in territory without municipal organization and became part of a municipality in 2000 or 2001:

1. No adjustment shall be made under paragraph 3 of subsection 447.65 (1) of the Act in respect of changes in taxes for municipal purposes.

2. The property shall be deemed to not be part of the municipality for the purposes of this Part.

PART II

DETERMINATION OF TAX RATES IF SUBSECTION 366 (4.1) OR 368 (4.1) OF THE ACT APPLIES

General tax rate if subs. 366 (4.1) or 368 (4.1) of the Act applies

7. (1) This section provides for the manner in which the tax rates on property in a property class are to be determined under subsections 366 (4.1) and 368 (4.1) of the Act if the conditions set out in those subsections are satisfied.

(2) If the tax rate for the general levy for the property class would otherwise exceed the property class rate determined under paragraph 4 of subsection 4 (1) for the general levy, the tax rate for the general levy for the property class shall be the property class rate.

Special levy for tax increase

8. (1) If subsection 7 (2) applies with respect to a property class, the municipality shall, by special levy, raise an amount equal to the difference in what the revenue would be, in relation to the property class, if subsection 7 (2) did not apply.

(2) The special levy shall be raised under subsection 366 (3) or 368 (3) of the Act, as applicable, on all property other than property in a property class or classes in respect of which subsection 7 (2) applies.

(3) If the general levy of a municipality for 2000 was less than the general levy for 1999, the following apply:

1. The municipality may raise, under subsection (1), the amount described in paragraph 2 instead of the amount described in subsection (1).

2. The amount referred to in paragraph 1 is an amount equal to what the reduction in revenue under subsection 7 (2) would be if paragraphs 1 to 4 of subsection 4 (1) were applied in relation to the 1999 general levy instead of the 2000 general levy.

3. For the purposes of applying paragraphs 1 to 4 of subsection 4 (1) under paragraph 2, a reference to “2000” in section 4 shall be deemed to be a reference to “1999”.

PART III

PRESCRIBED ADJUSTMENTS UNDER

SECTION 447.67 OF THE ACT

Adjustment for school purposes, various provisions

9. There shall be no adjustment of taxes in respect of changes in taxes for school purposes for the purposes of subsection 447.67 (2), paragraph 2 of subsection 447.67 (4) and paragraphs 2 and 6 of subsection 447.67 (8) of the Act.

Adjustment for municipal purposes, various provisions

10. (1) This section provides for the adjustment of taxes in respect of changes in taxes for municipal purposes for the purposes of subsection 447.67 (2), paragraph 2 of subsection 447.67 (4) and paragraph 2 of subsection 447.67 (8) of the Act.

(2) The taxes shall be adjusted by multiplying the 2001 taxes for municipal and school purposes by a fraction determined in accordance with subsection (3).

(3) The fraction referred to in subsection (2) shall be determined in accordance with the following:

![]()

where,

“2001 adjustment fraction” means 2001 adjustment fraction under subsection 2 (3).

Adjustment for municipal purposes, para. 6 of subs. 447.67 (8) of the Act

11. (1) This section provides for the adjustment of taxes in respect of changes in taxes for municipal purposes for the purposes of paragraph 6 of subsection 447.67 (8) of the Act.

(2) The amount determined under paragraph 5 of subsection 447.67 (8) of the Act shall be adjusted,

(a) by increasing it by the amount determined in accordance with subsection (3) if that amount is positive; or

(b) by decreasing it by the amount determined in accordance with subsection (3) if that amount is negative.

(3) The amount referred to in clauses (2) (a) and (b) is equal to the amount determined under paragraph 5 of subsection 447.67 (8) of the Act multiplied by the 2001 adjustment fraction determined under subsection 2 (3).

Taxes not to be lower than uncapped 2001 taxes

12. (1) If the taxes for municipal and school purposes for 2001 as determined under subsection 447.67 (8) of the Act are less than the uncapped 2001 taxes, the taxes for municipal and school purposes for 2001 shall, despite subsection 447.67 (8) of the Act, be equal to the uncapped 2001 taxes.

(2) In this section,

“uncapped 2001 taxes” means the taxes for municipal and school purposes that would have been imposed for 2001 but for the application of Part XXII.3 of the Act.

Previously unorganized territory

13. The following apply with respect to a property that was in territory without municipal organization and became part of a municipality in 2000 or 2001:

1. No adjustment shall be made under subsection 447.67 (2), paragraph 2 of subsection 447.67 (4) or paragraph 2 or 6 of subsection 447.67 (8) of the Act.

2. Section 12 does not apply.

3. The property shall be deemed to not be part of the municipality for the purposes of this Part.

PART IV

MISCELLANEOUS

Special rule for assessments under ss. 33 and 34

of the Assessment Act

14. If an additional assessment is made under section 33 of the Assessment Act for the 2000 taxation year in relation to an improvement and, in relation to the same improvement, an additional assessment is made for the 2001 taxation year under section 34 of the Assessment Act, subsection 447.65 (8) of the Act shall not apply with respect to that latter additional assessment.

Special rule, eligible property under s. 447.70 of the Act

15. For taxation for 2001, the following are not eligible property for the purposes of section 447.70 of the Act:

1. Property of a designated electricity utility as defined in subsection 19.0.1 (5) of the Assessment Act that was acquired on April 1, 1999.

2. Property of a municipal electricity utility as defined in section 88 of the Electricity Act, 1998.

3. Property acquired under a transfer order under subsection 34 (1) of the Social Housing Reform Act, 2000.

4. Property of a non-profit housing corporation referred to in subsection 13 (1) of the Housing Development Act.

5. Property that would otherwise be eligible property only because of a change in classification from one class in the commercial classes to another class in the commercial classes or from one class in the industrial classes to another class in the industrial classes.

Special rule for ss. 447.65 and 447.67 of the Act for certain properties

16. Payments in lieu of taxes made under subsection 4 (3) of the Municipal Tax Assistance Act in respect of property described in paragraphs 2 and 3 of section 15 shall be deemed to be taxes for municipal and school purposes for the purposes of sections 447.65 and 447.67 of the Act.

James M. Flaherty

Minister of Finance

Dated on May 15, 2001.