Economic impact of infrastructure investments across asset categories in Ontario

This report examines the long-term quantitative economic impacts of Ontario’s infrastructure investment across a range of asset categories.

Executive Summary

Background and study objectives

The Province of Ontario is served by a large, complex portfolio of public infrastructure with an estimated replacement value of nearly $400 billion

In this context, the Ministry required a credible and quantitatively robust assessment of infrastructure investment impacts in Ontario that provides insight into the effects of historical infrastructure investment on the economic performance of the Province. To assist in this process, the Ministry retained Deloitte LLP (“Deloitte”) to lead a study (“Study”) to examine the long-term quantitative economic impacts of Ontario’s infrastructure investment across a range of asset categories. The findings from this Study presented in this report (“Report”) are intended to serve as an important input into the Ministry’s broader consideration of an investment allocation framework in support of future Provincial infrastructure investment decisions.

Scope of study and overview of approach

- Summarize Ontario infrastructure trends

- Conducting a review of data and key trends associated with historical infrastrcture investment in Ontario, including total infrastructure investiment, infrastructure investment trends by sector / asset category and additional metrics.

- Conduct summary of various liture reviews

- Preparing a literature review summary, including a review of different analytical methods for estimating the relative impack across asset categories on economic growth resulting in the identification of the prefered approach for estimating the long-term economic impact of infrastructure across assets in Ontario.

- Assess long-term exonomic impact of infrastructure investment in Ontario

- Conducting robust and reliable assessment estimating the long-term exonomic impact of infrastructure investment spending in Ontari, ncluding aggregate and sectore effects of aggregate infrastructure investment in Ontario.

- Interpretation of quantitative results, by exploring the conceptual link between investment and drivers of economic growth.

- Identify future investment allocation framework consideration

- Summarize potential applicability of findings to support investment decision making

- Identify additional parameters to be condifered in developing optimal infrastructure investment allocation.

Long-term economic impact assessment of public infrastructure investments in Ontario

Infrastructure asset categories

In this Study, economic effects are analyzed for investments across different infrastructure asset categories, allowing for the identification of which sectors have been the most economically beneficial for the Province over the long-term. These sectors include:

- Highways, Roads and Bridges

- Transit

- Education

- Health

- Waste, Water and Wastewater

- Government Administration and other infrastructure (including justice, public safety, and defence)

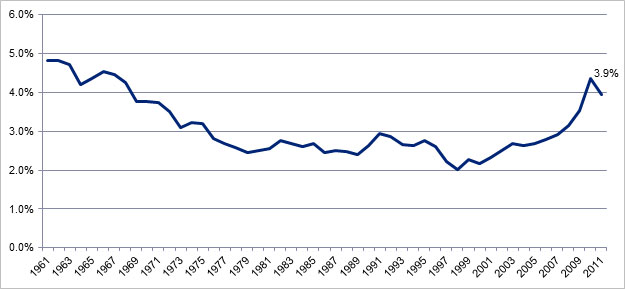

The data utilized in the Study includes annual data for the period 1976 to 2011, obtained from Statistics Canada and the Infrastructure Policy and Planning Division of MOI. The data reflect important general trends in Ontario, namely, growing infrastructure investment during the 1960s (a period outside our sample period), a subsequent slowdown in infrastructure investment during the 1970s, 1980s and 1990s, and a renewal in investment efforts since 2000. Public infrastructure investment was 4.3% of the GDP in the 1960s and declined to 2.6% during the 1980s and 1990s and has now reached 2.8% in the last decade.

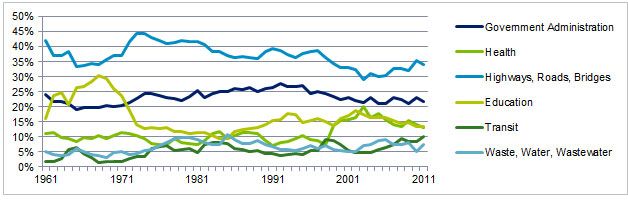

A breakdown of historical total public and private investment trends by asset category is provided in the figure below. With respect to total investment, Ontario has typically committed a relatively high portion of total investment in Highways, Roads and Bridges (34% of total investment in 2011), followed by Government Administration (22%), Education (13%), Health (13%), Transit (10%) and Waste, Water and Wastewater (8%).

Total infrastructure investment by sector, 1961-2011 (% proportion of total infrastructure investment)

Source: Ontario Ministry of Infrastructure, Infrastructure Policy & Planning Division

Notes: Based on infrastructure investment in 2007 dollars

Overview of methodology

To meet the MOI’s requirement for a robust and credible methodology to quantitatively assess the long-term economic impacts of historical infrastructure investments in Ontario by asset category, Deloitte engaged Professor Alfredo Pereira, a leading applied economist from the College of William and Mary in Williamsburg, Virginia, to utilize a tested methodology within an Ontario context. Professor Pereira has published a number of research papers in the economics literature investigating the economic impact of infrastructure investments across different infrastructure types or asset categories, including developing such analysis for the United States, Portugal and Spain. In addition to applying a methodology that is well-accepted in the literature, Pereira is one of few researchers in recent years who has looked beyond impacts of investing in infrastructure at the aggregate level and quantified the effect of infrastructure investment in specific sectors of the economy.

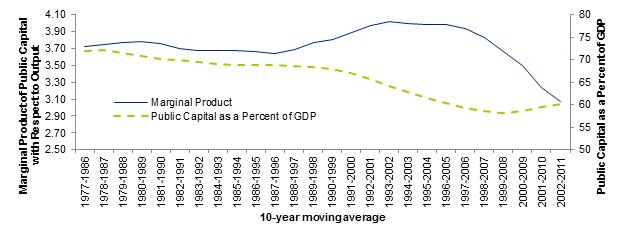

The objective of Pereira’s methodology is to understand the long-term effects of public infrastructure spending on the economy. Pereira’s approach produces an econometric determination of the long-run sensitivity of GDP to investment for each sector, identifying a numerical value which captures the dynamic effects that GDP and investment spending each have on the other. The approach employs Vector Autoregressive (VAR) modelling to analyze the impact of public infrastructure investment on economic performance in Ontario, first at the aggregate level, and then considering different asset categories or sectors. The analysis produces estimates of elasticities of GDP, employment, and private investment with respect to public infrastructure investments, and more importantly from a policy perspective, the marginal productivities of public infrastructure investment when considering the observed levels of relative infrastructure scarcity. In this context, “scarcity” refers to the value of the existing stock of an infrastructure asset as a proportion of GDP. Increases in the infrastructure stock relative to GDP indicate less “scarcity” of infrastructure that is available in an economy.

Overview of results

As noted above, the key quantitative results of the Study are expressed in the form of elasticities and marginal products. An “elasticity” is generally defined as the ratio of the percentage change in one variable (e.g., GDP) to the percentage change in another variable (e.g., infrastructure investment) and is meant to measure the responsiveness of one variable to another in a ‘unitless’ way. The long-term elasticities in this Study measure the total percentage point changes in the economic variables for a long-term accumulated percentage point change in public infrastructure investment.

In turn, the long-term accumulated marginal products measure the dollar changes in the economic variables for each dollar of accumulated change in public infrastructure investment

The table below provides estimates of the economic impact of public infrastructure investment on GDP as measured through elasticities, marginal products and rates of return at the asset category level

| - | Elasticity of GDP with respect to infrastructure investment by asset category | Marginal Product of GDP with respect to infrastructure Investment by asset category | Implied rate of return by infrastructure asset category (30 year lifespan) | Implied rate of return by infrastructure asset category (50 year lifespan) |

|---|---|---|---|---|

| Government Administration and Other | 0.001 | $0.16 | - | - |

| Health | 0.113 | $23.46 | 11.1% | 6.5% |

| Highways, Roads, Bridges | -0.038 | -$3.78 | - | - |

| Education | 0.068 | $14.17 | 9.2% | 5.4% |

| Transit | 0.068 | $29.19 | 11.9% | 7.0% |

| Waste, water and wastewater | 0.019 | $8.29 | 7.3% | 4.3% |

Source: Alfredo Marvão Pereira and Rui Manuel Pereira, Department of Economics- The College of William and Mary

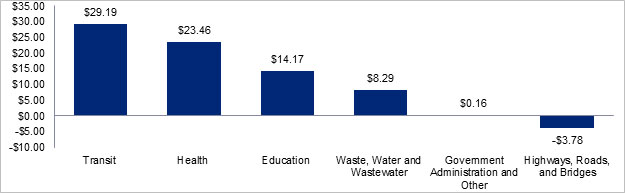

The effects of the different types of public infrastructure on output (as measured by elasticities) are positive, with the exception of Highways, Roads and Bridges, which is negative and Government Administration, which is rather small. The strongest effect on output is derived from investments in the infrastructure sectors of Health followed by Education, Transit, and Waste, Water, and Wastewater.

Marginal product figures can be considered a better measure (vis-à-vis elasticities alone) of the relative effects of different types of public infrastructure investments on output, because they reflect the relative scarcity of the different types of public investment at the margin of the sample period. The marginal products of output with respect to public infrastructure investment are computed using the ratio of GDP to the stock of capital and the ratio of the stock of capital to investment volumes over the past ten years. Infrastructure investment in Transit and Health infrastructure generate the highest marginal returns, followed by Education and Waste, Water and Wastewater. Investment in Government Administration infrastructure has a marginal product that is not statistically different from zero and investment in Highways has a negative marginal product. The interpretation of these results is discussed further in the following section.

Comparisons of results obtained in any study with the existing results in the relevant literature are always useful, although subject to important caveats around differences in data definitions and scope, methodologies used, jurisdictional context etc. For the purpose of this Study, we are well-positioned to compare the results for Ontario with the results developed in other jurisdictions by Pereira and his research team that have been published in the economics literature. Given the prior application of this methodology, we can compare the results obtained for Ontario with those developed by Pereira (2000) for the United States, the most widely cited and recognizable results.

The U.S. provides a comparison with an economy at a similar level of development and infrastructure scarcity as Ontario. Based on US data from 1956 to 1997, it is interesting to note that the directionality of sector-specific results is generally consistent. For example, for Transit, the U.S. elasticity of public infrastructure investment with respect to GDP is 0.021 (with a marginal product of $19.8) and Ontario’s corresponding value of 0.068 (with a marginal product of $29.2) are of the same order of magnitude. Transit effects are the largest of any of the asset types considered in the U.S., and are also the largest identified for Ontario. Similarly, the Highways, Roads and Bridges asset category generates the lowest elasticity and marginal products in both the U.S. and Ontario. For the U.S., a positive but low elasticity of 0.006 with a marginal product of $1.9 is estimated, while in the case of Ontario, the effect on GDP is marginally negative (elasticity of -0.038).

The comparisons above, which result in differential estimates between the U.S. and Ontario as would be expected, nevertheless are directionally consistent at the relevant comparable sector level.

Interpretation of results

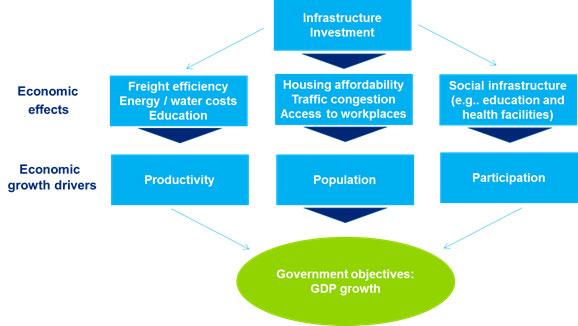

In order to supplement the long-term quantitative results above, we utilized qualitative analysis and supporting research literature findings to further understand the long-term dynamics and impacts of infrastructure investment across sectors. The long term economic effects of infrastructure investment are to be found in how the services provided by the infrastructure impact various “channels”, namely, population, productivity and participation that drive economic growth in the long term, drawing upon the link between investment types and their effect on these channels.

In the context of this framework, productivity, population and participation are defined as follows:

- population: population growth, and the demographic structure of the population determine the size of the future working age population

- participation: the size of the future working age population combined with expected participation rates will determine the number of persons employed in the economy

- productivity: growth in the number of persons employed and growth in productivity ultimately determine the rate at which the economy will grow in the future

As illustrated in the graph below, the Transit, Health and Education sectors generate the highest marginal products with respect to output (GDP) among the asset categories considered in this Study, indicating that investments in these three sectors in particular have had the most significant impact on GDP growth in Ontario over the historical period assessed.

Estimated marginal products of GDP with respect to public infrastructure investment

Source: Alfredo Marvão Pereira and Rui Manuel Pereira, Department of Economics- The College of William and Mary

The conceptual understanding of these results in terms of the expected effect of investment on the drivers of economic growth is summarized below for the highest impact categories (Transit, Health and Education) and the lowest impact category (Highways, Roads and Bridges):

- Transit: Investment in transit infrastructure (e.g., rapid transit systems) has the potential to positively impact population, participation and productivity in a number of ways. It helps in reducing traffic congestion and travel times thereby increasing time available for leisure and work activities and reducing lost productivity, in addition to increasing the reliability and safety of transportation. As well, investment can be expected to improve efficiency and accessibility to markets thereby increasing economic activity. It may also potentially serve as an economic development and site selection tool for new business development decisions. Transit infrastructure is also a particularly important form of infrastructure investment in a jurisdiction with a very high degree of urban concentration, as in the case of Ontario.

- Health: Investment in health infrastructure (e.g., hospitals) has the potential to impact population, participation and productivity by ultimately leading to improved health outcomes and its expected knock on effect on the economy. Investment in this sector would be expected to address a population’s growing healthcare needs and demand, drive efficiencies and cost savings within the healthcare system, assist in high quality job creation and potentially serve as an economic development and site selection tool in terms of encouraging businesses to locate in well-serviced areas. It should also be noted that the long term economic impact of health infrastructure investment would be expected to manifest over a potentially long period of time, as greater healthcare efficiencies or ultimately improved health outcomes resulting from improved facilities will be experienced over the course of several years after the investments in infrastructure are made.

- Education: Investment in education infrastructure (e.g., schools, colleges) and thereby the enhanced provision of educational services has the potential to positively impact population, participation and productivity by leading, in the longer term, to a more educated, competent, sophisticated, and knowledgeable and thereby more productive labor force – a human capital effect. The effects may be manifest through the greater provision of skills and training, an improved teaching environment, attracting population growth, potentially serving as an economic development and site selection tool and also facilitating the integration of modern information and learning technologies in education.

The positive elasticity and marginal product results estimated for Ontario for the Transit, Health and Education asset categories are thus consistent with the expected economic impact of investments in these sectors as described above. This is a pattern consistent with the mounting international evidence of the importance of human capital (driven by health and education sector investments) for long term economic performance. The results from this Study can be interpreted as providing high level directional guidance on prioritizing infrastructure sectors from an investment perspective based on historical performance. Thus a potential implication of these findings in terms of input into a forward-looking assessment is that continued emphasis on investment in these specific sectors may be viewed as beneficial to the long-term economic growth prospects of Ontario.

The negative results for the Highways, Roads and Bridges category warrant careful attention in ensuring they are interpreted appropriately. At a conceptual level, there are a number of potential drivers that may be expected to positively impact economic growth through impact of Highways, Roads and Bridges investment on population, participation and productivity, such as congestion reduction, improved accessibility and transportation efficiency and economic development effects. However, in considering the non-significant effect on GDP estimated in this Study in the context of conceptual economic understanding which would generally point to a positive relationship, additional factors may be at play that help to explain the direction of the results obtained in Ontario.

While it is possible that improved highway infrastructure will lead to greater private investment and output, it is also possible that improved highway provision leads to more efficient transportation services which can be accommodated with better equipment and less personnel. Additionally, Ontario is the largest exporting province in Canada, with high level of international trade with U.S. as well as interprovincial trade. This indicates the openness of the Ontario economy with strong links to other provinces and the U.S. and connectedness of its highway infrastructure with other jurisdictions. When demand for transportation services is driven by general patterns of interprovincial and international trade, as may be the case with an open economy as is Ontario, it is possible not to observe any positive output effects. The results found here for Ontario are consistent with evidence found for U.S. states which border the province found in Pereira (2012). In this context, regional spillovers are a particularly important consideration. Additionally, the level of infrastructure development may be a factor to consider as well. Given Ontario’s well-developed state of highway infrastructure, the results may indicate the presence of diminishing returns as the highway network has expanded over time, suggesting that continued maintenance and rehabilitation may have important impacts relative to further expansion in light of the maturity of the highway asset base in Ontario.

To be clear, the negative elasticity and marginal product for the sector does not imply that Ontario should be divesting its highways, but rather the opposite. It likely means that the road network in Ontario is sufficient at meeting transportation needs at the Province-wide level (if not necessarily regional) without significant incremental investments. The important point to note from Pereira (2012) is that ensuring that the network is well-integrated with Ontario’s neighbours is of utmost importance, and that benefits may accrue from expansion in other jurisdictions that may contribute to the economic impact of investments in Ontario.

Future infrastructure investment allocation

The Province has demonstrated its continued focus on investing in public infrastructure, particularly in areas that support economic growth and competitiveness. As the Province is expected to continue to commit significant funds to improve Ontario’s infrastructure beyond the current planning horizon, the need for a systematic investment allocation framework has been identified to assist in the investment decision making across infrastructure sectors. Clearly a comprehensive investment allocation framework requires the consideration of various factors that may include, for example, the stock and quality of current infrastructure assets, an assessment of future demand, needs and priorities, project level benefit-cost analysis etc. in addition to an assessment of historical investment performance.

As noted, this Study has developed a set of important findings using a tested methodology and rigorous quantitative analysis that may feed into the MOI’s investment allocation framework to support decision making. The findings provide an understanding of the economic impact of investments across infrastructure sectors in Ontario, and provide a historical perspective on the most productive investments across infrastructure sectors.

Specifically, the findings presented in the Study establish that public infrastructure investment in aggregate, as well as in most of the sectors considered have a positive impact on private investment, employment and output.

As the results from this Study have shown, investments in transit, health and educational infrastructure have had the most significant impact on GDP growth in Ontario over the period assessed. As noted, the results may be applied to provide high level directional guidance on prioritizing infrastructure sectors from an investment perspective based on historical performance, thus underscoring the continued emphasis on these specific sectors in future infrastructure investment plans as potentially beneficial to the long-term economic growth prospects of Ontario.

As a next step, further analysis of effects of infrastructure investment at the industry and regional level in Ontario as well as the interaction between investments in Ontario and the economic performance of neighbouring provinces and vice versa, may be pursued. This may be particularly important to achieve a more complete understanding of the effects of infrastructure investments, particularly for the highway infrastructure category. Further work may also be considered in analyzing sector-specific spending at a more disaggregated level that may consider breakdown between new infrastructure capital, maintenance/repair expenditures and capital refurbishment for example. This analysis would assist in understanding the potential economic impact of investments at a more detailed level of infrastructure spending, and would potentially further support and inform investment decision making across sectors at a more granular level based on the nature of investment.

Introduction

Background and study objectives

The Province of Ontario is served by a large, complex portfolio of public infrastructure with an estimated replacement value of nearly $400 billion

The Ontario Ministry of Infrastructure (the “Ministry” or “ MOI”) has conducted substantive analysis in understanding the impacts of infrastructure investment in Ontario. However, to date, there has been limited research and analysis examining the long-term economic impacts of investments across specific infrastructure sectors or asset categories in Ontario.

In this context, the Ministry requires a credible and quantitatively robust assessment of infrastructure investment impacts in Ontario across a range of asset categories that provides insight into the effects of historical infrastructure investment on the economic performance of the Province. It is expected that such analysis will assist the Ministry in its broader effort to develop an investment allocation framework across infrastructure sectors going forward. To assist in this process, the Ministry retained Deloitte LLP (“Deloitte”) to lead a study (“Study”) to examine the long-term quantitative economic impacts of Ontario’s infrastructure investment across a range of asset categories.

The key elements of the scope of this Study are illustrated in the figure below and described in more detail below.

Scope of study and overview of approach

The specific phases of the approach and methodology include the following:

- Conducting a review of data and key trends associated with historical infrastructure investment in Ontario and compiling a review of recent external analysis of the impacts of infrastructure investment in Ontario.

- Reviewing key strands in the research literature focused on assessing different analytical methods for estimating the economic impact of infrastructure investments, with the objective of identifying a preferred approach for estimating the long-term economic impact of infrastructure across asset categories in Ontario.

- Applying the selected methodology to Ontario infrastructure investment and economic data to develop reliable quantitative estimates of the long-term economic impact of infrastructure investment in Ontario at two levels:

- Effects of aggregate infrastructure investment in Ontario: The economic effects are measured in terms of elasticities and marginal products of infrastructure investment, whereby the long term accumulated effects of $1 of public infrastructure investment on output, employment and private investment are assessed.

- Effects of different types of infrastructure investment in Ontario: The economic effects are analyzed for different infrastructure investment asset categories thus allowing for the identification of which sectors or asset categories have been the most economically beneficial for the Province over the long-term amongst the following:

- Highways, Roads and Bridges

- Transit

- Education

- Health

- Waste, Water and Wastewater

- Government Administration and other infrastructure (including justice, public safety, and defence)

- Additionally, the quantitative results are augmented with a qualitative interpretation of the economic effects by exploring the conceptual link between investment across each identified infrastructure sector and resulting drivers of economic growth through impacts on productivity, population and participation growth.

- Summarizing the potential applicability of the Study findings and outlining key considerations in the development of future infrastructure investment allocation plans and discussing potential next steps.

Collectively, the analysis developed in this Study is intended to serve as an important input that feeds into the Ministry’s broader development of an investment allocation framework in support of future Provincial infrastructure investment decisions. It should be noted that a comprehensive allocation framework requires the consideration of many factors beyond historical investment impact analysis alone, including the stock and quality of current infrastructure assets, an assessment of future demand, needs and priorities, project level benefit-cost analysis, among other factors.

Structure of report

The balance of this Report presents the analysis of the various elements of the Study, organized as per the following sections:

- Infrastructure investment trends in Ontario (section 2) provides an overview of total and sector specific infrastructure investment trends and additional key metrics in Ontario

- Review of approaches to assess economic impact of infrastructure investments (section 3) provides a summary of existing research literature assessing the economic impact of infrastructure investments, including various approaches, methodologies, examples and results

- Long-term economic impact assessment of infrastructure investments in Ontario (section 4) describes the methodological approach and results of the quantitative and qualitative assessment of long term economic impacts of Ontario infrastructure investment across sectors

- Considerations for development of future infrastructure investment allocation plans (section 5) provides a summary of the potential application of the findings of this Study and a high level overview of additional parameters to be considered in developing infrastructure investment allocation plans going forward

Infrastructure investment trends in Ontario

Infrastructure investment overview

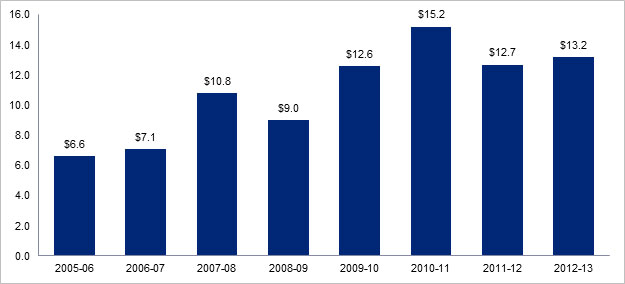

Figure 1: Total provincial infrastructure investment in Ontario, 2000-2013 ($ billions)

Source: Ontario Ministry of Infrastructure, Infrastructure Policy & Planning Division

Notes:

- Includes third-party contributions to capital investment (in consolidated schools, colleges, hospitals and provincial agencies), and federal government transfers for capital investments.

- Other includes investments in the water/environment sector, justice facilities, and municipal and local infrastructure.

- 2012-13 based on interim outlook forecast.

The following chart shows total investment infrastructure trends from 1961 to 2011 period, including public and private sector investment in publicly owned government administration, health, highways, roads and bridges, post-secondary education, schools, transit, waste, water and wastewater, and other infrastructure investment. In total, Ontario has invested some $515.5 billion in infrastructure from 1961 to 2011.

Figure 2: Total infrastructure investment in Ontario, 1961-2011 ($ billions)

Sources: Ontario Ministry of Infrastructure, Statistics Canada

Notes: These data are modeled, based on data from Statistics Canada that are survey-based and self-reported. Therefore, the responses are given from the perspective of the asset owner and may not correspond to Provincially-reported investments. Further, the definition of public infrastructure may not correspond to individual Provinces’ definitions.

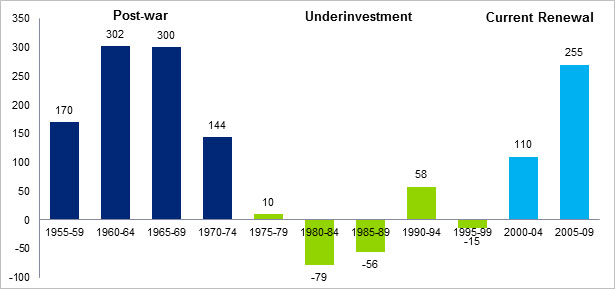

Ontario’s mix of public infrastructure reflects public sector decisions dating back more than 100 years. The current portfolio has been particularly shaped by three distinct eras of investment, starting with the Second World War

1945-1970s: Post-war development period

Between the end of the Second World War in 1945 and the early 1970s, Ontario experienced rapid growth in its economy and population. Infrastructure investment responded to urgent new needs, triggered especially by the baby boom, and earlier shortfalls caused by the war and the Great Depression.

Public policy decisions during this period led to the development of new infrastructure, such as social housing, and also shifted existing infrastructure to public ownership. For example, the introduction of universal health care in the 1960s ultimately resulted in provincial responsibility for hospitals and other health care infrastructure.

This nearly three-decade-long infrastructure boom essentially created the core of Ontario’s current public infrastructure, including many elementary and secondary schools still in use, eleven new universities and the community college system, the two main lines of the Toronto subway system, key portions of the 400-series highway network, and health care infrastructure.

1970s-1990s: Underinvestment period

In the early 1970s, investments in public infrastructure began to decline sharply and remained low for more than two decades, failing to keep pace with either growth in population or gross domestic product. This was in part because government spending had shifted towards other priorities, and also a result of economic conditions. For example, the oil shocks of the 1970s and inflationary pressures of the 1980s both resulted in deferred investments in infrastructure.

These decades of neglect significantly eroded the quality of public infrastructure and its capacity to meet economic and social needs. By the end of the last century, Ontario had accumulated a significant infrastructure deficit, which was threatening its economic competitiveness and standard of living.

2000 onward: Current renewal period

In the past seven years in particular, investments in infrastructure have reached record levels not seen since the 1950s and 1960s. In 2005, the government released ReNew Ontario, a long-term infrastructure plan designed to invest $30 billion over five years. ReNew Ontario also aimed to introduce long-term predictability and sustainability to public infrastructure planning. ReNew Ontario was completed in 2008–09, and resulted in major investments in key infrastructure sectors, including transportation, health and education.

The government has also changed the way infrastructure projects are planned, financed, and managed. Starting in 2004, it took steps to standardize and improve procurement activity, including creating Infrastructure Ontario, a crown corporation guided by provincial capital plans, to build on the success of ReNew Ontario and the Province’s Building a Better Tomorrow framework.

Ontario has also built partnerships to address infrastructure challenges. In response to the global economic downturn, the Province collaborated with the federal government, Ontario municipalities and other stakeholders in 2009 to undertake major stimulus spending, through which nearly 11,000 projects were approved.

The figure below highlights the significant differences across these three eras as measured through the average annual change in per capita net public infrastructure stock over time.

Figure 3: Average annual change in per capita net Ontario public infrastructure stock, 1955-2009 ($ millions)

Source: Ontario Ministry of Infrastructure, Infrastructure Policy & Planning Division

Key metrics and trends

The following section presents various metrics and trends of Ontario’s total infrastructure investment, including infrastructure investment relative to GDP, infrastructure investment per capita, net public infrastructure stock per capita, year-end gross infrastructure stock and investment trends by sector.

Infrastructure investment relative to GDP

Economic history has shown that changes in infrastructure systems have often underpinned phases of significant economic growth

Figure 4: Total infrastructure investment in Ontario as a % of total GDP, 1961-2011

Sources: Ontario Ministry of Infrastructure, Statistics Canada

Notes: These data are modeled, based on data from Statistics Canada that are survey-based and self-reported. Therefore, the responses are given from the perspective of the asset owner and may not correspond to Provincially-reported investments. Further, the definition of public infrastructure may not correspond to individual Provinces’ definitions.

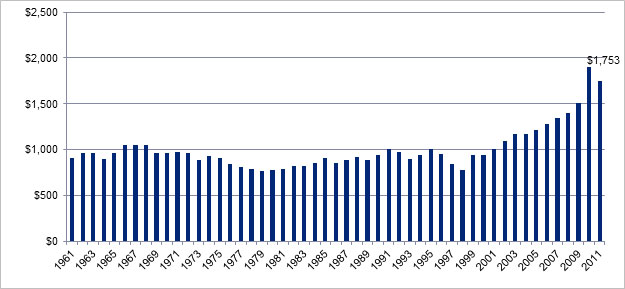

Infrastructure investment per capita

Infrastructure investment in Ontario has fluctuated near $1,000 per capita from the 1960s until 2001, after which infrastructure investment per capita began to rise, reaching $1,753 per capita in 2011. This represents the significant expansion in infrastructure spending over the last decade as discussed earlier.

Figure 5: Total infrastructure investment in Ontario per capita, 1961-2011

Sources: Ontario Ministry of Infrastructure, Statistics Canada

Notes: These data are modeled, based on data from Statistics Canada that are survey-based and self-reported. Therefore, the responses are given from the perspective of the asset owner and may not correspond to Provincially-reported investments. Further, the definition of public infrastructure may not correspond to individual Provinces’ definitions.

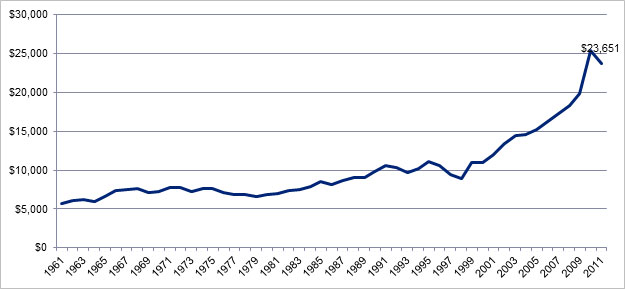

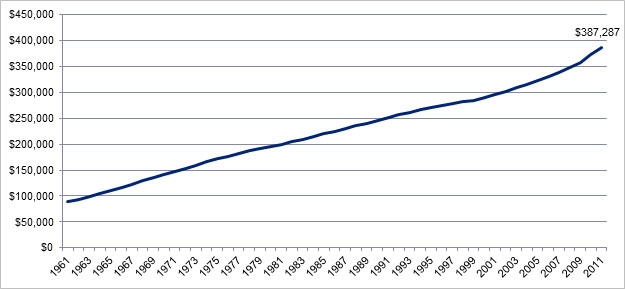

Year-end gross infrastructure stock

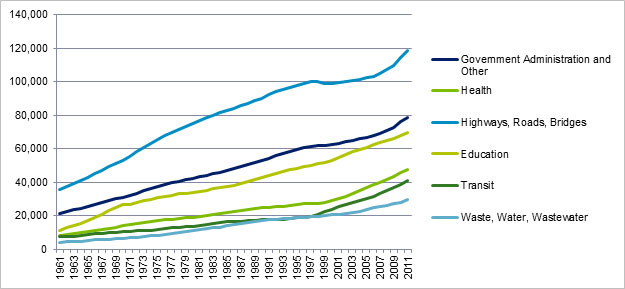

Ontario’s year-end gross stock of infrastructure has been on the continuous rise from 1961 to 2011, totalling $387.3 billion by 2011.

Figure 6: Total infrastructure investment in Ontario year-end gross stock, 1961-2011($ millions)

Sources: Ontario Ministry of Infrastructure, Statistics Canada

Notes: These data are modeled, based on data from Statistics Canada that are survey-based and self-reported. Therefore, the responses are given from the perspective of the asset owner and may not correspond to Provincially-reported investments. Further, the definition of public infrastructure may not correspond to individual Provinces’ definitions.

Investment trends by sector

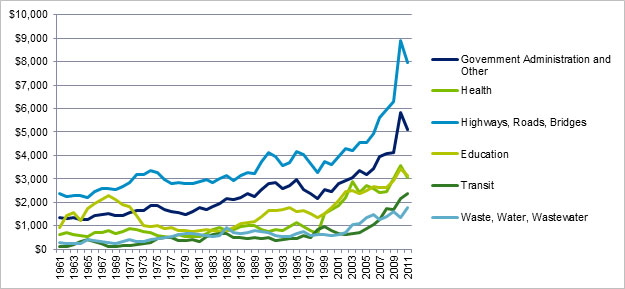

Generally, infrastructure investment across specific sectors has followed a similar pattern, steadily growing from 1961 to the late 1990s, followed by significant increase across the 2000s. After peaking in 2010, total investment in 2011 in Ontario’s Highways, Roads and Bridges totaled nearly $8.0 billion, followed by $5.1 billion in Government Administration, $3.1 billion in Education, $3.1 billion in Health, $2.4 billion in Transit, and $1.8 billion in Waste, Water and Wastewater

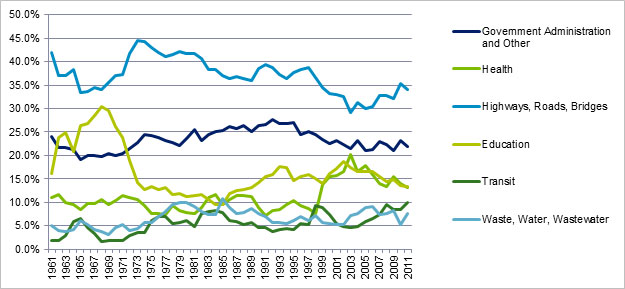

Infrastructure investment in Highways, Roads and Bridges reached its highest share of total investment in infrastructure during the 1970s, reaching nearly 41.3% of the total. Since that time, the importance of investment in highways, roads and bridges has been steadily declining in a manner consistent with the fact that Ontario currently possesses a well-developed road infrastructure network. In contrast, after a substantial decline during the 1970s, investment in Education infrastructure has been growing in importance from a minimum of 11.3% of total investment during the 1980s to 16.3% of total public investment in infrastructure between 2000 and 2009. The remaining categories of infrastructure investment present no clear trend, although Health infrastructure has reached its largest share of the total since 2000, accounting for 16% of total infrastructure investment.

Figure 7: Total infrastructure investment in Ontario by sector / asset, 1961-2011 ($ millions)

Sources: Ontario Ministry of Infrastructure, Statistics Canada

Notes: These data are modeled, based on data from Statistics Canada that are survey-based and self-reported. Therefore, the responses are given from the perspective of the asset owner and may not correspond to Provincially-reported investments. Further, the definition of public infrastructure may not correspond to individual Provinces’ definitions.

With respect to historical investment allocation across infrastructure sectors, Ontario has typically invested a relatively high portion of total investment in highways, roads and bridges (34% of total investment in 2011), followed by government administration (22%), education (13%), health (13%), transit (10%) and waste, water and wastewater (8%).

Figure 8: Total infrastructure investment in Ontario by sector / asset, 1961-2011 (% proportion of total infrastructure investment)

Sources: Ontario Ministry of Infrastructure, Statistics Canada

Notes: These data are modeled, based on data from Statistics Canada that are survey-based and self-reported. Therefore, the responses are given from the perspective of the asset owner and may not correspond to Provincially-reported investments. Further, the definition of public infrastructure may not correspond to individual Provinces’ definitions.

Figure 9: Total Ontario infrastructure year-end gross stock by sector / asset, 1961-2011($ millions)

Sources: Ontario Ministry of Infrastructure, Statistics Canada

Notes: These data are modeled, based on data from Statistics Canada that are survey-based and self-reported. Therefore, the responses are given from the perspective of the asset owner and may not correspond to Provincially-reported investments. Further, the definition of public infrastructure may not correspond to individual Provinces’ definitions.

Recent economic impact studies of Ontario’s infrastructure investments

In light of Ontario’s significant increase in infrastructure investment, there has been a range of research and analysis conducted on the economic impact of these investments in recent years. The following section highlights the approaches and findings of four recent Ontario-specific studies which explore the economic impact of provincial infrastructure investments.

Conference Board of Canada, “The Economic Impact of Public Infrastructure in Ontario” (2010)

Background

The Conference Board of Canada (the “Conference Board”) started working with Infrastructure Ontario to assess the economic contribution of Ontario’s infrastructure investment program, ReNew Ontario. In this study, quantitative methods identified through a literature review are used to assess the impact of infrastructure on Ontario’s labour productivity, and an economic impact analysis is conducted to examine the impact that ReNew Ontario is having on employment and output associated with the construction phase of the program.

Approach and methodology

Total factor productivity

The Conference Board uses a growth accounting approach to examine the extent to which investments in public infrastructure have helped drive private sector productivity, output, and competitiveness in Ontario. The contribution is quantified by splitting public capital out from total factor productivity (“TFP”).

TFP is essentially a driver of economic prosperity. According to this study, positive TFP growth contributes, one for one, to overall GDP growth and labour productivity and remains a key long-term driver of competitiveness and real per capita income. Public infrastructure also contributes to output and labour productivity by adding to the stock of capital per worker. Thus, by using the production function framework and accounting for public infrastructure separately from the estimate of TFP, it is possible to account for the contribution of public infrastructure to labour productivity.

Aggregate infrastructure investment shock

As a second set of analyses, aggregate infrastructure investment data were used to “shock” the Conference Board’s provincial economic model of Ontario, and identify the effect the infrastructure spending has had on Ontario’s economy. The model simulations were performed for the years 2006 to 2010. The shock to the Conference Board’s Ontario economic model was to real public construction investment and real public M&E capital outlays. The government construction and M&E deflators from Statistics Canada’s Provincial Economics Account were used to deflate the public investment data.

Results

Total factor productivity

The Conference Board finds that public capital has been a strong contributor to private sector performance in Ontario

| - | 1980–89 | 1990–99 | 2000–08 | 1980–08 |

|---|---|---|---|---|

| Labour productivity | 1.39 | 2.03 | 0.93 | 1.47 |

| Business capital contribution | 0.63 | 0.61 | -0.01 | 0.43 |

| Labour composition contribution |

0.00 | -0.04 | -0.13 | -0.05 |

| Total factor productivity (TFP) | 0.76 | 1.46 | 1.07 | 1.10 |

| Public capital contribution | 0.16 | 0.16 | 0.23 | 0.18 |

| TFP net of public capital | 0.60 | 1.30 | 0.84 | 0.92 |

Source: The Conference Board of Canada, 2010

The public capital contribution to labour productivity has been relatively constant over the past 30 years, averaging 0.2% per year. However public capital had a larger impact on labour productivity in the 2000s than in other decades: it accounted for 24% of labour productivity growth in the 2000s, compared with only 8% in the 1990s, when budget balancing resulted in fewer funds for infrastructure. While public infrastructure programs such as Move Ontario and ReNew Ontario contributed to this larger share, so did the significant decline in the contributions from business capital and labour intensity.

Aggregate infrastructure investment shock

In real terms, the cumulative $53.6 billion in public infrastructure spending generates a total of $59.3 billion in real GDP over 2006 to 2010. In other words, each dollar of real public infrastructure spending generates $1.11 in real GDP. Over the same period, a total of 822,335 person-years of employment are created in the province, with annual job creation expected to peak in 2010 with over 223,000 jobs supported, when the unemployment rate edges down 1.3 percentage points.

| Investment | 2006 | 2007 | 2008 | 2009 | 2010 | Total |

|---|---|---|---|---|---|---|

| Total investment generated ($M) | 6,753 | 9,451 | 8,476 | 13,931 | 17,934 | 56,545 |

| Total investment generated (2002 $M) | 6,644 | 9,164 | 8,011 | 13,061 | 16,677 | 53,557 |

| Effects | 2006 | 2007 | 2008 | 2009 | 2010 | Total |

|---|---|---|---|---|---|---|

| Real GDP at market prices (2002 $M) | 10,328 | 11,619 | 8,375 | 13,150 | 15,819 | 59,292 |

| Personal income ($M) | 7,798 | 8,223 | 7,364 | 11,342 | 13,975 | 48,701 |

| Labour force | 86,682 | 98,077 | 69,724 | 113,917 | 138,849 | 507,248 |

| Employment (person-years of employment) | 141,855 | 160,487 | 113,827 | 182,897 | 223,268 | 822,335 |

| Unemployment rate (difference in percentage points) | -0.86 | -0.96 | -0.67 | -1.07 | -1.29 | - |

| Retail sales ($M) | 2,268 | 4,636 | 5,946 | 7,418 | 9,052 | 29,320 |

| Housing starts | 3,863 | 9,289 | 2,546 | 8,935 | 9,397 | 34,031 |

| Total indirect taxes ($M) | 423 | 784 | 1,062 | 926 | 1,084 | 4,280 |

| Federal personal income tax collections ($M) | 793 | 901 | 811 | 1,248 | 1,538 | 5,291 |

| Provincial personal income tax collections ($M) | 472 | 485 | 426 | 656 | 809 | 2,847 |

| Corporate profits ($M) | 1,055 | 2,566 | 1,547 | 2,485 | 2,633 | 10,286 |

Source: The Conference Board of Canada, 2010

Capital investment spending from the ReNew Ontario program is also estimated to lift personal income by a cumulative $48.7 billion from 2006 to 2010 and add $10.3 billion to corporate profits. Personal income and indirect tax collections are lifted by a cumulative $12.4 billion: 43% accrued to federal coffers, 23% to the province, and the remainder due to a lift in indirect taxes collected by both levels of government.

On a calendar-year basis, the level of infrastructure investment rises by $5 billion in 2009 and a further $3.6 billion in 2010. This boost to infrastructure spending helps lift real GDP growth by 0.9 percentage points in 2009 and a further 0.4 percentage points in 2010. Additionally, if not for the stimulative impact of the increase in public investment, Ontario’s economy would have lost an additional 70,000 jobs in 2009.

Conference Board of Canada, “The Economic Impact of Ontario’s Investment Program” (2013)

Approach and methodology

This paper directly follows the previous study, providing updates to assess the contribution of Ontario’s infrastructure investment program to the province’s economy. As in the original 2010 study, a total factor productivity measure is utilized, and aggregate infrastructure investment data was used to “shock” the Conference Board’s provincial economic model of Ontario. The model simulations were performed over the 2006 to 2014 period.

Results

The range of increases in real productivity capacity lies between 1.1% and 2.6% in 2012, with the range increasing to 1.2% to 3.0% in 2014. At a minimum, the average Ontarian is earning $536 more per year today because of investments in infrastructure that occurred from 2006 to 2012. If investments progress as planned through to 2014, the minimum benefit grows to $620 per person in 2014 (in constant 2012 dollars).

Cumulative infrastructure spending will total an estimated $96.7 billion, in current dollars, from 2006 to 2014. In real 2002 dollars, the cumulative value of the past and planned investment will be an estimated $89.7 billion, with $39.9 billion toward structures and $49.8 billion toward machinery and equipment

For every $100 million (inflation-adjusted) invested in public infrastructure, real GDP is boosted by $114 million and roughly 1,670 person-years of employment are supported. In other words, for each $100 million of public infrastructure investment, about 1,670 jobs will be created for one year.

RiskAnalytica, “Public Infrastructure Investment in Ontario” (2011)

Background

The Residential and Civil Construction Alliance of Ontario (“RCCAO”) commissioned this study developed by RiskAnalytica, which combines a look at the positive impacts infrastructure investment has on GDP and the economy as well as a look at the potential negative impacts that may result from insufficient infrastructure spending

Approach and methodology

To address this analysis, RiskAnalytica first established a demographic model which considers four primary processes: birth, death, migration, and aging. Historically observed trends, such as decreasing mortality rates, are also preserved in the model. The second key component is the economic model, which is integrated with the demographic component through detailed modelling of the labour force. The basis of the economic production model is a Cobb-Douglas function which relates the total economic production to the labour capital, private capital and public capital stocks. The elasticities of production, used in this study are sourced from Macdonald (2008)

Results

This study finds Ontario’s 10-year Building Together infrastructure plan to be a step toward increasing the economic potential of the province. However, there is still additional room for further infrastructure investment from the current levels of 3% of provincial GDP to up to 5% of provincial GDP before the marginal returns disappear.

In parallel with increasing the level of overall infrastructure investment, it is recommended that the allocation to maintenance of existing infrastructure should be increased significantly, by up to 22% of total infrastructure investment. Ontario has historically spent 12% of total infrastructure investment on maintenance, which is well below the Canadian average. Relative to the recent trend in infrastructure investment, the anticipated increase in infrastructure investment and maintenance is estimated to:

- increase after-tax wages by almost 60%, with those entering the work force today having the equivalent of more than $400,000 real wages earned by age 65

- increase net profits after tax by almost 30%, equivalent to a 0.7% annual increase

- increase employment by over 12 million person-years

- result in an additional $7 trillion in cumulative government revenue while costing only $1.5 trillion (over the 50 years)

Haider et al., “Investing in Ontario’s Infrastructure for Economic Growth and Prosperity” (2013)

Background

The RCCAO commissioned another study by Haider, Crowley and DiFrancesco, to explore the potential benefits, costs, and risks associated with investing in public infrastructure to address the adverse economic impacts of recession

- Any investment in critical infrastructure will add to the productive capacity of the economic engine. Thus, when the demand for goods and services starts to increase, the newly added capacity, brought about in part by investments in infrastructure, will sustain and promote continued economic growth.

- Infrastructure development during recessions creates job opportunities at a time when lack of investment and/or expansion by the private sector results in either no new job creation or worse, and, more likely in the emerging context, job losses.

Approach and methodology

In order to address the above areas, this study simulates the impact of infrastructure investments in Ontario using an input-output (IO) model to determine the multiplier effects of infrastructure investments in the socio-economic spheres of Ontario, economy based on a 2008 industry structure.

Results

Using an input-output model of the Ontario economy based on a 2008 industry structure, the simulation exercise estimated the economic impact of a $12 billion public sector investment in non-residential building and engineering construction in Ontario. This infrastructure investment is estimated to have a $38.4-billion impact on the province’s economy. The $12 billion investment would create an estimated 203,000 jobs (person-years of employment) in the provincial economy, generate an estimated $10 billion in employment income and increase the provincial GDP by an estimated $18.5 billion. This investment would also generate an estimated $668.7 million in corporate taxes and $161.2 million in personal income taxes.

These benefits are in addition to the longer term direct benefits of infrastructure investments that would result from the use of new or rehabilitated infrastructure. For instance, a $12 billion investment in transportation infrastructure could result in a significant improvement in accessibility and mobility in the region, and related improvements in labour and business productivity. The monetized impacts of infrastructure investments, however, include more than the positive impacts on accessibility and productivity.

Summary

It is noted that while each study discussed above has made a significant positive contribution to developing a better understanding of the economic effects of infrastructure investments in Ontario, the research conducted to date has not provided a comprehensive assessment of the economic impact of historical investments over a long term horizon nor at the asset category or infrastructure sector level that is the focus of this Study.

Review of approaches to assess economic impact of infrastructure investments

Overview

The subject of public infrastructure and its many implications has prompted the development of an extensive, growing collection of economic research literature in this field. The emerging consensus in many such studies is that public infrastructure contributes to economic growth, and this finding appears stronger in more recent literature. However, there exists relatively limited research and analysis examining the economic impacts of investments across different infrastructure sectors or asset categories in the literature.

Summary of key approaches and methodologies

The following section explores existing research assessing the economic impact of investments in public infrastructure, including various approaches and methodologies utilized and the nature and type of results of several research studies found in the literature. This review represents a summary of various other recent literature reviews and related commentary, as conducted in the following studies:

- Infrastructure Analytics Group - Ontario Ministry of Infrastructure ( MOI), “Optimal Investment in Public Infrastructure in Ontario” (2012)

- The College of William and Mary – Thomas Jefferson Program in Public Policy, “The Economic Impact and Financing of Infrastructure Spending” (2012)

- Residential and Civil Construction Alliance of Ontario – Haider, Crowley and DiFrancesco, “Investing in Ontario’s Infrastructure for Economic Growth and Prosperity” (2013)

Single‐equation model studiesfootnote 13

The standard single‐equation model is an expansion of the typical aggregate production function of private capital and employment, to include public capital and interpret the coefficient as an output elasticity of public capital

Application of single‐equation models include work completed by Aschauer (1989), Munnell (1990), Evans and Karra (1994), Wylie (1996), Nourzad (1998), Paul, Sahni and Biswal (2004), Macdonald (2008), Brox (2008) and Gu and MacDonald (2009)

Some of the key results of these studies include the following:

- Output elasticity of public capital is estimated to be in the range of 0.15 to 0.56 (i.e., $100 spent on public capital increases output by $15‐$56) - Aschauer (1989), Wylie (1996), Munnell (1990)

- Public capital productivity exceeds that of private capital - Aschauer (1989), Wylie (1996)

- Public capital generates a rate of return in the range of approximately 5% to 29% - Paul, Sahni and Biswal (2004), Macdonald (2008), Brox (2008)

As noted in the MOI study cited above, single‐equation models are widely used in public infrastructure studies due to their simplicity, reduced data requirements, and straightforward interpretation. However, their estimates are sometimes found to be on the high side and biased. Their static nature does not account for simultaneity between variables which yields estimates that are unclear about the causality between output and capital. Some studies avoid the problem by estimating public capital sector by sector, assuming that firms do not “cause” public infrastructure.

In spite of such criticism, single‐equation studies tend to demonstrate the positive role of public capital and provide key policy information: the marginal effect of increasing public infrastructure when everything else is held constant. However, other approaches such as theory‐based Endogenous Growth models and Vector Autoregressive (VAR) model are considered to address some of the issues noted above.

Endogenous growth modelsfootnote 15

In growth theory, certain variables are interconnected with economic growth, including savings rates, the level of investment, and population growth. This approach can be used to investigate how much government should spend on public infrastructure to maximize GDP per capita based on the implication that one can choose a level of public capital to obtain the most cost‐effective and achievable total effects (direct and indirect) on output. The underlying idea is based on the nonlinear relationship between public capital and economic growth – which implies a rationality of optimization – where the output elasticity is highest at the growth‐maximizing level of public capital.

Conceptually, the policy rule in growth models implies an optimally stationary equilibrium where the efficient share of public investment can be expressed as a fraction of total output (Barro, 1990). Here, capital, labour and other drivers of economic growth are considered internal to the economic system. The result is that an increase in savings rates in public capital will increase the steady‐state growth rate (permanent income per capita), with elasticity approximately equal to the elasticity of public capital in the aggregate production function.

Application of endogenous growth models include work completed by Barro (1990), Easterly and Rebelo (1993), Devarajan et al. (1996), Aschauer (1998), Sartre and Soares (2003), Bond et al. (2004), Gosh and Roy (2004), Irmen and Kuehnel (2008), RCCAO (2010), and Fosu, et. al. (2011).

Some of the key results of these studies include the following:

- Public capital investment is a necessary condition for growth to reach steady state - Irmen and Kuehnel (2008), and an increase in investment as a share of GDP predicts a higher growth rate of output per worker, both temporarily, and in the steady state - Bond et al. (2004)

- Suggested public investment to Gross Domestic Product ratios of 5% up to 13% - Barro (1990), RiskAnalytica (2010), Fosu, et. al. (2011)

- The growth‐maximizing ratio of public on capital stock yields elasticity of 61% that he called optimal ratio of public to private capital

footnote 16 - Aschauer (1998) - Sartre and Soares (2003) observed that the optimal share of public investment should equal the government capital elasticity of output

An endogenous growth framework appears to be a comprehensive method for analyzing the economy‐wide impacts of public infrastructure. Traditionally, growth theory assumes a balanced government budget, meaning that expenditures on public infrastructure are paid with tax revenues. However, few studies have examined the cases of deficit‐financed government capital spending, and those which did found that public debt crowds out public investment (i.e. Heinemann (2002); Gong et al. (2001)).

Input-output models

There are multiple sets of input-output (IO) multipliers available for use in analyses of the short-run impact of specific spending. The most popular measures provide local or county-level detail, and allow for large multi-sector analyses of geographic and regional impacts. These multipliers are used primarily in local-focused studies, as seen in Krop et al. (2008), Weinstein and Clower (2007), and Wubneh (2008).

The academic literature on the use of input-output analysis to determine short-run impacts notes some points of caution. For example, Zaman et al. (2010) discusses the time stability of input-output findings, and confirms that technical input-output coefficients are valid and consistent in both the short- and medium-run, but not to exceed roughly five years’ time.

Cohen et al. (2012) contend that because input-output models are typically calculated in a closed model with no feedback from price effects and the financial sector, their estimates are biased upward in terms of describing the ultimate economic effect of infrastructure spending. This is a major criticism of input-output models, and partially the reason why such findings can describe only the temporary impact of spending rather than the long-run permanent effects. Without taking into account greater macroeconomic conditions and dynamic relationships between economic output and public investment whereby changes in each variable are both caused by and the causing variation in the other, the consistency of input-output findings should be taken with significant caution

In light of these criticisms, it is apparent that input-output models cannot determine the permanent long-run effects of public infrastructure investment. However, these models are sometimes considered valuable to policymakers as a first step toward understanding these effects. The shortcomings of input-output models in describing lasting and robust effects are best overcome by the long-run vector autoregression (VAR) approach discussed next.

Vector autoregressive (VAR) modelsfootnote 20

A VAR model is considered to be sufficiently able to account for the multiple feedback loops involved in public infrastructure spending, output, and GDP. The VAR approach assumes the relationships between variables are not based on economic theory but on their relational specificities and variables can be ordered in an ad hoc manner. In the VAR approach the modeller is required to identify the variables that are believed to be interacting in the economy and select a number of lags significant enough to capture the effects that the variables have on each other. Given that VAR does not depend on a fully specified structural model, it is suitable for examining the impulse responses of public capital in the economy without any preconceptions.

VAR impulse‐response functions reveal the long‐run effects of shocks to the different variables in the system, provided they are stationary or co‐integrated. Since the VAR model specifies the correlations between realizations of the variables, it is natural and considered easy to use for forecasting purposes, with the knowledge of current and past values of the variables required. This is in contrast to other common econometric forecasting scenarios, where current values of other variables are included on the right-hand side of equations, meaning that before a one-period ahead forecast can be made, it is necessary to have the one-period ahead estimates for the other variables.

Application of VAR models include work completed by Erenburg and Wohar (1995), Otto and Voss (1996), Voss (2000), Mittnik and Neumann (2001), Pereira and Roca‐Sagales (2001), and Kamps (2004).

Some of the key results of these studies include the following:

- Mixed findings in terms of evidence of the presence of crowding-in or feedback effects between public and private investment - Erenburg and Wohar (1995), Voss (2000), Pereira and Roca‐Sagales (2001)

- Positive long‐run elasticities or output effect of public capital, typically smaller than those reported in the production function approach - Otto and Voss (1996), Mittnik and Neumann (2001), Pereira and Roca‐Sagales (2001), Kamps (2004)

As noted in Cohen et al (2012), the key advantage of the VAR approach is that the time-series method allows for the possibility of dynamic feedback effects (i.e., back and forth effects between public capital and private output). It does not impose an a priori restriction on the dynamic relationship, meaning it accounts for observed feedback in its estimates of the elasticity of GDP to public capital.

Summary

The subject of public infrastructure and its many implications has prompted the development of an extensive, growing collection of literature. Based on the literature reviewed above, it is evident that infrastructure investments are strongly linked to economic activity and growth. The primary methodologies observed in these studies include:

- Single‐equation production function models

- Endogenous growth models

- Input-Output models

- Vector Autoregressive (VAR) models

There are a number of challenges associated with each of these methods. For example, single‐equation models are found to be associated with high and biased estimates and their static nature does not account for simultaneity between variables, thus yielding estimates that are unclear about the causality between output and capital. Various authors find that input-output analysis is valid for use in the short to medium term, but is not appropriate for capturing long-term effects.

There is some consensus that the VAR approach is a potentially robust method in assessing the long-term relationship between public capital and private output as a VAR model can sufficiently account for the multiple feedback loops involved in public infrastructure spending, output, and GDP. Cohen et al. (2012) and others note that while the single-equation production function has traditionally been the most commonly used approach in this literature, the use of the VAR approach has grown in popularity in recent years as a more sophisticated analytical method.

Sector-specific studies

As the previous section has shown, a range of methodologies have been adopted to address the impacts of infrastructure investment on an aggregate basis. However, far less focus has been given to investigating the impacts by asset category or infrastructure sector level.

Cohen et al (2012) conducted an extensive literature review to identify findings regarding sector level infrastructure investment impact analysis. They found that several of the research papers that assessed infrastructure investment at the asset category level studied some form of highway spending and to a lesser extent, water and wastewater, but very few studies looked at multiple sectors. Pereira (2000) was an example of such a study that looked at a broad spectrum of asset categories, assessing the economic impact of investment in the United States as measured through elasticities of output relative to investment across a number of sectors that included highways and streets; electric power generation or gas fired power generation and mass transit systems; sewage and water treatment facilities; public buildings; and conservation and development structures.

The following table highlights findings of elasticity by sector, and confirms that Pereira’s research work is one of very few studies that examined economic impacts across a number of sectors. It can be noted from the table that most elasticities across sectors were found to be positive, with the exception of highways, roads and bridges – which yielded negative elasticities in some cases.

| - | Eberts, R. (1986) | Deno, K. (1988) | Aschauer, D. (1989) | Munnell, A. & L. Cook (1990) | Dalenbar, D.R. & R.W. Eberts (1992) | Finn, M. (1993) | Evans, P. & G. Karras (1994) | Moomaw Mullen & M. Williams (1985) | Garcia Mila, T., T. McGuire & R Porter (1986) | Kelejian, H. & D. Robison (1987) | Attaray, E. (1998) | Batina, R. G. (1998) | Pereira, A. (2000) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Aggregate | .04 | 0.69 | 0.38-0.56 | 0.15 | - | - | (-0.223)( to 0.102 | 0.07 to 0.26 | - | (-0.102) to 0.145 | - | (-0.11) VAR to 0.022 | 0.043 |

| Highways, roads, bridges | 0.03 | 0.31 | 0.24 | 0.06 | 0.104-0.149 | 0.16 | -0.062 | 0.001 to 0.027 | 0.230 to 0.370 | (-1.93) to 0.101 | 0.25 | (VECM) | 0.006 |

| Water and wastewater systems | 0.08 | 0.12 | - | 0.011 | 0.003 to 0.3045 | 0.043 to 0.069 | (-0.031) to 0.147 | - | 0.024 | 0.009 | |||

| Transit | - | - | - | - | - | - | - | - | - | - | - | 0.021 | |

| Health | - | - | 0.02 | - | - | - | - | - | - | - | - | - | 0.017 |

Long-term economic impact assessment of infrastructure investments in Ontario

Background

Alfredo Pereira, a Professor at the College of William and Mary in Williamsburg, Virginia has published a number of economic papers investigating the economic impact of infrastructure investments across different infrastructure types or asset categories. For example, he developed an analysis of infrastructure investments across various sectors in the United States in his paper, “Is All Public Capital Created Equal?” (2000), published in the Review of Economics and Statistics. The findings from this work were used in a recent research study “The Economic Impact and Financing of Infrastructure Spending” (2012), prepared by Cohen, Freiling and Robinson for the Associated Equipment Distributors (AED) to assess the long-term impact of government spending on infrastructure in the United States. Pereira has applied a similar methodology to study the effects of infrastructure investment in other countries, notably Spain and Portugal.

The objective of Pereira’s research in this field is to understand the long-term effects of public infrastructure spending on the economy. As noted in the previous section, in addition to applying a VAR methodology that is well-accepted in the literature, Pereira is one of few researchers in recent years who has looked beyond impacts at the aggregate level and quantified the effect of infrastructure investment in various sectors on the economy. Pereira’s approach produces an econometric determination of the long-run sensitivity of GDP to investment for each sector, identifying a numerical value which captures the dynamic effects that GDP and investment spending each have on the other.

In light of the review of various methodologies applied in the assessment of long term impacts of infrastructure investment as described in the previous section, it was concluded that Pereira’s methodology offers an appropriate approach to meet the scope requirements of the Study, particularly given its explicit emphasis on the assessment of impacts at the asset category or sector level.

Pereira’s approach offers a credible and proven means through which these long-run effects can be estimated at the sector level. Deloitte engaged Professor Pereira as a sub-consultant to develop the quantitative analysis leveraging his methodology and modeling expertise to apply to Ontario data. Key elements of the methodology, data, testing procedures and results are contained in the following sections.

Approach and methodology

Quantitative analysis

Introduction to VAR approach

The following approach considers the analysis of the impact of public infrastructure investment on economic performance in Ontario, first at the aggregate level, and then considering different asset categories or sectors. The objective of this analysis is to produce elasticities of output, employment, and private investment with respect to public infrastructure investments, and more importantly from a policy perspective, the marginal productivities of public infrastructure investment when considering the observed levels of relative infrastructure scarcity.

This approach utilizes a multivariate dynamic time series methodological approach, based on the use of VAR models, developed in Pereira and Flores (1999) and Pereira (2000, 2001). This methodology has been subsequently applied to, among others, the United States in Pereira and Andraz (2003, 2004), to Portugal in Pereira and Andraz (2005, 2006), and to Spain in Pereira and Roca-Sagales (2003), for example.

This econometric approach addresses the criticisms leveled against the univariate static production function approach conventionally used in the literature – the challenge of the endogeneity of all variables, the absence of a dynamic element, and the inability to establish causation – in a rigorous and comprehensive manner. It also brings a more precise conceptual focus to the debate about whether or not infrastructure capital is productive and how productive it is.

The approach is directed to highlight the dynamic nature of the relationship between infrastructure and the economy. It does so at three distinct levels: first, by addressing explicitly contemporaneous correlations among innovations; second, by considering an intertemporal feedback structure among all variables; and, third, by accommodating the possibility of existence of long-term relationships among the variables. Built into the approach is the ability to determine causality and not only correlations.

Dynamic feedbacks are essential to a conceptual understanding of the relationship between public infrastructure capital and economic performance. Public infrastructure affects output directly as an additional input in the production function. As positive externalities to production, public infrastructure should, all other things being equal, lead to higher production. Public infrastructure also affects production indirectly through effects on capital and labour. It is conceivable that a greater availability of public infrastructure could reduce the demand for inputs (a substitution effect). More public infrastructure, however, also increases the marginal productivity of these inputs, lowering the marginal costs of production, thereby potentially increasing production (a scale effect).

The evolution of inputs and outputs can, in turn, be expected to affect public infrastructure investment. Increasing output provides the government with a growing tax base and the potential for greater investment. Furthermore, declining employment has often led to short-term policy packages that involve increased public infrastructure investment. Therefore there is a significant possibility that reverse causality exists, meaning that it is possible that output and other inputs may be leading to growth in public infrastructure investment and not (or not only) the other way around.

Finally, although this approach is eminently empirical, it is not theoretical, as this analysis is supported by a dynamic model of the economy. In this model, the economy uses a production technology based on the use of capital and labour, as well as public infrastructure capital, to generate output. Given the market conditions and the availability of public infrastructure, the economy decides on the level of input demands and output supply. In turn, the public sector decides on the evolution of the public infrastructure investment using a policy rule that relates public infrastructure to the evolution of the economic variables. The estimated VAR models can be thought of as a reduced form for the production function, input demands and policy function.

Data sources and description

The data utilized within this analysis includes annual data for the period 1976 to 2011, obtained from Statistics Canada. Gross Domestic Product (“gdp”), private investment (“inv”), and public investment (“pinv”) are in millions of constant 2007 Canadian dollars while employment (“emp”) is noted in thousands of employees. The data for private and public investment is sourced from Infrastructure Analytics Group of the Infrastructure Policy and Planning Division of the MOI, based on Statistics Canada data.

In addition to aggregate public infrastructure investment, six different sectors of public infrastructure investment are considered:

- Government Administration and Other Infrastructure (“pinv1”) - includes investments in public administration buildings and also includes a small residual component of public infrastructure investment. It represents 24.5% of public infrastructure investment over the sample period and peaked in the 1990s with 26.2% of the total.

- Health Infrastructure (“pinv2”) - includes fixed non-residential capital investment for ambulatory health care services, hospitals, and nursing and residential care facilities. It represents 11.4% of public infrastructure investment and has seen a sharp increase in the last decade.

- Highways, Roads and Bridges Infrastructure (“pinv3”)

footnote 18 – includes investments in roadway infrastructure including highways, roads and bridges and accounts for 36.2% of public infrastructure investment and peaked at 41.3% in the 1970s. - Education Infrastructure (“pinv4”) - includes investment in fixed assets by elementary and secondary schools, community colleges, universities, business schools and computer and management training centres, technical and trade schools, other schools and institutions and educational support services. It represents 14.1% of total infrastructure investment. It declined to an all-time low of 11.3% in the 1980s and rebounded thereafter.

- Transit Infrastructure (“pinv5”) - includes transit and other ground passenger transportation services. It has sharply increased from 3.4% to 6.5% of total public infrastructure investment for a sample average of 6.3%.

- Waste, Water and Wastewater Infrastructure (“pinv6”) - includes water, sewage and other systems and waste management and remediation services. It accounts for 7.4% of total public infrastructure investment.

The data reflect important general trends in Ontario, namely, growing infrastructure investment during the 1960s (a period outside our sample period), a subsequent slowdown in infrastructure investment during the 1970s, 1980s and 1990s, and a renewal in investment efforts since 2000. Public infrastructure investment was 4.3% of the GDP in the 1960s and declined to 2.6% during the 1980s and 1990s and has now reached 2.8% in the last decade.

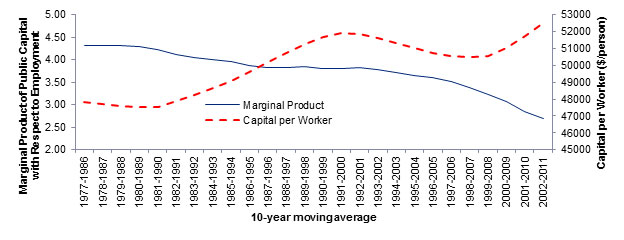

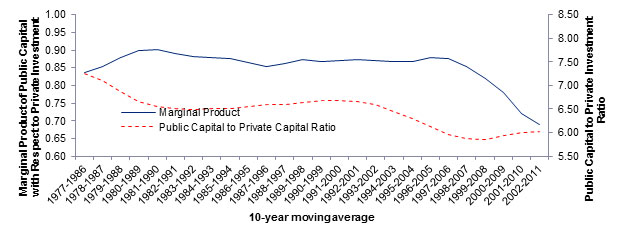

The strong levels of infrastructure investment during the 1960s and 1970s are consistent with the construction of the Trans-Canada Highway and other major projects, such as Toronto’s subway system. With the completion of these projects, growth in infrastructure slowed until the late 1990s. As the growth rate of GDP exceeded that of the infrastructure stock, the stock’s share fell steadily during that time.