Procedure for the Calculation of the Monetary Benefit Component of Environmental Penalties

The purpose of environmental penalty orders (EP orders) is to protect the environment by making companies comply with environmental regulations and take swift action in the event of a spill, discharge, or other environmental violation.

June 2024

Please note that the regulations will take precedence where a conflict or ambiguity exists between this Procedure Document and the requirements of the regulations. While every effort has been made to ensure the accuracy of the information contained within this Procedure Document, it should not be construed as legal advice.

Addendum – Interpretation of Procedure

The Tables in Appendix A of this Procedure Document are deemed to be replaced by Table 2 and 3 of O. Reg. 222/07 made under the Environmental Protection Act and Table 2 of O. Reg. 223/07 made under the Ontario Water Resources Act.

Part 1: Overview

1.1 Context

The Ministry of the Environment (“Ministry”) is responsible for developing, enforcing and providing education and outreach on Ontario’s environmental laws. The purpose of environmental penalty orders (EP orders) is to protect the environment by inducing companies to comply with environmental regulations and take swift remedial action in the event of a spill, discharge, or other environmental violation.

The Ministry expects all companies and individuals to comply with all the environmental laws that apply to them. When one of those laws has not been complied with, the primary objective of the Ministry’s compliance and enforcement program is to see that those responsible act quickly to deal with the impacts of a violation, return to compliance with environmental laws as soon as practicable, and take every practical measure to prevent the recurrence of the incident.

EP orders were introduced through the Environmental Enforcement Statute Law Amendment Act (Bill 133), passed in June 2005. This legislation amended the Environmental Protection Act (EPA) and the Ontario Water Resources Act (OWRA), establishing the overall framework for EP orders. O. Reg. 222/07 made under the EPA and O. Reg. 223/07 made under the OWRA provide details on how, when and to which types of violations EPs will be applied. Both regulations contain the same concepts so for ease of reference this Procedure will only refer to O. Reg. 222/07 (“the regulation or the “EP regulation”) except in Appendix A.

Basically, EP orders are monetary penalties that companies may be required to pay if they have violated a requirement under the OWRA or EPA that is specified in the EP regulation. Because the primary goal of EP orders as an abatement tool is to encourage quick and effective action to restore, reduce or prevent harm to the environment or human health, there are ways for companies to have the amount of the penalty adjusted, based on actions they took before, during and after an incident.

1.2 Calculation of Environmental Penalty Amount

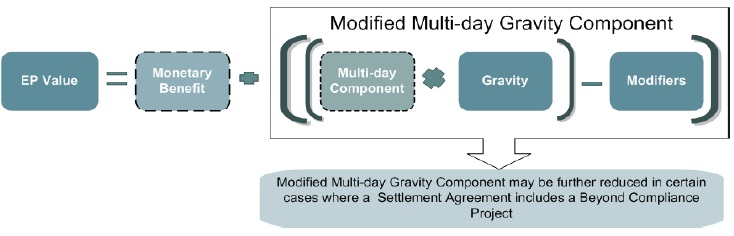

The formula for calculating the amount of an EP order is set out in s.7 of the regulation. In general terms, an EP order is comprised of a modified multi-day gravity component and where applicable a monetary benefit component (see diagram below).

The “gravity component” of the penalty is assessed based on the type and seriousness of the violation. For violations that continue for more than one day (such as a failure to install equipment), the regulation requires that the gravity component be multiplied by a “multi-day component” depending on the length of the violation. The modifiers reduce the gravity component of the penalty, in accordance with the EP regulation, by considering the preventive and mitigative measures taken or planned to be taken by the regulated person and whether the regulated person had a certified environmental management system in place.

In addition, a reduction to the modified multi-day gravity component may be allowed through completion of a settlement agreement as noted in the diagram below. The “monetary benefit” component of the penalty includes financial benefits gained by the regulated person because of its non-compliance with legal requirements and cannot be reduced by entering into a settlement agreement.

This Procedure deals with the monetary benefit component of EPs. For information on the other components, please refer to the “Guideline for Implementing Environmental Penalties (Ontario Regulations 222/07 and 223/07)”.

1.2.1 Monetary Benefit – Overview

When a regulated person fails to comply with a requirement under the EPA or OWRA, whether the violation was deliberate or accidental, the regulated person may acquire a monetary benefit from the non-compliance. Section 8 of the EP regulation defines two sources of monetary benefit that a Director will consider when issuing an EP order: (1) Avoided Costs and (2) Delayed Costs. Where the Director determines that the regulated person has acquired a monetary benefit from the contravention, section 8 then requires the Director to determine the timeframe during which the regulated person acquired the monetary benefit and then to determine the amount of the monetary benefit in accordance with this Procedure.

In each case where an EP order is used to respond to a violation, the Director will consider whether the regulated person has acquired a monetary benefit from the non-compliance for avoided or delayed costs. However, a monetary benefit component will only be added to the EP order by the Director when avoided or delayed costs can be identified and clearly linked to legal requirements under the OWRA and EPA, including orders, approvals or regulations under those Acts and the total amount of the monetary benefit acquired by the regulated person is over $300.

Examples of violations that are likely to result in delayed or avoided costs that would lead to the calculation of monetary benefits include, but are not limited to:

- failure to obtain an environmental compliance approval

- failure to install, operate or maintain pollution prevention or mitigation equipment as required by an environmental compliance approval or provincial officer order

- failure to sample, analyze and report as required by regulations or an environmental compliance approval

Unlike the gravity component of an environmental penalty, a regulated person cannot seek and obtain reductions to the monetary benefit component of the penalty. Also, the monetary benefit component can not be reduced by entering into a settlement agreement with the Director.

Part 2: Description of Key Terms

2.1 Monetary Benefit

One of the key purposes of a civil administrative penalty scheme like environmental penalties is to level the playing field for all regulated actors. A regulated person that does not invest the necessary financial resources to ensure its operations comply with environmental protection laws gains a monetary benefit over those who do. For example, the benefits may come from being able to invest in other revenue-producing activities or avoiding the costs associated with borrowing the funds to invest in upgrades required to be in compliance with environmental protection laws.

2.2 Avoided and Delayed Costs (Section 8 of the EP Regulation)

Avoided Costs

The regulation defines “avoided costs” to mean:

costs that the regulated person avoided incurring by failing to comply with a provision described in Table 2 or 3 of the EP regulation.

Appendix A to this Procedure includes the list of provisions described in Table 2 and 3 of the EP regulation.

Avoided costs apply in respect of provisions that must be complied with on or by a certain date and that, once that date has passed, cannot be complied with on a future date.

Avoided costs would include, among others: costs associated with human resources; energy; consumable materials; disposal of residuals; laboratory analyses; routine training and emergency drills. For example, if a regulated person does not undertake daily sampling and analysis of a regulated substance over a period of a month, it can never incur the costs for that month’s sampling and analysis, even when daily sampling and analysis is resumed.

Delayed Costs

The regulation defines “delayed costs” to mean:

costs that the regulated person delayed incurring by delaying compliance with a provision described in Table 2 or 3

Appendix A to this Procedure includes the list of provisions described in Table 2 or 3 of the EP regulation.

Delayed costs are those which will eventually be incurred when a regulated person comes into compliance.

Delayed costs would include, among others: depreciable capital investments, such as pollution control equipment (e.g. wastewater treatment systems, stormwater management systems) and secondary (spill) containment systems; and non-depreciable things, such as spill prevention plan development, spill contingency plan development and environmental compliance approvals — related studies, preparation of application and application fee.

2.3 Input Variables

The formulas for the calculation of monetary benefit use a number of variables. In order to facilitate the calculation of monetary benefit, the Ministry has established default values for these variables including:

- weighted cost of capital

- inflation rate

- useful life of equipment

- depreciation rate

- corporate income tax rate

- cost estimates

Appendix B of this Procedure contains the methods and data used to develop the default values for all variables (inputs) to the monetary benefit formulas. All data will be updated from time to time.

Section 6 of the EP regulation sets out that the regulated person may provide additional information to assist in developing input values more specific to the violation for which the monetary benefit is being calculated. This information is to be provided at the time of the request for a review of an Environmental Penalty Notice of Intent (See Chapter 3.1 of this Procedure and the “Guideline for Implementing Environmental Penalties (Ontario Regulations 222/07 and 223/07)” for details on the process for issuing EP orders).

2.4 Non-Compliance Period

When determining the monetary benefit component of an environmental penalty, the Director must determine the date by which the regulated person was required to take action to comply with a requirement and the date by which the person will come back into compliance with the requirement. This period of non-compliance is an input to the formulas set out in Part 4 of this Procedure that calculate the amount of the monetary benefit. The period of non-compliance is determined in the following way:

- Start date of non-compliance: the first day following the date by which a regulated person was required to take action to comply with a legal requirement. (For instance, if a person was required to install equipment by January 1, 2024, the start date would be January 2, 2024)

- End date of non-compliance:

- For continuous violations, the date on which the regulated person came back into compliance or is anticipated to come back into compliance, as specified in an order. An example of a continuing violation is the failure to install equipment by a date specified in an approval or failure to obtain an approval. See example C1 and C2 in Appendix C.

- For recurring violations, the date on which the regulated person has resumed or is anticipated to resume complying with the requirement, as specified in an order. An example of a recurring violation is the failure to take samples on the first day of each month. If the person has failed to take samples in two consecutive months but resumes sampling in the third month, the length of the non-compliance period (for the purpose of calculating monetary benefit) would be 2 months. See example C3 in Appendix C.

Note that the number of days of non-compliance for the purposes of calculating the gravity component of recurring violations is different. See Chapter 2.2.5 of the “Guideline for Implementing Environmental Penalties (Ontario Regulations 222/07 and 223/07)” for details.

In the formulas used to calculate the monetary benefit, “T” refers to the total period of noncompliance in days (e.g. 100 days). The term “t” refers to each incremental unit of time in terms of days (e.g. day 1, day 2, …day 100).

Part 3: Monetary Benefits and Notices of Intention

3.1 Environmental Penalty Notice of Intention

Before a Director issues an environmental penalty order to a regulated person for a contravention that occurs at its plant or landfilling site or is related to the operations of its plant or landfilling site, section 5 of the regulation requires the Director to first provide a 15-day notice of intention (NOI) to the regulated person. The NOI is intended to provide the regulated person with an opportunity to provide the Director with information that he or she should consider when calculating an EP for the violation(s) listed in the notice.

When the regulated person receives an NOI or an amendment to an NOI, the Ministry indicates whether a monetary benefit is included in the EP penalty amount. If so, the NOI also includes the estimated amount of monetary benefit, a summary of how it was determined, and the timeframe that was used to estimate it (see paragraph 8 of subsection 5(1) of the EP regulation).

If the NOI includes an estimate of monetary benefit, the regulated person may request under paragraph 1 of subsection 6(1) of the regulation that the Director consider any information to modify the default values of the variables used to calculate the monetary benefit to be more reflective of the violation and regulated facility or landfilling site (e.g. case-specific interest rates, more specific costs of capital). All such requests must follow the process and deadlines consistent with the regulations and the “Guideline for Implementing Environmental Penalties (Ontario Regulations 222/07 and 223/07)”. The additional information may be used by the Ministry to re-determine the amount of the monetary benefit if it would result in a higher degree of accuracy for one or more of the variables used in the formulas.

3.2 Calculating Monetary Benefit

The calculation of monetary benefit will be performed by specially trained Ministry staff using the formulas in this Procedure.

Part 4: Calculation of Monetary Benefit

4.1 Overview

4.1.1. Delayed Costs

Delayed costs will eventually be incurred by the violator when coming back into compliance.

There are three formulas to calculate the monetary benefit obtained by delaying cost, depending on the characteristics of the costs involved; for instance, whether the costs are subject to depreciation).

Please note that the actual formulas are set out in Chapter 4.2 of this document and examples of calculations using the formulas are provided in Appendix C.

Formula I

Formula I is used when the assets that are the subject of the violation (e.g. equipment, structures) depreciate over time and the estimated useful life of the equipment is longer than the duration of non-compliance. This means that at the end of the non-compliance period, the equipment that would have been installed if the regulated person had been in compliance, would still have some useful life.

Formula II

Formula II is used when assets that are the subject of the violation (e.g. equipment, structures) depreciate over time and the estimated useful life of the equipment is shorter than the duration of non-compliance. This means that during the period of non-compliance, a compliant regulated person would have installed more than one piece of equipment because the useful life of the first piece of equipment has ended.

Formula III

Formula III is used for items that do not depreciate, such as the preparation of an environmental compliance approval or a spill prevention plan.

4.1.2. Avoided Costs

Avoided costs refer to costs that will never be incurred by the violator even when they come back into compliance.

Formula IV

Formula IV is used to calculate the monetary benefit obtained through avoiding costs, typically operating and maintenance costs or other recurring costs necessary for compliance. For example, the failure to sample as required by an environmental compliance approval, order or regulation.

Please note that the actual formula is set out in Chapter 4.3 of this document and that an example using this formula is provided in Appendix C.

4.2 Formulas for Delayed Costs

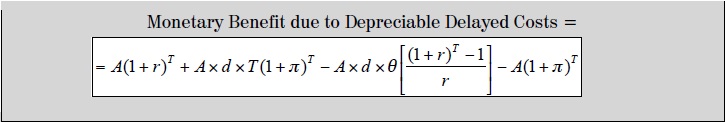

4.2.1 Formula I

Formula I is used to calculate the monetary benefit resulting from delaying the purchase of depreciable asset when the useful life of the asset is longer than the duration of noncompliance.

Where:

- A

- Cost to comply at first date of non-compliance ($)

- d

- Depreciation rate (% per day) (See Appendix B.5)

- r

- Weighted cost of capital (% per day) (see Appendix B.1)

- T

- Duration of non-compliance (days)

- θ

- Corporate income tax rate (See Appendix B.3)

- π

- Inflation rate (% per day) (See Appendix B.2)

Discussion

The formula consists of four terms:

Term 1: A(1+r)T

The cost to comply at the first date of non-compliance is “A”. Since the non-compliant regulated person has not purchased the equipment and systems that would have been necessary for compliance, they can use this money to invest in other activities that earn a return (this is the value “r”). The return is compounded over the total period of non-compliance.

Note “r” is already adjusted for both taxes and inflation.

Term 2: + A × d × T (1 + π)T

Terms 2 and 3 adjust the monetary benefit for depreciation.

Depreciation of the Asset

The asset purchased by the regulated person at the start date of compliance will depreciate in value during the non-compliance period. This is represented by A × d × T.

Also due to inflation, this asset will be worth more at the end date of non-compliance. This is represented by (1 + π)T.

Term 3: − A × d × θ [((1 + r)T − 1) ⁄ r]

Tax Benefit of Depreciation

This term calculates the tax savings due to depreciation received throughout the period of noncompliance. A compliant regulated person can reduce their taxable income by the full amount of the depreciation on the capital equipment for pollution control. This reduces the compliant regulated person’s taxes. This is represented by A × d × θ.

The second part of this term takes the tax savings mentioned in the paragraph above and calculates what it would be worth at the end date of non-compliance. This is represented by [(1 + r)T − 1) ⁄ r].

Term 4 − A (1 + π)T

At the end of the non-compliance period, the regulated person must purchase the depreciable asset whose cost has been delayed. The regulated person pays the current price of the asset therefore inflation is used to adjust the capital cost to its current value. This is represented by A (1 + π)T.

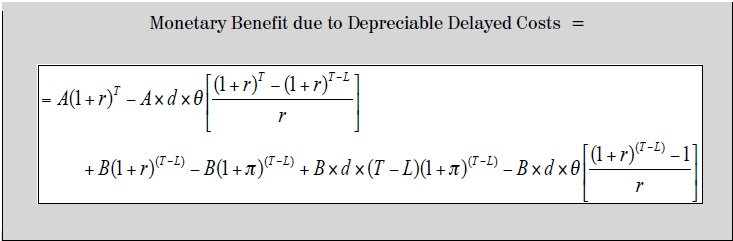

4.2.2 Formula II

Formula II is used to calculate the monetary benefit resulting from delaying the purchase of a depreciable asset when the useful life of the asset is shorter than the duration of non-compliance.

Where:

- A

- Cost to comply at first date of non-compliance ($)

- B

- Cost to replace equipment / structures at the end of the useful life period ($)

- d

- Depreciation rate (% per day)

- r

- Weighted cost of capital (% per day)

- L

- Useful Life of Equipment (days) (See Appendix B.4)

- T

- Duration of non-compliance (days)

- θ

- Corporate income tax rate

- π

- Inflation rate (% per day)

Discussion

The difference between Formula I and Formula II is that in Formula II the useful life of the equipment is shorter than the duration of non-compliance. This means that during the period of non-compliance, a compliant regulated person would have installed not only the original piece of equipment but its replacement to ensure compliance.

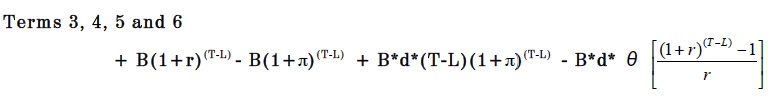

This formula consists of six terms:

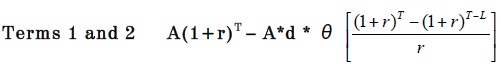

Terms 1 and 2 in Formula II are virtually identical to Terms 1 and 3 in Formula I. Like in Formula I, Term 1 represents the return on money not spent by the non-compliant person, and Term 2 is the tax saving the compliant firm would experience due to depreciation as brought forward to the end date of non-compliance.

Note that Formula II has no equivalent to Terms 2 and 4 in Formula 1 for the first piece of equipment. This is because the original piece of equipment is held for its entire useful life, depreciating to a value equal to 0 before the end date of compliance and is not purchased when the regulated person comes back into compliance.

The remaining portion of the formula denotes the gain received by the non-compliant regulated person due to delaying the investment in the replacement piece of equipment. Its form is identical to Formula I.

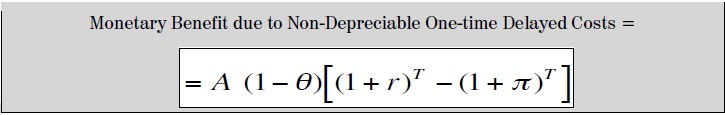

4.2.3 Formula III

Formula III is used to calculate the monetary benefit resulting from delaying investment in items that do not depreciate, such as an environmental compliance approval or a spill prevention plan.

Where:

- A

- Cost to comply at first date of non-compliance ($)

- r

- Weighted cost of capital (% per day)

- T

- Duration of non-compliance (days)

- θ

- Corporate income tax rate

- π

- Inflation rate (% per day)

Discussion

This formula removes the depreciation calculation component of Formula I.

The formula consists of three terms:

Term 1: A(1 − θ)

Term 1 is used to calculate the cost of the asset at the beginning of the period of non-compliance adjusted for taxes because non-depreciable expenditures are 100% tax deductible in the year they are purchased.

Non-depreciable expenditures like an environmental compliance approval reduce taxable income, thereby reducing income taxes paid by the compliant person. Therefore, when compliance costs are not incurred, the non-compliant regulated person pays more taxes than they would have had they complied. So, the advantage from non-compliance is not the full amount of non-depreciable expenditure but the net of taxes value.

Term 2: (1 + r)T

Term 2 denotes the gain received by the non-compliant firm by investing the money that should have been spent on compliance.

Term 3: − (1 + π)T

The cost of the non-depreciable expenditure will increase by the amount of inflation by end of the non-compliance period. This is the amount the compliant firm will pay when it comes back into compliance.

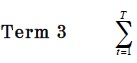

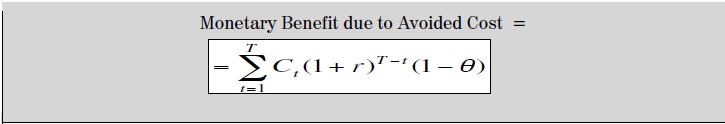

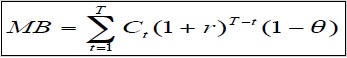

4.3 Formula for Avoided Costs

4.3.1 Formula IV

Formula IV is used to calculate the monetary benefit obtained by avoiding costs. Formula IV sums the recurring costs that were avoided during the period of time relevant to the contravention, plus the return on investment of the costs avoided. Formula IV also adjusts for taxes.

Where:

- C

- Daily Avoided Cost ($)

- r

- Weighted cost of capital (% per day)

- θ

- Corporate income tax rate

- T

- Duration of non-compliance (days)

- t

- Units of time of non-compliance in days to a maximum of day “T” (e.g. day 1, day 2, … day “T”)

Discussion

The formula has three terms:

Term 1: Ct (1 +r )T−t

Since the non-compliant regulated person has not spent the money on operations and maintenance or recurring costs necessary for compliance they can invest this money in other activities that earn a return (this is value “r”). This return is compounded daily until the date of compliance.

Term 2: (1 − θ)

Operations and maintenance expenditures reduce taxable income, thereby reducing income taxes paid by the compliant person. Therefore, when compliance costs are not incurred, the non-compliant regulated person pays more taxes than they would have had they complied. So, the advantage from non-compliance is not the full amount of avoided operational expenditures but the net of taxes value. The amount of the tax reduction that results from claiming operations and maintenance expenses (100% deductible in year they are incurred) is deducted from the sum of the avoided costs.

The calculation of the avoided costs are carried out for each day of non-compliance and then summed over the entire non-compliance period.

Appendix A: List of Contraventions under the Environmental Protection Act and the Ontario Water Resources Act that are Subject to EPs

| Item | Provision of the Act | Description of the contravention | Circumstances | First date on which an environmental penalty may be ordered for the contravention | Type of contravention | Section of this Regulation that specifies the type of consequence |

|---|---|---|---|---|---|---|

| 1. | Subclause 182.1 (1) (a) (i) | Contravention of section 14 of the Act (prohibits discharge of a contaminant into the natural environment that causes or may cause an adverse effect) | 1. The discharge is to land or water. 2. The discharge is of a pollutant as defined under Part X of the Act. | August 1, 2007 | Type 3 | 10 |

| 2. | Subclause 182.1 (1) (a) (ii) | Contravention of section 93 of the Act (duty to mitigate and restore where pollutant is spilled that causes or is likely to cause an adverse effect) | The spill is to land or water. | August 1, 2007 | Type 3 | 11 |

| 3.1 | Subclause 182.1 (1) (a) (iii) | Contravention of a provision of the regulations that establishes or has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | 1. The contravention is of subsection 5 (1) of Ontario Regulation 530/18 (Air Pollution - Discharge of Sulphur Dioxide from Petroleum Facilities Before 2029). 3. The discharges giving rise to the contravention have not been previously subject to an order under subclause 182.1 (1) (a) (iii). | July 1, 2019 | Type 3 | 12 |

| 3.2 | Subclause 182.1 (1) (a) (iii) | Contravention of a provision of the regulations that establishes or has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | 1. The contravention is of section 8, 9, 10, 11, 12, 14, 15, 16 or 17 of Ontario Regulation 88/22 (Air Pollution — Discharge of Sulphur Dioxide from Petroleum Facilities). 3. The discharges giving rise to the contravention have not been previously subject to an order under subclause 182.1 (1) (a) (iii). | July 1, 2024 | Type 3 | 12 |

| 3.3 | Subclause 182.1 (1) (a) (iii) | Contravention of a provision of the regulations that establishes or has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | 1. The contravention is of section 13 of Ontario Regulation 88/22 (Air Pollution — Discharge of Sulphur Dioxide from Petroleum Facilities). 3. The discharges giving rise to the contravention have not been previously subject to an order under subclause 182.1 (1) (a) (iii). | January 1, 2027 | Type 3 | 12 |

| 3.4 | Subclause 182.1 (1) (a) (iii) | Contravention of a provision of the regulations that establishes or has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | 1. The contravention is of subsection 2 (1) of Ontario Regulation 206/24 (Air Pollution — Discharge of Benzene from INEOS Styrolution). | The day that section 2 of O. Reg. 206/24 comes into force. | Type 3 | 12 |

| 4. | Subclause 182.1 (1) (a) (iv) | Contravention of a provision of an order under the Act that establishes or has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | 1. The discharge is to land or water. 2. In the case of an order issued in respect of the plant described in item 86 of Table 1, the discharge is to the natural environment and the contravention occurred on or after the day that O. Reg. 207/24 comes into force. | August 1, 2007 | Type 1 | 12 |

| 4.1 | Subclause 182.1 (1) (a) (v) | Contravention of a provision of an environmental compliance approval, certificate of property use, renewable energy approval, licence or permit under the Act that establishes or has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | 1. The contravention is of a provision of an environmental compliance approval issued in respect of an activity mentioned in subsection 53 (1) of the Ontario Water Resources Act. 2. The environmental compliance approval is not issued in respect of the plant described in item 86 of Table 1. | The day subsection 2 (79) of Schedule 7 to the Open for Business Act, 2010 comes into force. | Type 1 | 12 |

| 4.2 | Subclause 182.1 (1) (a) (v) | Contravention of a provision of an environmental compliance approval, certificate of property use, renewable energy approval, licence or permit under the Act that establishes or has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | The contravention is of a provision of an environmental compliance approval issued in respect of the plant described in item 86 of Table 1. | The day that O. Reg. 207/24 comes into force. | Type 1 | 12 |

| 5. | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | 1. The spill is to land or water. 2. The contravention is of section 92 of the Act. | August 1, 2007 | Type 2 | 15 |

| 9. | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of section 91.1 of the Act. | December 1, 2008 | Type 2 | 15 |

| 9.1 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of subsections 5 (3), 5 (4), 5 (5), 6 (4), 6 (6), 7 (7), 7 (9), 7 (11), 8 (5) or 8 (6) or section 9 or 10 of Ontario Regulation 530/18 (Air Pollution — Discharge of Sulphur Dioxide from Petroleum Facilities Before 2029). | April 26, 2022 | Type 1 | 15 |

| 9.2 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of subsection 6 (3), 7 (1), 7 (6) or 7 (8) of Ontario Regulation 530/18 (Air Pollution — Discharge of Sulphur Dioxide from Petroleum Facilities Before 2029). | April 26, 2022 | Type 2 | 15 |

| 9.3 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of subsection 8 (1) or (2) of Ontario Regulation 530/18 (Air Pollution — Discharge of Sulphur Dioxide from Petroleum Facilities Before 2029). | April 26, 2022 | Type 3 | 15 |

| 9.4 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of section 18 of Ontario Regulation 88/22 (Air Pollution — Discharge of Sulphur Dioxide from Petroleum Facilities). | April 26, 2022 | Type 3 | 15 |

| 9.5 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of section 19, 22, 23, 24, 25, 26 or 28 of Ontario Regulation 88/22 (Air Pollution —Discharge of Sulphur Dioxide from Petroleum Facilities). | July 1, 2024 | Type 2 | 15 |

| 9.6 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of section 20, 21, 27, 29, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 41, 42, 43 or 45 of Ontario Regulation 88/22 (Air Pollution — Discharge of Sulphur Dioxide from Petroleum Facilities). | October 25, 2022 | Type 1 | 15 |

| 9.7 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | 1. The contravention is of subsection 42 (5) of Ontario Regulation 419/05 (Air Pollution — Local Air Quality). 2. The contravention is of section 66 of the Petrochemical – Industry Standard as set out in the Technical Standards publication, within the meaning of subsection 1 (1) of Ontario Regulation 419/05 (Air Pollution — Local Air Quality) made under the Act. 3. The contravention is in respect of the plant described in item 86 of Table 1. | The day that O. Reg. 207/24 comes into force. | Type 1 | 15 |

| 9.8 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of subsection 3 (3), section 4, 5, subsection 6 (4) or (8), subsection 7 (1), section 8, 9, section 10 other than subsection 10 (1), section 11, 12, 13, 14, 15 or 16 of Ontario Regulation 206/24 (Air Pollution — Discharge of Benzene from INEOS Styrolution). | The day that section 5 of O. Reg. 206/24 comes into force. | Type 1 | 15 |

| 9.9 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | The contravention is of subsection 3 (1) or (5) or subsection 10 (1) of Ontario Regulation 206/24 (Air Pollution — Discharge of Benzene from INEOS Styrolution). | The day that section 2 of O. Reg. 206/24 comes into force. | Type 2 | 15 |

| 9.10 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | 1. The contravention is of subsection 42 (5) of Ontario Regulation 419/05 (Air Pollution — Local Air Quality). 2. The contravention is of section 60 of the Petrochemical – Industry Standard as set out in the Technical Standards publication, within the meaning of subsection 1 (1) of Ontario Regulation 419/05 (Air Pollution — Local Air Quality) made under the Act. 3. The contravention is in respect of the plant described in item 86 of Table 1. | The day that O. Reg. 207/24 comes into force. | Type 2 | 15 |

| 9.11 | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, other than a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) of the Act. | 1. The contravention is of section 9 of the Act. 2. The contravention is in respect of the plant described in item 86 of Table 1. | The day that O. Reg. 207/24 comes into force. | Type 1 | 15 |

| 10. | Subclause 182.1 (1) (b) (ii) | Contravention of a provision of an order under the Act, other than an order under section 99.1, 100.1 or 150 of the Act, an order of a court or a provision referred to in subclause 182.1 (1) (a) (iv) of the Act. | The provision of the order requires the regulated person to report a failure to comply with another provision of the order that has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | August 1, 2007 | Type 1 | 15 |

| 11. | Subclause 182.1 (1) (b) (ii) | Contravention of a provision of an order under the Act, other than an order under section 99.1, 100.1 or 150 of the Act, an order of a court or a provision referred to in subclause 182.1 (1) (a) (iv) of the Act. | 1. The order is issued under section 7, 8, 17, 18, 97, 157 or 157.1 of the Act. 2.In the case of an order issued under section 7, 8, 17, 18, 97 or 157.1, the circumstances giving rise to the order relate to a discharge or a potential discharge to land or water, or in the case of an order issued in respect of a plant described in item 86 of Table 1 of this Regulation, the circumstances giving rise to the order relate to a discharge or a potential discharge to the natural environment and the discharge occurred on or after the day that O. Reg. 207/24 comes into force. 3. In the case of an order issued under section 157, the order is issued in response to a contravention specified in this Table. 4. The provision of the order that is contravened relates to, i. preventing, eliminating or ameliorating an adverse effect, or ii. the construction, installation or modification of any thing. | December 1, 2008 | Type 2 | 15 |

| 12. | Subclause 182.1 (1) (b) (ii) | Contravention of a provision of an order under the Act, other than an order under section 99.1, 100.1 or 150 of the Act, an order of a court or a provision referred to in subclause 182.1 (1) (a) (iv) of the Act. | 1. The order is issued under section 7, 8, 17, 18, 97, 157 or 157.1 of the Act. 2. In the case of an order issued under section 7, 8, 17, 18, 97 or 157.1, the circumstances giving rise to the order relate to a discharge or a potential discharge to land or water, or in the case of an order issued in respect of a plant described in item 86 of Table 1 of this Regulation, the circumstances giving rise to the order relate to a discharge or a potential discharge to the natural environment and the discharge occurred on or after the day that O. Reg. 207/24 comes into force. 3. In the case of an order issued under section 157, the order is issued in response to a contravention specified in this Table. 4. The provision of the order that was contravened is not a provision of an order described in item 4, 10 or 11 of this Table. | December 1, 2008 | Type 1 | 15 |

| 12.1 | Subclause 182.1 (1) (b) (iii) | Contravention of a provision of an environmental compliance approval, certificate of property use, renewable energy approval, licence or permit under the Act. | 1. The contravention is of a provision of an environmental compliance approval issued in respect of an activity mentioned in subsection 53 (1) of the Ontario Water Resources Act. 2. The provision of the environmental compliance approval that is contravened requires the regulated person to conduct an acute lethality test on contaminated or potentially contaminated sewage. 3. The environmental compliance approval is not issued in respect of the plant described in item 86 of Table 1. | The day subsection 2 (79) of Schedule 7 to the Open for Business Act, 2010 comes into force. | Type 2 | 13 |

| 12.2 | Subclause 182.1 (1) (b) (iii) | Contravention of a provision of an environmental compliance approval, certificate of property use, renewable energy approval, licence or permit under the Act. | 1. The contravention is of a provision of an environmental compliance approval issued in respect of an activity mentioned in subsection 53 (1) of the Ontario Water Resources Act. 2. The provision of the environmental compliance approval that is contravened is not a provision of an approval described in item 4.1, 12.1 or 12.3 of this Table. 3. The environmental compliance approval is not issued in respect of the plant described in item 86 of Table 1. | The day subsection 2 (79) of Schedule 7 to the Open for Business Act, 2010 comes into force. | Type 1 | 15 |

| 12.3 | Subclause 182.1 (1) (b) (iii) | Contravention of a provision of an environmental compliance approval, certificate of property use, renewable energy approval, licence or permit under the Act. | The environmental compliance approval issued in respect of an activity mentioned in section 53 of the Ontario Water Resources Act requires the regulated person to report a failure to comply with a provision of the approval that has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. 2. The environmental compliance approval is not issued in respect of the plant described in item 86 of Table 1. | The day subsection 2 (79) of Schedule 7 to the Open for Business Act, 2010 comes into force. | Type 1 | 15 |

| 12.4 | Subclause 182.1 (1) (b) (iii) | Contravention of a provision of an environmental compliance approval, certificate of property use, renewable energy approval, licence or permit under the Act. | 1. The contravention is of a provision of an environmental compliance approval issued in respect of the plant described in item 86 of Table 1. 2. The provision of the environmental compliance approval that is contravened is not a provision described in item 4.2 of this Table. | The day that O. Reg. 207/24 comes into force. | Type 1 | 15 |

| 13. | Subclause 182.1 (1) (b) (v) | Contravention of a provision of an agreement under subsection 182.1 (9) of the Act. | N/A | August 1, 2007 | Type 2 | 14, 15 |

| Item | Provision of the Act | Description of the contravention | Circumstances | First date on which an environmental penalty may be ordered for thecontravention | Type of contravention | Section of this Regulation that specifies the type of consequence |

|---|---|---|---|---|---|---|

| 1. | Subclause 182.1 (1) (a) (i) | Contravention of section 14 of the Act (prohibits discharge of acontaminant into the natural environment that causes or may cause an adverseeffect) | The discharge is of a pollutant as defined under Part X of the Act. | The day on which O. Reg. 338/23 comes into force. | Type 3 | 10 |

| 2. | Subclause 182.1 (1) (a) (ii) | Contravention of section 93 of the Act (duty to mitigate and restorewhere pollutant is spilled that causes or is likely to cause an adverseeffect) | The spill is to the natural environment. | The day on which O. Reg. 338/23 comes into force. | Type 3 | 11 |

| 3. | Subclause 182.1 (1) (a) (iv) | Contravention of a provision ofan order under the Act that establishes or has the effect of establishing anumerical limit, including a limit of zero, on the amount, concentration orlevel of anything that may be discharged to the natural environment. | The discharge is to the natural environment. | The day on which O. Reg. 338/23 comes into force. | Type 1 | 12 |

| 4. | Subclause 182.1 (1) (a) (v) | Contravention of a provision ofan environmental compliance approval, certificate of property use, renewableenergy approval, licence or permit under the Act that establishes or has theeffect of establishing a numerical limit, including a limit of zero, on theamount, concentration or level of anything that may be discharged to thenatural environment. | The contravention is of a provision of an environmental complianceapproval. | The day on which O. Reg. 338/23 comes into force. | Type 1 | 12 |

| 5. | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, otherthan a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) ofthe Act. | 1. The spill is to thenatural environment. 2. Thecontravention is of section 92 of the Act. | The day on which O. Reg. 338/23 comes into force. | Type 2 | 15 |

| 6. | Subclause 182.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations, otherthan a provision referred to in subclause 182.1 (1) (a) (i), (ii) or (iii) ofthe Act. | The contravention is of sections 27, 40 or 41 of the Act. | The day on which O. Reg. 338/23 comes into force. | Type 1 | 15 |

| 7. | Subclause 182.1 (1) (b) (ii) | Contravention of a provision of an order under the Act, other than anorder under section 99.1, 100.1 or 150 of the Act, an order of a court or aprovision referred to in subclause 182.1 (1) (a) (iv) of the Act. | 1. The order is issuedunder section 7, 8, 17, 18, 97, 157 or 157.1 of the Act. 2. In the case ofan order issued under section 7, 8, 17, 18, 97 or 157.1, the circumstancesgiving rise to the order relate to a discharge or a potential discharge tothe natural environment. 3. In the case ofan order issued under section 157, the order is issued in response to acontravention specified in this Table. 4. The provisionof the order that is contravened relates to, i. preventing,eliminating or ameliorating an adverse effect, or ii. the construction,installation or modification of any thing. | The day on which O. Reg. 338/23 comes into force. | Type 2 | 15 |

| 8. | Subclause 182.1 (1) (b) (ii) | Contravention of a provision of an order under the Act, other than anorder under section 99.1, 100.1 or 150 of the Act, an order of a court or aprovision referred to in subclause 182.1 (1) (a) (iv) of the Act. | 1. The order is issuedunder section 7, 8, 17, 18, 97, 157 or 157.1 of the Act. 2. In the case of anorder issued under section 7, 8, 17, 18, 97 or 157.1, the circumstancesgiving rise to the order relate to a discharge or a potential discharge tothe natural environment. 3. In the case ofan order issued under section 157, the order is issued in response to acontravention specified in this Table. 4. The provisionof the order that was contravened is not a provision of an order described initem 3 or 7 of this Table. | The day on which O. Reg. 338/23 comes into force. | Type 1 | 15 |

| 9. | Subclause 182.1 (1) (b) (iii) | Contravention of a provision ofan environmental compliance approval, certificate of property use, renewableenergy approval, licence or permit under the Act. | 1. The contravention isof a provision of an environmental compliance approval. 2. The provision of theenvironmental compliance approval that is contravened is not a provision ofan approval described in item 4 of this Table. | The day on which O. Reg. 338/23 comes into force. | Type 1 | 15 |

| 10. | Subclause 182.1 (1) (b) (v) | Contravention of a provision of an agreement under subsection 182.1(9) of the Act. | N/A | The day on which O. Reg. 338/23 comes into force. | Type 2 | 14, 15 |

| Item | Provision of the Act | Description of the contravention | Circumstances | First date an EP may be ordered for the contravention | Type of contravention | Section of this Regulation that specifies the type of consequence | |

|---|---|---|---|---|---|---|---|

| 1. | Subclause 106.1 (1) (a) (i) | Contravention of subsection 30 (1) of the Act (creates offence to discharge or cause or permit the discharge of any material of any kind into or in any waters or on any shore or bank thereof or into or in any place that may impair the quality of the water of any waters). | (N/A) | August 1, 2007 | Type 3 | 10 | |

| 2. | Subclause 106.1 (1) (a) (iii) | Contravention of a provision of an order, notice, direction, requirement or report under the Act that establishes or has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | (N/A) | August 1, 2007 | Type 1 | 11 | |

| 4. | Subclause 106.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations other than a provision referred to in clause 106.1 (1) (a) of the Act. | The contravention is of subsection 30 (2) of the Act. | August 1, 2007 | Type 2 | 14 | |

| 5. | Subclause 106.1 (1) (b) (i) | Contravention of a provision of the Act or the regulations other than a provision referred to in subclause 106.1 (1) (a) (i) or (ii) of the Act. | The contravention is of subsection 53 (1) of the Act. | December 1, 2008 | Type 2 | 14 | |

| 6. | Subclause 106.1 (1) (b) (ii) | Contravention of a provision of an order or direction under the Act, other than an order under section 84 of the Act, an order of a court or a provision of an order or direction referred to in subclause 106.1 (1) (a) (iii) of the Act. | The provision of the order or direction requires the regulated person to report a failure to comply with another provision of the order or direction that has the effect of establishing a numerical limit, including a limit of zero, on the amount, concentration or level of anything that may be discharged to the natural environment. | August 1, 2007 | Type 1 | 14 | |

| 7. | Subclause 106.1 (1) (b) (ii) | Contravention of a provision of an order under the Act, other than an order under section 84 of the Act, an order of a court or a provision referred to in subclause 106.1 (1) (a) (iii) of the Act. | 1. The contravention is of a provision of an order or direction issued under section 16, 16.1, 16.2, 31, 32, 61, 91 or 92 of the Act. 2. In the case of an order issued under section 16 of the Act, the order is issued in response to a contravention specified in this Table. 3. The provision of the order or direction that was contravened relates to, i. preventing, reducing or alleviating any impairment of the quality of water or the effects of any impairment of the quality of the water, or ii. the construction, installation or modification of any thing. | December 1, 2008 | Type 2 | 14 | |

| 8. | Subclause 106.1 (1) (b) (ii) | Contravention of a provision of an order under the Act, other than an order under section 84 of the Act, an order of a court or a provision referred to in subclause 106.1 (1) (a) (iii) of the Act. | 1. The contravention is of a provision of an order or direction issued under section 16, 16.1, 16.2, 31, 32, 61, 91 or 92 of the Act. 2. In the case of an order issued under section 16 of the Act, the order is issued in response to a contravention specified in this Table. 3. The provision of the order or direction that was contravened is not a provision of an order or direction described in item 2, 6 or 7 of this Table. | December 1, 2008 | Type 1 | 14 | |

| 12 | Subclause 106.1 (1) (b) (iv) | Contravention of a provision of an agreement under subsection 106.1 (9) of the Act. | (N/A) | August 1, 2007 | Type 2 | 13, 14 |

Appendix B: Deriving the Input Variables

The information contained in this Appendix is derived from reports published by Statistics Canada. While this information will be used by the Director when calculating the monetary benefit component of an environmental penalty set out in a notice of intention, it is open to a regulated person to provide the Director with economic or financial information which more accurately reflects their plant or landfilling site. (See paragraph 1 of subsection 6(1) of the EP regulation)

B.1 Weighted Cost of Capital

In the formulas, the weighted cost of capital is represented by “r”.

The weighed cost of capital is applied in both the cost avoided and cost delayed formulas because it represents the weighted average of the industry-specific investment return on money not spent on pollution control expenditures and the avoided costs of borrowing to finance these expenditures. The default weighted cost of capital used in the cost avoided and cost delayed formulas is calculated by sector, using Statistics Canada data described below.

The weighted cost of capital is a composite of the three types of rates:

- Internal Rate of Return (IRR) - a return on investment that is sufficient to attract investors (i.e. shareholders);

- Borrowing rate - a return necessary to repay its debt holders (i.e. banks); and

- Tax Rate - See B.5.

The general formula for calculating the weighted cost of capital “r” is shown below:

r = (a) * IRR + (1-a) * Borrowing Rate * (1- θ)

Where:

- “a”

- is the percent (share) of a company’s investments that are funded from internal sources of money.

“a” is calculated using the following formula:

“a” = Equity to Debt Ratio ⁄ (1+ Equity to Debt Ratio)

The Equity to Debt Ratios are specific to industrial sectors across Canada and are available from Statistics Canada, Table 33-10-0500-01, as amended from time to time.

Note: The default values used in the weighted cost of capital formula for the equity/debt ratio are based on a five year average.

- “IRR”

- is the annual (percent) return on investing money (rather than spending money on required compliance) in other activities. This return is also called the Equity Rate. The IRR values are specific to industrial sectors across Canada and are based on data available from Statistics Canada, Table 33-10-0500-01, as amended from time to time.

Note: The default values used in the weighted cost of capital formula for the internal rate of return are based on a five year average.

- “(1-a)”

- is the percent (share) of a company’s investments that are financed by borrowing.

- “Borrowing Rate”

- is the midterm corporate bond rate. This rate is obtained from Statistics Canada, Table10-10-0122-0, , as amended from time to time. The default value used in the weighted cost of capital formula for the borrowing rate is based on a five year average.

- “(1-θ)”

- is the after tax value, where “θ” is the Effective Corporate Tax Rate. See B.5 for an explanation of the tax rate.

Note: The data series used for the Internal Rate of Return, Equity to Debt Ratios and Borrowing rate use nominal rates. This means that this data includes inflation.

B.2 Inflation Rate

The inflation rate is represented in the formulas as “π”.

The inflation rate is used in the cost delayed formulas in order to adjust costs during the period of non-compliance.

The inflation rate is the weighted average of the inflation rates for machinery and non-residential construction. Weighting of machinery to non-residential construction is estimated based on the specific type of equipment whose costs were delayed.

To calculate the inflation rate to be used in the monetary benefit formulas, the first step is to derive the inflation rate per year (“π”) using the formula below.

Inflation Rate Calculation

The price index for machinery and equipment is for all industrial equipment, is reported monthly and is available from Statistics Canada, Industrial Product Price Index, Table 18-10-0265-01 , series v1230996001, as amended from time to time.

The price index for non-residential construction is reported on a quarterly basis, and is available from Statistics Canada, Table 18-10-0276-01 (selected for Toronto and total industrial structures), as amended from time to time.

πm =10^(LOG(I2 ⁄ I1) ⁄ T) − 1

πNRC = 10^(LOG(I2 ⁄ I1) ⁄ T) − 1

Where:

- πm

- is the inflation rate per year over the period of non-compliance for machinery

- πNRC

- is the inflation rate per year over the period of non-compliance for non-residential construction

- I1

- price index (for machinery or non-residential construction) at first date of non-compliance

- I2

- price index (for machinery or non-residential construction) at end date of non-compliance

- T

- non-compliance period (year)

The next step is to take the results from above and calculate the weighted inflation rate.

Weighted Inflation Rate

The weighted inflation rate formula is used when a compliance expenditure includes both machinery and construction activities. The weighted inflation rate is always used in the monetary benefit formulas.

The results of the above calculation for machinery will be inserted into the formula below as "πm"

The results of the above calculation for non-residential construction will be inserted into the formula below as "πNRC"

The weighting factor “α” is estimated based on the portion of the cost that is spent on the machinery.

Weighted inflation rate = απm + (1 − α) πNRC

Where:

- "πm"

Is the inflation rate for machinery and equipment calculated using the formula above with the price indices taken from Table18-10-0265-01 .

- "πNRC"

Is the inflation rate for non-residential construction calculated using the formula above from the price indices for non-residential construction taken from Table 18-10-0276-01.

- α

- Is the share of machinery and equipment in the total compliance cost

- 1 − α

- Is the share of non-residential construction in the total compliance cost

B.3 Useful Life of Equipment

The useful life of equipment is represented in the formulas as “L”.

The useful life is the predetermined time period during which a piece of equipment or structure is presumed to be operable.

The useful life determines the number of years in a replacement cycle. Equipment with a long useful life is replaced less frequently than equipment with a short useful life.

B.4 Depreciation Rate

The depreciation rate is represented in the formulas as “d”.

Depreciation is the rate of the decrease in value of an asset due to its physical deterioration from wear and tear, corrosion, accidents, and deterioration due to age.

Depreciation is used only in the delayed costs formulas to account for the fact that physical capital equipment deteriorates and consequently loses value over time. At the end of their useful life, the equipment must be replaced.

The equation for calculating the depreciation rate is:

d = 1 ⁄ L

Where:

- "d"

- depreciation rate

- "L"

- useful life of the asset

The delayed cost formulas use a straight-line method to calculate depreciation. This method presumes a constant rate of depreciation over the useful life of the asset. The straight line is the most widely used method for internal accounting.

B.5 Tax Rate

The tax rate is represented in the formulas as “θ”.

The tax rate is used in both the cost avoided and cost delayed formulas to adjust:

- depreciation on the equipment experienced by the compliant regulated person (depreciation is tax deductible)

- non-depreciable delayed costs

- the sum of the total avoided costs (operating and maintenance costs are tax deductible)

The tax rate is the Effective Corporate Tax Rate which is the combined federal and provincial corporate tax rate for all Ontario corporations.

θ = Ctax ⁄ Cprofit

Where:

- “θ”

- effective corporate tax rate

- “Ctax”

- corporate taxes assessed across all Ontario Corporations

- “Cprofit”

- corporate profits before taxes across all Ontario Corporations

Both corporate taxes and corporate profits are from Statistics Canada, Provincial Economic Accounts, Tables and Analytical Document, catalogue 13-213, as amended from time to time. The data used to calculate the default value for the effective corporate tax rate is the most recent year available from Statistics Canada.

B.6 Cost Estimates

Cost estimates are represented in the formula as “A” (delayed costs) “B” (cost to replace equipment / structures at the end of the useful life) and “C” (avoided costs).

In order to calculate any monetary benefit, estimates of delayed and avoided costs must be generated, obtained or provided.

Initial estimates of above-noted costs are called “base costs” and can be estimated generically by the Ministry or can be supplied by the regulated person for their facility.

Generic base cost estimates for various

In order to adjust the generic base cost estimates to a specific facility, scaling factors have also been prepared. Scaling factors include such things as: flow rate of waste streams; size of the equipment (volume, area, etc.); number of pieces of equipment.

The base cost estimates are derived using the least cost method to comply.

Appendix C: Sample Calculations

C.1 Sample Calculation using Formula I (Delayed Cost)

A facility had an environmental compliance approval which required an upgrade of the wastewater treatment system including the installation and operation of a carbon adsorption unit by January 1, 2006 but the system was not functional until July 1, 2006.

| Variables | Values |

|---|---|

Non-Compliance Period (“T”)

| 182 days (6 months) |

| Capital cost for purchase and installation (“A”) | $1,000,000.00 |

| Useful life of equipment (“L”) | 20 years |

Depreciation rate (“d”) (1 ⁄ Useful Life)

| .0137% |

| Tax rate (“θ”) | 36% |

| Weighted Cost of Capital (“r”) Annual: 7% Daily: (1 + 7%)1 ⁄ 365 − 1 = .018% | .018% |

| Inflation rate (“π”) Annual: 2.5% Daily: (1 + 2.5%)1 ⁄ 365 − 1= .007% | 0.007% |

Calculation

MB = A(1 + r)T − A(1 + π)T + A × d × T(1 + π)T − A × d × θ [((1 + r)T − 1) ⁄ r]

=$1,000,000(1 + .00018)182 − $1,000,000(1 + .00007)182 + $1,000,000 × .000137 × 182(1 + .00070182 − $1,000,000 × .000137 × .36 [((1 + .00018)182 − 1) ⁄ .00018]

Monetary benefit = $38,036.00 for 182 days of violation or $208.99 per day

C.2 Sample Calculation using Formula III (Delayed Cost)

A facility was required to develop a spill contingency plan by January 1, 2005 but did not do so until January 1, 2006.

| Variables | Values |

|---|---|

Non-Compliance Period (“T”)

| 365 days |

| Non-depreciable cost of a spill contingency plan (“A”) | $22,000.00 |

| Tax rate (“θ”) | 36% |

| Weighted Cost of Capital (“r”) Annual: 7% Daily: (1 + 7%)1 ⁄ 365 − 1 = .018% | .018% |

| Inflation rate (“π”) Annual: 2.5% Daily: (1 + 2.5%)1 ⁄ 365 −1= .007% | 0.007% |

Calculation

MB = A(1 − θ) [(1 + r)T − (1 + π)T

= $22,000 (1 − .36) [(1 + .00018)365 − (1 + .00007)365

Monetary benefit = $634.00 for 365 days or $1.74 per day

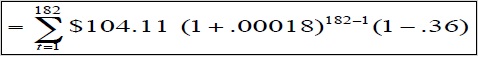

C.3 Sample Calculation using Formula IV (Avoided Costs)

An inspection of a metal mine determined that the sampler had broken on July 1, 2005 and was not repaired and brought back into service until Jan 1, 2006. The environmental compliance approval requires sampling for total metals including arsenic 400 times/year for the mine.

| Variables | Values |

|---|---|

Non-Compliance Period (“T”)

| 182 days |

Total annual cost (“C”)

| $104.11 ⁄ day |

| Tax rate (“θ”) | 36% |

| Weighted Cost of Capital (“r”) Annual: 7% Daily: (1 + 7%)1 ⁄ 365 −1 = .018% | .018% |

| Inflation rate (“π”) Annual: 2.5% Daily = (1 + 2.5%)1 ⁄ 365 −1 = .007% | 0.007% |

Calculation

Monetary benefit = $12,332.42 over 182 days of violation or $67.76 per day

Footnotes

- footnote[1] Back to paragraph The monetary benefit amount is displayed in per day amounts for illustrative purposes only. The total EP cannot exceed $100,000 per day.

- footnote[2] Back to paragraph The monetary benefit amount is displayed in per day amounts for illustrative purposes only. The total EP cannot exceed $100,000 per day.

- footnote[3] Back to paragraph The monetary benefit amount is displayed in per day amounts for illustrative purposes only. The total EP cannot exceed $100,000 per day.