Progress Report 2014: pocketbook initiatives

The Ontario government has taken significant steps to help people in their everyday lives and lower the cost of living — especially for middle-income families. Ontario’s 2014 Pocketbook Progress Report highlights achievements that are helping to protect people across the province, such as:

- moving forward with a made-in-Ontario plan to improve retirement security

- strengthening consumer protection measures

- increasing the minimum wage

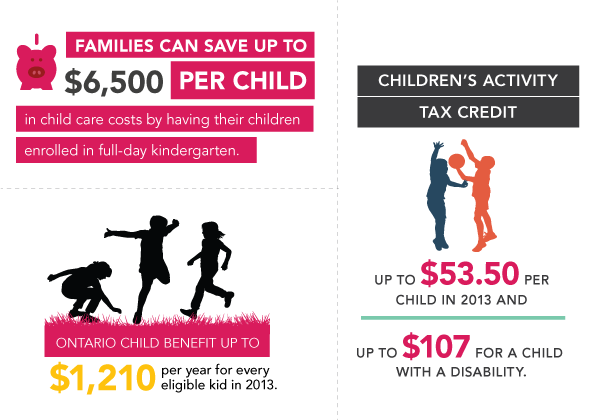

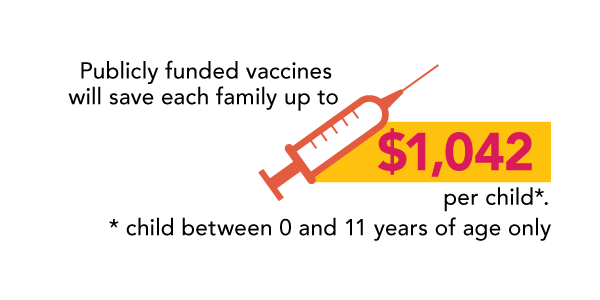

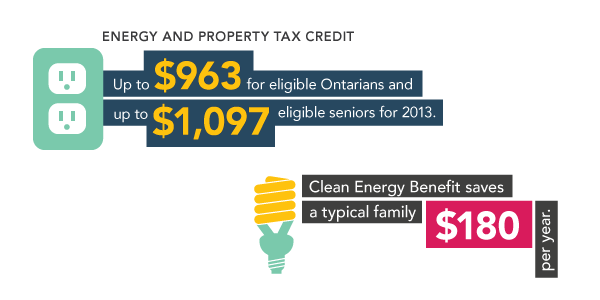

Graphic: The average two-income family is paying $360 less in income tax this year compared to 2009. A 2013 Sales Tax Credit up to $278 per person. Energy and Property Tax Credit up to $963 for eligible Ontarians and up to $1,097 eligible seniors for 2013. Clean Energy Benefit saves a typical family $180 per year. Land Transfer Tax Rebate up to $2,000 for 1st time home buyers. Ontario Child Benefit up to $1,210 per year for every eligible kid in 2013. Children’s Activity Tax Credit up to $53.50 per child in 2013 and up to $107 for a child with a disability.

Pocketbook initiatives

Ontario families are busy. Whether working hard to make ends meet, shuttling children from school to Little League, caring for aging parents or launching grown children, families face more pressures than ever as they try to balance the household budget and save for the future. Individuals and families who are financially squeezed are the first victims of these pressures, but we all suffer when fellow Ontarians fall behind.

The government wants to build a thriving economy in every part of the province and help people to live happier, healthier and longer lives. We want people to feel optimistic about their own future and that of the province, not constrained by a lack of support or resources. That’s why we’ve worked to alleviate people’s everyday financial pressures and, through a variety of means, create conditions that relieve people’s long-term concerns for an affordable retirement, a clean environment and good jobs for their children.

Our government will continue to make people’s everyday lives better and more affordable — particularly for middle-income earners and their families. By ensuring fair wages, better accessibility to postsecondary education and by strengthening the social safety net, we’re helping families. In this way, we strengthen communities and grow the economy.

Assistance for families

Our government is focused on investing in our people — this includes giving families a helping hand so parents can put their skills to work, and ensuring every child in Ontario has the opportunity to reach their full potential.

Full-day kindergarten

Ontario’s full-day kindergarten program is giving children the best possible start in school by preparing them for success in Grade 1 and beyond. It can also save families thousands of dollars a year in child care costs.

In 2013–14, more than 184,000 children are enrolled in full-day kindergarten at approximately 2,600 schools across Ontario. Once fully implemented in September 2014, full-day kindergarten will be available to about 260,000 four- and five-year-olds across Ontario. For every child enrolled in full-day kindergarten, families can save up to $6,500 in child care costs.

Child care

Licensed spaces in child care centres have increased by approximately 107,400 over the past 10 years — there are now nearly 300,000 spaces in licensed child care centres in Ontario. To improve quality and capacity, we’ve increased funding for child care by 90 per cent since 2003.

Ontario also stepped in with an investment of $63.5 million a year to permanently fill the funding gap left by the federal government, which at the time, preserved approximately 8,500 child care spaces and helped 1,000 child care workers keep their jobs. We’ve also made funding more responsive to local needs, so families have more options closer to home.

Ontario Child Benefit

The Ontario Child Benefit (OCB) pays monthly support to low- to- moderate- income families — whether they are working or not — to help them provide for their children. Eligible families are automatically qualified when they file their taxes, and receive monthly OCB payments along with federal payments.

In the 2013 Budget, we increased the OCB by $110 so that eligible families now receive up to $1,210 per year for each child, and we passed legislation to increase the OCB to $1,310 starting July 2014.

Children’s Activity Tax Credit

The Children’s Activity Tax Credit helps parents with the cost of registering children in organized activities, such as sports, music and language lessons.

To keep up with the rising cost of children’s activities, we’ve indexed the credit to inflation. For 2014, the credit provides up to $54.10 per child and up to $108.20 for a child with a disability.

Adoption subsidies

Ontario provides financial subsidies to eligible parents who adopt or take legal custody of Crown wards 10 years of age and over, or siblings. The subsidies are available through Children Aid Societies to families with a net annual income of up to $85,000. Eligible families receive subsidies in the amount of $950 per month per child or $11,400 per year per child.

Family law reform

Since 2011, Ontario has implemented significant reforms to strengthen the family justice system and to help make the system easier to use, less confrontational and more affordable. A new approach to settling family disputes is helping more Ontario families avoid the courtroom in favour of an early, affordable, out-of-court resolution.

The 2013 Budget allocated $30 million over three years to improve the delivery of frontline client services through Family Law Service Centres and community and legal clinics. In the first year, 70 per cent of the new funding is being used to help more low-income families access legal advice, duty counsel and mediation services. For example, Legal Aid Ontario has used some of the funding to launch a mediation pilot project in 14 communities around the province, expanding access to justice to low-income Ontarians.

Helping people pay for postsecondary education

Parents want to see their children grow up to be happy and successful in life. In today’s world, success depends on having a postsecondary education.

The government remains committed to making postsecondary education accessible based on students’ ability to learn, not their ability to pay. We don’t want parents to have to choose between saving for retirement and saving for their children’s education, and we can’t let bright young minds miss their chance at success just because they cannot afford tuition. We’re investing in the success of the province’s youth by continuing to support programs that help students access a world-class postsecondary education, pursue their passions and, through their successes, contribute to the 21st-century economy.

In 2003, deregulated tuition put the cost of postsecondary education out of reach for too many students and their families. We put a cap on tuition increases, and made sure college and university remain affordable by enhancing student financial assistance. Today, Ontario has one of the most generous student assistance programs in the country, with more than 370,000 students receiving financial aid in 2012–13 — more than half of the full-time student population.

We have also introduced a Student Access Guarantee to ensure that every qualified Ontario student in need has access to the resources they need to pay for their tuition, books and mandatory fees, through government and institutional aid programs.

30% Off Ontario Tuition Grant

The 30% Off Ontario Tuition Grant is helping to make postsecondary education more affordable for Ontario families, and putting more money in people’s pockets for essentials like textbooks or housing.

The grant helps postsecondary students from low- and middle-income families save up to $1,730 on tuition in degree programs and $790 for students in diploma or certificate programs. Many recipients of the 30% Off Ontario Tuition Grant actually pay less tuition than students paid ten years ago, in inflation-adjusted dollars.

When it was launched two years ago, the 30% Off Ontario Tuition Grant helped 207,000 students with the cost of their education. In 2012–13, the grant helped about 230,000 students. In 2013, Ontario expanded eligibility to students at OSAP-approved private institutions in Ontario, and students in the final year of five-year co-op programs. About 5,000 more students will benefit from extra support.

Fairer fees

In December 2013, the government established a fairer, more consistent approach to tuition billing at colleges and universities that will save students money and create a more flexible and transparent fee system.

Starting in the 2014–15 academic year:

- tuition fees for a fall term will not be due before the beginning of August

- students receiving financial aid will not have to pay tuition until their classes start

- all students will be able to pay tuition in per-term instalments without paying deferral fees or interest charges

- colleges and universities may continue to charge a deposit on tuition, but it will be capped and must be applied against the student’s tuition fee balance

Ontario Distance Grant

Ontario continues to support students from remote and rural Ontario areas with their commuting and travel costs with the Ontario Distance Grant.

In 2012–13, Ontario provided $5 million in distance grants to support the educational aspirations of 13,000 students from remote and rural areas.

Beginning in 2013–14, OSAP-eligible Francophone students who attend full-time studies in French are eligible for Ontario Distance Grants, even if there is another institution closer to home. This expanded eligibility criteria is expected to benefit an additional 1,000 Francophone students this year.

More spaces

Since 2002–03, there are 161,000 more spaces at Ontario’s colleges and universities. Not only has this increased postsecondary enrolment by 40 per cent and helped Ontario achieve the highest postsecondary attainment rate in the OECD, it has also helped students and their families save money by reducing the need to relocate to study in a program of their choice.

Ontario Student Opportunity Grant

The Ontario Student Opportunity Grant limits a student’s annual repayable OSAP debt to $7,300 for a two-term academic year, and $10,950 for a three-term academic year. No matter how much a student borrows, Ontario limits the amount a student needs to repay each year after his or studies have ended.

Youth leaving care

The Living and Learning Grant helps students enrolled in full-time postsecondary studies, aged 21 to 24, who were previously eligible for the Continued Care and Support for Youth allowance (or Extended Care and Maintenance allowance) from their Children’s Aid Society. This grant provides $500 per month of study to help cover living costs.

Starting in September 2013, the government partnered with all Ontario universities and a third of the province’s colleges to cover 100 per cent of tuition fees, up to a maximum of $6,000 per year, for former Crown wards and youth who are in and leaving care.

Extending interest-free grace periods/pre-study contributions

As of September 2012, student loan borrowers who choose to work or volunteer for not-for-profit organizations do not have to start paying off their loans until one full year after their studies. And as of fall 2013, borrowers who start a new business in Ontario do not have to start paying off their loans for one full year. The same grace period will also apply to students who volunteer for the Toronto 2015 Pan/Parapan American Games.

Health care

Excellent health care is one of our government’s fundamental responsibilities. Our health determines our quality of life. When we’re healthy, we can spend more time with loved ones, participate in our community, start a business or go back to school. We will continue to help families by expanding care and by lowering the cost of staying healthy.

Ontario is helping families manage their health care costs by:

- reducing generic drug prices, providing private drug plans and cash-paying recipients up to $265 million in savings in 2013

- expanding access to home care for 76,000 more seniors over the past two years

- enhancing access to publicly funded physiotherapy, exercise and fall-prevention services for more than 200,000 additional seniors and eligible patients

- delivering about 765,000 free flu shots through trained pharmacists during the 2013/14 flu season

- expanding eligibility for free dental care to up to 70,000 more children and youth in low-income families beginning in April 2014, bringing savings of up to $400 annually in dental costs to more than 460,000 families eligible for dental treatment through the province’s low-income dental programs

- increasing funding for Community Care Access Centres (CCACs) by more than $1 billion — and now our CCACs are helping more than 650,000 people find the care they need

- funding 21 different (routine and non-routine) vaccines that protect us against 16 diseases — up from eight routine vaccines in 2003. The total cost savings for an individual in Ontario, who starts his/her immunization in infancy and receives all eligible routine vaccines, is about $2,545 per person, if paid out of pocket

- helping people pay for treatments to quit smoking. In 2012–13, we expanded support for smoking cessation and more than 15,000 smokers received no-cost nicotine replacement therapy and counselling through primary care and public health; 8,400 Ontario Drug Benefit recipients received smoking cessation counselling from a community pharmacy; and, 58,800 Ontario Drug Benefit recipients received smoking cessation prescription medications

- assisting Ontarians who need to purchase devices and supplies through the Assistive Devices Program (ADP), including mobility devices, home oxygen and hearing aids. In 2013/14 alone, ADP expenditures amounted to $437.9 million. Without ADP funding, people with long-term physical disabilities would have to pay 100 per cent of the cost of devices and supplies or forgo the independence that the equipment gives them

- becoming the first province to fully fund insulin pumps for children and youth with type 1 diabetes. This is saving families up to $18,300 per child in the first 5 years. To date, Ontario has provided approximately 13,700 Ontarians with funding for the purchase of insulin pumps

Seniors

Older Ontarians have helped to build our province, and their contributions continue to be wide-ranging and significant. They are volunteers, mentors, leaders, caregivers and skilled workers who offer their experience to their families, workplaces and communities.

That’s why our government is working to provide seniors and their families with the programs and services they need to remain healthy, safe, independent and active, and to reduce the financial and social burden on families caring for both aging parents and young children.

Healthy Homes Renovation Tax Credit

The government created the Healthy Homes Renovation Tax Credit to help seniors stay in their homes longer. Seniors can claim up to $1,500 each year for home renovations that increase their safety and mobility. Individuals who live with a senior family member can also claim this credit.

Seniors Homeowners’ Property Tax Grant

The grant provides up to $500 a year to help low- to moderate-income senior homeowners with the cost of property taxes.

Helping seniors get the care they need at home

Ontario is ensuring seniors have better access to home care and community supports so they can live independently in their homes longer, saving seniors and their families money on long-term care homes and day-to-day trips to the doctor. The 2013 Budget provided a $260-million increase in supports to programs across the province that help 637,000 seniors and their families get the right care, in the right place, at the right time. $185 million of this new funding has gone specifically to home care to help an additional 46,000 seniors benefit from home care while reducing wait times for home care patients with complex needs who require nursing and personal support worker services.

Improved driver’s licence renewal for seniors

Starting April 21, 2014, drivers 80 -years -old and over will participate in a shorter, simpler licence renewal program.

Seniors Community Grant Program

This new grant provides $500 to $10,000 to not-for-profit community groups for projects that encourage greater social inclusion, volunteerism and community engagement for seniors across the province.

New Canadians

Immigration is essential for Ontario to remain competitive in today’s global economy. Every week, more than 1,900 newcomers arrive in Ontario to start a new life, and many of them are leaving their loved ones behind.

Our government is working to ensure immigrants to Ontario have the tools they need to succeed so they can build strong roots, raise healthy families and contribute to our province’s economic success.

Newcomer settlement and integration

The Newcomer Settlement Program helps recent immigrants adapt and succeed in Ontario. The program is delivered by a province-wide network of community-based not-for-profit agencies that provide newcomers with information, guidance and support as they establish their new lives here.

Since 2003, the government has invested $900 million in programs and services to help newcomers settle, get job-ready and licensed to work, including $73 million in the Newcomer Settlement Program.

As part of that investment, Ontario is providing $17.9 million over two years to 98 settlement agencies across Ontario to help more than 80,000 newcomers annually access settlement supports. This investment includes support for the development and implementation of a new Orientation to Ontario program.

The Ontario Bridge Training Program

Since 2003, the government has invested more than $240 million in more than 300 Bridge Training programs that have helped nearly 50,000 highly skilled immigrants get the training they need to find a job in their fields of expertise.

Over the next three years, Ontario will increase its investment in the Ontario Bridge Training Program to more than $63 million, which will help an estimated 15,000 additional newcomers. The federal government will contribute $16.6 million over the same period.

Language training

We’ve invested approximately $578 million in adult non-credit language training since 2003. This year, nearly 120,000 immigrants will enrol in adult ESL / FSL training to help them improve their English and French skills. We have also invested nearly $10 million in 81 projects that have provided job-specific language training to nearly 8,000 immigrants.

We have expanded our English as a Second Language (ESL) program to immigrants whose first language is French, increasing opportunities for people to access tuition-free language training to support their social integration and success in the job market.

Energy

In 2003, the province had an aging electronic system in which coal accounted for 25 per cent of Ontario’s generation, contributed to higher emissions and costly brownouts.

Today, Ontarians are benefitting from a modern, clean and reliable energy system. The province has fulfilled its commitment to eliminate coal-fired electricity generation, and Ontario is coal free. Doing the necessary work to build a cleaner, more efficient electricity system and ensure the lights stay on has come with additional costs. We’re helping Ontario families manage rising costs as we continue the transition to cleaner power.

Ontario Clean Energy Benefit

The Ontario Clean Energy Benefit provides a 10 per cent rebate on applicable electricity charges and taxes for eligible residential consumers, small businesses and farms on the first 3,000 kilowatt hours of consumption.

Ontario Energy and Property Tax Credit

The province is helping low- to -moderate-income Ontarians by providing tax relief for the sales tax on energy, including electricity, and for property taxes through the Ontario Energy and Property Tax Credit.

It provides up to $973 for low-to moderate-income individuals and families and up to $1,108 for eligible seniors for the 2014 benefit year.

Ontario’s Low-Income Energy Assistance Program (LEAP)

Ontario’s Low-Income Energy Assistance Program provides emergency financial assistance, targeted customer service rules and energy conservation programs to eligible low-income consumers.

Eligible consumers can receive up to $600 of emergency financial assistance once a year in the form of grants applied directly to electricity and natural gas bills.

Northern Ontario Energy Credit

The Northern Ontario Energy Credit helps qualifying low- to -moderate income individuals and families living in Northern Ontario with energy costs by providing individuals -18 -years -old and older with a credit of up to $141, and families, including single parents, with up to $216 for the 2014 benefit year.

Consumer protections

Our government is helping Ontario consumers make informed choices, spend wisely and protect their hard-earned money. We are working to ensure a fair, safe and informed marketplace. This includes new legislation to help make all cell phone/wireless services agreements easier to understand and walk away from, providing more safeguards in door-to-door sales, ensuring debt-settlement services are fair and our plan to make auto insurance more affordable for all Ontarians.

Wireless Services Agreements Act

This new legislation came into effect April 1, 2014, and will help the 80 per cent of Ontario families who have cell phone/wireless services agreements.

It requires clearly written, easier-to-understand contracts with no hidden fees, customer consent before contracts are amended, as well as lower contract cancellation fees. Wireless customers are now in a better position to compare costs and services in the marketplace.

Stronger Protection for Ontario Consumers Act

This recently passed legislation will strengthen consumer protection and increase consumer rights for Ontario families across a wide range of common or everyday marketplace transactions, including door-to-door sales, debt settlement services and real estate sales.

We’ve taken further steps to save people money by making sure Ontarians know about their enhanced consumer protections and rights.

Bill 146, The Stronger Workplaces for a Stronger Economy Act, 2014

Ontario introduced this legislation to take important steps to ensure that everyone gets the paycheque they have earned and provide more protection to the province’s vulnerable workforce, while increasing fairness for both employees and businesses.

If passed, the Stronger Workplaces for a Stronger Economy Act would protect vulnerable workers while creating a level playing field for companies that follow the rules by:

- eliminating the $10,000 cap on the recovery of unpaid wages and increasing the period of recovery from six and 12 months to two years for employees. This would help keep more disputes out of the court system, saving both employees and businesses time and money

- making clients of temporary help agencies share liability with agencies for certain employment standards violations

- prohibiting employers from charging recruitment and other fees and seizing personal documents like passports by extending the application of the Employment Protection for Foreign Nationals Act (Live-in Caregivers and Others), 2009 to cover all foreign employees who come to Ontario under an immigration or temporary foreign employee program

Auto insurance

In 2013, the government established an auto insurance average rate reduction target of 15 per cent, to be achieved by August 2015, and introduced the Auto Insurance Cost and Rate Reduction Strategy. We have already made progress toward an interim average reduction target of 8 per cent by August 2014. In fact, approved rates have dropped by 5.7 per cent on average between August 2013 and April 2014.

The government will continue to take new steps to make auto insurance more affordable, to fight fraud and abuse, and protect consumers.

In March 2014, the government introduced Bill 171 (Fighting Fraud and Reducing Automobile Insurance Rates Act, 2014), which would reduce costs and uncertainty in the auto insurance system and help accident victims settle disputed claims faster.

In April 2014, the government introduced legislation that would, if passed, regulate the towing and vehicle storage industries and help save over nine million drivers money when having their vehicle towed or stored.

Ontario is also proposing to include tow trucks in the province’s existing Commercial Vehicle Operator’s Registration system to improve road safety through government monitoring and enforcement measures. The proposed changes and additional oversight would contribute to lower costs in Ontario’s auto insurance system.

Online driver’s licence renewal

In September 2013, Ontario became the first province in Canada to provide drivers with an online driver’s licence renewal service. Now, eligible Ontario drivers can save time by renewing their licence at their convenience.

As of March 2014, more than 60,000 drivers have successfully renewed their licence online.

Other initiatives

Retirement security

Ontario is leading the way to develop a made-in-Ontario pension solution that will help people retire with better security.

More than 35 per cent of households are not saving enough to ensure a similar standard of living in retirement, and in 2012, 66 per cent of Ontario’s workers did not belong to a workplace pension plan.

Ontario’s Technical Advisory Group on Retirement Security, which is comprised of leading pension experts from the public, private and non-profit sectors and also includes representation from PEI and Manitoba, is currently looking at a range of options to enhance retirement savings so that Ontarians can afford the retirement they’ve worked so hard for.

Increased minimum wage

In 2003, Ontario’s lowest earners had not received a raise in 9 years — minimum wage was stuck at $6.85 an hour. Since then, we’ve increased minimum wage to $10.25 an hour, and will increase it to $11 an hour on June 1, 2014. That’s an increase of 60 per cent since 2003.

For full-time workers on minimum wage, it’s a raise of $8,092.50 a year since 2003.

To help businesses plan for future increases and make sure minimum wage doesn’t fall behind again, we’ve introduced legislation that would, if passed, tie annual increases in minimum wage to inflation.

Social assistance

Over the past 10 years, the government has reaffirmed its commitment to supporting families and individuals on social assistance. Social assistance rates have increased by 16 per cent for Ontario Works families and individuals with disabilities, and by 18.7 per cent for single people without children receiving Ontario Works benefits. We have modernized the program rules to help people enter the work force.

Changes announced last year include:

- raising the amount recipients can earn without reducing their assistance to $200 a month. This will help clients to gain a foothold in the labour force, improve their incomes and move toward greater independence

- increasing support by 1 per cent for all Ontario Works recipients and individuals with disabilities receiving Ontario Disability Support Program (ODSP) benefits. Single adults without children receiving Ontario Works benefits received an additional $14 per month, for a total increase of $20 a month, or about 3 per cent

- increasing the amount of assets Ontario Works clients are allowed to retain, such as bank savings or a car, so clients won’t have to give up everything they own before they can get help

Affordable housing

Since 2003, Ontario has invested nearly $3 billion towards affordable housing — that’s the largest investment in the province’s history.

Through this, we’ve supported:

- the creation of over 17,000 affordable rental housing units

- more than 263,000 repairs and improvements to social and affordable housing units

- provided rental and down payment assistance to more than 81,000 households in need

As part of our government’s Poverty Reduction Strategy, we created the Long-Term Affordable Housing Strategy — the first of its kind in Ontario.

The Strong Communities Rent Supplement Program provides $50 million in long-term annual funding, assisting more than 6,700 households.

Tackling homelessness

On January 1, 2013, Ontario launched the Community Homelessness Prevention Initiative, which provides funding for services that prevent, address and reduce homelessness across the province.

For 2013–14, the province invested $246 million to assist individuals and families who are homeless or at risk of homelessness, including those who are on social assistance and those with low incomes.

For 2014–15, the government’s investment is $251 million.

Protecting tenants

In June 2012, the government passed the Residential Tenancies Amendment Act (Rent Increase Guideline), which revised the Rent Increase Guideline formula to limit rent increases to no more than 2.5 per cent. This amendment helps struggling families cope by giving them certainty about their monthly rent.

The 2014 Rent Increase Guideline is 0.8 per cent, the second-lowest guideline in the history of rent regulation in Ontario.

Personal income tax bracket rate

Ontario’s lowest personal income tax bracket rate was reduced from 6.05 per cent to 5.05 per cent on January 1, 2010. This tax cut benefitted 93 per cent of personal income tax filers in Ontario and helped 90,000 low-income Ontarians by no longer requiring them to pay personal income taxes to the province.

Second Career

Second Career provides laid-off, unemployed workers with skills training to help them find jobs in high-demand occupations in Ontario. The program helps pay the cost of tuition, books, living expenses and other expenses associated with training for a new career. Ontario has helped more than 74,000 Ontarians participate in training by providing up to $28,000 per person based on individual need.

Training for vulnerable women

The Women in Skilled Trades and Information Technology (WIST/IT) training program gives low-income women the training they need to get better-paying jobs. In the current WIST/IT 2012–2014 program, more than 350 women have participated in training.

The new Microlending for Women in Ontario Program is helping low-income women build and grow their own businesses. It provides training over three years to an anticipated 800 low-income women in the skills needed to start and run a business.

Additionally, the Employment Training for Abused/at-Risk Women Program is helping women enhance their employment potential, find jobs and support their economic security. For the 2013–2015 program, more than 600 abused/at-risk women are expected to participate in employment training.

Ticket Speculation Act

In 2010, Ontario passed legislation to strengthen consumer protection by ensuring Ontarians have fair access to tickets for their favourite concerts, sporting events and theatrical performances.

The law ensures that companies, brokers or agents cannot withhold popular event tickets from sale on the primary market in order to sell them through a related company at a higher price on the secondary market.

Drive Clean

Beginning April 1, 2014, Ontario drivers will pay $5 less for their Drive Clean emissions tests.

From 1999 through 2010, smog-causing emissions of nitrogen oxides and hydrocarbons from light-duty vehicles were reduced by an estimated 335,000 tonnes. And during the same period, the light-duty program also reduced emissions of carbon monoxide by about 3.18 million tonnes and carbon dioxide, a key greenhouse gas, by more than 296,000 tonnes.

Paralegal regulation

In 2007, Ontario became the only jurisdiction in Canada to regulate paralegals. More than 5,500 paralegals are now licensed and insured in Ontario, resulting in a more efficient legal services market for consumers.