We're moving content over from an older government website. We'll align this page with the ontario.ca style guide in future updates.

Contaminated fuel procedures

Bulletin FT 1-2010

Published: July 2010

Content last reviewed: July 2012

ISBN: 978-1-4249-7844-1 (Print), 978-1-4249-7846-5 (PDF), 978-1-4249-7845-8 (HTML)

- The information in this bulletin is for bulk fuel purchasers and others with fuel storage such as farms, construction firms, trucking firms, service stations, bulk plants, and transporters. Also provided are the procedures to follow in the event of fuel contamination and a listing of who to contact for assistance throughout the province from the Ministry of Finance.

- This bulletin provides general information only and does not replace the Fuel Tax Act and its regulations.

Fuel Tax refund may be available

Service stations, bulk plants, transporters and purchasers with fuel storage, such as farms, construction and trucking firms, may be eligible for a refund of tax when fuel has become contaminated. If clear and coloured fuels become accidentally mixed, the Fuel Tax Act may permit a refund of fuel tax paid or payable on the clear fuel portion. However, selling the mixed (contaminated) fuel or dispensing it to licensed motor vehicles may result in prosecution.

For more information about tax refunds on contaminated fuel, please review Ontario Tax Bulletin FT/GT 2-99 Tax Refunds: Bad debts and lost, destroyed, stolen or contaminated product.

What to do

To avoid having to pay fuel tax or a penalty related to the contaminated fuel, or liability for prosecution, dealers and others in possession of contaminated fuel must follow ministry guidelines.

If clear fuel is delivered into coloured fuel, or if coloured fuel is delivered into clear fuel, immediately do the following:

- If the fuel delivery is still in progress, stop loading or unloading the fuel to minimize the contamination;

- Quarantine and put the contaminated storage tank and pump or nozzle "out of service";

- Notify the Ministry of Finance (see contact information below)

- Record the plate number and vehicle description, driver's name and phone number for any licensed motor vehicles supplied with the contaminated fuel;

- Take a volume measure "dip reading" of the contaminated storage tank;

- If clear fuel storage is affected, quarantine or return the contaminated product to the supplier;

- If coloured fuel storage is affected, do not use until authorized to do so by the Ministry;

- If tank is refilled, take a further "dip reading" when completed;

- Obtain and keep the following information and documents for the ministry to collect at the time of inspection:

- Fuel delivery invoice/Bill of Lading;

- All dip readings including of the tank contents before the mistaken delivery;

- A record of the date and time of the delivery;

- A record of contaminated fuel sold or dispensed after the delivery;

- Details of motor vehicles fueled with contaminated fuel;

- Receipt or invoice for the tank pump out and, if applicable, disposal of the product;

- Fuel delivery invoice or Bill of Lading for the replacement fuel, if any.

Ministry contact information

In the information that follows you will find the name and phone number of your Ministry contact and an alternate. If neither is available be prepared to leave a message with the following information:

- Your name;

- Company name, address and phone number;

- Date, time and location of the contamination;

- Tank number(s) involved;

- Nature of the contamination i.e., the types and respective volumes of the fuels involved;

- If any, how much contaminated fuel was sold or dispensed to licensed motor vehicles before the contamination was discovered.

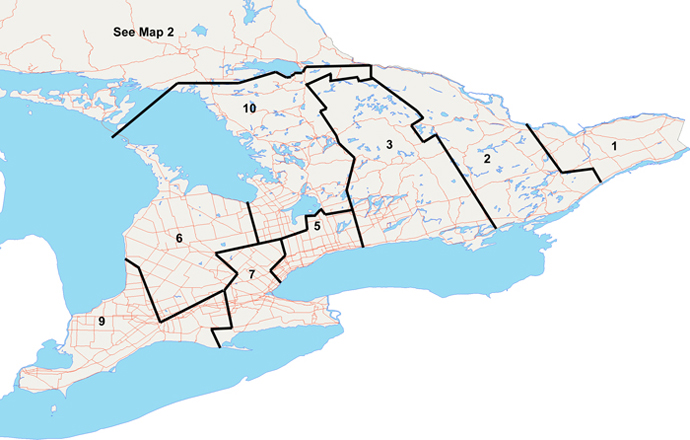

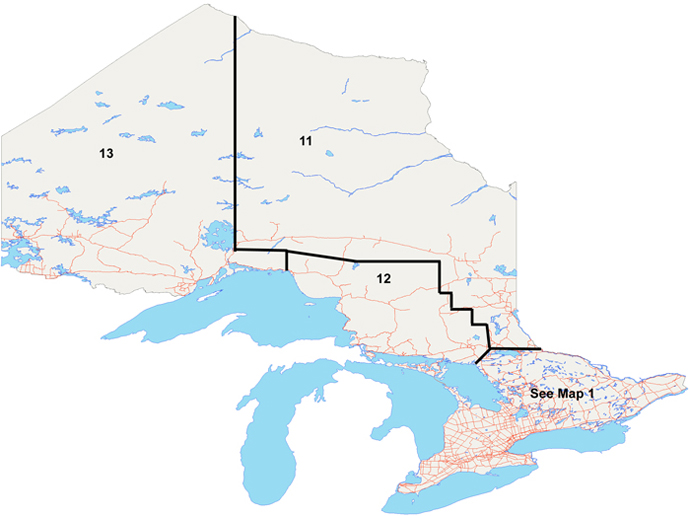

Find your district on the map below and your contact in the list that follows:

Districts

District 1

North: Ottawa River.

South: St. Lawrence River.

East: Quebec.

West: From Arnprior then south along Hwys 29 and 15 to Smith Falls, east to Spencerville and south along Hwy 416 to the United States border.

District 2

North: Ottawa River from Arnprior to the west boundary of Renfrew County.

South: St Lawrence River from Hwy 416 to Sandhurst on Lake Ontario (southeast of Napanee)

East: Hwy 416 north to Spencerville, west to Smith Falls, north on Hwy 15 and 29 to Arnprior.

West: From Sandhurst on Lake Ontario north to Napanee and along the west boundaries of Lennox and Addington and Renfrew counties north to Algonquin Park. North across the park to Nipissing's east border and to Quebec.

District 3

North: North boundary of Algonquin Park.

South: Lake Ontario.

East: From the east peninsula of Quinte (off Sandhurst) and north along Hastings County from Napanee to Barry's Bay. Along the Renfrew west boundary to Algonquin Park and across the park to the west limit of Renfrew.

West: South along the west park border, south on Hwy 60 then Hwy 35 to Lake Ontario.

District 5

East: Hwy 35 from Lake Ontario to Lindsay.

North: Hwy 7 west from Lindsay to Hwy 12. North to Beaverton and west along south shore of Simcoe to Cook's Bay.

West: South on Regional Road 12 to Regional Road 31. West to the 407. South along 407 to Lake Ontario at Oakville.

Contact Inspector Peter Ferkl at 905 244-0275

District 6

North: Tobermory.

West: Lake Huron.

South: From Goderich southeast on Hwy 8 to Clinton then south on Hwy 4 thru London to 401 exit 186, east on Hwy 401 to exit 268 beyond Ayr.

East: From Hwy 9 at Mono Mills north on regional road 18 and 43 to Hwy 26 at the beach.

Contact Inspector Ken Henderson at 519 281-7819

District 7

North: Hwy 109 and Hwy 9 from Arthur to Schomberg.

South: Lake Erie east of Long Point.

West: Hwy 59 from Long Point to Hwy 3. East on 3 to Simcoe then north on 24 to the 401. North at Hespeler to Hwy 6 to Arthur.

East: From Lake Ontario and Hwy 427 at Oakville north via Hwy 407 then Hwy 27 north to Hwy 9.

Contact Inspector Ken Henderson at 519 281-7819

District 9

South: Lake Erie west of Long Point.

West: United States border.

North: From Goderich southeast on Hwy 8 to Clinton then south on Hwy 4 thru London to 401 exit 186, east on Hwy 401 to exit 268 beyond Ayr.

East: South along regional road 15 and Hwy 24 to Simcoe, west on Hwy 3 to Courtland and south on Hwy 59 to Lake Erie.

Contact Inspector Ken Henderson 519-281-7819

District 10

West: Hwy 26 from Nottawasaga Bay, south on regional roads 42 and 18 to Hwy 9.

South: From Mono Mills east on Hwys 9 and 31 to regional road 12, north to Lake Simcoe and east along the south shore to Beaverton. South on Hwy 12 and east on Hwy7 to Lindsay.

East: Hwy 35 north to Hwy 60 to west and north boundaries of Algonquin Park to Renfrew. North to Hwy 17.

North: South of and along Hwy 17 and the south shore of Lake Nipissing and the French River to Georgian Bay.

Contact Inspector Peter Ferkl at 905 244-0275

District 11

All of Nipissing, Timiskaming, and Cochrane Districts. That part of Thunder Bay District east of 88° longitude and north of Manitouwadge. That part of Algoma District north of the Chapleau Crown Game Preserve.

Contact Inspector Julie Bernard at 705 272-8271

District 12

All of Sudbury District. That part of Thunder Bay District east of Marathon and south of Lake Manitouwadge. That part of Algoma District south of Oba.

Contact Inspector Julie Bernard at 705 272-8271

District 13

All of Thunder Bay District west of 88° longitude or west of Marathon on Hwy 17, and south of Kagiano Lake. All of Kenora, Rainey River and Central Patricia Districts.

If the Inspector above is unavailable, call the Ministry of Finance Field Operations Manager, at 519 671-6378.

You must contact the ministry without delay. Please note that failure to contact the Ministry immediately may result in having to pay fuel tax or a penalty related to the contaminated fuel, or liability for prosecution. Calls after hours, on weekends and on holidays will be responded to on the next business day.

Additional Information

If this bulletin does not completely address your particular situation, refer to the Fuel Tax Act and related regulations, visit our website at ontario.ca/finance or contact:

Ministry of Finance

Investigations and Inspections Branch

Inspections Section

33 King Street West

Oshawa ON L1H 8H9

Telephone

- 1 866 ONT-TAXS (1 866 668-8297)

- Fax: 905 436-4507

- 1 800 263-7776 for teletypewriter (TTY)