This page was published under a previous government and is available for archival and research purposes.

A Reliable and Clean Supply

While Conservation First is an important element of the LTEP, a clean, reliable and affordable supply of electricity also requires a diversity of generation types. Ontario will continue to develop new sources of supply to ensure that we reach these goals.

Nuclear

Ontario has made important investments in nuclear generation. The Canadian Manufacturers and Exporters reports that 15,600 people are employed in the operation and support of nuclear plants in Ontario, and 9,000 more would be employed for the refurbishment of the Ontario plants, for a total employment of approximately 25,000 people during the refurbishment period. The Organization of Canadian Nuclear Industries reports that an additional 30,000 people are employed in the nuclear manufacturing, engineering, construction and consulting, fuel fabrication, research and development, and medical isotopes sectors, in support of domestic and offshore nuclear projects.

The industry has been successful in exporting Canadian technology around the world to countries including Argentina, South Korea, China, Romania and India. International opportunities to use the nuclear expertise based in Ontario will continue to be explored.

Nuclear power is also part of Canada’s science and innovation advantage, involving more than 30 universities and six major research centres, many of them in Ontario. The nuclear industry generates $2.5 billion in direct and secondary economic activity in Ontario every year. Retaining this nuclear expertise is crucial.

The province’s nuclear generating stations at Darlington, Bruce and Pickering have historically provided about half of the province’s electricity supply. The 2010 LTEP forecast that new capacity would need to be built at Darlington. New nuclear capacity is not needed at this time because the demand for electricity has not grown as expected, due to changes in the economy and gains in conservation and energy efficiency. The decision to defer new nuclear capacity helps manage electricity costs by making large investments only when they are needed.

Ontario continues to have the option to build new nuclear reactors in the future, should the supply and demand picture in the province change over time. The ministry will work with OPG to maintain the licence granted by the Canadian Nuclear Safety Commission, to keep open the option of considering new build in the future.

The government will ensure a reliable supply of electricity by proceeding with the refurbishment of the province’s existing nuclear fleet taking into account future demand levels. Refurbishment received strong, province-wide support during the 2013 LTEP consultation process. The merits of refurbishment are clear:

- Refurbished nuclear is the most cost-effective generation available to Ontario for meeting baseload requirements.

- Existing nuclear generating stations are located in supportive communities, and have access to high-voltage transmission.

- Nuclear generation produces no greenhouse gas emissions.

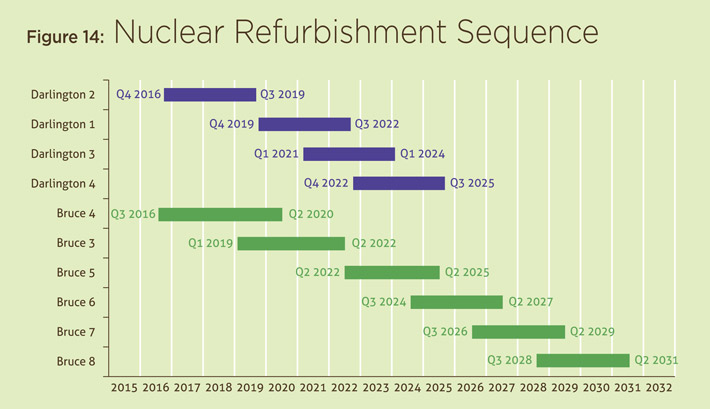

Ontario plans to refurbish units at the Darlington and Bruce Generating Stations. The refurbishment has the potential to renew 8,500 MW over 16 years. The province will proceed with caution to ensure both flexibility and ongoing value for Ontario ratepayers. Darlington and Bruce plan to begin refurbishing one unit each in 2016. Final commitments on subsequent refurbishments will take into account the performance of the initial refurbishments with respect to budget and schedule by establishing appropriate off-ramps.

The nuclear refurbishment sequence shown in Figure 14 will be implemented subject to processes designed to minimize risk to ratepayers and to government. For example, appropriate off-ramps will be implemented should operators be unable to deliver the projects on schedule and within the established project budget.

The nuclear refurbishment process will adhere to the following principles:

- Minimize commercial risk on the part of ratepayers and government;

- Mitigate reliability risks by developing contingency plans that include alternative supply options if contract and other objectives are at risk of non-fulfillment;

- Entrench appropriate and realistic off-ramps and scoping;

- Hold private sector operator accountable to the nuclear refurbishment schedule and price;

- Require OPG to hold its contractors accountable to the nuclear refurbishment schedule and price;

- Make site, project management, regulatory requirements and supply chain considerations, and cost and risk containment, the primary factors in developing the implementation plan; and

- Take smaller initial steps to ensure there is opportunity to incorporate lessons learned from refurbishment including collaboration by operators.

These principles reaffirm ratepayer value as the fundamental driver behind decisions on future refurbishment. The government will encourage the province’s two nuclear operators, Bruce Power and OPG, to find ways of finding ratepayer savings through leveraging economies of scale in the areas of refurbishment and operations. This could include arrangements with suppliers, procurement of materials, shared training, lessons learned, labour arrangements and asset management strategies.

The continued operation of Pickering facilitates the refurbishment of the first units at Darlington and Bruce by providing replacement capacity and energy without greenhouse gas emissions while managing prices. However, an earlier shutdown of the Pickering units may be possible depending on projected demand, the progress of the fleet refurbishment program, and the timely completion of the Clarington Transformer Station.

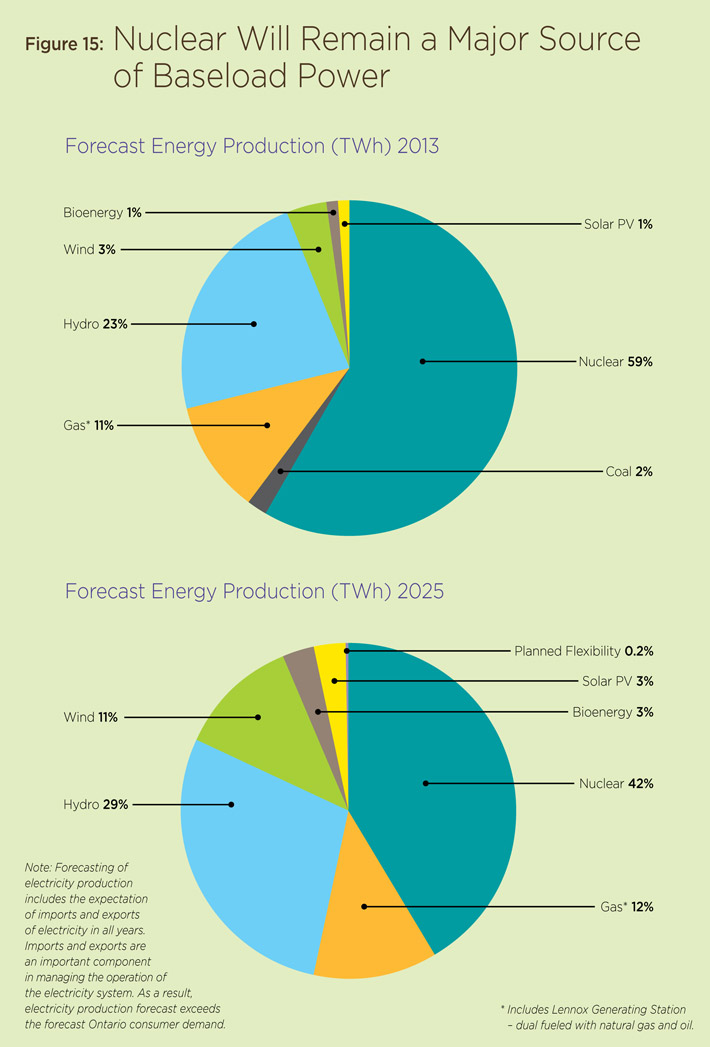

The government is committed to nuclear power. It will continue to be the backbone of our electricity system, supplying about half of Ontario’s electricity generation.

Renewables

Since launching the Feed-in Tariff (FIT) program in 2009, Ontario has firmly established itself as a North American leader in renewable energy.

To date, Ontario has more than 18,500 MW of renewable energy online or announced, which includes more than 9,000 MW of hydroelectric capacity and more than 9,500 MW of solar, wind and bioenergy capacity.

This is remarkable progress, and Ontario is proud of the role renewable energy is playing in the supply mix. This investment in clean, renewable energy sources is helping Ontario reduce its reliance on fossil fuels. The coal phase-out is the single largest climate change initiative in North America, reducing greenhouse gas emissions and air pollution. Coal use had accounted for $4.4 billion per year in health, environmental, and financial costs. At the same time, Ontario’s clean energy initiatives have attracted billions of dollars in new private sector investment, and have contributed to the creation of more than 31,000 clean energy jobs across the province.

Earlier this year, the government committed to making 900 MW of new capacity available between 2013 and 2018 for the FIT (systems larger than 10 kW up to 500 kW) and microFIT programs. Starting in 2014, FIT will have an annual procurement target of 150 MW, with a 50 MW annual target for microFIT. These projects are expected to create more than 6,000 jobs while producing enough electricity each year for more than 125,000 homes. Annual price reviews for these programs are expected to reduce costs, as we saw in the recent price reviews.

| Source | % |

|---|---|

| Bioenergy | 1% |

| Wind | 3% |

| Hydro | 23% |

| Gas |

11% |

| Solar PV | 1% |

| Nuclear | 59% |

| Coal | 2% |

| Source | % |

|---|---|

| Wind | 11% |

| Hydro | 29% |

| Planned Flexibility | 0.2% |

| Solar PV | 3% |

| Bioenergy | 3% |

| Nuclear | 42% |

| Gas |

12% |

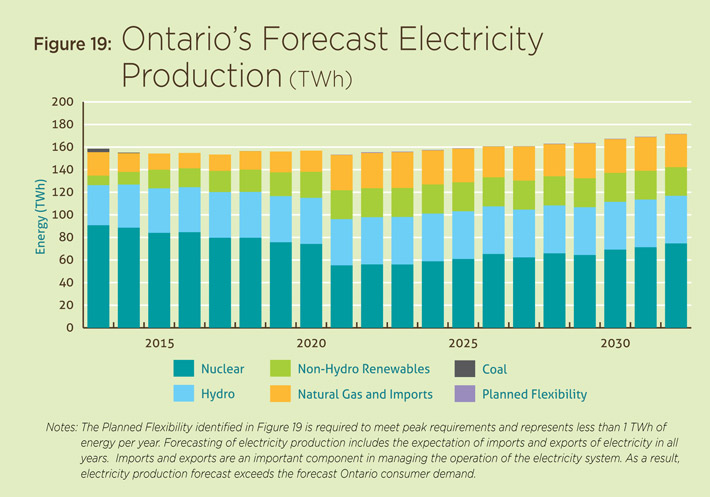

Note: Forecasting of electricity production includes the expectation of imports and exports of electricity in all years. Imports and exports are an important component in managing the operation of the electricity system. As a result, electricity production forecast exceeds the forecast Ontario consumer demand.

Exporting Ontario’s Nuclear Expertise

Commercial nuclear power plants have been operating in Ontario for approximately 45 years. This has resulted in the development and growth of supporting industries to provide products and services. These may be exported to jurisdictions where nuclear generation currently exists, as well as to developing nations currently seeking to build nuclear power plants.

Ontario’s power workers have developed expertise in the successful day-to-day operation of large nuclear power plants. In 2012, OPG’s Darlington Generating Station was awarded the Institute of Nuclear Power Operators award of excellence in recognition of its world-class performance. In addition, expertise in the execution of complex projects, such as unit refurbishments and safe storage shutdowns successfully completed by Ontario’s plants, is worthy of export to other jurisdictions.

The refurbishment of Ontario’s nuclear fleet represents a multi-billion dollar investment and continued support of the province’s nuclear supply chain and operations for decades to come. This will create a strong foundation where Ontario’s nuclear suppliers can market their products and services to a global nuclear industry that could reach over 500 reactors by 2030. By working with Ontario’s nuclear operators, Bruce Power and OPG, these suppliers will demonstrate their capability to deliver domestically and internationally, creating jobs and economic opportunities for the province. The province will encourage operators to compete internationally and consider opportunities and partnerships.

Expertise in the design of sophisticated systems for current and future reactors and required structures, systems and components exist in the skilled and knowledgeable engineering and technical staff working at laboratories in several Ontario communities. Both domestic and offshore nuclear projects are supported by Ontario’s nuclear supply chain through companies largely located in Ontario. For example, Babcock and Wilcox Canada Limited, headquartered in Cambridge, employs experts in the design and fabrication of nuclear plant specific equipment, such as steam generators. The company plans to export nuclear components to the Tennessee Valley Authority in support of the development of Small Modular Reactors. Laker Energy Products of Burlington is another company that has exported nuclear reactor components to Romania, China and Argentina for several years.

The government decided to end large renewable procurements through the standard offer FIT program (projects greater than 500 kW), instead directing the OPA to move to a competitive procurement model. The competitive procurement model will allow for the consideration of contract awards for cost-efficient and well-supported projects. The OPA will consult with the public, municipalities, Aboriginal communities and other stakeholders on the design of the program in early 2014, and seek to launch the procurement process for new large renewables before the end of the first quarter of 2014.

The program will adhere to the following principles:

- Follow a provincial and/or regional electricity system need;

- Consider municipal electricity generation preferences;

- Engage early and regularly with local and Aboriginal communities;

- Occur in multiple successive rounds, providing opportunity for a diverse set of participants;

- Identify clear procurement needs, goals and expectations; and

- Encourage innovative technologies and approaches, including consideration of proposals that integrate energy storage with renewable energy generation.

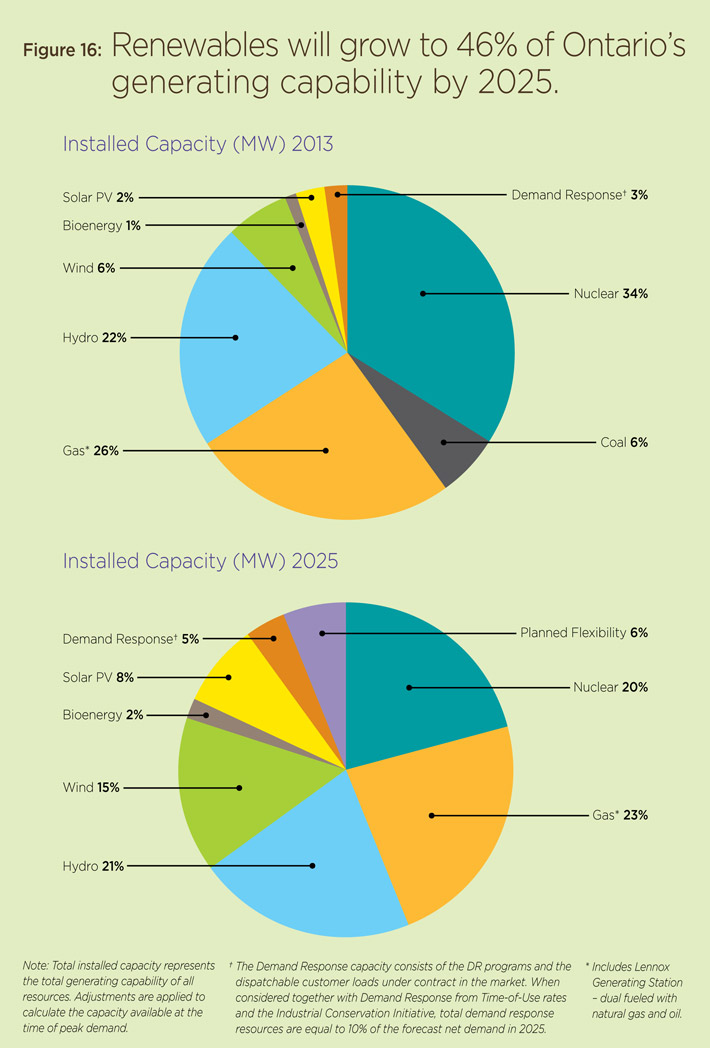

Further, the government would like to provide the renewable sector with a predictable procurement schedule. The government will extend the existing target of 10,700 MW for wind, solar, and bioenergy to 2021, and expand the existing hydro target of 9,000 MW to 9,300 MW by 2025. By 2025, 20,000 MW of renewable energy will be online, representing about half of Ontario’s installed capacity. Annualized renewable energy procurement targets will be realized through a new competitive process.

Ontario plans to make available for procurement up to 300 MW of wind, 140 MW of solar, 50 MW of bioenergy and 50 MW of hydroelectric capacity in 2014. In 2015, the targets would be up to 300 MW of wind, 140 MW of solar, 50 MW of bioenergy and 45 MW of hydroelectricity. Any capacity that is not procured under these procurements, or not developed under existing contracts, would be reallocated for procurement in 2016 for each renewable technology. Through annual reporting and the next LTEP update, Ontario will review and consider expanded targets for wind, solar, hydroelectricity and bioenergy.

This procurement schedule will provide proponents the predictability and stability for large renewable procurements that have previously been announced for FIT and microFIT programs.

A key aspect of attainable renewable energy targets is ensuring there is space on the transmission system to incorporate safely and effectively the power generated by additional renewable energy facilities. Factoring in generators’ responsibility for connecting their projects to the grid, both the 2021 target for wind, solar and bioenergy, and the 2025 hydroelectric target are expected to be accommodated on the existing transmission system. This can be done without the need for new major transmission projects beyond those already in progress, such as upgrades to key area stations or the rewiring of a line west of London.

Atikokan Generating Station

The Atikokan Generating Station is located approximately 200 km west of Thunder Bay. In 2008, a biomass testing program was implemented using wood pellets to produce electricity. In September 2012, Atikokan burned its last piece of coal. The conversion from coal to biomass is on track to be completed in 2014.

The conversion project represents an investment of $170 million – growing clean power capacity in Ontario and supporting jobs in the community. The project is expected to help sustain jobs in the forestry sector, create more than 150 new jobs through the fuel supply contracts, and create approximately 200 construction jobs. Plant modifications were required for the conversion, involving the construction of a fuel storage and handling system that can deliver up to 90,000 tonnes of biomass fuel annually from two, new 43-metre tall storage silos.

Upon completion, the 205 MW facility will be one of the largest biomass plants in North America and provide peaking capacity to northwestern Ontario. Atikokan is expected to generate 150,000 MWh of renewable power annually – enough to power approximately 15,000 homes each year.

Thunder Bay Generating Station

As part of Ontario’s effort to phase out coal-fired generation by the end of 2014, the government intends to convert one unit at the Thunder Bay Generating Station to run on advanced biomass over a five-year term, starting in 2015, preserving operational capacity for the future. Ontario is also maintaining the option to convert the second coal-fired unit to run on advanced biomass in the future.

An advanced biomass conversion can be done with minimal capital expenditure, and the fuel is well suited to the type of valuable peaking operation that coal plants have historically provided to the province.

The conversion will be the first of its kind globally and will put Ontario on the leading edge of the emerging advanced biomass industry. This enables Ontario to develop knowledge and expertise that can be exported around the world to enable cost-effective conversion of coal plants to renewable fuels.

| Source | % |

|---|---|

| Solar PV | 2% |

| Bioenergy | 1% |

| Wind | 6% |

| Hydro | 22% |

| Gas |

26% |

| Demand Response |

3% |

| Nuclear | 34% |

| Coal | 6% |

| Source | % |

|---|---|

| Demand Response |

5% |

| Solar PV | 8% |

| Bioenergy | 2% |

| Wind | 15% |

| Hydro | 21% |

| Planned Flexibility | 6% |

| Nuclear | 20% |

| Gas |

23% |

Note: Total installed capacity represents the total generating capability of all resources. Adjustments are applied to calculate the capacity available at the time of peak demand.

What is Combined Heat and Power?

Combined Heat and Power (CHP) is the simultaneous production of electricity and heat using a single fuel such as natural gas or biomass. In most applications, heat produced from the electricity generating process (for example, from the exhaust system of a gas turbine) is captured and used to produce steam or hot water that can be used for industrial and commercial heating or cooling purposes. Alternatively, waste heat can be captured at the end of a process and used to power a turbine and generator to produce electricity.

Assuming that the heat is well-used, CHP can achieve the highest use of the energy available from a fuel, making it the most efficient way to use fossil fuels while generating electricity. CHP can achieve up to 80% overall efficiency when it is designed to follow the heat load.

Wind

Wind projects are an important part of Ontario’s energy mix, creating thousands of jobs across Ontario and providing clean, renewable energy to power our homes and businesses.

Ontario now has more than 2,300 MW of wind power online, which is expected to produce enough electricity each year to power more than 600,000 homes.

A clean, reliable energy system relies on a balance of resources. When clean energy from the wind is available, it reduces our need to rely on fossil fuel sources of electricity that contribute to smog, pollution and climate change.

Wind energy creates new, high-value jobs, and provides economic benefits and opportunities to municipalities and local businesses. Development of wind power in Ontario has created opportunities for landowners, local community co-operatives, Aboriginal communities and municipalities to partner with wind project developers, or lead their own wind projects, which ensures that the benefits of the project remain in the local community.

Ontario has been working to integrate wind energy more fully into Ontario’s electricity system. This includes improved forecasting of when wind energy will be available to supply power to the grid. New rules will allow the IESO to tell wind generators to reduce or stop producing power when the electricity system does not require it. From a system perspective, the IESO estimates that these changes to the market rules could save ratepayers up to $200 million per year. Related OPA contract amendments could save ratepayers up to $65 million over the next five years.

Solar

Ontario is a leader in the use of solar photovoltaic (PV) electricity to power our homes and businesses. Ontario has the most solar PV capacity of any jurisdiction in Canada, with more than 900 MW of generation capacity online. This amount is expected to produce enough electricity to power more than 100,000 homes each year.

District Energy

District Energy systems can make effective and efficient use of CHP technology to heat, cool and power densely populated areas such as city centres, university campuses and hospitals.

Markham District Energy – (5.85 MW)

Markham District Energy’s two most recent OPA supported plants at Bur Oak and Birchmount are due to become operational in September 2014.

The Bur Oak Energy Centre CHP facility will have 3.25 MW of OPA- contracted capacity and will supply thermal energy to buildings in the area, including the Markham Stouffville Hospital, East Markham Community Centre, a fire station, a health services building and new developments in the vicinity.

The Birchmount Energy Centre will have 2.6 MW of OPA- contracted capacity and will provide space heating and domestic hot water to buildings served by the Markham Centre District Energy System, owned and operated by Markham District Energy Inc., as well as electricity generation.

London Cogeneration Facility (12 MW) – London

London Co-generation Facility is a natural gas-fired 12 MW CHP facility. In addition to electricity production, steam from the co-generation facility will be used to provide space heating and cooling to nearby commercial, government and residential buildings.

Durham College District Energy (2.3 MW) – Oshawa

Durham College District Energy is a natural gas-fired 2.3 MW CHP facility at Durham College in Oshawa. In addition to behind–the-meter electrical production, hot water is provided to Durham College for space heating and domestic use.

Greenhouse Operations

Greenhouse operations are a particularly suitable candidate for CHP. They consume electricity for lighting, pumping and refrigerated storage of produce. They also require heat to supplement solar gain, especially at night. In addition to these benefits, greenhouses can also use the CO2 produced by the generation to enhance the growth of plants. This is sometimes called tri-generation (electricity, heat and CO2 are all used).

Rosa Flora Limited (4.04 MW) – Dunnville

Rosa Flora, one of Canada’s largest cut-flower producers, recently entered into a combined heat and power contract with the OPA to produce 4.04 MW of electricity to stay ahead in a highly competitive international market. This project will provide greenhouse heating and electricity that can be used internally for lighting, pumps and other uses, or exported to supply grid needs.

Great Northern Hydroponics (11.3 MW) – Kingsville

The Great Northern tri-generation facility is a natural gas-fired 12 MW combined heat and power facility that operates on the property of Great Northern Hydroponics, in Kingsville. Great Northern Hydroponics specializes in tomato production through the application of state-of-the-art hydroponics technology.

In addition to electricity production, hot water and carbon dioxide from the co-generation facility is used by Great Northern Hydroponics for heating and fertilizing crops in the existing 50-acre hydroponics greenhouse.

Solar PV systems produce most of their power during the afternoon, which helps us meet summer peak electricity demand from air conditioning systems. This peak shaving helps our grid operate more effectively, and reduce the use of fossil fuel electricity generation on hot, smoggy days. When solar PV systems are located on rooftops that are close to electricity users, this reduces the need for the grid to transport electricity long distances, and may help offset future requirements for grid upgrades.

The cost of solar PV systems has previously been affected by high material costs. New innovations and global market expansion are helping to substantially reduce the cost of these systems. Since the FIT and microFIT programs were launched in 2009, Ontario has seen a reduction in the average costs for new solar PV systems – of at least 40% – and the industry aspires to reach grid parity.

Reductions in costs and the ability to deploy solar energy systems close to the customer also offer the opportunity to expand and enhance net metering, where homeowners use solar-generated power to offset their own electricity needs. Ontario will examine the potential for the microFIT program to evolve from a generation purchasing program to a net metering program.

In addition, homes and businesses can use solar thermal systems to heat water and supplement their space heating needs.

Bioenergy

Energy from organic material is another key clean and renewable resource. Currently, there are almost 300 MW of bioenergy generation capacity online in Ontario, including biomass, biogas and landfill gas systems.

Bioenergy systems are valued for their ability to turn organic waste streams into a renewable, flexible and clean source of power particularly suited to rural and remote communities.

Using bioenergy helps to support Ontario’s forestry and agricultural industries, and optimizes the use of available biomass resources. Bioenergy systems can also be closely integrated with local jobs and industry in small rural communities.

Biomass systems can use residues from forestry and agriculture to generate electricity and useful heat. Biogas systems can help manage farm waste while generating electricity, and also produce organic by-products that can be added to the soil.

Biomass and biogas systems can adjust their output to generate power during times of peak electricity demand. This helps reduce our reliance on fossil fuel during peak times. Biomass and biogas systems can also operate constantly, helping contribute to our baseload electricity supply.

Generating electricity from landfill gas not only offsets fossil fuel use but also reduces the greenhouse gas impact of methane on the environment. It is truly a win-win situation for Ontario.

Hydroelectric

Ontario has a long and productive history with water power. More than half of Ontario’s renewable energy supply comes from hydroelectric facilities, which continue to provide more than 20% of the province’s electricity. Existing hydro has been the lowest-cost form of generation in Ontario, and in many cases, has provided reliable generation to meet peak demand. The province’s hydroelectric resources generated the energy to power approximately 3.5 million homes in 2012. This shows that hydroelectric power will continue to play a significant role in Ontario’s diverse supply mix.

Today, Ontario has well over 8,000 MW of water power in service and enough projects contracted and under development to meet our 2010 LTEP target of 9,000 MW of installed hydroelectric capacity by 2018. Earlier this year, the government directed the OPA to procure additional hydroelectric capacity, including up to 40 MW from existing facilities with the potential to expand capacity, and up to 60 MW from new municipal projects under the recently launched Hydroelectric Standard Offer Program. In addition, the government directed the OPA to enter into negotiations with OPG and the Taykwa Tagamou Nation for a power purchase agreement to procure electricity from the proposed New Post Creek hydroelectric generating station, with a capacity of approximately 25 MW.

The government will continue to build on this foundation by adding to the hydroelectricity target, increasing the province’s hydroelectric portfolio to 9,300 MW by 2025. With this increased target, Ontario will maximize the potential for new large-scale hydro facilities on what the current transmission system can support.

Ontario will continue to work with the sector to assess future hydroelectric development carefully, so it is ready to generate power when and where we need it. The ministry is reviewing the potential of both large and small hydroelectric sites in Northern Ontario, including projects close to off-grid First Nation communities. The ministry will also continue to work with the sector to examine the use of existing dam sites to generate hydroelectric power.

Pumped Hydro Storage

Pumped hydro storage can be used to store energy when it is not needed and deliver it to the grid during periods of peak demand. Projects will continue to be examined to determine their cost-effectiveness and their ability to provide value to ratepayers.

Natural Gas

While the government will not require new natural gas procurement to fill province-wide needs over the near term, this form of energy will still be an essential element of our responsive and flexible electricity system. Natural gas generation is cost effective to operate and can provide some of our lowest-cost capacity. Its output can be dispatched quickly to match changes in demand, and supports variable resources such as wind and solar. From 2003 to 2012, as Ontario succeeded in phasing out coal-fired generation, natural gas generation increased by 38%, from approximately 16 TWh to approximately 22 TWh.

Ontario’s natural gas fleet has capacity and flexibility to fill energy needs arising during the nuclear refurbishment period.

The province’s existing NUGs, contracted in the 1990s with the former Ontario Hydro, currently provide 1,200 MW of natural gas generation. The contracts for 75% of that capacity will expire by the end of 2018. The OPA has been directed to enter into new contracts with the NUGs after the current ones have expired, but only if the contract results in cost and reliability benefits to Ontario ratepayers.

Natural gas prices have declined sharply since 2008, and are expected to remain relatively low over the next decade. The price of natural gas, though is historically quite volatile, and is affected by factors outside of Ontario’s control. It is therefore in Ontario’s best interest to keep a balanced supply mix, and not depend too heavily on natural gas, as a hedge against this volatility.

Combined Heat and Power

Combined Heat and Power (CHP) can be an efficient way to use natural gas to generate electricity as well as useable heat or steam. Given the right circumstances, CHP can help support regional economic development, and local energy needs, while reducing carbon dioxide (CO2) emissions at a competitive cost.

The OPA has run four rounds of competitive procurements and two standard offer programs for small-scale CHP since 2005, resulting in 420 MW of capacity from CHP projects – 414 MW of which are in commercial operation. Approximately 6 MW are under development, and scheduled to be in service in 2014.

We have learned that in general, CHP projects work better if they are driven primarily by the need for heat, with electricity as a by-product. CHP projects need to be the right size, in the right location and at the right price to ensure optimal benefits to the electricity system, in addition to serving the needs of their heat loads.

The OPA has conducted procurements for CHP projects representing a wide range of technologies, applications, industries and geographic locations. Future procurements will focus on considerations such as efficient CHP applications and locations with regional capacity. These could include a new program for CHP at greenhouse operations, agri-food and district energy projects.

The way that CHP supports economic development while reducing CO2 emissions is best illustrated in the examples.

Energy from Waste

Energy from Waste (EFW) refers to waste treatment technologies that generate electricity and/or heat by burning various kinds of waste material.

Most EFW facilities burn the waste material directly to obtain energy but there are alternative technologies being developed that promise better efficiency and lower greenhouse gas emissions than conventional EFW.

To encourage the development of these new technologies in Ontario, the OPA is considering projects that have received Ministry of the Environment approval. These Ontario-based projects offer the potential for job creation and export opportunities. Testing will verify whether new technologies can operate successfully with environmental performance superior to conventional EFW technologies.

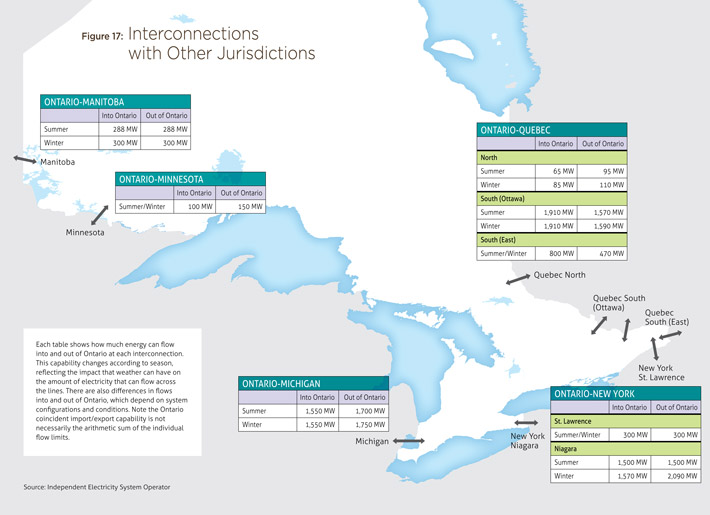

Clean Imports

Ontario has several interconnections with the provinces of Manitoba and Quebec as well as with the states of Minnesota, Michigan and New York. Taken together, Ontario has approximately 4,500 to 5,200 MW of import-export capacity. However, actual power flows do not reach these levels because of operational constraints in and outside Ontario.

Ontario exports and imports a significant amount of electricity as part of the regular operation of its electricity market and is expected to have sufficient energy and capacity in the near term to meet province-wide needs. The electricity wholesale market has proven to be extremely effective in enabling power to flow between Ontario and its neighbours.

Ontario will continue to rely on the wholesale market to provide flexibility and to balance power flows on a short-term basis. However, an import arrangement with a neighbour to guarantee the firm delivery of clean power could offer a cost-effective alternative to building domestic supply. Import contracts can be structured to meet multiple system needs such as capacity for peaking, ramping, backup or reserve purposes, or the firm delivery of energy over a specified timeframe, or a combination.

Contracted energy imports can provide value if their price is less than domestic generation. They can also further diversify Ontario’s supply. While clean energy imports offer potential benefits to Ontario, the value to Ontario depends on the willingness of those supplying imports to offer a product that matches Ontario needs and represents better value than the domestic alternatives.

Ontario will only pursue contractual arrangements for firm imports where cost effective and well matched to Ontario’s electricity needs.

Planned Flexibility

While the OPA is forecasting lower growth in electricity demand, we must take into account the element of uncertainty inherent in all forecasts. The government has to be prepared to respond if the economy or energy demand does not evolve as expected. In other words, Ontario needs to be flexible to meet the inherent uncertainty of predicting how demand will grow. Therefore, the government will plan for a wide range of possibilities but only commit resources as needs become clearer, while ensuring Ontarians have the energy they need, when and where they need it.

Starting in 2014, an Ontario Energy Report will be issued annually to update Ontarians on the energy supply and demand picture for the province, and review progress in implementing the LTEP.

The LTEP will continue to be updated every three years. These annual reports will give everyone an opportunity to monitor progress and understand developments that will be important in the next formal review.

This is a direct response to what we heard during the LTEP engagement sessions, where ratepayers, members of the public, stakeholders and Aboriginal communities wanted to be involved in an ongoing dialogue about energy planning.

2013 LTEP Supply Mix

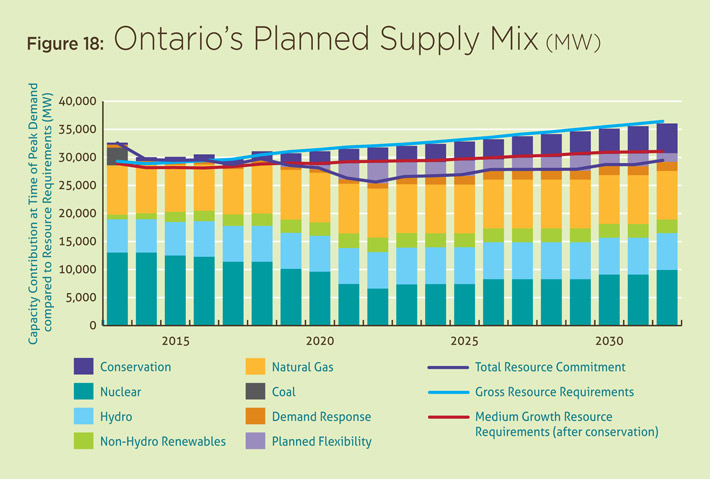

Figures 18 and 19 present an integrated picture of the supply mix elements as described above including the Conservation First and DR targets, forecast demand, renewable targets and planned nuclear refurbishments. Reflecting the need to maintain flexibility as circumstances change, future options to be determined are also illustrated here.

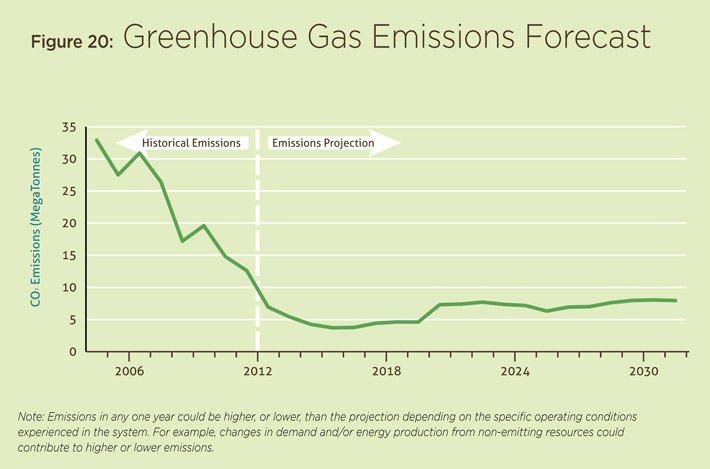

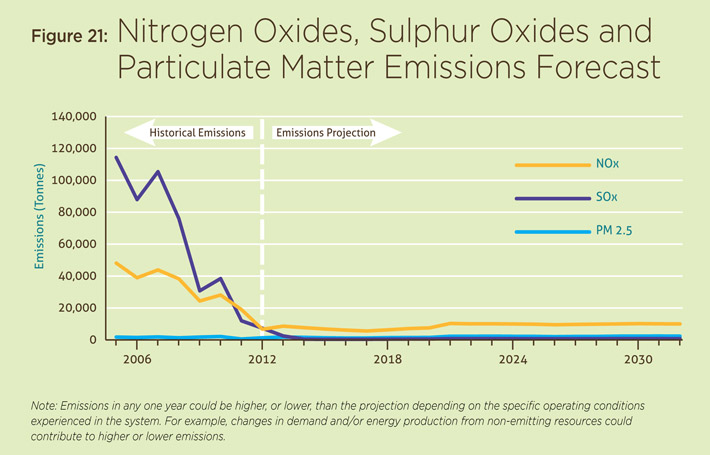

Since 2003, greenhouse gas emissions from coal-fired generation in the electricity sector have been reduced by nearly 90%. In addition, the emissions of sulphur dioxide and nitrogen oxides have dropped by 93% and 90%, respectively, while mercury levels are at their lowest level in 45 years.

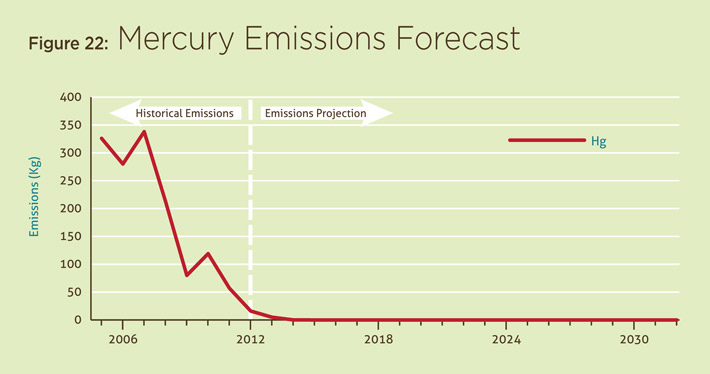

Figures 20, 21 and 22 are historical and forecast emissions of greenhouse gases, sulphur dioxide, nitrogen oxides, particulate matter and mercury for Ontario’s electricity sector.

Air emissions from Ontario’s electricity sector are expected to remain at historically low levels, although there may be variations in future emissions attributable to changes in demand, the use of natural gas, clean imports, and demand response.

In Summary

Nuclear

- Ontario will not proceed at this time with the construction of two new nuclear reactors at the Darlington Generating Station. However, the Ministry of Energy will work with Ontario Power Generation (OPG) to maintain the site licence granted by the Canadian Nuclear Safety Commission.

- Nuclear refurbishment is planned to begin at both Darlington and Bruce Generating Stations in 2016.

- During refurbishment, both OPG and Bruce Power will be subject to the strictest possible oversight to ensure safety, reliable supply and value for ratepayers.

- Nuclear refurbishment will follow seven principles established by the government, including minimizing commercial risk to the government and the ratepayer, and ensuring that operators and contractors are accountable for refurbishment costs and schedules.

- The Pickering Generating Station is expected to be in service until 2020. An earlier shutdown of the Pickering units may be possible depending on projected demand going forward, the progress of the fleet refurbishment program, and the timely completion of the Clarington Transformer Station.

- Ontario will support the export of our home-grown nuclear industry expertise, products and services to international markets.

Renewable Energy

- By 2025, 20,000 MW of renewable energy will be online, representing about half of Ontario’s installed capacity.

- Ontario will phase in wind, solar and bioenergy over a longer period than contemplated in the 2010 LTEP, with 10,700 MW online by 2021.

- Ontario will add to the hydroelectricity target, increasing the province’s portfolio to 9,300 MW by 2025.

- Recognizing that bioenergy facilities can provide flexible power supply and support local jobs in forestry and agriculture, Ontario will include opportunities to procure additional bioenergy as part of a new competitive process.

- Ontario will review targets for wind, solar, bioenergy and hydroelectric annually as part of the Ontario Energy Report.

- The Ministry of Energy and the OPA are developing a new competitive procurement process for future renewable energy projects larger than 500 kilowatts (kW), which will take into account local needs and considerations. The ministry will seek to launch this procurement process in early 2014.

- Ontario will examine the potential for the microFIT program to evolve from a generation purchasing program to a net metering program.

Natural Gas/Combined Heat and Power

- Natural gas-fired generation will be used flexibly to respond to changes in provincial supply and demand and to support the operation of the system.

- The OPA will undertake targeted procurements for Combined Heat and Power (CHP) projects that focus on efficiency or regional capacity needs, including a new program targeting greenhouse operations, agri-food and district energy.

Clean Imports

- Ontario will consider opportunities for clean imports from other jurisdictions when such imports would have system benefits and are cost effective for Ontario ratepayers.

Footnotes

- footnote[2] Back to paragraph Includes Lennox Generating Station – dual fueled with natural gas and oil.

- footnote[] Back to paragraph The Demand Response capacity consists of the DR programs and the dispatchable customer loads under contract in the market. When considered together with Demand Response from Time-of-Use rates and the Industrial Conservation Initiative, total demand response resources are equal to 10% of the forecast net demand in 2025.