This page was published under a previous government and is available for archival and research purposes.

Where we are now

Ontario can be proud of what it has accomplished in energy in the past decade. The elimination of coal-fired electricity generation is the single largest greenhouse gas reduction measure in North America. This is helping to improve Ontarians' health, environment and quality of life.

Last year, coal accounted for less than 3% of total generation, and Ontario will be coal free by the end of 2014. This is a big change from a decade ago, when coal-fired generation provided 25% of Ontario’s electricity supply. This has produced a real improvement in air quality in Ontario. Since 2003, the emissions of sulphur dioxide coming from coal-fired generation in the electricity sector have dropped by 93%, there has been a 90% reduction in nitrogen oxides, and mercury levels are at their lowest in 45 years. Greenhouse gas emissions have been reduced by almost 90%.

The province now has a reliable foundation on which to build. In 2004, Ontario’s supply outlook was not sufficient to meet North American reliability standards. Today’s margins are above required levels. This reflects the strong supply of electricity the province is enjoying. Ontario has gone from a deficit of 3,800 MW in 2003 to a comfortable surplus in 2013.

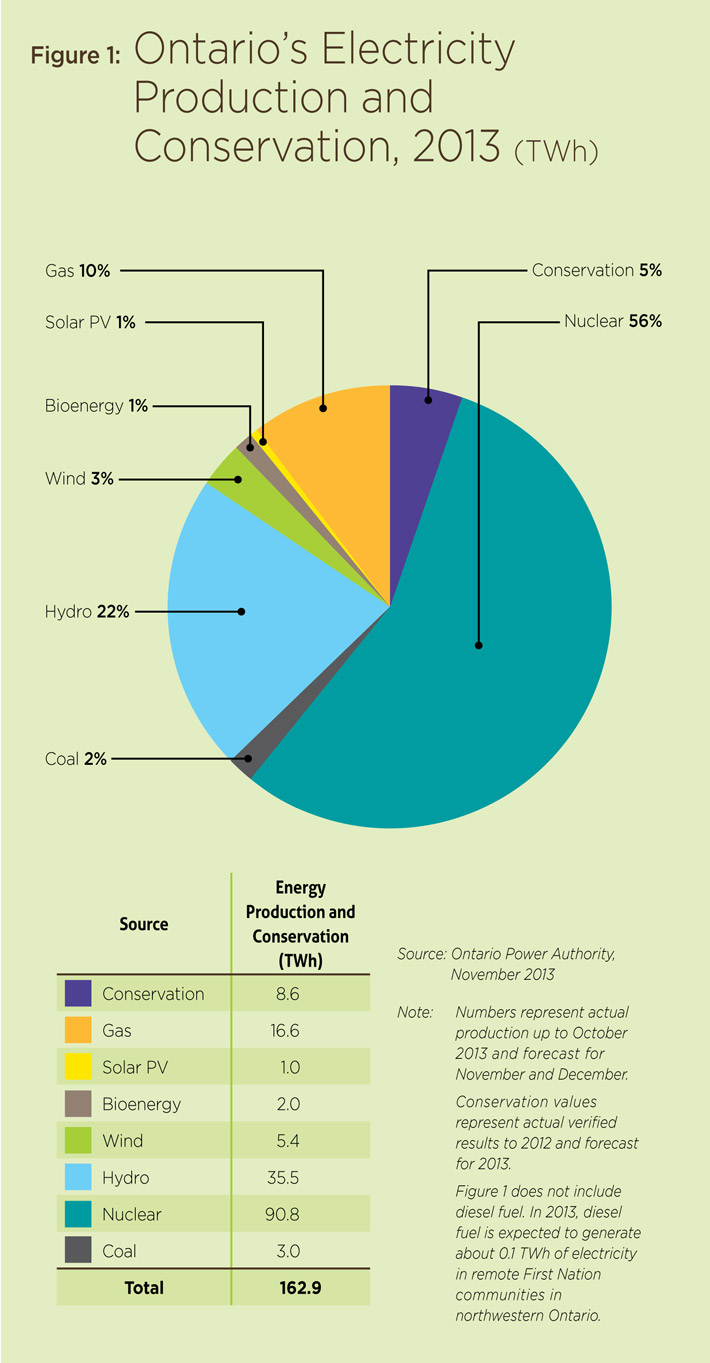

Figure 1 shows the current supply mix (generation and conservation) on which Ontarians rely.

| Source | % |

|---|---|

| Nuclear | 56% |

| Hydro | 22% |

| Gas | 10% |

| Conservation | 5% |

| Wind | 3% |

| Coal | 2% |

| Bioenergy | 1% |

| Solar PV | 1% |

| Source | Terrawatt-hours |

|---|---|

| Conservation | 8.6 |

| Gas | 16.6 |

| Solar PV | 1.0 |

| Bioenergy | 2.0 |

| Wind | 5.4 |

| Hydro | 35.5 |

| Nuclear | 90.8 |

| Coal | 3.0 |

| Total | 162.9 |

Source: Ontario Power Authority, November 2013.

Note: Numbers represent actual production up to October 2013 and forecase for November and December.

Conversation values represent actual verified results to 2012 and forecast for 2013.

Above tables do not include diesel fuel. In 2013, diesel fuel is expected to generate about 0.1 TWh of electricity in remote First Nation communities in northwestern Ontario.

Ontario is in a strong supply position and is benefitting from a decade of investments in conservation, generation, transmission and distribution.

- The province has added about 12,000 MW of new and refurbished generation since 2003 - enough electricity to power both the Greater Toronto Area and the City of Ottawa. Wind-powered generation now provides more electricity than coal-fired generation.

- From 2005 to the end of 2013, it is projected that Ontarians will have conserved 8.6 TWh of electricity - enough to power a city about the size of Mississauga.

- Water is now flowing through the third tunnel at Niagara Falls, producing enough electricity to power 160,000 homes, or a city the size of Barrie.

- The Lower Mattagami project will add almost 440 MW of new hydroelectric capacity when completed. Construction on the project is currently underway, and about 1,600 workers are employed, including more than 250 First Nation and Métis individuals. This $2.6-billion investment in Northern Ontario will upgrade four generating stations located about 70 km northeast of Kapuskasing.

- More than 35 First Nation and Métis communities are involved in wind, solar and hydroelectric projects. They are participating in 239 projects, representing over 1,000 MW of clean electricity.

- Since 2003, Hydro One has upgraded more than 10,000 km of its transmission and distribution lines. That is equivalent to a round trip from Montreal to Vancouver. These investments have contributed to increasing the province’s transmission capacity by about 10,000 MW.

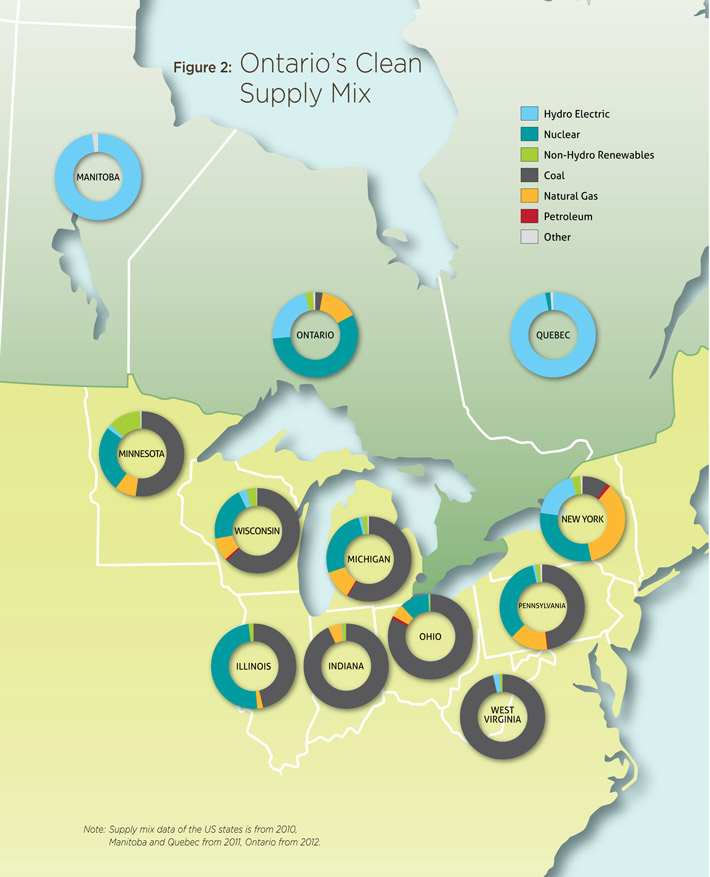

These accomplishments have produced a cleaner electricity system than those of our neighbours in the United States. We have done this without the abundant supply of hydroelectric resources enjoyed by Manitoba and Quebec.

As we look to the future, we must acknowledge that forecasting is not an exact science. In the 2010 LTEP, the government developed its plans to accommodate a moderate amount of growth in the demand for electricity. However, events since 2010 demonstrate why plans should be flexible to meet changing conditions.

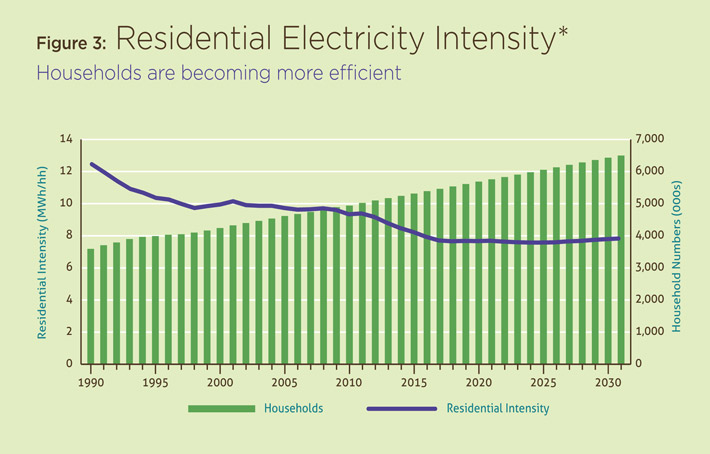

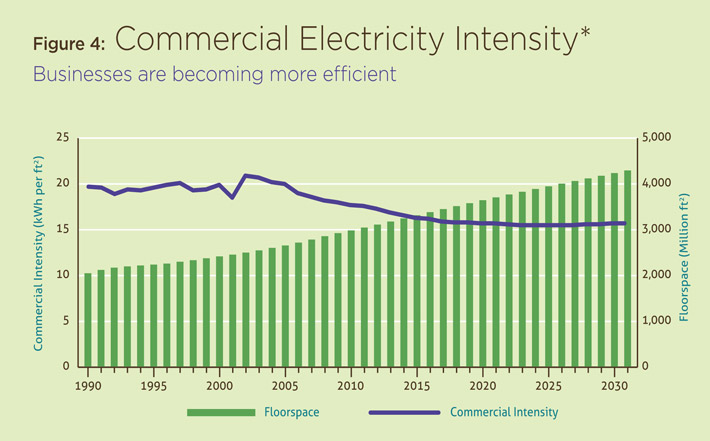

In the past few years, demand for electricity in Ontario has declined because of across-the-board reductions by the average household, business and industrial user; changes in the composition of Ontario’s industrial sector; notable increases in the efficiency of energy use; and savings from conservation programs.

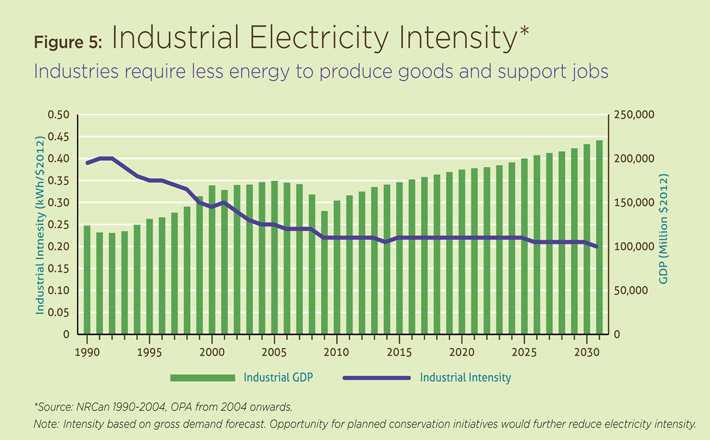

The future promises to be less energy-intensive than the past, because the demand for energy is no longer as closely linked to economic growth, due to improvements in residential, commercial and industrial electricity intensity. While economic activity is increasing as the recovery takes hold, the demand for electricity continues to be relatively flat, and is expected to remain so for the next decade. This is certainly a welcome development because while economic growth continues to be positive and productivity increases, demand for electricity remains flat.

The energy profile of the Ontario economy has changed for a variety of reasons. In 2005, the five largest industrial sectors of transmission-connected electricity consumption (pulp and paper, mining, iron and steel manufacturing, petroleum products and auto manufacturing) accounted for 12% of total electricity consumption in the province. By 2012, this share had fallen to 9%, for a total decline of 5.5 million kWh, roughly the equivalent of the annual production from one of Ontario’s nuclear units.

There was new growth as well. Low electricity demand no longer means low economic growth. Recent gains in energy efficiency and improvements in commercial and industrial electricity intensity have reduced the system costs associated with economic growth. As we continue to support a growing economy with less energy, Ontario’s net economic productivity will increase. In the past decade, Ontario has seen a burgeoning advanced technology sector that holds much promise for the future growth of the provincial economy. These new industries require less energy to produce goods and support jobs.

Energy efficiency has also reduced demand. Ontario’s Building Code has been updated, requiring the construction of more energy-efficient homes, offices and industrial facilities. At the same time, homeowners and businesses are buying more energy-efficient products, as they replace their existing equipment, technology and appliances.

It is clear that we need to prepare for an energy-efficient future in Ontario. That’s why Ontario is committing resources to meet a lower-demand forecast while maintaining flexibility to respond to higher needs. In the future, a new annual energy reporting process will help us identify changes in demand and plan prudently for more resources if and when they are needed.

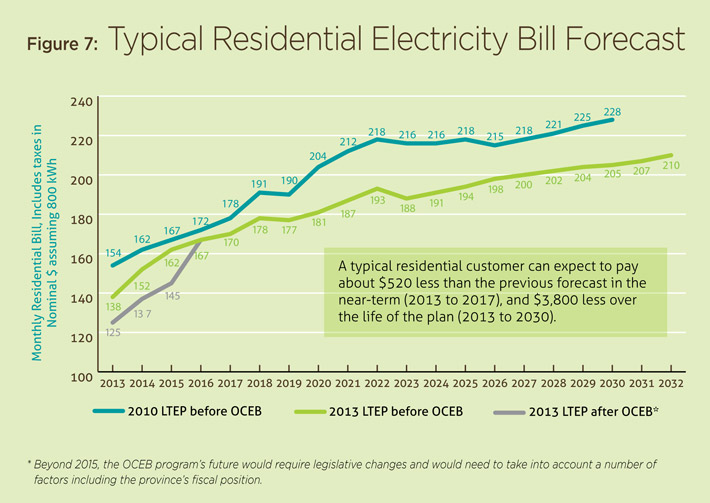

Managing Electricity Costs

The government introduced the Ontario Clean Energy Benefit (OCEB), which gives residential customers, small businesses and farms a 10% reduction on their electricity bills for the first 3,000 kWh they use every month until the end of 2015. Beyond 2015, the OCEB program’s future would require legislative changes and would need to take into account a number of factors including the province’s fiscal position.

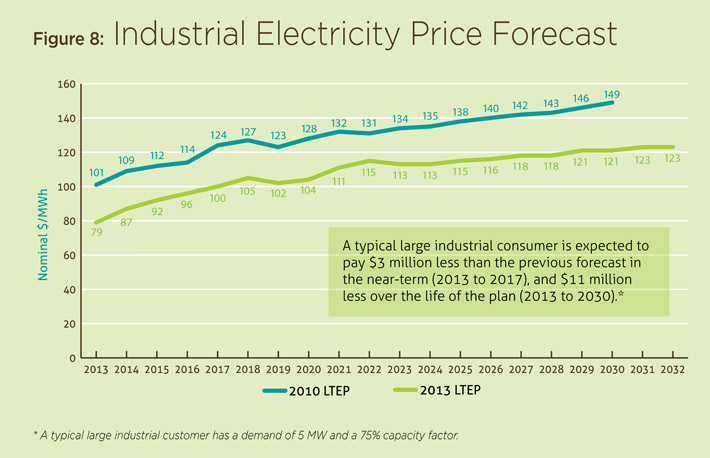

The government is committed to ensuring that where possible and appropriate, industrial electricity rate mitigation programs can help support a dynamic and innovative climate for business to thrive, grow and create jobs.

Northern Industrial Electricity Rate (NIER) Program

The province has extended the NIER program to 2016 to support continued growth and development in the northern resource and manufacturing sector. Originally set to end in 2013, the $360-million program extension ($120 million per year) provides electricity price rebates of 2 cents per kWh to qualified large northern industrial consumers. This represents about a 25% reduction in electricity prices and helps qualified facilities that commit to an energy management plan.

Industrial Electricity Incentive (IEI) Program

This program assists in the management of electricity demand by encouraging increased industrial production. Eligible companies in the manufacturing and resource-extraction sectors can qualify for a reduced electricity rate for bringing new investment and employment opportunities to the province. The benefits of incremental industrial electricity demand to the electricity system include reduced surplus energy volumes. The IEI program offers up to 5 TWh of annual electricity consumption, and is currently allocated in two distinct streams:

- Stream 1 is capped at 3 TWh and is for industrial consumers willing to operate a facility and undertake a large capital investment in technologies, products or processes that are not currently being used or produced in Ontario.

- Stream 2 is capped at 2 TWh and is for current consumers that will expand their existing, or build a new, industrial facility.

The government will actively pursue opportunities to broaden this program, based on updated supply forecasts to align with the power needs of industry looking to make investments in Ontario. The government will seek to open a new program intake window in 2014.

Industrial Conservation Initiative

This initiative helps the province’s largest industrial and manufacturing facilities reduce their electricity consumption during peak periods, lower their costs and increase competitiveness. Charging the Global Adjustment (GA) based on peak demand is a form of demand response that incents Ontario’s largest customers to shift their consumption away from peak periods thereby improving reliability and lowering system costs. About 200 of Ontario’s largest energy consumers are part of this initiative. This contributed to industrial rates for large users (more than 5 MW) being on average 25% lower in 2012 than those forecast in the 2010 LTEP.

Industrial Accelerator Program

The Industrial Accelerator Program is run by the OPA and helps transmission-connected electricity users fast-track capital investment in major energy-efficiency projects.

The program provides attractive financial incentives to encourage investment in innovative process changes and equipment retrofits so that the rate of return is competitive with other capital projects. In exchange, participants will commit under contract to deliver specific conservation savings within a set period of time and to maintain them over the expected life of the project.

Global Adjustment Review

The IESO is undertaking an independent review of the GA to examine the possibility of greater responsiveness from customers. Stakeholders have been consulted to ensure that the approach and analysis in this review are comprehensive. The IESO will publish a report on its findings.

Additional Measures: Electricity Rate Mitigation and Sector Efficiency

Currently in Ontario, the electricity system costs about $18 billion per year to operate. That makes it essential for all the players in the sector-agencies, generators, transmitters, distributors and the like-to operate as efficiently as possible.

Reducing future capital investments will mitigate upward pressure on rates. The province has undertaken a wide range of initiatives to help reduce electricity rates outlined below.

Amending the Green Energy Investment Agreement

The province, in collaboration with the Korean Consortium, revised provisions of the Green Energy Investment Agreement (GEIA). The revised GEIA reduces contract costs by $3.7 billion, assures continued clean energy investment by the Korean Consortium, and protects existing job commitments to 2015, while adding a commitment to job creation that extends to 2016.

Feed-in Tariff Program (FIT) Prices

The OPA achieved further cost savings with a significant reduction in the purchase price of renewable electricity in new FIT contracts. The lower FIT prices have reflected the reduction of domestic content requirements and a reduction in technology prices, saving $1.9 billion.

Non-Utility Generators (NUG) Negotiations

The government has directed the OPA to negotiate new contracts with the province’s thermal non-utility generators (NUGs) as they expire, only if the new contracts result in cost and reliability benefits for Ontario’s electricity consumers. The new contract structure will reduce NUG costs and greatly reduce NUGs' contribution to surplus baseload generation.

Sector Efficiencies

Over the past three years, Hydro One and OPG have achieved efficiency savings of approximately $500 million. These are driven by transformative initiatives that are tailored to the needs and realities of each organization. For example, OPG has increased productivity by centralizing and streamlining corporate and support functions. Hydro One has improved the efficiency of its operations as a result of investments in intelligence tools designed to augment the availability and performance of its key assets.

Wind Dispatch

The IESO has brought in new rules to allow transmission-connected wind generation to be dispatched when the system does not require it. This could save ratepayers up to $200 million per year. In addition, related OPA contract amendments could save ratepayers up to $65 million over the next five years.

Deferral of New Nuclear

Due to lower forecast demand growth, the government recently announced that the construction of two new nuclear units at OPG's Darlington site will be deferred. This represents up to $15 billion in capital investments that are not currently required.

Early Coal Closure

In early 2013, Ontario announced it would cease coal-fired generation at the Lambton and Nanticoke plants by the end of 2013, one year earlier than previously planned. Ratepayers will save $95 million with the early closure of these stations. Savings will arise from reduced maintenance and project costs.

The work to mitigate electricity rate increases and secure efficiencies in the electricity sector will not end there:

- The government will encourage OPG and Hydro One to explore new business lines and opportunities inside and outside Ontario. These opportunities would allow OPG and Hydro One to leverage their existing areas of expertise and grow revenues for the benefit of Ontarians.

- The government will also work with its energy agencies to develop efficiency targets, reduce costs and save money for ratepayers. For example, over a five-year period, ratepayers could expect to save close to $400 million if energy agencies were to reduce their operations, maintenance and administration expenses by 2%.

- Since distribution costs play an important part in consumers' electricity bills, the government established the Distribution Sector Review Panel. The panel, which delivered its report in late 2012, identified the potential for significant savings and recommended the consolidation of the province’s LDCs. As a result, the government expects that LDCs will pursue innovative partnerships and transformative initiatives to drive efficiencies that will result in ratepayer savings.

- The OEB is currently implementing a renewed regulatory framework for the electricity distribution sector. This framework is expected to set performance outcomes that improve productivity and drive efficient investment in the distribution sector. As this is implemented, the government will look closely at some of its key features, such as the Scorecard, to develop further distribution sector policy options. The Scorecard will help measure performance; distributors will be required to report their progress annually based on key performance outcomes such as customer service, operational effectiveness, public policy responsiveness and financial performance.

- Megawatt (MW)

- A unit of power equal to 1,000 kilowatts (kW) or one million watts (W).

2013 LTEP Cost and Price Forecasts

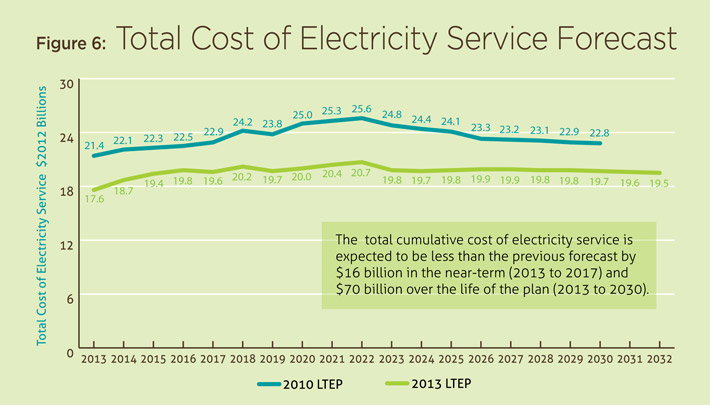

Since the 2010 LTEP, electricity prices have not increased as much as they were forecast to at that time.

Figures 6, 7 and 8 illustrate the 2013 LTEP forecasts for the total cost of electricity service, for a typical monthly residential bill, and for industrial electricity prices. These forecasts are based on the 2013 LTEP conservation and supply mix elements, including Conservation First and DR targets, anticipated demand, renewable targets and planned nuclear refurbishments as well as the other elements described throughout this document.

Overall electricity costs show a decrease from the 2010 projections for all years, based on several factors, including lower demand forecasts and the various rate mitigation measures enacted by government, described in the previous section. Recent decisions, such as the deferral of new nuclear and the reduction in FIT contract pricing, as well as an emphasis on conservation, are responsible for the significantly lower projections after 2018. Containing costs and mitigating rate increases will continue to be a priority as the 2013 LTEP is implemented. Since the 2010 LTEP, the Ontario government has taken strong action that has started to mitigate rate increases and decrease the pressure on Ontario electricity consumers.

Rate mitigation measures undertaken by the government, in collaboration with energy agencies as well as private sector partners, result in savings that last over the life of the plan.

In Summary

- The 2013 LTEP cost and price forecasts are lower than previously forecast in 2010.

- Significant ratepayer savings will be realized as a result of reduced Feed-in Tariff (FIT) prices, the ability to dispatch wind generation, the amended Green Energy Investment Agreement, and the decision to defer new nuclear.

- The government will continue to work with its agencies - Hydro One, OPG, the IESO, the OPA and the OEB - to develop business plans and efficiency targets that will reduce agency costs and result in significant ratepayer savings.

- The government will encourage Ontario Power Generation and Hydro One to explore new business lines and opportunities inside and outside Ontario. These opportunities will help leverage existing areas of expertise and grow revenues for the benefit of Ontarians.

- The Distribution Sector Review Panel, which delivered its report in late 2012, identified the potential for significant savings among the province’s Local Distribution Companies (LDCs). The government expects that LDCs will pursue innovative partnerships and transformative initiatives that will result in electricity ratepayer savings.

- The government will look closely at key features of the OEB's new regulatory framework for LDCs such as the Scorecard, which will report annually on key LDC performance metrics, to develop further distribution sector policy options.

- An annual Ontario Energy Report will be issued to update the public on changing supply and demand conditions, and to outline the progress to date on the LTEP.